Market Overview

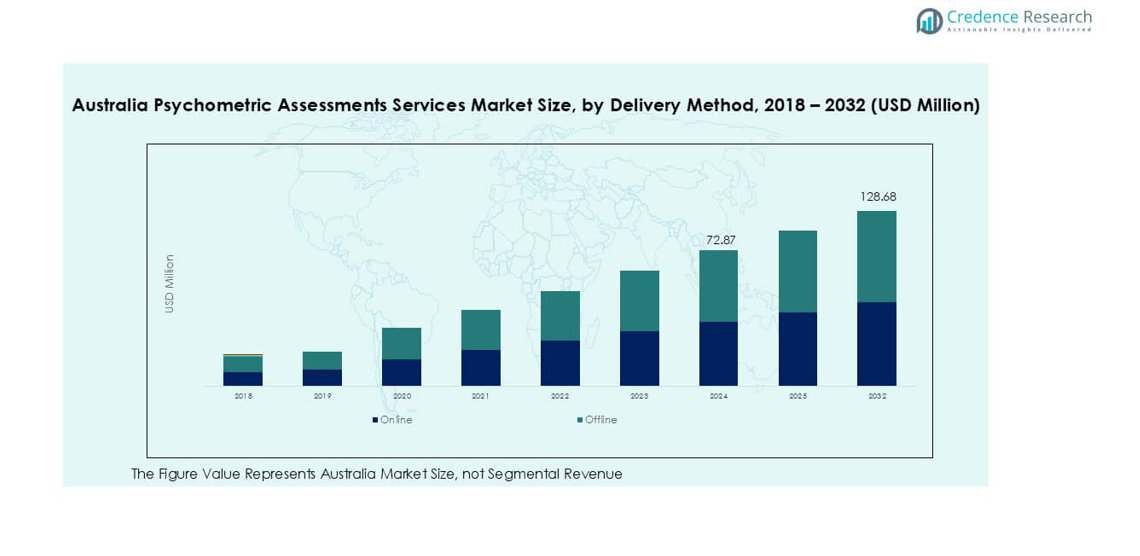

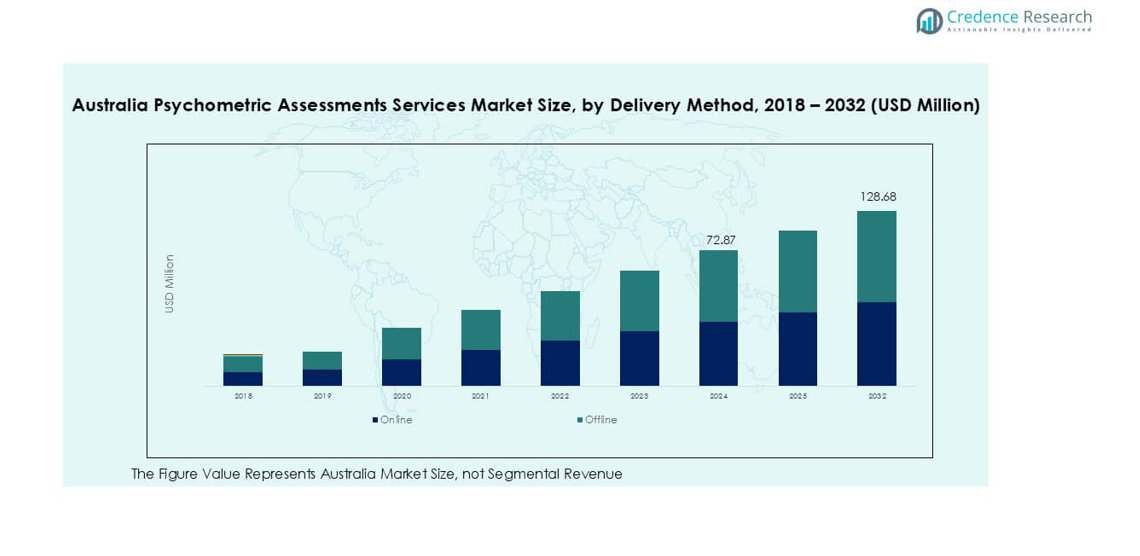

Australia Psychometric Assessments Services market size was valued at USD 58.05 million in 2018 and increased to USD 72.87 million in 2024. It is anticipated to reach USD 128.68 million by 2032, registering a CAGR of 7.37% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Australia Psychometric Assessments Services Market Size 2024 |

USD 72.87 million |

| Australia Psychometric Assessments Services Market, CAGR |

7.37% |

| Australia Psychometric Assessments Services Market Size 2032 |

USD 128.68 million |

The Australia psychometric assessments services market is led by key players such as Peter Berry Consultancy, McArthur Talent Architects, SACS Consulting, and Mapien. These companies dominate through advanced digital testing platforms, leadership diagnostics, and data-driven recruitment tools. Firms like Converge International and Merit Solutions strengthen their presence by offering tailored assessment and employee well-being programs. Peter Berry Consultancy remains a front-runner due to its validated Hogan assessment suite and extensive corporate clientele. Regionally, New South Wales leads the market with a 32% share, supported by strong corporate demand and technological infrastructure, followed by Victoria with 25%, driven by rapid adoption in education, healthcare, and finance sectors.

Market Insights

- The Australia Psychometric Assessments Services market was valued at USD 72.87 million in 2024 and is projected to reach USD 128.68 million by 2032, growing at a CAGR of 7.37%.

- Growth is driven by rising demand for data-driven recruitment, employee development, and leadership assessment programs across corporate and government sectors.

- Trends include the rapid adoption of AI-powered and cloud-based testing platforms, enabling remote assessments and personalized candidate analysis.

- Key players such as Peter Berry Consultancy, SACS Consulting, and McArthur Talent Architects dominate, focusing on validated psychometric tools and digital integration, while new entrants emphasize mobile and gamified solutions.

- Regionally, New South Wales leads with a 32% share, followed by Victoria at 25% and Queensland at 18%; by type, aptitude tests dominate with 38% share, primarily used for recruitment and large-scale workforce evaluation.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Aptitude tests dominate the Australia psychometric assessments services market, accounting for nearly 38% share in 2024. These tests are widely used for evaluating cognitive abilities and logical reasoning during recruitment and promotion processes. Growing adoption by corporate and public-sector employers to ensure objective hiring decisions supports demand growth. Personality and skill tests are also gaining traction, especially in leadership development programs. The increasing integration of AI-based test analytics further enhances result accuracy, making aptitude assessments a preferred choice for large-scale hiring across industries.

- For instance, SHL reports that over 35 million assessments are taken per year globally, including many in Australia.

By Application

Recruitment and selection hold the largest share of around 52% in 2024, driving market expansion across corporate and government sectors. Organizations use psychometric tools to identify cultural fit, decision-making ability, and job readiness. The demand for psychometric evaluation is rising due to a competitive labor market and the need to minimize hiring errors. Training and development applications are also growing rapidly, supported by employee engagement and performance improvement initiatives. The use of data-driven assessments is improving workforce retention and optimizing human capital strategies.

- For instance, Canditech, a cloud assessment provider, offers more than 500 validated tests on its platform.

By End-User

The corporate segment leads the market with a 46% share in 2024, driven by continuous talent acquisition and leadership assessment programs. Companies across finance, IT, and manufacturing are increasingly adopting online testing platforms for scalability and efficiency. Educational institutions are emerging users, applying psychometric tools for student counseling and career guidance. Government organizations are also incorporating these services into civil recruitment and competency evaluations. The shift toward digital and remote assessment models further supports adoption across diverse end-user groups, improving accessibility and decision-making outcomes.

Key Growth Drivers

Increasing Emphasis on Data-Driven Recruitment

Organizations across Australia are increasingly shifting toward data-backed hiring to improve workforce quality. Psychometric assessments enable employers to evaluate cognitive, behavioral, and emotional traits with measurable accuracy. Companies in sectors such as finance, IT, and professional services use these assessments to minimize subjective hiring biases and reduce turnover. The digitalization of HR processes and the rise of AI-based analytics further enhance predictive hiring decisions. Employers are also integrating psychometric insights into workforce planning and succession strategies, reinforcing the long-term adoption of these tools in both large enterprises and small businesses.

- For instance, SHL’s global operations deliver about 30 million assessments annually.

Expansion of Remote and Digital Assessment Platforms

The transition toward remote work and online recruitment has fueled demand for web-based assessment solutions. Organizations increasingly prefer digital psychometric platforms for their scalability, accessibility, and faster reporting capabilities. Cloud-based solutions allow seamless testing across locations, improving candidate experience while reducing administrative burden. Service providers are investing in mobile-friendly interfaces, adaptive questioning, and AI-driven scoring algorithms to enhance reliability. Educational institutions and training centers are also using digital assessments for student profiling and skill evaluation. The growing comfort with virtual hiring and online learning environments continues to accelerate adoption of remote testing technologies.

