Market Overview:

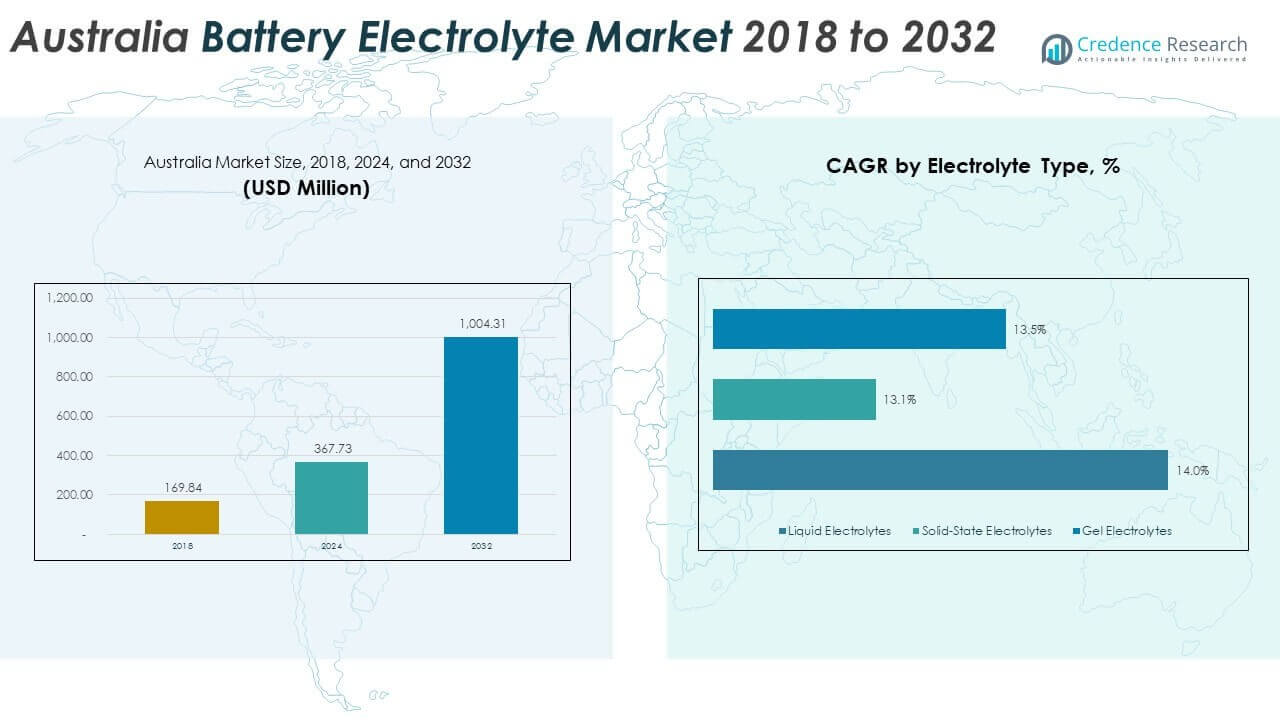

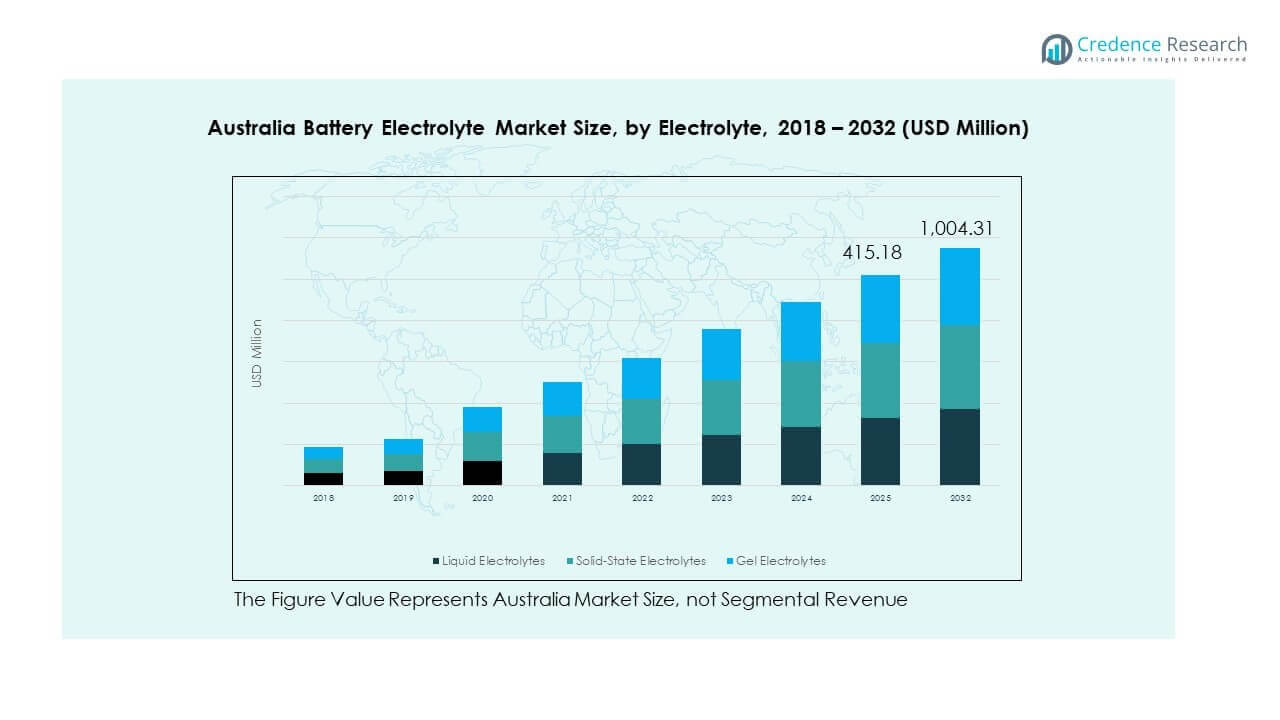

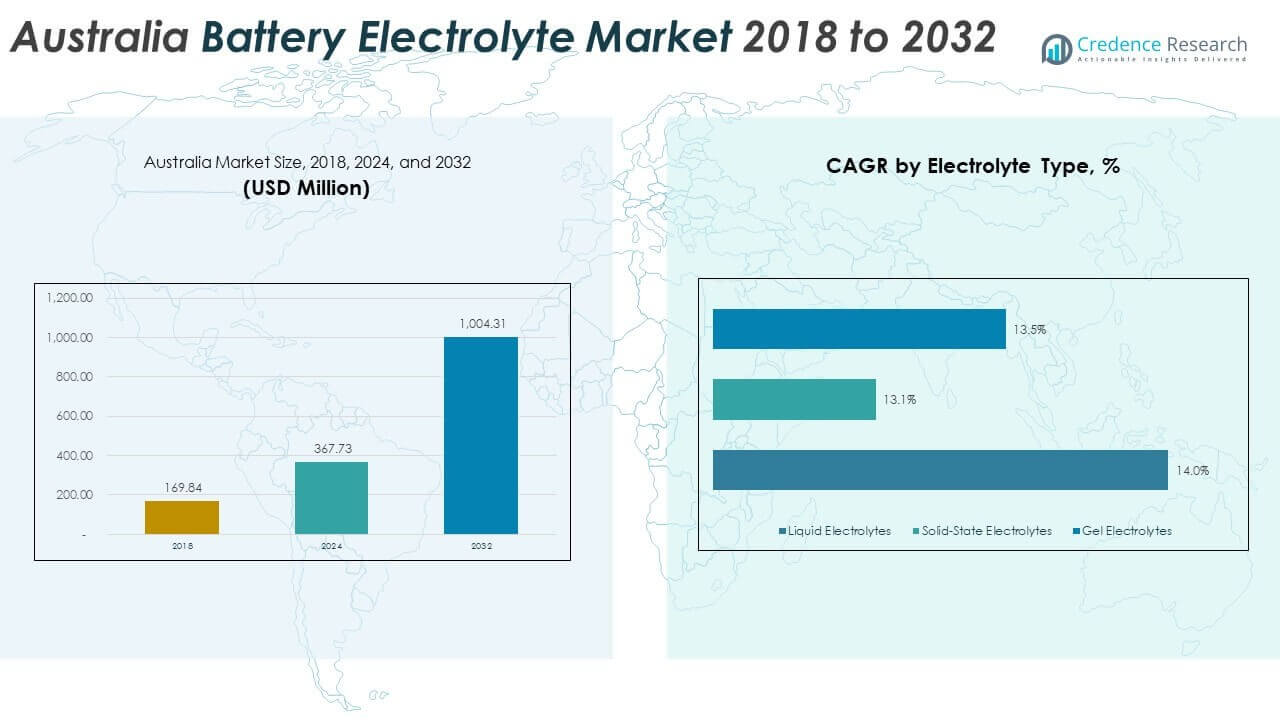

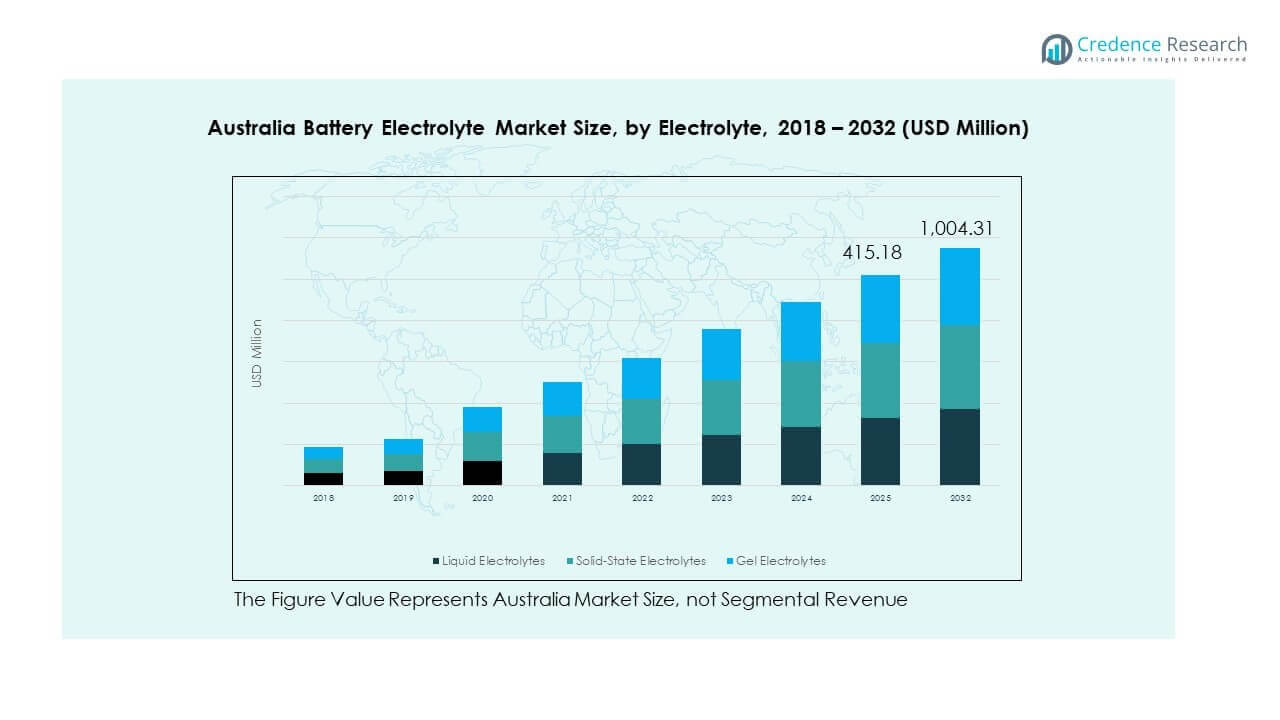

The Australia Battery Electrolyte Market size was valued at USD 169.84 million in 2018, reached USD 367.73 million in 2024, and is anticipated to reach USD 1,004.31 million by 2032, at a CAGR of 13.38% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Australia Battery Electrolyte Market Size 2024 |

USD 367.73 Million |

| Australia Battery Electrolyte Market, CAGR |

13.38% |

| Australia Battery Electrolyte Market Size 2032 |

USD 1,004.31 Million |

Growth in the market is driven by the rising adoption of electric vehicles and renewable energy storage systems. Increasing government policies supporting clean energy and the push to reduce carbon emissions are strengthening demand. Technological innovations in solid and liquid electrolytes are improving efficiency and safety, encouraging wider usage. Expanding consumer electronics production further supports the uptake of advanced electrolytes.

Regionally, Australia is shaping into a key hub due to its rich lithium reserves and growing battery manufacturing ecosystem. The eastern states, particularly Queensland and Victoria, are leading with strong industrial activity and clean energy investments. Western Australia is emerging rapidly because of its mining capacity and strategic role in global supply chains. This geographic advantage positions the country as both a leading producer and an attractive investment destination.

Market Insights:

Market Insights:

- The Australia Battery Electrolyte Market was valued at USD 169.84 million in 2018, reached USD 367.73 million in 2024, and is projected to reach USD 1,004.31 million by 2032, expanding at a CAGR of 13.38% during the forecast period.

- Eastern Australia commanded the largest share at 34% in 2024 due to strong industrial activity and clean energy investments. Queensland followed with 28%, supported by renewable projects, while Victoria held 23% driven by automotive and electronics adoption.

- Western Australia is the fastest-growing region, holding 15% share in 2024, fueled by abundant lithium reserves and rapid expansion in mining-linked battery production.

- By electrolyte type, liquid electrolytes accounted for around 52% share in 2024, dominating due to their extensive use in lithium-ion and lead acid batteries.

- Solid-state electrolytes captured 31% share in 2024, while gel electrolytes represented 17%, showing emerging adoption in specialized applications and energy storage.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Adoption of Electric Vehicles Across Australia

The rapid shift toward electric vehicles is a major driver in the Australia Battery Electrolyte Market. Government policies supporting EV adoption are creating strong demand for high-quality electrolytes. Consumers are responding positively to incentives and subsidies, driving growth in lithium-ion battery demand. Charging infrastructure expansion further accelerates adoption across urban and regional centers. Automakers are launching new models that require reliable and efficient batteries. This expansion directly boosts electrolyte requirements. It positions the market as a core enabler of the EV revolution.

- For instance, Energy Renaissance, an Australian battery manufacturer, operates a 4,500 square meter gigafactory in Tomago with an annual production capacity of up to 1 GWh, supporting the domestic supply of lithium-ion batteries for EVs and stationary applications as of 2022.

Rising Investments in Renewable Energy Storage Projects

Large-scale renewable projects are driving higher demand for advanced battery electrolytes. Australia’s solar and wind capacity expansion requires strong storage solutions for grid stability. Electrolytes ensure the performance and durability of storage batteries. Utility providers are investing in large storage plants to reduce reliance on fossil fuels. This supports both short-term and long-term demand growth. The Australia Battery Electrolyte Market benefits from these developments, making it an attractive sector for investors. It continues to play a crucial role in the renewable energy ecosystem.

- For instance, in the first quarter of 2025, Australia saw over AUD 2.4 billion invested in large-scale battery energy storage systems, adding 1.5 GW of storage capacity and 5 GWh of energy output through six major projects.

Increasing Demand From Consumer Electronics and Portable Devices

The electronics sector is expanding with smartphones, laptops, and wearables leading consumption. All these devices rely heavily on advanced battery systems. Electrolytes enhance performance, durability, and safety in portable batteries. Global manufacturers are sourcing more from Australia to meet growing regional demand. The rising middle-class population further boosts the use of consumer devices. This creates continuous growth momentum for local and international suppliers. The Australia Battery Electrolyte Market gains long-term support from electronics innovation.

Technological Innovations Enhancing Battery Efficiency and Safety

R&D efforts are improving battery performance through advanced electrolyte formulations. Solid-state electrolytes are gaining traction for higher safety and stability. Researchers are exploring hybrid materials for cost and efficiency improvements. Manufacturers are scaling production to meet growing industrial demand. Such advancements position electrolytes as central to next-generation energy storage. Partnerships between universities and companies accelerate the pace of innovation. It secures the Australia Battery Electrolyte Market as a hub of technological progress.

Market Trends:

Market Trends:

Shift Toward Solid-State and Gel Electrolyte Technologies

A clear trend is the move toward safer and more efficient solid-state electrolytes. These technologies promise greater energy density and improved safety. Gel electrolytes are also gaining traction in specific industrial uses. The Australia Battery Electrolyte Market is aligning with global innovation patterns. Companies are investing in R&D for new product lines. These shifts reflect growing confidence in alternative electrolyte solutions. It highlights the industry’s focus on long-term sustainability.

- For instance, Australian battery developer Li-S Energy has developed a third-generation semi-solid state lithium sulfur battery cell with a 45% increase in volumetric energy density and a gravimetric energy density of over 400 Wh/kg, nearly double traditional lithium-ion cells.

Strategic Collaborations and Global Partnerships in Supply Chains

Firms are entering global alliances to strengthen supply security and technology exchange. Partnerships ensure steady raw material access and innovation sharing. Local producers are linking with global battery manufacturers for supply agreements. The Australia Battery Electrolyte Market benefits from these collaborations, which enhance its international reach. Supply chain resilience is becoming a top priority. Such strategies ensure long-term competitiveness in the global market. It helps the industry remain agile in meeting rising global demand.

- For instance, BHP collaborated with CSIRO to build a pilot plant producing battery-grade nickel sulfate in Western Australia, supporting supply chain reliability for lithium battery materials, with the first batch produced in Kwinana.

Integration of Recycling and Circular Economy Practices

Recycling initiatives are gaining momentum in the battery sector. Producers are focusing on recovering electrolytes and other materials from used batteries. Circular economy practices reduce environmental impact and enhance sustainability. The Australia Battery Electrolyte Market is adopting these practices to meet regulatory expectations. Policies encourage recycling-based innovation and new revenue streams. Companies are piloting projects to recover and reuse materials at scale. It positions the market as an eco-conscious industry segment.

Focus on Domestic Production and Export Competitiveness

Australia is working to expand local manufacturing capacities for global exports. Domestic production reduces reliance on imports and strengthens supply chains. Government support is encouraging new industrial facilities. The Australia Battery Electrolyte Market is aligning with this focus to boost competitiveness. Strong export potential creates opportunities in Asia-Pacific and beyond. This trend highlights Australia’s role as a global supplier. It secures long-term economic and industrial benefits for the nation.

Market Challenges Analysis:

High Production Costs and Raw Material Supply Constraints

Electrolyte production requires specialized processes and consistent access to raw materials. Rising costs of chemicals and logistics create strong financial pressure. The Australia Battery Electrolyte Market faces challenges from global supply fluctuations. Price volatility of lithium and other key inputs adds uncertainty. Limited domestic manufacturing scale further intensifies cost pressures. Companies are struggling to balance quality with affordability. It highlights the urgent need for stronger supply chain resilience.

Regulatory Complexities and Technological Uncertainty

Strict environmental regulations require costly compliance measures. Firms must adapt to evolving global standards on safety and emissions. The Australia Battery Electrolyte Market experiences delays in approvals and certifications. Rapid technological change adds risk for producers investing in new methods. Solid-state transitions require high capital and research spending. Smaller firms often find it difficult to compete at scale. It creates a fragmented landscape with both risks and opportunities.

Market Opportunities:

Leveraging Australia’s Rich Lithium Reserves for Global Supply

Australia holds abundant lithium resources critical for battery manufacturing. This advantage supports electrolyte production growth and export expansion. The Australia Battery Electrolyte Market can leverage this position to become a global hub. Integration with global value chains enhances competitiveness. Companies can secure partnerships with EV and electronics manufacturers. It strengthens Australia’s role in the global clean energy economy. The resource advantage creates long-term industrial benefits.

Rising Demand for Energy Storage in Emerging Applications

Beyond EVs and consumer electronics, new sectors are adopting advanced storage. Applications include defense, marine, and off-grid renewable solutions. The Australia Battery Electrolyte Market benefits from such diversification in demand. Research institutions are also exploring niche industrial uses. This broadens the commercial landscape for producers. It creates steady demand across multiple industries. The market has a strong foundation for sustainable growth.

Market Segmentation Analysis:

By Electrolyte Type

The Australia Battery Electrolyte Market is segmented into liquid, solid-state, and gel electrolytes. Liquid electrolytes currently dominate due to their wide use in lithium-ion and lead acid batteries. Solid-state electrolytes are gaining momentum with their higher safety profile and energy density. Gel electrolytes cater to niche applications, offering flexibility in specialized energy storage. Each type is attracting research and development to improve stability and performance. It reflects the market’s alignment with both traditional and advanced storage needs.

- For instance, CSIRO is actively collaborating with companies to develop high-purity, spheroidized graphite anode materials to enhance lithium-ion battery performance, a critical component of liquid electrolyte batteries widely used in Australia.

By Battery Type

Lithium-ion batteries lead the demand, supported by electric vehicles and consumer electronics adoption. Lead acid batteries maintain strong relevance in backup power and industrial uses. Flow batteries are emerging in large-scale renewable energy storage projects. Other battery types cater to specialized segments with specific efficiency or cost requirements. The Australia Battery Electrolyte Market benefits from the diversification across these technologies. It ensures growth momentum is balanced across established and emerging categories.

- For instance, Allegro Energy is scaling up mass production of its Redox Flow Battery technology with a $1.85 million grant awarded in early 2025, boosting long-duration energy storage capabilities complementing lithium-ion systems.

By Application

Automotive represents the largest application, driven by rising EV penetration and charging network expansion. Consumer electronics sustain steady demand with continuous innovation in smartphones, laptops, and wearables. Energy storage is expanding quickly, supported by investments in solar and wind integration. Other applications such as defense and marine storage add further scope to the sector. The Australia Battery Electrolyte Market demonstrates a broad application base that strengthens its long-term outlook. It highlights the market’s adaptability to multiple industries.

Segmentation:

Segmentation:

By Electrolyte Type

-

- Liquid Electrolytes

- Solid-State Electrolytes

- Gel Electrolytes

By Battery Type

-

- Lithium-ion

- Lead Acid

- Flow Battery

- Others

By Application

-

- Automotive

- Consumer Electronics

- Energy Storage

- Others

Regional Analysis:

Eastern Australia – Industrial and Clean Energy Leadership

Eastern Australia commanded the largest share of 34% in the Australia Battery Electrolyte Market in 2024. The region benefits from a strong concentration of industrial hubs, advanced infrastructure, and significant clean energy investments. Government-backed initiatives to promote electric vehicles and renewable energy storage further strengthen demand. Large-scale solar and wind projects in New South Wales and Queensland increase the requirement for reliable battery electrolytes. It demonstrates leadership through early adoption of energy technologies and consistent policy support. Eastern Australia remains a core driver of national growth, with manufacturers and research institutions concentrated in this corridor.

Queensland and Victoria – Expanding Demand from EV and Electronics

Queensland held 28% market share in 2024, supported by rapid deployment of renewable storage systems and state-level clean energy programs. The growing adoption of electric vehicles across major cities is boosting lithium-ion battery demand. Victoria accounted for 23% share, driven by a combination of automotive production and consumer electronics manufacturing. Both states show strong alignment with the national push toward energy transition. It highlights their capacity to attract investments in advanced battery research and manufacturing facilities. Together, Queensland and Victoria provide critical momentum to diversify applications and sustain electrolyte demand across end-use industries.

Western Australia – Fastest Growing Resource-Based Hub

Western Australia represented 15% share in 2024, making it the fastest-growing region in the Australia Battery Electrolyte Market. The region is strengthened by abundant lithium reserves and established mining infrastructure, which supply raw materials to global battery producers. Growth in battery-grade chemical processing facilities supports domestic value addition. Local partnerships with international companies further enhance the state’s role in the global supply chain. It underscores Western Australia’s transition from a mining hub to a key participant in the battery value ecosystem. With increasing investments in processing and exports, the region is expected to expand its influence in the coming years.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Australia Battery Electrolyte Market is highly competitive, shaped by global leaders and regional players. Large chemical companies such as BASF, Mitsubishi Chemical Group, and Evonik Industries focus on innovation in advanced electrolyte formulations to strengthen their presence. Domestic firms like Australian Vanadium Limited contribute by integrating resource advantages into local production. Partnerships and research collaborations are common strategies to enhance technology adoption. It is also characterized by firms expanding their portfolios across liquid, solid-state, and gel electrolytes to capture diverse demand. Companies emphasize sustainability, efficiency, and safety to gain an edge. The market reflects a balance between established multinationals and emerging innovators.

Recent Developments:

- In August 2025, the Australian Renewable Energy Agency (ARENA) launched the Battery Breakthrough Initiative (BBI), a fund of AUD 500 million aimed at expanding domestic battery manufacturing capacity. This initiative supports production across the battery value chain, including battery active materials like cathode, anode, and electrolytes, as well as battery cell and pack assembly.

- In May 2025, the household energy storage market in Australia saw significant activity with several top brands driving adoption. Sungrow, a key player, launched its 5kWh household battery system SBS050, a lithium iron phosphate system designed for scalable capacity up to 20.48kWh, highlighting advances in residential battery technology.

- In January 2025, Honda commenced the production of new solid-state EV batteries using a pioneering roll-pressing technique to improve energy efficiency and production speed. This marked a significant step in battery technology development with implications for the Australian EV battery market as the country shifts toward electric mobility.

Report Coverage:

The research report offers an in-depth analysis based on electrolyte type, battery type, and application segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Growing demand for advanced electrolytes in electric vehicles will drive market expansion.

- Solid-state technologies are expected to gain significant adoption across multiple industries.

- Local lithium resources will strengthen Australia’s role as a global supply hub.

- Energy storage projects will accelerate demand for innovative electrolyte solutions.

- Consumer electronics will sustain steady growth in liquid electrolyte consumption.

- Recycling and circular economy practices will reshape industry supply chains.

- Partnerships between local and global firms will enhance competitiveness and innovation.

- Regulatory frameworks will encourage sustainable production and adoption of eco-friendly technologies.

- Export opportunities in Asia-Pacific will expand Australia’s international footprint.

- Continuous R&D will secure the Australia Battery Electrolyte Market as a center for technological progress.

Market Insights:

Market Insights: Market Trends:

Market Trends: Segmentation:

Segmentation: