Market Overview:

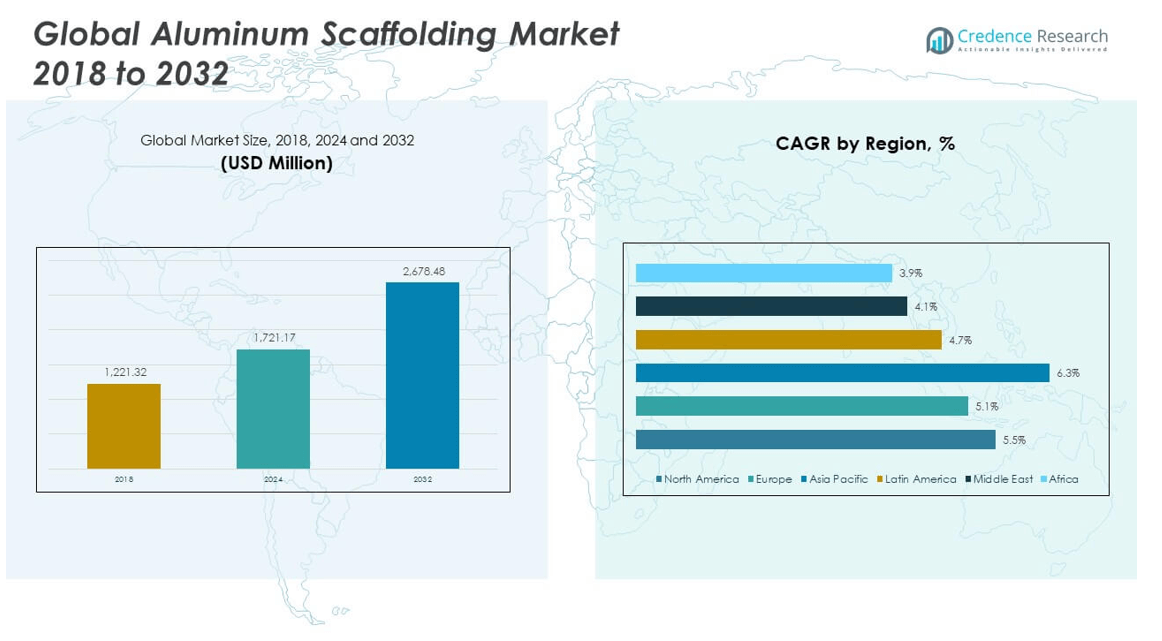

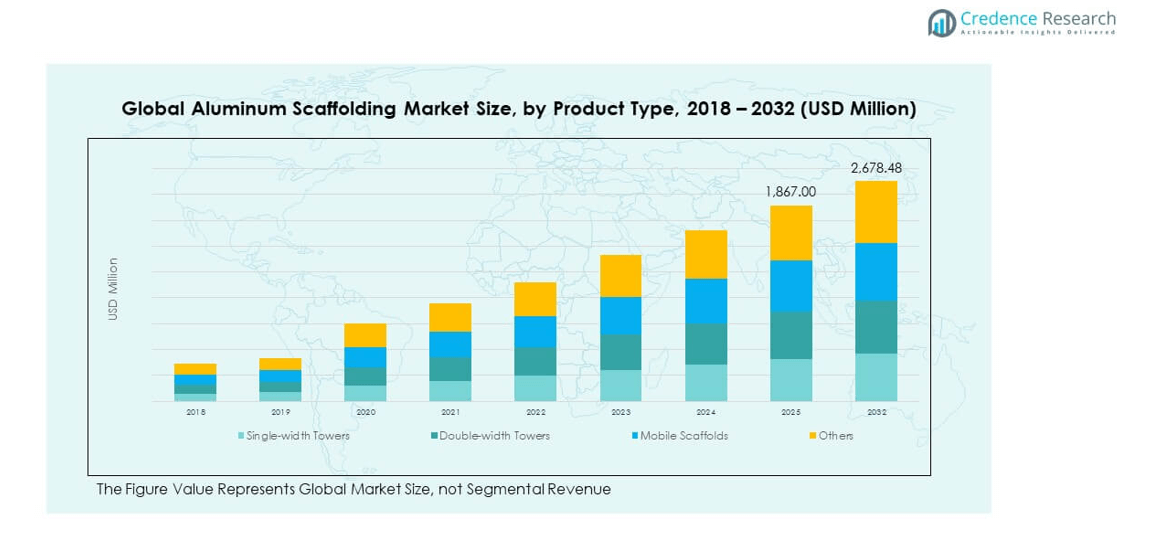

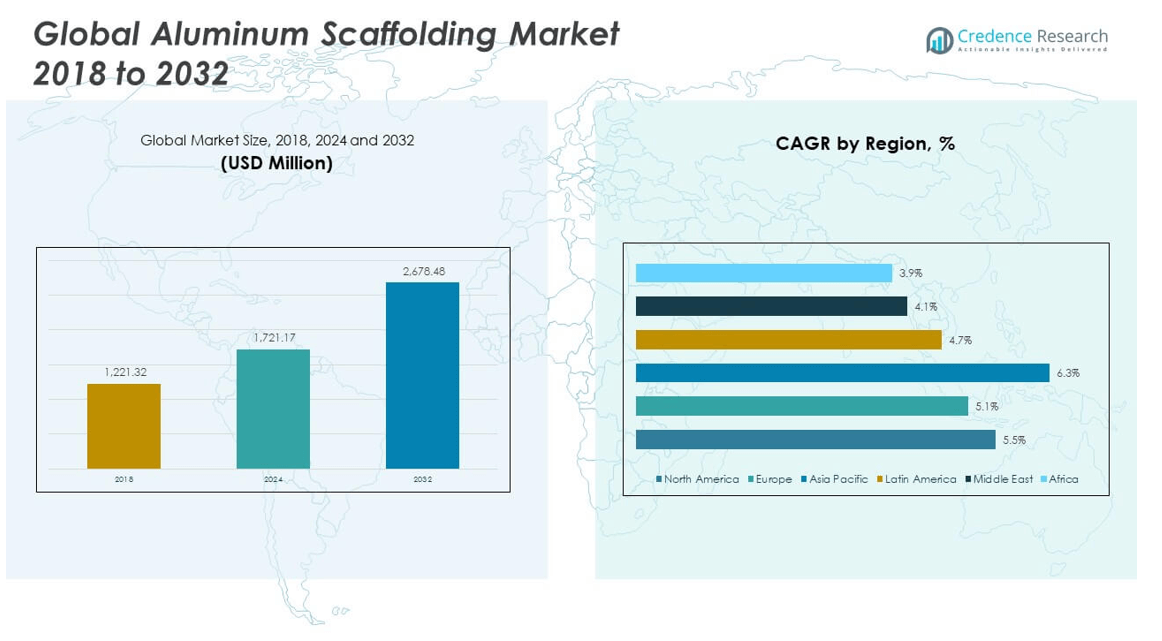

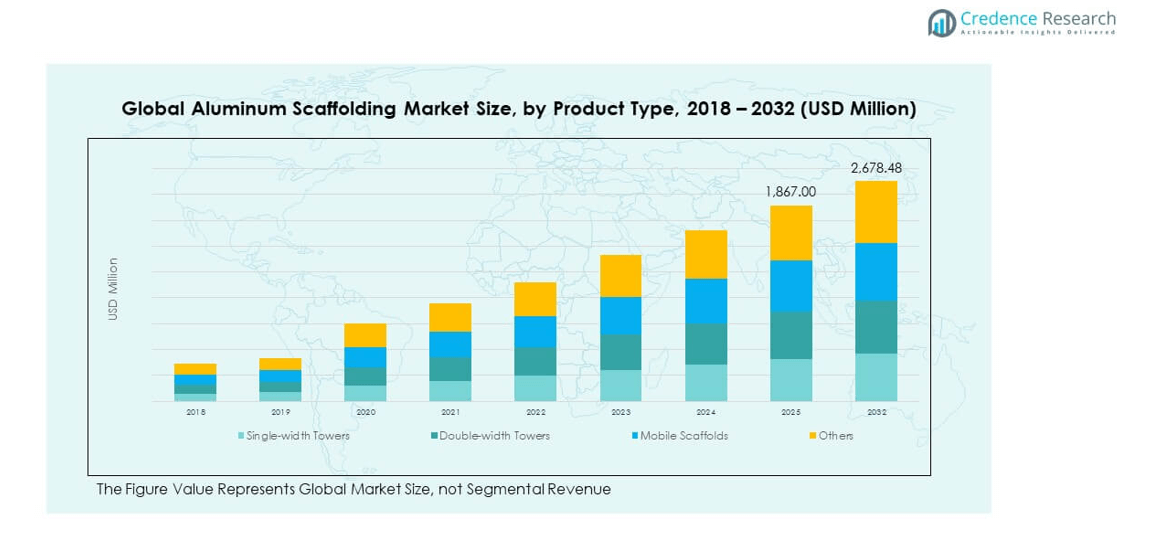

The Global Aluminum Scaffolding Market size was valued at USD 1,221.32 million in 2018 to USD 1,721.17 million in 2024 and is anticipated to reach USD 2,678.48 million by 2032, at a CAGR of 5.29% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Aluminum Scaffolding Market Size 2024 |

USD 1,721.17 million |

| Aluminum Scaffolding Market, CAGR |

5.29% |

| Aluminum Scaffolding Market Size 2032 |

USD 2,678.48 million |

The growth of the aluminum scaffolding market is driven by increasing demand across construction, industrial maintenance, and infrastructure development projects. Lightweight, corrosion-resistant, and easy-to-install properties of aluminum scaffolding make it a preferred choice over traditional steel scaffolding. Rapid urbanization, rising emphasis on worker safety, and growing adoption of modular and mobile scaffolding systems have further contributed to market expansion. Additionally, the increasing number of renovation and restoration projects in developed economies and the need for flexible access solutions in industrial sectors are supporting the market’s continued growth globally.

Regionally, North America and Europe dominate the aluminum scaffolding market due to their strong construction and industrial infrastructure, stringent safety regulations, and early adoption of advanced equipment. Countries like the U.S., Germany, and the UK lead in terms of deployment across diverse applications. Meanwhile, the Asia-Pacific region is emerging rapidly, driven by large-scale infrastructure projects, booming construction activities, and increasing investments in industrial sectors in countries such as China, India, and Southeast Asian nations. The Middle East is also gaining traction due to ongoing megaprojects and rising demand for efficient scaffolding solutions in extreme environments.

Market Insights:

- The Global Aluminum Scaffolding Market was valued at USD 1,721.17 million in 2024 and is projected to reach USD 2,678.48 million by 2032, growing at a CAGR of 5.29%.

- Strong demand from the construction sector continues to drive adoption of aluminum scaffolds due to their lightweight, corrosion-resistant properties.

- Growing maintenance and industrial repair activities support sustained demand for mobile and modular scaffolding systems.

- High raw material price volatility and dependency on aluminum supply chains remain key restraints affecting manufacturer margins.

- North America dominated the market in 2024, holding 43.27% of the global share due to advanced infrastructure and safety regulations.

- Asia Pacific is emerging rapidly due to infrastructure expansion in China, India, and Southeast Asia, coupled with rising safety awareness.

- Strict regulatory standards across Europe and North America are pushing demand for certified, high-performance aluminum scaffolding solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Strong Demand from the Expanding Construction and Infrastructure Sector

The Global Aluminum Scaffolding Market benefits significantly from rapid expansion in global construction and infrastructure projects. Governments and private developers are investing in residential, commercial, and public infrastructure. It supports a wide range of applications, from high-rise buildings to bridges and industrial facilities. The demand for durable and lightweight access equipment has intensified across developing economies. Aluminum scaffolding offers better corrosion resistance and ease of transportation, increasing its usage over traditional systems. The market responds to the increasing need for safety and efficiency on construction sites. It caters to time-bound projects requiring quick assembly and disassembly. Contractors continue to prioritize productivity, further supporting market growth.

- For example, Layher, a leading global scaffolding manufacturer, offers the Allround Aluminum Scaffolding System known for its bolt-free modular design and rapid assembly features. The system is widely used in high-rise and complex projects due to its ability to reduce setup time and enhance worker safety, although its use at the Lakhta Center has not been officially confirmed.

Increased Preference for Lightweight and Modular Access Systems

Growing awareness of operational efficiency and worker safety has increased the preference for aluminum over steel scaffolding. The Global Aluminum Scaffolding Market benefits from the material’s lightweight nature, which simplifies handling and reduces labor fatigue. Its modular design allows easy customization to project-specific needs. It supports reduced installation times and streamlined logistics for temporary or mobile applications. Manufacturers focus on designing compact, foldable, and multi-functional systems. The adaptability of aluminum scaffolds makes them suitable for indoor and outdoor use. It aligns with changing project dynamics, especially in urban environments. The push for ergonomic equipment has helped elevate product appeal among contractors.

Rising Industrial Maintenance and Facility Management Activities

Routine maintenance work in industrial facilities continues to grow, contributing to stable demand in the Global Aluminum Scaffolding Market. It provides access solutions in oil and gas plants, manufacturing units, and power generation facilities. Industries prefer aluminum scaffolding due to its lightweight, non-sparking properties, and minimal damage to surrounding infrastructure. Market participants have diversified offerings to include maintenance-specific designs. Government regulations enforce periodic maintenance in hazardous and heavy-duty sectors. It ensures consistent demand across varied applications. The need for efficient systems that support worker mobility and safety in confined spaces strengthens market appeal. Ongoing industrial automation further boosts periodic inspections and retrofitting needs.

Strict Safety Regulations Driving Product Adoption and Certification Standards

Regulatory authorities worldwide mandate compliance with safety protocols in work-at-height environments. The Global Aluminum Scaffolding Market reflects this trend through enhanced focus on product certifications and international quality standards. Buyers increasingly demand products tested for load capacity, stability, and anti-slip performance. Manufacturers comply with regional safety codes to retain competitive positioning. It ensures credibility among contractors, project managers, and regulatory inspectors. Frequent inspections and penalties for non-compliance encourage procurement of certified scaffolding. Product innovation focuses on safety locks, stabilizers, and guardrails. The emphasis on worker protection promotes aluminum scaffolding as a safe and cost-effective access solution.

- For example, Altrex’s MiTOWER mobile access tower earned TÜV Rheinland certification under EN 1004 Class 3 It supports platform loads up to 200 kg (approximately 440 lbs), assembles quickly by a single operator in under 10 minutes, and offers a compact footprint with integrated trolley-based transport and safe, stable portability

Market Trends

Growing Adoption of Mobile Towers for Versatile Access and Quick Setup

Contractors are shifting toward mobile towers due to their fast assembly and repositioning features. The Global Aluminum Scaffolding Market reflects this trend with increasing adoption of wheeled towers for internal and maintenance-related work. These towers offer height flexibility without permanent installation, catering to fit-out contractors, painters, and HVAC technicians. Manufacturers design modular frames to fit narrow spaces and complex layouts. It allows users to work efficiently in indoor environments with minimal disruption. Markets in urban centers prefer portable scaffolds that reduce labor intensity. Rapid project turnover continues to shape this evolving preference. Lightweight components allow faster relocation across project sites.

- For instance, Shizhan Group supplies mobile aluminum scaffold towers with polyurethane 8-inch double-brake universal wheels enabling 360° directional movement and adjustable feet up to 30 cm in height. Each platform supports a load capacity of 200 kg/m², while the entire frame can bear up to 900 kg, ensuring active site repositioning without compromising stability or safety

Integration of Digital Tools to Optimize Scaffolding Design and Assembly

Companies are integrating digital technologies into scaffolding planning and management processes. The Global Aluminum Scaffolding Market sees increased use of software for scaffold modeling, structural load analysis, and project estimation. It improves installation accuracy and minimizes assembly errors. Digital twin platforms simulate scaffold deployment across complex surfaces. Contractors adopt digital checklists and safety compliance trackers. This digital transformation supports error reduction and material optimization. It also enhances inventory control and logistics planning. Integration with Building Information Modeling (BIM) helps project managers visualize scaffold structures in advance. Digital tools align the product lifecycle with safety and productivity benchmarks.

Rising Focus on Sustainability and Recyclable Scaffold Components

Sustainability has become a priority across global industrial and construction sectors. The Global Aluminum Scaffolding Market aligns with this shift through recyclable, reusable, and long-life product lines. Manufacturers emphasize reduced environmental impact through eco-friendly manufacturing practices. Aluminum is inherently recyclable, which appeals to contractors aiming for green certifications. It maintains mechanical strength over multiple usage cycles. Companies design scaffolding with minimal components to reduce waste and packaging material. Reusability also lowers lifecycle costs and simplifies disposal. Demand is increasing for energy-efficient production methods. The emphasis on carbon footprint reduction enhances product positioning in developed markets.

Product Customization Based on Project-Specific Functional and Aesthetic Needs

End-users increasingly request customized scaffolding systems tailored to project design and functionality. The Global Aluminum Scaffolding Market caters to this need through modular kits, load-bearing variants, and compact folding platforms. Architects and engineers influence scaffold requirements to match site layouts. Contractors select scaffold types based on indoor vs outdoor use, working height, and surface conditions. It drives demand for low-profile systems and ergonomic add-ons like step ladders, railings, and access gates. Manufacturers offer powder-coated finishes for visual harmony in commercial and retail environments. Customization supports brand differentiation and meets client-specific project needs. This trend expands market relevance across diverse segments.

- For instance, Rapid, an aluminum scaffolding manufacturer based in Wuxi, China, offers customizable platforms with widths of 750 mm or 1,350 mm and lengths up to 3 m, supporting working heights from 2 m to 14 m, using certified 6061‑T6 aluminum. These configurations meet diverse site needs while maintaining structural safety and mobility.

Market Challenges Analysis

Fluctuations in Raw Material Prices and Supply Chain Disruptions Impact Profitability

The Global Aluminum Scaffolding Market faces pressure from volatile aluminum prices and unpredictable raw material availability. It relies heavily on stable sourcing from international suppliers, making it vulnerable to geopolitical events and trade policy shifts. Tariffs and duties also affect final product costs, reducing margins for small and medium manufacturers. Procurement delays caused by transportation issues and customs clearance complicate lead times. Companies must forecast demand accurately to avoid excess inventory or shortages. They invest in diversified sourcing and long-term contracts to mitigate risks. However, price-sensitive buyers may shift toward alternative materials during high-cost periods. These challenges demand strategic planning and agile supply chain management.

Intense Market Competition and Limited Product Differentiation Slow Down Value Growth

Competition among regional and global manufacturers intensifies pricing pressure. The Global Aluminum Scaffolding Market includes numerous players offering similar product portfolios. It becomes difficult to establish brand differentiation in a market where functionality is prioritized over brand loyalty. Local manufacturers offer cost-competitive solutions that appeal to price-conscious buyers. Innovation cycles are often slow due to regulatory approval requirements. Companies face difficulty expanding into new regions without strong distribution partnerships. Marketing budgets remain limited for smaller firms, reducing their ability to promote advanced features. Limited differentiation lowers the incentive to invest in premium or high-margin solutions. Maintaining consistent product quality becomes critical for brand credibility.

Market Opportunities

Expanding Renovation and Retrofit Projects Create Steady Demand for Compact Scaffold Systems

Global emphasis on infrastructure renewal drives demand for adaptable scaffolding systems. The Global Aluminum Scaffolding Market can tap into this opportunity by targeting contractors involved in heritage restorations, facility upgrades, and commercial retrofits. Compact and modular aluminum platforms fit tight indoor spaces and comply with evolving safety codes. It supports work on ceilings, facades, and internal utilities without extensive setup. Municipal buildings, schools, and hospitals undergoing renovation prefer lightweight access systems that reduce setup time and structural load. Builders favor aluminum scaffolds for temporary interior work where surface protection and maneuverability are essential. These applications expand the product’s value in low-rise, repetitive maintenance projects.

Emerging Markets in Asia-Pacific and Africa Offer Untapped Growth Potential

Rising construction activity in emerging regions opens new revenue streams. The Global Aluminum Scaffolding Market can scale through partnerships with regional suppliers and rental companies. It supports public infrastructure, affordable housing, and industrial expansion projects. Increasing regulatory enforcement around safety creates favorable market conditions. Rapid urbanization across second-tier cities boosts localized scaffold demand. Cross-border collaborations with local manufacturers allow faster market penetration and price competitiveness. By aligning product offerings with regional building codes and labor conditions, manufacturers can position aluminum scaffolds as reliable and efficient alternatives.

Market Segmentation Analysis:

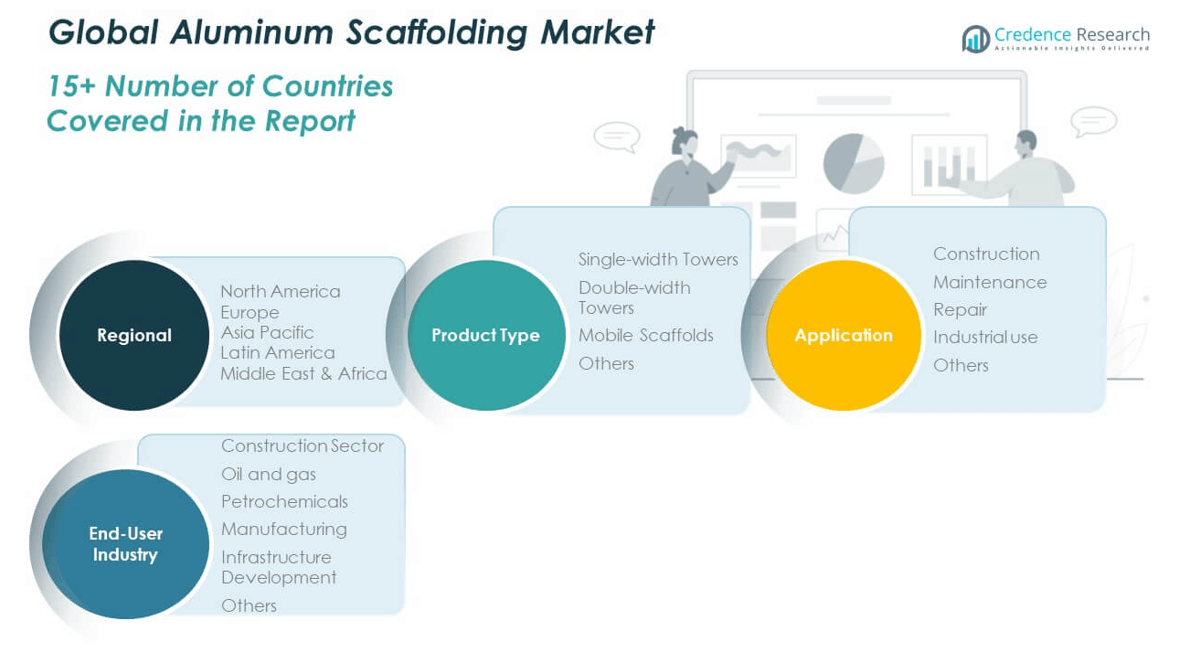

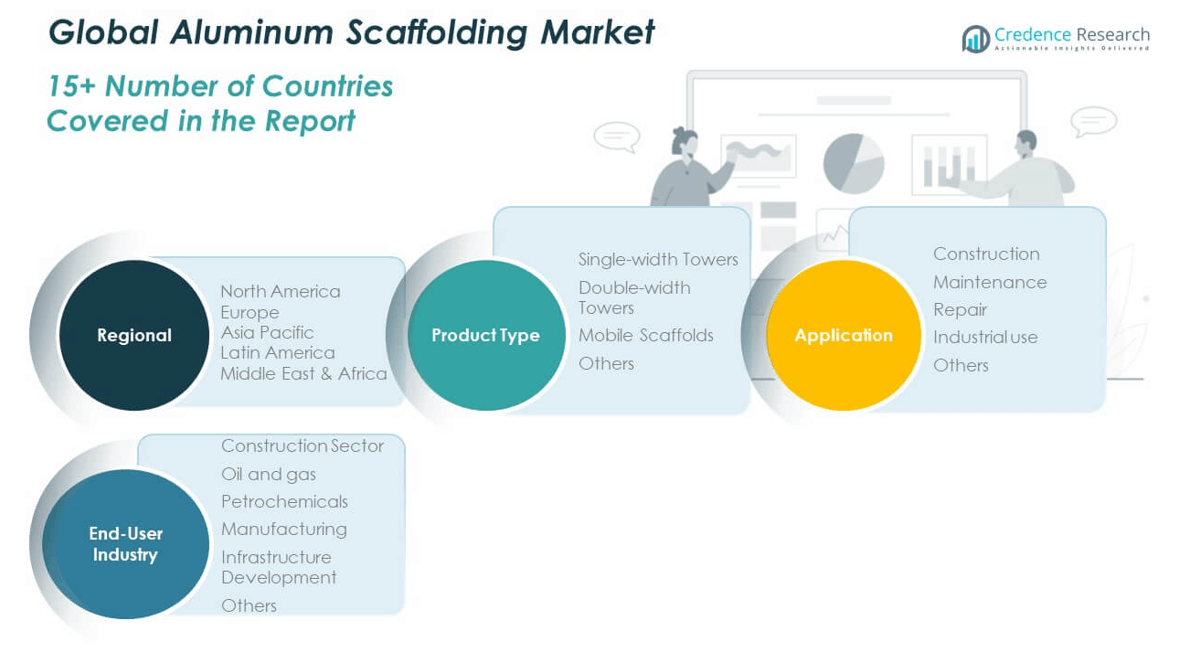

The Global Aluminum Scaffolding Market is segmented by product type, application, and end-user industry, each contributing uniquely to overall demand.

By product type, mobile scaffolds hold a strong position due to their flexibility, ease of movement, and quick assembly, which are essential for indoor tasks and time-sensitive operations. Double-width towers gain traction in large-scale construction, offering greater platform area and load-bearing capacity. Single-width towers cater to confined spaces, while the “others” category includes custom and specialty systems designed for niche applications.

- For instance, Gazelle’s G6106 Single Width Scaffold Tower suits narrow spaces with a tower height of 0 m, platform height of 6.0 m, working height of 8.0 m, and platform dimensions of 80 cm × 180 cm. It supports a maximum load capacity of 600 kg, includes guardrails, braces, and toe boards for safety, and enables fast, secure setup with snap‑pin locking

By application, construction dominates due to extensive use of scaffolds in high-rise building, residential, and commercial projects. Maintenance and repair segments show steady growth driven by industrial upkeep, facility management, and routine inspections. Industrial use reflects consistent demand across oil refineries, manufacturing plants, and energy facilities that require frequent access solutions in complex environments.

- For instance, Scaffolding Solutions in the United States engineered custom scaffolds for a variety of specialized projects, including the restoration of historical courthouses and structural support at NASA’s Wallops Island Flight Facility.

By end-user industry, the construction sector leads due to ongoing urbanization and infrastructure upgrades. Oil and gas and petrochemical industries require scaffolding systems for high-risk environments, where safety and material performance are critical. Manufacturing and infrastructure development segments prefer modular aluminum systems for their reusability and lightweight features. The market serves a broad set of users through durable, customizable, and regulation-compliant solutions.

Segmentation:

By Product Type

- Single-width Towers

- Double-width Towers

- Mobile Scaffolds

- Others

By Application

- Construction

- Maintenance

- Repair

- Industrial Use

- Others

By End-User Industry

- Construction Sector

- Oil and Gas

- Petrochemicals

- Manufacturing

- Infrastructure Development

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The North America Global Aluminum Scaffolding Market size was valued at USD 534.14 million in 2018 to USD 744.94 million in 2024 and is anticipated to reach USD 1,162.49 million by 2032, at a CAGR of 5.3% during the forecast period. North America accounted for 43.27% of the global market share in 2024. The region maintains its leadership due to advanced construction practices, strong regulatory enforcement, and high safety standards. It supports large-scale infrastructure development and maintenance projects across the United States and Canada. Urban redevelopment and commercial fit-outs sustain demand for lightweight, mobile scaffold solutions. The industrial sector, including oil and gas and manufacturing, uses aluminum scaffolds for periodic facility maintenance. Companies benefit from rental model adoption and digital planning tools that optimize scaffold usage. Manufacturers cater to evolving project needs through certified, modular, and ergonomic systems. North America remains a key market due to early product adoption and advanced application diversity.

Europe

The Europe Global Aluminum Scaffolding Market size was valued at USD 227.58 million in 2018 to USD 303.12 million in 2024 and is anticipated to reach USD 428.86 million by 2032, at a CAGR of 4.0% during the forecast period. Europe held 17.61% of the global market share in 2024. It reflects high product maturity and strong presence of established manufacturers. The region emphasizes eco-friendly construction, supporting demand for recyclable and reusable scaffolding materials. Strict compliance with EN standards and worker protection norms enhances product adoption. Renovation and restoration of heritage structures contribute to stable scaffold usage. Industrial automation requires periodic equipment access, further boosting demand. European contractors prefer engineered, load-certified scaffolds to meet project-specific requirements. Rental companies dominate the supply chain with large inventories. Europe retains a mature but stable growth outlook due to emphasis on sustainability and safety.

Asia Pacific

The Asia Pacific Global Aluminum Scaffolding Market size was valued at USD 358.53 million in 2018 to USD 533.04 million in 2024 and is anticipated to reach USD 903.54 million by 2032, at a CAGR of 6.4% during the forecast period. Asia Pacific contributed 30.96% of the global market share in 2024. It represents the fastest-growing region driven by infrastructure development and construction megaprojects. Countries like China, India, Indonesia, and Vietnam are investing in transport, housing, and commercial facilities. It meets the growing need for safe and lightweight access systems on high-density worksites. Rising awareness of safety protocols and increasing regulatory oversight support market expansion. Contractors seek cost-effective, reusable scaffolding solutions for time-bound projects. Domestic manufacturers scale operations to meet demand spikes. Asia Pacific remains highly dynamic with strong growth potential across urban and semi-urban areas.

Latin America

The Latin America Global Aluminum Scaffolding Market size was valued at USD 56.47 million in 2018 to USD 78.57 million in 2024 and is anticipated to reach USD 107.91 million by 2032, at a CAGR of 3.6% during the forecast period. Latin America represented 4.57% of the global market share in 2024. It sees moderate growth driven by urban expansion and public infrastructure upgrades. Countries like Brazil, Mexico, and Chile are investing in smart city projects and residential development. The market remains largely price-sensitive, encouraging demand for rental scaffolding services. Contractors opt for modular aluminum systems that allow flexibility on diverse job sites. It supports ongoing industrial maintenance and facility management requirements. Distribution challenges and uneven regulatory enforcement slow down broader product penetration. However, safety awareness continues to grow, promoting certified aluminum scaffolds in commercial projects.

Middle East

The Middle East Global Aluminum Scaffolding Market size was valued at USD 30.81 million in 2018 to USD 39.28 million in 2024 and is anticipated to reach USD 50.42 million by 2032, at a CAGR of 2.8% during the forecast period. Middle East held 2.28% of the global market share in 2024. It reflects selective but consistent demand driven by oil and gas infrastructure and large-scale commercial development. The UAE and Saudi Arabia remain the primary hubs for high-rise and industrial projects. It benefits from demand for lightweight scaffolding solutions in extreme temperatures. Aluminum scaffolds enable quick deployment and reduce worker fatigue. Safety compliance in mega construction projects boosts demand for certified equipment. The market sees concentrated growth in cities with active development zones. Suppliers expand rental services to meet project timelines and regulatory expectations.

Africa

The Africa Global Aluminum Scaffolding Market size was valued at USD 13.79 million in 2018 to USD 22.22 million in 2024 and is anticipated to reach USD 25.26 million by 2032, at a CAGR of 1.2% during the forecast period. Africa accounted for 1.29% of the global market share in 2024. It remains in an early growth stage with sporadic demand tied to public infrastructure projects. Countries like South Africa, Kenya, and Nigeria lead in scaffold adoption. Budget constraints and limited safety enforcement delay broader penetration of aluminum scaffolds. Contractors often rely on steel systems due to lower initial cost. It sees gradual adoption where international contractors enforce global safety practices. Growth in urban housing and telecommunications infrastructure creates localized demand. Market development depends on training, regulatory reform, and supplier presence. Africa holds long-term potential as construction activity and compliance frameworks mature.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Layher Ltd

- Aluminium Scaffold Towers Limited

- Zarges

- Svelt SpA

- Metaltech

- Youngman India

- Ullrich Aluminium

- QuickAlly Access Solutions

- ADTO Industrial Group

- Altrad Group

- BrandSafway

- Atlantic Pacific Equipment

Competitive Analysis:

The Global Aluminum Scaffolding Market features intense competition among established global manufacturers and regional suppliers. It includes companies that compete through product certifications, ergonomic design, and modular features. Major players invest in R&D to introduce lightweight, durable systems with improved load capacity and safety mechanisms. They leverage strong distribution networks and service offerings to support rental and refurbishment channels. Smaller regional firms maintain pricing advantage in local markets and serve price-sensitive buyers. It offers rental services that complement product sales and strengthen customer loyalty. The market rewards companies that invest in digital design tools, BIM integration, and client-specific customization options. Manufacturers differentiate by providing training, inspection services, and maintenance contracts. Industry leadership depends on innovation, compliance with safety standards, and responsive logistics to diverse project needs.

Recent Developments:

- In April 2025, Layher Ltd introduced advancements in scaffolding design with the innovative Steel Deck Lightweight (LW) system, which offers a 10% reduction in weight while maintaining traditional steel deck strength and capacity. This product aims to provide faster assembly, easier handling, and logistical benefits for construction projects.

- In April 2025, Atlantic Pacific Equipment (AT‑PAC) completed its full integration into Umdasch Industrial Solutions following its acquisition by Doka in 2023. This consolidation enhanced AT‑PAC’s logistical capacity and broadened its offerings across construction and industrial scaffolding services in North America. The move positions it to operate as a full-spectrum access solutions provider with expanded support infrastructure

- In June 2025, PERI Group launched two new formwork solutions—SKYFLEX and LEVO—introduced at World of Concrete 2025 in Las Vegas. These systems integrate elevated safety features and efficient assembly protocols tailored for North American construction environments. PERI aims to reinforce its position by offering scaffolding-related formwork that merges durability with rapid deployment.

Market Concentration & Characteristics

The Global Aluminum Scaffolding Market remains moderately fragmented, with several global firms holding notable shares and a larger number of regional producers serving local demand. It displays characteristics of a market in which certified products and modular systems drive buyer preference over unbranded solutions. Regional manufacturers offer competitive pricing but lack brand recognition and service infrastructure present among global competitors. Product differentiation depends on safety certification, build quality, and project-specific customization. Rental model adoption acts as a key growth mechanism, enabling broader access to equipment without capital investment. Buyers prioritize suppliers that guarantee product reliability and compliance with regional standards. Market growth depends on scalability of distribution networks, after‑sales support, and ability to tailor systems for diverse applications.

Report Coverage:

The research report offers an in-depth analysis based on product type, application, and end-user industry. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising infrastructure development across emerging economies will sustain long-term demand for aluminum scaffolding.

- Adoption of lightweight, corrosion-resistant platforms will increase across indoor and high-rise construction projects.

- Integration of digital planning tools and BIM-compatible scaffold systems will support precision and efficiency.

- Growth in industrial maintenance and retrofit activities will drive repeat procurement and rental usage.

- Stricter global safety regulations will promote certified and load-tested aluminum scaffolding systems.

- Expansion of the rental model will broaden market access for small and mid-sized contractors.

- Product innovation focusing on modularity and quick assembly will attract urban project developers.

- Growing sustainability standards will favor recyclable and reusable aluminum scaffold solutions.

- Strategic partnerships between global manufacturers and regional suppliers will boost market penetration.

- Increasing demand for ergonomic and compact scaffolding designs will shape future product offerings.