| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| A-(4-Chlorophenyl)-Glycine Market Size 2024 |

USD 3,220.12 Million |

| A-(4-Chlorophenyl)-Glycine Market, CAGR |

5.85% |

| A-(4-Chlorophenyl)-Glycine Market Size 2032 |

USD 5,243.44 Million |

Market Overview

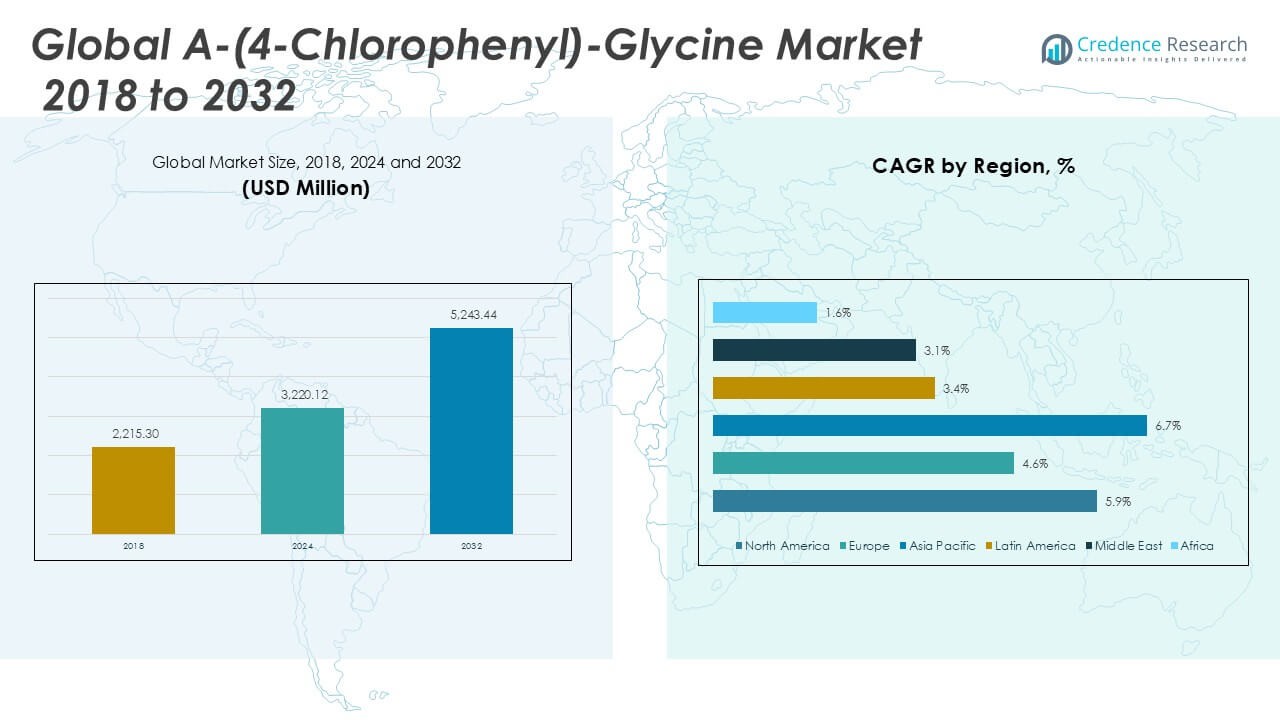

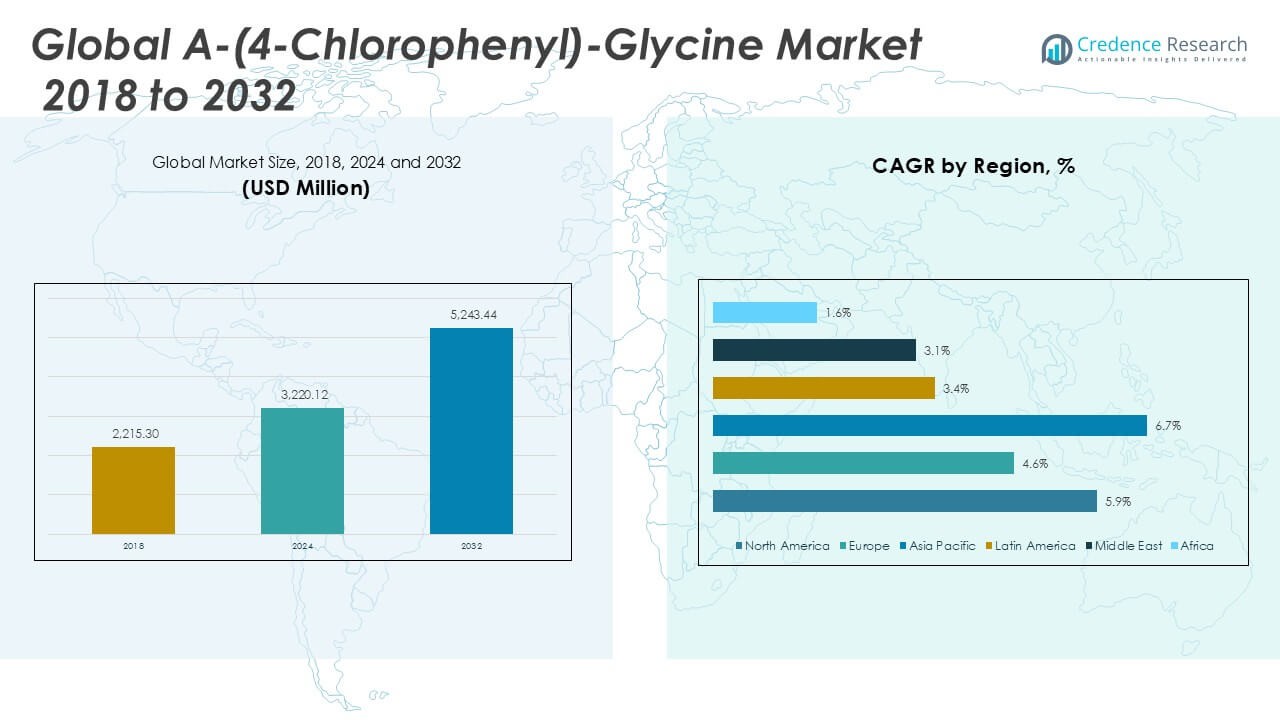

The A-(4-Chlorophenyl)-Glycine Market was valued at USD 2,215.30 million in 2018, reached USD 3,220.12 million in 2024, and is anticipated to reach USD 5,243.44 million by 2032, at a CAGR of 5.85% during the forecast period.

The A-(4-Chlorophenyl)-Glycine market is experiencing significant growth, driven by rising demand in pharmaceutical manufacturing, particularly as an intermediate in the synthesis of active pharmaceutical ingredients. Increasing investment in drug development and the growing prevalence of chronic diseases have strengthened the need for high-purity specialty chemicals such as A-(4-Chlorophenyl)-Glycine. Stringent quality standards and regulatory compliance requirements across global markets are further prompting manufacturers to adopt advanced production technologies. Market expansion is also supported by the development of cost-effective and scalable synthetic routes, enhancing supply chain reliability and product consistency. Trends include a growing focus on research and development activities aimed at discovering new applications in the agrochemical and life sciences sectors, along with a shift toward sustainable production practices to minimize environmental impact. Collectively, these factors are shaping a competitive and innovation-driven landscape, fueling steady market growth throughout the forecast period.

The A-(4-Chlorophenyl)-Glycine market demonstrates a strong global presence, with significant activity across North America, Europe, and Asia Pacific. North America and Europe benefit from advanced pharmaceutical industries and high regulatory standards, supporting stable demand for specialty chemicals. Asia Pacific stands out due to robust pharmaceutical manufacturing and increasing investments in research and development, particularly in China, India, and Japan. Latin America, the Middle East, and Africa are emerging regions, gradually expanding their pharmaceutical and research capabilities. Key players in the market include Tokyo Chemical Industry (TCI), Santa Cruz Biotechnology, Inc., and Alfa Chemistry. These companies are recognized for their diverse grade portfolios, innovation in product development, and ability to serve both bulk chemical and specialty research markets. Their global distribution networks and strong R&D focus enable them to maintain a competitive edge in supplying high-quality A-(4-Chlorophenyl)-Glycine to various end-use sectors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The A-(4-Chlorophenyl)-Glycine Market reached USD 3,220.12 million in 2024 and is projected to reach USD 5,243.44 million by 2032, registering a CAGR of 5.85% during the forecast period.

- Rising demand from the pharmaceutical sector for high-purity intermediates and growing investment in drug discovery continue to drive market expansion.

- The market trends highlight a shift toward sustainable production practices and advanced synthesis methods, responding to stricter environmental and regulatory standards.

- Key players such as Tokyo Chemical Industry (TCI), Santa Cruz Biotechnology, Inc., and Alfa Chemistry are focusing on portfolio diversification, innovation, and expanding their global reach.

- Market restraints include complex regulatory compliance requirements and frequent fluctuations in raw material prices, challenging manufacturers’ ability to maintain cost efficiency.

- Asia Pacific remains the largest and fastest-growing regional market, fueled by expanding pharmaceutical manufacturing in China, India, and Japan, while North America and Europe sustain steady growth through robust R&D activity.

- Competitive dynamics are shaped by ongoing investments in technology, partnerships with research organizations, and the ability to supply both bulk and specialty-grade A-(4-Chlorophenyl)-Glycine to diverse end-user industries.

Market Drivers

Rising Demand in Pharmaceutical Manufacturing Drives Market Expansion

A significant driver for the A-(4-Chlorophenyl)-Glycine Market is the growing demand from the pharmaceutical sector, particularly for its use as an intermediate in the synthesis of active pharmaceutical ingredients. Pharmaceutical companies continue to invest in new drug development to address chronic and lifestyle-related diseases. This trend increases the requirement for high-purity specialty chemicals. Strict regulations and the need for consistent product quality have prompted manufacturers to focus on advanced synthesis methods. The market benefits from a strong pipeline of generic and branded drug formulations, further driving sales. The robust presence of global pharmaceutical hubs enhances procurement and supply chain stability. Continuous innovation in drug chemistry supports the ongoing need for this essential intermediate.

- For instance, Lonza has produced over 1,000 metric tons of advanced pharmaceutical intermediates in 2023 at its Visp facility, directly supplying major global drug manufacturers.

Regulatory Standards and Quality Compliance Encourage Advanced Production Techniques

The implementation of stringent quality standards and global regulatory compliance frameworks is pushing the A-(4-Chlorophenyl)-Glycine Market toward the adoption of advanced production technologies. Regulatory bodies such as the FDA and EMA emphasize purity, traceability, and consistency in pharmaceutical raw materials. Compliance with these standards often requires investment in upgraded facilities and analytical technologies. Market participants leverage automation, real-time monitoring, and digital quality management systems to meet these expectations. These efforts improve batch-to-batch consistency and reduce contamination risks. The drive for compliance ensures that only high-quality products reach end-users. This emphasis on quality positions the market as a trusted segment in the chemical industry.

- For instance, WuXi AppTec operates more than 15 GMP-certified manufacturing plants equipped with 120 high-performance liquid chromatography (HPLC) units for quality assurance and batch verification.

Advancements in Synthetic Routes Enhance Cost-Efficiency and Scalability

Continuous research and process optimization are making significant contributions to cost-effective and scalable synthetic routes in the A-(4-Chlorophenyl)-Glycine Market. Manufacturers are shifting toward catalytic and green chemistry approaches to improve yield and minimize waste. Efficient synthesis reduces raw material costs and shortens production timelines. These innovations help address supply chain disruptions and support high-volume orders. Companies that implement flexible manufacturing capabilities can respond quickly to fluctuating demand. The focus on sustainable and efficient synthesis methods strengthens market competitiveness. It also aligns production practices with global environmental goals.

Expansion into Agrochemical and Life Sciences Sectors Provides New Growth Opportunities

The A-(4-Chlorophenyl)-Glycine Market is benefiting from new application areas in the agrochemical and life sciences sectors. Research institutions and specialty chemical companies are exploring its potential in crop protection products and biotechnology. These emerging applications increase overall market demand and diversify end-user segments. The market’s adaptability to serve multiple industries ensures long-term growth prospects. Partnerships between chemical suppliers and research organizations facilitate faster development cycles. This cross-industry collaboration encourages innovation and expands the product’s reach. Sustained interest from non-pharmaceutical sectors continues to support a healthy demand outlook.

Market Trends

Emphasis on Sustainable and Green Chemistry Practices Shapes Industry Direction

Sustainability has emerged as a central trend in the A-(4-Chlorophenyl)-Glycine Market, prompting manufacturers to embrace environmentally responsible production methods. Companies prioritize green chemistry techniques that minimize hazardous waste and reduce the environmental footprint. Many firms invest in process optimization and cleaner catalysts to meet both regulatory and consumer expectations. The transition toward sustainable practices aligns with broader corporate social responsibility goals. It fosters a competitive advantage for manufacturers who achieve environmental certifications. Efforts to lower energy consumption and resource utilization are gaining momentum. This sustainability-driven approach is setting new standards across the chemical industry.

- For instance, Evonik Industries’ Marl Chemical Park has implemented catalytic hydrogenation processes that have reduced annual hazardous solvent waste by 900 metric tons since 2022.

Strategic Research and Development Initiatives Drive Product Innovation

Innovation through research and development is defining the competitive landscape of the A-(4-Chlorophenyl)-Glycine Market. Companies allocate significant resources to develop advanced synthesis routes and high-purity grades. Focus areas include enhancing yield, improving process safety, and supporting the creation of new derivatives. Partnerships with academic and research institutions encourage knowledge sharing and accelerate technological breakthroughs. Product portfolios are expanding to address niche market requirements and industry-specific challenges. It enables firms to respond to evolving customer needs and regulatory requirements. This trend underpins the continuous evolution of product offerings in the market.

- For instance, BASF registered 870 new chemical process patents in 2023, including 11 specific to chiral glycine derivatives, supporting innovation in active ingredient synthesis.

Integration of Automation and Digitalization Improves Operational Efficiency

Manufacturers in the A-(4-Chlorophenyl)-Glycine Market are adopting automation and digital technologies to enhance operational efficiency and product quality. Automated systems ensure precision and consistency across production batches. Real-time monitoring and data analytics support rapid quality control and process optimization. Companies that embrace digital transformation improve supply chain transparency and responsiveness. These tools also support compliance with rigorous industry standards. It enables firms to scale up production while maintaining strict quality benchmarks. The move toward smart manufacturing is reshaping traditional production paradigms.

Diversification of Application Segments Expands Market Reach

Diversifying applications across industries represents a prominent trend in the A-(4-Chlorophenyl)-Glycine Market, supporting its long-term growth trajectory. Its use is expanding beyond pharmaceuticals into agrochemicals, biotechnology, and specialty chemical sectors. End-users in crop science and life sciences are recognizing the compound’s unique properties and value. Collaborative ventures with downstream industries foster product adaptation for emerging needs. These efforts create new revenue streams and buffer the market against sector-specific slowdowns. It strengthens the resilience and relevance of the market in a dynamic global landscape.

Market Challenges Analysis

Stringent Regulatory Requirements and Compliance Complexities Hinder Market Growth

The A-(4-Chlorophenyl)-Glycine Market faces significant challenges from strict regulatory frameworks and evolving compliance standards across regions. Pharmaceutical and chemical companies must adhere to demanding guidelines from agencies such as the FDA and EMA, which increases operational complexity. It often leads to higher costs for documentation, quality assurance, and product testing. Delays in regulatory approvals can stall product launches and disrupt supply chains. Smaller manufacturers may struggle to meet these requirements, impacting their competitiveness. The continuous updates to safety and environmental standards require regular investments in process upgrades. Navigating these multifaceted regulations remains a persistent challenge for industry participants.

Volatility in Raw Material Prices and Supply Chain Disruptions Impact Stability

Volatile prices for raw materials and ongoing supply chain disruptions present notable obstacles in the A-(4-Chlorophenyl)-Glycine Market. Fluctuations in the cost of key chemical inputs can erode profit margins and create pricing uncertainty for market participants. It is further compounded by logistical challenges, transportation bottlenecks, and geopolitical tensions that impact global trade. Sudden shortages or delays in sourcing critical materials can disrupt production schedules and customer deliveries. Companies must maintain resilient procurement strategies to manage these risks. Price instability can also make long-term planning difficult for manufacturers. Addressing these issues requires strategic sourcing and robust risk management frameworks.

Market Opportunities

Expansion into New End-Use Industries Unlocks Revenue Streams

The A-(4-Chlorophenyl)-Glycine Market holds strong opportunities through diversification into new end-use industries such as agrochemicals, biotechnology, and advanced materials. Companies are exploring its unique chemical properties to develop innovative formulations and specialty products tailored to emerging market needs. Research collaborations between manufacturers and research institutions help accelerate the identification of novel applications. Expanding the product’s presence in crop science, life sciences, and industrial sectors broadens its revenue base. It supports resilience against demand fluctuations in the pharmaceutical sector. The ability to adapt and cater to multiple industries provides a strategic advantage for market participants. Companies investing in application-driven innovation are well positioned for future growth.

Adoption of Advanced Manufacturing Technologies Enhances Market Competitiveness

The adoption of advanced manufacturing technologies presents significant opportunities for efficiency gains and quality improvements in the A-(4-Chlorophenyl)-Glycine Market. Automation, process optimization, and real-time analytics support higher production yields and improved product consistency. Firms leveraging digital quality management and sustainable practices can meet rigorous regulatory standards more efficiently. It also allows rapid scaling of operations in response to dynamic market conditions. These advancements create a favorable environment for cost reduction and margin expansion. Companies that prioritize technological upgrades strengthen their competitive position in global markets. The ongoing integration of smart manufacturing techniques continues to reshape the industry landscape.

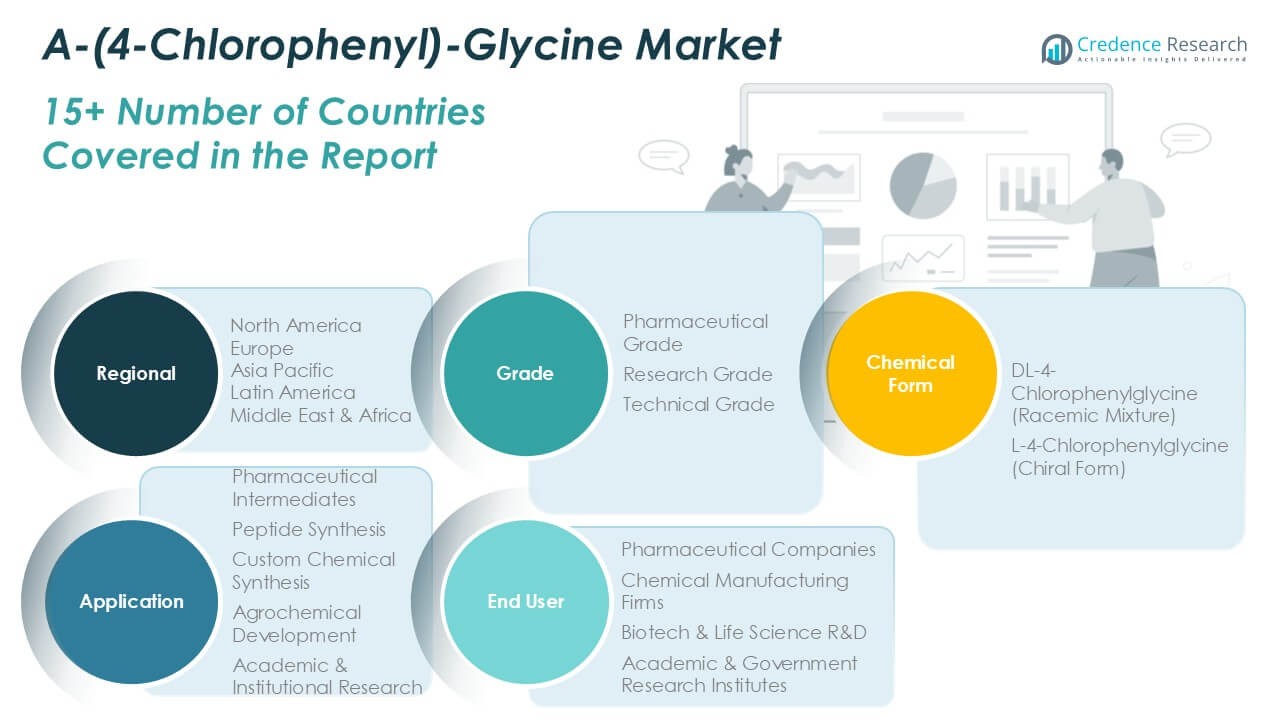

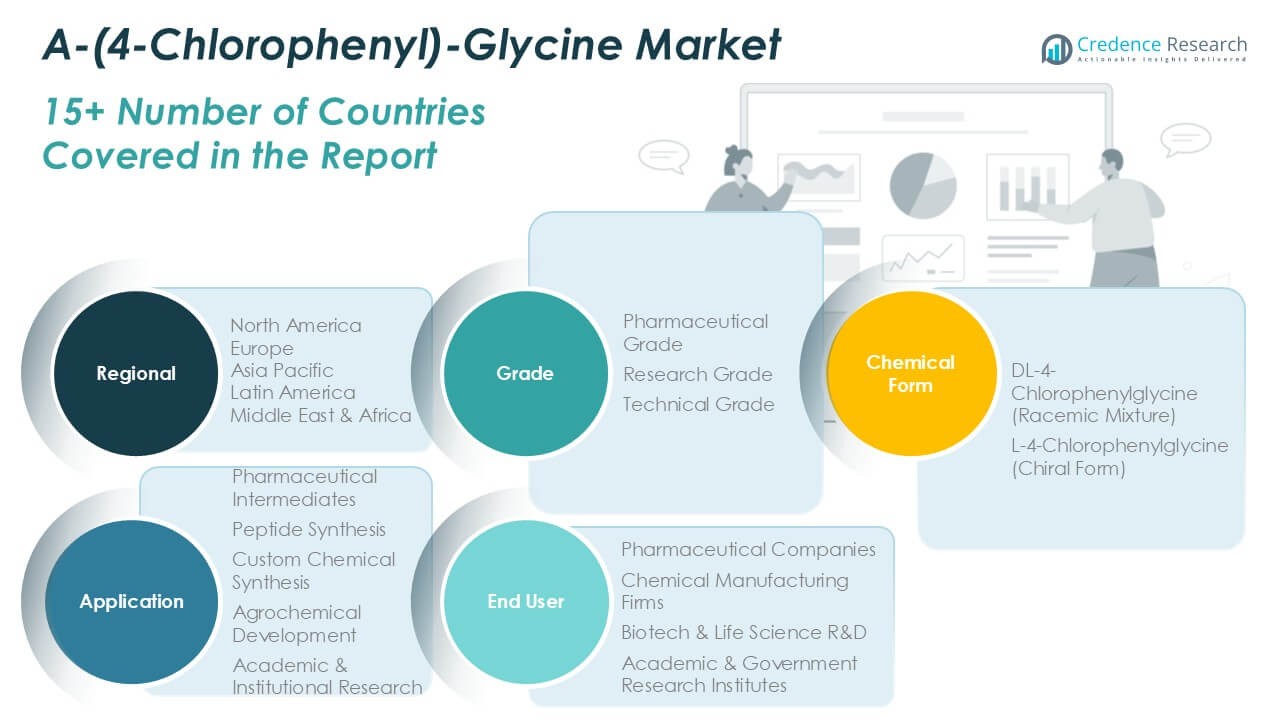

Market Segmentation Analysis:

By Grade:

Pharmaceutical grade dominates market share, driven by stringent purity requirements and regulatory standards in drug manufacturing. Pharmaceutical companies and contract manufacturers prioritize high-purity A-(4-Chlorophenyl)-Glycine for use in active pharmaceutical ingredient (API) synthesis and formulation development. Research grade addresses the specialized needs of laboratory and institutional research, supporting fundamental studies and early-phase discovery. Technical grade finds application in less regulated environments, serving bulk chemical processes and pilot studies where ultra-high purity is not essential.

- For instance, Merck KGaA supplied more than 500 metric tons of pharmaceutical-grade amino acid derivatives with a purity level of 99.7% in 2023 to research and drug manufacturing clients.

By Chemical Form:

DL-4-Chlorophenylglycine (Racemic Mixture) represents a widely used option in both pharmaceutical synthesis and academic research, valued for its availability and cost-effectiveness. L-4-Chlorophenylglycine (Chiral Form) caters to markets demanding enantiomeric purity, particularly in chiral drug synthesis and peptide production. Supplements and liquid formulations address the needs of niche and emerging segments, supporting customized applications in biotechnology and advanced materials. It allows manufacturers and end-users to adapt product offerings to evolving requirements, ensuring competitive flexibility and market responsiveness.

- For instance, Thermo Fisher Scientific’s chiral amino acid division produced over 300 kg of L-4-Chlorophenylglycine with enantiomeric purity of 99.8% in 2023 for pharmaceutical and biotech R&D projects.

By Application:

Pharmaceutical intermediates account for the largest segment, underpinned by sustained drug discovery and increasing demand for specialty intermediates. Peptide synthesis forms a critical application area, where the product’s unique chemical properties contribute to high-yield and high-fidelity peptide production. Custom chemical synthesis attracts specialty chemical manufacturers seeking to create value-added products tailored to end-user specifications. Agrochemical development represents a growing field, leveraging A-(4-Chlorophenyl)-Glycine for novel crop protection solutions and agrochemical research. Academic and institutional research further broadens market reach, with universities and public research organizations utilizing the compound for a variety of chemical, biological, and life science investigations. The segmentation profile ensures that the A-(4-Chlorophenyl)-Glycine Market remains adaptable and resilient, well positioned to address diverse and evolving industry demands.

Segments:

Based on Grade:

- Pharmaceutical Grade

- Research Grade

- Technical Grade

Based on Chemical Form:

- DL-4-Chlorophenylglycine (Racemic Mixture)

- L-4-Chlorophenylglycine (Chiral Form)

- Supplements

- Liquid Formulations

Based on Application:

- Pharmaceutical Intermediates

- Peptide Synthesis

- Custom Chemical Synthesis

- Agrochemical Development

- Academic & Institutional Research

Based on End-User:

- Pharmaceutical Companies

- Chemical Manufacturing Firms

- Biotech & Life Science R&D

- Academic & Government Research Institutes

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America A-(4-Chlorophenyl)-Glycine Market

North America A-(4-Chlorophenyl)-Glycine Market grew from USD 722.98 million in 2018 to USD 1,036.30 million in 2024 and is projected to reach USD 1,693.74 million by 2032, reflecting a compound annual growth rate (CAGR) of 5.9%. North America is holding a 32% market share. The United States leads regional consumption, driven by a robust pharmaceutical sector, ongoing drug innovation, and strong presence of contract manufacturing organizations. Canada contributes with a steady demand from research institutes and biotech firms. Regulatory compliance and a focus on advanced manufacturing technologies sustain regional growth.

Europe A-(4-Chlorophenyl)-Glycine Market

Europe A-(4-Chlorophenyl)-Glycine Market grew from USD 424.42 million in 2018 to USD 584.00 million in 2024 and is anticipated to reach USD 867.05 million by 2032, with a CAGR of 4.6%. Europe accounts for a 17% market share. Germany, France, and the United Kingdom remain leading contributors, supported by established pharmaceutical and specialty chemical industries. The market benefits from rigorous regulatory standards, significant R&D investments, and demand for high-purity specialty intermediates. Presence of leading academic and research institutions fuels the application landscape.

Asia Pacific A-(4-Chlorophenyl)-Glycine Market

Asia Pacific A-(4-Chlorophenyl)-Glycine Market grew from USD 918.81 million in 2018 to USD 1,387.52 million in 2024 and is forecast to reach USD 2,404.27 million by 2032, representing a CAGR of 6.7%. Asia Pacific holds a dominant 45.9% market share. China, India, and Japan are key drivers, underpinned by expanding pharmaceutical manufacturing, growing exports, and rapid adoption of advanced production techniques. Regional cost advantages, supportive government policies, and increasing contract research activities strengthen market prospects.

Latin America A-(4-Chlorophenyl)-Glycine Market

Latin America A-(4-Chlorophenyl)-Glycine Market grew from USD 71.90 million in 2018 to USD 102.62 million in 2024 and is projected to reach USD 139.00 million by 2032, at a CAGR of 3.4%. Latin America represents a 3% market share. Brazil and Mexico lead market activity, driven by investments in pharmaceutical production and rising focus on generics. The region faces challenges in regulatory alignment but benefits from improving healthcare infrastructure and increased research collaboration.

Middle East A-(4-Chlorophenyl)-Glycine Market

Middle East A-(4-Chlorophenyl)-Glycine Market grew from USD 52.79 million in 2018 to USD 68.99 million in 2024 and is expected to reach USD 91.36 million by 2032, growing at a CAGR of 3.1%. The Middle East captures a 2% market share. Saudi Arabia and the United Arab Emirates represent leading markets, supported by government-led healthcare initiatives and investment in local pharmaceutical manufacturing. Demand remains focused on imports for advanced intermediates, with gradual progress toward domestic capabilities.

Africa A-(4-Chlorophenyl)-Glycine Market

Africa A-(4-Chlorophenyl)-Glycine Market grew from USD 24.41 million in 2018 to USD 40.70 million in 2024 and is projected to reach USD 48.02 million by 2032, posting a CAGR of 1.6%. Africa holds a 1% market share. South Africa and Egypt are primary contributors, with growth stemming from healthcare modernization and limited domestic production. The region remains dependent on imports, with market development linked to broader improvements in infrastructure and regulatory harmonization.

Key Player Analysis

- Tokyo Chemical Industry (TCI)

- OTTO Chemie Pvt. Ltd.

- Santa Cruz Biotechnology, Inc.

- Leap Chem Co., Ltd.

- Wuhan Kemi-Works Chemical Co., Ltd.

- Alfa Chemistry

- BOC Sciences

- Combi-Blocks Inc.

- Hangzhou J&H Chemical Co., Ltd.

- Advanced ChemTech

Competitive Analysis

The competitive landscape of the A-(4-Chlorophenyl)-Glycine Market features prominent players including Tokyo Chemical Industry (TCI), Santa Cruz Biotechnology, Inc., Alfa Chemistry, OTTO Chemie Pvt. Ltd., Leap Chem Co., Ltd., Wuhan Kemi-Works Chemical Co., Ltd., BOC Sciences, Combi-Blocks Inc., Hangzhou J&H Chemical Co., Ltd., and Advanced ChemTech. These companies compete through their comprehensive product portfolios, offering pharmaceutical, research, and technical grade A-(4-Chlorophenyl)-Glycine to a global clientele. Their focus on high product purity, regulatory compliance, and robust quality assurance standards enables them to serve leading pharmaceutical, research, and chemical manufacturing firms. The top players invest in advanced manufacturing technologies and R&D to innovate new synthesis routes, enhance process efficiency, and develop application-specific grades. Strong distribution networks and international partnerships help them secure market presence in key regions such as North America, Europe, and Asia Pacific. The ability to adapt to evolving regulatory requirements and respond quickly to customer demands strengthens their competitive position. Ongoing portfolio expansion, customer-centric solutions, and collaborations with academic institutions and contract manufacturers reinforce their market leadership and ensure sustainable growth in a dynamic global market.

Market Concentration & Characteristics

The A-(4-Chlorophenyl)-Glycine Market displays a moderately concentrated structure, with a select group of established global players accounting for a significant share of total supply. Key companies maintain strong competitive positions through advanced manufacturing capabilities, broad grade portfolios, and robust distribution networks. It is characterized by high entry barriers related to regulatory compliance, technical expertise, and capital investment required for producing pharmaceutical-grade and specialty-grade products. Companies compete by offering high-purity grades, reliable quality assurance, and tailored solutions for pharmaceutical, research, and industrial end-users. The market demonstrates a dynamic blend of innovation and operational efficiency, driven by ongoing investments in R&D, process optimization, and sustainable production practices. It features long-term supply contracts, established customer relationships, and close collaboration with research institutions, supporting product innovation and consistent market demand. The overall landscape supports stable pricing and supply reliability, with a focus on meeting evolving global standards and customer requirements.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Grade, Chemical Form, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Market growth will accelerate due to expansion beyond pharmaceutical synthesis into agrochemical and biotech applications.

- Companies will increase investment in green and sustainable production technologies.

- High-purity chiral grades will gain traction in peptide and specialty API applications.

- Automation and digital process control will improve manufacturing efficiency.

- Regional growth will shift toward Asia Pacific with continued pharmaceutical manufacturing expansion.

- Strategic collaborations between industry players and research institutes will support novel applications.

- Regulatory alignment across regions will streamline product approvals and market entry.

- Raw material sourcing strategies will diversify to minimize supply chain disruptions.

- Companies will focus on custom synthesis services tailored to client-specific requirements.

- Emerging markets in Latin America, the Middle East, and Africa will gradually contribute to global demand.