| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Australia Green Data Center Market Size 2024 |

USD 594.23 Million |

| Australia Green Data Center Market, CAGR |

19.65% |

| Australia Green Data Center Market Size 2032 |

USD 2,496.78 Million |

Market Overview

The Australia Green Data Center Market is projected to grow from USD 594.23 million in 2024 to an estimated USD 2,496.78 million by 2032, with a compound annual growth rate (CAGR) of 19.65% from 2025 to 2032. This robust growth reflects the increasing demand for sustainable digital infrastructure, driven by stringent environmental regulations, rising energy costs, and the country’s commitment to reducing carbon emissions.

Key drivers propelling this market include government incentives for energy-efficient infrastructure, advancements in cooling and power technologies, and the growing emphasis on corporate sustainability. Trends such as the integration of renewable energy sources, implementation of advanced cooling systems, and the adoption of energy-efficient hardware are becoming increasingly prevalent. These developments not only reduce operational costs but also align with global sustainability goals, making green data centers an attractive investment for businesses aiming to enhance their environmental credentials.

Geographically, major data center hubs in Australia—such as Sydney, Melbourne, and Brisbane—are leading the shift towards green infrastructure, supported by access to renewable energy sources and favorable climatic conditions. Key players in the Australian green data center market include AirTrunk, NEXTDC, Canberra Data Centres (CDC), Equinix, Global Switch, DCI Data Centers, Keppel Data Centres, Digital Realty, and STACK Infrastructure. These companies are investing heavily in sustainable technologies and expanding their operations to meet the growing demand for eco-friendly data storage and processing solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Australia Green Data Center Market is projected to grow from USD 594.23 million in 2024 to USD 2,496.78 million by 2032, with a CAGR of 19.65% from 2025 to 2032.

- The global Green Data Center Market is expected to grow from USD 59,645.02 million in 2024 to USD 239,470.06 million by 2032, at a CAGR of 18.98% from 2025 to 2032.

- Key drivers include rising energy costs, government incentives for sustainable infrastructure, and the increasing adoption of energy-efficient and renewable-powered data center solutions.

- Australia’s commitment to net-zero emissions by 2050 and state-level policies promoting clean energy are major factors propelling the market growth.

- Advanced cooling systems, AI-powered energy optimization, and renewable energy integration are transforming the operational efficiency of data centers.

- High capital investment for green infrastructure and limited access to renewable energy in remote areas present challenges for operators, particularly small enterprises.

- New South Wales and Victoria lead the market, supported by robust infrastructure and renewable energy access, while Queensland and Western Australia show growing potential.

- Major players like AirTrunk, NEXTDC, and Equinix are heavily investing in sustainable technologies to meet the growing demand for environmentally responsible data storage solutions.

Report Scope

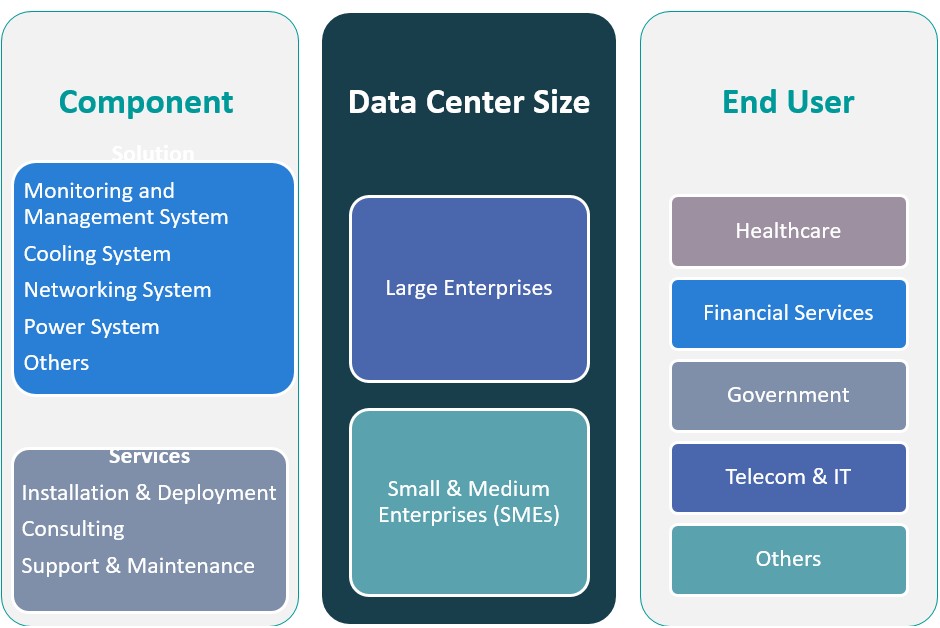

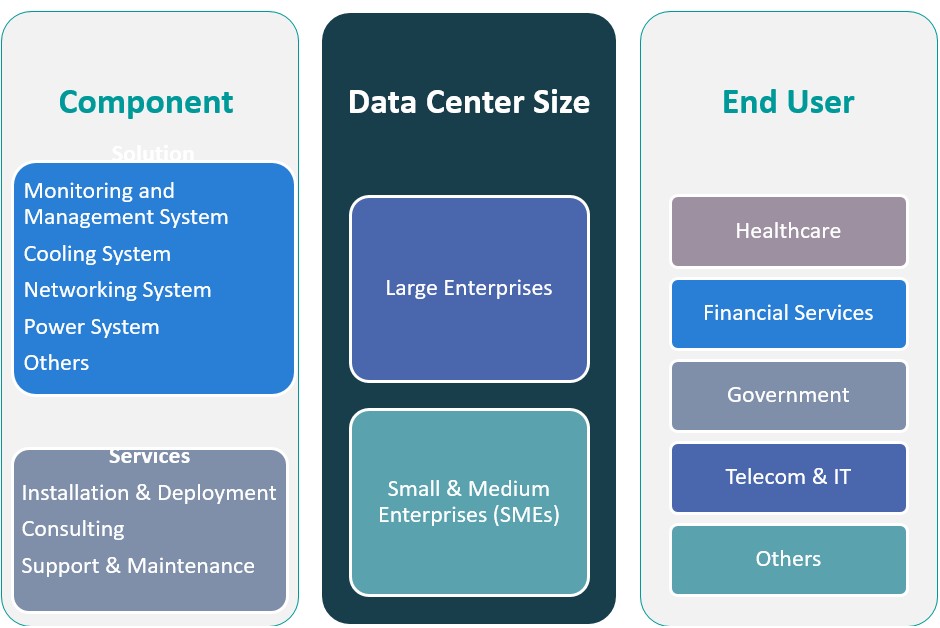

This report segments the Australia Green Data Center Market as follows:

Market Drivers

Integration of Renewable Energy and Green Building Certifications

The shift toward renewable energy integration is another major catalyst for the green data center market in Australia. As organizations strive to meet sustainability targets, renewable power sources—such as solar, wind, and hydro—are being incorporated into data center operations. Australia’s abundant solar and wind resources make it an ideal environment for such initiatives. Leading operators like NEXTDC and AirTrunk have signed long-term Power Purchase Agreements (PPAs) with renewable energy providers to offset their carbon emissions and enhance green credentials. Moreover, data centers are increasingly seeking certifications like NABERS (National Australian Built Environment Rating System), Green Star, and ISO 50001 to demonstrate their energy and sustainability performance. These certifications not only validate environmental efforts but also offer competitive advantages by attracting eco-conscious clients and investors. Building infrastructure to meet these standards involves using sustainable construction materials, intelligent lighting systems, rainwater harvesting, and energy-efficient HVAC units. The result is a market where green building certification has evolved from a desirable attribute to a business imperative, directly impacting facility design and energy procurement strategies.

Rising Corporate Sustainability Commitments and ESG Investment Trends

The growing emphasis on corporate social responsibility and sustainable investment practices has influenced businesses to prioritize environmental stewardship in their operations. Enterprises across Australia, especially in sectors like finance, technology, and telecommunications, are embedding sustainability into their strategic frameworks. This shift is significantly affecting data center selection, with clients favoring service providers that operate energy-efficient, carbon-neutral facilities. As green credentials become central to brand reputation and investor relations, demand for green colocation and hyperscale data centers is accelerating. Furthermore, the rise of ESG-focused investment is reinforcing this market shift. Investors are now scrutinizing environmental performance metrics before allocating capital, and data centers with strong sustainability benchmarks are more likely to attract long-term funding. Companies listed on the Australian Securities Exchange (ASX) are also subject to growing disclosure expectations regarding their environmental footprint, further driving demand for green infrastructure. As sustainability becomes a core metric in valuation models, green data centers are emerging as critical assets in corporate sustainability portfolios, ensuring both regulatory alignment and investor confidence.

Government Regulations and Sustainability Policies

The Australian government’s commitment to environmental sustainability has become a critical driver of the green data center market. As part of its broader climate strategy, Australia aims to achieve net-zero emissions by 2050, prompting stricter energy consumption regulations and carbon emission reduction mandates across industries. The data center sector, known for its high energy demands, is under increasing pressure to align with these national and regional policies. Government initiatives, such as the Emissions Reduction Fund (ERF), provide financial incentives for facilities implementing renewable energy solutions or adopting energy-efficient practices. For instance, GreenSquareDC has developed a hyperscale green data center in Western Australia, powered entirely by clean energy and equipped with advanced cooling systems to minimize environmental impact. Additionally, state-level programs in New South Wales, Victoria, and Queensland actively support the deployment of sustainable technologies through rebates, low-emission building codes, and mandatory reporting on energy efficiency measures. These regulatory developments have not only raised awareness among data center operators but also mandated environmental accountability, pushing organizations to rethink traditional energy models. Consequently, data centers are now integrating low-PUE (Power Usage Effectiveness) systems, smart cooling technologies, and modular designs to comply with the latest standards.

Escalating Demand for Energy-Efficient Infrastructure

Australia’s rapidly expanding digital economy has led to surging data storage and processing demands, driving the construction of new data centers nationwide. With this expansion comes a proportional increase in energy consumption, making operational efficiency a strategic priority for facility operators. Green data centers are designed to minimize energy use through advanced power and cooling systems, enabling enterprises to reduce operational expenditure while ensuring environmental compliance. For instance, GreenSquareDC’s WAi1 facility incorporates liquid cooling systems and renewable energy sources to reduce power draw and carbon emissions. Energy optimization strategies, including server virtualization, workload consolidation, AI-powered cooling systems, and renewable energy sourcing, are being widely adopted. Operators are transitioning away from legacy infrastructure in favor of scalable, high-density computing environments that minimize carbon footprints. Technologies such as Direct Liquid Cooling (DLC), economizer systems, and AI-driven energy analytics tools are helping data centers make real-time adjustments to maintain performance without excessive power draw. This enhanced focus on sustainable energy management not only supports operational resilience but also aligns with the increasing emphasis on ESG (Environmental, Social, Governance) goals among investors and stakeholders.

Market Trends

Integration of Renewable Energy Sources

Australia’s green data center market is increasingly embracing renewable energy to power operations sustainably. With the nation’s abundant solar and wind resources, data center operators are investing in on-site renewable energy generation and entering into power purchase agreements (PPAs) with renewable energy providers. For instance, NEXTDC has committed to sourcing 100% renewable energy for its facilities, achieving a reduction of approximately 80,000 metric tons of CO2 emissions annually. Similarly, AirTrunk has installed solar panels capable of generating 1.5 megawatts of clean energy at its Melbourne facility, significantly lowering its reliance on grid electricity. Such initiatives align with Australia’s commitment to achieving net-zero emissions by 2050 and cater to the growing demand from clients for environmentally responsible data storage solutions. The integration of renewables is becoming a standard practice, enhancing the appeal of green data centers to both investors and customers.

Adoption of Advanced Cooling Technologies

To enhance energy efficiency, Australian data centers are adopting advanced cooling technologies. Traditional cooling methods are being replaced with innovative solutions like liquid immersion cooling and free-air cooling systems. For instance, Equinix has implemented liquid immersion cooling in its Sydney facility, reducing cooling energy consumption by 30% compared to traditional air-based systems. Additionally, a data center in Brisbane has adopted free-air cooling technology, achieving a Power Usage Effectiveness (PUE) ratio of 1.3, which is significantly more efficient than the industry average. These technologies significantly reduce energy consumption by efficiently managing the heat generated by high-density computing equipment. The adoption of such technologies not only lowers operational costs but also contributes to achieving lower PUE ratios, a critical metric for energy efficiency in data centers. As sustainability becomes a key differentiator, the implementation of cutting-edge cooling solutions is a trend set to continue in the Australian market.

Expansion of Hyperscale and Edge Data Centers

The Australian data center landscape is witnessing significant growth in hyperscale and edge data centers. Hyperscale facilities, operated by major cloud service providers like AWS, Microsoft, and Google Cloud, are expanding to meet the escalating demand for cloud services and big data analytics. Simultaneously, the rise of edge computing is driving the development of smaller, decentralized data centers closer to end-users, enhancing data processing speeds and reducing latency. This dual expansion addresses the needs of a digital economy increasingly reliant on real-time data processing and low-latency applications. The growth of both hyperscale and edge data centers underscores Australia’s strategic position as a digital hub in the Asia-Pacific region.

Emphasis on Sustainability Certifications and Standards

Sustainability certifications are becoming pivotal in the Australian green data center market. Operators are striving to achieve certifications like the National Australian Built Environment Rating System (NABERS) and ISO 50001 to demonstrate their commitment to energy efficiency and environmental responsibility. These certifications not only validate the sustainability efforts of data centers but also enhance their competitiveness in attracting clients who prioritize environmental stewardship. For instance, the NABERS data center starters program provides financial incentives to encourage energy-efficient practices. Achieving such certifications involves implementing measures like efficient energy management systems, use of sustainable materials, and adoption of best practices in operations. As clients and stakeholders increasingly value sustainability, adherence to recognized standards is becoming a critical factor in the market.

Market Challenges

High Capital Investment and Operational Costs

The transition to green data centers in Australia presents a significant financial challenge due to the high capital expenditure associated with sustainable infrastructure development. For instance, building an energy-efficient facility requires substantial investment in advanced cooling systems, renewable energy integration, smart power management technologies, and green-certified construction materials. These components often incur higher upfront costs compared to conventional data center models. Additionally, ongoing operational costs—such as maintaining high-efficiency cooling systems or managing renewable energy sources—can be substantial and may deter small to mid-sized operators from adopting green practices at scale. For instance, while long-term savings from energy efficiency and potential government incentives offer financial benefits, the initial cost burden poses a barrier to market entry for new players and slows down the modernization of older facilities. Smaller companies may struggle to justify the return on investment without substantial financial backing or a clear path to energy savings. Furthermore, frequent changes in energy policy and the variability of renewable power generation may introduce cost unpredictability. This can impact long-term planning and investment decisions for operators seeking green transformation.

Limited Access to Renewable Energy Infrastructure in Remote Areas

Although Australia has abundant solar and wind resources, the distribution of renewable energy infrastructure remains uneven, particularly in remote or less-developed regions. Many data centers located outside major metropolitan hubs like Sydney or Melbourne face challenges in sourcing consistent, high-quality renewable power. Grid limitations, inadequate connectivity, and transmission inefficiencies can restrict the availability of renewable energy, forcing operators to rely on traditional energy sources, which contradicts green objectives. This challenge becomes more pronounced for edge data centers or colocation facilities established to serve regional clients. Without access to robust green energy infrastructure, these centers may struggle to achieve sustainability certifications or meet corporate ESG goals. Overcoming this challenge will require coordinated investments in energy infrastructure and stronger government-private sector collaboration to ensure widespread accessibility to clean energy sources.

Market Opportunities

Expansion of Renewable Energy Integration

One of the most significant opportunities in the Australia Green Data Center Market lies in the integration of renewable energy sources. As Australia continues to prioritize sustainability and reduce carbon emissions, there is a growing emphasis on using clean energy to power data centers. With abundant solar and wind resources, regions such as New South Wales and Queensland present an ideal environment for renewable energy-powered data centers. Companies can capitalize on this opportunity by establishing facilities that are fully powered by renewables, reducing operational costs and enhancing their environmental credentials. Additionally, long-term power purchase agreements (PPAs) with renewable energy providers can ensure a stable and cost-effective energy supply, making green data centers increasingly attractive for investors and clients seeking eco-friendly solutions.

Rising Demand for Edge Data Centers and Localized Solutions

Another opportunity lies in the increasing demand for edge computing, which requires smaller, localized data centers to provide faster processing and reduce latency. With the growing adoption of IoT devices, AI applications, and real-time data analytics, edge data centers are becoming crucial for sectors like healthcare, telecom, and finance. These smaller, decentralized data centers present a unique opportunity for green technologies to be implemented at a regional level. By leveraging energy-efficient systems, advanced cooling technologies, and renewable energy sources, operators can meet the rising demand for localized, sustainable data processing solutions while reducing energy consumption and carbon footprints. This trend is expected to accelerate, offering a significant growth avenue for businesses in the green data center sector.

Market Segmentation Analysis

By Component:

The green data center market in Australia is driven by several key components, each contributing to energy efficiency and sustainability. The monitoring and management system is vital for tracking the performance and efficiency of data center operations. These systems allow operators to identify inefficiencies and optimize power usage. The cooling system segment is also critical, with innovations such as liquid cooling and free-air cooling driving substantial energy savings. As cooling often constitutes a significant portion of energy consumption in traditional data centers, adopting more efficient systems is a central aspect of the green transition. The networking system and power systems segments are similarly essential, focusing on providing low-energy alternatives while ensuring robust data transmission and uninterrupted power supply. The power system includes solutions that optimize the distribution of energy from renewable sources, such as solar or wind power, into the data center operations. The others segment includes additional infrastructure components such as backup systems and energy-efficient hardware.

By Data Center Type:

The Australia green data center market is also segmented by data center type, primarily distinguishing between large enterprises and small & medium enterprises (SMEs). Large enterprises are typically the leading adopters of green data center solutions, driven by the need for large-scale operations, significant data storage capabilities, and sustainability commitments. These companies often invest heavily in green infrastructure, including renewable energy adoption and energy-efficient technologies. On the other hand, SMEs represent a growing segment, with increasing interest in energy-efficient solutions as costs decrease and awareness of environmental impacts rises. SMEs are likely to adopt colocation services or edge data centers to reduce initial investment and leverage existing green data center infrastructures.

Segments

Based on Component

- Solution

- Monitoring and Management System

- Cooling System

- Networking System

- Power System

- Others

- Services

- Installation & Deployment

- Consulting

- Support & Maintenance

Based on Data Center Type

- Large Enterprises

- Small & Medium Enterprises (SMEs)

Based on End User

- Healthcare

- Financial Services

- Government

- Telecom & IT

- Others

Based on Region

- New South Wales

- Victoria

- Queensland

- Western Australia

Regional Analysis

New South Wales (38%)

New South Wales holds the largest market share in the Australia Green Data Center Market, accounting for approximately 38% of the total market. Sydney, the state capital, serves as the primary hub for data center operations, driven by its status as Australia’s largest digital and financial services center. The region benefits from robust infrastructure, government incentives for renewable energy, and access to a diverse pool of clients in sectors like finance, telecom, and healthcare. Additionally, the region is increasingly investing in renewable energy sources like solar and wind, further boosting the adoption of green data centers.

Victoria (30%)

Victoria is the second-largest player in the green data center market, contributing approximately 30% of the total market share. Melbourne, the capital, is a prominent hub for data center operations, fueled by its proximity to renewable energy infrastructure and the growing demand for cloud services. The state has been proactive in implementing policies that support sustainability, such as energy efficiency standards and incentives for green building certifications. This has led to the adoption of eco-friendly technologies, including renewable-powered data centers and efficient cooling systems.

Key players

- AirTrunk

- NEXTDC

- Canberra Data Centres

- Equinix

- Macquarie Data Centres

Competitive Analysis

The Australia Green Data Center Market is highly competitive, with key players like AirTrunk, NEXTDC, Canberra Data Centres, Equinix, and Macquarie Data Centres driving innovation and growth. AirTrunk stands out for its focus on scalable, hyperscale data centers that emphasize sustainability, integrating renewable energy sources and energy-efficient technologies. NEXTDC is another prominent player, renowned for its commitment to reducing environmental impact through its green data centers, and its extensive footprint across major Australian cities enhances its market reach. Canberra Data Centres focuses on providing secure, energy-efficient data storage solutions to government and enterprise clients, offering specialized services tailored to critical applications. Equinix leverages its global presence and sustainable infrastructure, making significant investments in green data centers across Australia. Lastly, Macquarie Data Centres focuses on creating energy-efficient solutions, ensuring high operational performance while maintaining sustainability across its portfolio. The competition among these players revolves around continuous innovation in energy efficiency, renewable energy integration, and expansion into key regional markets.

Recent Developments

- In December 2023, Vertiv acquired CoolTera Ltd., a provider of liquid cooling infrastructure solutions. This acquisition strengthens Vertiv’s capabilities in high-density compute cooling, aligning with the industry’s shift towards energy-efficient data center technologies.

- In July 2024, Huawei unveiled three green data center facility solutions at the Global Smart Data Center Summit. These include the AeroTurbo fans, IceCube polymer heat exchangers, and iCooling AI energy efficiency cooling solutions, designed to optimize cooling efficiency and reduce energy consumption.

- In May 2024, Microsoft launched its first hyperscale cloud data center region in Mexico, located in Querétaro. This facility aims to provide scalable, highly available, and resilient cloud services, supporting digital transformation and sustainable innovation in the region.

- In June 2024, HPE partnered with Danfoss to introduce the HPE IT Sustainability Services – Data Center Heat Recovery. This turnkey heat recovery module helps organizations manage and repurpose excess heat, contributing to more sustainable IT infrastructures.

- In November 2024, Google announced a partnership with SB Energy Global to supply 942 MW of renewable energy to power its data center operations in Texas. This initiative supports Google’s commitment to operate on carbon-free energy and aligns with its sustainability goals.

- In January 2025, AWS announced plans to invest approximately $11 billion in Georgia to expand its infrastructure, supporting cloud computing and AI technologies. This investment is expected to create at least 550 new high-skilled jobs and enhance the state’s digital innovation capabilities.

- In May 2024, IBM announced a partnership with Schneider Electric to develop and deploy energy-efficient data center solutions, focusing on reducing carbon emissions and improving operational efficiency.

Market Concentration and Characteristics

The Australia Green Data Center Market is moderately concentrated, with a few key players dominating the landscape, such as AirTrunk, NEXTDC, Canberra Data Centres, Equinix, and Macquarie Data Centres. These companies are actively shaping the market by investing in energy-efficient technologies, renewable energy integration, and sustainable building practices. The market is characterized by high capital investment in advanced infrastructure, including renewable-powered data centers, efficient cooling systems, and cutting-edge power management solutions. Additionally, as Australia continues to prioritize sustainability through governmental incentives and stringent environmental regulations, green certifications such as NABERS and Green Star have become essential for operators. The market is also marked by increased competition for securing large-scale contracts, particularly in sectors like healthcare, finance, and telecom, where there is a rising demand for both secure and environmentally responsible data storage solutions. The growing focus on environmental, social, and governance (ESG) criteria further fuels market developments, with major players striving to maintain leadership through innovation and adherence to global sustainability standards.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Component, Data Center Type, End User and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The shift toward renewable energy sources will continue to grow, driven by both government policies and corporate sustainability goals, ensuring greener data center operations.

- Hyperscale data centers will dominate the market, offering massive storage capacities while implementing green technologies to reduce operational costs and carbon footprints.

- The development and implementation of advanced cooling solutions, such as liquid and free-air cooling, will be pivotal in reducing energy consumption in data centers across Australia.

- With the rise of edge computing, regional and smaller-scale green data centers will emerge, catering to local demand for real-time data processing while maintaining sustainability.

- Australian government incentives will play a significant role in encouraging green data center development, providing tax benefits and funding for sustainable infrastructure.

- AI and machine learning technologies will be increasingly adopted for energy optimization and predictive maintenance, improving efficiency and reducing energy waste in data centers.

- Companies operating green data centers will intensify efforts to meet environmental, social, and governance (ESG) reporting requirements, ensuring transparency and attracting investment.

- The demand for hybrid cloud services will drive the adoption of green data centers, as businesses seek energy-efficient solutions for balancing on-premise and cloud infrastructure.

- Key data center hubs in major Australian cities like Sydney, Melbourne, and Brisbane will expand, supported by increased demand for digital infrastructure and renewable energy sources.

- Global collaboration among data center operators will push forward sustainability initiatives, with Australian players adopting international best practices and sharing technological innovations for greener operations.