- For instance, SHL reports that more than 35 million assessments are taken annually via its cloud and online platforms.

Rising Focus on Employee Development and Retention

Employee well-being and retention have become strategic priorities for Australian employers, driving psychometric assessment use beyond recruitment. Organizations are utilizing these tools for training, leadership development, and team alignment initiatives. Personality and emotional intelligence assessments help identify behavioral gaps and support personalized coaching. Employers in sectors like healthcare, retail, and government use these insights to boost productivity and job satisfaction. Continuous learning programs supported by psychometric tools enhance engagement and reduce turnover costs. This shift from one-time recruitment tools to continuous employee development solutions strengthens market growth and service diversification.

Key Trends & Opportunities

Integration of Artificial Intelligence and Predictive Analytics

AI and machine learning are transforming psychometric testing by enhancing test precision, scalability, and customization. Advanced analytics allow organizations to predict job performance and cultural fit more accurately. Companies are leveraging AI-driven dashboards to monitor candidate behavior patterns and identify potential leadership qualities. Predictive analytics also improve the reliability of large-scale assessments, particularly in high-volume hiring. Vendors are investing in algorithmic transparency to comply with ethical AI standards. The fusion of AI and psychometrics represents a major opportunity for innovation and improved decision-making across corporate and educational applications.

- For instance, SHL’s Verify G+ test is adaptive and presents 30 questions in its algorithmic sequence.

Growing Demand in Education and Counselling Sectors

Educational institutions are increasingly adopting psychometric tools to assess student aptitude, learning style, and emotional well-being. These assessments support career counseling and help students make informed academic choices. Universities and vocational centers use them for entrance evaluations and personality mapping. The integration of psychometric testing in school guidance programs enhances student outcomes and reduces dropout rates. The rising emphasis on mental health and student success in Australia creates a significant growth opportunity for service providers catering to educational and psychological counselling markets.

- For instance, Pearson’s Q-interactive system digitizes dozens of clinical assessments, including the BASC and WAIS, for administration on a two-tablet setup.

Key Challenges

Concerns Over Test Validity and Cultural Bias

One of the major challenges in the Australian psychometric market is ensuring assessment fairness and accuracy across diverse cultural backgrounds. Standardized tests designed for global use may not always reflect local language nuances or behavioral norms. This can lead to biased outcomes, particularly for candidates from multicultural or Indigenous communities. Organizations and providers must continuously validate and localize assessments to maintain reliability. Regulatory scrutiny and public awareness of equity in hiring further intensify the need for culturally adaptive testing models and transparent scoring methodologies.

Data Privacy and Regulatory Compliance Issues

Psychometric testing involves sensitive personal and behavioral data, creating concerns about information security and ethical handling. Compliance with Australia’s Privacy Act 1988 and emerging data protection standards requires strict governance practices. Breaches or misuse of assessment results can damage both organizational credibility and employee trust. Service providers must implement robust encryption, anonymization, and consent management frameworks. The increasing reliance on AI-based assessment tools also raises questions about algorithmic accountability and data transparency. Addressing these regulatory and privacy challenges remains critical for sustainable market expansion.

Regional Analysis

New South Wales

New South Wales leads the Australia psychometric assessments services market with a 32% share in 2024. The region’s dominance stems from the concentration of corporate headquarters, financial institutions, and government agencies adopting data-driven recruitment tools. Sydney-based enterprises are investing heavily in online testing and AI-integrated assessment platforms to streamline hiring. Educational institutions are also expanding their use of psychometric tools for academic and counseling applications. The region’s strong digital infrastructure and advanced HR technology adoption continue to support sustained demand for both online and hybrid assessment formats.

Victoria

Victoria holds about 25% of the national market share, supported by its growing technology, education, and healthcare sectors. Melbourne’s corporate and educational ecosystem has rapidly adopted psychometric assessments for recruitment, team development, and student evaluation. The state government’s initiatives to promote workforce skill development further encourage adoption. Increasing integration of cloud-based and mobile-friendly assessment tools enhances accessibility across small and medium enterprises. Rising demand for diversity and inclusion-focused testing solutions also strengthens Victoria’s market position within Australia’s evolving HR analytics landscape.

Queensland

Queensland accounts for roughly 18% share of the psychometric assessments services market in 2024. The region’s expanding industrial base and strong presence of energy and public-sector organizations are key growth drivers. Employers are using psychometric tools to assess leadership potential and workforce readiness across distributed teams. The education sector also contributes significantly through career counseling and academic performance evaluations. Growing investment in digital assessment platforms and employee engagement analytics supports market expansion. Brisbane continues to emerge as a hub for HR technology innovation and testing services adoption across corporate and educational institutions.

Western Australia

Western Australia represents nearly 14% of the market share, driven by the mining, construction, and government sectors. Companies use psychometric evaluations to improve workforce safety, reliability, and leadership competency in high-risk industries. Increasing emphasis on remote assessment tools aligns with the state’s geographically dispersed workforce. Perth-based organizations are integrating AI-enabled testing to enhance recruitment efficiency and reduce turnover rates. The state’s gradual digital transformation in human resources and growing awareness of evidence-based hiring practices contribute to stable market growth within the region.

South Australia and Others

South Australia, along with Tasmania and the Northern Territory, collectively accounts for about 11% of the total market share. Adoption is growing steadily due to the increasing use of psychometric tools in public service recruitment and higher education institutions. Universities in Adelaide are incorporating these assessments into academic counseling and student support programs. Small and medium enterprises are also exploring cost-effective digital platforms for employee evaluation. Though smaller in scale, these regions are experiencing a consistent rise in demand as awareness of data-driven talent management practices spreads nationwide.

Market Segmentations:

By Type

- Aptitude Tests

- Personality Tests

- Skill Tests

- Integrity Tests

- Others

By Application

- Recruitment & Selection

- Training & Development

- Clinical & Counselling

- Others

By End-User

- Corporate

- Educational Institutions

- Government

- Others

By Delivery Mode

By Geography

- New South Wales

- Victoria

- Queensland

- Western Australia

- South Australia and Others

Competitive Landscape

The Australia psychometric assessments services market is highly competitive, with several established and emerging players offering diverse testing and consulting solutions. Companies such as Peter Berry Consultancy, SACS Consulting, and McArthur Talent Architects lead the market with advanced behavioral analytics, leadership profiling, and talent assessment tools. These firms emphasize scientific validation, AI-driven interpretation, and digital delivery to improve client outcomes. Mid-tier players like Mapien, Merit Solutions, and Converge International focus on customized workforce solutions for corporate and government clients. New entrants are increasingly adopting cloud-based testing platforms and integrating gamified assessments to enhance user engagement. Partnerships with educational institutions and HR software vendors further strengthen competitive positioning. Continuous innovation, reliability of assessment models, and compliance with data privacy regulations are critical differentiators influencing market share. Overall, competition is intensifying as demand for remote, data-driven, and culturally adaptive psychometric tools continues to grow across Australia’s corporate, educational, and public sectors.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In October 2025, SHL introduced a new Personality and Ability Assessment Training Program in Czechia, focusing on professional development for HR teams to increase self-sufficiency in test interpretation and talent evaluation. This initiative forms part of SHL’s updated global training calendar for advanced psychometric assessment methodologies.

- In April 2025, TalentSmartEQ launched its 2025 State of EQ Report, analyzing data from over 37,000 Emotional Intelligence Appraisal participants. The report highlighted a shift toward people-first leadership and the growing use of emotional intelligence training to support employee well-being and adaptability in dynamic workplaces.

- In 2025, Hogan Assessments focused on leveraging AI for deeper behavioral insights in its predictive personality assessments, as presented at the IPAC 2025 conference. This aligns with Hogan’s emphasis on ethical AI and enhanced cross-cultural validity, a priority highlighted in their April 2025 Top Trends in Personality Assessment report. Hogan was also a platinum sponsor of the IPAC conference, which was held from July 27–30 in Atlanta.

- In March 2023, Talent Select AI, a Milwaukee-based company, announced the official launch of its ground-breaking, self-titled psychometric assessment tool.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-User, Delivery Mode and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for AI-driven and adaptive testing platforms will continue to grow across sectors.

- Integration of psychometric tools with HR analytics and talent management systems will expand.

- Remote and mobile-based assessment adoption will rise due to flexible hiring trends.

- Educational institutions will increasingly use assessments for career guidance and student development.

- Data privacy and ethical testing standards will become more critical for service providers.

- Customized and culturally adaptive assessments will gain traction among diverse workforces.

- Partnerships between psychometric firms and software vendors will enhance digital delivery.

- Continuous learning and employee well-being programs will drive recurring assessment usage.

- SMEs will increase adoption as subscription-based SaaS models become more affordable.

- AI transparency and compliance with Australian data laws will shape long-term market credibility.