Market Overview:

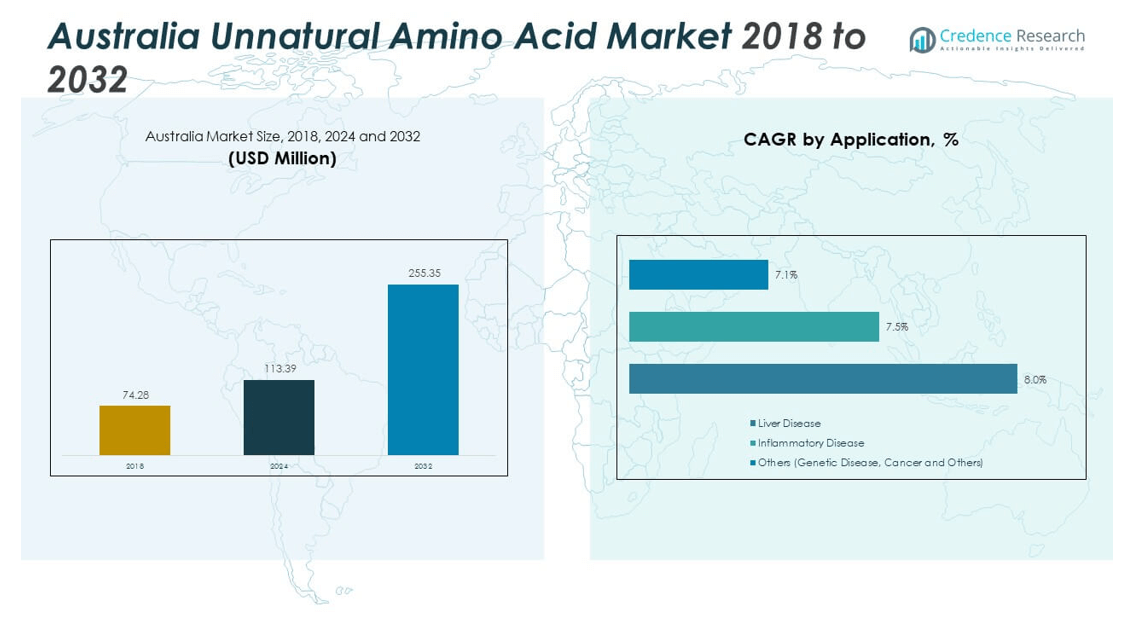

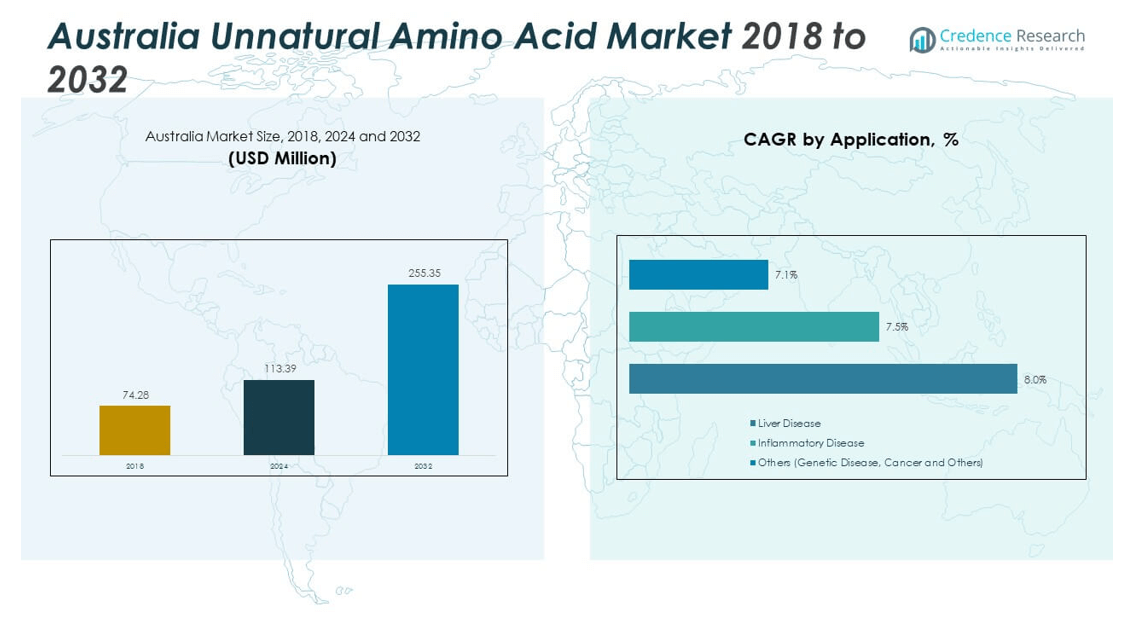

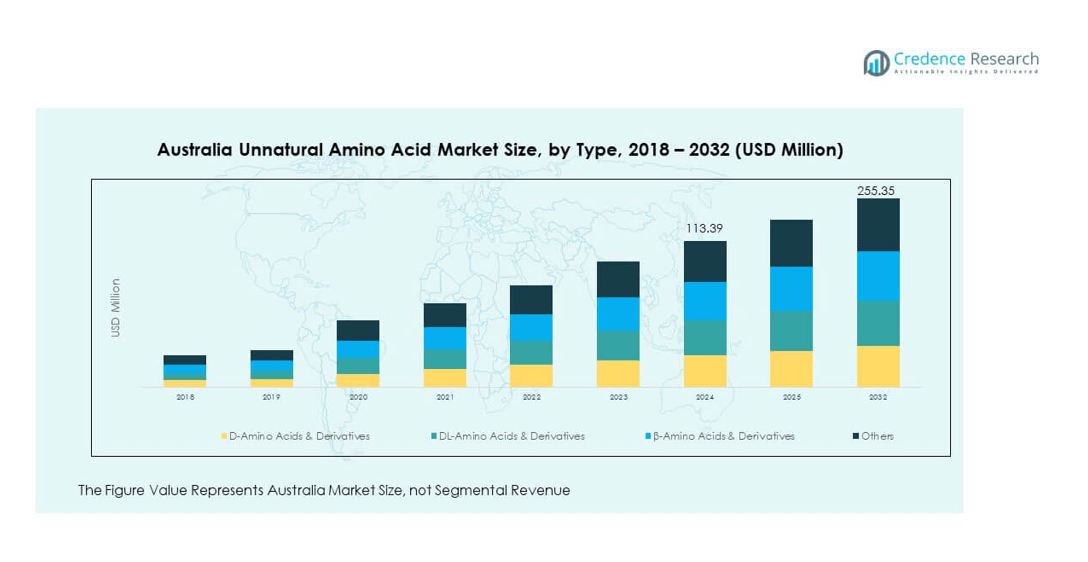

The Australia Unnatural Amino Acid Market size was valued at USD 74.28 million in 2018 to USD 113.39 million in 2024 and is anticipated to reach USD 255.35 million by 2032, at a CAGR of 10.68% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Australia Unnatural Amino Acid Market Size 2024 |

USD 113.39 million |

| Australia Unnatural Amino Acid Market, CAGR |

10.68% |

| Australia Unnatural Amino Acid Market Size 2032 |

USD 255.35 million |

The market in Australia is experiencing strong growth due to rising demand for advanced drug development and precision medicine. Pharmaceutical and biotech companies are increasingly integrating unnatural amino acids into therapeutic proteins and enzyme engineering to improve stability and efficacy. Growing research in cancer therapy, metabolic disorders, and rare diseases is fueling adoption. Supportive government initiatives, expanding healthcare infrastructure, and rising investment in biopharmaceutical R&D are also creating opportunities. These drivers collectively position the market as a key growth area in the healthcare innovation landscape.

Regionally, Australia plays an important role in advancing the adoption of unnatural amino acids across Asia-Pacific, supported by its strong research infrastructure and clinical trial environment. Countries like Japan and South Korea are emerging as significant contributors, driven by biopharmaceutical advancements. Meanwhile, China continues to strengthen its presence with expanding biotechnology hubs and large-scale manufacturing capacities. Together, these markets are shaping a competitive regional landscape, with Australia acting as a leader in specialized research and innovation.

Market Insights:

- The Australia Unnatural Amino Acid Market was valued at USD 74.28 million in 2018, reached USD 113.39 million in 2024, and is expected to attain USD 255.35 million by 2032, growing at a CAGR of 10.68%.

- New South Wales held 34% share, supported by strong biotech clusters and clinical trial activity, while Victoria followed with 29% due to its research-driven ecosystem, and Queensland accounted for 22% through expanding healthcare facilities and research partnerships.

- Western Australia and South Australia together held 15% but represent the fastest-growing subregions, driven by rising government-backed initiatives and emerging biotech investments.

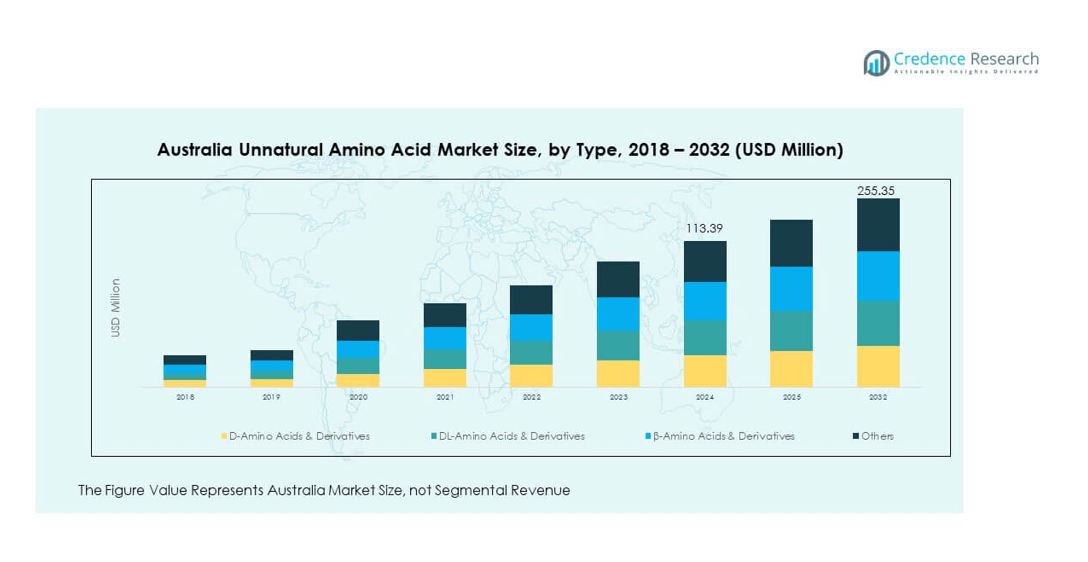

- D-Amino Acids & Derivatives captured 36% share in 2024, reflecting their high adoption in pharmaceutical synthesis and enzyme applications.

- DL-Amino Acids & Derivatives accounted for 28%, β-Amino Acids & Derivatives held 22%, while Others contributed 14%, highlighting their role in niche therapeutic and industrial applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Role of Drug Discovery and Protein Engineering in Advancing Therapeutic Innovation

The Australia Unnatural Amino Acid Market is driven by the increasing role of drug discovery programs and protein engineering applications. Pharmaceutical companies use these compounds to improve the half-life, stability, and bioavailability of drugs. It supports therapeutic innovation in fields like oncology, metabolic disorders, and rare disease treatment. Biotech firms prioritize precision medicine, which requires site-specific protein modifications. Research institutions in Australia actively contribute by developing advanced bioengineering tools. Rising collaborations between academia and industry further expand the usage of these amino acids. Government-funded projects encourage the translation of laboratory research into commercial drug pipelines. This driver positions the market at the center of healthcare innovation.

Rising Demand for Specialty Materials Across Healthcare and Biotechnology Industries

The increasing adoption of specialty materials across healthcare and biotechnology fuels the Australia Unnatural Amino Acid Market. It enhances enzyme design and supports efficient industrial biocatalysis. Biopharmaceutical companies integrate unnatural amino acids into peptides for higher activity and resistance. This adoption reduces production costs and supports green chemistry practices. Growing attention to sustainable and efficient synthesis methods encourages the sector’s expansion. The healthcare industry uses them in diagnostics and imaging tools, creating broader applications. Biotechnology hubs in Australia strengthen their adoption through technology incubators and start-ups. Industry-wide recognition of their versatility solidifies market growth.

Expanding Role of Personalized and Precision Medicine in the Healthcare Ecosystem

The Australia Unnatural Amino Acid Market benefits from the expanding role of personalized and precision medicine. Patients demand targeted therapies with fewer side effects, driving innovation in biologics. It supports drug formulations tailored to specific genetic and molecular profiles. Pharmaceutical firms use these compounds to design antibody-drug conjugates with improved safety. The rising pipeline of personalized therapies in oncology and immunology strengthens demand. Clinical research organizations in Australia adopt advanced tools for patient-specific models. Investment in genomic mapping and patient stratification drives the integration of these solutions. This driver positions the market as a pillar of patient-centered healthcare.

- For instance, in July 2024, the University of Queensland’s Australian Institute for Bioengineering and Nanotechnology secured a $3.3 million federal grant to establish a facility for personalized mRNA cancer vaccine research within its BASE mRNA facility.

Strong Government Support and Research Funding Encouraging Clinical and Industrial Applications

The Australia Unnatural Amino Acid Market gains momentum from strong government support and funding programs. Research councils provide grants for projects in advanced therapeutics. It encourages early-stage biotech firms to explore innovative applications. Public-private partnerships create opportunities for scaling production capabilities. National strategies promote clinical trials involving engineered proteins and peptides. Universities collaborate with international institutes to transfer knowledge and resources. The presence of regulatory clarity accelerates the approval of innovative therapies. These actions strengthen the country’s leadership role in global healthcare innovation.

- For instance, in April 2024, CSL, the University of Melbourne, and the Walter and Eliza Hall Institute officially launched Jumar, Australia’s first biotech incubator, which is managed by operator Cicada Innovations. Supported by funding from the Victorian Government’s Breakthrough Victoria Fund, Jumar currently houses 16 startups focused on translating academic research including protein and peptide engineering into commercial medical applications.

Market Trends:

Expansion of Advanced Protein Modification Platforms Supporting Industrial and Clinical Growth

The Australia Unnatural Amino Acid Market observes a trend toward advanced protein modification platforms. Pharmaceutical and biotech firms integrate them into site-specific labeling technologies. It increases efficiency in bioconjugates and therapeutic protein design. Cutting-edge platforms allow precise incorporation into antibodies and enzymes. Demand for such platforms rises due to their role in drug delivery and imaging tools. Industrial applications also grow, particularly in enzyme engineering for sustainable processes. This trend encourages collaborations between platform developers and end-users. It reflects a push toward scalable and application-focused innovation.

- For instance, Ajinomoto Bio-Pharma Services has developed the AJICAP™ platform, which uses affinity peptide reagents to achieve site-specific chemical conjugation to native IgG1 antibodies, including at heavy-chain Lys288. This technology enables the production of antibody–drug conjugates with high homogeneity, enhanced stability, and consistent therapeutic profiles, offering an alternative to methods that require genetic modification.

Growing Collaborations Between Industry and Academia Driving Applied Research Outcomes

Collaborations between academia and industry create a clear trend in the Australia Unnatural Amino Acid Market. Research institutions provide expertise in novel protein chemistry methods. It enables companies to bring academic discoveries into practical applications. Joint projects focus on peptide synthesis, enzyme resistance, and protein labeling. Australian universities establish innovation hubs to accelerate commercialization. Pharmaceutical players invest in campus-based partnerships to secure access to talent and research output. Industry demand for translational science strengthens these collaborations. The trend demonstrates how cooperative ecosystems advance biotechnology.

Rising Role of Synthetic Biology Platforms in Expanding Application Possibilities

The Australia Unnatural Amino Acid Market benefits from the rising role of synthetic biology platforms. It expands the range of possible protein engineering techniques. Synthetic biology enables efficient design of novel therapeutic proteins. Emerging start-ups apply these tools for agricultural biotechnology and healthcare. Demand for new pathways encourages investment in biofoundries and automation. Synthetic biology reduces costs and time in developing engineered proteins. This trend attracts investors focusing on high-potential biotechnology ventures. The market reflects a transition toward an integrated, technology-led ecosystem.

Increasing Focus on Rare Disease Therapeutics Creating New Market Niches

The Australia Unnatural Amino Acid Market shows a trend toward rare disease therapeutics. It addresses unmet medical needs in genetic and metabolic conditions. Pharmaceutical developers leverage these compounds to design stable, long-acting drugs. Rare disease drug pipelines gain attention from regulatory authorities and investors. Biotech firms adopt these solutions for niche patient populations. Research programs in Australia explore orphan drug development with specialized compounds. Partnerships with international players extend clinical reach. This trend creates new market opportunities with targeted therapies.

- For instance, BioMarin Pharmaceutical Australia is actively advancing rare disease drug development, introducing orphan drugs such as enzyme replacement therapies targeted at genetic disorders, and leveraging Australia’s supportive environment for rare disease research and regulatory approval.

