| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Africa Construction Aggregates Market Size 2024 |

USD 23,998.93 million |

| Africa Construction Aggregates Market, CAGR |

3.86% |

| Africa Construction Aggregates Market Size 2032 |

USD 32,501.85 million |

Market Overview

Africa Construction Aggregates market size was valued at USD 23,998.93 million in 2024 and is anticipated to reach USD 32,501.85 million by 2032, at a CAGR of 3.86% during the forecast period (2024-2032).

The Africa construction aggregates market is driven by rapid urbanization, infrastructure development, and government investments in residential and commercial construction projects. Increasing demand for sustainable and high-quality building materials fuels market growth, while public-private partnerships (PPPs) further accelerate infrastructure expansion. The rise in road and highway construction, coupled with industrialization, enhances aggregate consumption. Advancements in mining and crushing technologies improve production efficiency, reducing costs and environmental impact. However, supply chain disruptions and fluctuating raw material prices pose challenges. The market also sees a growing shift towards recycled aggregates and eco-friendly alternatives to meet sustainability goals. Foreign investments in Africa’s construction sector contribute to market expansion, while regulatory frameworks and quality standards shape competitive dynamics. The increasing adoption of mechanized mining techniques and digital solutions is expected to enhance operational efficiency. Overall, the sector’s steady growth is supported by strong demand from real estate, transportation, and industrial construction projects.

The Africa construction aggregates market is geographically diverse, with significant growth in countries such as Egypt, Nigeria, Algeria, and Morocco, driven by urbanization, infrastructure development, and government-backed construction projects. Expanding road networks, commercial buildings, and residential housing fuel aggregate demand across the continent. Key players in the market include CRH plc, Heidelberg Materials AG, Vulcan Materials Company, Martin Marietta Materials Inc., Adbri Limited, Eagle Materials Inc., SRC Group, Tarmac, Sika AG, and Boral Limited. These companies focus on sustainable production methods, advanced quarrying technologies, and strategic partnerships to enhance market presence. Many industry leaders are investing in recycled aggregates and environmentally friendly materials to comply with regulatory standards and reduce environmental impact. Additionally, foreign investments and public-private partnerships (PPPs) play a crucial role in supporting aggregate production and distribution. With continuous infrastructure advancements, Africa’s construction aggregates market is expected to witness steady expansion and increased competition among key industry players.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Africa construction aggregates market was valued at USD 23,998.93 million in 2024 and is projected to reach USD 32,501.85 million by 2032, growing at a CAGR of 3.86% from 2024 to 2032.

- Rapid urbanization and large-scale infrastructure projects, including roads, bridges, and residential developments, are key drivers of market growth.

- The adoption of sustainable and recycled aggregates is increasing as governments enforce stricter environmental regulations.

- Major players like CRH plc, Heidelberg Materials AG, and Vulcan Materials Company are investing in advanced mining technologies and regional expansion.

- Challenges such as supply chain disruptions, fluctuating raw material prices, and regulatory constraints hinder market growth.

- Egypt, Nigeria, Algeria, and Morocco are leading regional markets, driven by government-backed construction initiatives and foreign investments.

- The growing demand for high-quality aggregates in commercial and industrial projects is expected to create new growth opportunities in the coming years.

Report scope

This reports segments are Africa Construction Aggregates Market as Follows;

Market Drivers

Rapid Urbanization and Population Growth

Africa’s construction aggregates market is primarily driven by rapid urbanization and a steadily growing population. As cities expand to accommodate rising urban dwellers, the demand for residential, commercial, and industrial infrastructure increases significantly. Governments across the continent are investing in affordable housing projects and smart city developments, fueling the need for construction aggregates such as sand, gravel, and crushed stone. The United Nations projects that Africa’s urban population will double by 2050, necessitating massive infrastructure investments. This surge in urban development directly influences the consumption of aggregates, making them a critical component in urban planning and real estate expansion.

