| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Acrylic Paper Market Size 2024 |

USD 1,460.50 Million |

| Acrylic Paper Market, CAGR |

7.15% |

| Acrylic Paper Market Size 2032 |

USD 2,272.70 Million |

Market Overview:

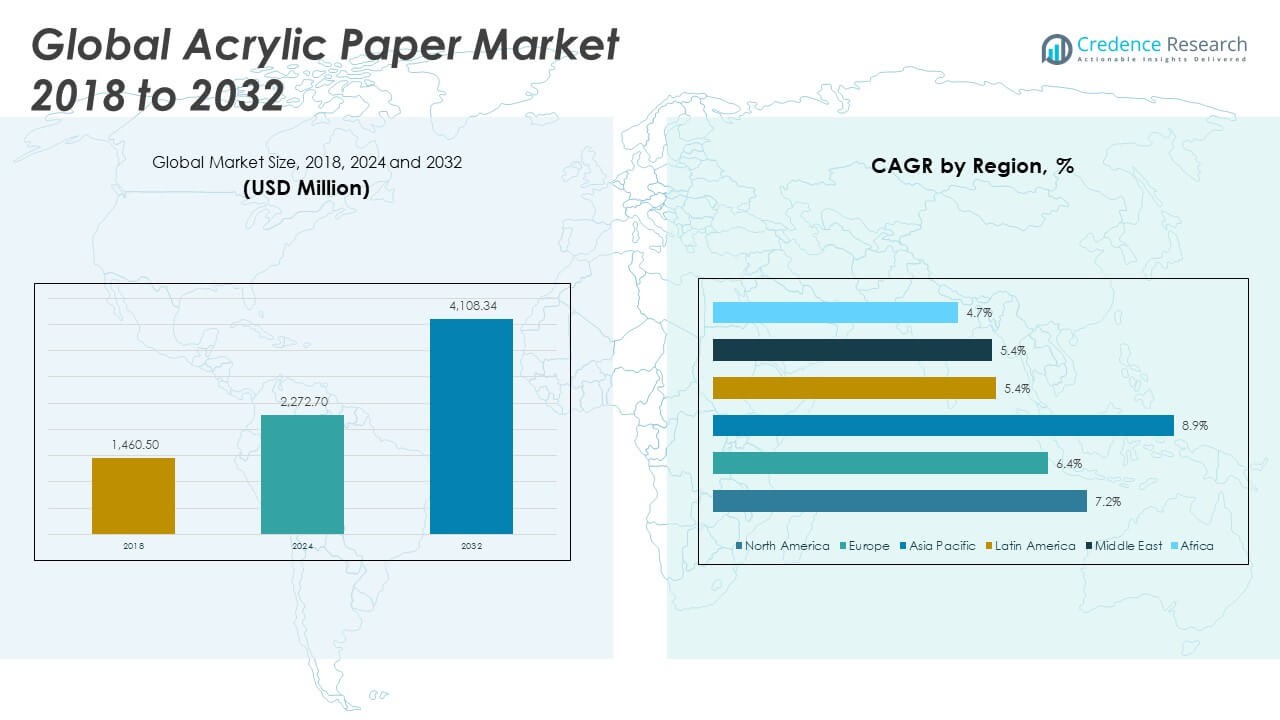

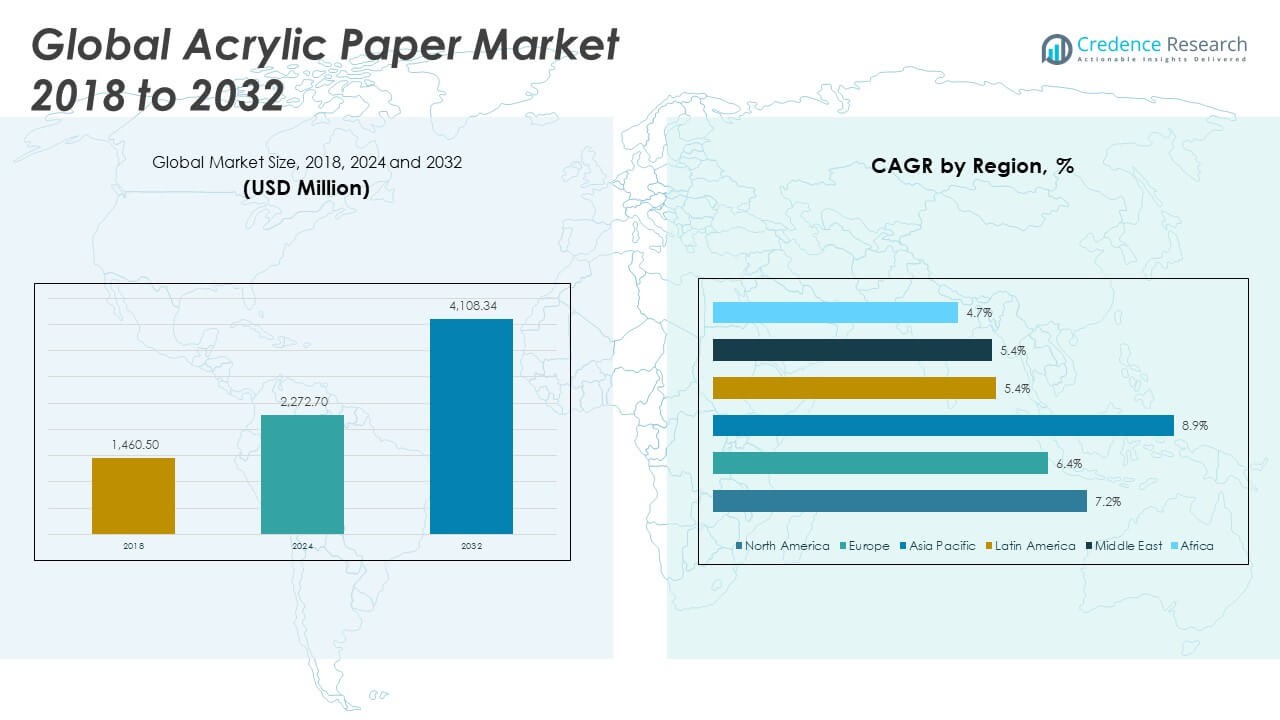

The Global Acrylic Paper Market size was valued at USD 1,460.50 million in 2018 to USD 2,272.70 million in 2024 and is anticipated to reach USD 4,108.34 million by 2032, at a CAGR of 7.15% during the forecast period.

The Global Acrylic Paper Market is driven by rising demand across packaging, advertising, and healthcare sectors. Acrylic paper’s ability to deliver superior print quality, moisture resistance, and durability makes it a preferred material for high-end packaging in cosmetics, food, and pharmaceuticals. As brands seek to enhance shelf appeal and product differentiation, the adoption of acrylic-based labels and packaging is increasing. Additionally, the proliferation of digital printing technologies such as inkjet and laser printers has amplified the need for smooth, compatible surfaces—where acrylic paper excels. The signage and display industry also contributes to market expansion, leveraging acrylic paper for weather-resistant outdoor applications and vivid point-of-sale displays. Furthermore, the shift towards sustainable materials has prompted innovation in recyclable acrylic paper, enabling companies to align with global environmental regulations. These factors collectively position acrylic paper as a versatile and value-added solution, supporting market growth across diverse industrial and commercial applications.

North America currently holds the largest share of the global acrylic paper market, driven by advanced packaging, healthcare, and advertising industries. The United States leads consumption, supported by high demand for premium print media and widespread adoption of digital printing technologies. Europe follows with a substantial share, where sustainability initiatives and stringent regulations are pushing the development of eco-friendly acrylic paper solutions. Countries like Germany, France, and the UK are seeing consistent uptake across food packaging and medical labeling applications. Asia-Pacific is the fastest-growing region, fueled by rapid industrialization, expanding retail infrastructure, and increasing demand for visually appealing, durable packaging in countries like China, India, and South Korea. Rising investments in signage and display technologies further boost demand. Meanwhile, Latin America and the Middle East & Africa show moderate growth, supported by increasing urbanization and infrastructure projects. These regional dynamics highlight the widespread applicability and rising significance of acrylic paper in global markets.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Global Acrylic Paper Market expanded from USD 1,460.50 million in 2018 to USD 2,272.70 million in 2024 and is projected to reach USD 4,108.34 million by 2032, growing at a CAGR of 7.15% due to increasing demand across packaging, signage, and commercial printing sectors.

