Market Overview:

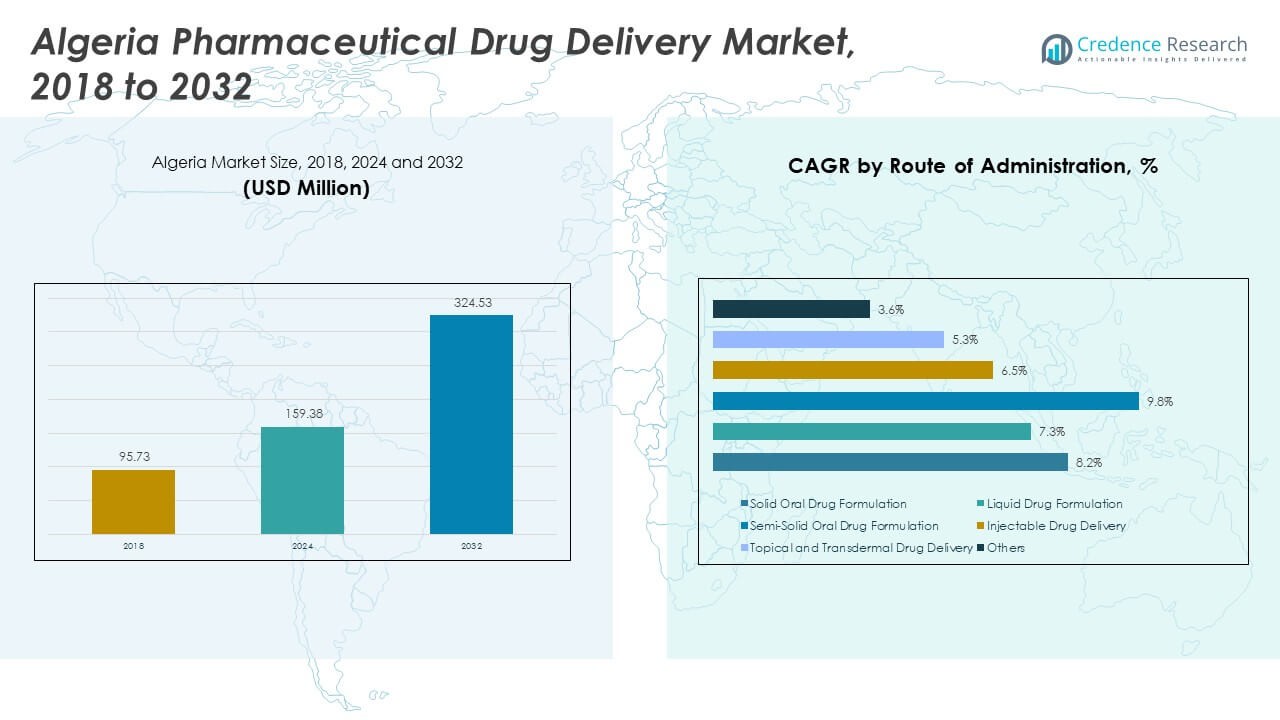

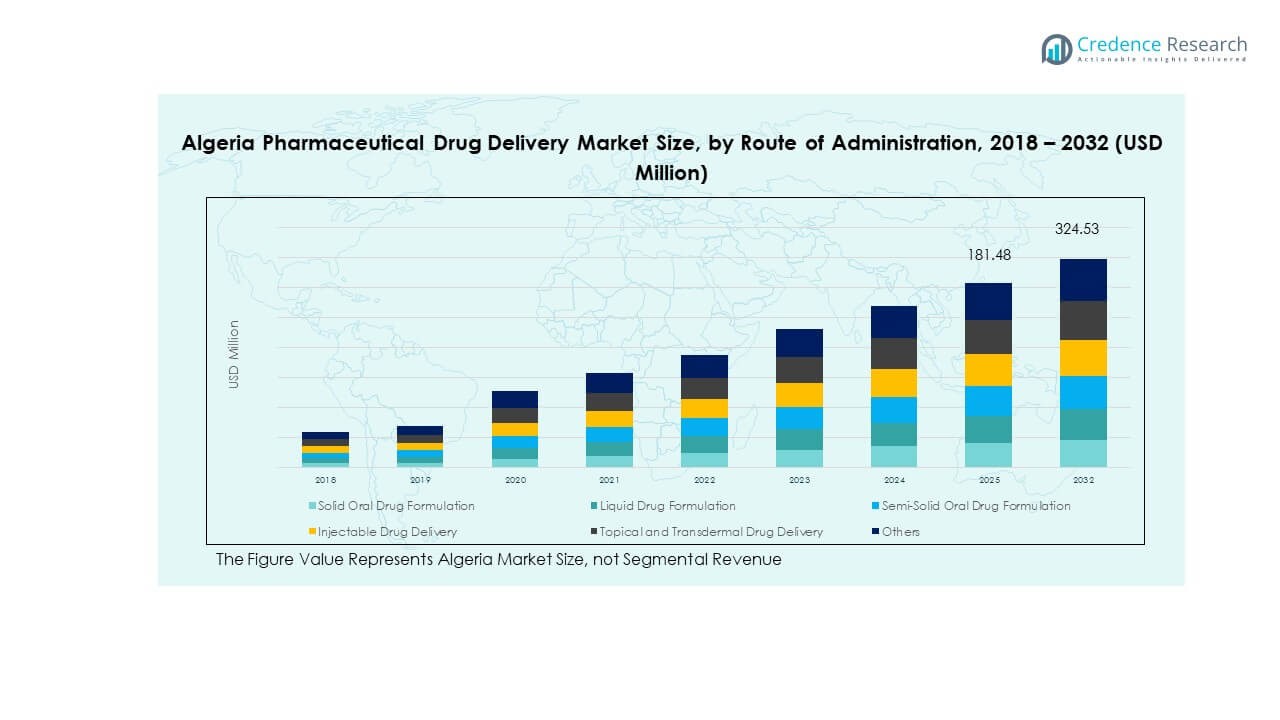

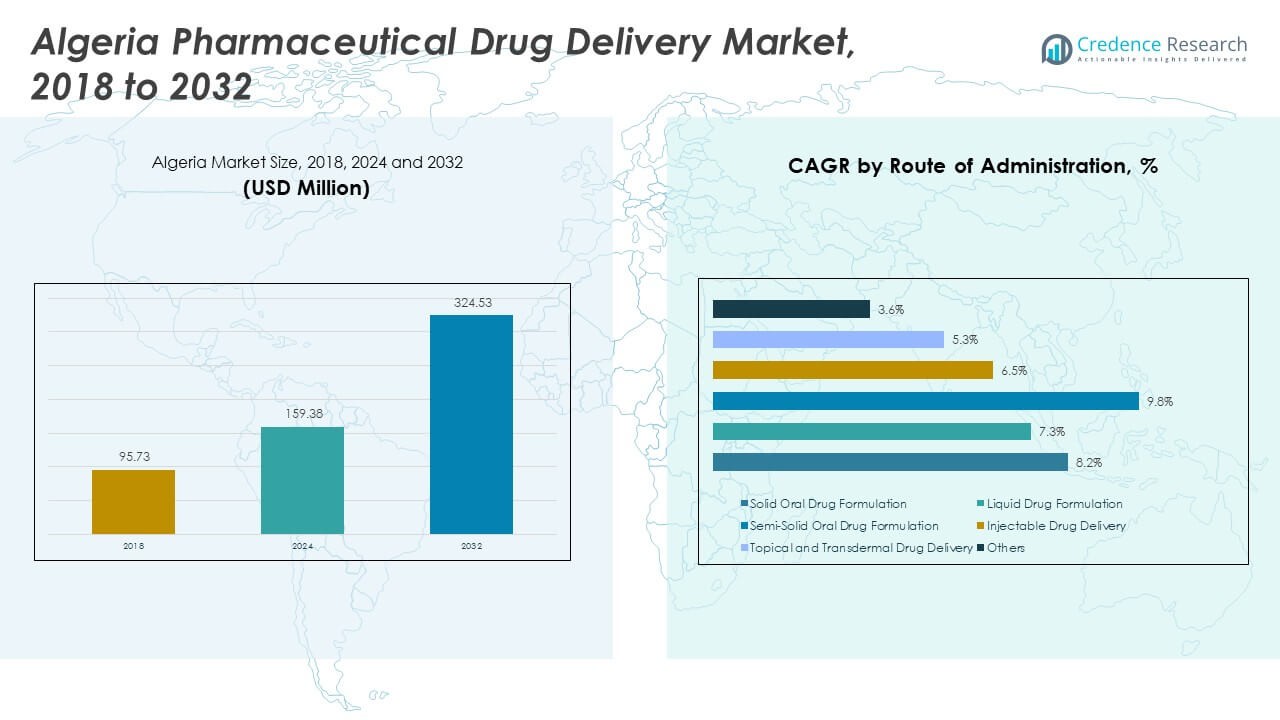