Infrastructure Development and Government Investments

Large-scale infrastructure projects, including roads, highways, bridges, railways, and ports, are key drivers of the construction aggregates market in Africa. For instance, government initiatives like South Africa’s Strategic Integrated Projects (SIPs) and Ethiopia’s Growth and Transformation Plan (GTP) emphasize extensive construction activity, increasing demand for aggregates. Initiatives like the African Union’s Agenda 2063 and national infrastructure master plans encourage extensive construction activity, increasing demand for aggregates. Additionally, public-private partnerships (PPPs) and foreign direct investments (FDIs) from China, Europe, and the Middle East are further accelerating infrastructure growth. The expansion of industrial corridors and trade routes also enhances aggregate consumption across various sectors.

Technological Advancements in Mining and Production

The adoption of modern technologies in the extraction and processing of construction aggregates is enhancing efficiency and reducing environmental impact. For instance, companies like Lafarge Africa and Dangote Cement are implementing advanced crushing and screening equipment to improve productivity while minimizing waste. Sustainable mining practices, such as the use of recycled aggregates and eco-friendly processing techniques, are gaining traction as governments enforce stricter environmental regulations. The integration of AI and IoT in aggregate production enables better quality control and cost optimization, making it easier for companies to meet growing market demand. These innovations contribute to a more competitive and sustainable aggregates industry.

Rising Demand for Sustainable and High-Quality Materials

Sustainability concerns and the push for environmentally responsible construction practices are shaping the demand for aggregates in Africa. As regulatory frameworks tighten around resource extraction and carbon emissions, there is an increasing preference for recycled aggregates and alternative materials such as manufactured sand. Construction firms are adopting greener materials to comply with sustainability standards and achieve long-term cost savings. Additionally, the demand for high-quality aggregates with enhanced strength and durability is rising, driven by stringent building codes and safety regulations. As the construction sector prioritizes resilience and longevity, the market for premium-grade aggregates continues to grow, further supporting industry expansion.

Market Trends

Expansion of Infrastructure and Mega Construction Projects

The rapid expansion of infrastructure projects, including highways, railways, airports, and smart cities, is a dominant trend in the African construction aggregates market. For instance, the African Union’s Agenda 2063 emphasizes the development of transcontinental highways and railways, boosting aggregate consumption. Countries such as Nigeria, Egypt, Kenya, and South Africa are witnessing an upsurge in urban development, increasing aggregate consumption. Moreover, the rise of public-private partnerships (PPPs) is accelerating investment in transportation networks, boosting aggregate demand. As governments focus on improving connectivity and trade routes, the market is poised for continuous growth.

Technological Advancements in Aggregate Production

The adoption of modern technologies in aggregate extraction, processing, and transportation is revolutionizing the industry. For instance, companies like Dangote Cement are utilizing automated crushing plants and AI-driven quality control systems to enhance operational efficiency and reduce waste. Innovations such as automated crushing plants, AI-driven quality control, and IoT-enabled monitoring systems are enhancing operational efficiency and reducing waste. The use of advanced screening and washing equipment ensures higher-quality aggregates that meet stringent construction standards. Additionally, digital solutions for logistics and supply chain management are improving aggregate distribution, minimizing delays, and reducing costs. As Africa’s construction sector modernizes, the integration of smart technologies will continue to drive efficiency and sustainability in aggregate production.

Increasing Adoption of Recycled and Sustainable Aggregates

The Africa construction aggregates market is witnessing a significant shift toward sustainable and recycled materials. As environmental concerns and resource conservation efforts gain momentum, construction companies are increasingly utilizing recycled aggregates from demolished structures and industrial by-products such as slag and fly ash. Governments and regulatory bodies are implementing stricter environmental policies, encouraging the use of eco-friendly alternatives to natural aggregates. This trend not only reduces environmental degradation caused by excessive mining but also enhances cost efficiency for construction projects. Sustainable construction practices are becoming a key factor in project approvals, further driving demand for green aggregates.

Rising Demand for High-Performance Aggregates

The growing emphasis on durability and structural integrity in construction is driving demand for high-performance aggregates. Engineers and builders are prioritizing materials that enhance the strength and longevity of structures, especially in large infrastructure and commercial projects. High-strength concrete, asphalt mixtures, and advanced building materials require superior-quality aggregates, pushing manufacturers to improve processing techniques. Additionally, the increasing prevalence of extreme weather conditions and climate resilience initiatives necessitate the use of aggregates that enhance structural stability. As construction standards become more stringent, the market for premium-grade aggregates is expected to grow, reinforcing Africa’s infrastructure development efforts.

Market Challenges Analysis

Supply Chain Disruptions and Resource Constraints

The Africa construction aggregates market faces significant challenges related to supply chain inefficiencies and resource constraints. Inconsistent raw material availability, inadequate transportation infrastructure, and logistical bottlenecks hinder the smooth distribution of aggregates across various regions. Many African countries struggle with poor road networks and limited railway connectivity, increasing transportation costs and delaying project timelines. Additionally, fluctuations in fuel prices and import dependency on mining equipment further strain the supply chain, making aggregate procurement expensive and unpredictable. Unregulated and illegal mining activities also pose risks to resource sustainability, leading to environmental degradation and stricter governmental restrictions that limit aggregate extraction in certain areas.

Regulatory Challenges and Environmental Concerns

Strict environmental regulations and evolving government policies present another major challenge for the construction aggregates market in Africa. For instance, government initiatives in Kenya and Tanzania have introduced stricter mining laws to control excessive quarrying and protect natural ecosystems. While these regulations support long-term sustainability, they also increase compliance costs for businesses, requiring investments in eco-friendly mining techniques and waste management solutions. Moreover, obtaining necessary permits for quarrying operations can be time-consuming and bureaucratic, delaying project approvals. The increasing demand for sustainable alternatives, such as recycled aggregates, requires significant infrastructure and technology investments, which many local producers struggle to afford. Without clear policy frameworks and improved regulatory coordination, these challenges can slow down market growth and hinder the availability of essential aggregates for large-scale construction projects.

Market Opportunities

Africa’s construction aggregates market presents significant growth opportunities driven by rising infrastructure development and urban expansion. Governments across the continent are heavily investing in large-scale projects, including roads, highways, bridges, airports, and railways, to support economic growth and regional connectivity. Public-private partnerships (PPPs) and foreign direct investments (FDIs) from countries such as China, the United States, and the European Union are further accelerating construction activities. The demand for high-quality aggregates is increasing as builders prioritize durable materials that enhance structural integrity and longevity. Additionally, rapid urbanization and population growth continue to fuel demand for residential and commercial real estate, creating a steady need for aggregates in cement production and concrete applications. The expansion of industrial and manufacturing sectors also drives the consumption of aggregates in industrial flooring, precast concrete, and specialized construction projects.

Sustainability and technological advancements present additional market opportunities. As environmental concerns gain traction, the demand for recycled aggregates and eco-friendly alternatives is rising. Governments are promoting sustainable construction practices, encouraging the use of secondary aggregates from demolished structures and industrial by-products. This shift creates opportunities for companies investing in innovative recycling technologies and sustainable aggregate production. Additionally, advancements in mining and quarrying equipment, including automation and digital monitoring systems, are improving operational efficiency and reducing waste. The adoption of AI and IoT-enabled logistics solutions further enhances supply chain management, enabling faster and more cost-effective distribution of aggregates. As Africa continues to modernize its construction sector, companies that leverage technology, sustainability, and efficient resource management will gain a competitive edge, making the construction aggregates market a lucrative industry for long-term investment.

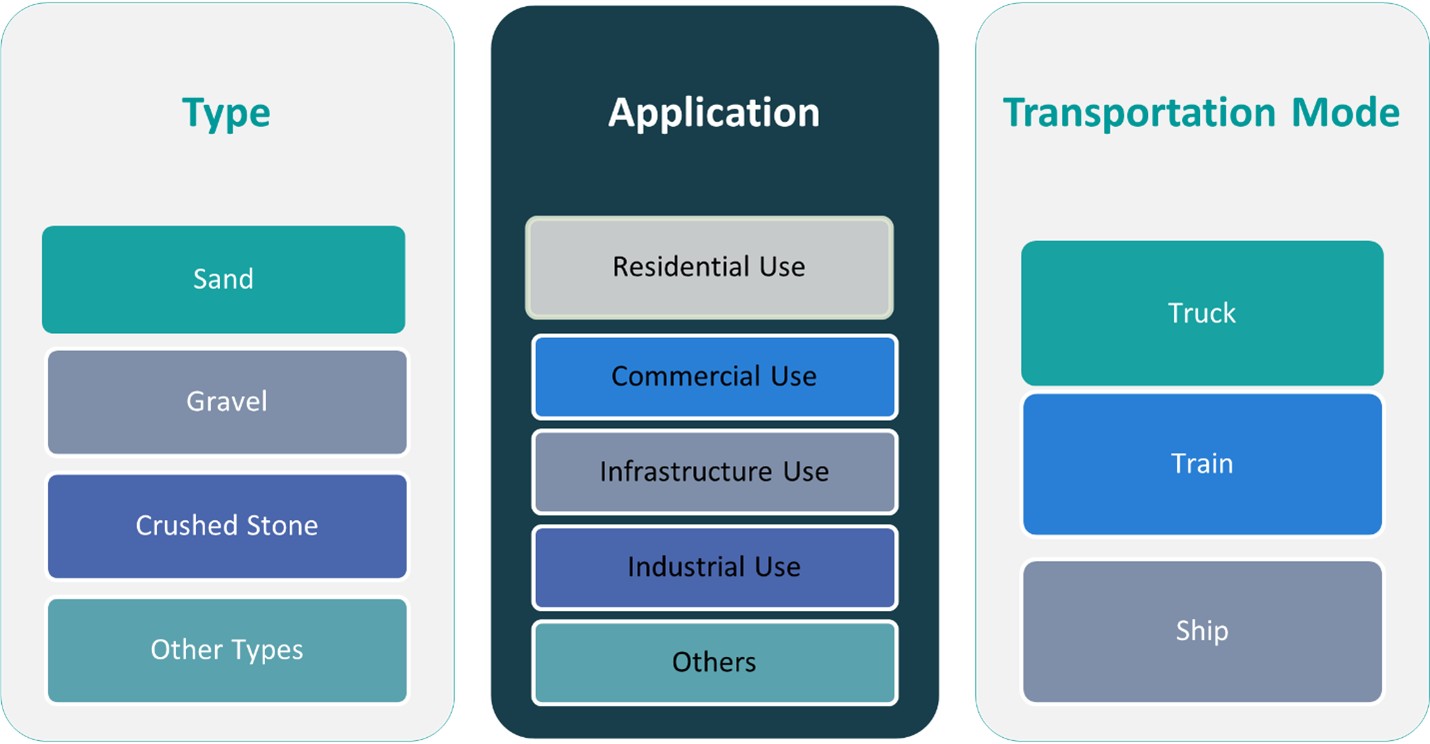

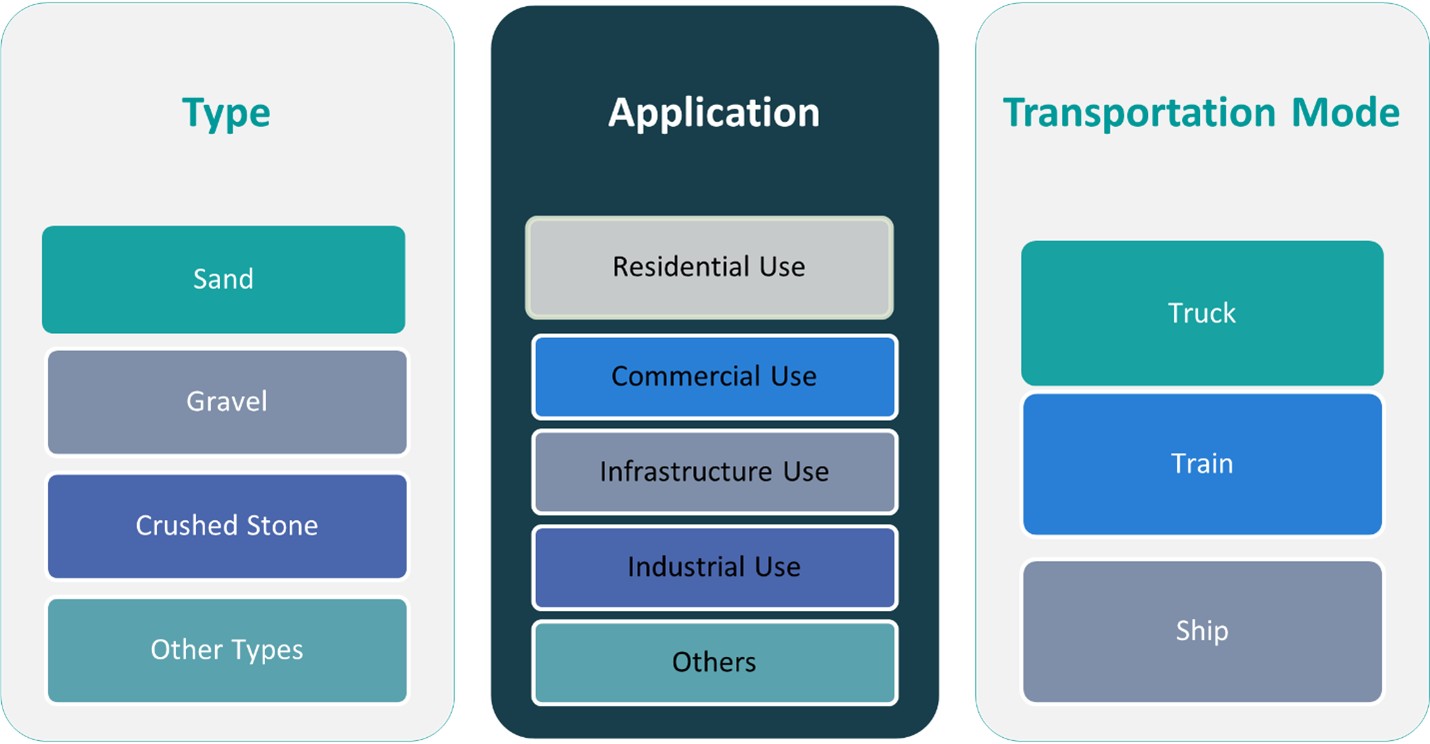

Market Segmentation Analysis:

By Type:

The Africa construction aggregates market is segmented into sand, gravel, crushed stone, and other types. Sand remains the most widely used aggregate due to its essential role in concrete production, masonry work, and plastering. The increasing demand for high-quality fine aggregates in urban construction projects drives the growth of this segment. However, environmental concerns related to excessive sand mining have led to stricter regulations, encouraging the adoption of alternatives like manufactured sand. Gravel is another key segment, extensively utilized in road construction, drainage systems, and railway ballast. Its durability and cost-effectiveness make it a preferred choice for large infrastructure projects. Crushed stone holds a significant share in the market, primarily used in concrete mixtures, road base materials, and foundation construction. The demand for crushed stone is growing due to its superior strength and versatility. The other types segment includes lightweight aggregates, recycled aggregates, and specialty materials, which are gaining traction as sustainable construction practices become more prevalent across Africa.

By Application:

The application-based segmentation of Africa’s construction aggregates market includes residential, commercial, infrastructure, and industrial uses. Residential construction is a major consumer of aggregates, driven by rapid urbanization, population growth, and increasing government initiatives for affordable housing. The expansion of smart cities and urban development projects further fuels demand in this segment. Commercial use includes shopping malls, office spaces, and hospitality infrastructure, where high-quality aggregates are essential for durable and aesthetically appealing structures. The infrastructure segment is the largest market driver, with roads, bridges, railways, and ports requiring vast quantities of aggregates for stability and longevity. Government investments and international funding for infrastructure development significantly boost this segment. Lastly, industrial applications encompass manufacturing plants, warehouses, and specialized facilities that require high-strength concrete and advanced building materials. The increasing focus on industrialization across Africa is expected to drive demand for aggregates in this segment, supporting economic growth and modernization.

Segments:

Based on Type:

- Sand

- Gravel

- Crushed Stone

- Other Types

Based on Application:

- Residential Use

- Commercial Use

- Infrastructure Use

- Industrial Use

Based on End- User:

Based on the Geography:

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

Egypt

Egypt holds the largest market share of approximately 28%, driven by its booming construction sector, infrastructure megaprojects, and urban expansion initiatives. The Egyptian government is investing heavily in new cities, including the New Administrative Capital and large-scale residential developments. Additionally, major infrastructure projects such as the expansion of the Suez Canal, bridges, and highways significantly boost the demand for construction aggregates. With strong government support, foreign direct investments, and a rising focus on sustainable construction materials, Egypt continues to dominate the regional market.

Nigeria

Nigeria follows closely with a market share of around 23%, fueled by rapid urbanization, population growth, and substantial infrastructure development. As Africa’s largest economy, Nigeria is experiencing increased demand for residential, commercial, and industrial construction projects. Government-led initiatives such as the National Integrated Infrastructure Master Plan and large road rehabilitation projects have accelerated aggregate consumption. Lagos, Abuja, and other rapidly growing cities are witnessing a surge in real estate developments, increasing the need for high-quality aggregates. Additionally, the expansion of industrial hubs and transportation networks, including rail and airport projects, is expected to sustain Nigeria’s market growth in the coming years.

Algeria

Algeria holds a market share of approximately 18%, with strong government investments in housing and public infrastructure projects. The Algerian government has launched several initiatives to modernize road networks, airports, and industrial zones, which significantly contribute to aggregate demand. Additionally, Algeria is a key producer of construction materials, with abundant limestone reserves supporting the crushed stone segment. The country’s focus on diversifying its economy and reducing reliance on oil has led to increased investments in real estate and tourism infrastructure, further driving the construction aggregates market. Sustainable mining practices and the use of alternative aggregates are gaining attention as Algeria implements stricter environmental regulations.

Morocco

Morocco accounts for around 15% of the market, benefiting from a steady rise in urbanization, smart city projects, and infrastructure expansion. The Moroccan government has prioritized transportation infrastructure, including new highways, railway projects such as the high-speed rail (Al Boraq), and port expansions. The construction of industrial parks and economic free zones is further increasing aggregate consumption. Additionally, Morocco’s growing tourism industry has led to a rise in hotel, resort, and commercial developments, boosting the demand for high-quality construction aggregates.

Rest of Africa

The Rest of Africa collectively contributes to the remaining 16% of the market, driven by infrastructure growth in countries like Kenya, South Africa, and Ethiopia. These nations are experiencing increased aggregate consumption due to rising foreign investments, government-backed housing schemes, and industrialization efforts. As regional economies continue to develop, the construction aggregates market across Africa is expected to witness steady growth, offering opportunities for local and international industry players.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- CRH plc

- Heidelberg Materials AG

- Vulcan Materials Company

- Martin Marietta Materials Inc.

- Adbri Limited

- Eagle Materials Inc.

