Market Overview:

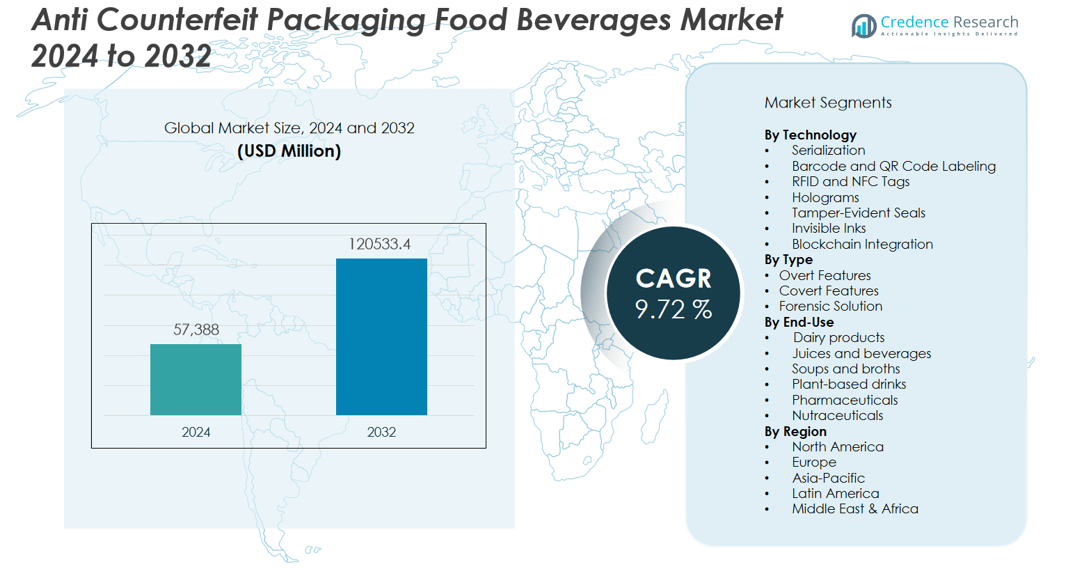

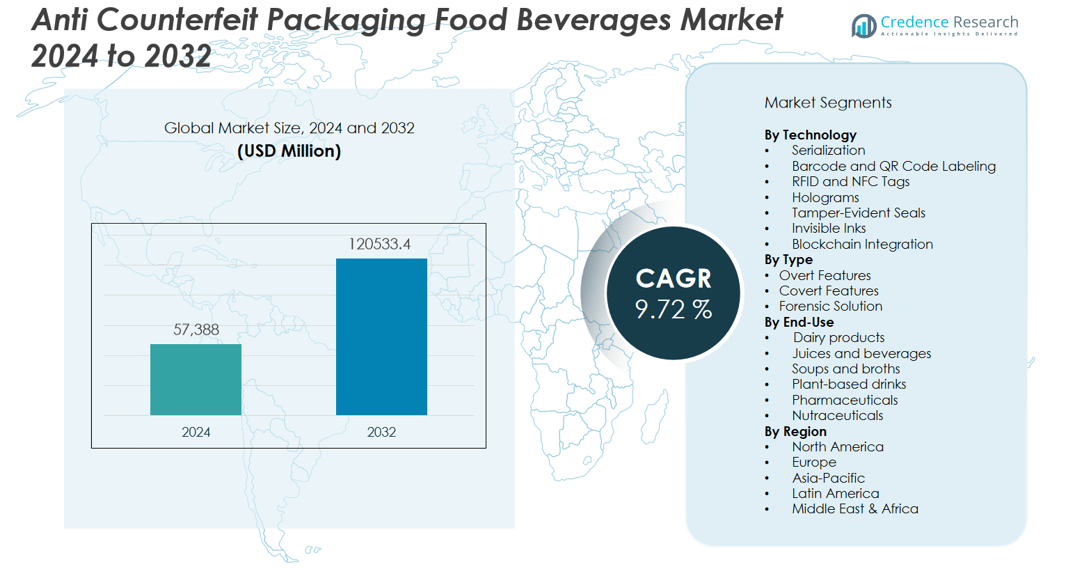

The anti counterfeit packaging food beverages market size was valued at USD 57,388 million in 2024 and is anticipated to reach USD 120533.4 million by 2032, at a CAGR of 9.72 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Anti-Counterfeit Packaging Food & Beverages Market Size 2024 |

USD 57,388 million |

| Anti-Counterfeit Packaging Food & Beverages Market, CAGR |

9.72% |

| Anti-Counterfeit Packaging Food & Beverages Market Size 2032 |

USD 120533.4 million |

The primary drivers of the anti-counterfeit packaging market in the food and beverages sector include heightened regulatory enforcement, increasing awareness of food safety, and rising incidences of product recalls and fraud. Government agencies worldwide have intensified regulations mandating traceability, authentication, and labeling standards, pushing manufacturers to adopt innovative solutions for product integrity. In addition, the surge in global trade and e-commerce accelerates the demand for robust anti-counterfeit technologies to ensure supply chain transparency and combat illicit distribution. Consumer preference for safe, authentic, and traceable food products further compels brands to invest in secure packaging solutions, integrating smart labels, QR codes, and blockchain-enabled systems for real-time verification.

Regionally, North America holds the largest market share in 2024, driven by stringent regulatory frameworks, high consumer awareness, and early adoption of authentication technologies by key players such as Phoenix Packaging, Impinj, Sato Holdings, Label Lock, and Honeywell. Europe follows, benefitting from harmonized standards and increasing cross-border trade. The Asia-Pacific region is projected to record the fastest growth, supported by expanding food and beverage markets, escalating counterfeit threats, and strengthening government policies in China, India, and Southeast Asia. The Middle East, Africa, and Latin America present growing opportunities as manufacturers respond to rising risks and evolving regulatory demands in these emerging markets.

Market Insights:

- The anti counterfeit packaging food beverages market reached USD 57,388 million in 2024 and is forecast to hit USD 120,533.4 million by 2032.

- Regulatory enforcement, heightened food safety awareness, and rising product recalls drive manufacturers to adopt advanced packaging solutions.

- Governments mandate traceability, authentication, and labeling standards, fueling investments in tamper-evident labels, holograms, and RFID.

- Growth in global trade and e-commerce boosts demand for supply chain transparency, driving the adoption of track-and-trace technologies.

- North America leads with a 38% share in 2024, supported by strong regulations and early use of authentication technologies by major players.

- Europe follows with a 29% share, strengthened by harmonized product safety standards, while Asia-Pacific holds 23% share and records the fastest growth.

- High implementation costs, integration complexities, and fragmented regulatory standards remain major challenges for broader market adoption.

Market Drivers:

Regulatory Mandates Intensify Need for Advanced Packaging Solutions:

Stringent regulations from government bodies across major economies drive the adoption of anti-counterfeit packaging in the food and beverages market. Regulatory authorities now require traceability, serialization, and clear labeling to protect public health and ensure product integrity. Food and beverage companies face regular audits and compliance checks, compelling them to implement secure packaging technologies. It has led to significant investments in tamper-evident labels, holograms, barcodes, and RFID systems. Regulatory compliance not only minimizes the risk of product recalls and liability but also enhances consumer trust. International trade agreements have further harmonized packaging standards, making advanced anti-counterfeit solutions a global necessity.

- For instance, Chipotle successfully rolled out RFID technology nationwide—requiring all suppliers to tag products—which enabled real-time traceability and inventory accuracy across more than 200 restaurant locations, setting a new compliance benchmark in the industry.

Growing Threat of Counterfeit Products Spurs Technology Adoption:

The proliferation of counterfeit food and beverage products threatens both consumer safety and brand reputation. Counterfeiters increasingly target packaged foods, beverages, and nutritional supplements, often with serious health risks. It drives companies to strengthen their packaging with authentication technologies and smart packaging features. Brands deploy QR codes, blockchain-based systems, and invisible inks to facilitate product verification at every stage of the supply chain. The rising incidence of food fraud, especially in high-value product categories, accelerates the implementation of robust anti-counterfeit measures. It helps companies deter illicit trade, protect market share, and maintain regulatory compliance.

- For instance, AlpVision protects over 30 billion branded products per year using its digital invisible authentication technologies, helping global food and beverage companies significantly reduce counterfeiting across their supply chains.

Expanding Global Supply Chains Demand Enhanced Transparency:

The rapid expansion of international food and beverage trade amplifies the need for transparent and secure supply chains. Companies must monitor goods across complex distribution networks, from raw material sourcing to retail shelves. It increases the adoption of track-and-trace technologies, enabling real-time monitoring and instant authentication of products. Transparent supply chains improve operational efficiency and minimize opportunities for counterfeiters to infiltrate distribution channels. Multinational brands invest in integrated packaging solutions to maintain product integrity across diverse markets. Supply chain transparency ultimately supports both compliance and consumer confidence.

Consumer Awareness and Demand for Product Authenticity Accelerate Market Growth:

Consumers are more informed and vigilant about food safety, authenticity, and the risk of counterfeits. Growing media coverage of food fraud and product recalls raises public concern, prompting consumers to seek reliable, traceable brands. It leads to higher demand for secure packaging and clear on-pack authentication features. Food and beverage companies respond by incorporating smart labels, tamper-evident seals, and digital verification tools. The shift in consumer behavior encourages manufacturers to invest in innovative packaging that communicates safety and authenticity. Strong consumer demand for trusted products reinforces the growth of the anti counterfeit packaging food beverages market.

Market Trends:

Digital Authentication and Smart Packaging Technologies Gain Traction:

Smart packaging technologies are rapidly transforming the anti counterfeit packaging food beverages market. Brands are investing in digital authentication features such as QR codes, NFC tags, and blockchain-based systems that enable real-time product verification. It allows consumers, retailers, and regulators to instantly check product authenticity using smartphones or connected devices. The integration of track-and-trace software supports end-to-end supply chain visibility, reducing the risk of counterfeit products entering legitimate channels. Manufacturers also deploy tamper-evident seals, holographic labels, and invisible inks to enhance packaging security. These innovations provide both deterrence for counterfeiters and value-added engagement for consumers seeking transparent product information.

- For instance, in 2023, 91 million smartphone users in the US scanned a QR code, highlighting widespread adoption of digital authentication in consumer products.

Sustainability Initiatives and Eco-Friendly Packaging Solutions Influence Market Direction:

Sustainability has emerged as a significant trend shaping anti-counterfeit packaging strategies in the food and beverages sector. Companies are adopting eco-friendly materials and recyclable packaging formats that align with both regulatory expectations and consumer preferences for sustainable products. It has led to the development of compostable films, biodegradable labels, and solvent-free inks integrated with security features. Brands highlight their sustainability efforts alongside anti-counterfeit technologies to differentiate themselves in the marketplace and build consumer trust. The growing synergy between advanced security features and environmental responsibility supports new product innovations and strengthens market competitiveness. Sustainability-driven packaging solutions are expected to become standard across industry leaders, influencing future market evolution.

- For instance, Avery Dennison has introduced the S9500 adhesive, which is both biodegradable and compostable, and is certified “OK Compost” according to EN 13432 standards for industrial composting, allowing full label breakdown in industrial composting environments.

Market Challenges Analysis:

High Implementation Costs and Integration Complexities Restrain Market Adoption:

The adoption of advanced anti-counterfeit technologies often involves significant upfront investment in specialized equipment, secure materials, and staff training. Many small and medium-sized enterprises face budget constraints that limit their ability to implement sophisticated packaging solutions. Integration of digital authentication tools and track-and-trace systems with existing production lines can require substantial technical expertise and ongoing maintenance. It may lead to disruptions in manufacturing workflows and slower return on investment. The need for continuous technology upgrades to outpace counterfeiters adds to operational expenses. These cost and complexity barriers slow market penetration, especially in price-sensitive regions.

Limited Standardization and Fragmented Regulatory Landscape Create Uncertainty:

Lack of universal standards and fragmented regulatory requirements across regions challenge consistent adoption of anti-counterfeit packaging in the food and beverages sector. Companies operating in multiple markets must navigate diverse regulations related to labeling, serialization, and traceability. It complicates supply chain management and increases compliance costs. Absence of harmonized guidelines often results in varied product authentication practices, reducing overall effectiveness. This regulatory inconsistency hinders seamless integration of security solutions and may slow the global growth of the anti counterfeit packaging food beverages market.

