| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Asia Pacific Data Center Containment Market Size 2024 |

USD 835.31 Million |

| Asia Pacific Data Center Containment Market, CAGR |

12.80% |

| Asia Pacific Data Center Containment Market Size 2032 |

USD 2,189.11 Million |

Market Overview

The Asia Pacific Data Center Containment Market is projected to grow from USD 835.31 million in 2024 to an estimated USD 2,189.11 million by 2032, with a compound annual growth rate (CAGR) of 12.80% from 2025 to 2032. The increasing demand for data processing, storage, and enhanced cooling systems in data centers is expected to drive substantial growth in the market.

The Asia Pacific Data Center Containment Market is primarily driven by the rapid growth of digitalization and the increasing need for efficient and cost-effective data center cooling solutions. The rising adoption of cloud computing, artificial intelligence, and big data analytics is boosting the demand for data centers. Furthermore, the increasing focus on sustainability and energy efficiency is promoting the adoption of containment systems that optimize airflow and cooling performance, thereby reducing operational costs.

Geographically, the Asia Pacific region is witnessing significant growth, driven by major markets such as China, India, Japan, and South Korea. These countries are rapidly expanding their data center infrastructures to support digital transformations. Key players in the market include leaders like Schneider Electric, Vertiv Group Corporation, and STULZ GmbH, who are focusing on innovative containment solutions to meet the evolving demands of data centers across the region.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Asia Pacific Data Center Containment Market is projected to grow from USD 835.31 million in 2024 to USD 2,189.11 million by 2032, with a CAGR of 12.80% from 2025 to 2032.

- The Global Data Center Containment Market is projected to grow from USD 3,719.95 million in 2024 to USD 8,654.34 million by 2032, driven by a CAGR of 11.13% from 2025 to 2032.

- Rapid digitalization, including the rise of cloud computing and big data analytics, is driving the demand for data centers and efficient containment solutions.

- The increasing need for sustainable and energy-efficient cooling systems is encouraging the adoption of advanced containment technologies to optimize airflow and reduce operational costs.

- Major markets like China, India, Japan, and South Korea are significantly expanding their data center infrastructures to support digital transformation, fueling market growth.

- High initial investment and installation costs for containment solutions can be a restraint for small to medium-sized businesses and emerging markets.

- The growing adoption of modular and scalable containment systems is meeting the needs of rapidly growing data centers and providing flexibility for future expansion.

- The Asia Pacific market is heavily influenced by China and India, with strong government initiatives, technological advancements, and increasing cloud and edge data center demand driving the regional growth.

Market Drivers

Surge in Hyperscale Data Centers and Cloud Services

The growth of cloud computing and the proliferation of hyperscale data centers in the Asia Pacific region have significantly impacted the demand for data center containment solutions. Hyperscale data centers, which are designed to handle massive volumes of data and support the rapid scaling of cloud services, require specialized containment solutions to maintain efficiency and performance. These data centers typically operate with high-density servers that generate considerable heat, making effective cooling systems crucial for their optimal functioning. Containment solutions help to manage this heat by directing airflow in a controlled manner, ensuring that cooling systems work at peak efficiency. Additionally, as cloud service providers expand their operations to meet the growing demand for cloud-based services, they are increasingly focused on reducing operational costs and improving system reliability. Data center containment solutions enable them to achieve both objectives by enhancing cooling performance, reducing energy consumption, and ensuring that the infrastructure can support the increasing workloads. As the adoption of cloud services continues to rise, particularly in emerging markets in Asia Pacific, the demand for containment solutions will remain strong.

