Market Overview

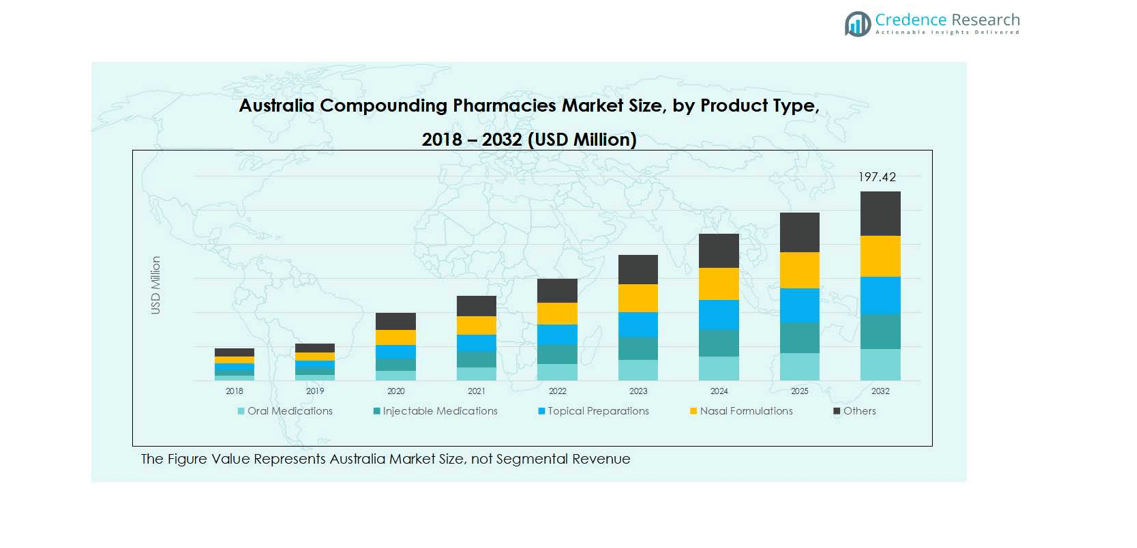

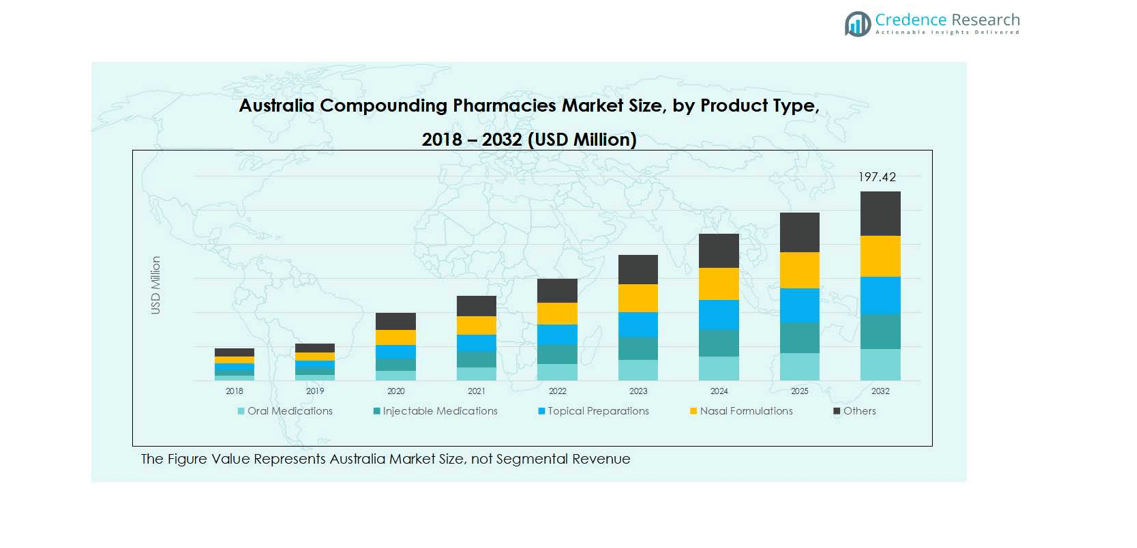

Australia Compounding Pharmacies Market size was valued at USD 67.82 million in 2018 and grew to USD 106.69 million in 2024. It is anticipated to reach USD 197.42 million by 2032, at a CAGR of 7.45% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

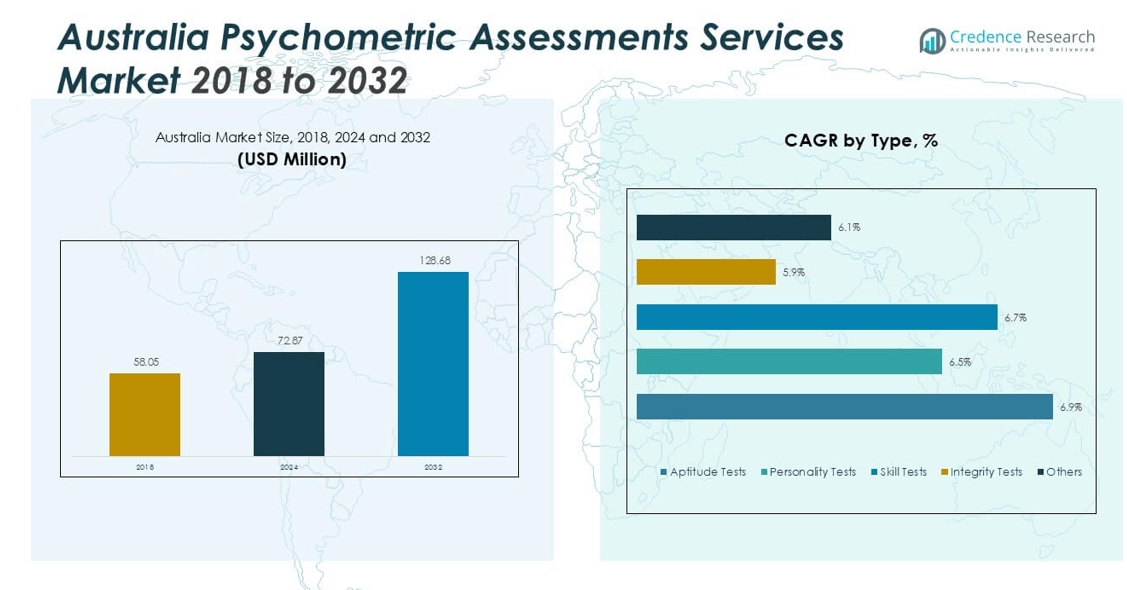

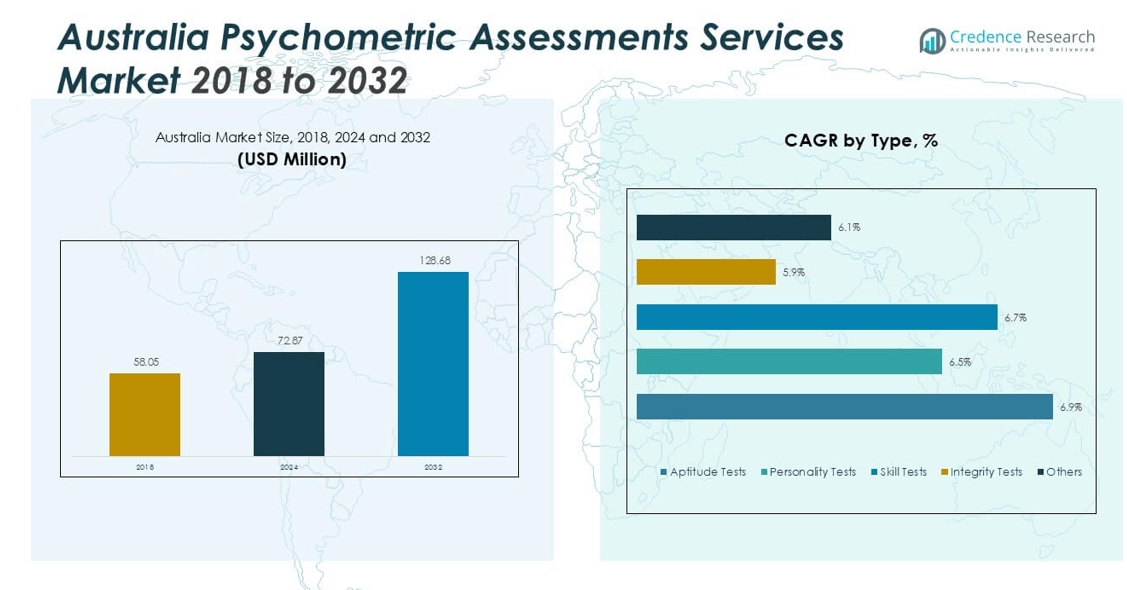

| Australia Psychometric Assessments Services Market Size 2024 |

USD 106.69 million |

| Australia Psychometric Assessments Services Market, CAGR |

7.45% |

| Australia Psychometric Assessments Services Market Size 2032 |

USD 197.42 million |

The Australia Compounding Pharmacies Market is dominated by key players including Symbion Pharmaceutical Services, Galen Pharmaceuticals, Sigma Pharmaceuticals, API Pharmaceuticals, Central Coast Compounding Pharmacy, Australian Compounding Pharmacy, Healthcare Australia Pharmaceutical, Medlab Clinical, Quality Pharma, and Pharmacy2U Australia. These companies focus on expanding service portfolios, enhancing both sterile and non-sterile compounding capabilities, and leveraging digital prescription platforms to improve patient access and operational efficiency. Strategic initiatives such as partnerships, mergers, and facility expansions have strengthened regional presence and market share. Geographically, New South Wales leads the market with 28% revenue contribution, followed by Victoria at 22% and Queensland at 18%. The dominance of these regions is driven by dense urban populations, advanced healthcare infrastructure, and increasing demand for personalized and specialty medications. Combined with robust growth strategies from leading players, these regions continue to drive the expansion and competitiveness of the Australia Compounding Pharmacies Market.

Market Insights

- The Australia Compounding Pharmacies Market was valued at USD 106.69 million in 2024 and is projected to reach USD 197.42 million by 2032, growing at a CAGR of 7.45%. Oral medications lead the market with a 38% share, while 503A pharmacies dominate the pharmacy type segment at 65%, and sterile compounding accounts for 55% of total revenue.

- Growth is driven by rising demand for personalized medications, increasing adoption of sterile compounding for injectable therapies, and supportive healthcare infrastructure enhancing patient access and service quality.

- Market trends include the integration of digital prescription platforms, telemedicine adoption, and expansion into niche therapeutic areas such as hormone replacement therapy, dermatology, and specialty drugs.

- Competitive analysis highlights key players including Symbion Pharmaceutical Services, Galen Pharmaceuticals, Sigma Pharmaceuticals, and API Pharmaceuticals focusing on service expansion, partnerships, and infrastructure modernization.

- Regionally, New South Wales leads with 28% revenue share, followed by Victoria at 22% and Queensland at 18%, driven by urban healthcare concentration and higher patient demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type:

The oral medications segment dominates the Australia Compounding Pharmacies Market, accounting for approximately 38% of the total product-type revenue. Growth in this segment is driven by the increasing demand for personalized oral therapies, including customized doses for chronic conditions and hormone replacement treatments. Injectable medications follow closely, supported by rising requirements for sterile preparations in hospitals and specialty clinics. Topical and nasal formulations are witnessing moderate growth due to rising dermatology and respiratory care needs, while other niche formulations contribute a minor share of the market.

- For instance, DoseMe, an Australian-founded medical technology company, enables clinicians to deliver precise chemotherapy dosing tailored to individual cancer patients’ pharmacokinetic profiles, improving treatment outcomes significantly.

By Pharmacy Type:

503A pharmacies lead the market in Australia, holding nearly 65% of the pharmacy-type revenue share. These pharmacies focus on patient-specific compounded prescriptions, offering flexibility in dosage forms and personalized treatments, which drives adoption. In contrast, 503B pharmacies, which cater to larger-scale sterile production for hospitals and clinics, account for a smaller share but show steady growth due to increased regulatory compliance and demand for ready-to-use sterile medications. The preference for personalized healthcare remains a key driver for the dominant 503A segment.

- For instance, the U.S. 503B compounding pharmacy sector, valued at around USD 1.25 billion in 2025, is growing steadily by producing ready-to-use sterile injectables vital for ICU and emergency care, backed by stringent FDA oversight.

By Sterility:

Sterile compounding represents the largest segment, contributing roughly 55% of total market revenue in Australia. Growth in this sub-segment is fueled by the rising prevalence of injectable therapies, oncology treatments, and intravenous nutritional supplements requiring sterile conditions. Non-sterile compounding accounts for the remaining share, driven primarily by oral, topical, and nasal formulations, where sterility is not critical. Increasing patient awareness about safety and precision in sterile preparations continues to strengthen the dominance of sterile compounding in the market.

Key Growth Drivers

Rising Demand for Personalized Medications

Australia’s compounding pharmacies market is propelled by growing demand for personalized medications tailored to individual patient needs. Patients with chronic conditions, hormone imbalances, or allergies increasingly seek custom dosages and formulations unavailable in standard therapies. This trend drives both 503A and 503B pharmacies to expand their offerings in oral, injectable, and topical medications. The ability to provide patient-specific treatments enhances adherence and efficacy, supporting sustained revenue growth across product types and contributing to the market’s overall expansion in both urban and regional healthcare centers.

- For instance, Australian Custom Pharmaceuticals Pty Ltd, which specializes in producing medications free from allergens like dyes, preservatives, and lactose to achieve better therapeutic results.

Expansion of Sterile Compounding Services

The market benefits from increased adoption of sterile compounding services, particularly for injectable therapies, oncology medications, and intravenous nutrition. Hospitals, specialty clinics, and long-term care facilities are increasingly outsourcing sterile preparations to ensure patient safety and compliance with stringent regulations. The focus on sterile compounding mitigates contamination risks and supports higher-quality care, which drives both demand and market revenue. Rising awareness among healthcare providers about the importance of sterile preparation standards ensures that sterile compounding remains the dominant segment in Australia’s market landscape.

- For instance, Baxter Healthcare offers tailored compounding services in Australia and New Zealand, including chemotherapy and IV additives, leveraging their extensive network of licensed facilities to support hospital pharmacies with high-quality sterile preparations.

Regulatory Support and Healthcare Infrastructure Growth

Supportive regulatory frameworks and expansion of healthcare infrastructure significantly boost the compounding pharmacies market in Australia. Government initiatives promoting patient safety and quality control encourage compliance with USP <797>/<800> standards, strengthening market trust. Simultaneously, investments in modern compounding facilities and training programs enhance capacity, efficiency, and service quality. These developments foster greater adoption of compounded medications across therapeutic areas, including pain management, dermatology, and hormone therapy, thereby reinforcing the overall growth trajectory of compounding pharmacies nationwide.

Key Trends and Opportunities

Integration of Digital Prescription Platforms

The integration of digital prescription platforms is transforming the Australia compounding pharmacies market. Pharmacies are leveraging online ordering, telemedicine consultations, and automated prescription management to streamline operations and enhance patient convenience. This trend improves access to personalized medications, reduces dispensing errors, and strengthens patient engagement. By bridging healthcare providers and pharmacies through technology, the market is expanding its reach, particularly in remote and regional areas, presenting significant growth opportunities for both 503A and 503B pharmacies.

- For instance, the Australian Digital Health Agency’s electronic prescribing system allows prescribers to create electronic prescriptions that patients receive as unique tokens via SMS or email, which can be securely redeemed at any pharmacy, improving access and reducing dispensing errors.

Expansion into Niche Therapeutic Areas

The market presents opportunities for growth in niche therapeutic areas such as hormone replacement therapy, pediatric care, and dermatology treatments. Rising patient awareness and demand for customized formulations in these areas create potential for specialized services. Pharmacies that develop expertise in specific therapeutic segments can capture higher revenue shares and foster long-term customer loyalty. Additionally, combining personalized medication offerings with educational support and monitoring programs enhances patient outcomes, making targeted therapy expansion a lucrative avenue for market players.

- For instance, Arcutis Biotherapeutics advances medical dermatology with a robust pipeline focused on biologically validated targets for immuno-dermatology, enhancing personalized treatment options.

Key Challenges

Stringent Regulatory Compliance

Strict regulatory requirements pose challenges for the compounding pharmacies market in Australia. Compliance with state and federal guidelines for sterile and non-sterile compounding, including rigorous documentation, facility standards, and quality assurance protocols, increases operational complexity. Smaller pharmacies may struggle with the cost and expertise needed to meet these standards, potentially limiting market entry. Non-compliance risks penalties and reputational damage, requiring continuous investment in training, audits, and infrastructure, which can constrain growth despite rising demand for compounded medications.

Limited Awareness and Adoption in Regional Areas

A significant challenge in the Australian market is the limited awareness and adoption of compounded medications in regional and remote areas. Patients and some healthcare providers may lack knowledge of the benefits of personalized therapies, resulting in lower demand outside urban centers. Logistical issues in delivering customized formulations and maintaining sterility further impede market penetration. Overcoming these barriers requires targeted education, outreach programs, and investment in distribution networks to expand accessibility, ensuring the full potential of compounding pharmacies is realized nationwide.

Regional Analysis

New South Wales

New South Wales holds a leading position in the Australia compounding pharmacies market, contributing 28% of the total revenue. The region benefits from a high concentration of hospitals, specialty clinics, and urban healthcare facilities that demand personalized and sterile compounded medications. Rising patient awareness about tailored therapies, particularly for hormone replacement and pain management, supports growth in both oral and injectable formulations. Additionally, increasing regulatory compliance and infrastructure investments have strengthened the capacity of local compounding pharmacies, making New South Wales a critical market hub and setting trends adopted by other regions across Australia.

Victoria

Victoria accounts for 22% of Australia’s compounding pharmacies market revenue, driven by strong adoption of both 503A and 503B pharmacies. Urban centers like Melbourne have seen rising demand for injectable therapies and topical preparations, particularly in dermatology and specialty drug segments. The presence of advanced healthcare infrastructure, growing geriatric population, and awareness of personalized medication benefits continue to support the market. Additionally, regional expansion initiatives by leading compounding pharmacies have increased accessibility to customized treatments, positioning Victoria as a key revenue-generating region within Australia.

Queensland

Queensland contributes 18% to the national compounding pharmacies market revenue. The state is witnessing increasing demand for oral medications, sterile compounding, and hormone replacement therapies due to growing chronic disease prevalence and rising patient preference for tailored medications. Expansion of healthcare facilities in cities like Brisbane and regional centers has enhanced access to compounded therapies. Moreover, the integration of digital prescription platforms and telemedicine services is improving outreach in rural areas. These factors collectively drive growth in Queensland, making it an important market for both large-scale 503B and patient-specific 503A compounding pharmacies.

Western Australia

Western Australia holds 12% of the market share in the compounding pharmacies sector. Growth is fueled by rising demand for injectable and topical formulations in urban centers such as Perth, supported by the expansion of private clinics and hospital networks. Sterile compounding services are increasingly preferred for oncology and intravenous nutrition treatments, strengthening revenue in this segment. Additionally, patient awareness campaigns and regulatory compliance initiatives have encouraged adoption of personalized therapies. While population density is lower compared to eastern states, targeted regional strategies and digital prescription platforms have enabled compounding pharmacies to maintain steady growth in Western Australia.

South Australia

South Australia accounts for 10% of the total revenue in the Australia compounding pharmacies market. The state is seeing steady adoption of non-sterile oral medications and topical preparations due to rising dermatology and nutritional supplement demands. Compounding pharmacies in Adelaide and surrounding regions are increasingly leveraging telemedicine and digital prescription services to reach patients in smaller towns. Investments in pharmacy infrastructure and adherence to regulatory standards enhance patient trust and market penetration. These initiatives, coupled with rising awareness about personalized medicine, support sustained growth, positioning South Australia as a key contributor to the national compounding pharmacies market.

Other Regions (Tasmania, Northern Territory, Australian Capital Territory)

Other regions, including Tasmania, Northern Territory, and the Australian Capital Territory, collectively contribute 10% to Australia’s compounding pharmacies market revenue. Demand in these regions is primarily driven by oral medications and non-sterile compounding, supported by regional hospitals and local clinics. Telemedicine and digital prescription platforms are critical in improving accessibility to customized therapies in remote and sparsely populated areas. Awareness campaigns and partnerships with larger compounding pharmacy chains have enhanced adoption, ensuring steady growth. While these regions represent smaller market shares individually, their combined contribution is essential for national market coverage and strategic expansion opportunities.

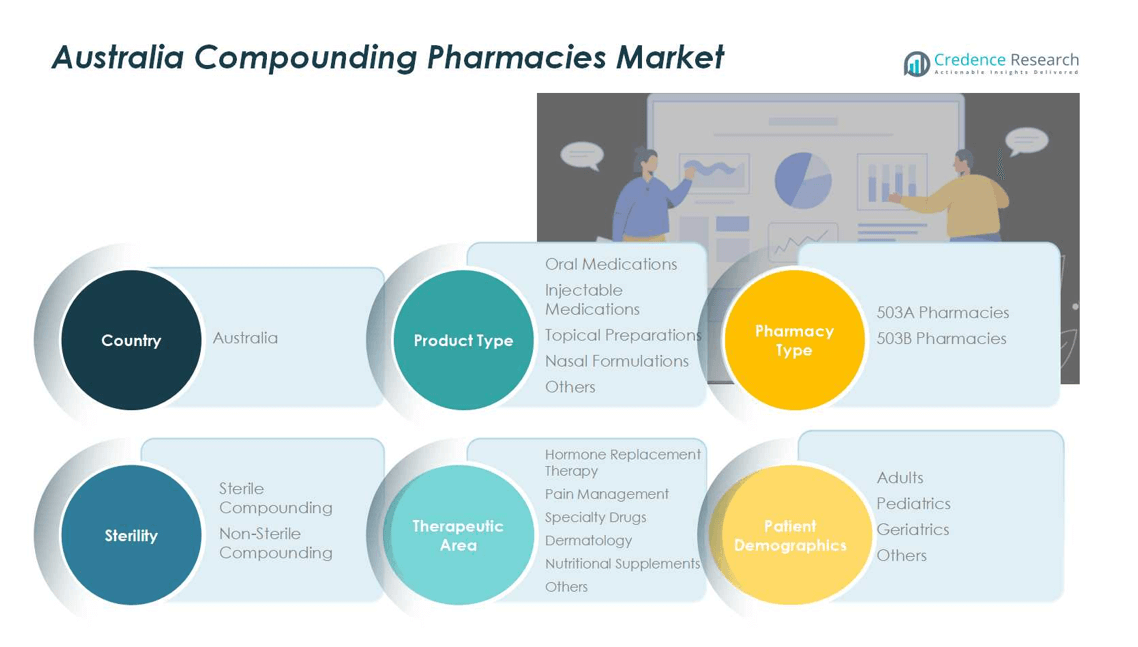

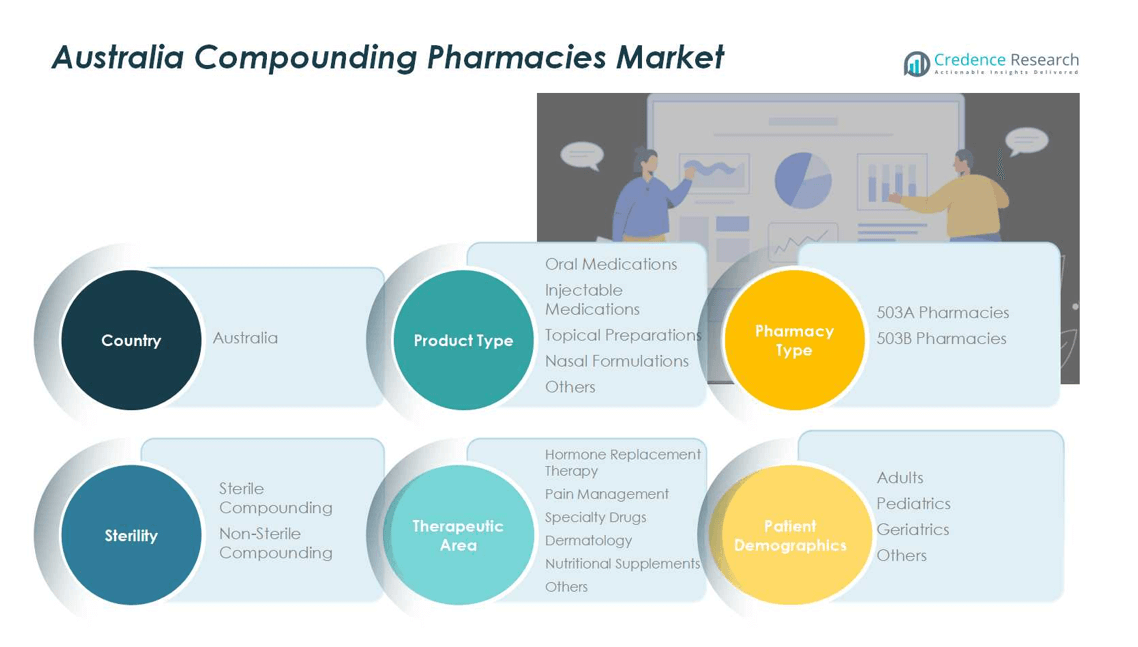

Market Segmentations:

By Product Type

- Oral Medications

- Injectable Medications

- Topical Preparations

- Nasal Formulations

- Others

By Pharmacy Type

- 503A Pharmacies

- 503B Pharmacie

By Sterility

- Sterile Compounding

- Non-Sterile Compounding

By Therapeutic Area

- Hormone Replacement Therapy

- Pain Management

- Specialty Drugs

- Dermatology

- Nutritional Supplements

- Others

By Patient Demographics

- Adults

- Pediatrics

- Geriatrics

- Others

By Region

- New South Wales

- Victoria

- Queensland

- Western Australia

- South Australia

- Others

Competitive Landscape

The competitive landscape of the Australia compounding pharmacies market is led by key players including Symbion Pharmaceutical Services, Galen Pharmaceuticals, Sigma Pharmaceuticals, API Pharmaceuticals, Central Coast Compounding Pharmacy, Australian Compounding Pharmacy, Healthcare Australia Pharmaceutical, Medlab Clinical, Quality Pharma, and Pharmacy2U Australia. Market players are focusing on expanding their service portfolios, enhancing sterile and non-sterile compounding capabilities, and leveraging digital prescription platforms to improve patient access and operational efficiency. Strategic initiatives such as partnerships, mergers, and facility expansions are common to strengthen regional presence and capture higher market share. Companies are also investing in specialized therapeutic areas like hormone replacement therapy, pain management, and dermatology, while ensuring compliance with stringent regulatory standards. Innovation in personalized formulations, patient-centric services, and infrastructure modernization are key strategies driving competitiveness and sustaining growth in the Australian compounding pharmacies market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In April 2025, Bedrocan introduced two standardized cannabis API products Bedropuur® and Bedrolina® to support Australian compounding pharmacies. These products are produced in Bedrocan’s EU-GMP-certified facility in Denmark.

- In February 2025, My Compounding Pharmacy launched a new line of customizable compounded medications, including Low Dose Naltrexone, Ketoprofen & Lignocaine cream, and Amitriptyline cream.

- In January 2025, LTR Pharma Limited entered a national distribution partnership with Symbion Pty Ltd to distribute SPONTAN®, a novel nasal spray for erectile dysfunction, across Symbion’s network of nearly 3,900 pharmacies.

- In June 2025, St Vincent’s Hospital Melbourne initiated a pilot program using an AI-driven verification system from Veriphi to enhance IV compounding accuracy and safety in its sterile pharmacy unit.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Pharmacy Type, Sterility, Therapeutic Area, Patient Demographics and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is expected to grow steadily driven by increasing demand for personalized medications.

- Expansion of sterile compounding services will continue to support injectable therapies and hospital requirements.

- Digital prescription platforms and telemedicine integration will enhance accessibility in urban and regional areas.

- Growth in hormone replacement therapy and specialty drug segments will create new revenue opportunities.

- 503A pharmacies will maintain dominance due to patient-specific prescription services.

- Regulatory compliance and infrastructure modernization will strengthen market credibility and patient trust.

- Adoption of topical, oral, and nasal formulations will rise with increasing chronic disease prevalence.

- Partnerships, mergers, and strategic collaborations will drive competitive advantage among key players.

- Awareness campaigns and patient education will boost adoption in regional and remote locations.

- Investment in niche therapeutic areas and tailored solutions will sustain long-term market growth.