Market Overview

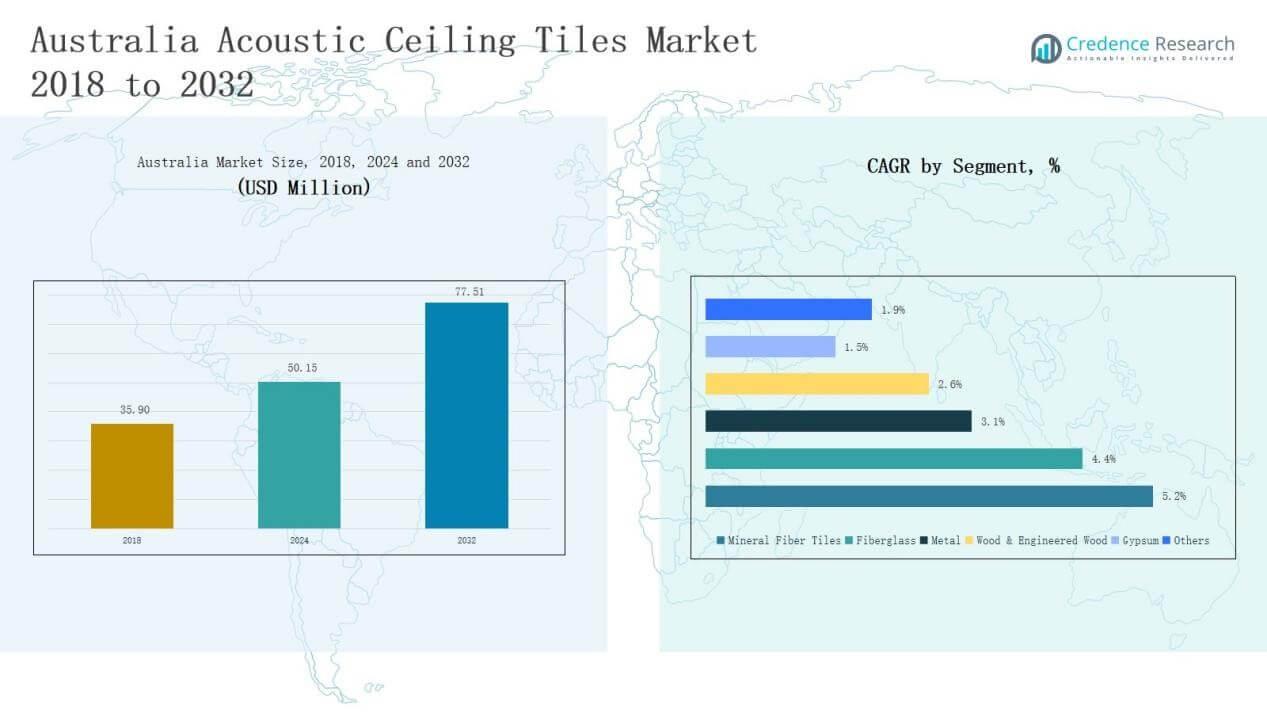

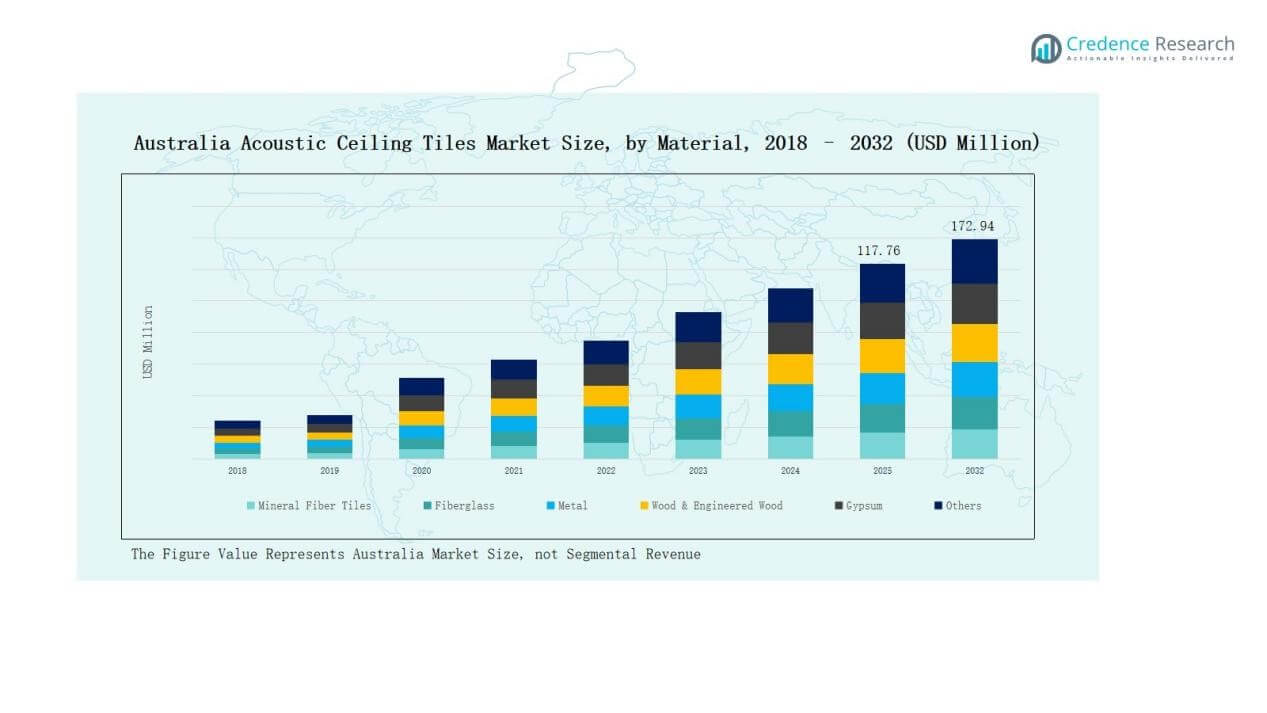

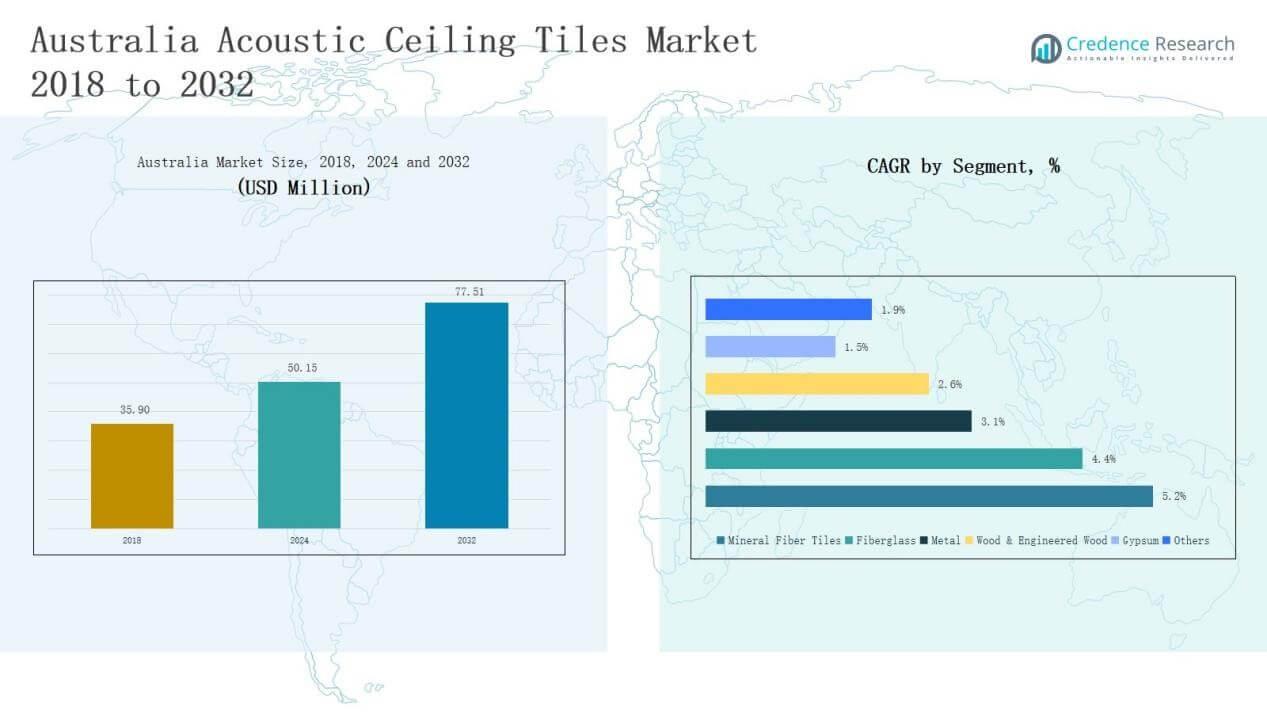

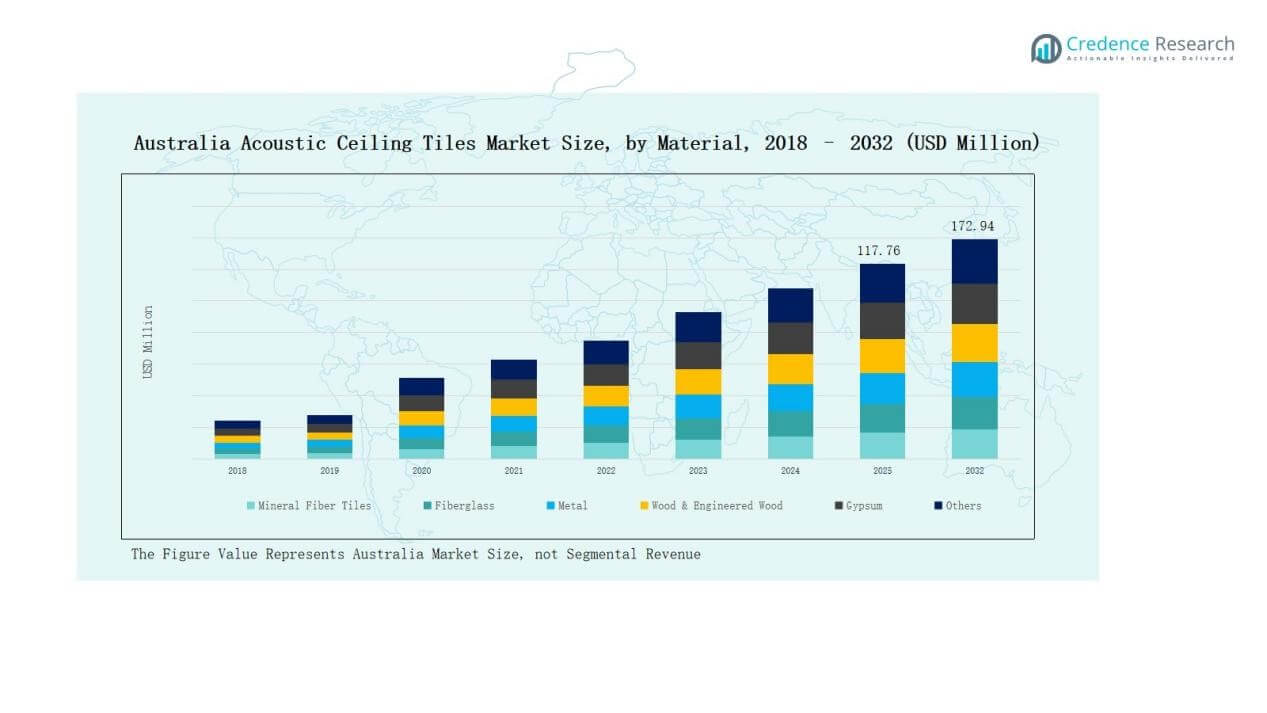

The Australia Acoustic Ceiling Tiles Market size was valued at USD 35.90 million in 2018, reached USD 50.15 million in 2024, and is anticipated to reach USD 77.51 million by 2032, growing at a CAGR of 5.21% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Australia Acoustic Ceiling Tiles Market Size 2024 |

USD 50.15 Million |

| Australia Acoustic Ceiling Tiles Market, CAGR |

5.21% |

| Australia Acoustic Ceiling Tiles Market Size 2032 |

USD 77.51 Million |

The Australia Acoustic Ceiling Tiles Market is shaped by global leaders and regional specialists focusing on product innovation and sustainable solutions. Key companies include Armstrong World Industries, USG Boral, Knauf, Hunter Douglas, Rockfon, Autex Acoustics, SAS International, OWA, Texaa, and Acoustical Surfaces Australia. These players compete through diversified portfolios, advanced acoustic technologies, and strong distribution networks targeting commercial, institutional, and residential projects. Among regions, New South Wales leads with a 34% market share in 2024, driven by robust commercial construction activity, government-backed infrastructure projects, and high adoption of energy-efficient building materials.

Market Insights

Market Insights

- The Australia Acoustic Ceiling Tiles Market grew from USD 35.90 million in 2018 to USD 50.15 million in 2024 and will reach USD 77.51 million by 2032.

- Mineral fiber tiles held the largest share at 42% in 2024, supported by strong acoustic performance, fire resistance, and cost-effectiveness across offices, schools, and hospitals.

- Suspended ceiling tiles dominated with 72% share in 2024, favored in large-scale projects for versatility and ease of concealing wiring, ductwork, and lighting systems.

- Building contractors accounted for 46% share in 2024, driving demand through major infrastructure, commercial, and institutional projects, followed by architects and interior designers at 28%.

- New South Wales led regionally with 34% share in 2024, driven by strong commercial construction activity, government-supported urban projects, and high adoption of sustainable acoustic building materials.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

By Material

Mineral fiber tiles dominate the Australia Acoustic Ceiling Tiles Market with a 42% share in 2024. Their popularity stems from strong acoustic performance, fire resistance, and cost-effectiveness, making them widely used in offices, schools, and hospitals. Fiberglass follows with a 21% share, supported by lightweight properties and thermal insulation benefits. Metal tiles hold around 15%, preferred in modern commercial projects requiring durability and sleek designs. Wood and engineered wood contribute 10%, driven by premium aesthetics in retail and hospitality spaces. Gypsum accounts for 8%, while other niche materials cover the remaining 4%.

For instance, Armstrong offers mineral fiber acoustic ceiling tiles in Australia designed for offices, healthcare, and schools that deliver Total Acoustics performance, antimicrobial properties, and have undergone rigorous fire resistance testing, making them a popular solution where noise reduction and safety are required.

By Installation Type

Suspended ceiling tiles lead the market with a 72% share in 2024, reflecting their dominance in large commercial buildings, airports, and institutional projects. Their flexibility for concealing wiring, ductwork, and lighting systems strengthens demand. Surface-mounted ceiling tiles account for 28%, favored in smaller-scale projects where installation speed and direct application are priorities. Rising use in residential upgrades and small offices supports growth for this segment. However, suspended systems remain the primary choice due to versatility, scalability, and enhanced acoustic insulation.

For instance, at San Diego International Airport, a rapid-setting tile system was adopted to ensure seamless, durable installation while maintaining daily airport operations, qualifying for a 15-year warranty and contributing to Platinum LEED certification.

By End User

Building contractors represent the largest end-user segment, holding a 46% market share in 2024. They drive bulk demand through large-scale infrastructure, commercial complexes, and institutional projects. Architects and interior designers follow with a 28% share, influencing adoption through specifications that balance functionality with aesthetics. Facility managers account for 18%, focusing on retrofit and renovation projects to improve noise control and energy efficiency. Other end users, including retail owners and smaller project developers, hold 8%, reflecting growing but limited adoption outside large professional networks.

Key Growth Drivers

Key Growth Drivers

Rising Demand for Sustainable and Energy-Efficient Buildings

The Australia Acoustic Ceiling Tiles Market is expanding as developers adopt green building practices. Acoustic ceiling tiles made from recyclable materials reduce energy consumption and support eco-friendly certifications. With growing awareness of sustainability in commercial and residential spaces, demand for these tiles is accelerating. The focus on reducing carbon footprints and improving energy efficiency further strengthens adoption. Building codes and government-backed initiatives promoting sustainable construction are expected to play a vital role in boosting the market’s long-term growth.

For instance, Armstrong Ceiling Solutions introduced MetalWorks Snap On Baffles and Heradesign wood wool acoustic panels, both designed to contribute toward Green Star certification and showcased in recent CBD office fitouts for improved visual and acoustic comfort.

Expansion of Commercial and Office Infrastructure

Australia’s increasing investments in modern commercial spaces, educational institutions, and healthcare facilities are driving ceiling tile adoption. Acoustic ceiling tiles offer sound absorption and aesthetic appeal, making them a preferred choice for architects and contractors. The growth of co-working spaces and flexible offices is further pushing demand for modular ceiling solutions. Rising urbanization and large-scale real estate development projects enhance the penetration of acoustic solutions. The commercial sector continues to dominate consumption, creating strong revenue opportunities for market participants.

For instance, CSR Gyprock introduced its Perforated Plasterboard Ceilings in commercial offices across Sydney to improve sound insulation in open-plan spaces.

Technological Advancements in Acoustic Materials

Manufacturers in the Australia Acoustic Ceiling Tiles Market are introducing innovative designs with superior acoustic performance. Developments in mineral fiber, fiberglass, and composite materials provide better durability, moisture resistance, and sound control. Integration of fire-resistant and lightweight properties has made acoustic ceiling tiles more versatile across applications. These advancements cater to the evolving requirements of end users such as contractors, facility managers, and designers. Continuous R&D investments ensure that companies remain competitive while meeting diverse building performance standards and customer preferences.

Key Trends & Opportunities

Growing Adoption in Renovation and Retrofit Projects

Australia’s focus on renovating aging infrastructure is creating significant opportunities for acoustic ceiling tile suppliers. Retrofit projects in schools, hospitals, and commercial offices often require noise control and aesthetic upgrades. Acoustic ceiling tiles meet these dual needs efficiently. Their ease of installation and compatibility with existing structures enhance their suitability for retrofit work. As facility managers prioritize improving indoor environments without heavy construction, acoustic ceiling tiles are positioned as cost-effective and sustainable solutions.

For instance, Knauf’s Heradesign acoustic tiles were used in hospital retrofit projects, offering durable sound absorption while meeting strict hygiene and fire-safety standards.

Increased Customization and Design Aesthetics

A key trend in the Australia Acoustic Ceiling Tiles Market is the rising demand for customized designs. End users seek tiles that balance acoustic functionality with modern aesthetics. Manufacturers are offering varied colors, patterns, and textures to cater to architects and interior designers. This customization helps projects align with branding, user experience, and interior themes. Demand for stylish yet functional ceiling systems is particularly strong in premium offices, retail outlets, and hospitality spaces, opening new revenue streams for tile producers.

For instance, Ecoustic Sculpt offers a patented, award-winning acoustic ceiling tile system available in diverse striking designs from simplicity to dramatic sculptural shapes, catering to designers and architects aiming to create visually impactful ceilings

Key Challenges

High Initial Installation Costs

The Australia Acoustic Ceiling Tiles Market faces challenges due to high upfront costs of materials and installation. While these tiles deliver long-term benefits in terms of energy efficiency and sound insulation, the capital-intensive setup limits adoption among small-scale projects. Contractors often choose low-cost alternatives to meet budget constraints, especially in residential construction. Price sensitivity in certain market segments hampers faster penetration of premium acoustic solutions.

Availability of Low-Cost Alternatives

The presence of cheaper substitutes such as standard gypsum boards and PVC ceilings restricts growth in some applications. These alternatives provide basic aesthetic appeal at significantly lower costs. Many small contractors and facility managers opt for such solutions where advanced acoustic performance is not a priority. This competitive pressure reduces the market share potential of advanced acoustic ceiling tiles, especially in cost-conscious regions.

Supply Chain and Raw Material Volatility

Volatile raw material prices and supply chain disruptions present persistent challenges for market players. Materials such as mineral fiber and fiberglass face cost fluctuations linked to global supply conditions. Rising transportation and labor expenses further increase overall project costs. Market participants must manage these challenges while maintaining competitive pricing. Dependence on imports for certain inputs adds another layer of risk to the Australian supply chain, affecting consistent market growth.