Market Opportunities:

Rising Demand for Digital Solutions and Smart Packaging Expands Growth Prospects:

The increasing use of smartphones and digital technologies presents significant opportunities for the anti counterfeit packaging food beverages market. Brands can leverage mobile-enabled authentication tools such as QR codes, NFC chips, and blockchain platforms to offer instant product verification for consumers and retailers. It enables companies to create interactive experiences, strengthen customer trust, and collect valuable supply chain data. The shift toward smart packaging solutions supports new service offerings, including real-time tracking and analytics for both manufacturers and end-users. Companies that invest in digital integration and consumer engagement stand to capture higher market share and build stronger brand loyalty.

Expanding Presence in Emerging Markets Unlocks New Revenue Streams:

Emerging economies in Asia-Pacific, Latin America, and Africa offer untapped potential for anti-counterfeit packaging providers. Rising incidences of counterfeit food and beverages in these regions have increased regulatory scrutiny and consumer awareness. It creates opportunities for packaging companies to introduce cost-effective and scalable security solutions tailored to local market needs. Partnerships with regional manufacturers and government agencies can accelerate technology adoption and foster long-term growth. The ability to deliver adaptable solutions across diverse regulatory environments will position market leaders to capitalize on future demand and establish a robust presence in fast-growing economies.

Market Segmentation Analysis:

By Technology:

The anti counterfeit packaging food beverages market leverages a diverse range of technologies to ensure product safety and authenticity. Serialization and track-and-trace solutions dominate, providing comprehensive visibility across supply chains. Companies also deploy barcode and QR code labeling for easy product verification, while RFID tags and NFC chips facilitate automated authentication at distribution and retail points. Holograms, tamper-evident seals, and invisible inks offer layered security and act as deterrents against counterfeit attempts. Blockchain integration is gaining traction, enabling secure, immutable records of product movement and ownership.

- For instance, SAP Advanced Track and Trace for Pharmaceuticals solution is deployed by global pharmaceutical manufacturers, assigning unique serial numbers to over 8 billion individual medicine packages annually for regulatory compliance and patient safety.

By Type:

The market segments its solutions into overt, covert, and forensic types. Overt features, such as holographic labels and security seals, are visible and assure consumers of authenticity at a glance. Covert solutions, including invisible inks and microtext, are detectable only with specialized devices and support internal checks. Forensic methods, such as taggants and molecular markers, provide advanced protection and support regulatory investigations, further strengthening brand defense strategies.

- For instance, OPSWAT’s MetaDefender Kiosk series enables secure, overt scanning and sanitization of physical media, protecting critical operational environments with more than 30 advanced scanning engines for over 100,000 files daily.

By End-Use Application:

Food and beverage manufacturers, distributors, and retailers drive the adoption of anti-counterfeit packaging solutions. It addresses the rising demand in high-risk categories such as dairy, spirits, packaged foods, nutritional supplements, and baby food. The market’s broad end-user base ensures steady uptake across global supply chains, reflecting diverse regulatory environments and consumer expectations for safety and authenticity.

Segmentations:

By Technology:

- Serialization

- Barcode and QR Code Labeling

- RFID and NFC Tags

- Holograms

- Tamper-Evident Seals

- Invisible Inks

- Blockchain Integration

By Type:

- Overt Features

- Covert Features

- Forensic Solutions

By End-Use:

- Dairy Products

- Alcoholic Beverages

- Packaged Foods

- Nutritional Supplements

- Baby Food

- Non-Alcoholic Beverages

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America :

North America commands 38% share of the anti counterfeit packaging food beverages market in 2024, reflecting the region’s advanced regulatory environment and high consumer awareness. The United States leads in the deployment of authentication technologies and track-and-trace solutions, driven by strict food safety standards and active government intervention. Manufacturers in the region invest in digital packaging, tamper-evident labels, and smart labels to meet compliance requirements and consumer expectations. Canada also contributes to growth through harmonized regulations and increasing demand for secure food supply chains. Market participants benefit from a mature infrastructure that supports rapid adoption of innovative packaging formats. The presence of global food and beverage brands accelerates regional expansion and technological advancement.

Europe :

Europe accounts for 29% share of the anti counterfeit packaging food beverages market, underpinned by robust regulatory frameworks and unified product safety initiatives. The region benefits from collaborative efforts among EU member states to enforce harmonized traceability and labeling standards. Leading food and beverage companies in countries such as Germany, France, and the United Kingdom invest in serialization and smart packaging to comply with evolving regulations. It supports high uptake of authentication solutions and bolsters market resilience against counterfeit activities. Ongoing investments in digital transformation and sustainable packaging align with both consumer expectations and legislative requirements. The region’s strong focus on sustainability continues to influence product innovation and adoption of eco-friendly anti-counterfeit technologies.

