| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Australia Diabetes Drugs Market Size 2023 |

USD 586.15 Million |

| Australia Diabetes Drugs Market, CAGR |

3.48% |

| Australia Diabetes Drugs Market Size 2032 |

USD 826.11 Million |

Market Overview

Australia Diabetes Drugs Market size was valued at USD 586.15 million in 2023 and is anticipated to reach USD 826.11 million by 2032, at a CAGR of 3.48% during the forecast period (2023-2032).

The Australia diabetes drugs market is primarily driven by the rising prevalence of diabetes, fueled by an aging population, sedentary lifestyles, and increasing obesity rates. Growing awareness about diabetes management and early diagnosis, supported by government healthcare initiatives, further stimulates market demand. Additionally, advancements in drug formulations, such as the development of novel insulin therapies and oral antidiabetic agents, contribute to market expansion. The increasing adoption of combination therapies and personalized treatment approaches also supports sustained growth. Moreover, the pharmaceutical sector’s focus on research and development, along with strategic collaborations and product launches, is fostering innovation in the market. Trends such as the rising preference for once-daily dosing, minimally invasive drug delivery methods, and the integration of digital health tools for diabetes monitoring are shaping the market landscape. Collectively, these drivers and trends are expected to accelerate the growth trajectory of the Australia diabetes drugs market over the forecast period.

The Australia diabetes drugs market is geographically diverse, with major demand concentrated in highly populated states such as New South Wales, Victoria, Queensland, and Western Australia. Urban regions benefit from advanced healthcare infrastructure, while rural and remote areas face challenges in accessing specialized diabetes treatments, driving the need for telehealth and digital health solutions. Government initiatives and healthcare subsidies play a crucial role in ensuring equitable access to diabetes medications across all regions. Key players in the market include Novo Nordisk A/S, Sanofi, Merck & Co., Inc., Eli Lilly and Company, AstraZeneca, Takeda Pharmaceutical Company Limited, Boehringer Ingelheim International GmbH, Novartis AG, Johnson & Johnson Services, Inc., and Bayer AG. These companies focus on research and development, strategic partnerships, and innovative drug formulations to enhance diabetes management. The rising adoption of GLP-1 receptor agonists, SGLT2 inhibitors, and insulin analogs reflects the evolving treatment landscape, with major pharmaceutical firms driving advancements in patient-centric diabetes care.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Australia diabetes drugs market was valued at USD 586.15 million in 2023 and is projected to reach USD 826.11 million by 2032, growing at a CAGR of 3.48% during the forecast period.

- Rising diabetes prevalence, driven by lifestyle changes and an aging population, is increasing demand for innovative treatment options.

- Advanced drug classes, such as GLP-1 receptor agonists and SGLT2 inhibitors, are gaining traction due to their superior efficacy and additional health benefits.

- Pharmaceutical companies are focusing on personalized medicine and digital health integration to enhance diabetes management.

- High treatment costs and stringent regulatory requirements remain key challenges, limiting access to novel therapies for some patients.

- New South Wales and Victoria dominate the market, while remote regions face challenges in healthcare access, driving the adoption of telehealth solutions.

- Leading players like Novo Nordisk, Sanofi, Merck, Eli Lilly, and AstraZeneca are driving competition through R&D investments and strategic partnerships.

Report Scope

This report segments the Australia Diabetes Drugs Market as follows:

Market Drivers

Rising Prevalence of Diabetes and Associated Risk Factors

The growing prevalence of diabetes, particularly Type 2 diabetes, is a key driver of the Australia diabetes drugs market. Australia is experiencing a steady increase in the number of diabetes cases due to factors such as an aging population, unhealthy dietary habits, physical inactivity, and the rising incidence of obesity. For instance, nearly one in five individuals aged 80–84 were affected. Additionally, males were found to be 1.3 times more likely to have diabetes compared to females. The burden of diabetes is further amplified by its strong association with cardiovascular diseases, kidney disorders, and other chronic conditions, driving the demand for effective pharmaceutical interventions. As the affected population continues to expand, the need for sustained blood glucose management will significantly boost the consumption of diabetes drugs across Australia.

Increasing Awareness and Government Healthcare Initiatives

Heightened awareness regarding diabetes management and its complications among both patients and healthcare providers serves as a crucial market growth driver. Public health campaigns, educational programs, and government-sponsored initiatives are playing a vital role in promoting early diagnosis and timely treatment. The Australian government and various healthcare organizations are actively engaged in enhancing diabetes screening, management, and support services. For instance, NDSS registration data indicates that over 1.3 million Australians benefit from its resources. Furthermore, subsidized pricing policies under the Pharmaceutical Benefits Scheme (PBS) make essential diabetes medications more affordable, enhancing treatment adherence and accessibility.

Advancements in Drug Formulations and Therapeutic Innovations

Continuous advancements in pharmaceutical research and development are significantly contributing to the expansion of the diabetes drugs market in Australia. Pharmaceutical companies are investing heavily in the development of novel drug formulations, including long-acting insulin analogs, GLP-1 receptor agonists, SGLT2 inhibitors, and fixed-dose combination therapies. These innovations are designed to enhance treatment efficacy, reduce adverse effects, and improve patient compliance. The availability of once-daily dosing regimens and user-friendly delivery systems, such as insulin pens and pumps, has made diabetes management more convenient for patients. The growing emphasis on personalized medicine and the integration of new technologies into drug development further stimulate the adoption of innovative diabetes therapies in the market.

Growing Demand for Combination Therapies and Digital Health Integration

The rising preference for combination therapies is another significant factor fueling market growth. Combination drugs offer better glycemic control by targeting multiple pathways, reducing the pill burden, and improving patient outcomes. Physicians are increasingly recommending combination therapies to address the complex and progressive nature of diabetes. Furthermore, the integration of digital health tools, including mobile health applications, continuous glucose monitoring systems (CGMs), and telemedicine platforms, is transforming diabetes care in Australia. These technologies help improve treatment adherence and patient engagement, resulting in better health outcomes. The synergy between pharmaceutical advancements and digital health solutions is expected to drive sustained growth in the Australian diabetes drugs market over the forecast period.

Market Trends

Growing Adoption of Novel Drug Classes

One of the prominent trends in the Australia diabetes drugs market is the increasing adoption of novel drug classes, such as Sodium-Glucose Cotransporter-2 (SGLT2) inhibitors and Glucagon-Like Peptide-1 (GLP-1) receptor agonists. These innovative therapies have gained significant traction due to their superior efficacy in glycemic control, weight management benefits, and cardiovascular risk reduction. Australian healthcare professionals are progressively incorporating these advanced drug classes into treatment regimens, particularly for patients with Type 2 diabetes who are at risk of cardiovascular complications. The shift toward these novel therapies reflects a broader trend of evidence-based prescribing patterns, which aim to deliver holistic diabetes management beyond blood sugar regulation.

Rising Demand for Personalized Treatment Approaches

The trend toward personalized medicine is increasingly influencing the diabetes drugs market in Australia. Healthcare providers are moving away from a “one-size-fits-all” treatment model and are focusing on tailoring therapies based on patient-specific factors, including age, comorbidities, lifestyle, and genetic predispositions. For instance, the Australian National Diabetes Strategy emphasizes the importance of individualized care plans, which have been shown to improve patient outcomes in clinical trials. Pharmaceutical companies are responding to this trend by expanding their product portfolios and developing targeted therapies that offer greater flexibility and efficacy. The growing focus on precision medicine is expected to reshape treatment protocols and create new opportunities within the Australian market.

Integration of Digital Health and Remote Monitoring

The integration of digital health technologies is emerging as a transformative trend in the Australian diabetes drugs market. The adoption of continuous glucose monitoring systems (CGMs), mobile health applications, wearable devices, and telehealth platforms is enhancing patient engagement and treatment adherence. For instance, a government report on rural healthcare access revealed that telehealth platforms have enabled over 50,000 diabetes patients in remote areas to receive timely consultations and medication adjustments. Pharmaceutical companies and healthcare providers are increasingly collaborating with technology firms to offer integrated care solutions that combine medication with digital monitoring. This trend is particularly relevant in Australia, where remote patient monitoring is vital for reaching individuals in rural and remote areas with limited access to healthcare services.

Increased Focus on Preventive Healthcare and Early Intervention

Preventive healthcare and early intervention have become central themes in Australia’s approach to diabetes management. There is a growing emphasis on lifestyle modification, early diagnosis, and pharmacological intervention to delay disease progression and prevent complications. This trend is driving the demand for first-line diabetes drugs, such as metformin and DPP-4 inhibitors, and encouraging the use of low-dose combination therapies in newly diagnosed patients. Additionally, public health campaigns and screening programs are promoting early detection, leading to a higher number of individuals entering the treatment pipeline. The increased focus on prevention aligns with national healthcare strategies and is expected to sustain demand for diabetes drugs in the long term.

Market Challenges Analysis

High Treatment Costs and Limited Access to Advanced Therapies

One of the major challenges confronting the Australia diabetes drugs market is the high cost associated with advanced therapies and novel drug formulations. While government programs like the Pharmaceutical Benefits Scheme (PBS) provide subsidies for essential medications, many of the latest diabetes treatments, such as GLP-1 receptor agonists and SGLT2 inhibitors, remain expensive for a significant portion of the population. For instance, a report by the Australian Institute of Health and Welfare highlighted that medications dispensed through the PBS accounted for 28% of total diabetes-related healthcare expenditure, underscoring the financial strain on patients requiring advanced therapies. Additionally, surveys conducted in rural regions revealed that patients often face logistical challenges in accessing these treatments, further exacerbating disparities in healthcare access. The financial burden of long-term diabetes management—including the cost of medications, monitoring devices, and associated healthcare services—poses a barrier to optimal treatment adherence and disease control. Additionally, disparities in access to specialized diabetes care across different socioeconomic groups continue to challenge the market’s growth potential.

Stringent Regulatory Requirements and Safety Concerns

The complex and stringent regulatory framework governing pharmaceutical approvals in Australia presents another significant challenge for market players. Diabetes drugs undergo rigorous safety and efficacy evaluations by regulatory authorities such as the Therapeutic Goods Administration (TGA), which can lead to delays in the approval and commercialization of new therapies. Compliance with evolving clinical trial standards, post-marketing surveillance, and pharmacovigilance requirements further adds to the time and cost burden on manufacturers. Moreover, safety concerns related to certain diabetes medications, such as cardiovascular risks, hypoglycemia, and adverse side effects, often prompt regulatory warnings and product recalls. These factors can negatively impact patient confidence and physician prescribing behavior. As a result, pharmaceutical companies operating in the Australian market must continually invest in clinical research, safety monitoring, and regulatory compliance to mitigate these challenges and ensure sustainable market access.

Market Opportunities

The Australia diabetes drugs market presents significant growth opportunities driven by the increasing emphasis on preventive healthcare and the rising demand for innovative treatment options. As the prevalence of diabetes continues to grow, particularly Type 2 diabetes, there is a substantial opportunity for pharmaceutical companies to expand their product portfolios and offer differentiated therapies. The growing awareness of early diagnosis and the importance of effective glycemic control has created a favorable environment for the introduction of novel drugs and treatment combinations. Moreover, the Australian government’s focus on improving healthcare infrastructure and accessibility, coupled with supportive reimbursement policies, is expected to encourage the adoption of advanced diabetes therapies across urban and regional areas.

Another promising opportunity lies in the integration of digital health solutions with pharmaceutical care. The rising use of telehealth services, mobile applications, and wearable devices in diabetes management opens avenues for pharmaceutical companies to collaborate with technology providers and deliver comprehensive treatment packages. Additionally, Australia’s growing elderly population and increasing rates of obesity further create long-term demand for effective diabetes medications. Pharmaceutical companies that invest in patient-centric treatment models, real-world evidence studies, and value-based care initiatives are well-positioned to capitalize on these opportunities. Expanding clinical research activities and strategic partnerships with healthcare providers, research institutions, and digital health firms will allow market players to address unmet needs, improve patient outcomes, and strengthen their market presence in the evolving Australian diabetes drugs landscape.

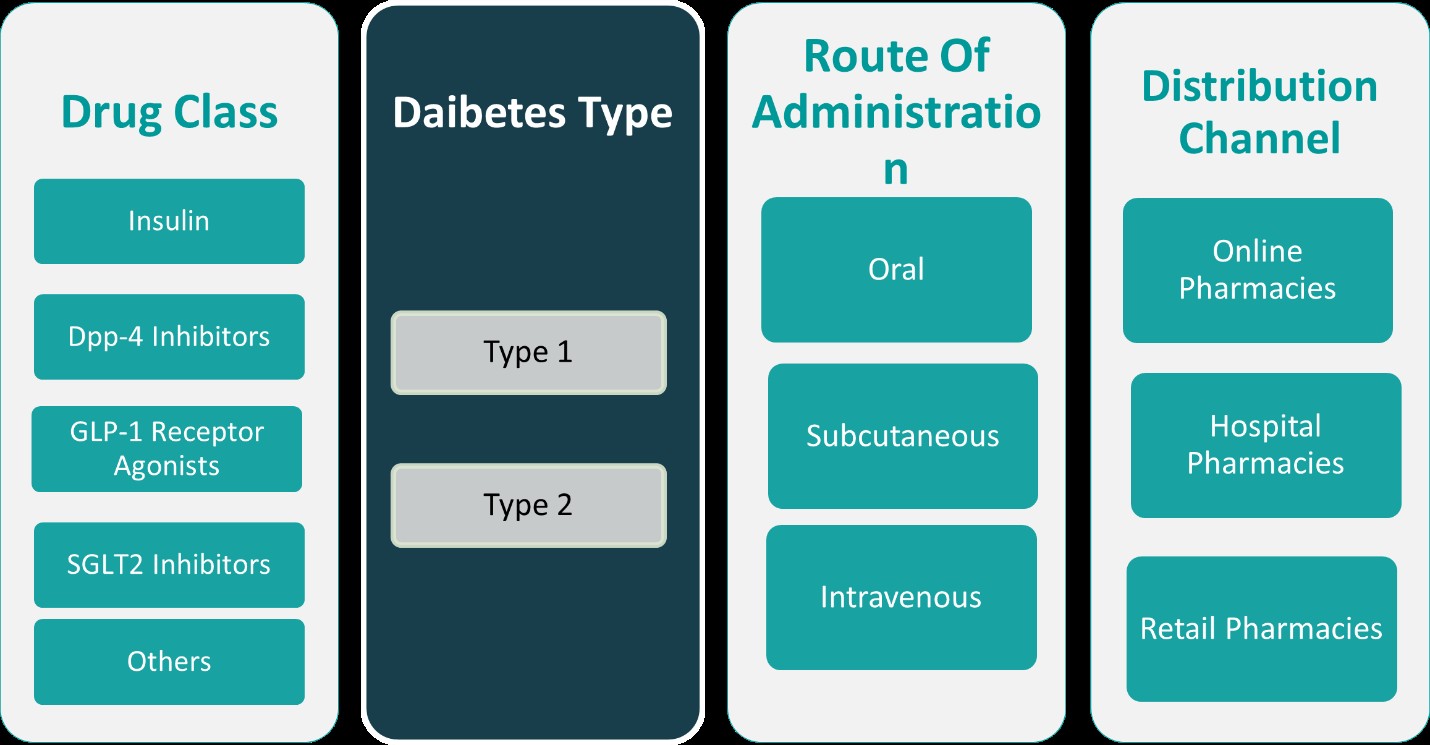

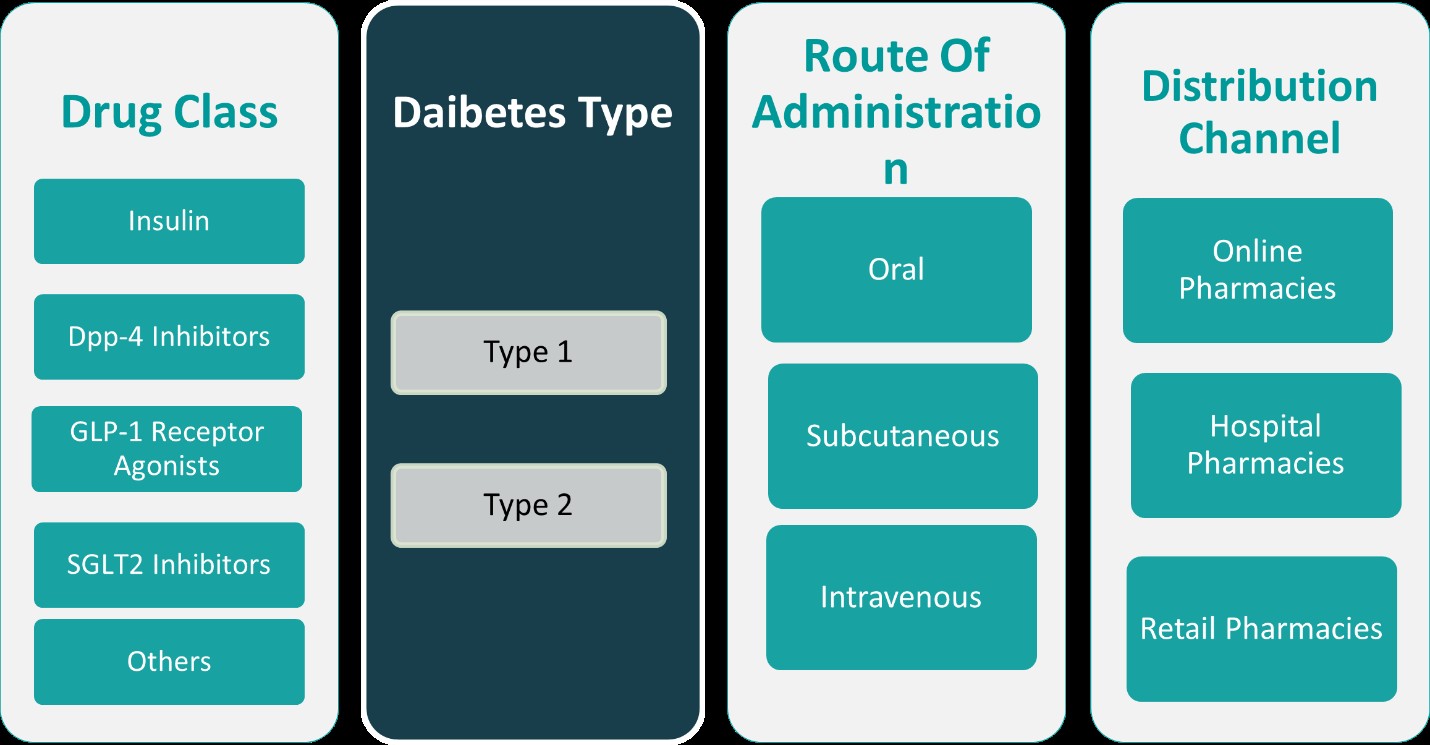

Market Segmentation Analysis:

By Drug Class:

The Australia diabetes drugs market is segmented by drug class, including insulin, DPP-4 inhibitors, GLP-1 receptor agonists, SGLT2 inhibitors, and others. Insulin remains a dominant segment, driven by its essential role in Type 1 diabetes management and its increasing use in advanced Type 2 diabetes cases. The demand for long-acting and ultra-fast-acting insulin analogs is rising, reflecting a shift towards more convenient and effective treatment options. DPP-4 inhibitors continue to gain traction due to their ability to regulate blood sugar levels with minimal risk of hypoglycemia, making them a preferred choice among physicians for early-stage Type 2 diabetes treatment. GLP-1 receptor agonists are witnessing substantial growth, supported by their dual benefits in glucose control and weight management, which align with the growing focus on obesity-related diabetes. SGLT2 inhibitors have gained popularity for their cardiovascular and renal protective benefits, making them an attractive choice for patients with comorbidities. The “Others” segment includes emerging drug classes and combination therapies, catering to the evolving needs of diabetes management.

By Diabetes Types:

The market is also segmented based on diabetes types, including Type 1, Type 2, and lesser-known diabetes classifications such as Type 3, Type 4, and Type 5. Type 1 diabetes primarily drives the demand for insulin therapy, with an increasing focus on continuous glucose monitoring (CGM) integration for enhanced treatment outcomes. Type 2 diabetes remains the largest segment due to its high prevalence, fueled by lifestyle factors, obesity, and an aging population. This segment exhibits strong demand for oral antidiabetic drugs, GLP-1 receptor agonists, and SGLT2 inhibitors, reflecting a diversified treatment landscape. Diabetes Types 3, 4, and 5, though less common, represent emerging segments with growing research interest. These classifications often include neurological, genetic, or atypical diabetes forms, necessitating specialized treatment approaches. As medical advancements continue to redefine diabetes classifications, pharmaceutical companies have an opportunity to develop targeted therapies addressing these niche segments, further expanding the scope of the Australia diabetes drugs market.

Segments:

Based on Drug Class:

- Insulin

- DPP-4 Inhibitors

- GLP-1 Receptor Agonists

- SGLT2 Inhibitors

- Others

Based on Diabetes Types:

- Type 1

- Type 2

- Diabetes Type 3

- Diabetes Type 4

- Diabetes Type 5

Based on Route of Administration:

- Oral

- Subcutaneous

- Intravenous

- Route of Administration 4

- Route of Administration 5

Based on Technology:

- Technology 1

- Technology 2

- Technology 3

Based on Distribution Channel:

- Online Pharmacies

- Hospital Pharmacies

- Retail Pharmacies

- Distribution Channel 4

- Distribution Channel 5

Based on the Geography:

- New South Wales

- Victoria

- Queensland

- Western Australia (WA)

- South Australia

Regional Analysis

New South Wales (NSW)

New South Wales (NSW) holds the largest market share in the Australia diabetes drugs market, accounting for approximately 35% of the total market. The high market share is attributed to the region’s large population, advanced healthcare infrastructure, and strong government initiatives focused on diabetes prevention and management. NSW has a significant number of specialized diabetes clinics, research institutions, and public health programs that support early diagnosis and effective treatment. Additionally, the increasing prevalence of Type 2 diabetes, particularly in urban areas such as Sydney, is driving the demand for innovative diabetes therapies, including GLP-1 receptor agonists and SGLT2 inhibitors. The availability of government subsidies and reimbursement policies under the Pharmaceutical Benefits Scheme (PBS) further enhances access to diabetes medications in the region.

Victoria

Victoria represents the second-largest market, contributing around 28% of the Australia diabetes drugs market. Melbourne, as a major healthcare and pharmaceutical hub, plays a key role in driving regional market growth. The high rate of obesity and sedentary lifestyles in Victoria has led to an increasing incidence of Type 2 diabetes, which fuels demand for oral antidiabetic medications and insulin therapies. Moreover, Victoria is home to several leading hospitals and diabetes research centers, facilitating clinical trials and the adoption of innovative treatment approaches. The government’s proactive healthcare initiatives, including digital health integration and patient education programs, are improving diabetes management outcomes and boosting drug adoption rates across the state.

Queensland

Queensland accounts for approximately 20% of the Australia diabetes drugs market, with a steadily growing demand for diabetes medications. The state has witnessed an increase in diabetes prevalence, particularly in regional and remote areas where healthcare access remains a challenge. Rising awareness and telehealth adoption have contributed to improved diagnosis and treatment accessibility. Brisbane and other metropolitan areas have well-established healthcare facilities, ensuring widespread availability of advanced diabetes drugs. However, Queensland faces unique challenges such as disparities in healthcare access between urban and rural populations, necessitating further government intervention to enhance affordability and distribution networks for diabetes treatments.

Western Australia (WA)

Western Australia (WA) holds a market share of 12%, with growing opportunities for diabetes drug manufacturers. While Perth serves as the central hub for healthcare services, remote and regional areas face challenges in accessing specialized diabetes treatments. The prevalence of diabetes in WA is rising due to lifestyle changes and an aging population, creating a growing need for long-term management solutions. Government programs promoting diabetes awareness and subsidized treatment options have played a vital role in increasing patient adherence to prescribed medications. Additionally, WA has seen a rise in the adoption of digital health tools, including mobile applications and continuous glucose monitoring (CGM) systems, complementing pharmaceutical interventions and improving patient outcomes.

Key Player Analysis

- Novo Nordisk A/S

- Sanofi

- Merck & Co., Inc

- Eli Lilly and Company

- AstraZeneca

- Takeda Pharmaceutical Company Limited

- Boehringer Ingelheim International GmbH

- Novartis AG

- Johnson & Johnson Services, Inc.

- Bayer AG

- Ypsomed

Competitive Analysis

The Australia diabetes drugs market is highly competitive, with leading pharmaceutical companies focusing on innovation, strategic partnerships, and market expansion. Key players such as Novo Nordisk A/S, Sanofi, Merck & Co., Inc., Eli Lilly and Company, AstraZeneca, Takeda Pharmaceutical Company Limited, Boehringer Ingelheim International GmbH, Novartis AG, Johnson & Johnson Services, Inc., and Bayer AG dominate the market through extensive R&D investments and advanced drug formulations. These companies are driving the adoption of next-generation diabetes treatments, including GLP-1 receptor agonists, SGLT2 inhibitors, and ultra-fast-acting insulin analogs, to enhance patient outcomes and market reach. The increasing demand for personalized medicine and digital health solutions is further driving competition, with firms integrating advanced technologies such as AI-powered glucose monitoring and telehealth platforms to enhance patient care. The insulin segment remains a dominant category, with key industry players leveraging strong product pipelines and technological advancements to maintain their market positions. Oral antidiabetic drugs, particularly DPP-4 inhibitors and SGLT2 inhibitors, are witnessing increased adoption due to their efficacy and added cardiovascular benefits. Regulatory challenges and pricing pressures continue to shape competitive strategies, prompting companies to explore mergers, acquisitions, and collaborations to expand their market reach and ensure long-term sustainability in Australia’s evolving diabetes treatment landscape.

Recent Developments

- In March 2025, Novo Nordisk signed a deal worth up to $2 billion for the rights to UBT251, a new obesity and diabetes drug developed by United BioTechnology. The drug combines GLP-1, GIP, and glucagon to manage blood sugar and reduce hunger.

- In February 2025, Sanofi received FDA approval for MERILOG, the first rapid-acting insulin aspart biosimilar, to improve glycemic control in adults and pediatric patients with diabetes.

- In December 2024, JD Health began offering Merck’s GLUCOPHAGE XR (Reduce Mass) online in China, enhancing access to metformin hydrochloride extended-release tablets for type 2 diabetes patients.

- In December 2024, Torrent Pharma acquired three diabetes brands from Boehringer Ingelheim, including those with Empagliflozin, to strengthen its anti-diabetes portfolio

- In November 2024, AstraZeneca presented promising early data for its obesity pipeline, including AZD5004, an oral GLP-1 receptor blocker, at ObesityWeek 2024.

Market Concentration & Characteristics

The Australia diabetes drugs market is moderately concentrated, with a few dominant pharmaceutical companies holding a significant share due to their extensive product portfolios and strong distribution networks. The market is characterized by high research and development investments, regulatory compliance, and a growing focus on innovative treatment solutions. The presence of patented drugs and continuous advancements in insulin analogs, GLP-1 receptor agonists, and SGLT2 inhibitors contribute to market competitiveness. Additionally, the increasing adoption of biosimilars and generic alternatives is gradually influencing pricing dynamics and market accessibility. The industry also exhibits a strong inclination toward personalized medicine, digital health integration, and patient-centric treatment models. While urban areas benefit from well-established healthcare infrastructure, rural and remote regions present opportunities for market expansion through telehealth and government-supported initiatives. Overall, the market continues to evolve, driven by technological advancements, strategic collaborations, and an increasing emphasis on improving diabetes management outcomes across Australia.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Drug Class, Diabetes Types, Route of Administration, Technology, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for diabetes drugs in Australia will continue to rise due to increasing diabetes prevalence and an aging population.

- Advanced drug classes, such as GLP-1 receptor agonists and SGLT2 inhibitors, will see higher adoption due to their additional health benefits.

- Digital health integration, including AI-driven glucose monitoring and telemedicine, will enhance diabetes management and patient engagement.

- Biosimilars and generic alternatives will gain traction, increasing competition and improving affordability for patients.

- Personalized medicine and precision therapies will play a key role in tailoring treatment plans based on individual patient needs.

- Regulatory frameworks will continue to evolve, ensuring drug safety and effectiveness while encouraging innovation.

- Pharmaceutical companies will focus on strategic collaborations and partnerships to strengthen market presence and expand product portfolios.

- Government initiatives and reimbursement policies will drive better access to diabetes medications, particularly in regional and remote areas.

- Research in combination therapies and novel drug delivery systems will enhance treatment effectiveness and patient compliance.

- Sustainable healthcare practices and cost-effective treatment solutions will shape the future landscape of diabetes drug development in Australia.