Regional Analysis

New South Wales

New South Wales leads the Australia Acoustic Ceiling Tiles Market with a 34% share in 2024. Strong construction activity in Sydney’s commercial and office sectors drives demand. The presence of large-scale infrastructure and institutional projects increases adoption of suspended ceiling tiles. Architects and contractors prefer mineral fiber and fiberglass tiles due to their acoustic efficiency and fire resistance. Government-backed urban development plans continue to support market expansion. The state’s rising emphasis on sustainable and modern building designs further boosts long-term growth.

Victoria

Victoria holds a 27% market share in 2024, making it the second-largest region in the Australia Acoustic Ceiling Tiles Market. Melbourne’s commercial property growth and expanding residential developments fuel product adoption. Building contractors and designers are focusing on durable materials that combine functionality with aesthetics. Demand for customizable ceiling solutions is increasing in retail and hospitality projects. The growing popularity of green buildings adds momentum to mineral fiber and wood-based ceiling products. Victoria’s investment in public infrastructure, including schools and healthcare facilities, continues to sustain demand.

Queensland

Queensland accounts for a 19% share in 2024 of the Australia Acoustic Ceiling Tiles Market. The state benefits from rising construction in Brisbane and surrounding urban centers. Demand for acoustic solutions is strong in educational and healthcare projects where noise control is critical. Building contractors drive large orders, while architects encourage adoption in modern office designs. Investment in tourism-related infrastructure, including hotels and retail complexes, also contributes to growth. The region’s diverse mix of projects ensures steady demand across both suspended and surface-mounted tiles.

Western Australia

Western Australia represents a 12% market share in 2024. Perth remains the central hub for construction and interior design activity. The region’s focus on modern commercial spaces supports demand for premium acoustic ceiling solutions. Mining-driven economic activity indirectly fuels demand for office and residential developments. Facility managers are increasingly adopting retrofit solutions to upgrade older buildings. The preference for metal and gypsum ceiling tiles is gradually expanding in urban projects.

Other Regions

Other regions, including South Australia, Tasmania, and the Northern Territory, collectively hold an 8% share in 2024. Demand remains concentrated in smaller-scale projects, particularly in public infrastructure and residential construction. Facility managers focus on renovation and noise reduction in educational institutions and healthcare facilities. Limited large-scale commercial developments restrict broader adoption of premium acoustic tiles. However, gradual urban expansion and rising design preferences contribute to modest growth. It provides emerging opportunities for suppliers to expand distribution networks.

Market Segmentations:

Market Segmentations:

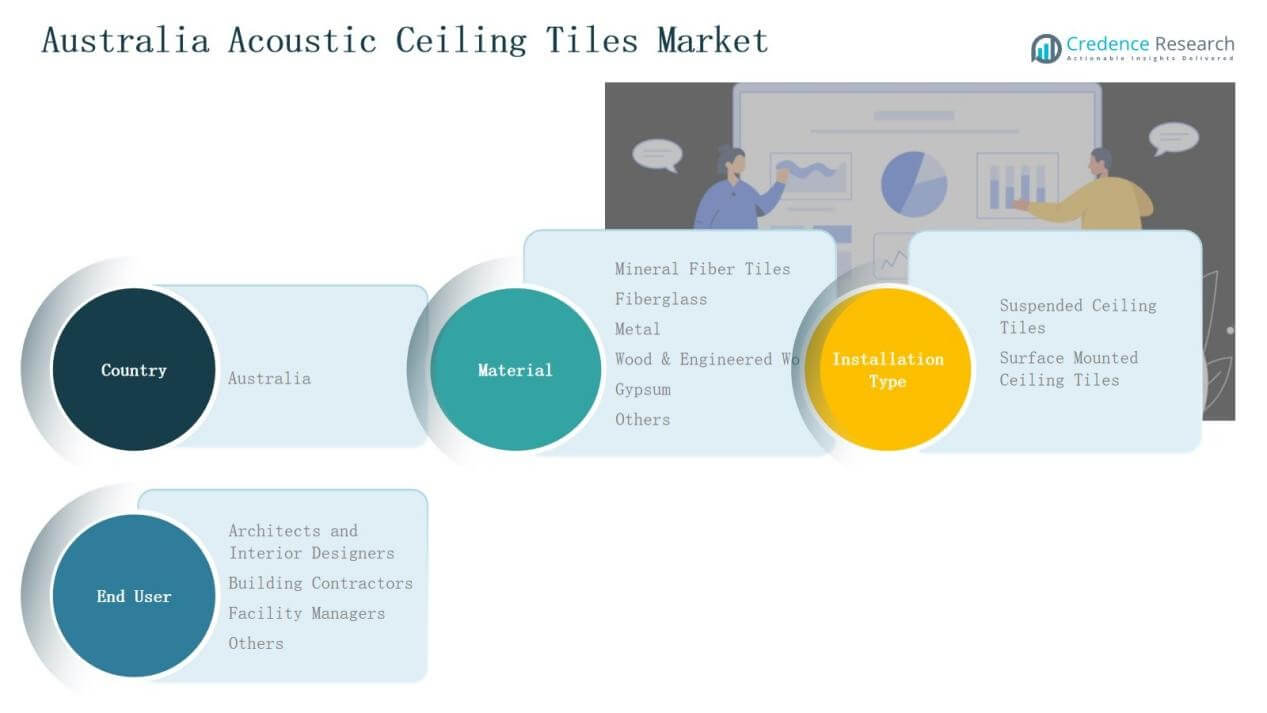

By Material

- Mineral Fiber Tiles

- Fiberglass

- Metal

- Wood & Engineered Woo

- Gypsum

- Others

By Installation Type

- Suspended Ceiling Tiles

- Surface Mounted Ceiling Tiles

By End User

- Architects and Interior Designers

- Building Contractors

- Facility Managers

- Others

By Region

- New Southwales

- Victoria

- Queensland

- Western Australia

- Other Regions

Competitive Landscape

The Australia Acoustic Ceiling Tiles Market is highly competitive, with global leaders and regional specialists actively shaping growth. Key players include Armstrong World Industries, USG Boral, Knauf, Hunter Douglas, Rockfon, Autex Acoustics, SAS International, OWA, Texaa, and Acoustical Surfaces. These companies compete through product innovation, sustainability initiatives, and strong distribution networks. Armstrong and USG Boral maintain leadership by offering advanced mineral fiber and fiberglass solutions, while Autex emphasizes eco-friendly products made from recycled materials. Knauf and Hunter Douglas strengthen their positions with diversified portfolios catering to both commercial and residential projects. Rockfon and OWA focus on premium acoustic performance and design customization, appealing to architects and designers. Local players expand influence through tailored solutions for small and mid-sized projects. The market is witnessing rising investments in R&D, partnerships with contractors, and strategic expansions, positioning established firms to defend share while enabling regional companies to capture niche opportunities.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

Recent Developments

- In 2025, Acoufelt launched QuietForm™ Tiles & Panels, a 3D acoustic ceiling and wall solution.

- In January 2024, Nanoleaf, known for smart lighting design, launched the Nanoleaf Skylight Modular Ceiling Light Panels. This product integrates customizable lighting with ceiling tiles, offering a novel solution combining aesthetics, lighting, and acoustic functionality, mainly impacting commercial environments.

- In 2025, Atkar introduced Inluxe Pure, a new clear coat finish for timber-acoustic panels.

- In April 2024, Luxxbox introduced its Motif acoustic panels that combine effective sound absorption with visually customizable designs, catering to architects and designers seeking both aesthetic appeal and acoustic performance in Australia.

Report Coverage

The research report offers an in-depth analysis based on Material, Installation Type, End User and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for acoustic ceiling tiles will rise with growing urban infrastructure projects.

- Green building initiatives will increase adoption of eco-friendly ceiling materials.

- Commercial offices and co-working spaces will drive consistent market expansion.

- Renovation and retrofit projects will create strong opportunities for suppliers.

- Customization in design and aesthetics will gain more importance among architects.

- Digital tools and BIM integration will enhance product specification and installation.

- Facility managers will prioritize noise control solutions in educational and healthcare sectors.

- Premium ceiling systems with fire and moisture resistance will see higher adoption.

- Competition will intensify as regional players expand into niche segments.

- Distribution networks and partnerships with contractors will remain central to growth.

Market Insights

Market Insights Key Growth Drivers

Key Growth Drivers Market Segmentations:

Market Segmentations: