| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

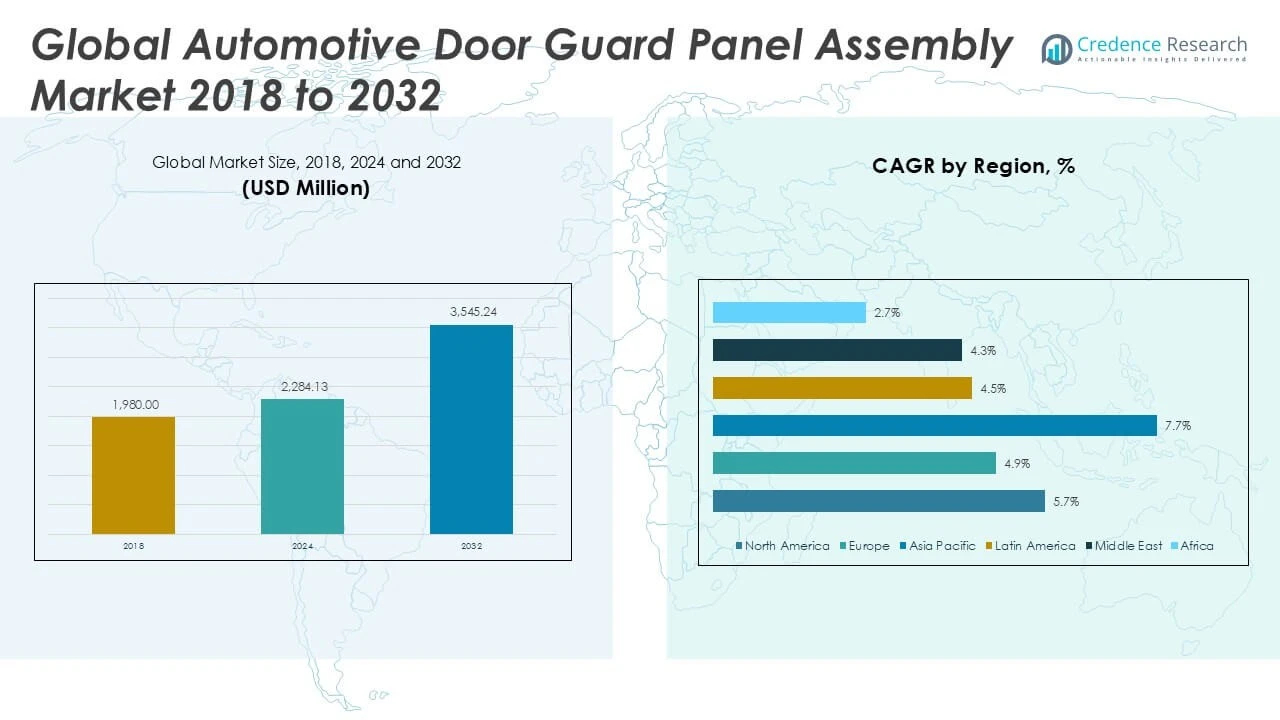

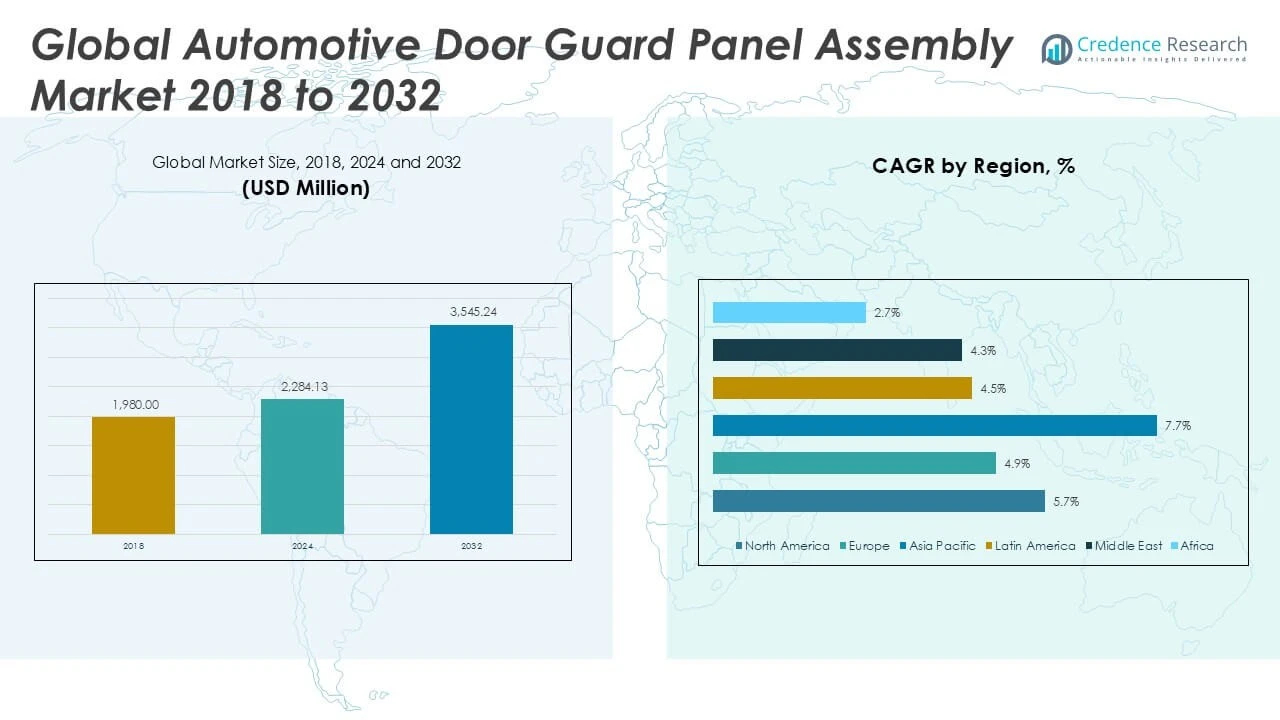

| Automotive Door Guard Panel Assembly Market Size 2024 |

USD 2,284.13 Million |

| Automotive Door Guard Panel Assembly Market, CAGR |

5.68% |

| Automotive Door Guard Panel Assembly Market Size 2032 |

USD 3,545.24 Million |

Market Overview

The Global Automotive Door Guard Panel Assembly Market is projected to grow from USD 2,284.13 million in 2024 to an estimated USD 3,545.24 million by 2032, registering a compound annual growth rate (CAGR) of 5.68% from 2025 to 2032.

Market growth is primarily driven by increasing vehicle production, especially in emerging economies, and growing consumer preference for customized and durable door guard panels that improve vehicle interiors’ appeal and protection. Trends such as the adoption of lightweight materials and advanced manufacturing techniques are shaping product development, enabling manufacturers to offer enhanced durability and corrosion resistance. Furthermore, the rising focus on electric and hybrid vehicles is influencing design and material choices in door guard panel assemblies, fostering innovation in the market.

Geographically, the Asia-Pacific region holds the largest share in the Automotive Door Guard Panel Assembly Market, fueled by rapid automotive production in countries like China, India, and Japan. North America and Europe follow, supported by advanced automotive manufacturing infrastructure and stringent safety regulations. Key players in the market include companies such as Magna International Inc., Faurecia, Lear Corporation, Adient plc, and Toyota Boshoku Corporation. These players focus on product innovation, strategic partnerships, and expanding production capacities to maintain competitive advantages in this growing market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Global Automotive Door Guard Panel Assembly Market is projected to grow from USD 2,284.13 million in 2024 to USD 3,545.24 million by 2032, with a CAGR of 5.68% from 2025 to 2032.

- Increasing global vehicle production, especially in emerging economies, drives strong demand for durable and customized door guard panel assemblies.

- Growing consumer preference for lightweight materials and advanced manufacturing techniques enhances product durability and corrosion resistance, fueling market growth.

- The shift toward electric and hybrid vehicles creates opportunities for innovative door guard panel designs tailored to new automotive architectures.

- High production costs and raw material price volatility pose challenges, impacting profit margins and market expansion efforts.

- Asia-Pacific dominates the market due to rapid automotive manufacturing growth in China, India, and Japan, supported by favorable government policies.

- North America and Europe maintain significant shares, backed by stringent safety regulations and investments in R\&D to drive product innovation.

Market Drivers

Rising Vehicle Production and Increasing Demand for Safety Features Propel Market Growth

The Global Automotive Door Guard Panel Assembly Market benefits significantly from the continuous rise in vehicle production worldwide. Increasing automotive manufacturing in emerging economies drives demand for high-quality door guard panels to enhance vehicle safety and durability. Consumers prioritize vehicle safety features, leading manufacturers to integrate advanced door guard assemblies that protect interiors and reduce damage risks. It supports the growth of premium and mid-segment vehicles where interior protection plays a key role in customer satisfaction. The shift toward electric and hybrid vehicles further emphasizes the need for innovative door guard panels tailored to new vehicle architectures. The market’s expansion closely follows automotive industry trends and regulatory safety requirements globally.

For instance, leading manufacturers such as Faurecia and Antolin have reported producing millions of automotive door guard panels annually to meet growing safety and durability demands

Technological Advancements and Material Innovation Boost Product Appeal

Technological progress in materials and manufacturing processes fuels the Global Automotive Door Guard Panel Assembly Market. The adoption of lightweight, durable materials like thermoplastics and composites enhances product performance by improving resistance to corrosion and wear. It allows manufacturers to reduce vehicle weight, contributing to fuel efficiency and emission reduction goals. Modern production techniques, including injection molding and automated assembly, improve product consistency and cost-effectiveness. Innovation in customizable and aesthetic designs increases consumer appeal and supports automakers in differentiating their vehicle interiors. Continuous research and development strengthen market competitiveness through superior quality offerings.

For instance, the automotive door panel market has seen thousands of new material innovations introduced globally to enhance durability and lightweight properties

Growing Consumer Preference for Vehicle Customization Drives Market Demand

Consumers increasingly seek personalized vehicle interiors, which positively impacts the Global Automotive Door Guard Panel Assembly Market. Customizable door guard panels in various colors, textures, and finishes allow automakers to meet diverse customer preferences. It enhances vehicle aesthetics while providing functional protection, contributing to overall user satisfaction. The rise in aftermarket accessories also supports growth by offering retrofit options for existing vehicles. This trend encourages suppliers to expand their product portfolios with tailored solutions that align with evolving consumer tastes. Market players leverage this demand by focusing on flexible manufacturing and design innovation.

Stringent Safety Regulations and Standards Support Market Expansion

Governmental and industry regulations regarding vehicle safety significantly influence the Global Automotive Door Guard Panel Assembly Market. Mandates on occupant protection and vehicle interior safety prompt automakers to comply through improved door guard assemblies. It drives the integration of advanced materials and design standards that meet or exceed regulatory requirements. Compliance with environmental norms regarding material recyclability and sustainability also shapes product development strategies. The focus on safety certifications enhances market credibility and encourages adoption among OEMs. Regulatory frameworks thus play a crucial role in sustaining consistent market growth.

Market Trends

Adoption of Lightweight and Sustainable Materials Shapes Market Dynamics

The Global Automotive Door Guard Panel Assembly Market increasingly incorporates lightweight and sustainable materials to meet evolving industry demands. Manufacturers shift toward advanced thermoplastics, composites, and recycled materials to reduce overall vehicle weight and improve fuel efficiency. It aligns with growing environmental regulations and consumer preference for eco-friendly products. The use of such materials also enhances durability and corrosion resistance, improving the longevity of door guard panels. This trend promotes innovation in material science and supports automakers’ sustainability goals. Suppliers invest in developing materials that balance performance with environmental impact, driving competitive differentiation.

For instance, the automotive door panel market is projected to grow significantly, driven by the increasing adoption of lightweight materials such as advanced plastics and composites

Integration of Advanced Manufacturing Technologies Enhances Product Quality

Manufacturers in the Global Automotive Door Guard Panel Assembly Market adopt cutting-edge manufacturing technologies to improve product precision and efficiency. Automation, robotics, and injection molding techniques enable consistent quality and reduced production times. It facilitates customization options and complex designs that meet specific OEM requirements. Enhanced process control reduces material waste and lowers production costs, benefiting both suppliers and automakers. The trend supports scalability and responsiveness to market demands, strengthening supply chain resilience. Ongoing investments in technology enable companies to maintain high standards and innovate continuously.

