Market Overview:

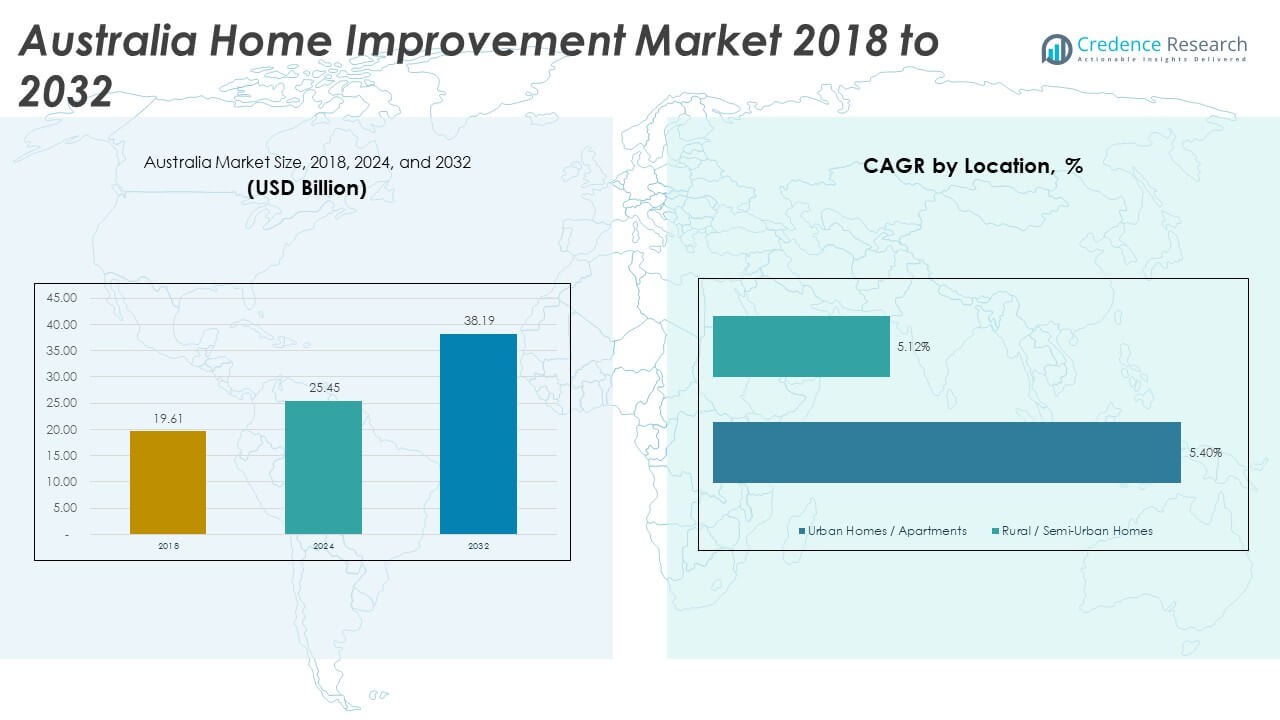

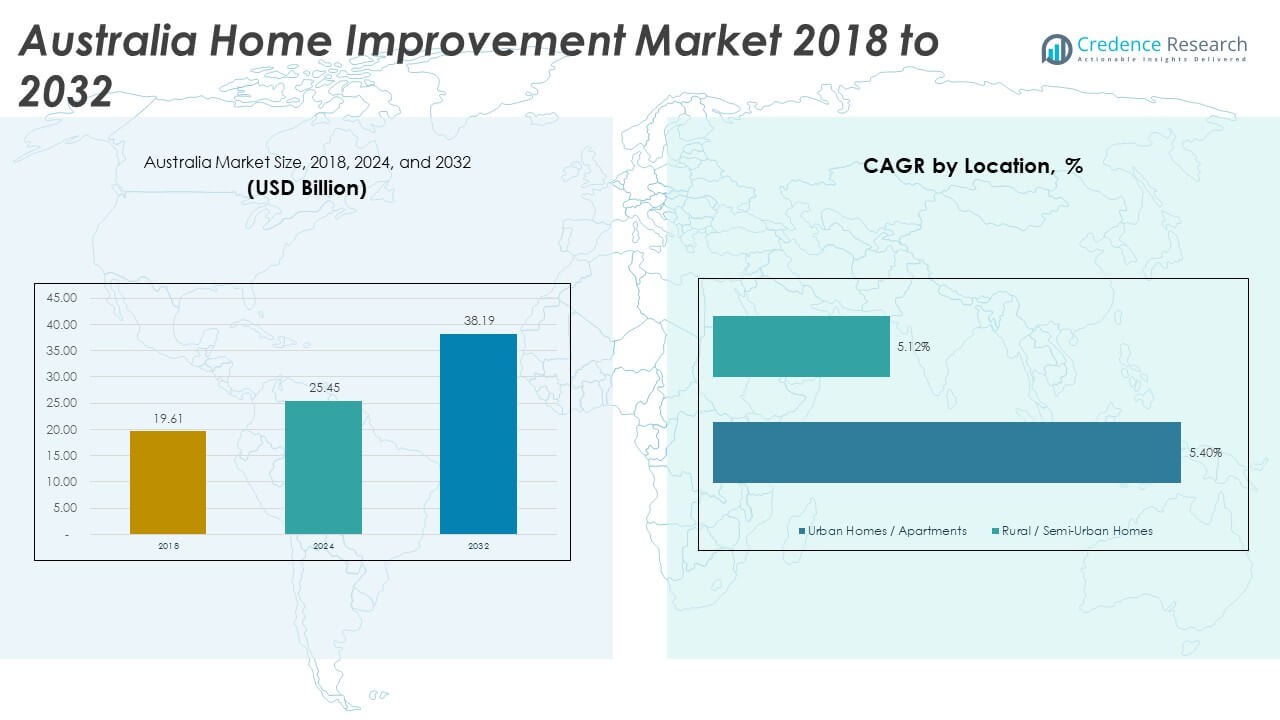

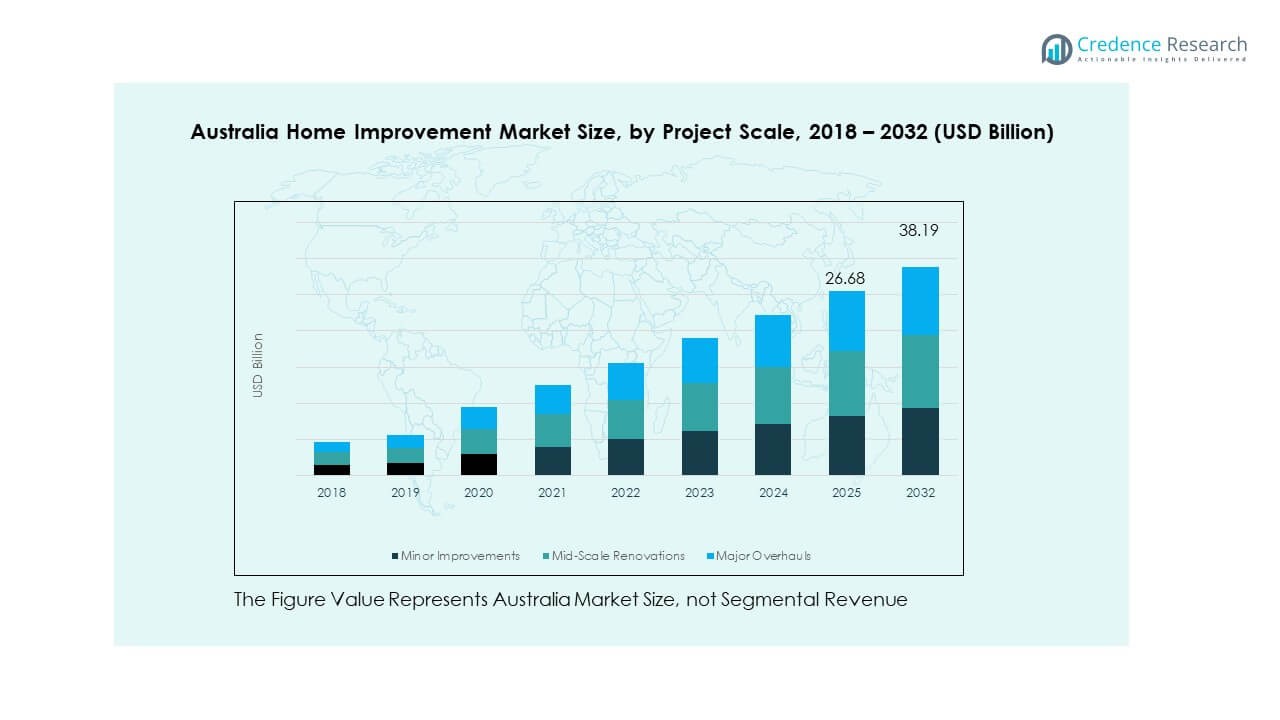

The Australia Home Improvement Market size was valued at USD 19.61 billion in 2018, increased to USD 25.45 billion in 2024 and is anticipated to reach USD 38.19 billion by 2032, at a CAGR of 5.23% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Australia Home Improvement Market Size 2024 |

USD 25.45 Billion |

| Australia Home Improvement Market, CAGR |

5.23% |

| Australia Home Improvement Market Size 2032 |

USD 38.19 Billion |

The market is driven by increasing homeowner confidence, as rising property values and higher disposable incomes empower Australians to invest in refurbishing their homes. Many consumers embrace DIY projects and outdoor living upgrades, while government incentives and sustainable‑home focus fuel renovations of smart homes and energy‑efficient features. The ageing housing stock also demands refreshing, so homeowners prefer renovating over relocating, which keeps demand strong.

Geographically, the major metropolitan centres of New South Wales and Victoria lead the home improvement market thanks to large homeowner populations and high renovation budgets. Emerging growth is seen in Queensland and Western Australia where regional migration and coastal‑living trends are boosting demand for outdoor upgrades and lifestyle renovations. Smaller states and territories, while less dominant, are increasingly attractive as homeowners seek value and trade up through re‑investment in existing properties.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Australia Home Improvement Market was valued at USD 19.61 billion in 2018, USD 25.45 billion in 2024, and is expected to reach USD 38.19 billion by 2032, growing at a CAGR of 23% during the forecast period.

- The top three regions dominating the market include New South Wales, Victoria, and Queensland, collectively contributing around 45%-50% of the total market share. These regions dominate due to their large urban populations, higher income levels, and significant renovation activities.

- Western Australia is the fastest-growing region, accounting for around 15% of the market share. The region’s growth is driven by a surge in property upgrades and regional migration toward coastal and suburban areas, further boosting demand.

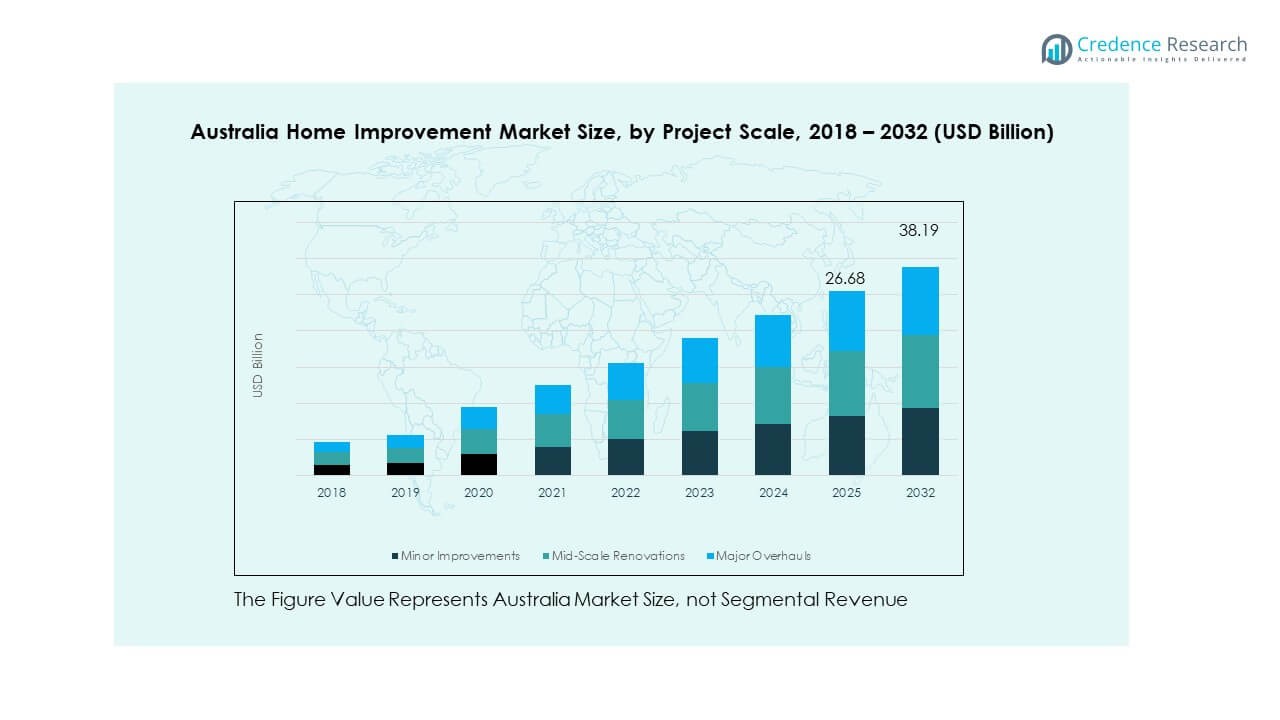

- Minor improvements hold a significant share in the market, contributing around 30% of the total market revenue, with a growing demand for small-scale DIY projects. Mid-scale renovations are also prominent, accounting for 35%, as more homeowners engage in comprehensive home upgrades.

- The Major overhauls segment contributes around 25%, driven by significant investments in larger, costlier home renovation projects aimed at enhancing living space or modernizing properties.

Market Drivers:

Increasing Homeownership and Renovation Confidence

The Australia Home Improvement Market is supported by increasing homeownership and consumer confidence in renovations. Rising property values encourage homeowners to invest in upgrading their living spaces. Australians are more willing to spend on home improvements due to a stable economy and growing disposable incomes. With the boom in property values, more people are opting to improve their current homes rather than moving, which drives demand for renovations. The trend is particularly evident in major cities like Sydney and Melbourne.

- For instance, the general trend suggests more people are opting to improve their current homes rather than moving, which drives demand for renovations. This trend is particularly evident in major cities like Sydney and Melbourne, where older homes are often considered “ripe for renovation” and have seen significant price growth in specific areas.

DIY and Outdoor Living Trends

The increasing popularity of DIY projects is a major driver for the Australia Home Improvement Market. Homeowners are more engaged in hands-on home projects as they seek to add a personal touch to their living spaces. This trend is further fueled by online platforms offering tutorials and guidance on home improvement. Moreover, Australians are focusing on enhancing their outdoor living spaces, which has led to a surge in demand for landscaping products, decks, and outdoor kitchens.

- For instance, Bunnings Group generated AUD 9.963 billion in sales in the first half of its 2023/24 financial year and achieved a year‑on‑year growth of 1.7 %.

Sustainability and Energy Efficiency

The shift toward sustainability in home improvements also plays a significant role in market growth. Consumers are increasingly adopting energy-efficient solutions such as solar panels, insulation, and eco-friendly building materials. This trend is not only driven by environmental concerns but also by government incentives promoting green home improvements. In line with this, smart home technologies that improve energy efficiency are gaining traction. These sustainable options help homeowners reduce utility bills, further motivating investments in renovations.

Government Policies and Incentives

Government initiatives encouraging renovations and home improvements have positively impacted the market. Various programs, rebates, and tax incentives are available for those improving their homes’ energy efficiency or investing in sustainable materials. These policies foster a positive renovation environment, making it financially easier for homeowners to undertake improvement projects. The government is also promoting the use of smart technologies in residential properties, further boosting demand in this sector.