Government Initiatives and Investments in Data Center Infrastructure

Government initiatives and investments aimed at bolstering the region’s digital infrastructure are another key driver for the growth of the Asia Pacific Data Center Containment Market. Governments in countries such as China, India, Japan, South Korea, and Australia are increasingly recognizing the importance of data centers in fostering economic growth, technological advancement, and national security. These governments are offering incentives and support for the construction of new data centers, particularly in emerging markets, as part of their broader digitalization strategies. For example, several countries in the Asia Pacific region are developing smart cities and promoting the growth of digital economies, which require a strong data center infrastructure. In parallel, governments are providing tax incentives, grants, and subsidies to encourage the construction of energy-efficient data centers. Such investments are not only driving the demand for data center space but also pushing for the adoption of state-of-the-art containment solutions to optimize space, cooling, and energy usage. Furthermore, the increase in government-backed digital projects such as e-government services and smart grids is further spurring the need for data centers that can handle the massive amounts of data generated. As governments continue to promote technological advancements and infrastructure growth, data center containment solutions will play a pivotal role in ensuring the operational success and sustainability of these new facilities.

Rapid Digital Transformation and Growing Demand for Data Centers

The ongoing digital transformation across industries in the Asia Pacific region is one of the primary drivers for the growth of the data center containment market. With businesses increasingly adopting technologies such as cloud computing, artificial intelligence (AI), the Internet of Things (IoT), and big data analytics, the demand for data storage and processing capabilities has surged. For instance, companies like Microsoft and Google are investing heavily in cloud infrastructure across countries such as China, Japan, and India, which further amplifies the need for robust data centers. As these technologies continue to evolve, there is a heightened need for efficient and scalable data centers to support the rising data traffic and storage requirements. Data centers, in turn, require effective containment solutions to ensure operational efficiency, optimal airflow management, and cooling systems capable of handling higher processing loads. Organizations across various sectors such as finance, healthcare, e-commerce, and telecommunications are expanding their data storage capacities to handle the growing volumes of data. This surge in demand for data centers has fueled the need for advanced containment technologies that not only enhance the cooling process but also optimize space utilization and reduce operational costs. As the Asia Pacific region continues to embrace digitalization, the market for data center containment solutions is expected to experience sustained growth.

Increasing Energy Efficiency and Sustainability Demands

Another significant driver for the Asia Pacific Data Center Containment Market is the increasing focus on energy efficiency and sustainability. Data centers are known for consuming vast amounts of energy, primarily for cooling systems, which account for a substantial portion of operational expenses. As energy costs rise and environmental concerns grow, organizations are under pressure to reduce their energy consumption and carbon footprint. For instance, governments in China and Singapore have introduced stringent regulations mandating data centers to achieve specific Power Usage Effectiveness (PUE) targets, emphasizing the need for energy-efficient designs. Data center containment solutions are designed to optimize cooling by managing airflow and minimizing the mixing of hot and cold air, thereby improving the overall energy efficiency of the facility. Containment systems, such as hot and cold aisle containment, help to isolate hot and cold air within the data center, allowing for more efficient temperature control and reduced reliance on traditional cooling methods. This not only results in lower energy consumption but also enhances the overall performance of the data center. Additionally, governments across the Asia Pacific region are promoting the use of renewable energy sources to power data centers, aligning with broader sustainability objectives and long-term operational efficiency goals.

Market Trends

Integration of Green and Sustainable Containment Solutions

Sustainability is increasingly becoming a top priority for data center operators in the Asia Pacific region, driven by both regulatory pressures and the need to reduce operational costs. In response, the demand for green and sustainable data center containment solutions has been on the rise. These solutions focus not only on improving the cooling efficiency of data centers but also on minimizing the environmental impact by reducing energy consumption and promoting the use of renewable energy sources. Several data centers in the region are adopting containment systems that incorporate energy-saving technologies such as variable frequency drives (VFDs), which allow cooling systems to operate more efficiently by adjusting to real-time cooling needs. In addition, there is a growing trend toward using renewable energy sources, such as solar and wind, to power data centers. Containment systems are being designed to optimize the use of these energy sources by improving cooling efficiency and reducing the overall power requirements of the data center. This trend aligns with the global shift towards sustainability and energy efficiency, which is gaining momentum in the Asia Pacific market. As governments and organizations continue to push for greener practices, data center containment solutions that support environmental sustainability will play an increasingly important role in the market.

