| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Adhesive Transfer Tape Market Size 2024 |

USD 6,853.96 million |

| Adhesive Transfer Tape Market, CAGR |

5.73% |

| Adhesive Transfer Tape Market Size 2032 |

USD 11,056.02 million |

Market Overview:

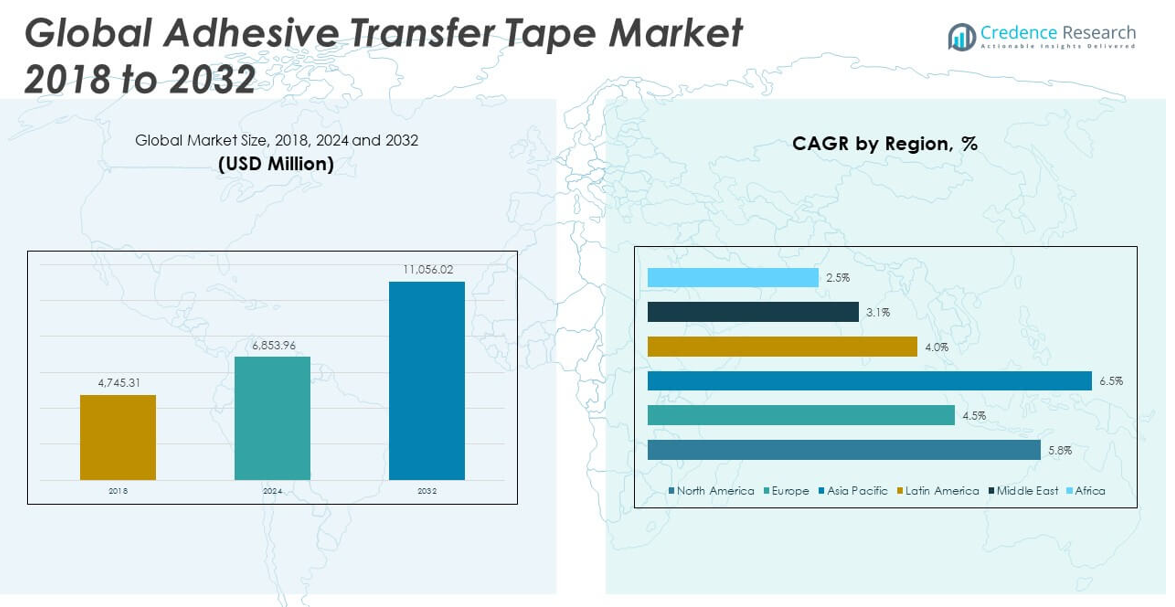

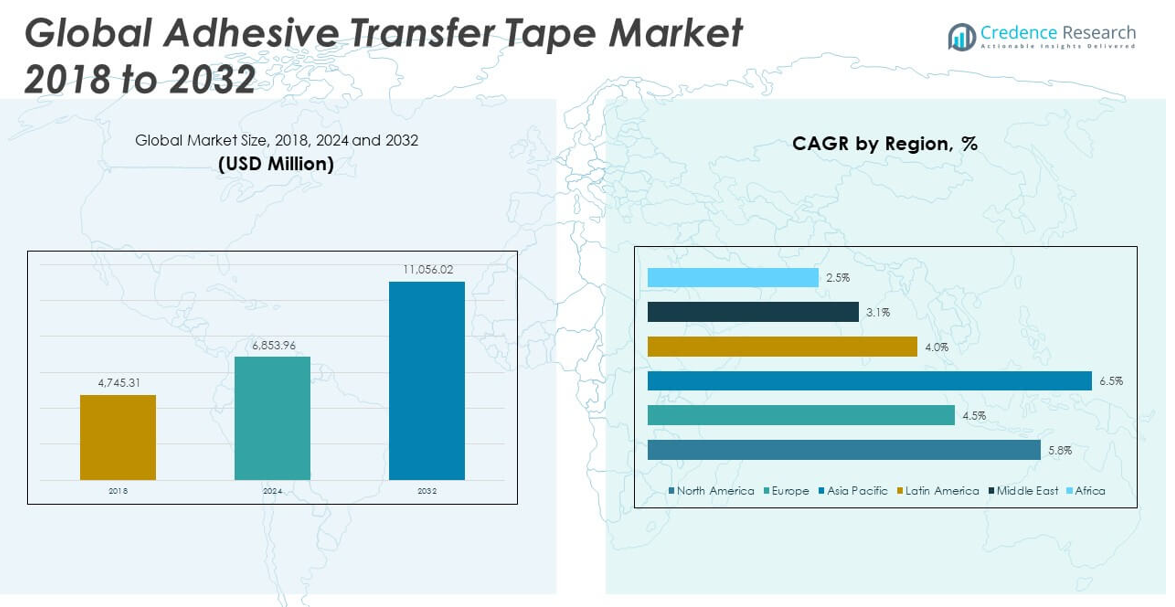

The Global Adhesive Transfer Tape Market size was valued at USD 4,745.31 million in 2018 to USD 6,853.96 million in 2024 and is anticipated to reach USD 11,056.02 million by 2032, at a CAGR of 5.73% during the forecast period.

The rising demand for pressure-sensitive adhesives across various end-use sectors is a key driver supporting the expansion of the adhesive transfer tape market. In the automotive industry, these tapes are increasingly used to replace traditional fasteners, contributing to weight reduction and improved fuel efficiency. As electric vehicles continue to proliferate, manufacturers are favoring adhesive solutions for battery module assembly and sensor integration. In the electronics sector, adhesive transfer tapes are widely employed in display module bonding, touch panel lamination, and printed circuit board insulation due to their high-temperature resistance and precision application. The packaging industry also plays a vital role, with e-commerce growth driving the demand for secure, tamper-evident packaging tapes. Additionally, advancements in adhesive chemistries such as UV-curable and solvent-free variants along with the push for environmentally sustainable materials, are catalyzing innovation and further adoption across industries. As sustainability regulations tighten globally, manufacturers are developing eco-friendly tape products that comply with REACH and RoHS directives, boosting market appeal.

Regionally, Asia-Pacific dominates the global adhesive transfer tape market, accounting for the largest revenue share in 2024 and expected to maintain its lead through 2034. Rapid industrialization, expanding automotive and electronics manufacturing hubs, and increasing infrastructure development in China, India, South Korea, and Southeast Asia are driving regional growth. Government initiatives promoting electric vehicle production and electronics exports have fueled adhesive demand across production lines. North America follows closely, backed by mature manufacturing industries and significant investments in automation and lightweight material integration. The United States, in particular, contributes heavily to demand from the automotive, aerospace, and packaging sectors. Europe also holds a substantial share, led by Germany, the UK, and France, where stringent quality standards and sustainability regulations have encouraged the adoption of high-performance, eco-compliant adhesives.

Market Insights:

- The Global Adhesive Transfer Tape Market was valued at USD 6,853.96 million in 2024 and is expected to reach USD 11,056.02 million by 2032, growing at a CAGR of 5.73%.

- Rising adoption of adhesive transfer tapes in automotive manufacturing is replacing mechanical fasteners, improving efficiency and supporting lightweight vehicle design.

- High demand in the electronics sector is driven by miniaturization trends and the need for thermally stable, precision bonding solutions in compact devices.

- Expansion of e-commerce has increased the need for secure, tamper-evident packaging tapes, driving strong uptake in the logistics and retail sectors.

- Growing sustainability regulations are prompting manufacturers to develop solvent-free and bio-based adhesive tapes compliant with REACH and RoHS standards.

- Asia-Pacific dominates the global market due to rapid industrialization, strong automotive production, and a booming electronics export base.

- North America and Europe maintain strong shares through automation investment, regulatory compliance, and early adoption of eco-friendly adhesive technologies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Increased Preference for Lightweight and Residue-Free Bonding in Automotive Manufacturing

The shift toward lightweight vehicles and cleaner assembly processes has intensified demand for high-performance adhesive solutions in the automotive industry. Adhesive transfer tapes eliminate the need for mechanical fasteners, offering a cleaner aesthetic and reducing overall vehicle weight. They support component integration, especially in interiors and electric vehicle battery modules, where precise bonding is critical. OEMs are increasingly replacing bolts and screws with tapes that simplify assembly and reduce production time. It contributes to enhanced structural integrity while supporting crash-resistant designs. The Global Adhesive Transfer Tape Market benefits directly from these priorities within the automotive manufacturing landscape.