Market Challenges Analysis:

High Production Costs and Complex Manufacturing Processes Limiting Scalability

The Australia Unnatural Amino Acid Market faces challenges due to high production costs and complex manufacturing methods. Specialized facilities are required to synthesize and purify these compounds. It increases barriers for small and mid-sized companies. Scalability becomes difficult without major capital investment. Stringent quality standards demand advanced equipment and skilled labor. Cost constraints limit their adoption in wider commercial applications. Companies struggle to balance affordability with innovation. These challenges restrict faster penetration into mainstream drug development.

Regulatory Uncertainty and Limited Commercial Awareness Restricting Wider Market Growth

The Australia Unnatural Amino Acid Market also faces regulatory uncertainty and limited commercial awareness. Approval processes for new compounds remain complex and time-consuming. It discourages firms from entering clinical applications quickly. Lack of awareness in broader healthcare circles slows adoption. Physicians and patients often prefer established therapies over novel ones. Regulatory frameworks evolve slowly, creating gaps between research and commercialization. Companies must invest heavily in compliance to ensure approval. These hurdles delay widespread market growth and adoption.

Market Opportunities:

Expansion of Biopharmaceutical Research and Development Infrastructure in Australia

The Australia Unnatural Amino Acid Market presents opportunities in biopharmaceutical research and development. It benefits from robust investments in R&D infrastructure. Local biotech firms expand capabilities in protein design and peptide therapeutics. Government strategies promote translational research and commercialization support. Collaborations with global pharmaceutical companies strengthen knowledge exchange. Opportunities emerge from Australia’s strong clinical trial landscape. The market can capitalize on these investments to scale innovations.

Growing Application Potential Across Non-Therapeutic Industrial Segments

The Australia Unnatural Amino Acid Market also holds opportunities across non-therapeutic sectors. It supports enzyme engineering for industrial biotechnology and green chemistry. Food and agriculture industries explore its use in innovative bio-based solutions. The cosmetic sector integrates peptides with enhanced stability for premium formulations. Demand for sustainable and functional compounds supports this expansion. Growing interest from chemical and industrial players widens the scope. Such diversification strengthens resilience against healthcare-only dependence.

Market Segmentation Analysis:

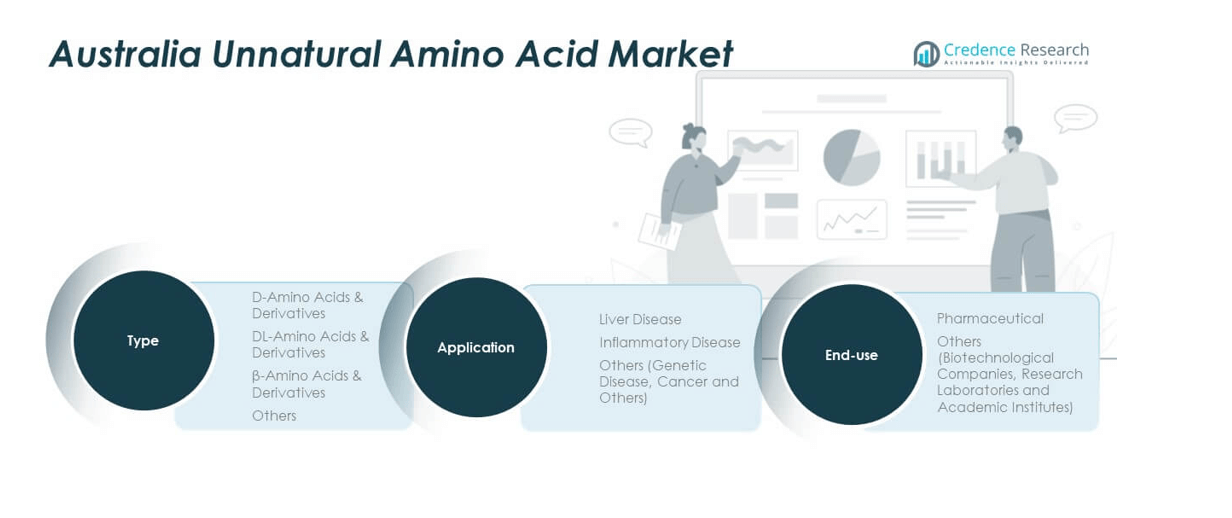

By type, the Australia Unnatural Amino Acid Market demonstrates significant growth across type-based categories, with D-Amino Acids & Derivatives holding strong demand due to their role in pharmaceutical synthesis and enzyme stability. DL-Amino Acids & Derivatives are increasingly adopted for peptide drug development and specialty biocatalysis. β-Amino Acids & Derivatives attract research interest for their resistance to enzymatic degradation and potential in long-acting therapeutics. Other specialized amino acids contribute to niche applications, expanding opportunities for innovation and tailored solutions in healthcare and industrial biotechnology.

- For instance, recent advancements in synthetic biology and analytical technologies have enabled pharmaceutical companies to incorporate D-amino acids in peptide-based drugs, improving their enzymatic stability and bioavailability.

By application, liver disease treatments represent a major share, driven by the need for enhanced protein therapies and metabolic disorder solutions. Inflammatory diseases also present a strong adoption base where these compounds improve drug design and therapeutic efficacy. The segment covering genetic diseases, cancer, and other rare conditions expands steadily, reflecting the focus on targeted therapies and precision medicine. The Australia Unnatural Amino Acid Market leverages these applications to support clinical research and commercial product pipelines.

By end-use segmentation highlights the pharmaceutical sector as the dominant consumer, utilizing unnatural amino acids in drug discovery, antibody-drug conjugates, and peptide-based therapies. It is reinforced by the growing pipeline of biologics and site-specific protein engineering. Biotechnological companies, research laboratories, and academic institutes also represent an important end-use group, applying these compounds in enzyme studies, structural biology, and diagnostics. This balance between commercial demand and academic exploration strengthens the market’s foundation and sustains its growth trajectory.

- For instance, researchers at The University of Queensland have been developing natural and unnatural amino acid delivery systems as part of drug discovery and peptide-based therapeutic projects, participating in Australia’s Economic Accelerator Launch Program and furthering both academic and commercial innovation in the field.

Segmentation:

By Type

- D-Amino Acids & Derivatives

- DL-Amino Acids & Derivatives

- β-Amino Acids & Derivatives

- Others

By Application

- Liver Disease

- Inflammatory Disease

- Others (Genetic Disease, Cancer, and Others)

By End-Use

- Pharmaceutical

- Others (Biotechnological Companies, Research Laboratories, and Academic Institutes)

Regional Analysis:

In the Australia Unnatural Amino Acid Market, New South Wales leads with a market share of 34%, supported by a strong concentration of pharmaceutical companies, medical research institutions, and universities engaged in advanced protein engineering. Sydney’s role as a biotechnology hub enhances the demand for customized amino acids in drug discovery and therapeutic development. The region benefits from government-backed healthcare projects and clinical trial activities. It plays a vital role in driving innovation and attracting investments from both domestic and global firms. The presence of well-established research clusters further secures New South Wales as the top-performing subregion.

Victoria follows with a market share of 29%, driven by Melbourne’s thriving biotechnology ecosystem and strong academic presence. The state’s research institutes are recognized for excellence in life sciences and protein chemistry, which supports the growing adoption of unnatural amino acids in therapeutic pipelines. It provides an enabling environment for partnerships between start-ups and established pharmaceutical players. Increasing focus on precision medicine and biologics research also contributes to higher adoption. The region’s emphasis on healthcare innovation ensures a steady demand for specialty amino acids. Victoria maintains a strong competitive position due to its diverse biotech landscape and advanced infrastructure.

Queensland accounts for 22% of the market, supported by a growing network of research organizations and expanding healthcare facilities. Brisbane plays a central role, fostering collaborations between academia and biotechnology firms in peptide drug development and enzyme design. It benefits from rising government investment in medical research and life sciences innovation. The state leverages its healthcare sector to adopt amino acid technologies for both clinical and industrial applications. Other subregions, including Western Australia and South Australia, together hold the remaining 15%, where smaller biotech clusters and academic initiatives contribute to gradual adoption. The Australia Unnatural Amino Acid Market continues to benefit from regional strengths, with each subregion playing a role in expanding overall capacity and innovation.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Ajinomoto Co., Inc.

- Kyowa Hakko Bio Co., Ltd. (Kirin Holdings)

- Yoneyama Yakuhin Kogyo Co., Ltd.

- Nagase & Co., Ltd.

- Nippon Rika Co., Ltd.

- Watanabe Chemical Industries, Ltd.

- Sekisui Chemical Co., Ltd. (Life Sciences division)

- Takeda Pharmaceutical Company Limited

- Astellas Pharma Inc.

- Otsuka Pharmaceutical Co., Ltd.

- Shionogi & Co., Ltd.

- Chugai Pharmaceutical Co., Ltd. (Roche Group Japan)

Competitive Analysis:

The Australia Unnatural Amino Acid Market features a competitive landscape shaped by global pharmaceutical leaders, regional chemical companies, and emerging biotechnology firms. Established players such as Ajinomoto Co., Inc., Kyowa Hakko Bio Co., Ltd., and Takeda Pharmaceutical Company Limited hold strong positions with extensive product portfolios and advanced research capabilities. Japanese firms, including Nagase & Co., Ltd. and Nippon Rika Co., Ltd., extend their influence through collaborations with Australian research institutions and distribution networks. These companies leverage scale and expertise to strengthen their role in specialized drug development and peptide engineering. It is also influenced by smaller biotechnology firms, research laboratories, and academic institutions that contribute innovative applications. Local research-driven enterprises emphasize niche segments such as β-amino acid derivatives and specialty peptides, creating differentiation within the market. Global pharmaceutical companies including Astellas Pharma Inc., Otsuka Pharmaceutical Co., Ltd., and Chugai Pharmaceutical Co., Ltd. expand their presence through partnerships and product launches tailored to Australian healthcare needs. Competitive activity is marked by mergers, collaborations, and clinical trial participation aimed at broadening product reach. The mix of established multinational corporations and research-focused local players ensures a dynamic market environment, fostering innovation and sustaining long-term growth opportunities.

Recent Developments:

- In September 2025, Enlaza Therapeutics entered a collaboration with Vertex Pharmaceuticals, centered on its War-Lock platform that incorporates non-natural amino acids to create covalent-acting protein drugs. The partnership aims to develop immune therapies for autoimmune diseases and improve treatment conditioning for sickle cell disease and thalassemia, with USD 45 million upfront and up to USD 2 billion in potential milestones.

- In August 2025, Ajinomoto Co., Inc. entered a strategic partnership with Australian plant-based meat producer v2food and was involved in v2food’s acquisition of Daring Foods, the leading unbreaded plant chicken brand in the U.S. This collaboration aims to transform global food systems by leveraging Ajinomoto’s expertise in amino acid science, advancing innovation in next-generation protein solutions, and supporting advanced developments in the Australia unnatural amino acid market.

- In July 2025, Kyowa Hakko Bio Co., Ltd. (a Kirin Holdings company), completed the sale of most of its amino acid and human milk oligosaccharide (HMO) business to Meihua Holdings Group, a China-based biomanufacturer. This divestment includes significant business units operating internationally, though some pharmaceutical-grade amino acids not included in the deal remain under Kyowa Hakko Bio’s management until 2026, ensuring continued supply and meeting their responsibilities in the Australian and wider international market.

- In July 2025, AstraZeneca announced a $50 billion investment to expand its US-based manufacturing and R&D capabilities by 2030. This expansion includes establishing a Virginia facility dedicated to cutting-edge drug substances such as peptides and small molecules—crucial for advancing APIs and biopharmaceutical manufacturing, indirectly supporting innovations in unnatural amino acids.

- In June 2025, Argenx partnered with Unnatural Products, agreeing on a collaboration worth up to USD 1.5 billion to develop oral macrocyclic peptides targeting inflammatory and immunological diseases. The deal aims to deliver once-daily oral alternatives to current infused antibody treatments, leveraging the advantages of macrocyclic peptides such as stability without cold storage and resistance to protease degradation.

Report Coverage:

The research report offers an in-depth analysis based on Type, Application and End-Use. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Australia Unnatural Amino Acid Market will expand steadily, supported by strong pharmaceutical research pipelines.

- Demand for engineered proteins and peptides will rise, driven by therapeutic innovations.

- Precision medicine adoption will increase, positioning amino acid derivatives as critical tools.

- Collaborations between academia and industry will accelerate the translation of research into clinical applications.

- Biopharmaceutical firms will strengthen investment in protein modification technologies to gain competitive advantage.

- Industrial biotechnology applications, including enzyme engineering, will broaden the scope beyond healthcare.

- Rare disease drug development will emerge as a promising growth area within the market.

- Expansion of clinical trials in Australian research hubs will attract global partnerships.

- Local start-ups and research labs will contribute to innovation in niche amino acid derivatives.

- Regulatory clarity and government support will continue to encourage commercialization and global alignment.