- SRC Group

- Tarmac

- Sika AG

- Boral Limited

Competitive Analysis

The Africa construction aggregates market is highly competitive, with leading players such as CRH plc, Heidelberg Materials AG, Vulcan Materials Company, Martin Marietta Materials Inc., Adbri Limited, Eagle Materials Inc., SRC Group, Tarmac, Sika AG, and Boral Limited dominating the industry. These companies compete based on product quality, pricing, innovation, and regional market presence. Many key players focus on expanding their production facilities, adopting advanced quarrying and crushing technologies, and enhancing supply chain efficiency to maintain a competitive edge. Sustainability and environmental regulations are shaping the competitive landscape, prompting major firms to invest in recycled aggregates and eco-friendly production methods. Mergers, acquisitions, and strategic partnerships are common strategies among these players to strengthen market positioning and expand their footprint across Africa. Additionally, foreign investments and government collaborations play a crucial role in determining market leadership. As demand for high-quality construction materials grows, companies with innovative solutions and strong distribution networks are expected to gain a significant advantage.

Recent Developments

- In September 2024, Holcim started the Holcim Sustainable Construction Academy. This is a free online training program that teaches about eco-friendly building methods. It helps people who work in construction learn new skills. The program offers both online classes and face-to-face training.

- In October 2024, CRH Ventures launched the Sustainable Building Materials accelerator to scale up creative climate and build technology firms that specialize in CO2-mineralized materials and sustainable binder solutions.

- In July 2024, Heidelberg Materials launched a recycling plant in Katowice, Poland, using a patented ReConcrete process to recycle demolition concrete and replace virgin material.

- In July 2024, Cemex USA formed a joint venture with Couch Aggregates and Premier Holdings for the production and distribution of aggregates in the Mid-South region. Cemex USA already had a strategic partnership with Couch Aggregates. The company stated that this vertical integration, combined with Premier Holdings’ Gulf Coast marine terminals, would accelerate its regional growth.

- In April 2024, Rogers Group joined The Road Forward initiative to advance sustainable asphalt production and paving practices.

- In January 2024, Heidelberg Materials launched Evo Build, its new global brand for low-carbon and circular products. This initiative aims to provide sustainable solutions for the construction industry, focusing on reducing carbon emissions and promoting circular economy principles.

Market Concentration & Characteristics

The Africa construction aggregates market exhibits a moderate to high market concentration, with a mix of global industry leaders and regional suppliers competing for market share. Major players such as CRH plc, Heidelberg Materials AG, Vulcan Materials Company, and Martin Marietta Materials Inc. dominate the market, leveraging advanced production technologies, extensive distribution networks, and strong financial capabilities. The industry is characterized by high demand for sustainable and high-quality aggregates, driven by infrastructure expansion and urban development. Market competition is further influenced by government regulations, environmental policies, and the availability of raw materials. Local and mid-sized suppliers play a crucial role in addressing regional demand, especially in areas with limited large-scale production facilities. Technological advancements in quarrying, crushing, and recycling processes are shaping industry dynamics, encouraging innovation and operational efficiency. As construction activities grow across Africa, market consolidation and strategic partnerships are expected to drive long-term growth and competitiveness.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Transportation Mode and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Africa construction aggregates market is expected to grow steadily, driven by increasing infrastructure and urban development projects.

- Government investments in road networks, bridges, and smart cities will continue to boost aggregate demand.

- Sustainability and environmental regulations will encourage the adoption of recycled and alternative aggregates.

- Technological advancements in quarrying, crushing, and processing will enhance efficiency and reduce production costs.

- Public-private partnerships and foreign direct investments will play a crucial role in market expansion.

- Rising demand for high-quality aggregates will push manufacturers to improve product standards and material durability.

- Supply chain improvements and better logistics infrastructure will help overcome transportation challenges.

- Local and regional players will expand their market presence to meet increasing domestic demand.

- Mergers, acquisitions, and strategic collaborations will drive market consolidation and competitiveness.

- The growing industrial and commercial construction sectors will create new opportunities for aggregate suppliers.