- For example, 3M™ VHB™ Tapes offer high-strength, double-sided acrylic foam construction capable of bonding dissimilar materials such as aluminum, steel, glass, and plastics, supporting vehicle weight reduction and eliminating the need for mechanical fasteners.

Rapid Growth in Electronics Sector Driving Demand for Precision Bonding Solutions

Consumer electronics and industrial electronics manufacturers rely on transfer tapes for precision applications in displays, sensors, and internal circuitry. These tapes ensure consistent thickness, high adhesion, and thermal resistance, making them ideal for smartphones, tablets, and wearable devices. Electronics producers favor them for optical clarity and minimal residue, which preserve sensitive components. The miniaturization of devices has made traditional adhesives unsuitable for complex layouts, increasing reliance on transfer tapes. It supports production speed and cost-efficiency by reducing rework and improving alignment accuracy. The Global Adhesive Transfer Tape Market is directly influenced by this surge in high-density electronics production.

Expansion of E-Commerce and Packaging Sector Enhancing Adoption of Secure Sealing Tapes

E-commerce growth has led to a spike in demand for robust, tamper-evident, and residue-free packaging materials. Transfer tapes offer superior adhesion on paper, cardboard, and plastic surfaces, enabling secure sealing for shipping boxes and product packaging. Retailers and logistics providers prefer these tapes for their clean finish and ability to withstand temperature fluctuations. Demand has risen sharply in warehousing and distribution sectors, where quick and consistent application is vital. It helps minimize product damage during transit and supports sustainable packaging goals. The Global Adhesive Transfer Tape Market gains momentum from the widespread need for reliable packaging solutions.

Sustainability and Regulatory Compliance Encouraging Innovation in Adhesive Formulations

Regulatory pressure to reduce environmental impact is prompting tape manufacturers to invest in solvent-free and bio-based adhesive technologies. Eco-friendly transfer tapes meet stringent standards such as RoHS and REACH, enabling brands to maintain compliance without sacrificing performance. End-users seek solutions that reduce VOC emissions and support recyclability. It drives research and development in pressure-sensitive adhesives with low environmental footprints. The market sees strong activity from manufacturers expanding their green portfolios to align with consumer and industrial sustainability targets. The Global Adhesive Transfer Tape Market is evolving in response to these regulatory and environmental demands.

- For instance, the tesafilm® Eco & Crystal tape features a backing made from 90% recycled PET, demonstrating tesa’s commitment to sustainable innovation without compromising reliability or quality.

Market Trends:

Rising Integration of Smart Manufacturing and Automated Tape Dispensing Systems

Manufacturers are adopting automated tape application systems to enhance production efficiency and precision. Automated dispensing improves the consistency of adhesive transfer tape application in high-speed environments, reducing material waste and operator error. Robotics and programmable systems allow for customization of tape length, placement, and pressure settings across various substrates. It enables seamless integration into modern assembly lines, particularly in electronics, aerospace, and medical device production. Companies investing in Industry 4.0 practices are incorporating smart systems that support adhesive usage analytics and process control. The Global Adhesive Transfer Tape Market reflects this shift toward intelligent, streamlined manufacturing processes.

Increased Adoption of Double-Sided and Differential Adhesive Tapes Across Niche Applications

Manufacturers are expanding their product portfolios to include advanced variants such as double-sided and differential adhesive transfer tapes. These products are tailored for specific use-cases, such as bonding dissimilar materials or achieving varied peel strength on different surfaces. Industries such as signage, medical wearables, and electronics benefit from this customization. It allows for enhanced flexibility in design and function, especially in applications requiring removable or repositionable bonding. Product engineers and designers prefer these solutions for their adaptability in both permanent and semi-permanent applications. The Global Adhesive Transfer Tape Market continues to evolve with the growing demand for specialized adhesive features.

- For example, PPI Adhesive Products’ RD-449 differential double-sided tape is engineered for overlap splicing and bonding dissimilar surfaces such as silicone to non-silicone, with customizable interliner options for die-cutting and varied application techniques.

Growth of Low-Profile and Ultra-Thin Adhesive Tape Solutions for Compact Devices

The trend toward miniaturization in consumer and industrial electronics is driving demand for ultra-thin adhesive transfer tapes. These low-profile products provide strong adhesion while occupying minimal space, supporting compact and lightweight product design. They are used in camera modules, batteries, flexible PCBs, and wearable devices where space constraints are critical. It enhances structural strength without interfering with internal components or increasing device thickness. Suppliers are developing thinner films with high bond strength and thermal stability to meet new application requirements. The Global Adhesive Transfer Tape Market is responding to this trend with innovations that match the demands of compact device engineering.

- For instance, Halco’s low-profile rubber R4 adhesive hook and loop tape features a 9–10 mil adhesive thickness and achieves 80% adhesion within one hour, reaching full strength in 24 hours—ideal for applications where space and rapid assembly are critical.

Emergence of Custom Printed and Functional Tapes for Branding and Utility

Companies are using adhesive transfer tapes not only for bonding but also for branding, traceability, and added utility. Custom printed tapes with logos, instructions, or tracking codes support brand identity and logistical transparency. Some variants offer anti-counterfeit features or integrate conductive or shielding properties for electronic applications. It adds functional value while maintaining strong adhesive characteristics, particularly in packaging, medical diagnostics, and industrial settings. This trend aligns with the broader movement toward multifunctional materials in product design. The Global Adhesive Transfer Tape Market is seeing increased interest in customizable and value-added tape solutions.

Market Challenges Analysis:

Increased Preference for Lightweight and Residue-Free Bonding in Automotive Manufacturing

The shift toward lightweight vehicles and cleaner assembly processes has intensified demand for high-performance adhesive solutions in the automotive industry. Adhesive transfer tapes eliminate the need for mechanical fasteners, offering a cleaner aesthetic and reducing overall vehicle weight. They support component integration, especially in interiors and electric vehicle battery modules, where precise bonding is critical. OEMs are increasingly replacing bolts and screws with tapes that simplify assembly and reduce production time. It contributes to enhanced structural integrity while supporting crash-resistant designs. The Global Adhesive Transfer Tape Market benefits directly from these priorities within the automotive manufacturing landscape.

Rapid Growth in Electronics Sector Driving Demand for Precision Bonding Solutions

Consumer electronics and industrial electronics manufacturers rely on transfer tapes for precision applications in displays, sensors, and internal circuitry. These tapes ensure consistent thickness, high adhesion, and thermal resistance, making them ideal for smartphones, tablets, and wearable devices. Electronics producers favor them for optical clarity and minimal residue, which preserve sensitive components. The miniaturization of devices has made traditional adhesives unsuitable for complex layouts, increasing reliance on transfer tapes. It supports production speed and cost-efficiency by reducing rework and improving alignment accuracy. The Global Adhesive Transfer Tape Market is directly influenced by this surge in high-density electronics production.

Expansion of E-Commerce and Packaging Sector Enhancing Adoption of Secure Sealing Tapes

E-commerce growth has led to a spike in demand for robust, tamper-evident, and residue-free packaging materials. Transfer tapes offer superior adhesion on paper, cardboard, and plastic surfaces, enabling secure sealing for shipping boxes and product packaging. Retailers and logistics providers prefer these tapes for their clean finish and ability to withstand temperature fluctuations. Demand has risen sharply in warehousing and distribution sectors, where quick and consistent application is vital. It helps minimize product damage during transit and supports sustainable packaging goals. The Global Adhesive Transfer Tape Market gains momentum from the widespread need for reliable packaging solutions.

Sustainability and Regulatory Compliance Encouraging Innovation in Adhesive Formulations

Regulatory pressure to reduce environmental impact is prompting tape manufacturers to invest in solvent-free and bio-based adhesive technologies. Eco-friendly transfer tapes meet stringent standards such as RoHS and REACH, enabling brands to maintain compliance without sacrificing performance. End-users seek solutions that reduce VOC emissions and support recyclability. It drives research and development in pressure-sensitive adhesives with low environmental footprints. The market sees strong activity from manufacturers expanding their green portfolios to align with consumer and industrial sustainability targets. The Global Adhesive Transfer Tape Market is evolving in response to these regulatory and environmental demands.

