Market Overview:

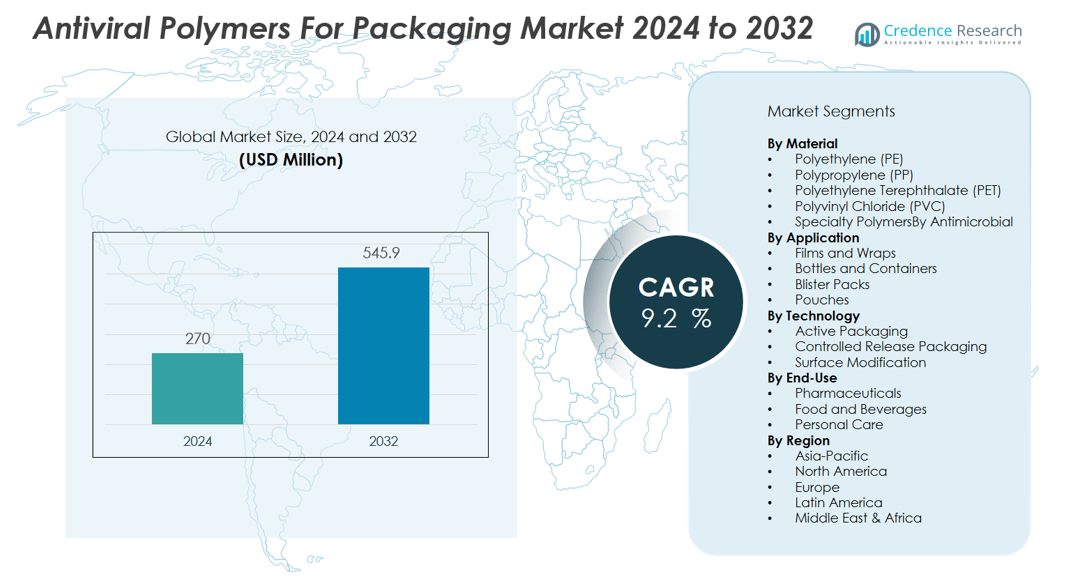

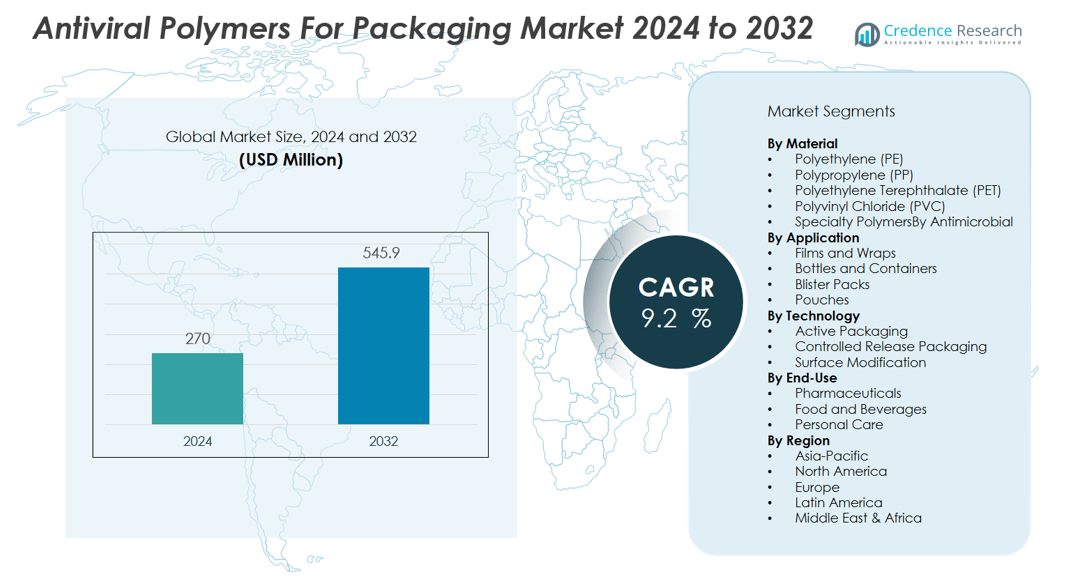

The Antiviral polymers for packaging market size was valued at USD 270 million in 2024 and is anticipated to reach USD 545.9 million by 2032, at a CAGR of 9.2 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Antiviral Polymers for Packaging Market Size 2024 |

USD 270 million |

| Antiviral Polymers for Packaging Market, CAGR |

9.2% |

| Antiviral Polymers for Packaging Market Size 2032 |

USD 545.9 million |

Key market drivers include stringent regulatory standards on packaging safety, consumer preference for hygienic and tamper-evident products, and continuous innovation in polymer science. Companies are investing heavily in the research and development of polymer additives, coatings, and films that demonstrate proven antiviral efficacy. The surge in e-commerce and direct-to-consumer delivery models has intensified the need for packaging solutions that can ensure the safe transit of goods. Furthermore, increasing awareness about cross-contamination risks and viral outbreaks has prompted manufacturers and brand owners to prioritize antiviral features as a critical component of their packaging strategies.

Regionally, Asia-Pacific commands the largest share of the antiviral polymers for packaging market, driven by high manufacturing output and rapid urbanization in China, India, Japan, and South Korea. North America follows, supported by strict packaging regulations, strong R&D infrastructure, and major players such as Dow Chemical Company, BASF SE, DuPont de Nemours, Inc., Solvay S.A., and Covestro AG. Europe maintains steady growth with a focus on healthcare standards and sustainable solutions, while Latin America and the Middle East & Africa present emerging opportunities due to growing investments in local manufacturing and healthcare.

Market Insights:

- The Antiviral polymers for packaging market reached USD 270 million in 2024 and will reach USD 545.9 million by 2032.

- Stringent regulatory standards, rising demand for hygienic and tamper-evident packaging, and innovation in polymer science drive growth.

- Companies focus on developing advanced additives, coatings, and films that ensure antiviral efficacy and regulatory compliance.

- E-commerce and direct-to-consumer delivery models boost the need for secure, antiviral packaging across multiple sectors.

- High development costs and supply chain complexity challenge broad market adoption, especially for smaller firms.

- Asia-Pacific leads with a 42% market share, fueled by manufacturing scale and urbanization in China, India, Japan, and South Korea.

- North America and Europe follow, supported by strict regulations, strong R&D infrastructure, and a growing shift toward sustainable materials.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Heightened Focus on Hygiene and Safety Across End-Use Industries:

The Antiviral polymers for packaging market is benefitting from a growing emphasis on hygiene and product safety in sectors such as food, beverages, pharmaceuticals, and personal care. Businesses and consumers are demanding solutions that reduce the risk of viral transmission through packaging surfaces. The heightened awareness of contamination risks has led to rapid adoption of packaging materials with built-in antiviral properties. It ensures safer product handling during distribution, retail, and final consumption. Increased media coverage of global viral outbreaks has made hygiene a critical purchasing factor. Brand owners are using antiviral packaging to strengthen consumer trust and differentiate their products. These dynamics are reinforcing the long-term demand for antiviral polymer solutions.

- For instance, polypropylene (PP) packaging coated with PBVP polymers achieved more than a 99.99% (over four orders of magnitude) reduction in viral infectivity titer after 60 minutes of contact in laboratory plaque assays, with the effect sustained even after surface abrasion due to the 3D distribution of the antiviral polymer.

Stringent Regulatory Standards and Industry Compliance Requirements:

Global regulations for packaging safety are growing stricter, driving demand for advanced materials in the Antiviral polymers for packaging market. Regulatory agencies in North America, Europe, and Asia-Pacific are updating standards to address risks of viral and microbial contamination. Packaging suppliers are required to demonstrate compliance with new performance, labeling, and efficacy requirements. Companies invest in R&D to create polymer solutions that meet these evolving regulations. It accelerates product development cycles and market entry for compliant materials. Government support for safer packaging practices is increasing in both developed and emerging economies. Regulatory pressure ensures that antiviral packaging remains a top priority for manufacturers.

Rapid Advancements in Polymer Science and Material Innovation:

Continuous advances in polymer science are expanding the range of antiviral additives, coatings, and films available for packaging applications. The Antiviral polymers for packaging market is seeing new material innovations that enhance efficacy against a broad spectrum of viruses. Research institutions and companies collaborate to develop cost-effective, scalable antiviral solutions. It helps address growing demand for both bulk and specialty packaging formats. The development of smart and multifunctional polymers is enabling the integration of additional benefits, such as recyclability and active freshness control. Material innovation is driving faster adoption across a wider range of industries.

Expansion of E-commerce and Direct-to-Consumer Channels:

E-commerce growth has increased the need for secure, hygienic, and tamper-evident packaging solutions, fueling demand in the Antiviral polymers for packaging market. The direct-to-consumer model exposes products to multiple touchpoints, heightening concerns about viral transmission during transit. Brands are adopting antiviral packaging to ensure safety from warehouse to doorstep. It supports customer satisfaction and brand reputation in an increasingly digital retail landscape. Large-scale online sales are pushing packaging suppliers to innovate rapidly and deliver reliable, scalable solutions. The e-commerce sector’s expansion is set to remain a significant driver for antiviral polymer adoption in the coming years.

- For instance, Returnity, in collaboration with Polygiene, has implemented ViralOff® antimicrobial solvent treatment in reusable shipping packaging, introducing antimicrobial protection for e-commerce shipments and enabling the reuse of packaging up to 40 times before replacement is required.

Market Trends:

Integration of Advanced Antiviral Agents and Multifunctional Packaging Solutions:

The Antiviral polymers for packaging market is witnessing strong momentum toward the use of advanced antiviral agents and multifunctional packaging formats. Companies are incorporating silver, copper, and zinc-based compounds into polymer matrices to provide broad-spectrum antiviral activity. It enables packaging to not only inhibit virus survival but also offer extended shelf life and improved product integrity. Leading manufacturers are developing polymer blends that combine antiviral, antimicrobial, and oxygen-scavenging properties in a single package. This trend is driving interest in smart packaging technologies, including real-time freshness indicators and QR code-based traceability features. Investments in R&D are accelerating the rollout of these next-generation solutions across food, pharma, and personal care segments.

- For instance, hybrid coatings containing silver, copper, and zinc cations applied to polymethylmethacrylate plates resulted in complete inactivation of human immunodeficiency virus type 1 within 10μl droplets after contact periods ranging from 5 to 240min.

Emphasis on Sustainable and Regulatory-Compliant Antiviral Packaging Materials:

Sustainability has become a top priority in the Antiviral polymers for packaging market, prompting the introduction of recyclable, biodegradable, and bio-based polymer alternatives. It is encouraging brands to shift away from traditional plastics and adopt eco-friendly antiviral packaging that meets regulatory requirements. Companies are focusing on lifecycle assessments and end-of-life strategies to reduce environmental impact without compromising antiviral efficacy. Certification standards from agencies in North America, Europe, and Asia-Pacific are influencing material selection and packaging design. Consumer demand for both safe and sustainable products is pushing suppliers to innovate at every stage of the value chain. This shift is reshaping procurement strategies and driving collaboration among raw material suppliers, converters, and brand owners.

- For instance, Astellas Pharma launched the world’s first biomass-based plastic drug blister pack using polyethylene derived from sugarcane, with 50 percent of the total raw material sourced from renewable biomass, for its Irribow Tablets in Japan since October 2021.

Market Challenges Analysis:

High Development Costs and Complex Manufacturing Processes:

The Antiviral polymers for packaging market faces high development costs and technical complexities that limit rapid adoption. Specialized antiviral agents and advanced polymer formulations require significant investment in R&D and testing. It drives up the overall cost structure for packaging manufacturers, making large-scale implementation challenging, especially for small and mid-sized firms. Integrating antiviral properties into packaging must ensure consistent efficacy without affecting mechanical strength or food safety compliance. Supply chain limitations for key raw materials further complicate manufacturing. Cost-sensitive end-use sectors hesitate to adopt premium-priced antiviral packaging unless regulatory or consumer pressures demand it.

Regulatory Uncertainty and Demonstrating Long-Term Efficacy:

Regulatory uncertainty remains a significant barrier in the Antiviral polymers for packaging market. Global standards for antiviral efficacy, labeling, and environmental impact continue to evolve, making it difficult for manufacturers to align product development with future requirements. Demonstrating reliable, long-term antiviral performance is a technical hurdle, especially for diverse real-world conditions. It raises the need for extensive validation and certification, prolonging product launch timelines. Complex approval processes can delay market entry, limiting the speed of innovation. Clearer regulatory guidance and harmonized standards are required to support broader market penetration.

Market Opportunities:

Expanding Applications in Healthcare, Food, and Consumer Goods Sectors:

The Antiviral polymers for packaging market offers strong growth potential through new applications in healthcare, food, and consumer goods. Hospitals and pharmaceutical companies are seeking enhanced protection against viral contamination for drug delivery systems and medical device packaging. It creates new avenues for high-performance antiviral polymer solutions. The food industry is exploring these materials to ensure safer packaging for ready-to-eat meals, beverages, and fresh produce. Consumer awareness of hygiene and safety is growing, leading brands to adopt antiviral features in daily-use packaging formats. These expanding applications support robust demand and open doors to premium product segments.

Rising Demand for Sustainable and Smart Packaging Solutions:

Sustainability and smart technologies are creating new opportunities in the Antiviral polymers for packaging market. Companies are developing recyclable, biodegradable, and bio-based antiviral polymers to align with environmental goals and regulatory trends. It allows brands to position their products as both safe and eco-friendly. The integration of sensors, freshness indicators, and traceability features can enhance value and differentiate packaging in crowded markets. Growth in e-commerce and direct-to-consumer models supports the need for packaging that assures both safety and transparency. These opportunities will drive further investment and innovation in the market.

Market Segmentation Analysis:

By Material:

The Antiviral polymers for packaging market segments by material into polyethylene (PE), polypropylene (PP), polyethylene terephthalate (PET), polyvinyl chloride (PVC), and specialty polymers. Polyethylene leads adoption due to its cost efficiency, versatility, and ease of modification with antiviral agents. Polypropylene gains traction in food and pharmaceutical applications for its superior barrier properties and chemical resistance. PET and PVC offer value in personal care and medical device packaging where transparency and rigidity are required. Specialty polymers, including bio-based and biodegradable variants, are gaining attention as sustainability becomes a top industry priority.

- For instance, a 2024 study achieved antiviral efficacy by functionalizing PP with a 3D surface-grafted poly(N-benzyl-4-vinylpyridinium bromide) layer, reducing the viral titer of an enveloped model virus by approximately 5 orders of magnitude after just 60minutes of contact; this performance was stable even after abrasion.

By Application:

The market divides by application into films and wraps, bottles and containers, blister packs, pouches, and others. Films and wraps represent the largest share, driven by demand in food and personal care sectors. Bottles and containers see robust growth in pharmaceuticals and beverages, where contamination risk is a concern. Blister packs and pouches appeal to healthcare and retail products needing unit-dose protection and extended shelf life. It enables product integrity throughout the supply chain.

- For instance, SCHOTT AG developed Type I borosilicate glass vials that meet USP <660> standards for chemical resistance, and over 5 billion of these vials were supplied to COVID-19 vaccine manufacturers, ensuring safe drug delivery and maintaining sterility for injectable products throughout the supply chain.

By End-Use:

Key end-use segments include food and beverages, pharmaceuticals, personal care, and others. Pharmaceuticals account for the largest share, reflecting strict hygiene standards and patient safety needs. Food and beverages benefit from rising consumer demand for hygienic, tamper-evident packaging. Personal care brands adopt antiviral packaging to build consumer trust and meet regulatory compliance. The market’s broad end-use profile supports ongoing innovation and expansion.

Segmentations:

By Material:

- Polyethylene (PE)

- Polypropylene (PP)

- Polyethylene Terephthalate (PET)

- Polyvinyl Chloride (PVC)

- Specialty Polymers

By Application:

- Films and Wraps

- Bottles and Containers

- Blister Packs

- Pouches

- Others

By End-Use:

- Pharmaceuticals

- Food and Beverages

- Personal Care

- Others

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Asia-Pacific :

Asia-Pacific holds 42% share of the Antiviral polymers for packaging market in 2024, the highest among all regions. Strong manufacturing output, rapid urbanization, and dense consumer populations drive significant demand for advanced packaging solutions in China, India, Japan, and South Korea. Governments across the region are enforcing strict hygiene standards and encouraging the adoption of innovative packaging materials to enhance public health and safety. Leading global and local manufacturers are expanding production capacity to meet rising requirements from food, pharmaceutical, and personal care sectors. It benefits from a dynamic R&D landscape, enabling the rapid commercialization of antiviral polymers. E-commerce growth further fuels demand for secure, hygienic, and sustainable packaging formats.