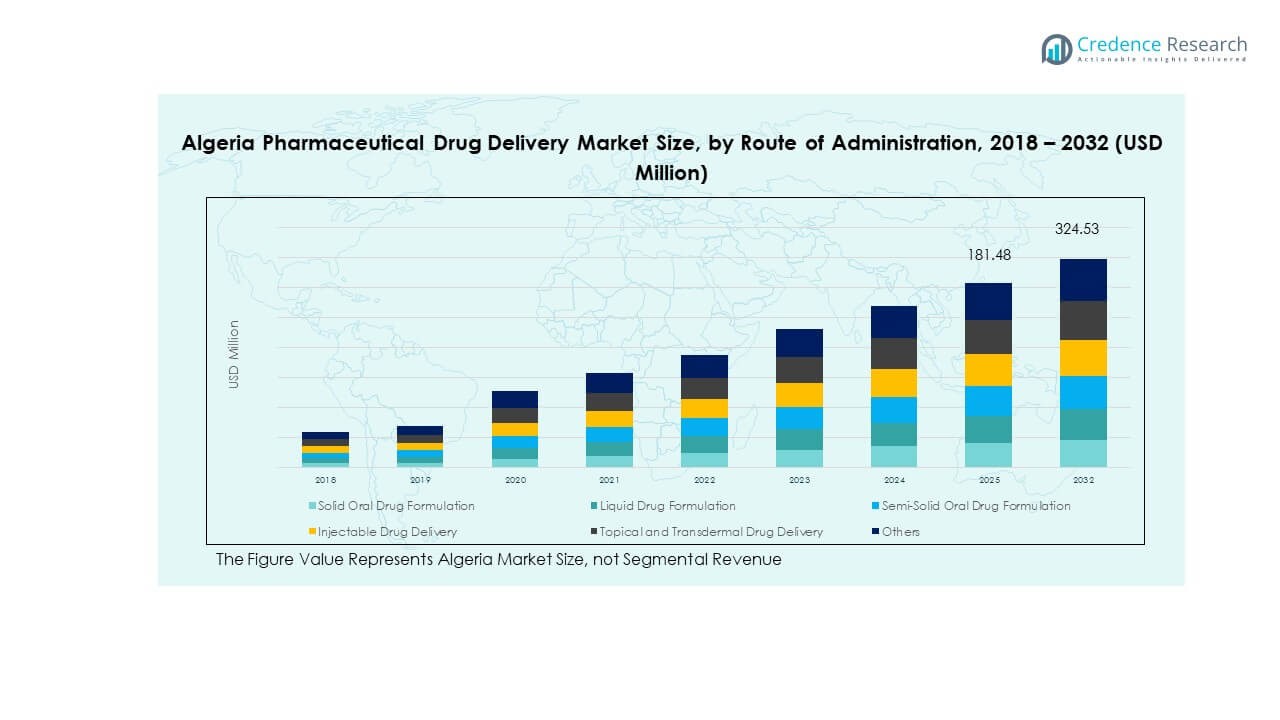

The Algeria Pharmaceutical Drug Delivery Market size was valued at USD 95.73 million in 2018 to USD 159.38 million in 2024 and is anticipated to reach USD 324.53 million by 2032, at a CAGR of 8.66% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Algeria Pharmaceutical Drug Delivery Market Size 2024 |

USD 159.38 Million |

| Algeria Pharmaceutical Drug Delivery Market, CAGR |

8.66% |

| Algeria Pharmaceutical Drug Delivery Market Size 2032 |

USD 324.53 Million |

Strong healthcare reforms drive growth for the Algeria Pharmaceutical Drug Delivery Market. The country invests in new treatment protocols that improve patient compliance and ease of use. Local manufacturers upgrade production lines to meet higher quality needs for inhalers, injectables, and controlled-release formats. Imported specialty therapies also expand due to wider availability of cold-chain networks. Chronic disease cases rise, pushing users toward targeted delivery methods that offer better dosing accuracy. Healthcare providers adopt advanced options that reduce errors and improve therapy efficiency across routine care settings.

Regional growth patterns reflect rising medical needs across Algeria’s major provinces. Northern urban regions lead due to stronger hospital infrastructure, larger pharmacy networks, and better access to specialty treatments. Central areas follow with improving adoption supported by new diagnostic centers and public health programs. Southern and remote regions emerge as new growth zones because outreach programs expand basic drug access and encourage uptake of simplified delivery devices. The Algeria Pharmaceutical Drug Delivery Market advances through broad national coverage that increases access across diverse patient groups.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Algeria Pharmaceutical Drug Delivery Market increased from USD 95.73 million in 2018 to USD 159.38 million in 2024, and it is projected to reach USD 324.53 million by 2032, growing at a CAGR of 8.66%, supported by expanding therapeutic needs and stronger clinical adoption.

- The Northern region holds 55% share, driven by advanced hospitals and dense treatment networks; the Central region holds 30% share due to expanding public facilities and rising chronic care demand; the Southern region holds 15% share, supported by government outreach and improving supply chains.

- The Southern region is the fastest-growing, supported by expanding mobile health programs, improved distribution logistics, and rising adoption of simplified delivery systems across remote centers.

- Solid oral drug formulations account for the largest share in the segment mix, supported by high patient preference and wide therapeutic coverage across primary and chronic care categories.

- Injectable drug delivery represents a notable share due to its critical role in cancer, diabetes, and emergency treatment pathways, supported by growing clinical infrastructure and wider hospital uptake.

Market Drivers:

Growing Demand for Advanced Therapeutic Delivery Systems

The Algeria Pharmaceutical Drug Delivery Market expands through rising need for precise therapies. Hospitals adopt safer devices that improve treatment outcomes across chronic cases. Providers focus on tools that reduce dosing errors in routine care. Users prefer delivery formats that improve comfort during long treatment cycles. Manufacturers upgrade portfolios to match higher clinical expectations nationwide. Government programs support wider access to controlled-release and injectable systems. Importers bring specialized devices that strengthen quality across major facilities. It gains steady traction through better clinical workflows nationwide.

- For instance, BD’s UltraSafe Plus™ passive safety system is designed to support low-volume pre-filled syringes, such as enabling drug visualization at 25 mL for the 1 mL version. This ergonomic design aims to improve patient control across long treatment cycles. The system provides enhanced features like extended finger flanges and an improved plunger head for stability and ease of use, which addresses the fact that providers focus on tools that reduce potential dosing errors and that users prefer delivery formats that improve comfort during extended therapy plans.

Strengthening Healthcare Infrastructure and Access Expansion

Expanding facilities push stronger adoption of modern delivery systems across major regions. New diagnostic centers enable faster uptake of inhalers and injectables. Urban hospitals invest in smart devices that improve therapy accuracy. Rural outreach programs increase awareness of patient-friendly formats. Private clinics expand networks offering improved chronic care solutions. Import channels improve availability of temperature-sensitive medications. Local producers align with global safety standards to gain approval. The Algeria Pharmaceutical Drug Delivery Market benefits from stronger nationwide reach.

- For instance, Propeller Health’s FDA-cleared smart inhaler sensors track over 90%+ of daily doses in real-world settings, improving adherence metrics. Rural outreach programs increase awareness of patient-friendly formats.

Growing Chronic Disease Burden Across Key Population Groups

Chronic illness growth raises demand for advanced delivery systems. Diabetes cases push interest in safe injection options. Respiratory disorders increase uptake of inhalers with accurate dose release. Cancer therapies require improved infusion solutions for stable outcomes. Providers upgrade systems supporting long treatment cycles. Patients favour devices offering comfort and lower failure risk. Hospitals follow strict protocols encouraging compliant delivery practices. It secures broader demand across multiple therapeutic areas.

Shift Toward Patient-Centric and Self-Administration Technologies

Users seek delivery devices that support daily routines with minimal strain. Self-use injectors gain traction for home treatment plans. Pre-filled systems improve convenience for elderly patients. Digital features enhance monitoring across long therapies. Pharmacies promote easy-use formats supporting consistent adherence. Hospitals train users to operate smart devices safely. Manufacturing upgrades improve ergonomics within consumer-focused designs. The Algeria Pharmaceutical Drug Delivery Market gains strength through wider patient acceptance.

Market Trends:

Rising Preference for Minimally Invasive Delivery Approaches

Demand grows for systems that reduce discomfort and recovery time. Needle-free injectors gain presence in routine care settings. Micro-delivery tools support delicate therapeutic applications. Controlled-dose inhalers gain adoption in respiratory programs. Hospitals favour low-pain formats for sensitive patients. Innovation accelerates toward softer device materials. Firms expand research on compact formats for home use. The Algeria Pharmaceutical Drug Delivery Market reflects rising focus on comfort.

- For instance, PharmaJet Stratis® delivers intramuscular and subcutaneous injections using injection velocity >100 m/s, eliminating needle injury risks and holding FDA and WHO PQ certifications.

Expansion of Biologic and Specialty Therapy Delivery Needs

Biologic treatments require stable and precise delivery systems. Hospitals adopt high-skill infusion tools supporting therapy durability. Cold-chain upgrades help protect sensitive formulations. Providers focus on formats that maintain drug integrity. Engineering teams develop systems reducing contamination risks. Specialty clinics expand volumes for advanced therapies. Import pipelines extend availability of high-grade devices. It aligns with growing biologic treatment adoption trends nationwide.

- For instance, Baxter’s SIGMA Spectrum IQ pump supports dose error reduction with 99.5% automated compliance in hospital drug library usage. Cold-chain upgrades help protect sensitive formulations.

Growing Digital Integration Across Delivery Platforms

Smart tools gain demand in clinical workflows. Devices include sensors supporting dose tracking. Care teams use data to adjust treatment plans. Remote alerts improve patient adherence levels. Pharmacies adopt digital tools guiding correct usage. Hospitals rely on automated systems reducing manual errors. Interfaces improve clarity for elderly users. The Algeria Pharmaceutical Drug Delivery Market sees rising digital integration momentum.

High Interest in Sustainable and Recyclable Delivery Components

Producers explore recyclable delivery formats for environmental goals. Hospitals reduce waste through redesigned consumables. Users prefer lighter materials with safe disposal profiles. Research teams adopt cleaner production methods. Regulators promote environmentally responsible device choices. Suppliers improve packaging for low environmental impact. Clinics align procurement with sustainability policies. It supports long-term ecological transition goals within healthcare.

Market Challenges Analysis:

Regulatory and Infrastructure Limitations Slowing Technology Adoption

Regulatory timelines delay access to advanced delivery systems. Hospitals face slow approval cycles for new devices. Import rules increase complexity across supply chains. Rural regions lack strong cold-chain support. Clinics struggle with shortages during peak demand. Training gaps reduce safe device usage in remote areas. Maintenance constraints limit effectiveness in smaller facilities. The Algeria Pharmaceutical Drug Delivery Market faces operational hurdles requiring stronger alignment.

High Cost Barriers and Limited Local Manufacturing Capabilities

Advanced systems carry higher purchase costs. Hospitals restrict buying due to budget strain. Users face affordability gaps for specialty devices. Local producers lack depth in high-precision manufacturing. Import dependence increases volatility during disruptions. Clinics delay upgrades without financial support. Providers avoid complex tools needing intensive maintenance. It experiences growth pressure due to structural cost constraints.

Market Opportunities:

Rising Investment in Local Production and Technology Transfer

Government programs encourage manufacturing expansion nationwide. Local plants aim to produce affordable delivery devices. Partnerships support transfer of global expertise. Hospitals gain access to improved domestic options. Import load reduces across essential categories. Clinics welcome lower-cost formats for routine care. Providers gain reliability through stronger local supply chains. The Algeria Pharmaceutical Drug Delivery Market gains momentum from new industrial activity.

Growing Demand for Home-Based and Remote-Care Therapies

Users prefer home treatment tools supporting daily needs. Pharmacies promote safe self-use devices. Digital monitoring improves adherence for long therapies. Clinics expand remote guidance programs. Elderly groups benefit from easy-use options. Hospitals reduce load through self-care systems. It expands through rising acceptance of decentralized healthcare models.

Market Segmentation Analysis:

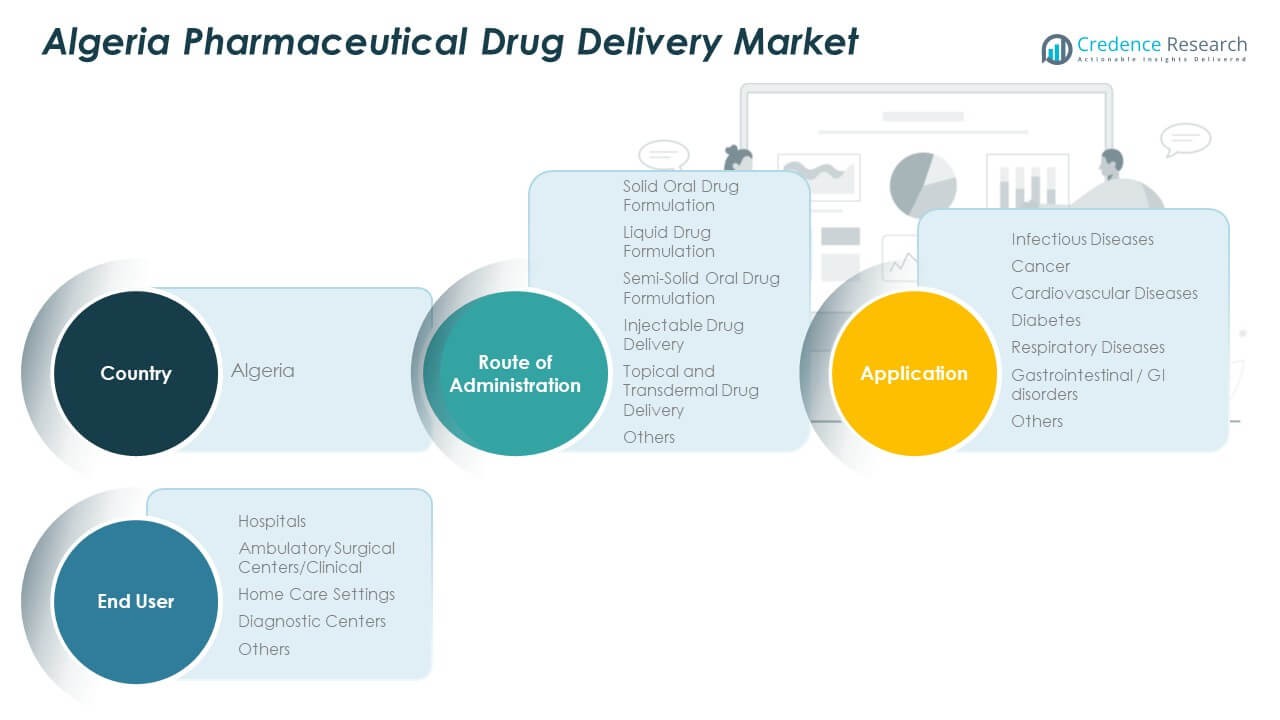

By Route of Administration

The Algeria Pharmaceutical Drug Delivery Market shows strong adoption across solid oral formulations due to patient familiarity and broad therapeutic coverage. Liquid and semi-solid formats support pediatric and geriatric care where easier swallowing is essential. Injectable drug delivery gains traction in chronic and acute cases that require precise dosing. Topical and transdermal systems expand due to rising demand for localized and sustained treatment. Hospitals and clinics prefer formats that reduce handling complexity. It advances with diversified options that align with clinical workflow needs across major regions.

By Application

Infectious diseases remain a major driver for advanced delivery formats. Cancer therapies rely on injectables and controlled-release systems that support complex regimens. Cardiovascular and diabetes care use oral and injectable routes that improve long-term adherence. Respiratory conditions benefit from inhalation-focused solutions that deliver targeted relief. Gastrointestinal disorders use tailored oral formats that support specific absorption needs. Other therapeutic areas gain access to flexible platforms that strengthen treatment precision. Market momentum reflects wide medical demand across national programs.

- For instance, AstraZeneca’s Turbuhaler® achieves fine-particle fraction >40%, improving lung deposition efficiency. Gastrointestinal disorders use tailored oral formats supporting specific absorption needs.

By End User

Hospitals lead due to high patient volumes and access to specialized equipment. Ambulatory surgical centers adopt injectables and topical systems suited for short-stay care. Home care settings grow with self-use devices that support chronic disease management. Diagnostic centers rely on supportive delivery tools within procedural workflows. Other settings adopt solutions that improve safety and operational efficiency. It supports diverse healthcare touchpoints that depend on reliable drug delivery systems.

Segmentation:

By Route of Administration

- Solid Oral Drug Formulation

- Liquid Drug Formulation

- Semi-Solid Oral Drug Formulation

- Injectable Drug Delivery

- Topical and Transdermal Drug Delivery

- Others

By Application

- Infectious Diseases

- Cancer

- Cardiovascular Diseases

- Diabetes

- Respiratory Diseases

- Gastrointestinal / GI Disorders

- Others

By End User

- Hospitals

- Ambulatory Surgical Centers / Clinical

- Home Care Settings

- Diagnostic Centers

- Others

By Country

- Country (Algeria-focused segmentation)

Regional Analysis:

Northern Region

The Algeria Pharmaceutical Drug Delivery Market records its highest concentration in the Northern region, holding nearly 55% share due to strong hospital density and advanced clinical infrastructure. Major cities support broader adoption of injectables, oral formulations, and specialized delivery systems. Private clinics expand capacity and strengthen patient access to chronic care therapies. Importers prioritize this region due to high prescription volumes and wider product circulation. Diagnostic centers also scale operations to support advanced therapeutic protocols. It gains stability here through mature healthcare networks and rising specialty treatment needs.

Central Region

The Central region accounts for nearly 30% share, driven by a mix of expanding public facilities and growing acceptance of modern drug delivery formats. Healthcare reforms improve access to vaccines, injectables, and transdermal systems. Providers upgrade equipment that supports accurate dosing across infectious and chronic disease cases. Population growth pushes higher outpatient visits, encouraging broader use of easy-to-handle formulations. Clinics adopt solutions that reduce therapy errors and shorten treatment cycles. It strengthens its foothold in this region through structured investment and improving distribution links.