Market Opportunities:

Expansion into Emerging Economies with Growing Manufacturing Infrastructure

Rapid industrialization across emerging markets in Asia-Pacific, Latin America, and Africa creates strong growth potential for adhesive tape manufacturers. Increasing investments in electronics, automotive, and consumer goods sectors in these regions boost demand for high-performance bonding solutions. Governments are supporting local production through favorable policies and infrastructure development. It enables adhesive transfer tape providers to establish regional facilities and cater to localized needs. The Global Adhesive Transfer Tape Market can capitalize on this momentum by offering cost-effective and application-specific solutions tailored to local industries.

Rising Demand for Sustainable and Eco-Friendly Adhesive Solutions

Environmental regulations and corporate sustainability goals are shifting preferences toward greener adhesive technologies. Manufacturers are innovating with solvent-free, biodegradable, and recyclable tape materials to meet evolving customer expectations. These advancements align with global climate goals and offer competitive differentiation. It opens new opportunities in markets that prioritize low-VOC emissions and waste reduction. The Global Adhesive Transfer Tape Market is well-positioned to benefit by expanding its eco-conscious product lines and forming partnerships with sustainability-driven brands.

Market Segmentation Analysis:

By Product Type

The Global Adhesive Transfer Tape Market offers a diverse range of products tailored to application-specific requirements. Single-lined tapes lead in usage due to their simplicity and efficiency in industrial automation. Double-lined variants are preferred in assembly processes where exact alignment is crucial. Extended-liner tapes support larger surface coverage and ease of manual handling. Fiber/scrim reinforced tapes offer enhanced tensile strength and are ideal for heavy-duty bonding in construction and automotive sectors. Each product type contributes to a wide range of industrial and commercial applications requiring clean and reliable adhesive performance.

- For instance, Tesa’s 4965 DL features two liners for precise die-cutting and exact positioning in assembly. It uses a 4.5 mil (0.11 mm) transparent PET film with a modified acrylic adhesive, allowing for high bond strength (up to 11 N/cm) and temperature resistance up to 392°F (200°C).

By Material Type

Material selection plays a critical role in performance, durability, and regulatory compliance. Acrylic adhesives dominate the Global Adhesive Transfer Tape Market due to their excellent UV resistance, adhesion strength, and versatility across substrates. Silicone materials serve high-temperature and chemically resistant environments, particularly in electronics and aerospace. Rubber adhesives provide strong initial tack for general-purpose use. Polypropylene and polyvinyl chloride offer cost-effective solutions for disposable or temporary applications. Paper-based tapes cater to eco-conscious markets and lightweight bonding. It also includes other specialized materials tailored for industry-specific use cases.

By Form

The market features a wide variety of adhesive transfer tapes by form to match functional and environmental demands. Waterproof tapes are widely used in automotive, construction, and marine industries for moisture-resistant bonding. Heat-resistant tapes support performance in elevated temperatures, particularly in engine components and electronics. Antistatic variants protect sensitive components from electrostatic discharge, a critical need in electronic assembly. Holographic and anti-counterfeit forms help ensure product authenticity and branding, especially in packaging and retail. Others include niche forms tailored for unique applications requiring flexibility or surface conformity. It reflects evolving demand for specialty features beyond basic adhesion.

- 3M’s Ultra High Temperature Adhesive Transfer Tape 9085, for instance, offers a 5 mil (0.13 mm) profile with exceptional peel and shear strength, and can withstand short-term temperatures up to 540°F (280°C) and long-term exposure at 350°F (177°C)

By Application

Applications span across both industrial and consumer markets. Packaging remains a key segment due to the need for secure, tamper-evident seals in logistics and e-commerce. Automotive applications continue to expand with growing adoption of adhesives in structural bonding, battery modules, and interior fittings. Electronics utilize these tapes for display bonding, insulation, and component assembly, where clean, residue-free application is essential. In healthcare, tapes serve medical device assembly and sterile packaging. Retail and consumer goods sectors apply them for branding, product protection, and user convenience. The Global Adhesive Transfer Tape Market addresses a broad application landscape with rising performance expectations across each sector.

Segmentation:

By Product Type

- Single-Lined

- Double-Lined

- Extended-Liner

- Fiber/Scrim Reinforced

By Material Type

- Acrylic

- Paper

- Polypropylene

- Polyvinyl Chloride

- Rubber

- Silicone

- Others

By Form

- Waterproof

- Heat-Resistant

- Antistatic

- Holographic

- Anti-Counterfeit

- Others

By Application

- Packaging

- Automotive

- Electronics

- Healthcare

- Retail & Consumer Goods

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

The North America Adhesive Transfer Tape Market size was valued at USD 1,416.76 million in 2018 to USD 2,015.24 million in 2024 and is anticipated to reach USD 3,264.01 million by 2032, at a CAGR of 5.8% during the forecast period. North America holds a 22% share of the Global Adhesive Transfer Tape Market, driven by strong demand from automotive, aerospace, and packaging sectors. The region benefits from advanced manufacturing facilities, a focus on lightweight vehicle design, and high consumer expectations for product quality. The United States leads the market with large-scale adoption of high-performance tapes in electronics and industrial applications. It supports consistent demand through innovation in bio-based adhesives and low-VOC solutions. Growing interest in sustainable packaging has also created new opportunities for adhesive tape suppliers. North America remains a lucrative region due to its early adoption of automation and regulatory focus on quality standards.

The Europe Adhesive Transfer Tape Market size was valued at USD 913.76 million in 2018 to USD 1,249.70 million in 2024 and is anticipated to reach USD 1,838.98 million by 2032, at a CAGR of 4.5% during the forecast period. Europe represents 14% of the Global Adhesive Transfer Tape Market, with significant contributions from Germany, France, and the UK. The region emphasizes eco-friendly adhesives and regulatory compliance, encouraging innovation in solvent-free and recyclable tape products. Automotive OEMs in Germany and electric vehicle production across the EU are fueling demand for high-strength tapes. It benefits from a skilled industrial base and robust R&D activities. Medical device manufacturing and electronics also contribute to steady growth. Europe’s regulatory-driven approach fosters steady but stable expansion across industrial segments.

The Asia Pacific Adhesive Transfer Tape Market size was valued at USD 2,023.12 million in 2018 to USD 3,032.71 million in 2024 and is anticipated to reach USD 5,197.60 million by 2032, at a CAGR of 6.5% during the forecast period. Asia Pacific holds the largest share at 39% of the Global Adhesive Transfer Tape Market, supported by expansive manufacturing capacity and rising domestic consumption. China, India, South Korea, and Japan are key contributors due to their thriving electronics, automotive, and packaging industries. Regional producers leverage cost advantages and scale to meet global and domestic demand. It witnesses rising demand for smart devices, EV batteries, and precision industrial tapes. Government incentives for local manufacturing and green technology adoption further encourage growth. Asia Pacific continues to outpace other regions in volume and production innovation.

The Latin America Adhesive Transfer Tape Market size was valued at USD 206.42 million in 2018 to USD 294.12 million in 2024 and is anticipated to reach USD 415.18 million by 2032, at a CAGR of 4.0% during the forecast period. Latin America contributes 3% to the Global Adhesive Transfer Tape Market and displays moderate but consistent growth. Brazil and Mexico drive demand, primarily from the consumer goods, food packaging, and automotive sectors. Regional growth is supported by investments in light manufacturing and logistics infrastructure. It faces pricing pressure and import reliance, which restricts rapid market penetration. Rising urbanization and demand for packaged goods provide tailwinds for expansion. Latin America presents emerging opportunities for suppliers offering affordable and sustainable tape solutions.

The Middle East Adhesive Transfer Tape Market size was valued at USD 116.73 million in 2018 to USD 152.11 million in 2024 and is anticipated to reach USD 201.15 million by 2032, at a CAGR of 3.1% during the forecast period. The Middle East holds a 2% share of the Global Adhesive Transfer Tape Market and is gradually expanding through infrastructure development and industrial diversification. The UAE and Saudi Arabia lead regional demand, especially in construction and electronics assembly. Packaging applications are also rising due to increasing e-commerce activity. It relies on imports for advanced adhesive materials but is investing in localized solutions. Growth remains steady due to limited domestic production capacity. The region offers potential in sectors seeking thermal insulation and lightweight adhesive solutions.

The Africa Adhesive Transfer Tape Market size was valued at USD 68.52 million in 2018 to USD 110.08 million in 2024 and is anticipated to reach USD 139.10 million by 2032, at a CAGR of 2.5% during the forecast period. Africa accounts for just 1% of the Global Adhesive Transfer Tape Market, with demand concentrated in South Africa, Nigeria, and Egypt. The region is still in the early stages of industrial tape adoption, driven by construction, consumer packaging, and healthcare sectors. Market expansion is limited by infrastructure gaps and low local manufacturing. It shows growing interest in medical-grade and temperature-resistant adhesive tapes. Suppliers targeting cost-effective, durable products may gain traction. Africa holds long-term potential as industrialization gains momentum.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- 3M Company

- Nitto Denko Corporation

- Saint-Gobain Group

- Tesa SE (Beiersdorf AG)

- Scapa Group PLC

- Kruse Adhesive Tape, Inc.

- CCT Tapes, Inc.

- Surface Shields, Inc.

- Vibac Group S.p.a.

- Advance Tapes International

Competitive Analysis:

The Global Adhesive Transfer Tape Market is moderately consolidated, with several global and regional players competing on technology, product performance, and pricing. Key companies include 3M Company, Nitto Denko Corporation, Avery Dennison Corporation, Tesa SE, Intertape Polymer Group, Scapa Group, and Lohmann GmbH. These firms focus on expanding their adhesive portfolios through innovation in solvent-free and high-strength tapes. It drives competition through strategic acquisitions, regional expansions, and partnerships with end-use industries such as electronics, automotive, and packaging. Emerging players from Asia-Pacific are intensifying price-based competition while introducing application-specific products. Leading manufacturers invest in R&D to enhance thermal stability, transparency, and environmental compliance. The Global Adhesive Transfer Tape Market exhibits dynamic growth patterns shaped by rapid product differentiation and evolving customer requirements.

Recent Developments:

- In March 2025, Vibac Group announced the opening of a new operation in Tennessee, USA. This strategic expansion strengthens Vibac’s presence in North America, enhancing product availability, optimizing logistics, and providing more direct support to customers and partners in the region. The new facility marks a key milestone in Vibac’s global growth strategy and commitment to innovation and quality in adhesive tapes.

- In March 2025, tesa (a leading global adhesive tape manufacturer) partnered with OMP in China to optimize its supply chain planning. It introduced advanced automation and analytics to strengthen inventory control and delivery efficiency across tesa’s regional operations.

- In May 2023, Nitto Denko introduced five new products certified under its PlanetFlags and HumanFlags sustainability initiatives. Among these is a bio-based adhesive tape with recycled films, designed as a functional double-sided tape for component fixation. This launch reflects Nitto’s commitment to creating products that contribute to the global environment and human wellbeing, aligning with its broader strategy for sustainable innovation.

Market Concentration & Characteristics:

The Global Adhesive Transfer Tape Market demonstrates a moderate to high level of concentration, with a few multinational corporations holding significant market shares. It features strong brand loyalty and long-term supplier relationships, especially in regulated industries such as automotive, medical, and electronics. The market is characterized by high technical requirements, including adhesive strength, thermal resistance, and residue-free application. Innovation cycles remain frequent, with firms introducing thinner, eco-friendly, and specialty-grade tapes to meet evolving industrial demands. It is also marked by a growing shift toward customization, where end-users seek application-specific formulations. While global players dominate in volume and reach, regional manufacturers offer localized solutions at competitive prices. The Global Adhesive Transfer Tape Market maintains a balance between established technologies and emerging innovations.

Report Coverage:

The research report offers an in-depth analysis based on Product Type, Material Type, Form, Application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising demand for eco-friendly and solvent-free tapes will drive innovation in adhesive formulations.

- Increasing use of transfer tapes in electric vehicle battery assembly will expand automotive applications.

- Growth in compact consumer electronics will boost adoption of ultra-thin and precision bonding tapes.

- E-commerce expansion will fuel demand for tamper-evident and high-strength packaging tapes.

- Automation in manufacturing will increase reliance on machine-compatible and consistent adhesive tapes.

- Customization of tapes for industry-specific needs will enhance product differentiation and market reach.

- Emerging economies will present new opportunities through expanding infrastructure and industrial sectors.

- Strategic partnerships and M&A among global players will reshape competitive dynamics.

- Regulatory pressure will accelerate the development of recyclable and low-VOC adhesive materials.

- Technological advancements in smart and functional tapes will unlock new industrial applications.