For instance, advancements in manufacturing technologies, including automation and robotics, are expected to drive efficiency and precision in automotive door panel production

Increasing Focus on Interior Aesthetics and Customization Drives Market Evolution

Consumer demand for visually appealing and customizable vehicle interiors impacts the Global Automotive Door Guard Panel Assembly Market substantially. Manufacturers offer door guard panels in diverse colors, textures, and finishes to enhance vehicle cabin aesthetics. It provides automakers with opportunities to differentiate products through personalized options tailored to target markets. The growing aftermarket for customized accessories also fuels demand for versatile door guard assemblies. This trend encourages collaboration between material suppliers and automotive designers to create innovative solutions. Enhanced focus on aesthetics supports customer satisfaction and brand loyalty.

Rising Production of Electric and Hybrid Vehicles Influences Market Trends

The transition toward electric and hybrid vehicles shapes the Global Automotive Door Guard Panel Assembly Market by redefining design and material requirements. Door guard panels must accommodate new vehicle architectures, weight distribution, and safety standards unique to electric drivetrains. It prompts innovation in lightweight construction and integration with electronic components. The shift encourages suppliers to develop multifunctional assemblies that contribute to overall vehicle efficiency and user experience. Growing EV production globally presents opportunities for market expansion and technological advancement. This trend drives continuous adaptation within the industry to meet emerging automotive needs.

Market Challenges

High Production Costs and Complex Manufacturing Processes Limit Market Expansion

The Global Automotive Door Guard Panel Assembly Market faces challenges from elevated production costs and complex manufacturing requirements. The use of advanced materials such as composites and lightweight thermoplastics increases raw material expenses. It requires specialized equipment and skilled labor, which raise overall manufacturing costs. Meeting stringent quality and safety standards further complicates production, leading to longer development cycles. These factors create cost pressures for suppliers and automakers, impacting pricing strategies and profit margins. Limited economies of scale in niche segments also restrict market growth potential. Overcoming these challenges demands continuous investment in efficient manufacturing technologies.

For instance, leading manufacturers such as Faurecia and Antolin have invested in over 500 automated production lines globally to streamline assembly processes and reduce costs.

Volatility in Raw Material Prices and Regulatory Compliance Impact Market Stability

Fluctuations in raw material prices pose significant risks to the Global Automotive Door Guard Panel Assembly Market’s stability. Variability in polymer and metal costs affects production budgets and supply chain planning. It challenges manufacturers to manage expenses while maintaining product quality and competitiveness. Strict environmental and safety regulations impose additional compliance costs and design constraints. Navigating diverse regional regulatory frameworks complicates global operations for market players. Ensuring sustainability without compromising performance demands innovation and strategic resource management. These obstacles require companies to adapt quickly to changing market and regulatory conditions.

Market Opportunities

Expanding Electric Vehicle Production Presents Significant Growth Opportunities

The Global Automotive Door Guard Panel Assembly Market benefits from the rapid expansion of electric vehicle (EV) production worldwide. The shift toward EVs drives demand for lightweight, durable, and multifunctional door guard panels tailored to new vehicle architectures. It creates opportunities for innovation in material selection and design integration to meet evolving safety and efficiency standards. Collaborations between automotive manufacturers and suppliers enhance product development focused on EV-specific requirements. Growing government incentives and consumer interest in electric mobility further boost market potential. This trend encourages investments in research and development to capture emerging segments within the automotive industry.

Rising Demand for Customization and Aftermarket Solutions Expands Market Reach

Increasing consumer preference for personalized vehicle interiors opens new avenues in the Global Automotive Door Guard Panel Assembly Market. The demand for customizable panels in diverse colors, finishes, and materials provides opportunities for product differentiation. It supports the growth of aftermarket solutions, enabling retrofitting and upgrades for existing vehicles. Suppliers can leverage flexible manufacturing techniques to cater to varied customer needs and enhance brand loyalty. Expansion into emerging markets with growing vehicle ownership further broadens the market base. These factors encourage market players to develop innovative, consumer-centric offerings that align with changing preferences.

Market Segmentation Analysis

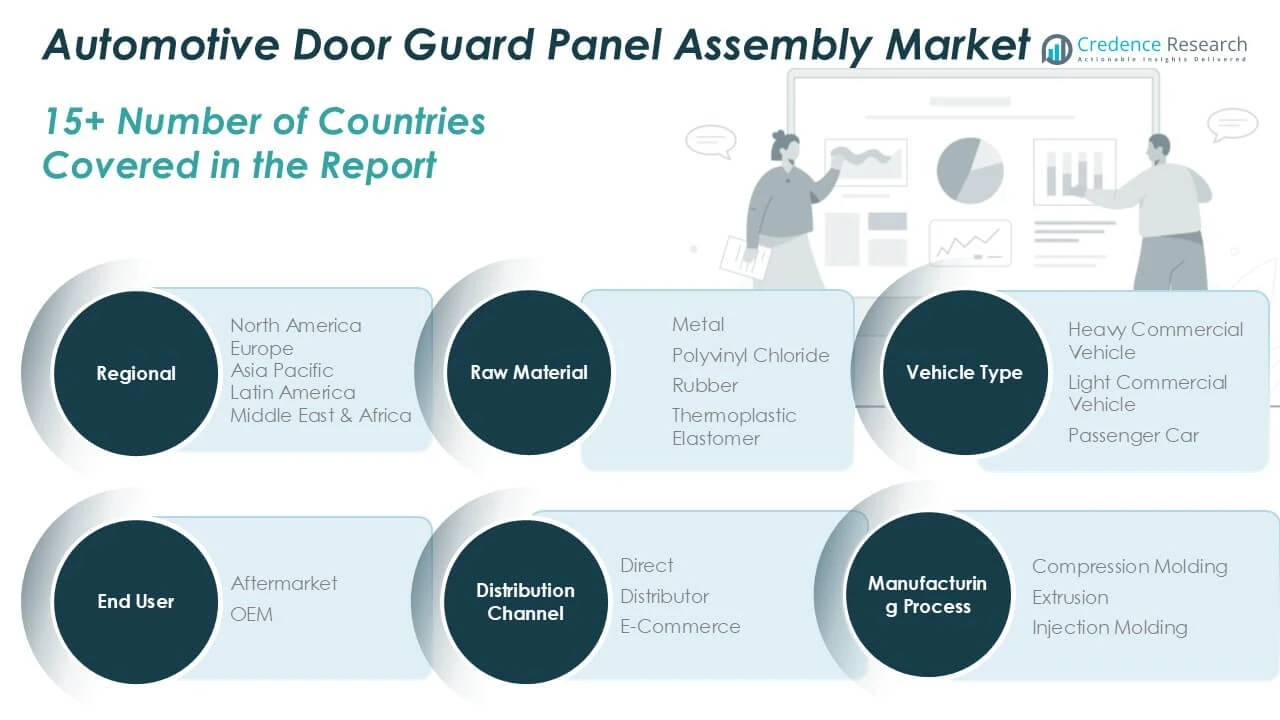

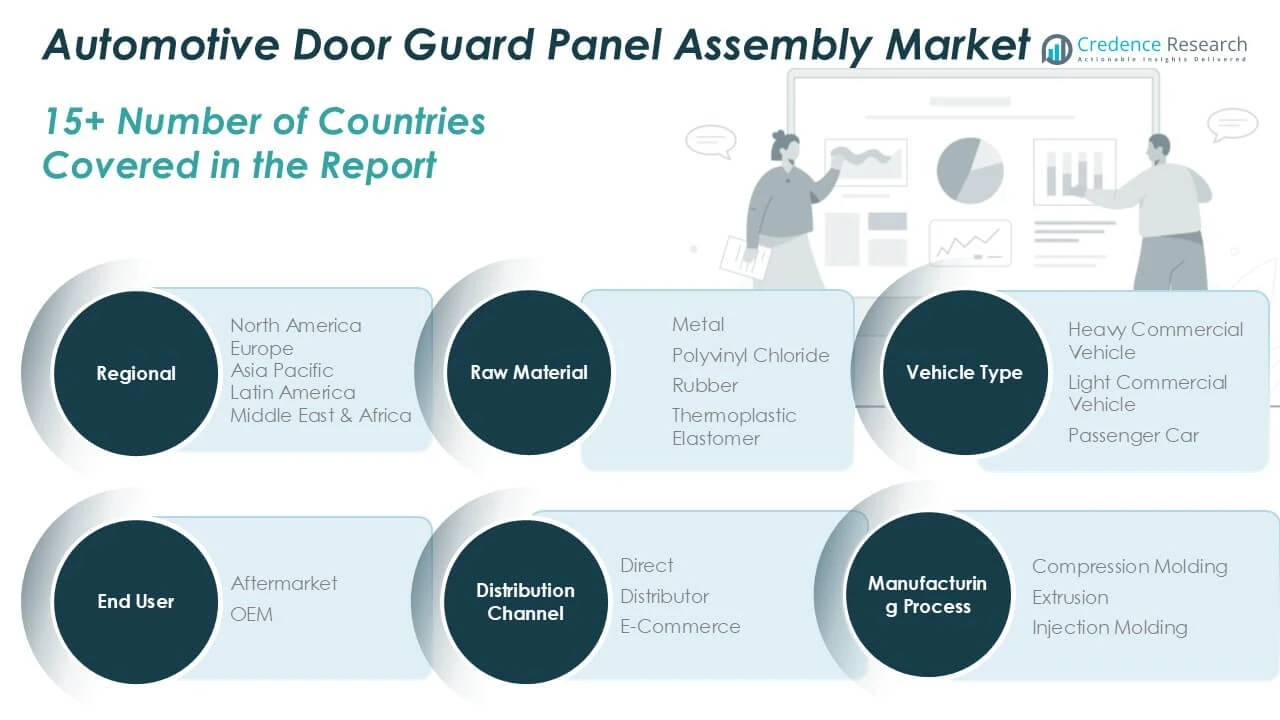

By Raw Material Segment

The Global Automotive Door Guard Panel Assembly Market divides into key raw material segments including metal, polyvinyl chloride (PVC), rubber, and thermoplastic elastomer (TPE). Metal maintains a significant revenue share due to its durability and structural strength, making it suitable for high-end and commercial vehicle applications. PVC and rubber offer cost-effective, flexible alternatives with strong resistance to wear and environmental factors, appealing to mass-market passenger vehicles. Thermoplastic elastomers gain traction for their lightweight properties and design versatility, supporting fuel efficiency and customization trends. The diversity of raw materials allows manufacturers to balance performance, cost, and aesthetic requirements across vehicle segments.

By Vehicle Type Segment

The market segments by vehicle type into heavy commercial vehicles, light commercial vehicles, and passenger cars. Passenger cars hold the largest share, driven by growing consumer demand for enhanced interior protection and aesthetic appeal. Light commercial vehicles contribute to steady market growth due to increasing logistics and delivery operations worldwide. Heavy commercial vehicles also account for a notable portion, with emphasis on rugged and durable door guard panel assemblies designed to withstand harsh operational conditions. Each vehicle type influences product specifications and material selection within the market.

By End-User Segment

The Global Automotive Door Guard Panel Assembly Market categorizes end-users into original equipment manufacturers (OEMs) and aftermarket segments. OEMs dominate revenue share by integrating door guard panels during vehicle production, focusing on quality and compliance with safety standards. The aftermarket segment shows rising demand driven by vehicle maintenance, repairs, and customization trends. Growing consumer interest in retrofitting older vehicles supports aftermarket growth. Both segments create dynamic opportunities for manufacturers and suppliers.

By Manufacturing Process Segment

Manufacturing processes in the market include compression molding, extrusion, and injection molding. Injection molding leads due to its efficiency, precision, and ability to produce complex designs with high repeatability. Compression molding offers advantages in handling thicker, more durable materials for heavy-duty applications. Extrusion provides cost-effective solutions for producing uniform profiles in large volumes. Process selection depends on material characteristics, design complexity, and production scale, influencing product quality and market competitiveness.

By Distribution Channel Segment

The market distributes through direct sales, distributors, and e-commerce platforms. Direct sales primarily target OEMs, ensuring seamless integration with vehicle manufacturing. Distributors support aftermarket reach by providing broad access to spare parts and accessories globally. E-commerce emerges as a growing channel, enabling convenient access to customized and replacement door guard panels for consumers and smaller businesses. Expanding digital sales channels enhances market penetration and customer engagement.

Segments

Based on Raw Material

- Metal

- Polyvinyl Chloride

- Rubber

- Thermoplastic Elastomer

Based on Vehicle Type

- Heavy Commercial Vehicle

- Light Commercial Vehicle

- Passenger Car

Based on End-user

Based on Control Mechanism

- Compression Molding

- Extrusion

- Injection Molding

Based on Distribution Channel

- Direct

- Distributor

- E-Commerce

Based on Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America Automotive Door Guard Panel Assembly Market

The North America Automotive Door Guard Panel Assembly Market holds the largest regional share of approximately 34.2%, valued at USD 781.91 million in 2024 and projected to reach USD 1,217.98 million by 2032, growing at a CAGR of 5.7%. The region benefits from a strong automotive manufacturing base, especially in the United States and Canada. It emphasizes stringent safety standards and advanced vehicle designs, driving demand for high-quality door guard panels. Consumer preference for premium and customized interiors supports market expansion. Investments in electric and autonomous vehicle technologies create further growth avenues. The mature aftermarket sector contributes steady revenue streams, solidifying North America’s market leadership.

Europe Automotive Door Guard Panel Assembly Market

Europe accounts for around 27.7% of the global Automotive Door Guard Panel Assembly Market, valued at USD 633.33 million in 2024 and expected to reach USD 926.27 million by 2032, with a CAGR of 4.9%. The region’s stringent vehicle safety regulations prompt manufacturers to adopt advanced door guard assemblies. Germany, France, and the UK serve as key automotive hubs, fostering innovation and quality improvements. Increasing electric vehicle adoption and sustainability focus influence product trends. Europe’s dedication to emission reduction drives demand for lightweight panels. Strong OEM presence and well-established aftermarket networks ensure market resilience.

Asia Pacific Automotive Door Guard Panel Assembly Market

The Asia Pacific region holds approximately 22.1% market share, with a value of USD 504.66 million in 2024 projected to rise to USD 903.36 million by 2032, reflecting the highest CAGR of 7.7%. Rapid industrialization and automotive production growth in China, India, Japan, and South Korea propel demand. Rising disposable incomes and increasing safety awareness drive adoption of premium door guard panels. Growing electric vehicle production expands market opportunities. A developing aftermarket and urbanization further boost market potential. Asia Pacific remains a critical target for manufacturers focusing on emerging economies.

Latin America Automotive Door Guard Panel Assembly Market

Latin America represents about 6.2% of the global market, valued at USD 141.14 million in 2024 and forecasted to reach USD 200.06 million by 2032, with a CAGR of 4.5%. Brazil and Mexico lead automotive production, supporting door guard panel demand. Trends toward vehicle customization and aftermarket replacements bolster growth. Economic development and infrastructure upgrades positively impact vehicle sales. Regulatory variability and supply chain challenges limit expansion. The region offers opportunities for cost-efficient, durable product solutions.

Middle East Automotive Door Guard Panel Assembly Market

The Middle East captures approximately 4.1% market share, with a valuation of USD 93.18 million in 2024, expected to grow to USD 130.44 million by 2032, at a CAGR of 4.3%. Expanding automotive sales of luxury and commercial vehicles stimulate demand for enhanced interior components. Investments in infrastructure and urban mobility encourage vehicle ownership. Economic volatility presents challenges, though increasing consumer spending on customization supports growth. The market aligns with regional efforts to boost vehicle safety standards. Opportunities exist for advanced materials adapted to local climates.

Africa Automotive Door Guard Panel Assembly Market

Africa holds about 5.7% of the global market share, with a valuation of USD 129.92 million in 2024 projected to reach USD 167.13 million by 2032, growing at a CAGR of 2.7%. Increasing vehicle ownership and demand for affordable aftermarket parts underpin market growth. South Africa leads regional manufacturing and aftermarket services. Economic constraints and limited regulatory enforcement restrain expansion but drive demand for cost-sensitive solutions. Urban infrastructure improvements and rising maintenance awareness offer future potential. Africa remains an emerging market with promising growth prospects.

Key players

- Yanfeng Automotive Interiors Co., Ltd.

- Magna International Inc.

- Faurecia SE

- Lear Corporation

- Adient plc

- Grupo Antolin-Irausa S.A.

- Plastic Omnium SE

- Toyota Boshoku Corporation

- Inteva Products, LLC

- NHK Spring Co., Ltd.

Competitive Analysis

The Automotive Door Guard Panel Assembly Market features intense competition among well-established global players and emerging suppliers. Leading companies such as Yanfeng Automotive Interiors, Magna International, and Faurecia focus on innovation, product quality, and strategic partnerships to strengthen market presence. It drives continuous improvements in material technology, manufacturing efficiency, and customization capabilities. Market leaders leverage extensive R\&D investments to develop lightweight, durable, and environmentally friendly door guard panels tailored to diverse vehicle types. The competitive landscape also emphasizes expanding geographic footprints and catering to the growing demand for electric and hybrid vehicles. Smaller players differentiate through niche product offerings and agility in meeting aftermarket requirements. This dynamic competition fosters ongoing product evolution and benefits end-users through enhanced safety and aesthetic options.

Recent Developments

- In November 2024, Adient entered into a joint development agreement with automation company Paslin to enhance automated processes for automotive interior components, including door panels.

- In April 2024, Plastic Omnium and Brose announced a partnership to manufacture and market new side-door systems for vehicles, incorporating cylinder-shaped door designs with both plastic and metal elements.

- In February 2025, Lear Corporation announced a key engineering integration with General Motors to introduce the ComfortMax Seat, integrating thermal comfort technologies into trim covers, providing occupant comfort and well-being, superior thermal management, and improved manufacturing efficiency.

Market Concentration and Characteristics

The Automotive Door Guard Panel Assembly Market exhibits a moderately concentrated structure dominated by a few key global players such as Yanfeng Automotive Interiors, Magna International, and Faurecia. It features high entry barriers due to the need for advanced manufacturing capabilities, stringent quality standards, and significant R&D investments. Leading companies maintain competitive advantages through innovation in lightweight materials, design customization, and compliance with evolving safety and environmental regulations. The market balances OEM demand with growing aftermarket opportunities, fostering diversified revenue streams. Regional specialization and strong supplier relationships further characterize market dynamics. Competitive differentiation often relies on technological expertise and the ability to adapt quickly to changing automotive trends. This concentration supports stable growth while encouraging continuous product development to meet diverse industry requirements.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Raw Material, Vehicle Type, End-user, Control Mechanism, Distribution Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Automotive Door Guard Panel Assembly Market will expand steadily, driven by increasing global vehicle production and rising demand for interior protection solutions.

- Adoption of lightweight and sustainable materials will accelerate, enabling manufacturers to meet stricter fuel efficiency and emission regulations.

- Technological advancements in manufacturing processes, such as automation and injection molding, will improve product quality and reduce production costs.

- Growth in electric and hybrid vehicle segments will create demand for innovative door guard panels tailored to new vehicle architectures.

- Rising consumer preference for vehicle customization will drive the development of diverse designs, colors, and finishes in door guard assemblies.

- The aftermarket segment will experience notable growth, fueled by vehicle maintenance, repair, and retrofit trends globally.

- Expansion in emerging markets, particularly Asia-Pacific and Latin America, will contribute significantly to overall market growth.

- Strategic collaborations between OEMs and suppliers will increase, fostering innovation and faster product development cycles.

- Regulatory pressure regarding safety, recyclability, and environmental sustainability will continue to influence material selection and product design.

- Digitalization of distribution channels, including e-commerce, will enhance market reach and provide consumers with convenient access to replacement and customized door guard panels.