| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Adhesive Tape Converter Market Size 2024 |

USD 11,934.42 million |

| Adhesive Tape Converter Market, CAGR |

6.15% |

| Adhesive Tape Converter Market Size 2032 |

USD 19,911.51 million |

Market Overview:

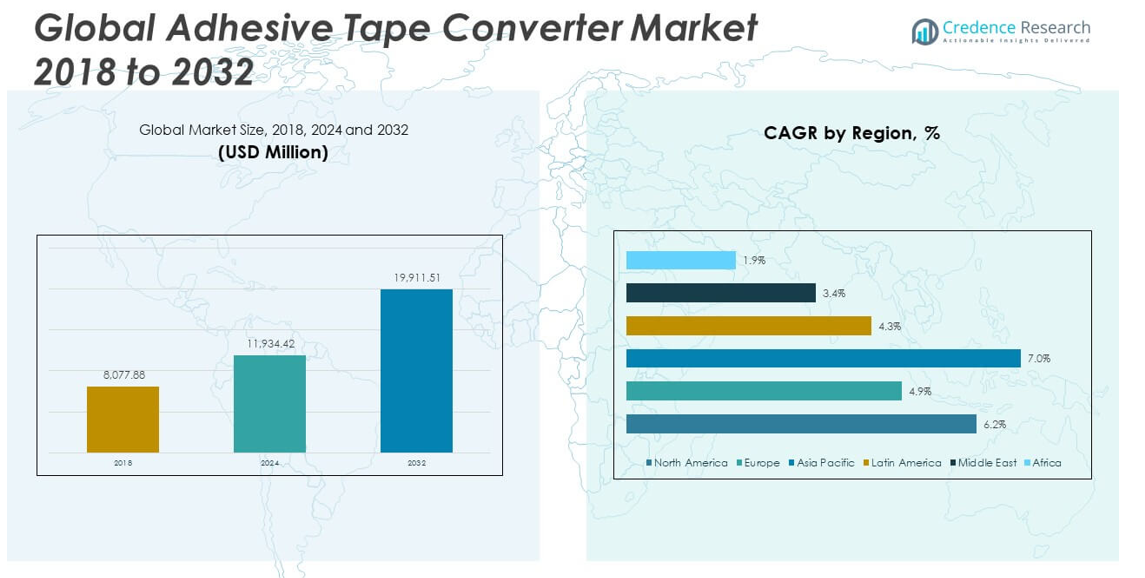

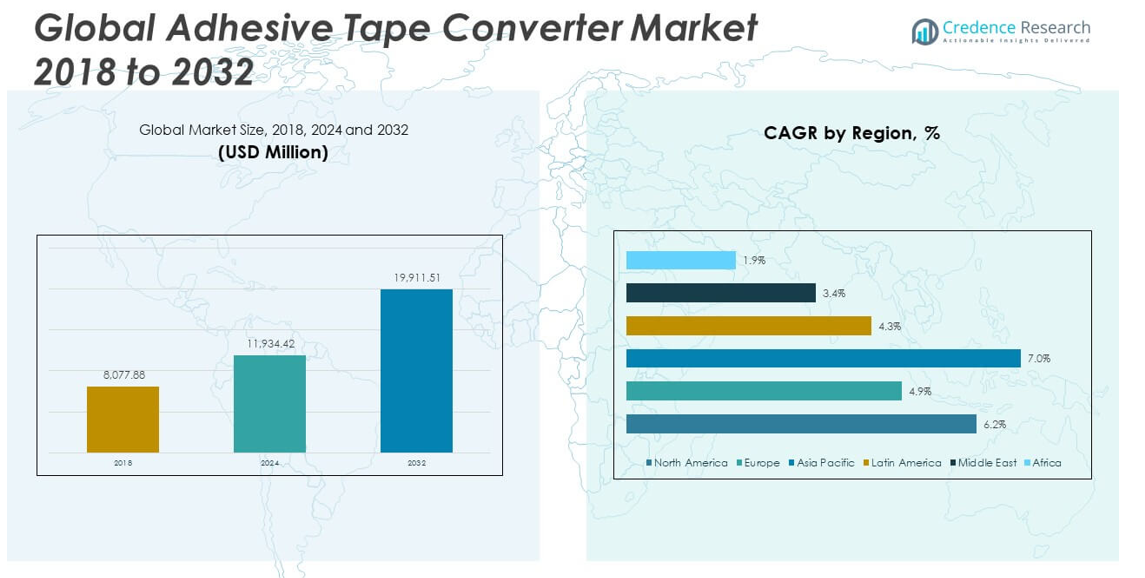

The Global Adhesive Tape Converter Market size was valued at USD 8,077.88 million in 2018 to USD 11,934.42 million in 2024 and is anticipated to reach USD 19,911.51 million by 2032, at a CAGR of 6.15% during the forecast period.

The growth of the adhesive tape converter market is primarily driven by its expanding use across diverse industries and the increasing emphasis on high-efficiency assembly and packaging solutions. In the automotive sector, adhesive tapes are being increasingly used for lightweight component bonding, noise reduction, and EV battery insulation—replacing traditional fasteners for better performance and efficiency. In electronics, the need for compact, reliable components has spurred demand for converted tapes offering thermal management, EMI shielding, and structural support. Additionally, the global boom in e-commerce has accelerated the need for advanced packaging solutions, with adhesive tapes offering tamper-evident features, secure seals, and compatibility with high-speed automation lines. Environmental concerns have also prompted converters to innovate with recyclable and biodegradable tape options, aligning with global sustainability goals.

Regionally, Asia-Pacific dominates the adhesive tape converter market, accounting for the largest revenue share due to its robust manufacturing base and rapid industrial expansion, especially in China, India, Japan, and South Korea. The region’s growth is fueled by rising demand from automotive, electronics, and construction sectors, alongside increasing investments in infrastructure and export-driven production. North America represents a mature yet dynamic market, with strong presence in healthcare, electronics, and automotive segments, particularly across the United States and Canada. Mexico is also emerging as a regional hub for tape conversion due to its cost advantages and proximity to major manufacturing centers. Europe follows closely, driven by stringent environmental regulations and strong demand for high-performance, eco-friendly tapes in automotive and industrial applications, with countries like Germany, France, and the UK leading innovation. Meanwhile, Latin America and the Middle East & Africa are witnessing growing adoption, supported by expanding infrastructure, retail, and healthcare sectors.

Market Insights:

- The Global Adhesive Tape Converter Market reached USD 11,934.42 million in 2024 and is projected to hit USD 19,911.51 million by 2032, growing at a CAGR of 6.15%.

- Automotive and electronics industries are key demand drivers, using converted tapes for lightweight bonding, EMI shielding, and EV battery insulation.

- Increasing preference for eco-friendly packaging has prompted converters to offer recyclable, biodegradable, and solvent-free tape solutions.

- Pressure-sensitive adhesive tapes are gaining traction across logistics, construction, and healthcare for their ease of use and versatility.

- Technological advancements in slitting and die-cutting equipment are enabling high-precision output, supporting demand from aerospace and medical sectors.

- Raw material price volatility and supply chain disruptions are major challenges, impacting production stability and pricing strategies for converters.

- Asia-Pacific leads the market with the highest revenue share, driven by strong manufacturing growth in China, India, Japan, and South Korea.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Demand from Automotive and Electronics Sectors Enhances Market Expansion

The Global Adhesive Tape Converter Market is witnessing strong demand from the automotive and electronics industries. Automotive manufacturers increasingly use converted tapes for bonding, noise reduction, surface protection, and thermal insulation. With the rise of electric vehicles, there is a need for high-performance tapes to ensure battery stability and electrical insulation. In electronics, the compact design of devices requires precise adhesive components for heat dissipation, EMI shielding, and structural integrity. The shift toward lightweight and high-durability materials drives the replacement of mechanical fasteners with specialized tapes. This reliance on advanced adhesive solutions supports the steady growth of the converter market across global manufacturing hubs.