Market Trends:

Growing Interest in Smart Home Technologies

One of the key trends in the Australia Home Improvement Market is the growing interest in smart home technologies. Homeowners are increasingly looking to integrate devices like smart thermostats, security systems, and lighting into their homes. These innovations not only offer convenience but also contribute to energy savings. The demand for home automation products continues to rise as consumers seek more control over their home environment through their smartphones. The market for these products is expected to continue expanding, particularly in urban areas.

- For instance, a 2021 survey found 69 % of Australian households owned at least one smart home device, with an average of five devices per household. These innovations offer convenience and energy savings. The demand for home‑automation products continues to rise as consumers seek more control over their home environment through smartphones, especially in urban areas.

Popularity of Modular and Prefabricated Homes

Modular and prefabricated homes are becoming more popular in the Australia Home Improvement Market. These homes, which are often more affordable and quicker to assemble, provide a practical solution for those seeking to reduce construction costs. These homes are also environmentally friendly, using sustainable materials and energy-efficient designs. This trend is contributing to the growth of the home improvement market by offering an alternative to traditional construction, especially for first-time homebuyers.

- For instance, the Commonwealth Bank of Australia joined industry body prefabAUS and introduced financing policy changes to support off‑site modular construction, removing a key barrier to wider adoption.

Increased Focus on Outdoor Living Spaces

Outdoor living spaces are increasingly being seen as an extension of the home, contributing significantly to the Australia Home Improvement Market. Homeowners are investing in outdoor kitchens, patio areas, and landscaping projects to create functional and aesthetic outdoor environments. This shift is driven by a growing desire for more functional outdoor spaces that can be used year-round. The rise in outdoor living is especially popular in warmer regions, where the climate allows for prolonged use of such spaces.

Rising Demand for Renovation Services

As the Australian population grows and the number of older homes increases, the demand for home renovation services is on the rise. Homeowners are seeking professional services for kitchen and bathroom upgrades, roofing, and structural repairs. The growing popularity of home renovation TV shows and social media platforms also encourages homeowners to embark on improvement projects. This trend is helping local contractors and service providers gain more visibility, further stimulating the market.

Market Challenges Analysis:

High Cost of Labor and Materials

One of the key challenges facing the Australia Home Improvement Market is the high cost of labor and building materials. The increasing price of raw materials such as timber, steel, and concrete makes it difficult for homeowners to complete large-scale renovation projects affordably. Skilled labor shortages further exacerbate this issue, leading to longer wait times and higher costs for home improvement services. This issue particularly impacts low-budget homeowners and has the potential to slow down market growth.

Market Saturation in Major Cities

The Australia Home Improvement Market is facing saturation in key metropolitan areas, particularly Sydney and Melbourne. As property values rise, many homeowners are already investing in home upgrades, leaving limited room for further growth in these areas. The challenge for businesses lies in differentiating their services and products to stand out in these highly competitive markets. At the same time, the saturation of the market makes it difficult for new players to enter without a unique offering.

Market Opportunities:

Increase in Demand for Sustainable and Green Home Improvements

The increasing focus on sustainability presents significant opportunities in the Australia Home Improvement Market. Homeowners are looking for ways to improve the energy efficiency of their homes, such as installing solar panels, upgrading insulation, and using sustainable building materials. The government’s ongoing support for green initiatives and energy-efficient home upgrades presents a ripe opportunity for companies to capitalize on this trend. This focus on sustainability is expected to drive demand for eco-friendly products and services.

Growth in the Regional Home Improvement Markets

While major cities like Sydney and Melbourne dominate, regional areas of Australia are emerging as key opportunities for home improvement growth. The increasing migration to suburban and regional areas is driving demand for home renovations as people invest in their properties to accommodate lifestyle changes. These areas often offer lower property costs, making home renovations more financially viable for residents. This shift in demographics presents an opportunity for businesses to cater to the growing regional market for home improvement.

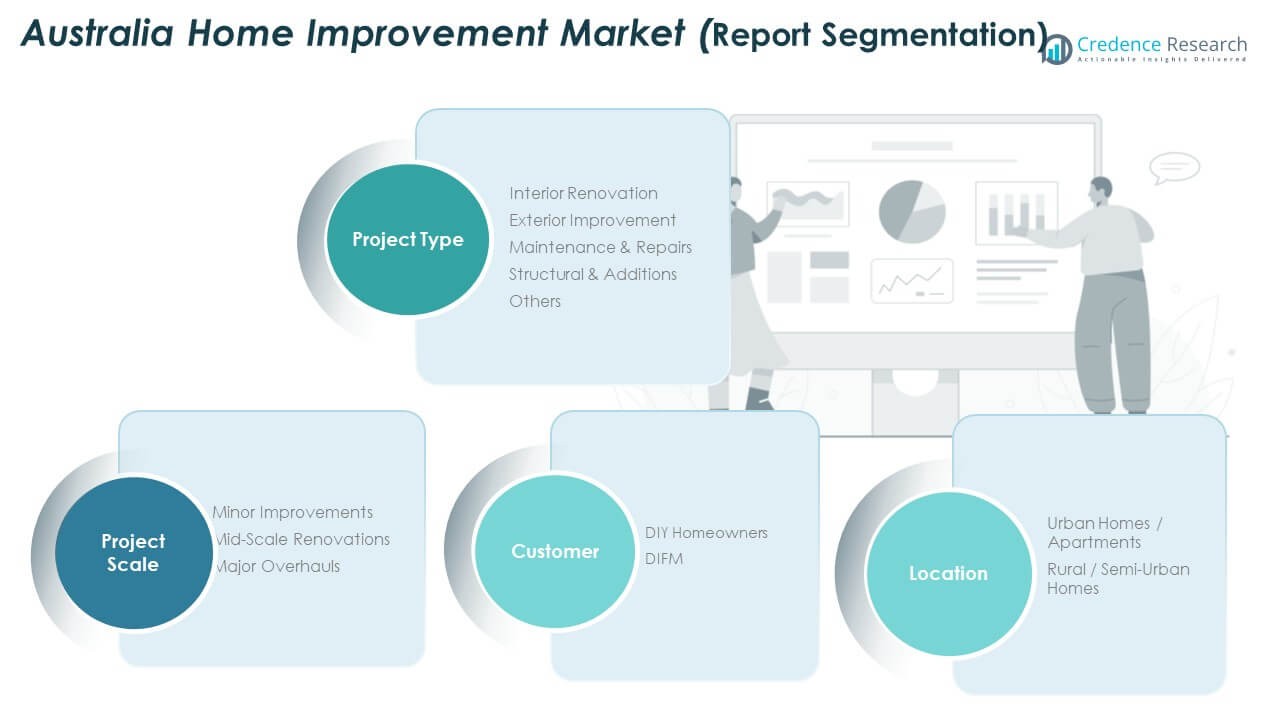

Market Segmentation Analysis:

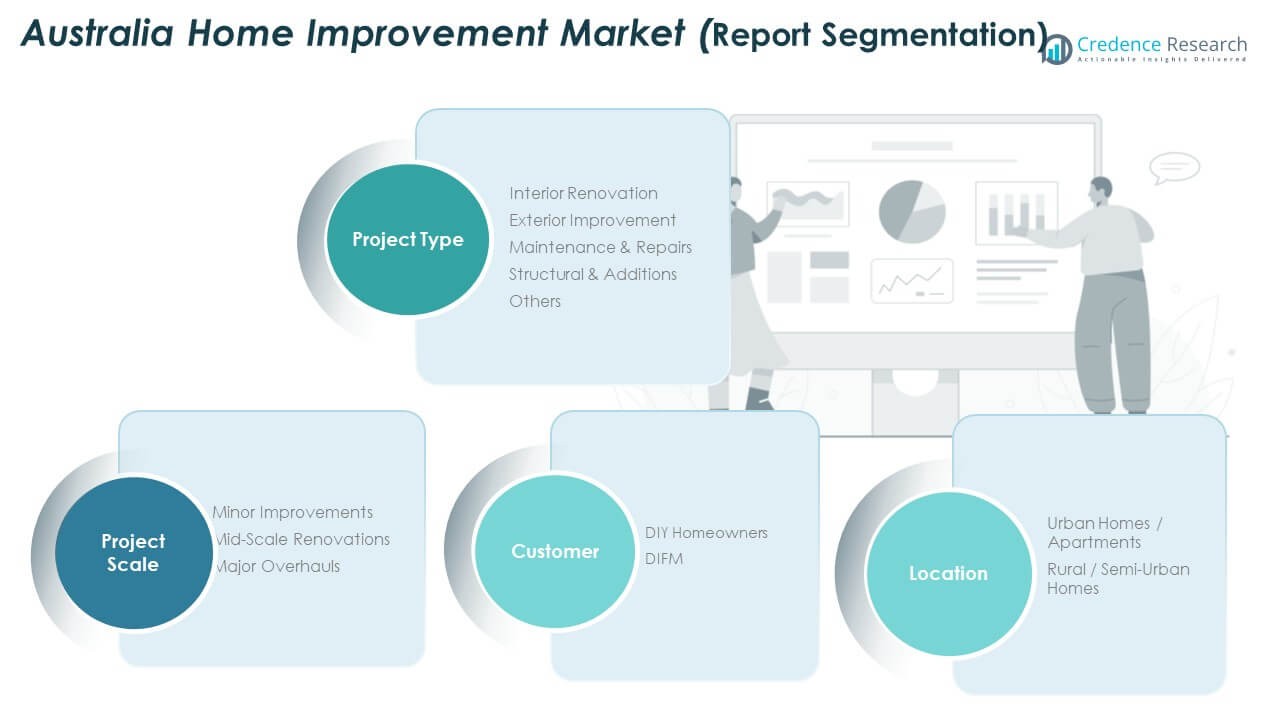

Project Type Analysis

The Australia Home Improvement Market is segmented into various project types, including interior renovation, exterior improvement, maintenance & repairs, structural additions, and other specialized projects. Interior renovations dominate, driven by homeowners seeking to modernize kitchens, bathrooms, and living spaces. Exterior improvements such as landscaping and facade upgrades are increasingly popular, particularly in enhancing curb appeal. Maintenance & repairs form a significant part of the market due to aging housing stock. Structural and addition projects, though costlier, continue to gain demand for expanding living spaces.

- For instance, the senior home‑services platform Hipages Group reported a 25 % increase in renovation job requests for kitchens and bathrooms in 2024.Exterior improvements such as landscaping and façade upgrades are increasingly popular for enhancing curb appeal. Maintenance & repairs form a large part of the market due to aging housing stock. Structural and addition projects, though costlier, continue to gain demand for expanding living spaces.

Project Scale Analysis

Project scale segmentation in the Australia Home Improvement Market spans minor improvements, mid-scale renovations, and major overhauls. Minor improvements, including cosmetic updates and small repairs, constitute a significant portion of market activity due to their affordability and quick returns. Mid-scale renovations are growing in popularity as homeowners seek more comprehensive upgrades without full overhauls. Major overhauls are less frequent but highly profitable, particularly in markets driven by property value appreciation and large-scale home transformations.

Customer Type Analysis

The market is also divided into DIY homeowners and DIFM (Do-It-For-Me) categories. DIY homeowners engage in self-managed projects, particularly in minor improvements and cost-effective upgrades. DIFM, which involves professional contractors handling larger, more complex projects, is a prominent segment as homeowners increasingly prefer expert assistance for major renovations or time-consuming tasks. Both segments are growing as consumer preferences evolve toward convenience and customization.

Segmentation:

Project Type

- Interior Renovation

- Exterior Improvement

- Maintenance & Repairs

- Structural & Additions

- Others

Project Scale

- Minor Improvements

- Mid-Scale Renovations

- Major Overhauls

Customer Type

- DIY Homeowners

- DIFM (Do-It-For-Me)

Location

- Urban Homes / Apartments

- Rural / Semi-Urban Homes

Regional Analysis:

National Capitals & Major State Capitals

The Australia Home Improvement Market shows strong presence in the capitals of New South Wales (NSW), Victoria (VIC), Queensland (QLD), and Western Australia (WA). Combined, these regions account for approximately 45%–50% of national market share. NSW and VIC lead thanks to denser populations, higher disposable incomes, and significant renovation activity. QLD and WA exhibit robust growth driven by both regional migration and property upgrades. Homeowners in urban centres drive demand for both interior upgrades and exterior improvements. Service providers concentrate investments in these states, given the scale and earning potential.

Regional & Suburban Growth Corridors

Regions beyond the capitals are emerging in the home‑improvement landscape, commanding about 25%–30% of market share. Semi‑urban areas in QLD’s Gold Coast and Sunshine Coast, VIC’s Geelong region, and parts of WA are seeing rapid uptake in renovation projects. Homeowners seek larger properties and lifestyle amenities, which fuels spending on landscaping, additions, and maintenance. The supply of contractors and materials is expanding to meet this shift. Regional growth presents fewer structural constraints and more scope for major overhauls and structural additions. The market in these zones offers attractive margins for specialised renovation services.

Rural & Remote Zones Including Smaller States and Territories

Rural and remote zones, plus smaller states and territories like Tasmania and Northern Territory, hold around 20%–25% of the market share. These areas exhibit steady demand driven by aging homes and the need for repairs and maintenance. Service penetration remains lower than in metropolitan zones, but renovation spending per project tends to be higher due to logistical and material cost factors. Businesses that offer bundled services or travel‑capable installation crews gain a competitive edge here. Growth in these areas relies on better access to skilled labour and mobile supply chains for remote locations.

Key Player Analysis:

- Studio JLA

- Smith & Sons

- Refresh Renovations

- Nexus Homes Group

- Renovare

- Anglian Home Improvements

- The Home Depot

- Kingfisher plc

- ADEO Group

Competitive Analysis:

The Australia Home Improvement Market remains competitive, with a range of local and international players vying for market share. Key players include both large-scale home improvement chains and regional service providers. These companies often focus on innovative product offerings and superior customer service to maintain their position. Technological advancements, such as smart home integration and eco-friendly solutions, are becoming key differentiators. Market participants are also expanding their service portfolios by partnering with contractors or entering strategic alliances to better cater to the growing demand for home renovations. The competitive landscape is further shaped by the demand for cost-effective solutions, which drives companies to offer a mix of premium and budget-friendly products.

Recent Developments:

- In September 2025, The Home Depot completed the acquisition of GMS Inc., a specialty building products distributor, for $5.5 billion through its SRS Distribution subsidiary. This acquisition was initially announced in June 2025 and closed on September 4, 2025.

- Kingfisher plc reported strong performance in its first half results for the six months ending July 31, 2025, announced in September 2025. The company achieved underlying like-for-like sales growth of 1.9%, with adjusted pre-tax profit increasing 10.2% to £368 million.

- In June 2025, Metcash Limited announced the merger of its Independent Hardware Group (IHG) and Total Tools Holdings to establish the Total Tools and Hardware Group. This strategic consolidation brings together Metcash’s well-known hardware brands including Mitre 10, Home Hardware, and Total Tools, creating a single leading and scaled hardware business serving trade professionals, home builders, and the DIY sector.

- Harvey Norman reported strong financial performance in 2025, with total revenue rising 5.5% to $9.35 billion. In Australia, same-store sales grew by 6.1%, supported by demand for technology products and AI devices.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on project types, customer segments, and regional markets. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Increased demand for energy-efficient solutions will drive innovations in sustainable building materials and technologies.

- Growing interest in DIY home improvement will spur demand for tools, guides, and materials catering to non-professionals.

- Smart home products will continue to play a significant role in the market, offering convenience and cost-saving features for homeowners.

- The rise in eco-conscious consumer behavior will lead to further growth in green renovations and sustainable product lines.

- Homeowners in suburban and rural areas will increasingly invest in home improvements as property values rise.

- The market for renovation services will grow, with a focus on professional assistance for mid- to large-scale projects.

- Technological advancements, including automation and AI, will streamline project management and customer experience in home improvements.

- Increased interest in outdoor living spaces will fuel demand for landscaping, decks, and garden design services.

- Regional markets will see a shift in focus, with more investment and growth expected outside major metropolitan areas.

- Competitive pressure will drive companies to diversify offerings, such as by bundling services and expanding product availability.