Growth in Edge Data Centers and Distributed Computing Models

Another notable trend in the Asia Pacific Data Center Containment Market is the rapid growth of edge data centers and the adoption of distributed computing models. With the proliferation of IoT devices, 5G networks, and the increasing need for low-latency processing, edge computing has emerged as a critical component of the digital infrastructure landscape. Edge data centers are designed to bring data processing closer to the end-user, reducing latency and improving the performance of applications. This shift towards edge data centers is driving the demand for smaller, more localized containment solutions that can efficiently manage airflow and cooling in facilities with limited space and resources. Unlike traditional large-scale data centers, edge data centers often operate in remote or smaller locations, where energy efficiency and the ability to scale quickly are critical considerations. Containment solutions for edge data centers need to be highly adaptable and efficient to handle the specific challenges posed by these environments. This trend is particularly relevant in countries such as China, India, and Japan, where the demand for edge computing is expected to increase significantly as 5G networks are deployed. As edge data centers proliferate, containment solutions must evolve to meet the specific requirements of these facilities. The integration of advanced cooling technologies, such as liquid cooling and direct-to-chip cooling, is becoming increasingly common in edge environments. Additionally, the trend toward micro data centers—compact, modular data centers designed for quick deployment—is also contributing to the rise in demand for specialized containment systems. As the Asia Pacific region continues to embrace edge computing, the role of efficient, scalable containment solutions will be integral to the success of these distributed data centers.

Adoption of Modular Containment Solutions

One of the significant trends in the Asia Pacific Data Center Containment Market is the increasing adoption of modular containment solutions. These solutions are designed to provide flexible, scalable containment strategies that can be tailored to the specific needs of data centers of varying sizes. Modular containment allows data centers to expand or reconfigure their cooling systems without having to make significant structural changes to the facility. This flexibility is especially critical as the demand for data storage and processing power continues to grow, and organizations seek cost-effective solutions that can adapt to changing requirements. For instance, companies like Vertiv and Upsite Technologies have highlighted the importance of modular designs in enhancing airflow management and reducing operational costs. Modular containment solutions are also easier to install, maintain, and upgrade compared to traditional containment systems, which often require substantial redesigns and downtime. This trend is becoming particularly prominent in hyperscale data centers, which need to continuously scale up their operations to meet increasing data traffic. By utilizing modular solutions, these data centers can optimize airflow management, reduce energy consumption, and improve cooling efficiency while ensuring that the facility remains adaptable to future growth. As modular containment solutions continue to gain traction, they are helping data centers stay competitive in an ever-evolving digital landscape.

Focus on Advanced Airflow Management Solutions

Airflow management remains a critical factor in the efficient operation of data centers, and one of the emerging trends in the Asia Pacific market is the increasing focus on advanced airflow management technologies. The rising power density of IT equipment in data centers has led to higher heat generation, which poses challenges for traditional cooling systems. To address this issue, data centers are increasingly implementing advanced airflow management strategies, such as hot and cold aisle containment, to ensure that cold air is directed to the intake of servers while hot air is isolated and exhausted from the data center. For instance, organizations such as QTS have successfully optimized airflow by implementing measures like airflow assessments and strategic use of airflow management devices. In addition to traditional containment methods, innovative solutions are being developed to further optimize airflow. The use of computational fluid dynamics (CFD) models to simulate airflow patterns within data centers is becoming more common. CFD analysis allows operators to design containment systems that are more efficient and capable of handling high-density computing environments. Furthermore, airflow management is being integrated with other technologies, such as liquid cooling and advanced ventilation systems, to create more energy-efficient and sustainable data centers. As data centers become more complex, the importance of advanced airflow management in maintaining operational efficiency and reducing energy consumption will continue to grow.

Market Challenges

High Initial Investment and Installation Costs

High initial investment and installation costs remain a critical challenge for the Asia Pacific Data Center Containment Market. Advanced containment solutions are designed to enhance energy efficiency and operational performance; however, their upfront financial requirements often deter smaller enterprises and emerging markets. For instance, companies operating in regions with stringent budget constraints may struggle to justify the expenditure on state-of-the-art technologies, especially when immediate cost-saving measures dominate business priorities. Additionally, the implementation process frequently necessitates modifications to existing infrastructure, leading to operational disruptions and downtime that further complicate adoption. The situation is exacerbated in competitive markets where thin profit margins make high capital investments appear prohibitive. Businesses focused on rapid returns on investment often hesitate to deploy containment systems, despite their long-term benefits in energy savings and operational reliability. For instance, government policies promoting large-scale infrastructure projects in countries like India have encouraged investments in data centers, but the financial barriers associated with containment solutions still limit broader adoption. While the market shows promise due to ongoing digital transformation and regulatory incentives for energy-efficient technologies, overcoming these initial cost challenges is essential for enabling widespread adoption and achieving sustainability goals across the region.

Lack of Skilled Workforce and Technological Expertise

Another critical challenge facing the Asia Pacific Data Center Containment Market is the shortage of skilled workforce and technological expertise required to implement and manage these advanced systems effectively. Data center containment solutions, particularly those involving complex airflow management, cooling systems, and integration with other technologies, require a high level of technical knowledge and expertise. The demand for qualified personnel in the field of data center design and containment is growing, but the supply of skilled professionals remains limited in several countries within the region. This skills gap presents difficulties for companies in adopting and maintaining sophisticated containment solutions. Without the necessary technical knowledge, businesses may face challenges in ensuring the proper installation, configuration, and ongoing optimization of containment systems, potentially leading to inefficiencies and underperformance of the data center infrastructure. Moreover, the rapid pace of technological advancements in the containment market means that professionals must constantly update their skills to stay current with the latest innovations. The lack of specialized training programs and certifications further exacerbates this challenge. To address this, organizations must invest in employee training and development programs, or face potential setbacks in maximizing the benefits of data center containment solutions.

Market Opportunities

Rising Demand for Edge Data Centers and Distributed Computing

The rapid growth of edge computing presents a significant opportunity for the Asia Pacific Data Center Containment Market. As businesses and industries increasingly rely on low-latency services driven by IoT devices, autonomous systems, and 5G networks, the demand for edge data centers is expected to expand. These localized data centers require efficient containment solutions to optimize cooling and airflow in environments with limited space and resources. The growth of edge data centers in the region presents a prime opportunity for containment solution providers to offer tailored, scalable solutions that meet the specific needs of these smaller, high-performance facilities. As the adoption of edge computing accelerates, companies can capitalize on the demand for cost-effective, energy-efficient containment systems that enable rapid deployment and scalability.

Government Initiatives Supporting Digital Infrastructure and Sustainability

Government initiatives across the Asia Pacific region are driving investment in digital infrastructure and sustainability, creating a favorable environment for data center containment solutions. Countries like China, India, and Japan are heavily investing in the development of smart cities, digital economies, and energy-efficient infrastructures. These initiatives are expected to spur the growth of data centers, particularly those that focus on sustainability through energy-efficient solutions. Data center operators are increasingly adopting containment systems that improve cooling efficiency while reducing energy consumption and environmental impact. The push for greener technologies presents an opportunity for containment solution providers to offer innovative, sustainable products that align with government regulations and sustainability goals, thereby positioning themselves as key players in the region’s evolving digital infrastructure landscape.

Market Segmentation Analysis

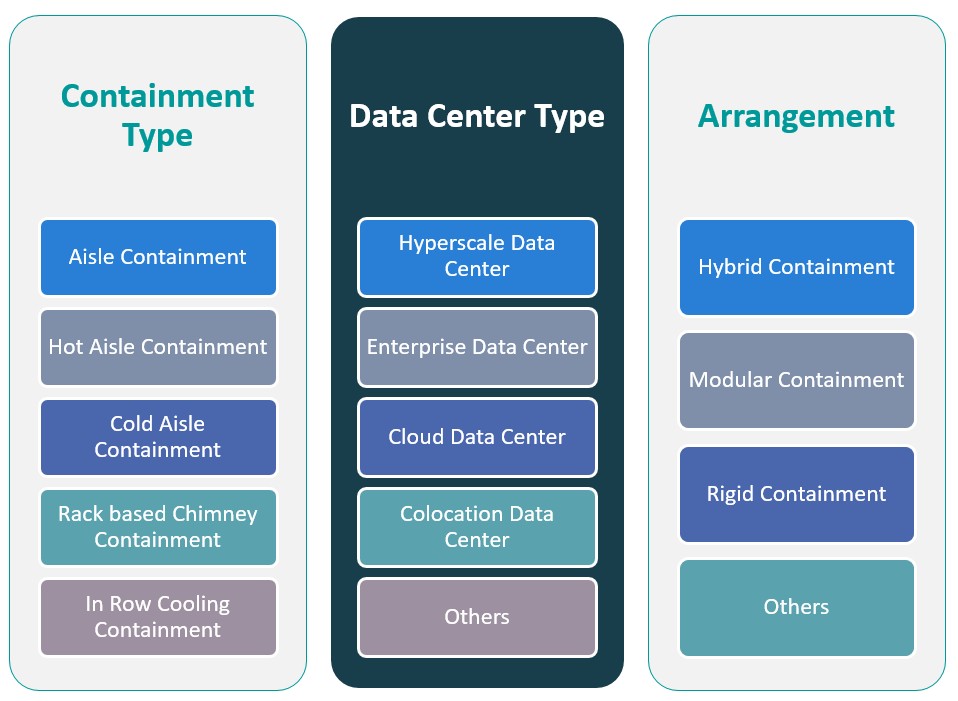

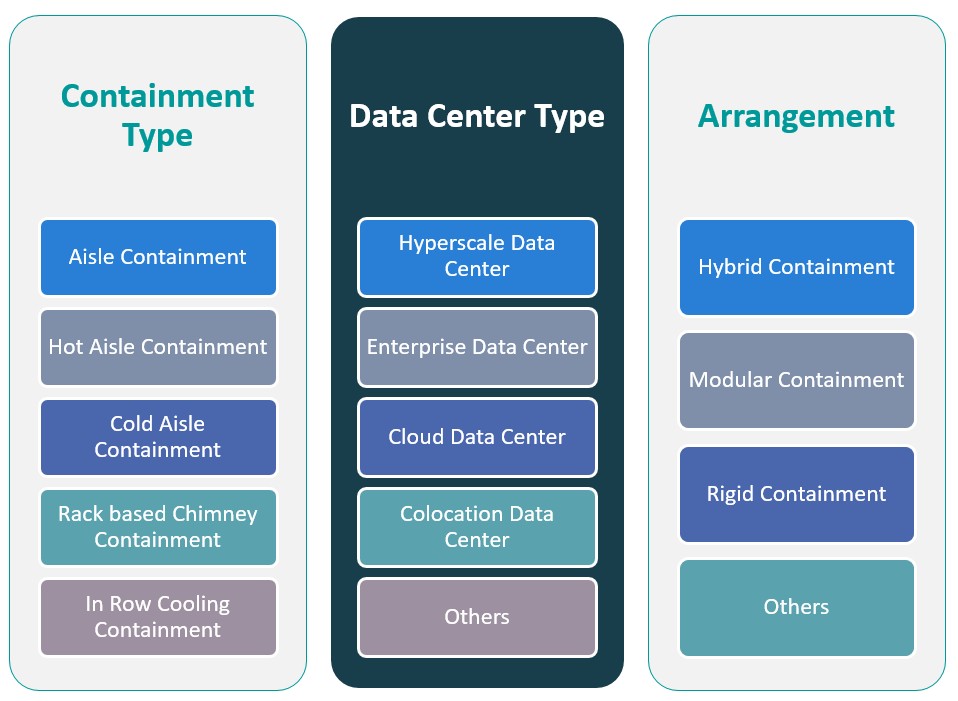

By Containment Type

Aisle containment systems, including both hot and cold aisle containment solutions, are commonly used in data centers to improve cooling efficiency by controlling airflow. These systems separate hot and cold air within the data center, significantly enhancing temperature regulation. The demand for aisle containment is growing as data centers scale and seek energy-efficient solutions. Hot aisle containment focuses on enclosing the hot aisle to prevent warm air from mixing with the cold air supplied to the servers. This method is widely adopted in large data centers that require higher cooling efficiency. The segment is growing steadily as companies look to reduce cooling energy costs while maintaining optimal operating conditions for high-density servers. Cold aisle containment involves enclosing the cold aisle, directing cold air to the server intakes while containing hot air. This solution is gaining popularity as it provides an energy-efficient cooling solution by isolating the hot and cold airflows, thus improving overall cooling effectiveness. Rack-based chimney containment is a highly effective solution for localized airflow management in dense server environments. This containment method focuses on individual racks, helping to control the cooling and airflow within each rack. It is commonly used in smaller or modular data centers where scalability and space utilization are crucial. In-row cooling containment integrates cooling units directly into the aisle or row of server racks. This method offers high cooling efficiency in high-density server environments by positioning the cooling units closer to the heat source, reducing the need for traditional air conditioning systems. As data centers shift towards high-performance computing, the demand for in-row cooling is growing.

By Data Center Type

Hyperscale data centers are designed to support massive data storage and processing needs, typically used by large cloud service providers and tech companies. These centers require highly efficient containment solutions to handle large-scale operations, optimize energy consumption, and reduce operational costs. The demand for containment solutions in hyperscale data centers is increasing as companies build larger and more energy-efficient facilities. Enterprise data centers serve organizations’ internal IT infrastructure needs. They are usually smaller than hyperscale data centers but still require advanced containment solutions to manage cooling and improve energy efficiency. As businesses increasingly adopt digital technologies, the need for energy-efficient solutions in enterprise data centers continues to grow. Cloud data centers host cloud computing services and support vast amounts of data processing for businesses and consumers. The expansion of cloud computing is driving the demand for more advanced containment systems to handle the growing data and processing needs. Cloud data centers require scalable and flexible containment solutions to ensure efficient cooling in diverse operational conditions. Colocation data centers provide shared space where businesses rent servers and other hardware. These data centers are typically smaller than cloud or hyperscale data centers but require containment solutions to ensure that cooling is efficiently managed across multiple tenants. The growing demand for colocation services is spurring the need for effective containment systems to support diverse clients. This category includes smaller or specialized data centers that do not fit into the standard types mentioned above. These could include edge data centers, small enterprise facilities, and temporary data center setups, all of which also require customized containment solutions.

Segments

Based on Containment Type

- Aisle Containment

- Hot Aisle Containment

- Cold Aisle Containment

- Rack based Chimney Containment

- In Row Cooling Containment

Based on Data Center Type

- Hyperscale Data Center

- Enterprise Data Center

- Cloud Data Center

- Colocation Data Center

- Others

Based on Arrangement

- Hybrid Containment

- Modular Containment

- Rigid Containment

- Others

Based on Region

- China

- India

- Japan

- South Korea

- Southeast Asia

Regional Analysis

India (25%)

India holds the second-largest share in the market, contributing around 25% to the overall market share. The country’s burgeoning digital economy, fueled by the growth of cloud services, e-commerce, and data-driven applications, has led to a rise in data center investments. As India increasingly becomes a hub for both domestic and international businesses, the demand for efficient cooling and airflow management systems in data centers has escalated. The growing adoption of hyperscale and enterprise data centers also supports the need for effective containment solutions. India’s government support for the IT and data center sectors, alongside favorable policies and infrastructure development, further boosts market expansion.

South Korea (12%)

South Korea holds a market share of approximately 12% in the Asia Pacific region. The country has experienced significant growth in data center infrastructure, driven by the expansion of cloud computing and data-driven industries. South Korea’s push for 5G technology and smart cities further stimulates the demand for data centers and containment solutions. Additionally, the increasing need for high-density computing environments in the country has led to a rise in the adoption of advanced containment systems to ensure optimal cooling and efficiency.

Key players

- Schneider Electric

- Vertiv

- Johnson Controls

- Emerson Network Power

- Huawei

Competitive Analysis

The Asia Pacific Data Center Containment Market is highly competitive, with key players like Schneider Electric, Vertiv, Johnson Controls, Emerson Network Power, and Huawei leading the industry. Schneider Electric holds a strong position with its comprehensive portfolio of energy-efficient containment solutions, complemented by its global presence and innovative cooling technologies. Vertiv is known for its high-performance products and strategic focus on sustainability, offering a wide range of containment and cooling solutions. Johnson Controls leverages its extensive expertise in building technologies to provide integrated containment solutions that optimize data center performance. Emerson Network Power (now part of Vertiv) focuses on providing reliable power and cooling systems, contributing significantly to containment efficiency. Huawei, a leading tech company, brings advanced containment solutions through its in-house data center infrastructure expertise. These companies continuously innovate and invest in advanced technologies, positioning themselves as leaders in the growing Asia Pacific market.

Recent Developments

- In November 2023, Huawei introduced two new additions to its Smart Modular Data Center and SmartLi uninterruptible power supply (UPS) series – FusionModule2000 6.0, a modular small/medium-sized data center solution, and UPS2000-H, a small-footprint power supply solution running on SmartLi Mini.

- In February 2025, Trane Technologies expanded its data center solutions to include liquid cooling thermal management systems, introducing the Trane 1MW Coolant Distribution Unit for high-performance workloads.

- In 2025, Honeywell launched a data center management suite to improve efficiency and sustainability by integrating operational and IT infrastructure data.

- In March 2025, Vertiv introduced new solutions to support dense AI and high-performance computing workloads, including consolidated infrastructure management software and prefabricated modular overhead infrastructure.

- In March 2025, Siemens announced a $285 million investment in U.S. manufacturing, including establishing new facilities in California and Texas. This investment aims to enhance manufacturing capabilities and advance AI technologies, supporting sectors such as commercial, industrial, construction, and AI data centers.

Market Concentration and Characteristics

The Asia Pacific Data Center Containment Market exhibits moderate concentration, with a few key players such as Schneider Electric, Vertiv, Johnson Controls, Emerson Network Power, and Huawei dominating the market. These companies hold significant market share due to their strong brand presence, extensive product portfolios, and established customer bases across various sectors including hyperscale, enterprise, and cloud data centers. However, the market is also characterized by the presence of several regional and smaller players who offer specialized, cost-effective containment solutions tailored to specific market needs. The growing demand for energy-efficient, scalable, and sustainable containment systems, driven by the rapid expansion of data centers, is encouraging both established and emerging players to innovate and enhance their offerings. As a result, while a few large players dominate the market, competition remains dynamic and increasingly focused on technological advancements, sustainability, and customization.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Containment Type, Data Center Type, Arrangement and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The growing need for hyperscale data centers to support cloud computing and big data will drive significant demand for advanced containment solutions. These facilities require highly efficient cooling and airflow management to handle the rising power densities of IT equipment.

- Sustainability will remain a key driver, as data center operators focus on reducing energy consumption. The adoption of energy-efficient containment solutions will help meet environmental goals and comply with stringent regulations in the Asia Pacific region.

- With the rise of edge computing, particularly in remote areas, the demand for compact and efficient containment solutions will increase. Edge data centers require highly adaptable and scalable systems to maintain efficiency in smaller spaces.

- The development of innovative cooling technologies such as liquid cooling and in-row cooling will transform data center containment. These advancements will optimize energy use and cooling efficiency in high-density server environments.

- Government initiatives promoting digital infrastructure and green technologies will support market growth. Subsidies and tax incentives for building energy-efficient data centers will encourage investment in containment solutions.

- Emerging markets in Southeast Asia, India, and China are seeing rapid cloud adoption, driving the demand for data centers. The rise of cloud service providers will require more advanced containment solutions to ensure efficiency and scalability.

- The trend towards modular data center designs will drive the growth of modular containment systems. These systems offer scalability and flexibility, making them ideal for fast-growing businesses and rapidly changing environments.

- The integration of AI and machine learning into containment systems will improve data center management. Automated cooling and airflow control will enhance operational efficiency and reduce human error.

- The growing adoption of colocation data centers will increase the need for containment systems that manage space and cooling more efficiently. These data centers must balance multiple clients’ needs within a single facility.

- As the market grows, competition will intensify, with both global and regional players innovating to offer customized containment solutions. Companies will focus on differentiating themselves through sustainability, cost-effectiveness, and technological advancements.