- Acrylic paper is widely used in premium packaging and labeling for cosmetics, food, and pharmaceuticals because of its superior print quality, moisture resistance, and glossy finish, with growing e-commerce and compliance standards further driving demand.

- The rise of digital printing technologies such as inkjet and laser has significantly boosted the need for compatible substrates like acrylic paper, which supports high-resolution, vibrant images and is ideal for personalized and on-demand printing.

- Its weather-resistant properties make acrylic paper suitable for outdoor signage, point-of-sale displays, and visual marketing in sectors like retail, real estate, and public infrastructure, where durability under environmental stress is crucial.

- Sustainability trends are pushing manufacturers to develop recyclable, eco-friendly versions of acrylic paper that meet regulatory standards while maintaining quality, performance, and brand appeal.

- The market faces challenges from fluctuating raw material costs, especially acrylic resins and coatings, and supply chain disruptions that impact production stability, pricing strategies, and customer satisfaction.

- Competitive pressure from substitute materials such as synthetic paper, coated cardstock, and biodegradable alternatives requires acrylic paper producers to focus on value differentiation, long-term durability, and consistent performance to retain market share.

Market Drivers:

Rising Demand for High-Performance Packaging and Labelling Solutions in Consumer Goods

One of the primary drivers fueling the Global Acrylic Paper Market is the increasing need for visually appealing and durable packaging solutions. Acrylic paper offers excellent printability, moisture resistance, and a glossy finish, making it a preferred material for packaging in industries such as cosmetics, food and beverages, and pharmaceuticals. Brands are investing in premium packaging to enhance product visibility and consumer perception. It plays a critical role in this shift by providing a superior surface for vibrant, long-lasting prints. The demand for clean and secure labeling, especially for compliance in regulated sectors, is also expanding the market scope. Growing e-commerce activities further drive the use of durable and presentable packaging materials like acrylic paper.

Expansion of Digital Printing Applications Across Commercial and Industrial Sectors

The adoption of digital printing technologies across sectors is significantly influencing the demand for acrylic paper. Inkjet and laser printing require substrates with smooth, consistent surfaces and strong ink adhesion properties, both of which acrylic paper provides. It supports high-resolution images and vibrant color reproduction, which are essential for signage, promotional materials, and decorative applications. Commercial printers and businesses prefer acrylic paper for its cost-efficiency in short-run production and its versatility across formats. The trend toward on-demand printing and personalized content is boosting the use of this material. With digital printing becoming integral to retail branding and marketing strategies, the demand for compatible paper solutions remains strong.

- For instance, A&C Plastics’ OPTIX Digital Acrylic sheets enable direct digital printing without adhesion promoters, supporting high-resolution prints (up to 1200 dpi) and providing resistance to scratching and graffiti—features confirmed in their product technical documentation.

Growing Use of Weather-Resistant Materials in Outdoor Signage and Displays

The need for materials that can withstand harsh outdoor conditions is driving the adoption of acrylic paper in signage and point-of-sale displays. It resists water, UV exposure, and temperature changes, making it suitable for prolonged outdoor use. Retailers, event organizers, and real estate companies rely on signage for high-impact visual communication, which acrylic paper supports with durability and clarity. Its ability to retain color and structure under environmental stress enhances its value for outdoor use. The market benefits from increasing urban development and public infrastructure projects that require reliable, long-lasting signage materials. This expanding demand base continues to reinforce the role of acrylic paper in the signage and display industry.

- For instance, ACRYLITE® Premium FF extruded acrylic offers 10–20 times more impact strength than glass and is backed by a 30-year warranty against yellowing, as detailed in ACRYLITE’s technical datasheet.

Emphasis on Sustainable and Recyclable Alternatives Supporting Innovation

Sustainability trends are influencing manufacturers to develop eco-conscious variants of acrylic paper. With rising awareness of environmental impact, companies are shifting toward recyclable materials that do not compromise on quality or performance. The Global Acrylic Paper Market is responding through innovations that reduce energy use, eliminate harmful coatings, and incorporate recycled content. It meets both regulatory and consumer expectations by aligning with green packaging goals. This driver is pushing suppliers to invest in R&D to create cost-effective, sustainable solutions. Such efforts not only improve environmental compliance but also enhance brand reputation among eco-aware consumers.

Market Trends:

Integration of Acrylic Paper in Fine Art and Creative Applications

The use of acrylic paper in the fine art sector is gaining momentum, especially among professional and hobbyist artists. Its textured surface mimics canvas while offering the convenience and portability of paper, making it ideal for acrylic painting. The Global Acrylic Paper Market benefits from this trend as more consumers explore mixed media and water-based acrylic art. Art schools, studios, and online retailers are promoting acrylic paper pads as accessible and cost-effective alternatives to traditional canvases. It supports layering, brush strokes, and heavy pigment application without warping, which enhances its appeal. This shift is encouraging manufacturers to introduce specialized variants tailored for artistic needs.

- For instance, Strathmore’s 400 Series Acrylic Pads feature a heavyweight linen finish paper at 400 gsm (246 lb.), specifically engineered to withstand multiple layers and heavy paint application without buckling, and are available in various sizes such as 9″ x 12″ and 18″ x 24″, with each pad containing 10 sheets.

Rise in Customization and Small-Batch Printing in the Craft and DIY Sector

The growth of DIY culture and personalized stationery has influenced the demand for premium paper materials, including acrylic paper. Small businesses and individual creators use it for customized cards, invitations, scrapbooks, and home décor. The Global Acrylic Paper Market is responding to this with diverse textures, thicknesses, and formats suited for craft-based applications. It offers high durability, rich color output, and a professional finish that elevates handmade projects. The surge in e-commerce platforms like Etsy has expanded the visibility and accessibility of such niche paper products. This trend is shifting market focus toward consumer-grade packaging and decorative uses.

Technological Advancements in Coating and Surface Finishing Processes

Manufacturers are investing in improved coating technologies that enhance the surface quality and performance of acrylic paper. These advancements allow for better ink absorption, scratch resistance, and anti-smudge properties, which are essential in premium and high-traffic use cases. The Global Acrylic Paper Market is evolving through innovations in UV coating, thermal finishes, and eco-friendly lamination. It helps meet the specific demands of sectors such as luxury packaging, promotional printing, and product labeling. The ability to offer custom finishes in matte, gloss, or satin formats is becoming a critical differentiator. Continuous R&D in surface engineering is positioning acrylic paper as a highly adaptable solution across evolving industries.

- For instance, Roymal Inc. has developed aqueous UV-curable coatings based on acrylic and polyurethane backbone polymers, which are applied via rotogravure or Meyer rod and provide excellent water and chemical resistance, as well as superior adhesion to films and paperboard, supporting high-performance printing and packaging applications.

Expansion of Distribution Through Online and Specialty Retail Channels

The growing prominence of e-commerce and niche retail stores is reshaping how acrylic paper reaches end-users. Online platforms offer wider product variety, comparison tools, and user reviews, influencing purchase decisions in both B2B and B2C segments. The Global Acrylic Paper Market is witnessing stronger visibility through digital marketplaces and specialized art supply websites. It allows manufacturers and distributors to target segmented audiences, including artists, commercial printers, and educators. Subscription models and curated kits are also driving repeat purchases and brand loyalty. This shift in distribution strategy is enabling smaller players to compete and innovate within targeted niches.

Market Challenges Analysis:

Volatile Raw Material Costs and Supply Chain Disruptions Impacting Production Stability

Fluctuations in the cost and availability of raw materials such as acrylic resins, specialty coatings, and high-quality pulp continue to pose challenges for manufacturers. Price volatility in petrochemical derivatives directly affects production expenses, making it difficult for companies to maintain consistent pricing strategies. The Global Acrylic Paper Market faces constraints when global supply chains are disrupted due to geopolitical conflicts, trade restrictions, or transportation bottlenecks. It becomes difficult to fulfill large-volume or time-sensitive orders during such periods, which affects customer satisfaction and vendor relationships. Manufacturers are under pressure to secure stable sourcing partnerships while also managing rising operational costs. These challenges can limit profit margins and slow down innovation investments in new product lines.

Intense Competition from Substitute Materials and Price-Sensitive Consumer Segments

The market faces increasing pressure from alternative paper and plastic-based materials that offer lower costs or comparable performance. Synthetic papers, coated cardstocks, and biodegradable substrates often compete directly with acrylic paper in packaging and signage applications. The Global Acrylic Paper Market must differentiate itself through performance, durability, and specialty features to maintain its competitive edge. It can be challenging to convince price-sensitive consumers or small-scale users to invest in premium acrylic options, especially when cost remains a primary factor in purchasing decisions. Some commercial printers and packaging firms may opt for less expensive alternatives to meet budget constraints. This competitive landscape requires companies to continuously emphasize product value and justify the pricing through quality, sustainability, and end-use performance.

Market Opportunities:

Volatile Raw Material Costs and Supply Chain Disruptions Impacting Production Stability

Fluctuations in the cost and availability of raw materials such as acrylic resins, specialty coatings, and high-quality pulp continue to pose challenges for manufacturers. Price volatility in petrochemical derivatives directly affects production expenses, making it difficult for companies to maintain consistent pricing strategies. The Global Acrylic Paper Market faces constraints when global supply chains are disrupted due to geopolitical conflicts, trade restrictions, or transportation bottlenecks. It becomes difficult to fulfill large-volume or time-sensitive orders during such periods, which affects customer satisfaction and vendor relationships. Manufacturers are under pressure to secure stable sourcing partnerships while also managing rising operational costs. These challenges can limit profit margins and slow down innovation investments in new product lines.

Intense Competition from Substitute Materials and Price-Sensitive Consumer Segments

The market faces increasing pressure from alternative paper and plastic-based materials that offer lower costs or comparable performance. Synthetic papers, coated cardstocks, and biodegradable substrates often compete directly with acrylic paper in packaging and signage applications. The Global Acrylic Paper Market must differentiate itself through performance, durability, and specialty features to maintain its competitive edge. It can be challenging to convince price-sensitive consumers or small-scale users to invest in premium acrylic options, especially when cost remains a primary factor in purchasing decisions. Some commercial printers and packaging firms may opt for less expensive alternatives to meet budget constraints. This competitive landscape requires companies to continuously emphasize product value and justify the pricing through quality, sustainability, and end-use performance.

Market Segmentation Analysis:

The Global Acrylic Paper Market is segmented

By product type into traditional acrylic paper, specialty/texture acrylic paper, and others. Traditional acrylic paper holds a significant share due to its wide availability and suitability for general-purpose painting. Specialty or textured acrylic paper is gaining popularity among professional artists for its enhanced surface characteristics that support layered applications and unique finishes.

- For instance, Canson® XL Acrylic Paper, a leading traditional acrylic paper, is engineered with a weight of 300 gsm and a unique surface sizing that allows up to 6 layers of acrylic paint without warping or bleeding, as detailed in Canson’s official product specifications.

By activity, the market is categorized into painting, sketching, and others. Painting accounts for the dominant share, supported by strong demand from both amateur and professional artists. Sketching is also growing steadily, especially in educational settings and art institutions, where acrylic-compatible surfaces are favored for versatile use.

- For instance, Winsor & Newton’s Oil & Acrylic Paper Pad features a canvas-textured surface and a weight of 230 gsm, specifically designed to support acrylic and oil painting without the need for priming. Its acid-free composition and surface sizing allow artists to apply multiple layers of paint with minimal risk of buckling, making it suitable for heavy-bodied acrylics and layered techniques, as confirmed in Winsor & Newton’s official product specifications.

By sales channel, the market includes wholesalers/distributors, online retailers, direct sales, stationery stores, and others. Wholesalers and stationery stores remain key channels for bulk and institutional purchases. Online retailers are rapidly gaining traction, offering product variety, accessibility, and convenience to both hobbyists and commercial buyers. The Global Acrylic Paper Market is expanding across all channels, with strong growth potential in e-commerce and customized distribution models.

Segmentation:

By Product Type:

- Traditional Acrylic Paper

- Specialty/Texture Acrylic Paper

- Others

By Activities:

- Painting

- Sketching

- Others

By Sales Channel:

- Wholesalers/Distributors

- Online Retailers

- Direct Sales

- Stationery Stores

- Others

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

The North America Acrylic Paper Market size was valued at USD 581.95 million in 2018 to USD 895.27 million in 2024 and is anticipated to reach USD 1,623.29 million by 2032, at a CAGR of 7.2% during the forecast period. North America holds the largest share of the Global Acrylic Paper Market, accounting for approximately 35% of the global revenue in 2024. It benefits from well-established packaging, advertising, and healthcare sectors that demand high-performance, durable, and visually appealing paper solutions. The U.S. leads regional consumption due to strong digital printing infrastructure and advanced retail packaging strategies. It supports widespread application across signage, pharmaceutical labeling, and customized print products. Manufacturers in the region emphasize sustainability and innovation, which fuels development of recyclable and premium acrylic paper variants. The region also hosts a large number of specialty paper suppliers and commercial printers, further boosting market penetration.

The Europe Acrylic Paper Market size was valued at USD 460.56 million in 2018 to USD 693.43 million in 2024 and is anticipated to reach USD 1,187.77 million by 2032, at a CAGR of 6.4% during the forecast period. Europe holds around 27% of the Global Acrylic Paper Market and demonstrates stable demand across industries. It is driven by increasing environmental awareness and regulatory support for sustainable packaging materials. Countries such as Germany, France, and the UK are key contributors due to strong pharmaceutical, cosmetics, and FMCG sectors. It is seeing expanded use of acrylic paper in promotional displays and product labeling as companies invest in brand differentiation. Innovation in coating and surface technologies is also strong across European manufacturers. The region’s emphasis on eco-friendly paper alternatives positions it as a leader in sustainable product development.

The Asia Pacific Acrylic Paper Market size was valued at USD 273.62 million in 2018 to USD 462.45 million in 2024 and is anticipated to reach USD 949.52 million by 2032, at a CAGR of 8.9% during the forecast period. Asia Pacific is the fastest-growing region in the Global Acrylic Paper Market, capturing approximately 18% market share in 2024. China, India, Japan, and South Korea are key growth engines due to rising demand from retail, education, and healthcare sectors. It is expanding rapidly in printed packaging and signage, driven by growing urbanization and digital advertising. Increasing local production capacity and favorable trade policies are improving market accessibility. Small businesses and art communities are also adopting acrylic paper for craft, printing, and educational uses. The region’s low-cost manufacturing environment supports the development of competitively priced products.

The Latin America Acrylic Paper Market size was valued at USD 66.06 million in 2018 to USD 101.46 million in 2024 and is anticipated to reach USD 161.39 million by 2032, at a CAGR of 5.4% during the forecast period. Latin America contributes nearly 4% to the Global Acrylic Paper Market in 2024. Brazil and Mexico lead regional demand, supported by growing investments in retail infrastructure, advertising, and educational printing. It is witnessing gradual adoption in signage, display boards, and promotional printing applications. The market benefits from rising consumer demand for packaged goods and localized branding. Supply chain limitations and cost sensitivity remain challenges, but regional distributors are expanding to improve accessibility. The market presents growth potential through product customization and import partnerships.

The Middle East Acrylic Paper Market size was valued at USD 50.15 million in 2018 to USD 72.58 million in 2024 and is anticipated to reach USD 114.76 million by 2032, at a CAGR of 5.4% during the forecast period. The Middle East holds close to 3% of the Global Acrylic Paper Market share in 2024. It is experiencing growth in hospitality, real estate, and event management sectors that require durable signage and branding materials. The UAE and Saudi Arabia are leading markets due to tourism-driven demand and public infrastructure projects. It is increasingly used for high-impact advertising and premium product packaging. Import reliance is high, but new investments in regional print service providers are supporting demand. Cultural emphasis on visual aesthetics and luxury packaging enhances market appeal.

The Africa Acrylic Paper Market size was valued at USD 28.17 million in 2018 to USD 47.52 million in 2024 and is anticipated to reach USD 71.61 million by 2032, at a CAGR of 4.7% during the forecast period. Africa represents around 2% of the Global Acrylic Paper Market in 2024. It is in the early stages of market development, with demand growing in South Africa, Nigeria, and Kenya. Urbanization, improved access to education, and growing retail trade are contributing to increased usage in signage, packaging, and institutional printing. It offers opportunities for low-cost, durable paper alternatives in resource-constrained environments. Market penetration remains limited due to infrastructure challenges and import costs. However, rising awareness of high-quality print materials is gradually encouraging wider adoption.

Key Player Analysis:

- Canson

- Strathmore Artist Papers

- Fabriano

- Arches

- Sennelier

- Daler-Rowney

- Winsor & Newton

- Royal Talens

- Hahnemühle

- Legion Paper

Competitive Analysis:

The Global Acrylic Paper Market is moderately fragmented, with competition driven by product quality, pricing, and customization capabilities. Leading players focus on developing premium-grade papers with enhanced surface finishes, durability, and eco-friendly features to differentiate themselves. It includes both international manufacturers and regional suppliers catering to diverse end-use sectors such as packaging, signage, fine art, and industrial printing. Key companies invest in research and development to improve coating technologies and expand product ranges suited for digital printing and artistic applications. Strategic partnerships with distributors, expansion into emerging markets, and online retail presence strengthen competitive positions. It remains dynamic, with players constantly innovating to meet the evolving needs of commercial printers, designers, and creative professionals. Continuous product innovation and responsiveness to sustainability trends are critical for maintaining market leadership.

Market Concentration & Characteristics:

The Global Acrylic Paper Market exhibits moderate concentration, with a mix of established global brands and regional players competing across specialized and mass-market segments. It features a balance between innovation-led companies focused on premium, coated papers and value-driven producers offering standard-grade products. Market participants differentiate based on surface texture, compatibility with printing technologies, and sustainability credentials. It is characterized by steady demand from packaging, signage, and artistic applications, with growing traction in emerging markets. Technological advancement, quality consistency, and supply chain efficiency define competitive advantage. Companies that adapt quickly to evolving design preferences and environmental regulations maintain a stronger market presence.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Product type, Activities and Sales Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising demand for high-quality packaging will continue to drive growth in food, cosmetics, and pharmaceutical sectors.

- Adoption of digital and on-demand printing technologies will expand applications across commercial printing.

- Growing interest in acrylic paper for fine art and mixed-media projects will open new consumer markets.

- Expansion into emerging economies will increase market share through localized distribution networks.

- Development of eco-friendly and recyclable acrylic paper variants will align with global sustainability goals.

- Advancements in surface coating technologies will enhance product durability and print performance.

- E-commerce growth will boost visibility and accessibility of specialty acrylic paper products.

- Strategic partnerships and acquisitions will reshape competitive dynamics and product innovation.

- Increased use in signage and outdoor displays will support long-term demand in urban infrastructure projects.

- Integration of acrylic paper in educational and institutional applications will create new growth avenues.