Market Overview

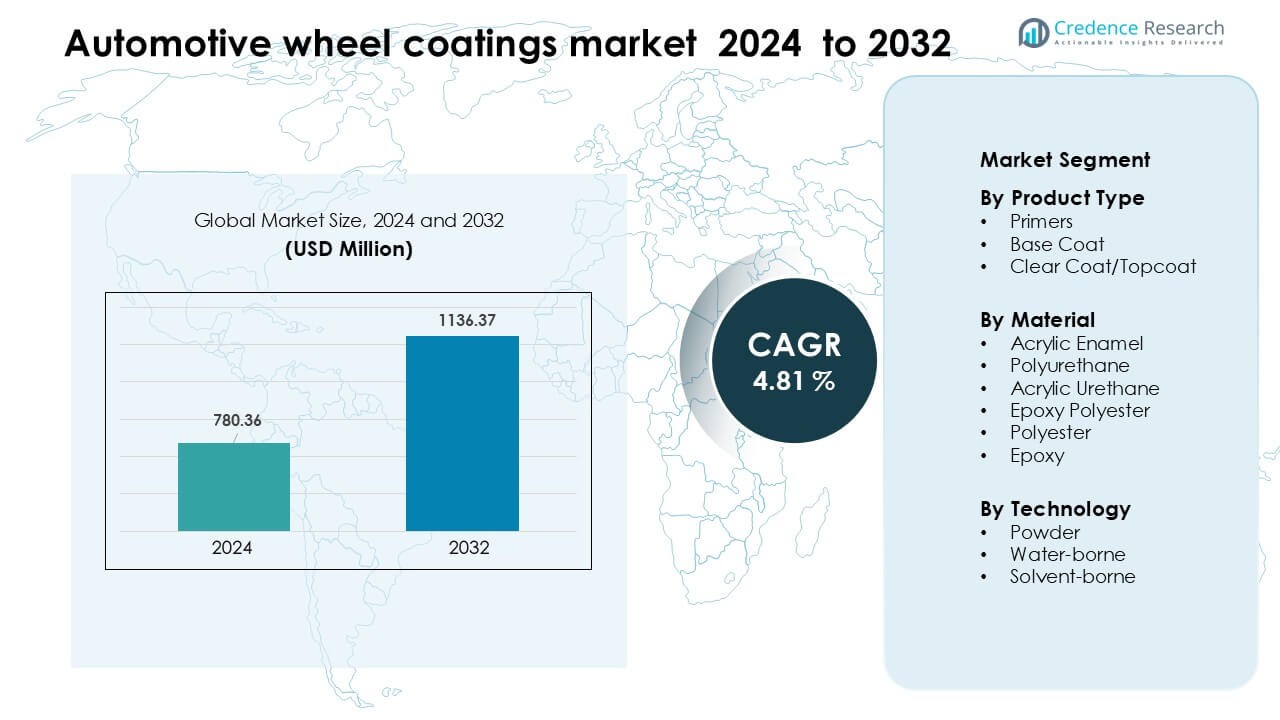

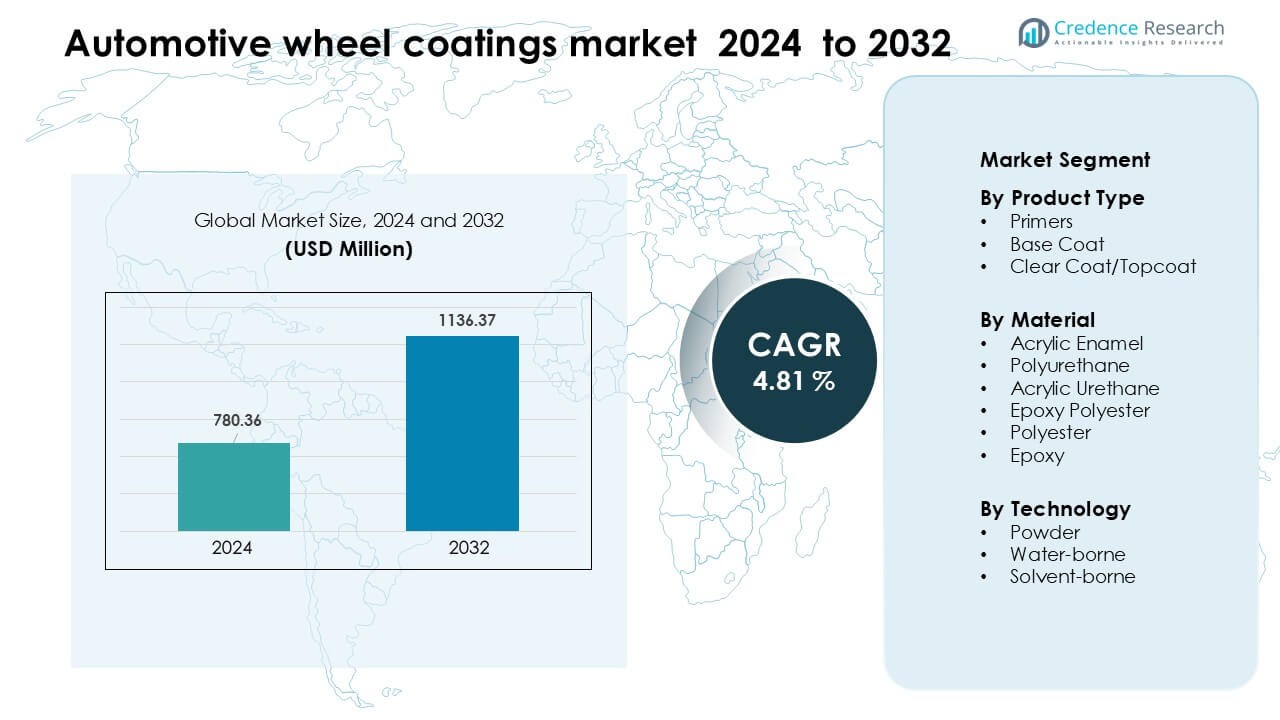

Automotive wheel coatings market was valued at USD 780.36 million in 2024 and is anticipated to reach USD 1136.37 million by 2032, growing at a CAGR of 4.81 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Automotive wheel coatings Market Size 2024 |

USD 780.36 Million |

| Automotive wheel coatings Market, CAGR |

4.81 % |

| Automotive wheel coatings Market Size 2032 |

USD 1136.37 Million |

The automotive wheel coatings market is shaped by leading companies such as Jotun A/S, Axalta Coating Systems LLC, KCC Corporation, BASF SE, Hempel A/S, Kansai Paint Co. Ltd., The Sherwin-Williams Company, Nippon Paint Holdings Co. Ltd., PPG Industries Inc., and AkzoNobel N.V. These manufacturers strengthened their positions through advanced primer, base coat, and powder-coating technologies that support durability, corrosion protection, and low-VOC compliance. Product innovation remained central as suppliers introduced harder clear coats and eco-friendly formulations for OEM and aftermarket wheels. Asia Pacific led the global market in 2024 with about 34% share, driven by large automotive production hubs and rapid alloy wheel adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The automotive wheel coatings market reached USD 780.36 million in 2024 and is projected to hit USD 1136.37 million by 2032, growing at a 4.81% CAGR during the forecast period.

- Strong demand for alloy wheels, low-VOC coatings, and durable powder technologies drives steady adoption across OEM and aftermarket sectors, with primers holding the largest segment share due to higher corrosion-protection needs.

- Trends show rapid growth in powder coatings, self-healing clear coats, and energy-efficient curing systems as manufacturers upgrade to automated and eco-friendly production lines.

- Competition remains high as leading companies expand portfolios in polyurethane, acrylic, and powder systems, focusing on scratch resistance, UV stability, and regulatory compliance while forming OEM supply partnerships.

- Asia Pacific led the market with 34% share in 2024, followed by North America and Europe; high vehicle production, EV growth, and rising customization trends strengthen regional dominance and widen future expansion opportunities.

Market Segmentation Analysis:

By Product Type

Primers led the product type segment in 2024 with about 41% share. Demand grew as automakers focused on stronger wheel adhesion, corrosion resistance, and better surface prep for multilayer systems. Base coats gained traction with rising customization trends, while clear coat/topcoat products advanced due to improved UV stability in premium models. Growth in the leading primer category came from wider OEM use, expanding alloy wheel production, and higher adoption of anti-chip formulations in mid-range vehicles.

- For instance, Axalta’s AquaEC range for automotive components can achieve the specified film thickness with a high first‑run‑OK rate, even on alloy wheels, ensuring strong adhesion and low waste.

By Material

Polyurethane dominated the material segment in 2024 with roughly 36% share. The material gained preference for its strong chemical resistance, flexible film structure, and long-term durability on high-speed wheels. Acrylic enamel and acrylic urethane maintained steady use in cost-focused models, while epoxy polyester coatings advanced due to their high hardness and scratch resistance. The leading polyurethane category benefitted from rising wheel personalization, growing EV output, and higher demand for finishes that withstand road salts and abrasive debris.

- For instance, Axalta manufactures a product named Imron® 2.1 PR Polyurethane Primer. It is a two-package, low HAPS polyurethane primer.

By Technology

Powder coatings held the dominant position in 2024 with nearly 52% share. Producers selected powder systems due to stronger environmental compliance, zero-solvent content, and high mechanical performance on aluminum and steel wheels. Water-borne systems gained momentum as OEMs reduced VOC levels, while solvent-borne coatings retained specific applications requiring fast drying cycles. Powder coating strength came from its uniform finish quality, lower waste generation, and wider deployment in automated coating lines across global wheel manufacturing hubs.

Key Growth Drivers

Rising Demand for Lightweight and Stylish Alloy Wheels

Automakers increased the use of lightweight alloy wheels to improve vehicle efficiency, fuel savings, and driving comfort. This shift supported stronger demand for advanced wheel coatings that deliver high adhesion, corrosion protection, and long-term finish stability. Buyers also preferred premium metallic and custom finishes, encouraging suppliers to expand UV-resistant and chip-resistant coating lines. Growing interest in personalization across passenger vehicles pushed OEMs and aftermarket vendors to adopt multi-layer coating systems with richer aesthetics. Electric vehicle manufacturers further accelerated this trend as lightweight wheels support extended driving range, requiring durable coatings that handle higher torque loads and frequent temperature shifts.

- For instance, BASF’s CathoGuard 800 e‑coat technology has been applied on more than 200 million cars, offering high throw‑power coverage even on complex wheel geometries and excellent edge corrosion protection under road‑salt exposure.

Strong Regulatory Pressure for Low-VOC and Eco-Friendly Technologies

Governments tightened emission rules, pushing automakers to adopt coatings that reduce VOC release and meet cleaner production standards. This increased interest in powder-based and water-borne coatings, which provide durable film build without harmful solvents. Production plants also upgraded curing systems to align with sustainability targets and reduce operational emissions. As environmental safety grew in importance, suppliers focused on low-toxicity formulations, recyclable materials, and reduced waste generation. These changes strengthened demand for eco-friendly coating technologies that deliver high mechanical strength and cost-efficient performance, making green coatings a preferred choice in OEM and aftermarket wheels.

- For instance, Axalta’s AquaEC® 6100 waterborne coating operates with a VOC content around 40 g/L, substantially lower than traditional solvent systems, while reducing bake temperatures by 28%, thereby cutting CO₂ emissions during curing.

Expansion of Global Vehicle Production and Aftermarket Customization

Higher vehicle output, especially in Asia-Pacific and North America, expanded the need for consistent and high-performance wheel finishing solutions. Growth in SUVs, crossovers, and premium sedans increased the use of protective coatings capable of resisting harsh road chemicals and abrasive debris. Aftermarket custom shops also saw a rise in demand for matte, gloss, textured, and metallic finishes, supporting wider use of clear coats and multi-layer systems. As consumers replaced wheels more frequently and opted for visually enhanced designs, coating suppliers benefited from recurring sales. This steady expansion helped manufacturers introduce faster-curing and scratch-resistant products tailored for large-scale coating lines.

Key Trend & Opportunity

Shift Toward Smart, Self-Healing, and High-Durability Coatings

Manufacturers explored smart coatings with self-healing properties that reduce micro-scratches and maintain finish quality across longer use cycles. Advanced polymer systems enhanced resilience against stone chips and road salts, helping automakers reduce warranty claims. Suppliers also developed nanostructured coatings that boost UV protection and chemical resistance, creating a strong opportunity for premium wheel designs. These new materials aligned well with high-performance EVs and luxury vehicles, where surface quality drives brand perception. As demand for long-life and low-maintenance wheels increased, high-durability and self-repairing coatings became a lucrative space for product differentiation.

- For instance, Feynlab Self Heal Plus ceramic nano‑coating reaches a thickness of up to 10 microns in a single application and up to 15 µm.

Automation and Digital Integration in Coating Lines

Wheel manufacturers adopted robotic spray systems, precision powder booths, and AI-based inspection tools to improve accuracy and reduce waste. Automated lines helped plants maintain uniform coating thickness, optimize curing cycles, and reduce labor costs. Digital monitoring tools tracked surface defects in real time, enabling faster correction and stronger quality control. These advancements created opportunities for suppliers offering smart sensors, integrated curing equipment, and energy-efficient furnace designs. As automation supported consistent large-volume production, coating manufacturers benefitted from stable demand across global OEM supply chains.

- For instance, ISRA Vision’s PAINTSCAN Compact system uses up to four robots equipped with LED line scanners that inspect surfaces at 200 Hz, detecting defects ≥ 0.15 mm with a > 98.5% detection rate.

Key Challenge

High Cost of Advanced Coating Materials and Equipment

Premium wheel coatings require specialized resins, pigments, curing systems, and high-temperature processing units. These inputs drive up production costs for OEMs and create adoption barriers for cost-sensitive segments, especially in developing regions. Powder coating lines also involve capital-intensive curing ovens, electrostatic guns, conveyors, and ventilation systems. Suppliers must balance performance with cost-effective formulations to stay competitive. Small and mid-scale manufacturers face difficulty upgrading to eco-friendly coatings due to operational overheads, limiting widespread market penetration.

Complexity of Meeting Diverse Performance and Compliance Standards

Wheel coatings must withstand varied conditions including heat cycles, UV exposure, high-speed debris, and chemical attacks from road salts or brake dust. Meeting strict global standards, such as REACH or low-VOC rules, adds complexity to formulation and testing processes. Differences in OEM specifications across regions require tailored coating blends, slowing production standardization. These challenges force suppliers to invest heavily in R&D and testing labs to ensure consistent performance. Compliance updates and evolving sustainability norms further increase pressure on manufacturers to rapidly adapt their product lines.

Regional Analysis

North America

North America held about 32% share of the automotive wheel coatings market in 2024, driven by strong vehicle production, wider use of alloy wheels, and high demand for premium finishes. OEMs in the U.S. and Canada adopted powder and polyurethane coatings to enhance durability and meet strict VOC regulations. Growth also came from rising SUV and pickup sales, which require heavy-duty wheel protection. Aftermarket customization remained strong, supporting demand for matte, gloss, and metallic finishes. Investments in automated coating lines and sustainable formulations further strengthened the region’s leadership.

Europe

Europe captured nearly 28% share in 2024, supported by advanced automotive manufacturing hubs and strict environmental laws that encouraged water-borne and low-VOC coating adoption. German, French, and Italian OEMs emphasized high-performance clear coats for luxury and performance models. The region also benefited from rising EV production, pushing demand for lightweight wheels that require durable powder coatings. Growth in corrosion-resistant solutions increased due to frequent winter road salt use across Northern and Central Europe. Sustainability targets accelerated R&D in recyclable and energy-efficient coating technologies, keeping Europe a key innovation center.

Asia Pacific

Asia Pacific dominated with around 34% share in 2024, driven by expanding automotive production in China, Japan, India, and South Korea. Strong consumer preference for alloy wheels and rising EV adoption supported demand for advanced primer and powder coating systems. Regional manufacturers upgraded facilities to meet stricter emission norms, increasing the use of water-borne solutions. Large aftermarket networks in India and Southeast Asia boosted sales of custom wheel finishes. Competitive manufacturing costs and rapid industrialization positioned Asia Pacific as the fastest-growing market for high-durability and eco-friendly wheel coating technologies.

Latin America

Latin America accounted for nearly 4% share in 2024, supported by moderate vehicle production in Brazil, Mexico, and Argentina. The market expanded as OEMs adopted improved corrosion-resistant coatings to handle humid climates and variable road conditions. Growth in mid-range passenger vehicles increased the use of acrylic and polyurethane coatings. Aftermarket customization also gained traction, particularly in urban centers where aesthetic upgrades are popular. Although environmental standards remain less strict than in Europe or North America, gradual regulatory tightening encouraged wider adoption of water-borne formulations across major manufacturing sites.

Middle East & Africa

The Middle East & Africa region held about 2% share in 2024, driven by rising vehicle imports, expanding aftermarket customization, and demand for coatings that withstand extreme heat and sand abrasion. Gulf countries increased use of high-durability clear coats and powder coatings to protect premium alloy wheels. South Africa supported regional demand through its established automotive assembly base. Growth remained steady as suppliers introduced UV-stable and corrosion-resistant solutions suited to harsh climates. Investment in urban mobility projects and higher adoption of SUVs further supported wheel coating consumption across key markets.

Market Segmentations:

By Product Type

- Primers

- Base Coat

- Clear Coat/Topcoat

By Material

- Acrylic Enamel

- Polyurethane

- Acrylic Urethane

- Epoxy Polyester

- Polyester

- Epoxy

By Technology

- Powder

- Water-borne

- Solvent-borne

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The automotive wheel coatings market features strong competition led by major companies such as Jotun A/S, Axalta Coating Systems LLC, KCC Corporation, BASF SE, Hempel A/S, Kansai Paint Co. Ltd., The Sherwin-Williams Company, Nippon Paint Holdings Co. Ltd., PPG Industries Inc., and AkzoNobel N.V. These manufacturers expanded portfolios across primers, base coats, clear coats, and advanced powder technologies to meet rising demand from OEMs and aftermarket suppliers. Vendors focused on corrosion resistance, UV durability, and low-VOC performance to align with tightening environmental rules across key regions. Companies invested in automated coating lines, new curing technologies, and eco-friendly formulations to enhance product efficiency and reduce operational costs. Strategic partnerships with automotive manufacturers supported large-volume supply agreements, while constant R&D strengthened offerings in scratch-resistant and high-appearance finishes. Competition intensified as EV production accelerated, pushing suppliers to deliver lightweight, high-performance coatings optimized for premium alloy wheels.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Jotun A/S

- Axalta Coating Systems LLC

- KCC Corporation

- BASF SE

- Hempel A/S

- Kansai Paint Co. Ltd.

- The Sherwin-Williams Company

- Nippon Paint Holdings Co. Ltd.

- PPG Industries Inc.

- AkzoNobel N.V.

Recent Developments

- In January 2025, Axalta announced its 2025 Global Automotive Color of the Year (Evergreen Sprint) a marketing/product move that supports OEM and refinish color portfolios used across vehicle exteriors and wheel-finishes. (Color leadership frequently drives specification choices for wheel/tire trim and accessory finishes).

- In March 2024, KCC entered into an agreement to fully acquire Momentive Performance Materials Group (a strategic acquisition expanding KCC’s materials and specialty solutions that can feed into automotive coatings and surface-protection technologies used on vehicle components, including wheel systems).

Report Coverage

The research report offers an in-depth analysis based on Product Type, Material, Technology and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow as automakers increase the use of lightweight alloy wheels.

- Demand will rise for low-VOC and eco-friendly coating technologies worldwide.

- Powder coatings will gain wider adoption due to durability and regulatory compliance.

- EV expansion will boost the need for high-performance and heat-resistant coating systems.

- Advanced clear coats with stronger UV and scratch resistance will see faster development.

- Automated coating lines will expand as manufacturers improve efficiency and quality control.

- Self-healing and nanotechnology-based coatings will create new premium opportunities.

- Aftermarket customization will strengthen demand for matte, gloss, and metallic finishes.

- Regional players will invest more in sustainable raw materials and greener processes.

- Collaboration between OEMs and coating suppliers will accelerate innovation and global supply stability.