Market Overview

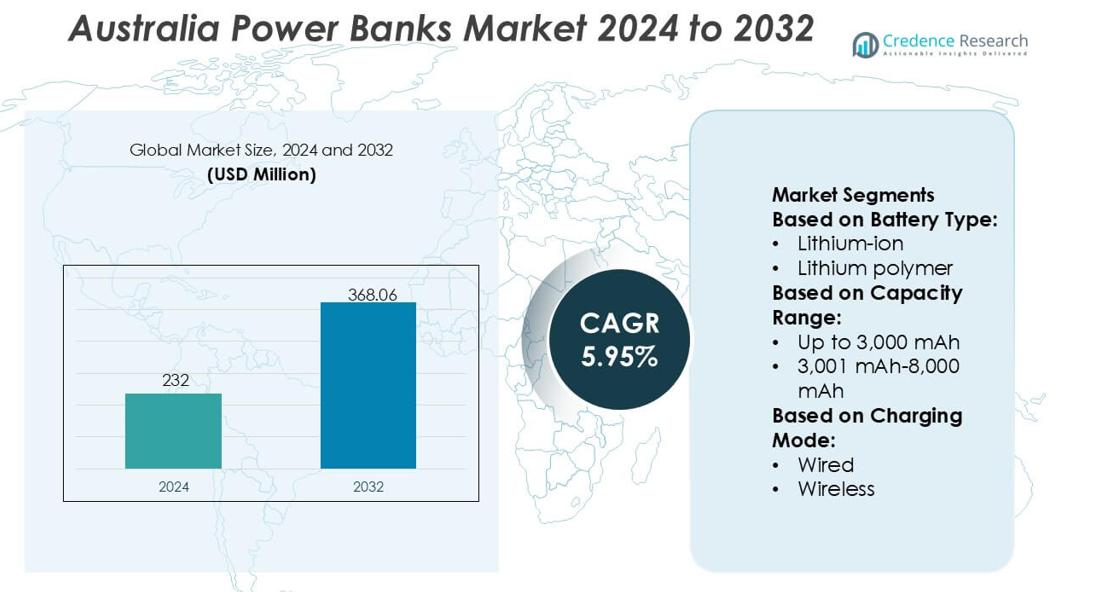

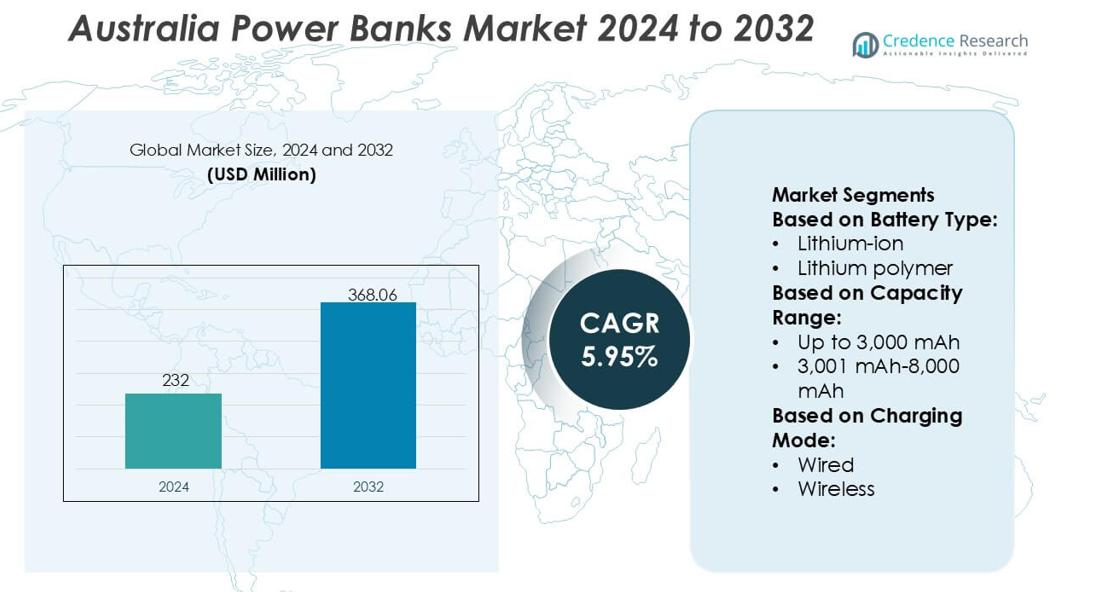

Australia Power Banks Market size was valued USD 232 million in 2024 and is anticipated to reach USD 368.06 million by 2032, at a CAGR of 5.95% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Australia Power Banks Market Size 2024 |