Asia-Pacific:

Asia-Pacific holds 23% share of the anti counterfeit packaging food beverages market in 2024 and records the fastest growth rate globally. The region’s expanding food and beverage industry, coupled with heightened regulatory action in China, India, and Southeast Asian countries, drives significant demand for secure packaging. Companies respond to increasing incidences of food fraud by adopting smart labels, blockchain-enabled verification, and tamper-evident formats. Government initiatives aimed at ensuring food safety and quality fuel rapid implementation of anti-counterfeit technologies across local and multinational brands. The rising middle-class population and growing e-commerce sector further contribute to market expansion. It positions Asia-Pacific as a strategic growth region for industry participants seeking to strengthen their global footprint.

Key Player Analysis:

- Phoenix Packaging

- Impinj

- Sato Holdings

- Label Lock

- Honeywell

- Meyer Packaging Solutions

- CCL Industries

- Avery Dennison

- The Smurfit Kappa Group

- Zebra Technologies

Competitive Analysis:

The anti counterfeit packaging food beverages market features intense competition among global and regional players focused on technological advancement and service differentiation. Key companies such as Phoenix Packaging, Impinj, Sato Holdings, Label Lock, and Honeywell lead innovation in digital authentication, tamper-evident solutions, and track-and-trace technologies. It drives market growth through robust research and development, strategic alliances, and frequent product launches. Players continually expand their portfolios to address evolving regulatory requirements and diverse client needs. Competitive dynamics encourage investment in smart labels, blockchain integration, and eco-friendly materials. Companies that deliver comprehensive, scalable, and easy-to-integrate solutions maintain strong market positioning, while strategic acquisitions and geographic expansion further intensify rivalry across the industry.

Recent Developments:

- In February 2025, MetPac-SA announced the expansion of its partnership with Phoenix for the Planet, strengthening support for community-driven recycling initiatives in South Africa.

- In February 2025, SATO launched the WT4-AXB 4-inch industrial label printer in the Asia-Pacific region, targeting small and medium-sized businesses seeking affordable labeling solutions.

- In May 2025, Honeywell introduced the HGuide o480, a high-performance single-card inertial navigation system for unmanned and autonomous vehicles across land, air, and sea.

Market Concentration & Characteristics:

The anti counterfeit packaging food beverages market demonstrates moderate to high market concentration, with several global leaders and a growing number of regional players competing on technology, innovation, and service integration. It features strong investments in research and development, driving advancements in smart packaging, digital authentication, and eco-friendly materials. Major companies form strategic alliances and pursue acquisitions to expand product portfolios and enhance geographic reach. The market’s key characteristics include rapid adoption of serialization, tamper-evident designs, and blockchain-based solutions tailored to evolving regulatory demands. It maintains a dynamic environment marked by continuous innovation, stringent compliance requirements, and heightened focus on both supply chain security and consumer engagement.

Report Coverage:

The research report offers an in-depth analysis based on Technology, Type, End-Use and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- Industry participants will accelerate deployment of blockchain-enabled traceability systems to reinforce supply chain transparency.

- Manufacturers will integrate IoT sensors and RFID tags to facilitate automated product authentication in retail environments.

- Consumer-facing mobile verification tools will gain prominence, enabling end-users to validate product legitimacy with smartphones.

- Regulatory bodies will intensify enforcement of serialization mandates, prompting wider adoption of track-and-trace frameworks.

- Packaging providers will develop lightweight, recyclable security materials that balance eco-friendliness with authentication needs.

- Tier-2 and tier-3 producers will adopt standardized anti-counterfeit modules to mitigate integration complexity and cost.

- Cross-industry collaborations between food brands, packaging firms, and tech providers will drive modular solution innovation.

- AI and machine learning tools will inform real-time fraud detection by analyzing supply chain data anomalies.

- Emerging economies will deploy localized anti-counterfeit solutions reflecting unique regulatory and infrastructural challenges.

- Brands will embed consumer engagement platforms—such as loyalty schemes and product information gateways—into secure packaging to enhance brand trust.