North America :

North America holds 27% share of the Antiviral polymers for packaging market in 2024, maintaining a strong position due to stringent regulations and robust R&D capabilities. The United States and Canada lead regional adoption, driven by high consumer awareness and strict food and pharmaceutical packaging standards. It fosters collaboration among packaging manufacturers, research institutions, and regulatory agencies to accelerate material innovation and compliance. The presence of major global packaging suppliers supports continuous investment in next-generation antiviral technologies. E-commerce expansion and direct-to-consumer sales drive the need for packaging that ensures safety throughout the distribution chain. North America’s commitment to sustainability accelerates the shift toward recyclable and bio-based antiviral polymers.

Europe :

Europe accounts for 18% share of the Antiviral polymers for packaging market in 2024, led by Germany, France, the UK, and Italy. The region’s robust healthcare standards and growing demand for sustainable solutions support strong market growth. Regulatory agencies are driving the development and adoption of safe, environmentally responsible packaging materials. It benefits from collaborative initiatives across the value chain, uniting polymer producers, converters, and brand owners to promote innovation. The presence of advanced research infrastructure and progressive consumer preferences drives rapid uptake of smart and multifunctional packaging. Growing focus on eco-friendly materials and recycling further strengthens Europe’s competitive position in the global market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Dow Chemical Company

- BASF SE

- DuPont de Nemours, Inc.

- Solvay S.A.

- Covestro AG

- Eastman Chemical Company

- SABIC

- LG Chem Ltd

- DuPont de Nemours, Inc.

- Clariant AG

Competitive Analysis:

The Antiviral polymers for packaging market remains highly competitive, featuring a diverse mix of global chemical leaders and specialized packaging firms. Key players include Dow Chemical Company, BASF SE, DuPont de Nemours, Inc., Solvay S.A., and Covestro AG. These companies invest in research and development to create proprietary polymer blends with proven antiviral efficacy and regulatory compliance. It supports growth through strategic collaborations, intellectual property, and new product launches targeting pharmaceutical, food, and personal care sectors. Companies compete by offering advanced materials that combine antiviral action with sustainability, shelf life extension, and compatibility with existing packaging lines. The market also sees smaller innovators targeting niche applications, creating a dynamic environment focused on both scale and specialty solutions

Recent Developments:

- In July 2025, LG Chem Ltd announced a postponement of its acquisition of additional shares in its joint venture in Hungary, LG Toray Hungary Battery Separator Kft., from June to December 2025.

- In May 2025, DuPont de Nemours, Inc. began a new collaboration with Epicore Biosystems to enhance worker safety through integrating wearable hydration technology with protective garments, targeting climate-related occupational health challenges.

- In May 2025, Clariant AG showcased its new “#BeautyTok Unboxed” concept at NYSCC Supplier’s Day, featuring six innovative personal care formulations inspired by viral beauty trends on social media and aiming at the North American market.

Market Concentration & Characteristics:

The Antiviral polymers for packaging market features moderate concentration, with a mix of global chemical manufacturers and specialized packaging companies competing for share. Leading firms focus on R&D investments, strategic partnerships, and patent-protected formulations to maintain a competitive edge. It attracts new entrants seeking opportunities in high-growth segments such as healthcare, food, and personal care. Large players leverage established distribution networks and compliance expertise, while smaller companies emphasize niche applications and rapid innovation cycles. The market is characterized by high regulatory scrutiny, a strong focus on product efficacy, and ongoing shifts toward sustainable and multifunctional polymer solutions.

Report Coverage:

The research report offers an in-depth analysis based on Material, Application, End-Use and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- The Antiviral polymers for packaging market will shift toward recyclable and biodegradable materials to satisfy sustainability requirements.

- Manufacturers will invest in multifunctional polymer systems combining antiviral, antimicrobial, and freshness-retention properties.

- Research teams will explore nano‑scale metal ion additives to enhance antiviral efficacy against a broader range of pathogens.

- Packaging suppliers will integrate smart features like freshness indicators, RFID tags, and QR codes for real‑time monitoring.

- E‑commerce and direct‑to‑consumer distribution will spark demand for tamper‑evident and hygienic packaging solutions.

- Rapid prototyping and modular production techniques will reduce cycle time and enable faster product launches.

- Partnerships between chemical firms and packaging converters will accelerate commercialization of new antiviral materials.

- Regulatory bodies will enforce harmonized global standards, pushing manufacturers to validate long‑term antiviral performance.

- Regional expansions into Latin America, Middle East, and Africa will create new growth pockets for antiviral packaging.

- Smaller specialized firms will capture niche markets through targeted, industry‑specific polymer applications.