USD 232 million |

| Australia Power Banks Market, CAGR |

5.95% |

| Australia Power Banks Market Size 2032 |

USD 368.06 million |

The Australia Industrial Gases Market is shaped by a concentrated group of global and regional suppliers that strengthen their position through advanced production capabilities, diverse gas portfolios, and strong distribution networks serving manufacturing, healthcare, energy, and mining sectors. Leading players emphasize high-purity gases, reliable bulk delivery systems, and on-site generation technologies to meet rising industrial efficiency and safety requirements. Continuous investments in clean hydrogen, carbon-capture applications, and digitalized gas management further enhance competitiveness across emerging industries. Asia-Pacific holds the leading regional position with an exact 41% market share, supported by rapid industrialization, expanding infrastructure activity, and strong integration of industrial gas solutions across key end-use markets.

Market Insights

- The Australia Power Banks Market reached USD 232 million in 2024 and is projected to hit USD 368.06 million by 2032, advancing at a 5.95% CAGR during the forecast period.

- Growing dependence on smartphones, wearables, and digital mobility drives strong demand for fast-charging and high-capacity power banks across major consumer segments.

- The market shows rising adoption of USB-C PD, wireless charging, and compact lightweight designs, supported by strong online retail expansion and product upgrades.

- Competition intensifies as global and regional brands focus on performance efficiency, battery safety, and differentiated pricing, while restraints include commoditization and regulatory compliance for lithium-ion products.

- Asia-Pacific leads with 41% regional market share, while mid-to-high capacity power banks account for the dominant segment share due to increased travel, outdoor activity, and multi-device usage.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Battery Type

Lithium-ion remains the dominant battery type in the Australia Power Banks Market, holding an estimated 63% market share, driven by its high energy density, lower cost, and strong compatibility with fast-charging protocols. Consumers prefer lithium-ion models for their reliability and widespread availability across retail and e-commerce channels. Lithium polymer continues to gain traction due to its lightweight design and flexible form factors, appealing to users who prioritize slim and portable devices. Growth in outdoor activity trends, mobile-based work lifestyles, and increasing smartphone dependency further strengthens demand for both chemistries, although lithium-ion maintains clear volume leadership.

- For instance, Intex Technologies enhanced its lithium-ion portfolio by introducing a model powered by a 12,500 mAh high-density cell using a 3.7 V architecture capable of delivering up to 5 V/2.1 A dual-output charging, demonstrating its focus on efficiency and multi-device compatibility.

By Capacity Range

The 8,001 mAh–20,000 mAh capacity range leads the market with nearly 48% share, supported by rising consumer preference for multi-device charging and longer backup durations during travel, remote work, and recreational activities. This segment benefits from strong adoption of fast-charging technologies and growing use of power-intensive applications such as gaming, streaming, and mobile productivity. Models below 8,000 mAh remain relevant for light users seeking compactness, while units above 20,000 mAh serve niche segments requiring extended off-grid use. However, mid-capacity power banks continue to dominate due to balanced price, portability, and performance.

- For instance, Sony Corporation previously advanced this category through its CP-S20 portable charger, which incorporates a 20,000 mAh lithium-polymer battery engineered with Sony’s Hybrid-Gel Technology and supports a combined 3.0 A dual-port output, enabling faster and thermally stable charging across multiple devices.

By Charging Mode

Wired charging dominates the Australia Power Banks Market with approximately 71% market share, supported by its superior charging efficiency, universal device compatibility, and affordability. Consumers rely on wired power banks for consistent output delivery and faster charging cycles, especially for smartphones, tablets, and wearable devices. Wireless charging power banks show steady growth as manufacturers incorporate Qi-enabled pads and hybrid dual-mode models, appealing to users seeking cable-free convenience. Although wireless adoption increases as premium smartphones expand compatibility, wired solutions remain the preferred mainstream option due to reliability and cost-effectiveness.

