Market Overview:

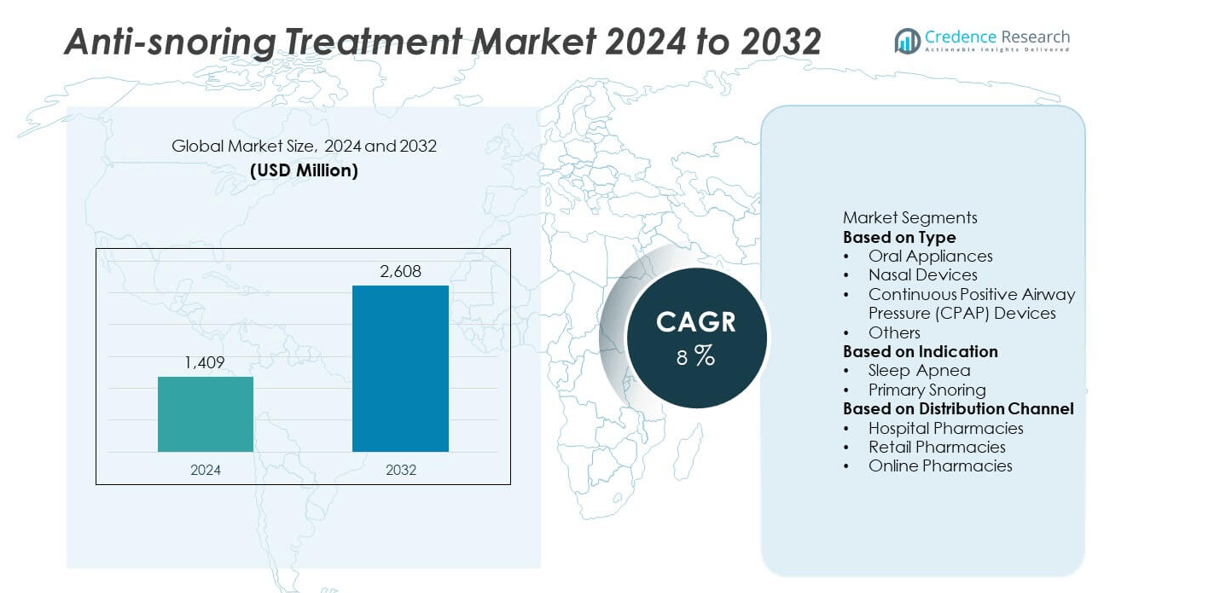

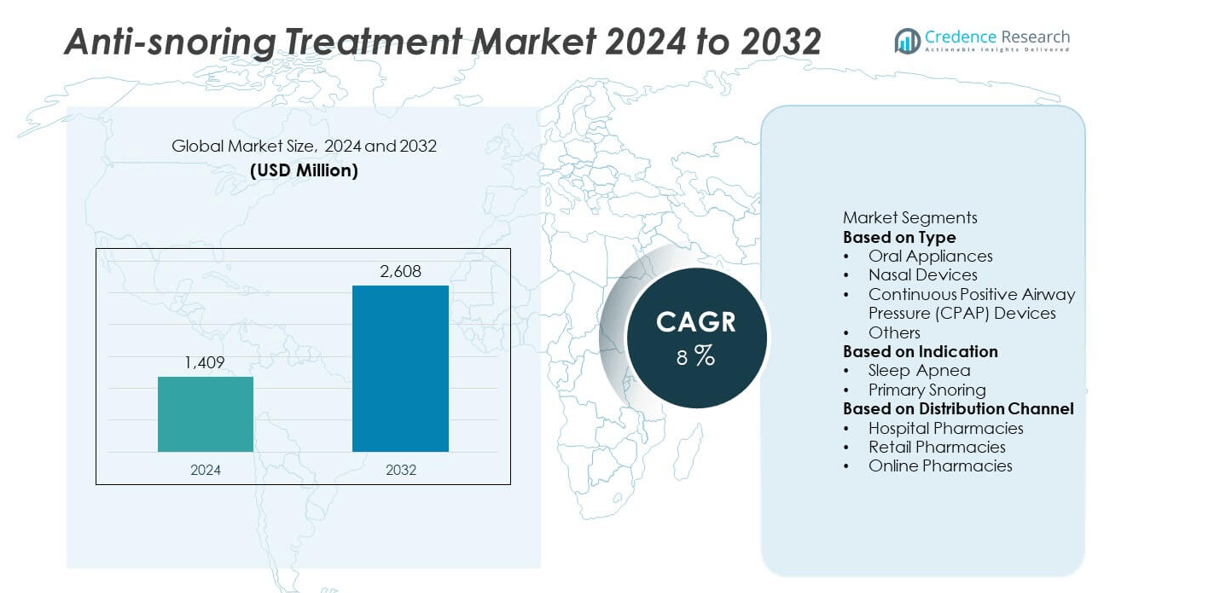

The global anti-snoring treatment market was valued at USD 1,409 million in 2024 and is projected to reach USD 2,608 million by 2032, registering a CAGR of 8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Anti-snoring Treatment Market Size 2024 |

USD 1,409 million |

| Anti-snoring Treatment Market, CAGR |

8% |

| Anti-snoring Treatment Market Size 2032 |

USD 2,608 million |

The anti-snoring treatment market features prominent players such as ResMed Inc., Philips Respironics, Fisher & Paykel Healthcare Limited, SomnoMed Limited, Signifier Medical Technologies Ltd., Apnea Sciences Corporation, AirAvant Medical Inc., ProSomnus Sleep Technologies, Glidewell Dental, and Whole You, Inc. These companies focus on advanced oral appliances, CPAP devices, and digital monitoring systems to improve therapy effectiveness and patient comfort. North America led the global market with a 42.8% share in 2024, supported by high awareness, robust healthcare infrastructure, and strong adoption of non-invasive solutions. Europe followed with 28.3%, while Asia Pacific emerged as the fastest-growing region with 19.7%, driven by expanding healthcare access and rising sleep disorder prevalence.

Market Insights

- The anti-snoring treatment market was valued at USD 1,409 million in 2024 and is projected to reach USD 2,608 million by 2032, growing at a CAGR of 8%.

- Rising cases of sleep apnea and growing awareness of sleep-related health risks are driving strong demand for oral appliances and CPAP devices.

- Smart and connected treatment solutions, including app-integrated CPAP systems and custom-fitted oral devices, are shaping market trends toward personalized therapy.

- Key players such as ResMed, Philips Respironics, and SomnoMed dominate the market through innovation, partnerships, and expanded distribution networks.

- North America led with a 42.8% share in 2024, followed by Europe with 28.3%, while Asia Pacific, holding 19.7%, remains the fastest-growing region; by type, oral appliances accounted for a 41.6% share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Oral appliances dominated the anti-snoring treatment market with a 41.6% share in 2024. Their popularity stems from ease of use, portability, and effectiveness in reducing mild to moderate snoring. These devices reposition the lower jaw and tongue to maintain airway openness during sleep. Increasing awareness about non-invasive treatments and rising adoption of dentist-prescribed mandibular advancement devices support market growth. SomnoMed reported over 730,000 fitted oral appliances globally, reflecting growing clinical acceptance and patient preference for comfortable and affordable snoring management solutions.

- For instance, SomnoMed Limited has delivered over 1 million oral appliance devices globally across 28 countries, with patients averaging 6.9 hours of nightly use and 91 % reporting improved sleep quality.

By Indication

Sleep apnea accounted for the largest share of 63.4% in 2024, driven by growing diagnosis rates and awareness of sleep-related breathing disorders. The condition’s link to obesity, cardiovascular issues, and aging populations has accelerated treatment demand. Advanced diagnostic technologies and physician-prescribed therapies further enhance this segment’s dominance. ResMed recorded over 20 million cloud-connected devices, helping physicians remotely monitor sleep apnea patients and optimize treatment adherence through digital platforms, improving patient outcomes and driving steady segment growth.

- For instance, ResMed Inc. reported more than 20 million cloud-connected devices deployed in over 140 countries, enabling remote monitoring and therapy optimisation of sleep apnea patients.

By Distribution Channel

Hospital pharmacies led the market with a 46.2% share in 2024, supported by higher patient visits for sleep disorder evaluations and specialist consultations. Hospitals serve as primary distribution points for prescription-based oral and CPAP devices, ensuring medical supervision and compliance. The segment benefits from rising hospital-based sleep clinics and integrated treatment centers. Philips Respironics expanded its hospital supply network across major U.S. healthcare systems to streamline device availability and post-treatment monitoring, enhancing patient accessibility and supporting segment leadership.

Key Growth Drivers

Rising Prevalence of Sleep Disorders

The increasing incidence of sleep apnea and chronic snoring is driving strong demand for treatment solutions. Factors such as obesity, stress, and aging contribute to airway obstruction during sleep. Rising public awareness of sleep-related cardiovascular risks supports early diagnosis and intervention. Healthcare organizations are promoting screening programs, boosting demand for both oral and CPAP devices. the American Academy of Sleep Medicine reports that about 30 million U.S. adults suffer from sleep apnea, highlighting the growing need for effective treatment devices.

- For instance, the American Academy of Sleep Medicine (AASM) estimates that about 30 million U.S. adults have obstructive sleep apnea, highlighting vast potential for increased diagnostic and treatment uptake.

Advancements in Non-Invasive Therapies

Non-invasive snoring treatments are becoming the preferred choice due to comfort and ease of use. Oral appliances, nasal dilators, and positional therapy devices offer effective results without surgical procedures. Manufacturers are developing hybrid and customizable products for better comfort and airflow. Zyppah introduced dual-action oral devices designed to reduce vibration-based snoring while keeping airways open. The rising focus on minimally invasive solutions continues to expand patient adoption and clinical acceptance across sleep clinics and dental practices.

- For instance, the Zyppah mouthpiece integrates both a tongue-stabilizing strap and mandibular advancement design and was clinically shown to achieve a 91% success rate in an FDA-cleared study for snoring reduction.

Expansion of Digital and Connected Devices

Smart and connected treatment devices are reshaping patient care and therapy management. Integration of sensors, mobile apps, and cloud-based monitoring enables real-time tracking of sleep performance and adherence. These technologies improve personalization and enhance long-term treatment success. ResMed’s myAir app supports over 15 million users globally by providing personalized feedback and data insights. Growing interest in digital health ecosystems is expected to accelerate the adoption of AI-driven and remote monitoring-enabled anti-snoring solutions.

Key Trends & Opportunities

Growing Shift Toward Home-Based Care

Home-based anti-snoring solutions are becoming increasingly popular for their convenience and affordability. Compact oral and CPAP devices allow users to manage snoring independently under telehealth supervision. The expansion of online sales channels further strengthens accessibility. AirAvant Medical’s Bongo Rx device offers portable, battery-free treatment suitable for home use. The growing demand for remote sleep therapy and e-commerce-driven device distribution is opening new opportunities for manufacturers targeting consumer-centric, portable solutions.

- For instance, Signifier Medical Technologies Ltd.’s eXciteOSA intra-oral electrical stimulator requires 20 minutes of use once per day for six weeks then twice weekly thereafter, bypassing overnight devices and enabling home-based self-treatment.

Increasing Role of Dental Professionals

Dental practitioners are playing a vital role in diagnosing and managing snoring through customized oral devices. Collaboration between dentists and sleep specialists ensures accurate fittings and effective outcomes. Advanced CAD/CAM technologies enable dentists to produce precise mandibular advancement devices efficiently. ProSomnus launched precision-milled oral appliances offering superior comfort and quicker fitting. This growing dental integration strengthens the availability of professional-grade snoring solutions, broadening market access and improving patient adherence rates.

- For instance, clinical studies on rigid oral appliances (also referred to as retainers or splints) demonstrate they generally result in minimal or clinically insignificant tooth movement when used for retention after orthodontic treatment.

Key Challenges

Limited Patient Compliance with CPAP Devices

Low adherence to CPAP therapy remains a persistent challenge due to noise, mask discomfort, and maintenance needs. Many patients discontinue use within months, affecting treatment effectiveness. Manufacturers are focusing on lighter, quieter, and ergonomically designed models to improve comfort. Research indicates that nearly 50% of CPAP users stop treatment within the first year. Enhancing user experience through better interfaces and customized fittings is crucial for improving compliance and therapy success.

High Cost of Advanced Treatment Solutions

The high cost of advanced snoring treatment devices restricts market reach in low- and middle-income regions. Premium CPAP systems and customized oral appliances remain unaffordable for many patients. Limited insurance coverage adds to the challenge, reducing adoption of clinically proven therapies. Advanced CPAP machines can exceed USD 1,000, deterring price-sensitive consumers. Manufacturers are focusing on cost-efficient production, subscription-based models, and direct-to-consumer channels to improve affordability and market penetration.

Regional Analysis

North America

North America dominated the anti-snoring treatment market with a 42.8% share in 2024. The region’s leadership is driven by high awareness of sleep disorders, advanced healthcare infrastructure, and strong adoption of CPAP and oral devices. Growing obesity rates and government-supported screening programs further boost treatment demand. The United States accounts for the largest portion, supported by established players such as ResMed and Philips Respironics. Rising use of telehealth platforms for sleep management and the availability of insurance coverage continue to enhance patient access and sustain regional market growth.

Europe

Europe held a 28.3% market share in 2024, supported by strong regulatory standards and growing adoption of non-invasive snoring treatments. Increasing cases of sleep apnea across the United Kingdom, Germany, and France drive clinical intervention rates. The region benefits from favorable reimbursement policies and expanding dental collaboration for oral appliance therapy. For instance, local manufacturers like SomnoMed Europe and Signifier Medical Technologies are advancing smart oral devices with improved comfort. The growing awareness of sleep hygiene and technological innovations continue to strengthen Europe’s position in the global market.

Asia Pacific

Asia Pacific accounted for a 19.7% share in 2024 and is projected to record the fastest growth through 2032. Rising urbanization, increasing disposable incomes, and growing awareness of sleep health are key drivers. China, Japan, and India are leading contributors due to expanding healthcare infrastructure and the rising prevalence of obesity-linked snoring. Local companies are introducing affordable oral and nasal devices to improve accessibility. The region’s growing telemedicine adoption and digital retail platforms are helping reach underserved populations, further boosting the market’s expansion in developing economies.

Latin America

Latin America captured a 5.6% market share in 2024, driven by increasing healthcare expenditure and awareness of sleep-related disorders. Brazil and Mexico are the leading markets owing to higher diagnosis rates and growing private healthcare investments. The region is witnessing gradual adoption of CPAP and oral appliances, supported by international brand partnerships and distribution expansion. For instance, Philips Healthcare has strengthened its Latin American network to improve device availability. Government health campaigns addressing lifestyle disorders are expected to increase screening rates and drive long-term market growth across the region.

Middle East & Africa

The Middle East & Africa held a 3.6% share in 2024, supported by rising healthcare investments and growing medical tourism. The Gulf Cooperation Council (GCC) countries are leading the region with higher diagnosis rates and hospital-based sleep clinics. Increasing awareness among healthcare professionals about sleep disorders is fueling demand for CPAP and oral devices. For instance, hospitals in the UAE and Saudi Arabia are partnering with global brands to expand access to advanced snoring therapies. However, limited awareness and affordability challenges continue to restrain widespread market adoption.

Market Segmentations:

By Type

- Oral Appliances

- Nasal Devices

- Continuous Positive Airway Pressure (CPAP) Devices

- Others

By Indication

- Sleep Apnea

- Primary Snoring

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the anti-snoring treatment market is characterized by strong innovation and technological advancement among major players such as ResMed Inc., Philips Respironics, Fisher & Paykel Healthcare Limited, SomnoMed Limited, Signifier Medical Technologies Ltd., Apnea Sciences Corporation, AirAvant Medical Inc., ProSomnus Sleep Technologies, Glidewell Dental, and Whole You, Inc. Companies are investing in research to develop comfortable, non-invasive, and digitally integrated solutions that improve patient adherence. The market is witnessing rapid adoption of smart oral devices and connected CPAP systems offering real-time data monitoring. Strategic collaborations between sleep specialists, dental clinics, and technology providers are expanding treatment accessibility and customization. Leading players are also leveraging e-commerce and telehealth platforms to strengthen their global distribution networks. Continuous innovation, regulatory approvals, and patient-centered product development remain central to sustaining competitiveness in this evolving healthcare segment.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- ResMed Inc.

- Philips Respironics

- Fisher & Paykel Healthcare Limited

- SomnoMed Limited

- Signifier Medical Technologies Ltd.

- Apnea Sciences Corporation

- AirAvant Medical Inc.

- ProSomnus Sleep Technologies

- Glidewell Dental

- Whole You, Inc.

Recent Developments

- In October 2025, ResMed Inc. launched the AirTouch™ F30i Comfort full-face CPAP mask in Australia featuring three cushion sizes (Small-Wide, Medium, Large) and three frame sizes (Small, Standard, Large).

- In November 2024, Fisher & Paykel Healthcare Limited launched the F&P Nova Micro™ nasal pillows mask in the U.S., which the company stated was their lightest and smallest CPAP/therapy mask to date, with 38 out of 39 participants in a trial rating the pillow feel “soft” or “very soft.”

- In April 2024, Philips Respironics entered a U.S. consent decree requiring remediation of its sleep therapy devices, with more than 99 % of actionable registrations remediated globally.

- In August 2023, ProSomnus Sleep Technologies announced updated clinical-trial data showing that their precision oral appliance therapy is non-inferior to CPAP therapy for moderate-to-severe obstructive sleep apnoea.

Report Coverage

The research report offers an in-depth analysis based on Type, Indication, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Growing awareness of sleep health will continue to drive adoption of anti-snoring treatments.

- Advancements in digital health technologies will enhance real-time monitoring and therapy personalization.

- Demand for non-invasive oral and nasal devices will rise among patients seeking comfort and convenience.

- Integration of AI and cloud-based systems will improve diagnosis accuracy and treatment adherence.

- Collaborations between dental professionals and sleep specialists will expand customized oral appliance therapy.

- Expansion of telemedicine and online pharmacies will strengthen global product accessibility.

- Manufacturers will focus on compact, travel-friendly CPAP systems to attract mobile consumers.

- Regulatory approvals for innovative devices will accelerate product launches across major regions.

- The Asia Pacific market will record strong growth due to increasing healthcare awareness and infrastructure.

- Sustainability trends will encourage the development of eco-friendly and reusable snoring treatment devices.