- For instance, 3M reports that their VHB™ Tape 5952, widely adopted in automotive assembly, delivers peel adhesion of 19 N/cm and shear strength exceeding 1500 kPa, enabling the replacement of mechanical fasteners in both interior and exterior automotive applications.

Shift Toward Sustainable Packaging Solutions Drives Tape Conversion Demand

The emphasis on sustainability has significantly influenced packaging practices across industries, contributing to the growth of the Global Adhesive Tape Converter Market. Brands and manufacturers are adopting eco-friendly, recyclable, and solvent-free adhesive tapes to comply with environmental regulations and consumer expectations. Converters are responding by offering biodegradable backings and water-based adhesives to meet these evolving standards. These materials reduce carbon footprint without compromising bonding strength or reliability. Governments are also implementing stricter packaging guidelines, reinforcing the need for compliant and efficient tape solutions. The push for sustainability has opened new opportunities for innovation in tape design and conversion capabilities.

Rising Application of Pressure-Sensitive Adhesives Across Industrial Use Cases

Pressure-sensitive adhesive (PSA) tapes are gaining widespread use across construction, logistics, healthcare, and general manufacturing, boosting the performance of the Global Adhesive Tape Converter Market. These tapes require no heat or water to activate, allowing faster and cleaner applications in high-volume production lines. Converters enable these adhesives to be customized in various formats including rolls, sheets, or die-cut parts based on client specifications. Industries rely on PSAs for assembly, labeling, masking, and protective sealing due to their strong adhesion and ease of removal. The versatility of these tapes increases their value across both temporary and permanent bonding applications. This multi-industry reliance strengthens the converter segment’s role in delivering tailored adhesive products.

- For example, Nitto Denko’s company reports indicate that their pressure-sensitive adhesive (PSA) tapes, such as Nitto 5000NS, achieve initial tack values of 18 N/25 mm and maintain holding power over 24 hours at 1 kg load, supporting rapid assembly in electronics and healthcare.

Advancement in Conversion Technology Supports High-Precision Output

The development of advanced slitting, die-cutting, and laminating equipment enhances the capabilities of the Global Adhesive Tape Converter Market. High-speed and automated machines allow converters to produce uniform, defect-free tape formats with minimal waste and downtime. These innovations improve accuracy, throughput, and customization, meeting the specific needs of complex industrial applications. It allows converters to work with a broad range of materials, including foams, films, foils, and specialty adhesives. Manufacturers demand tight tolerance and precision in tape dimensions, especially in aerospace, electronics, and medical devices. The adoption of cutting-edge conversion tools ensures that the market can keep pace with stringent industry requirements.

Market Trends:

Growing Adoption of Digitally Printed Adhesive Tapes Across Branding and Packaging

The integration of digital printing in tape conversion is reshaping the branding and packaging strategies of multiple industries. Businesses are increasingly requesting customized adhesive tapes that carry logos, QR codes, serial numbers, or usage instructions directly on the tape surface. This trend allows for improved brand visibility and product traceability, particularly in e-commerce and logistics. The Global Adhesive Tape Converter Market is leveraging this shift to offer short-run, high-resolution printing options with faster turnaround times. It supports personalized packaging without the need for additional labeling or external printing processes. The ability to print directly onto tapes enhances efficiency while meeting aesthetic and compliance requirements.

Expansion of Cold Chain Logistics Fuels Demand for Temperature-Resistant Tapes

Cold chain logistics is expanding rapidly in pharmaceuticals, food distribution, and chemical transport, leading to new requirements for adhesive tape solutions. Tapes used in these applications must perform reliably under low-temperature and humidity-sensitive conditions. The Global Adhesive Tape Converter Market is responding by developing conversion solutions that maintain adhesive performance in freezing, thawing, and refrigerated environments. It supports strict regulatory compliance and product integrity throughout the supply chain. These tapes often feature tamper-evident properties and robust seals for packaging boxes, containers, and labels. The trend reflects growing awareness of temperature-sensitive logistics and the need for durable adhesive technologies.

Increased Demand for Anti-Counterfeit and Security Features in Specialty Tapes

The need for product authentication and tamper detection is prompting the integration of security features into adhesive tapes. Industries such as electronics, pharmaceuticals, and luxury goods are requesting converted tapes with embedded holograms, microtext, and destructible film layers. The Global Adhesive Tape Converter Market is adopting advanced materials and technologies to deliver solutions that prevent product tampering and counterfeiting. It enables clients to protect their supply chains while complying with global regulatory standards. These security tapes offer visible evidence of tampering and reduce losses due to theft or product fraud. The incorporation of smart features supports broader risk management strategies in global trade.

- For instance, Avery Dennison produces thin transfer tapes with solvent-pure acrylic adhesives that bond anti-counterfeiting elements such as holograms, void labels, and tax stamps securely and irreversibly, ensuring any tampering attempt is visible and traceable.

Adoption of Multi-Function Adhesive Tapes to Streamline Product Design

There is a rising interest in tapes that combine multiple functions such as insulation, vibration dampening, sealing, and thermal management. Industries are reducing component count and streamlining product assembly by adopting multi-layered or multi-purpose tapes. The Global Adhesive Tape Converter Market is evolving to meet this demand through advanced lamination and die-cutting processes. It enables the delivery of tapes with complex structures that fulfill several roles in a single component. These tapes contribute to weight reduction and design simplification in sectors like automotive, aerospace, and wearable technology. The trend supports lean manufacturing and cost-efficiency objectives across product development cycles.

- For instance, 3F Adhesive Tapes manufactures solvent-free polyacrylate- and hotmelt-based tapes with advanced converting capabilities, producing cut rolls as narrow as 5 mm and long rolls up to 12,000 meters, enabling complex multi-layer and multifunctional tape constructions tailored to customer specifications.

Market Challenges Analysis:

Volatile Raw Material Prices and Supply Chain Disruptions Affect Production Stability

The Global Adhesive Tape Converter Market faces challenges due to fluctuations in raw material prices, particularly adhesives, polymers, and specialty films. Price volatility often stems from geopolitical tensions, oil price shifts, and regulatory constraints impacting chemical production. Supply chain disruptions, such as delays in resin imports or shortages of release liners, hinder timely procurement and lead to inconsistent production schedules. It creates uncertainty for converters in fulfilling large-volume or time-sensitive orders. Small and mid-sized converters struggle to absorb rising input costs, especially in competitive markets where pricing flexibility is limited. These external pressures increase operational risk and reduce profitability for stakeholders across the value chain.

Environmental Regulations and Disposal Concerns Limit Product Viability

Stringent environmental regulations and waste disposal issues present ongoing obstacles for the Global Adhesive Tape Converter Market. Many adhesive tapes are difficult to recycle due to the presence of synthetic backings, plastic films, and non-biodegradable adhesives. Regulatory agencies across North America and Europe have imposed limits on volatile organic compounds (VOCs) and solvent-based adhesives, requiring converters to reformulate or invest in greener technologies. It forces converters to navigate compliance complexities while managing higher production costs. Clients also expect environmentally responsible solutions, yet technical limitations restrict performance of some eco-friendly alternatives. Balancing sustainability, durability, and regulatory compliance continues to challenge innovation within the adhesive tape conversion sector.

Market Opportunities:

Expansion of Medical and Healthcare Applications Unlocks High-Value Growth

The increasing demand for specialized adhesive solutions in the medical sector presents a strong growth opportunity for the Global Adhesive Tape Converter Market. Medical-grade tapes are essential for wound care, surgical drapes, diagnostic devices, and wearable health monitors. It enables converters to offer hypoallergenic, breathable, and skin-friendly materials tailored to stringent healthcare standards. Aging populations and the rise of home healthcare accelerate the need for user-friendly, sterile adhesive products. Converters that invest in cleanroom production and FDA-compliant materials stand to gain a competitive edge. This segment offers higher margins and long-term growth potential through product innovation and strategic partnerships with medical device manufacturers.

Growth in Emerging Markets Supports Wider Commercial Penetration

Emerging economies in Asia, Latin America, and Africa present expanding opportunities for the Global Adhesive Tape Converter Market. Rapid urbanization, industrial growth, and increased consumer spending fuel demand for advanced packaging, automotive, and electronics solutions. It creates favorable conditions for converters to localize production and introduce cost-effective, customized adhesive products. Governments in these regions support infrastructure and manufacturing development, encouraging foreign investment. Tapping into these markets allows converters to diversify revenue streams and reduce dependence on mature markets. Competitive pricing, regional partnerships, and agile distribution strategies will be critical to capturing value in these high-potential geographies.

Market Segmentation Analysis:

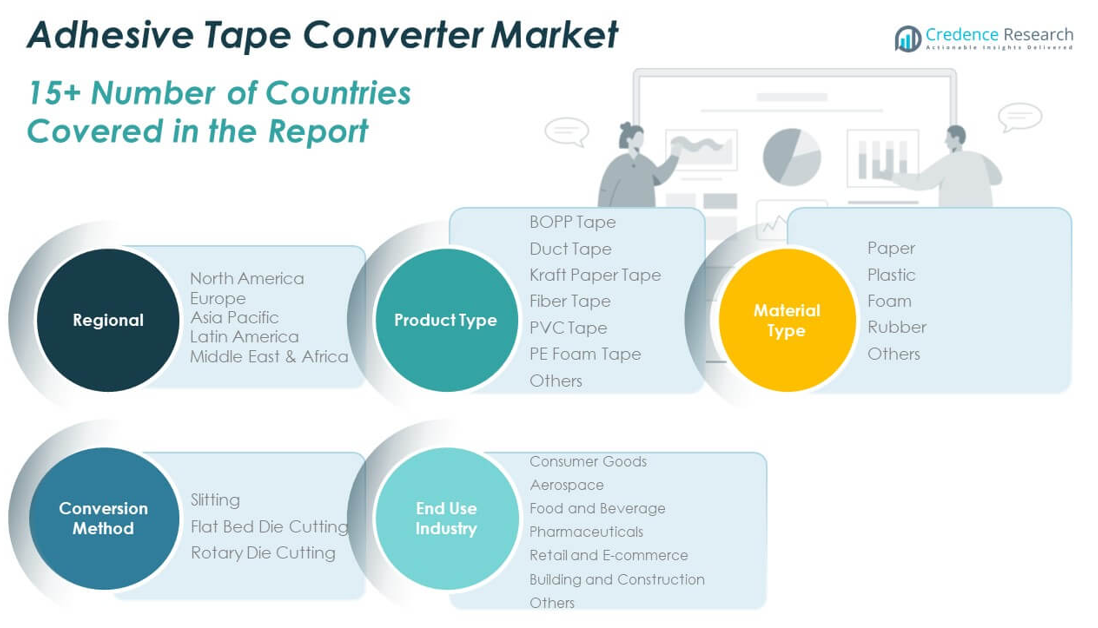

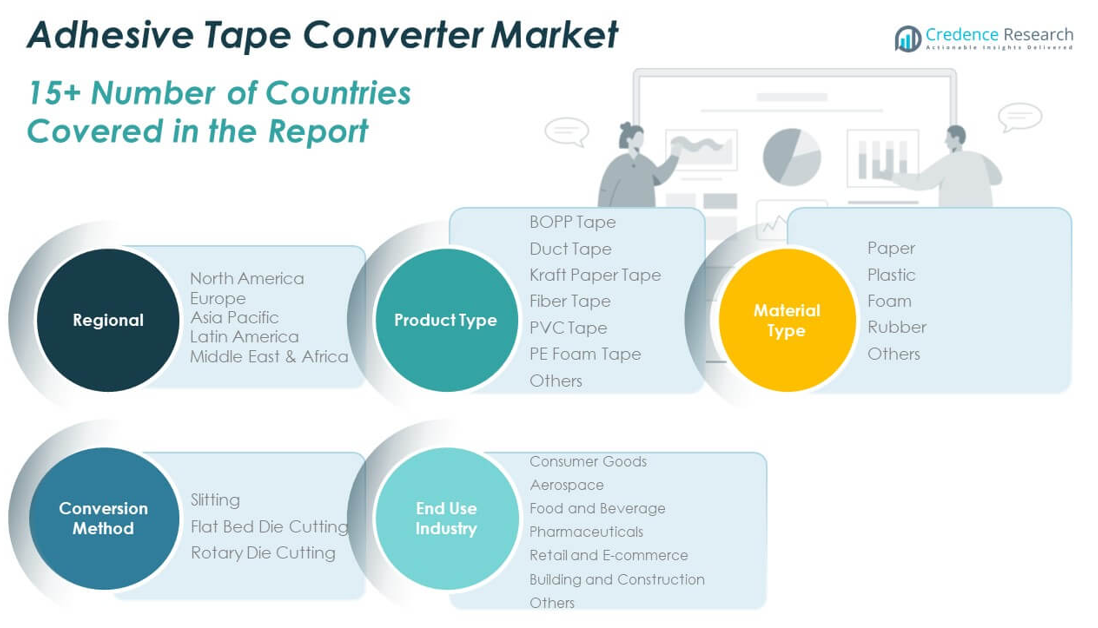

The Global Adhesive Tape Converter Market is segmented by product type, material type, conversion method, and end use industry.

By product types, BOPP tape holds a dominant share due to its widespread use in packaging, followed by duct tape and PVC tape, which serve industrial and electrical applications. Kraft paper and fiber tapes are gaining attention for their eco-friendly properties, while PE foam tapes are preferred for insulation and cushioning.

- For instance, 3M Scotch™ Box Sealing Tape 375 is a high-performance BOPP packaging tape featuring a tensile strength of approximately 30 N/cm, adhesion to steel of around 5.5 N/cm, and a total thickness of 79 microns (3.1 mil). It is widely used in industrial and automated packaging applications for its strong holding power, durability, and resistance to splitting, abrasion, and edge tearing.

By material type, plastic-based tapes lead the market due to their durability and versatility across sectors. Foam and rubber materials are used for vibration damping and sealing in automotive and construction applications. Paper-based tapes support sustainable packaging trends in retail and e-commerce.

By conversion methods, slitting remains the most common process due to its efficiency in producing standard rolls. Flat bed and rotary die cutting offer higher precision for complex formats used in electronics and healthcare.

- For example, Rotatek’s rotary die-cutting units deliver high-precision output with ±0.03 mm tolerance and support multi-format converting.

By end use industries. Consumer goods and retail dominate demand, while aerospace and pharmaceuticals require high-performance, precision-cut tapes. Food and beverage industries use specialty tapes for labeling and packaging, and the construction sector depends on durable, weather-resistant adhesive solutions. The Global Adhesive Tape Converter Market benefits from this multi-sector demand and continues to evolve with shifting industry needs.