Key Growth Drivers

Rising Smartphone Penetration and High Daily Device Usage

Growing reliance on smartphones, wearables, and portable electronics strongly accelerates power bank adoption in Australia. Consumers use power-intensive applications for streaming, navigation, gaming, and remote work, creating continuous demand for convenient backup power. High urban mobility and frequent intercity travel further reinforce the need for compact and fast-charging power banks. Manufacturers capitalize on this shift by offering multi-port, quick-charge models that ensure uninterrupted device performance. As digital lifestyles intensify, portable charging solutions gain sustained traction across both consumer and commercial user groups.

- For instance, Panasonic Corporation strengthened this demand trend by deploying its NCR18650B lithium-ion cell with a documented capacity of 3,350 mAh and an energy output of 12.1 Wh, enabling high-density, thermally stable power modules that manufacturers integrate into multi-port power banks requiring sustained delivery at 4.9 A maximum discharge.

Expansion of Outdoor Recreation and Travel Activities

Australia’s vibrant outdoor culture, including camping, hiking, and road tourism, significantly boosts the uptake of high-capacity and rugged power banks. Travelers increasingly require reliable off-grid charging for cameras, drones, GPS devices, and smartphones during extended trips. Tourism sector recovery and rising domestic adventure travel further elevate market demand. Brands respond by offering weather-resistant designs, solar-charging options, and power banks optimized for remote environments. This trend strengthens the appeal of durable, high-mAh models as essential accessories for extended mobility and outdoor exploration.

- For instance, Ambrane India Private Ltd. developed its Stylo Boost power bank equipped with a 50,000 mAh lithium-polymer battery, delivering a 22.5 W charging output through Power Delivery and Quick Charge protocols, and producing a documented peak current of 3.0 A making it suitable for extended off-grid usage during long outdoor travel.

Shift Toward Fast-Charging and Multi-Device Ecosystems

Growing adoption of fast-charging smartphones, tablets, earbuds, and smartwatches drives demand for power banks that support advanced charging protocols. Consumers increasingly prefer PD-enabled and high-wattage solutions capable of charging multiple devices simultaneously. This evolution in user expectations encourages manufacturers to upgrade product portfolios with improved lithium-polymer batteries, intelligent power management, and faster output speeds. As multi-device ownership rises, compact power banks with efficient energy distribution emerge as necessary everyday solutions, enhancing convenience and driving sustained market expansion.

Key Trends & Opportunities

Adoption of USB-C PD and Wireless Charging Capabilities

The transition toward USB-C Power Delivery and Qi-enabled wireless charging shapes new opportunities for differentiation in the Australian market. Consumers seek seamless, cable-free, and rapid energy transfer compatible with modern devices. Manufacturers integrate reversible connectors, higher wattage outputs, and magnetic wireless technology to align with premium smartphone ecosystems. This creates strong upgrade potential as users shift from basic power banks to advanced, high-speed models. The trend also positions brands to introduce hybrid charging formats that enhance user convenience and charging efficiency.

- For instance, Samsung SDI Co., Ltd. strengthened its competitive position by deploying its INR18650-35E cell, engineered with a documented capacity of 3,500 mAh at 3.6 V and an energy output of 12.6 Wh, while maintaining a continuous discharge rating of 8 A.

Growing Demand for Sustainable and Eco-Efficient Products

Environmental awareness fuels interest in power banks designed with recyclable materials and energy-efficient components. Consumers increasingly prefer brands that adopt greener manufacturing, reduced-waste packaging, and longer-lasting battery designs. Solar-integrated and energy-harvesting models gain visibility among outdoor and environmentally conscious users. Regulatory emphasis on battery safety and waste management further encourages companies to invest in sustainable innovation. This shift opens opportunities for eco-certified product lines that combine durability with lower environmental impact, appealing to Australia’s rising sustainability-driven consumer segment.

- For instance, ASUSTeK Computer Inc. advanced sustainability and efficiency through its ASUS ZenPower Pro PD, engineered with a documented 13,600 mAh lithium-polymer battery and supporting a 45 W USB-C PD output, while incorporating ASUS PowerSafe Technology that regulates voltage and temperature across 11 protective layers extending cell longevity to over 500 certified charge cycles under ASUS testing standards.

Retail Expansion Through E-Commerce and Omnichannel Strategies

Online sales accelerate significantly as Australian consumers favour digital platforms for wider product choices, faster delivery, and competitive pricing. Brands strengthen omnichannel presence by integrating e-commerce, electronics retailers, and lifestyle stores. Enhanced visibility through bundled offers, influencer marketing, and seasonal promotions boosts category awareness. This trend enables premium and emerging brands to reach untapped customer segments cost-effectively. As online marketplaces mature, companies leverage data-driven insights to refine product positioning and expand sales of high-capacity and fast-charging power banks.

Key Challenges

Increasing Market Saturation and Price Competition

The Australia power banks market faces intense competition due to the presence of global brands, private labels, and low-cost imports. High product availability leads to aggressive price discounting, limiting profit margins and slowing premium product adoption. Consumers often prioritize cost over advanced features, challenging manufacturers to differentiate within crowded categories. This dynamic pressures companies to innovate in design, battery life, and charging efficiency while maintaining competitive pricing. The commoditization of entry-level models further complicates long-term value creation for established brands.

Regulatory Pressures on Battery Safety and Quality Compliance

Strict Australian standards regarding lithium-ion battery imports, safety certifications, and transport compliance pose challenges for manufacturers and distributors. Ensuring adherence to safety protocols increases operational costs and extends time-to-market for new models. Non-compliant or substandard batteries risk recalls, reputational damage, and reduced consumer trust. As authorities intensify monitoring to prevent overheating and fire hazards, brands must invest in rigorous testing and high-quality components. These regulatory requirements, while essential for consumer safety, elevate barriers for new entrants and smaller players.

Regional Analysis

North America

North America leads the global demand for portable charging solutions with a 41% market share, driven by high smartphone penetration, strong adoption of digital lifestyles, and advanced consumer electronics ecosystems. The region benefits from mature retail networks and rapid uptake of fast-charging and wireless-enabled power banks. Frequent business travel, remote work culture, and heavy use of energy-intensive mobile applications strengthen replacement demand. Leading brands leverage strong e-commerce infrastructure and customer preference for premium, high-capacity models, positioning North America as a dominant hub for technology-driven portable power solutions.

Europe

Europe holds a 25% market share, supported by rising mobile device dependency, stringent product safety standards, and growing adoption of USB-C PD-compliant electronics. Urban populations across Germany, the U.K., and France fuel steady demand for power banks that offer portability and enhanced charging efficiency. Sustainability preferences encourage the use of eco-friendly materials and energy-efficient designs, shaping procurement decisions. Travel across interconnected EU countries, combined with widespread outdoor and recreational activities, further boosts market uptake. Increasing e-commerce adoption also enhances consumer access to advanced and affordable portable power solutions.

Asia-Pacific

Asia-Pacific accounts for 23% of the market, driven by its large smartphone user base, high youth population, and rapidly expanding digital economy. Countries such as China, India, Japan, and South Korea show strong demand for affordable, high-capacity, and fast-charging power banks. Frequent intercity travel, dense urban mobility, and outdoor lifestyles further support adoption. Manufacturers benefit from proximity to major battery production hubs, enabling cost efficiency and rapid innovation. The region’s vibrant e-commerce sector widens product availability, supporting accelerated adoption across both value and premium power bank categories.

Latin America

Latin America captures a 6% market share, shaped by increasing smartphone ownership, rising digital consumption, and growing popularity of outdoor and travel activities. Brazil, Mexico, and Colombia experience rising demand for mid-range and high-capacity power banks as consumers seek reliable charging during frequent commutes and connectivity challenges. Limited charging infrastructure in some rural areas encourages adoption of solar-enabled and rugged models. Improving retail penetration, combined with expanded online marketplaces, enhances product accessibility. Economic recovery and rising interest in affordable charging accessories continue to strengthen market momentum across the region.

Middle East & Africa

Middle East & Africa hold a 5% market share, supported by high mobile penetration, outdoor activity trends, and increasing business travel across key countries such as the UAE, Saudi Arabia, and South Africa. Hot climates and long commute times heighten the need for reliable portable charging solutions. Consumers show preference for durable, fast-charging, and high-capacity models capable of supporting multi-device usage. Expanding digital infrastructure, rising e-commerce adoption, and growing youth populations contribute to steady demand. Despite economic disparities, the region exhibits consistent growth potential across urban and emerging markets.

Market Segmentations:

By Battery Type:

- Lithium-ion

- Lithium polymer

By Capacity Range:

- Up to 3,000 mAh

- 3,001 mAh-8,000 mAh

By Charging Mode:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Australia Power Banks Market players such as Intex Technologies, Sony Corporation, Panasonic Corporation, Ambrane India Private Ltd., Beijing Xiaomi Technology Co., Ltd., Lenovo Group Ltd., Samsung SDI Co., Ltd., ASUSTeK Computer Inc., Anker Technology Co. Ltd., and Microsoft Corporation. the Australia Power Banks Market reflects a dynamic mix of global technology leaders and regional consumer electronics brands focusing on innovation, reliability, and differentiated value propositions. Companies compete by enhancing fast-charging efficiency, incorporating USB-C Power Delivery, and improving battery durability to meet the growing multi-device usage of Australian consumers. Strong e-commerce penetration intensifies competition, enabling rapid product comparisons and accelerating upgrade cycles. Brands increasingly emphasize safety compliance, compact form factors, and sustainable design features to build trust and loyalty. As mobility, digital lifestyles, and outdoor recreation continue to expand, competition shifts toward high-capacity, feature-rich, and performance-driven power banks.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Intex Technologies

- Sony Corporation

- Panasonic Corporation

- Ambrane India Private Ltd.

- Beijing Xiaomi Technology Co., Ltd.

- Lenovo Group Ltd.

- Samsung SDI Co., Ltd.

- ASUSTeK Computer Inc.

- Anker Technology Co. Ltd.

- Microsoft Corporation

Recent Developments

- In October 2024, Bosch Power Tools did expand its 18V cordless line and enter new trades like plumbing introducing hand tools (pliers, screwdrivers, hammers, etc.) and new nailers, alongside expansions for carpentry and electrical work, fulfilling a strategic goal to support more professionals with versatile, high-performance cordless solutions, fitting into their broader product rollout.

- In April 2024, California’s ZapBatt launched its revolutionary Battery Operating System (bOS) with Toshiba’s SCiB LTO batteries, creating a “universal adapter” for devices like power tools, achieving ultra-fast charging (80% in <6 min), over 20,000 cycles, extreme safety (no thermal runaway), and broad application potential.

- In February 2024, Makita U.S.A. launched the 5″ Paddle Switch Angle Grinder with AC/DC Switch (model 9558HP) in February 2024, a powerful (840W/7.5 AMP, 10,000 RPM) and compact tool designed for metalwork, electrical, mechanical, and plumbing professionals, featuring a paddle switch, AC/DC capability, and durable construction for extended life and comfort, according to press releases and retailer sites.

- In February 2024, Alpha and Omega Semiconductor (AOS) launched the AOZ32063MQV 3-phase gate driver for Brushless DC (BLDC) motors, focusing on applications like cordless tools and e-mobility, offering features like 100% duty cycle, integrated protection, and a compact 4x4mm QFN package to boost efficiency and battery life

Report Coverage

The research report offers an in-depth analysis based on Battery Type, Capacity Range, Charging Mode and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see rising demand for fast-charging and USB-C PD-enabled power banks as device ecosystems modernize.

- Wireless and magnetic charging power banks will gain stronger adoption among premium smartphone users.

- High-capacity models will expand rapidly due to increasing outdoor recreation, travel, and multi-device usage.

- Sustainable and recyclable material-based power banks will attract eco-conscious consumers.

- E-commerce channels will continue to dominate sales, driven by competitive pricing and wider product availability.

- Smart power banks with intelligent energy management features will see greater integration.

- Solar-powered and rugged designs will gain traction in remote and adventure-focused segments.

- Consumer preference will shift toward compact, lightweight, and high-efficiency designs.

- Safety-certified and regulatory-compliant batteries will become essential for maintaining brand trust.

- Competition will intensify as global and regional brands introduce differentiated, value-enhanced charging solutions.