Market Overview

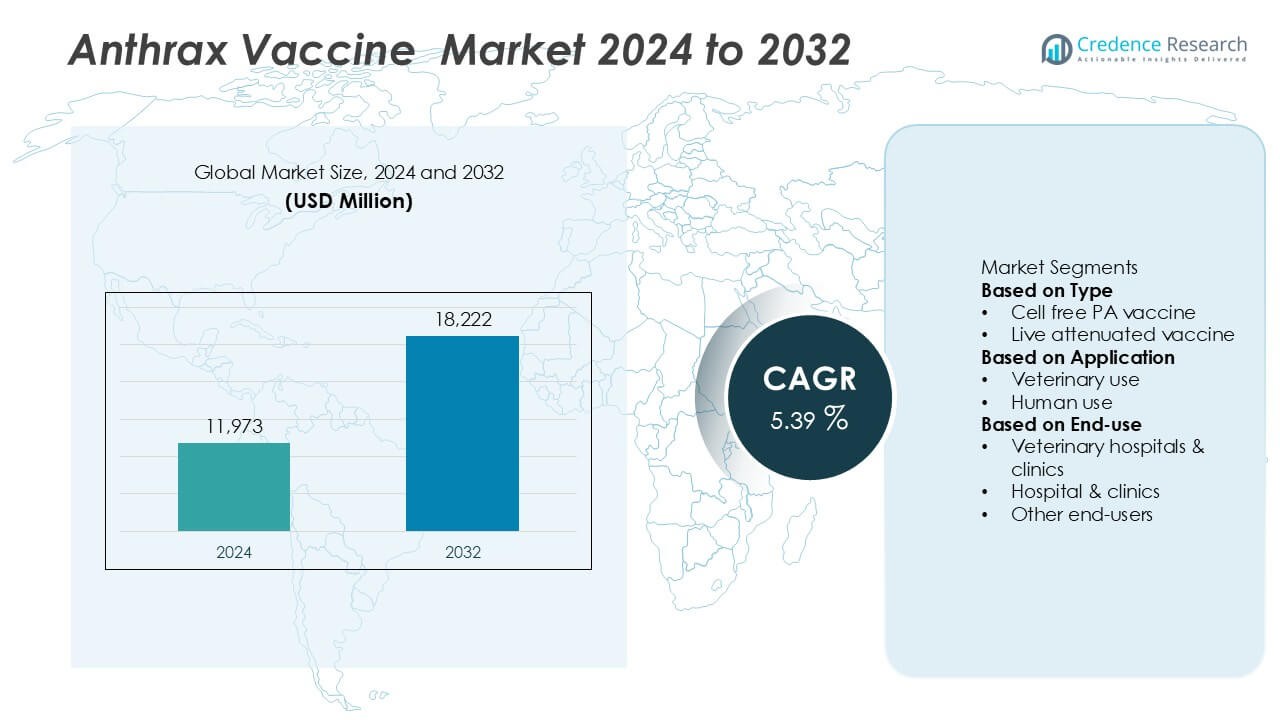

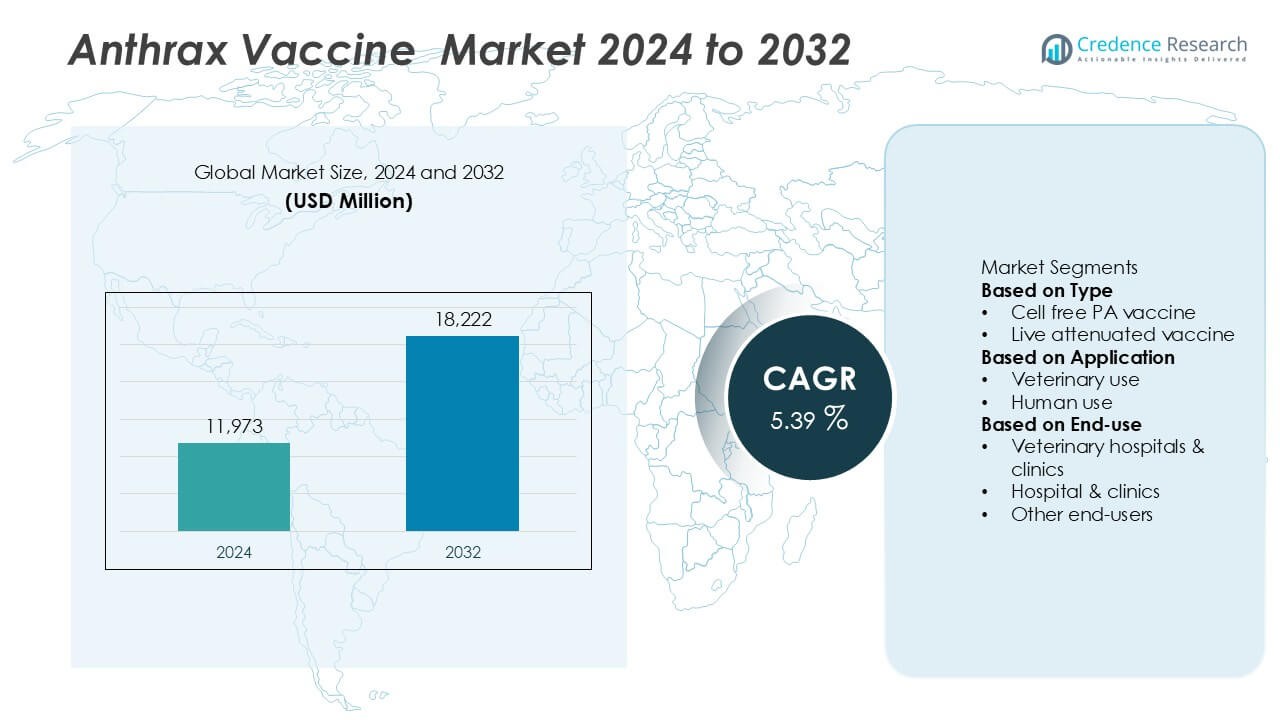

The global Anthrax Vaccine Market was valued at USD 11,973 million in 2024 and is projected to reach USD 18,222 million by 2032, growing at a compound annual growth rate CAGR of 5.39% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Anthrax Vaccine Market Size 2024 |

USD 11,973 Million |

| Anthrax Vaccine Market, CAGR |

5.39% |

| Anthrax Vaccine Market Size 2032 |

USD 18,222 Million |

The Anthrax Vaccine market is driven by major players such as Emergent BioSolutions, Bavarian Nordic, Ceva Sante Animale, Indian Immunologicals Ltd., Bayer AG, Altimmune Inc., Biogenesis Bago SA, Elusys Therapeutics Inc., Agrovet, and Colondo Serum Company. These companies compete through product innovation, government partnerships, and extensive vaccine distribution networks. Emergent BioSolutions leads the global market with strong biodefense contracts and a robust human vaccine portfolio, while Ceva Sante Animale and Indian Immunologicals Ltd. dominate the veterinary segment. Regionally, North America remains the leading market, holding 38% of global revenue in 2024, followed by Europe with 26%, driven by advanced healthcare infrastructure, government stockpiling initiatives, and growing investment in next-generation anthrax vaccine development.

Market Insights

- The global Anthrax Vaccine market was valued at USD 11,973 million in 2024 and is projected to reach USD 18,222 million by 2032, registering a CAGR of 5.39% during the forecast period.

- Rising government biodefense initiatives and increasing livestock vaccination programs are key drivers enhancing vaccine demand across both human and veterinary applications.

- Market trends highlight growing adoption of cell-free PA vaccines, which accounted for 65% of the market share in 2024, supported by improved safety and efficacy profiles.

- The competitive landscape is moderately consolidated, with major players such as Emergent BioSolutions, Bavarian Nordic, Ceva Sante Animale, and Indian Immunologicals Ltd. leading through R&D investment, global collaborations, and government supply contracts.

- North America dominated the market with 38% share, followed by Europe at 26% and Asia-Pacific at 21%, driven by advanced healthcare infrastructure, government support, and expanding vaccination programs in emerging economies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The cell-free PA vaccine segment dominated the Anthrax Vaccine market in 2024, accounting for approximately 65% of the total market share. Its dominance is driven by higher safety, fewer adverse effects, and strong immunogenicity compared to live attenuated vaccines. Increasing adoption of purified antigen-based formulations for both civilian and defense use has strengthened its position. In contrast, the live attenuated vaccine segment continues to serve niche markets, primarily in animal health and developing regions where cost-effectiveness and broad immune response remain critical factors.

- For instance, Emergent BioSolutions developed CYFENDUS, a next-generation anthrax vaccine adjuvanted with aluminum hydroxide, approved by the U.S. FDA for post-exposure prophylaxis. The company delivered over 100 million doses of its anthrax vaccine to U.S. federal agencies under the Strategic National Stockpile initiative, ensuring biodefense readiness.

By Application

The veterinary use segment held the largest market share of around 58% in 2024, reflecting the continued prevalence of anthrax outbreaks among livestock and the prioritization of animal vaccination programs in endemic regions. Governments and agricultural agencies increasingly emphasize livestock immunization to prevent zoonotic transmission and safeguard food security. Meanwhile, the human use segment is expanding steadily, driven by heightened awareness of bioterrorism threats, government stockpiling initiatives, and growing investment in biodefense vaccine development.

- For instance, Ceva Santé Animale is a global animal health company with a veterinary biologics division that is a world leader in veterinary vaccines used across over 110 countries.

By End-use

Among end-users, the veterinary hospitals and clinics segment led the market with an estimated 52% share in 2024, supported by widespread vaccination programs in livestock-dense regions and growing veterinary healthcare infrastructure. These facilities play a key role in vaccine distribution, disease surveillance, and field immunization efforts. The hospital and clinics segment for human use is gaining traction due to increasing vaccination among at-risk populations, including defense and laboratory personnel. Other end-users, such as research institutes and government agencies, also contribute to demand through biodefense research and national preparedness programs.

Key Growth Drivers

Rising Government Biodefense Investments

Growing global concern over bioterrorism and biological warfare has led to significant government investments in anthrax vaccine stockpiling. Defense agencies, particularly in the U.S. and Europe, are prioritizing procurement of cell-free PA vaccines for military and emergency preparedness programs. Strategic partnerships between public health authorities and vaccine manufacturers have enhanced production capacity and research funding. These initiatives aim to ensure readiness against potential anthrax threats, thereby driving consistent market growth and strengthening the commercial viability of advanced vaccine formulations.

- For instance, Bavarian Nordic utilizes its MVA-BN vaccine platform to develop various vaccine candidates, including for mpox, smallpox, Ebola, Marburg, and equine encephalitis viruses, with some programs funded by the U.S. government.

Increasing Incidence of Livestock Anthrax Outbreaks

The persistent occurrence of anthrax outbreaks among livestock populations continues to drive vaccine demand in veterinary applications. Countries in Africa, Asia, and parts of Europe have intensified vaccination programs to safeguard animal health and prevent zoonotic transmission to humans. Governments are introducing mandatory immunization policies in high-risk regions to protect food supply chains. Rising awareness among farmers and veterinary practitioners regarding disease prevention and improved access to veterinary healthcare infrastructure are further boosting the uptake of anthrax vaccines globally.

- For instance, Biogénesis Bagó SA produces more than 15 million doses of anthrax vaccine annually for cattle and small ruminants across South America. The company’s industrial complex in Garín, Argentina, includes over 12,000 square meters of biomanufacturing space certified under GMP standards.

Advancements in Vaccine Formulation and Production

Technological advancements in recombinant vaccine development and purification processes are accelerating the evolution of safer and more effective anthrax vaccines. Modern cell-free PA formulations offer improved stability, enhanced immune response, and reduced adverse effects compared to traditional live attenuated variants. Continuous R&D investments by pharmaceutical companies and public institutions are fostering innovation, including next-generation adjuvants and delivery systems. These advancements are expected to expand the vaccine’s application scope and improve its suitability for large-scale biodefense and public health programs.

Key Trends & Opportunities

Expansion of Human Vaccination Programs

Human vaccination against anthrax is witnessing growing acceptance due to heightened awareness of occupational risks and national biodefense strategies. Governments are expanding immunization to include high-risk civilian populations such as laboratory workers and healthcare professionals. The increasing inclusion of anthrax vaccines in emergency preparedness frameworks presents a substantial opportunity for manufacturers. Moreover, new clinical studies on improved dosing schedules and booster regimens are expected to support broader adoption and strengthen long-term immunity profiles.

- For instance, Altimmune Inc. advanced its NasoShield intranasal anthrax vaccine through Phase 1 clinical trials funded by the U.S. Biomedical Advanced Research and Development Authority. The vaccine was a single-dose intranasal product candidate designed to offer a more convenient alternative to the existing multi-dose anthrax vaccine.

Growing Focus on Emerging Markets

Emerging economies are becoming lucrative markets for anthrax vaccines due to rising livestock populations and government-led disease control programs. Regions in Asia-Pacific and Africa are prioritizing anthrax vaccination as part of their agricultural modernization and public health initiatives. Local production partnerships, supported by technology transfer from established manufacturers, are helping reduce dependency on imports. These developments are creating significant opportunities for vaccine suppliers to expand their geographic footprint and strengthen distribution networks in underpenetrated markets.

- For instance, Indian Immunologicals Ltd is exploring potential investments and collaborations in Africa to develop tools for controlling and eradicating diseases, in addition to exporting existing vaccines to over 60 countries globally.

Key Challenges

High Production and Storage Costs

Anthrax vaccine manufacturing involves complex purification and biosafety processes that significantly elevate production costs. Maintaining cold-chain logistics for vaccine storage and distribution further adds to operational expenses, particularly in remote or underdeveloped regions. These high costs often restrict large-scale deployment, especially in resource-limited countries. Additionally, limited private investment due to low commercial profitability compared to routine vaccines poses challenges for sustained innovation and capacity expansion across the global market.

Regulatory and Safety Constraints

Stringent regulatory frameworks governing the approval and distribution of anthrax vaccines often slow down market entry for new formulations. Comprehensive clinical testing and safety evaluations, while essential, extend product development timelines and increase costs. Public concerns about potential side effects, particularly with older vaccine types, continue to influence vaccination rates. Navigating these regulatory complexities and maintaining transparency in safety communications are critical challenges for manufacturers seeking to expand their market presence and public acceptance.

Regional Analysis

North America

North America held the largest share of the Anthrax Vaccine market in 2024, accounting for 38% of global revenue. The region’s dominance is driven by substantial government funding for biodefense, strong presence of key manufacturers, and advanced public health infrastructure. The U.S. Department of Defense and the Centers for Disease Control and Prevention (CDC) maintain extensive vaccine stockpiles for military and civilian use. Increasing investments in research for next-generation PA-based vaccines and high awareness of bioterrorism preparedness continue to reinforce the region’s leadership throughout the 2024–2032 forecast period.

Europe

Europe accounted for 26% of the Anthrax Vaccine market in 2024, supported by strong regulatory frameworks and government-led vaccination programs. Countries such as the United Kingdom, Germany, and France play a pivotal role in biodefense preparedness and livestock disease management. The European Medicines Agency’s initiatives to streamline vaccine approvals and enhance biosafety standards are fostering market stability. Rising anthrax cases in parts of Eastern Europe and continued veterinary vaccination drives further contribute to regional growth, while collaborations between research institutes and biotech firms enhance vaccine development capabilities.

Asia-Pacific

Asia-Pacific captured 21% of the global Anthrax Vaccine market in 2024, with growth driven by increasing livestock vaccination programs and expanding government efforts to control zoonotic diseases. Countries such as China, India, and Australia are prioritizing vaccination to protect agricultural economies and reduce public health risks. Expanding veterinary infrastructure, coupled with rising awareness of anthrax prevention among farmers, supports strong market growth. Moreover, local manufacturing initiatives and partnerships for technology transfer are improving vaccine accessibility and affordability, positioning the region as a high-growth market over the forecast period.

Latin America

Latin America represented 9% of the Anthrax Vaccine market in 2024, driven by rising efforts to mitigate livestock losses and prevent anthrax outbreaks in rural farming regions. Countries like Brazil, Argentina, and Mexico are expanding veterinary vaccination programs under government-supported disease control initiatives. Increasing investment in veterinary healthcare infrastructure and improved access to cold-chain logistics are enabling broader vaccine distribution. Although human vaccination adoption remains limited, growing agricultural trade and regional partnerships with international health organizations are expected to enhance long-term market development and vaccine coverage.

Middle East & Africa

The Middle East & Africa region accounted for 6% of the Anthrax Vaccine market in 2024, supported primarily by government vaccination initiatives and international aid programs. Several African nations face recurrent anthrax outbreaks among livestock, prompting sustained demand for affordable vaccine solutions. Veterinary-focused campaigns and collaborations with global health agencies are helping to strengthen disease surveillance and immunization rates. In the Middle East, biodefense preparedness and rising awareness of zoonotic disease prevention are gradually increasing human vaccination uptake, though limited manufacturing capabilities and funding constraints remain key challenges for market expansion.

Market Segmentations:

By Type

- Cell free PA vaccine

- Live attenuated vaccine

By Application

By End-use

- Veterinary hospitals & clinics

- Hospital & clinics

- Other end-users

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Anthrax Vaccine market features key players such as Bavarian Nordic, Biogenesis Bago SA, Ceva Sante Animale, Altimmune Inc., Indian Immunologicals Ltd., Elusys Therapeutics Inc., Agrovet, Bayer AG, Emergent BioSolutions, and Colondo Serum Company. The market is moderately consolidated, with a few global companies dominating through government contracts, research collaborations, and strong distribution networks. Emergent BioSolutions leads in human anthrax vaccines, supported by long-term supply agreements with defense and public health agencies. Meanwhile, veterinary-focused firms like Ceva Sante Animale and Indian Immunologicals Ltd. hold significant positions in livestock vaccination programs across emerging markets. Continuous innovation in recombinant vaccine technology and expanding biodefense initiatives are fostering new product development and partnerships. Companies are increasingly investing in R&D, facility expansion, and regional alliances to strengthen their competitive edge and cater to the growing demand for safe, effective, and stable anthrax vaccine formulations.

Key Player Analysis

- Bavarian Nordic

- Biogenesis Bago SA

- Ceva Sante Animale

- Altimmune Inc.

- Indian Immunologicals Ltd.

- Elusys Therapeutics Inc.

- Agrovet

- Bayer AG

- Emergent BioSolutions

- Colondo Serum Company

Recent Developments

- In September 2025, Emergent BioSolutions was awarded a contract modification for its anthrax vaccine programme.

- In January 2025, Emergent BioSolutions announced exercise of a US Department of Defense option to supply its anthrax vaccine BioThrax.

- In July 2023, the U.S. FDA approved CYFENDUS, developed by Emergent BioSolutions Inc., for post-exposure prophylaxis of disease in people between 18 years to 65 years identified with Bacillus anthracis infection. This vaccine is given in association with mandated antiviral drugs.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Anthrax Vaccine market will continue to grow steadily through 2032, supported by ongoing government biodefense and public health initiatives.

- Increasing demand for advanced vaccine formulations will drive research and innovation in recombinant and cell-free PA vaccine technologies.

- Expansion of livestock vaccination programs in developing regions will enhance market penetration across Asia-Pacific and Africa.

- Governments will strengthen national stockpiling strategies to improve preparedness against bioterrorism threats.

- Pharmaceutical companies will focus on developing next-generation vaccines with improved safety, stability, and immune response.

- Strategic collaborations between public health agencies and private manufacturers will accelerate vaccine development and distribution.

- Human anthrax vaccination programs will expand, particularly among defense personnel and laboratory workers.

- Rising awareness of zoonotic diseases will support the adoption of veterinary vaccines in rural and agricultural communities.

- Market players will invest in manufacturing capacity and cold-chain logistics to meet growing global demand.

- Regulatory harmonization and international partnerships will facilitate faster approval and wider global accessibility of anthrax vaccines.