Segmentation:

By Product Type

- BOPP Tape

- Duct Tape

- Kraft Paper Tape

- Fiber Tape

- PVC Tape

- PE Foam Tape

- Others

By Material Type

- Paper

- Plastic

- Foam

- Rubber

- Others

By Conversion Method

- Slitting

- Flat Bed Die Cutting

- Rotary Die Cutting

By End Use Industry

- Consumer Goods

- Aerospace

- Food and Beverage

- Pharmaceuticals

- Retail and E-commerce

- Building and Construction

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

The North America Adhesive Tape Converter Market size was valued at USD 2,603.82 million in 2018 to USD 3,792.82 million in 2024 and is anticipated to reach USD 6,351.87 million by 2032, at a CAGR of 6.2% during the forecast period. North America holds 25% share of the Global Adhesive Tape Converter Market, driven by technological advancements and demand across automotive, aerospace, and medical device sectors. The United States leads regional growth due to strong industrial infrastructure and presence of global adhesive manufacturers and converters. Demand for high-performance tapes in electric vehicles, electronics, and surgical applications continues to rise. It benefits from stringent regulatory frameworks that encourage the use of safe, compliant, and low-VOC adhesive systems. Digital printing on tapes, customized die-cut formats, and sustainable packaging solutions are growing trends in the region. The market supports innovation in high-value segments, with converters investing in automation and precision engineering.

The Europe Adhesive Tape Converter Market size was valued at USD 1,489.08 million in 2018 to USD 2,077.93 million in 2024 and is anticipated to reach USD 3,148.26 million by 2032, at a CAGR of 4.9% during the forecast period. Europe accounts for 17% of the Global Adhesive Tape Converter Market, with strong demand in Germany, France, and the UK. Strict environmental regulations drive the adoption of recyclable, solvent-free, and bio-based adhesive solutions. The region prioritizes sustainability and advanced manufacturing practices, particularly in automotive, electronics, and consumer goods packaging. It supports innovation in security tapes, high-temperature adhesives, and multi-functional formats for industrial use. European converters are focusing on energy efficiency and regulatory compliance to maintain their competitive position. Healthcare applications, driven by aging populations and medical device innovation, continue to contribute to steady growth.

The Asia Pacific Adhesive Tape Converter Market size was valued at USD 3,363.14 million in 2018 to USD 5,161.34 million in 2024 and is anticipated to reach USD 9,161.59 million by 2032, at a CAGR of 7.0% during the forecast period. Asia Pacific leads the Global Adhesive Tape Converter Market with a 41% share, driven by rapid industrialization and large-scale manufacturing in China, India, Japan, and South Korea. The electronics and automotive sectors dominate tape conversion demand due to high-volume production and innovation needs. It benefits from low production costs, skilled labor, and expanding domestic markets. Converters in the region are scaling operations and adopting advanced machinery to meet export and local demand. E-commerce, flexible packaging, and cleanroom healthcare solutions further support growth. Government initiatives supporting local manufacturing and infrastructure are expanding opportunities across emerging markets in Southeast Asia.

The Latin America Adhesive Tape Converter Market size was valued at USD 342.50 million in 2018 to USD 499.01 million in 2024 and is anticipated to reach USD 725.83 million by 2032, at a CAGR of 4.3% during the forecast period. Latin America holds 4% share of the Global Adhesive Tape Converter Market, with key growth coming from Brazil, Mexico, and Argentina. Rising demand for flexible packaging and healthcare infrastructure supports tape consumption across sectors. It is building converter capacity to support food and beverage, personal care, and construction industries. Cost-sensitive customers are driving innovation in affordable adhesive solutions and recyclable packaging formats. Regional growth is supported by trade expansion and growing manufacturing clusters. Economic recovery and digital transformation of logistics and retail also boost converter adoption in consumer goods.

The Middle East Adhesive Tape Converter Market size was valued at USD 189.43 million in 2018 to USD 251.14 million in 2024 and is anticipated to reach USD 339.36 million by 2032, at a CAGR of 3.4% during the forecast period. The Middle East represents 2% of the Global Adhesive Tape Converter Market, with growing applications in industrial packaging, electronics assembly, and infrastructure development. UAE and Saudi Arabia are leading contributors, driven by smart city projects and diversified industrial activity. It focuses on expanding capacity for thermally resistant and UV-stable tapes suitable for extreme weather conditions. Construction adhesives and insulation tapes are gaining traction in large-scale infrastructure projects. Local converters are enhancing their product portfolios with imported raw materials and precision equipment. The region shows interest in sustainability and is gradually transitioning to eco-compliant adhesive technologies.

The Africa Adhesive Tape Converter Market size was valued at USD 89.91 million in 2018 to USD 152.18 million in 2024 and is anticipated to reach USD 184.60 million by 2032, at a CAGR of 1.9% during the forecast period. Africa contributes 1% to the Global Adhesive Tape Converter Market, with modest growth led by South Africa, Nigeria, and Egypt. Demand is rising in agriculture, packaging, and consumer products, supported by a growing middle class. It remains a price-sensitive region, creating space for affordable, functional tape solutions. Limited local manufacturing capacity presents opportunities for global converters to enter through joint ventures and regional partnerships. Infrastructure upgrades, construction activity, and healthcare outreach programs are increasing demand for tapes in logistics and insulation. Gradual modernization of production systems will help scale converter presence across the continent.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Parafix

- Convertex

- Tecman

- Lynvale

- Strouse

- Polarseal

- Jeaton Group

- Preston Technical

- MBK

- Can-Do National Tape

- Tangent

- Budnick

Competitive Analysis:

The Global Adhesive Tape Converter Market is moderately fragmented, with a mix of multinational corporations and regional players competing across diverse application segments. Leading companies focus on customized tape solutions, precision slitting, die-cutting, and sustainable adhesive technologies to strengthen their market position. It rewards players that invest in automation, vertical integration, and R&D to meet evolving industrial needs. Strategic partnerships with OEMs and end-users allow converters to align product development with real-world performance requirements. Companies are also expanding their global footprint through acquisitions and joint ventures to enhance production capacity and regional access. Competitive intensity remains high in sectors like automotive, electronics, and medical tapes, where performance and compliance standards are critical. Innovation, operational efficiency, and environmental compliance continue to define leadership in this market.

Recent Developments:

- In February 2025, Nautic Partners acquired the specialty tapes segment from Berry Global, forming a newly branded company called Vybond™. It combines over 1,500 SKUs and legacy brands from Berry, including Adchem®, Nashua®, and Polyken®. This standalone business structured to deepen its focus on industrial and specialty tape markets. It will accelerate investments in R&D, expand customer service capabilities, and support industries like HVAC, automotive, aerospace, and medical with innovative converted tape solutions.

Market Concentration & Characteristics:

The Global Adhesive Tape Converter Market exhibits moderate concentration, with a balanced presence of large-scale manufacturers and specialized regional converters. It features a high degree of customization, driven by varied industry demands across packaging, automotive, electronics, and healthcare sectors. The market favors companies with strong technical capabilities, advanced machinery, and the ability to offer short lead times and flexible production volumes. It is characterized by rapid product innovation, increased automation, and a shift toward sustainable materials. Regulatory compliance and quality certifications play a critical role in market entry and retention, especially in medical and electronic applications. Buyers seek value-added features such as precision die-cutting, printed tapes, and eco-friendly adhesive systems. Competitive differentiation depends on service reliability, application expertise, and integration into client supply chains.

Report Coverage:

The research report offers an in-depth analysis based on product type, material type, conversion method, and end use industry. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising demand for EV battery insulation will boost converter activity in the automotive sector.

- Growth in wearable medical devices will increase the need for skin-friendly, breathable tapes.

- Expansion of e-commerce logistics will drive demand for tamper-evident and branded packaging tapes.

- Advancements in automation and robotics will enhance precision and scalability in tape conversion.

- Adoption of solvent-free and bio-based adhesives will accelerate under stricter environmental policies.

- Digital printing on tapes will gain traction for product identification, traceability, and branding.

- Emerging economies will offer new revenue streams through industrial and infrastructure investments.

- Demand for multi-functional tapes will rise to support lightweight product design in aerospace and electronics.

- Integration of smart features like conductivity and sensing will transform tape utility in high-tech sectors.

- Strategic collaborations between converters and OEMs will improve customization and application efficiency.