Southern Region

The Southern region contributes nearly 15% share, supported by government-led outreach and improving supply chains across remote areas. Facilities adopt simplified oral, topical, and injectable delivery systems that suit limited-resource environments. Mobile health units help expand access to essential formulations for chronic and emergency care. Training programs improve healthcare workers’ familiarity with modern devices. Regional procurement encourages steady availability of essential products across local centers. It gains gradual momentum here through broader outreach and rising demand for dependable therapy delivery formats.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Hikma Pharmaceuticals

- Biopharm

- Saidal Group

- GlaxoSmithKline

- Sanofi

Competitive Analysis:

The Algeria Pharmaceutical Drug Delivery Market features a competitive landscape shaped by strong domestic firms and established global players. Local companies strengthen supply reliability through essential formulations and region-focused distribution. International manufacturers expand access to advanced injectable, transdermal, and controlled-release systems. Hospitals and clinics prefer vendors with consistent quality and stable regulatory compliance. Partnerships with distribution networks improve product penetration across emerging regions. Firms invest in training programs that support correct device handling. It remains competitive through continuous product upgrades, expanded portfolios, and strategic collaborations that enhance market reach.

Recent Developments:

- In October 2025, Saidal announced a strategic cooperation agreement with Novo Nordisk Algérie, the subsidiary of the Danish biopharmaceutical multinational, to co-develop and manufacture next-generation insulin treatments in Algeria. The agreement includes a framework for establishing a fully integrated aseptic production facility in Algeria with technology transfer and technical know-how provided by Novo Nordisk, addressing the healthcare needs of Algeria’s estimated 4 million citizens living with diabetes, 1.5 million of whom are insulin-dependent. The partnership was confirmed through official company statements, with participation from Saidal’s General Director and Novo Nordisk Algérie’s leadership.

- On September 2, 2025, Saidal signed a memorandum of understanding with AbbVie, the American biopharmaceutical group, as confirmed through official press releases. Additionally, on May 31, 2025, Saidal formalized a strategic partnership with Truking, a Chinese conglomerate, focused on expanding anti-cancer drug production in the Constantine province.

- In August 2025, Hikma Pharmaceuticals, a Jordanian pharmaceutical company, inaugurated its first injectables manufacturing plant in the Stawali municipality of Algiers, marking a significant milestone for the region. The state-of-the-art facility, which represents the first of its kind in North Africa and the Middle East, was built with an investment of $30 million and features two high-tech production lines with an estimated annual capacity of 10 million vials. The plant manufactures a comprehensive range of injectable medicines, including antibiotics, anesthetics, resuscitation medications, gastrointestinal drugs, and cardiovascular treatments, all designed to reduce Algeria’s dependence on imported medicines while strengthening the country’s pharmaceutical autonomy. The collaboration with Hikma Pharma Portugal enabled technology transfer and training of local skills, reinforcing the plant’s commitment to maintaining international quality standards. According to its latest factsheet from August 2025, Hikma Pharmaceuticals is now ranked #3 among pharmaceutical companies in Algeria based on sales, maintaining a 6% market share of the total Algerian pharmaceutical market, and operates five manufacturing plants including the newly inaugurated injectables facility.

Report Coverage:

The research report offers an in-depth analysis based on Route of Administration, Application, End User, and Country. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for advanced delivery systems will rise due to expanding chronic care needs across major regions.

- Injectable and transdermal formats will gain wider adoption with improved clinical infrastructure.

- Local manufacturing capacity will strengthen through technology transfer and industry partnerships.

- Digital-enabled delivery devices will support better adherence and remote monitoring options.

- Hospitals will drive innovation uptake through procurement of accurate and patient-friendly systems.

- Home care adoption will increase with rising interest in self-administration tools.

- Import diversification will help stabilize supply flows across essential therapies.

- Sustainable delivery formats will gain momentum as institutions prioritize low-waste solutions.

- Training programs will enhance healthcare worker capability in managing specialty devices.

- It will advance toward more integrated, efficient, and accessible delivery platforms nationwide.