Market Overview

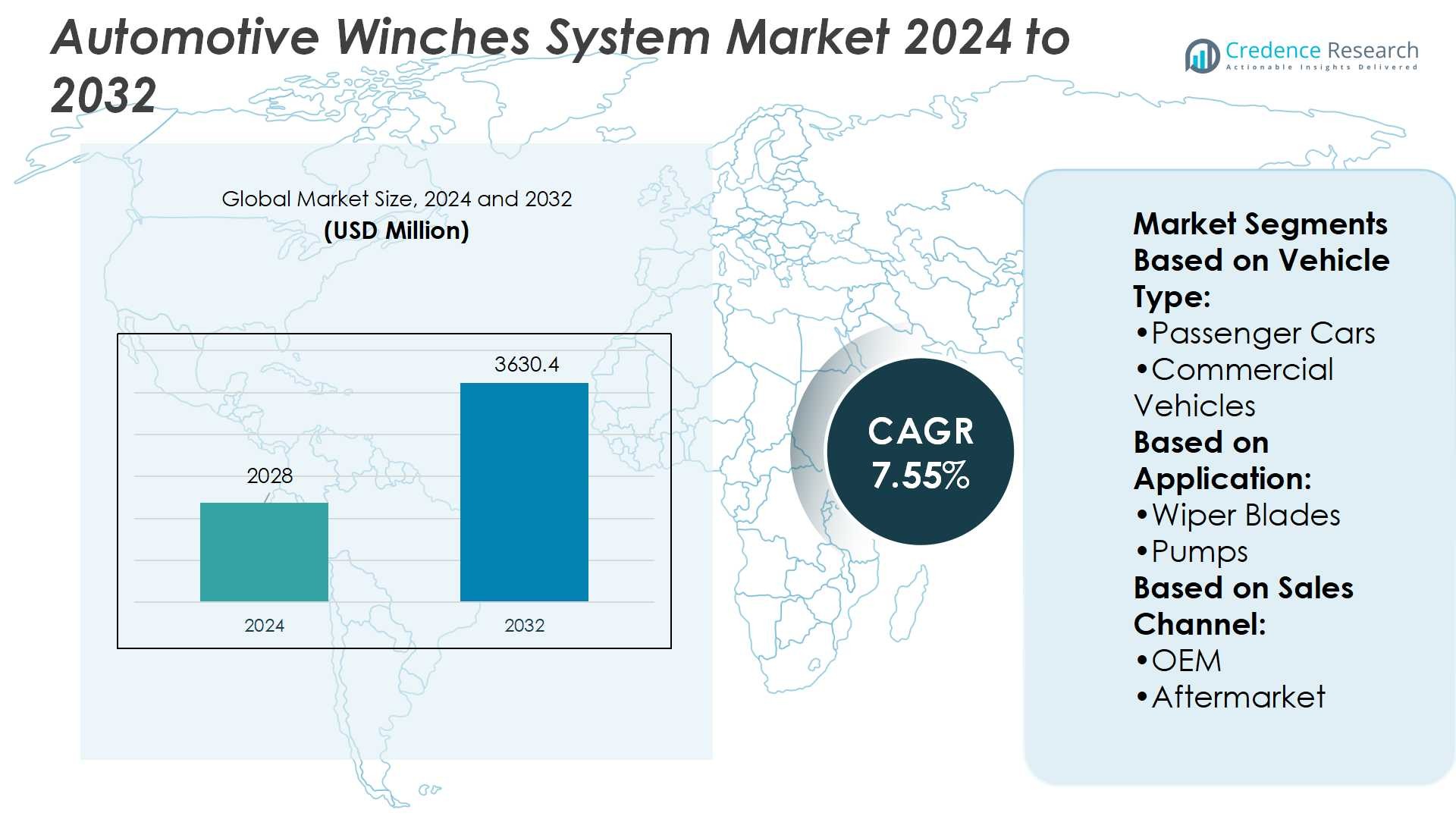

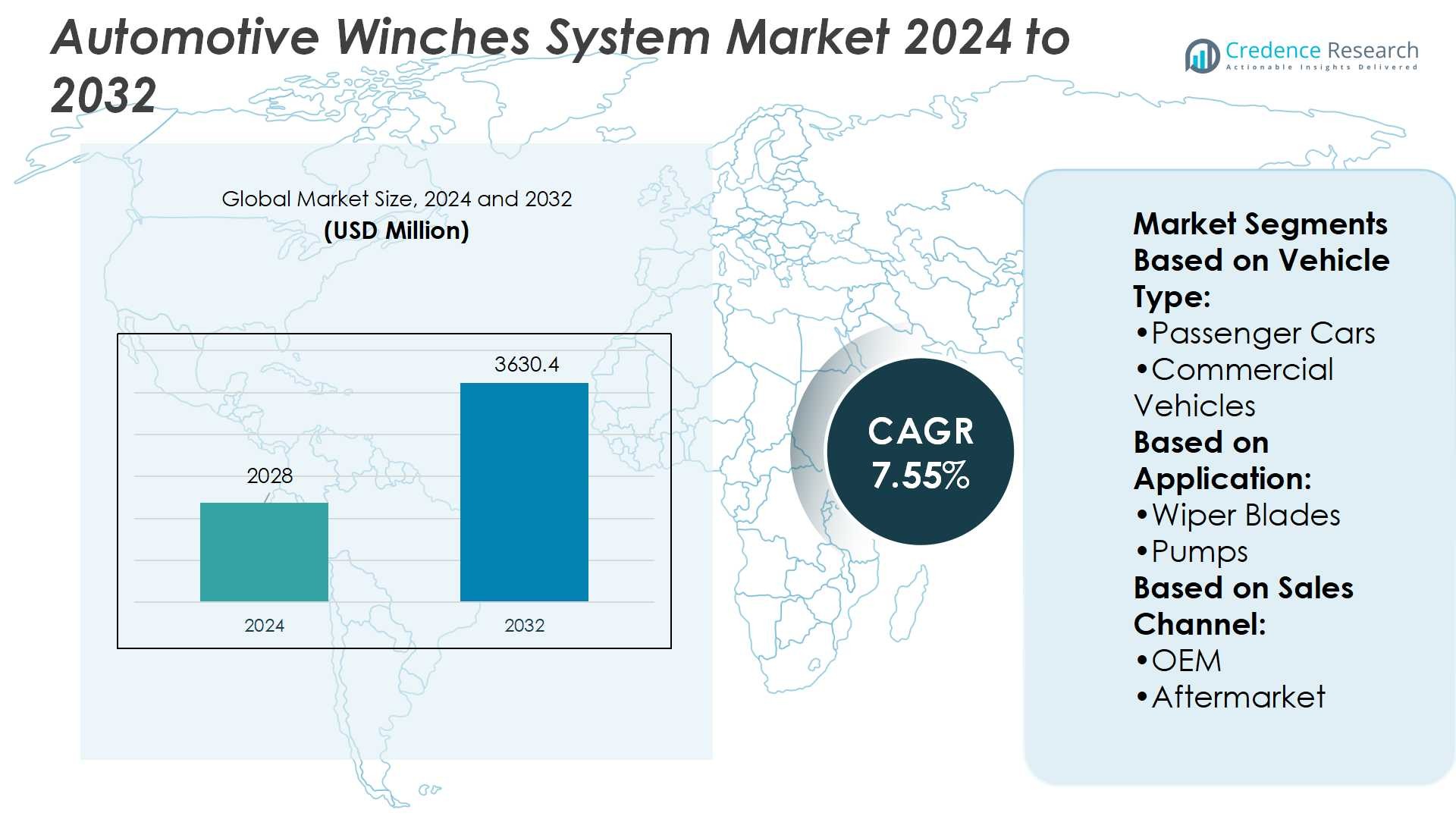

Automotive Winches System Market size was valued at USD 2028 million in 2024 and is anticipated to reach USD 3630.4 million by 2032, at a CAGR of 7.55% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Automotive Winches System Market Size 2024 |

USD 2028 Million |

| Automotive Winches System Market, CAGR |

7.55% |

| Automotive Winches System Market Size 2032 |

USD 3630.4 Million |

The Automotive Winches System Market is driven by rising demand for off-road vehicles, expanding use in commercial fleets, and growing emphasis on safety and operational efficiency. Consumers adopt winches for recovery, towing, and load handling, while industries rely on them for heavy-duty operations. It benefits from advancements in electric and hydraulic systems, supported by higher vehicle production and infrastructure growth. Market trends highlight the shift toward lightweight synthetic ropes, smart controls with wireless operation, and vehicle-specific customization. Increasing popularity of adventure tourism and the integration of durable, technology-enhanced winches further reinforce growth across both OEM and aftermarket channels.

The Automotive Winches System Market shows strong geographical presence, with North America leading due to high SUV and truck adoption, followed by Europe with strict safety standards and Asia Pacific emerging as the fastest-growing region. Latin America and the Middle East & Africa record steady demand from construction and utility sectors. Key players shaping the market include DENSO Corporation, DOGA Group, HELLA GmbH & Co. KGaA, Magneti Marelli S.p.A., Mitsuba Corporation, PEWAG Schneeketten GmbH, Robert Bosch GmbH, Tenneco Inc., TRICO Products Corporation, and Valeo SA.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Automotive Winches System Market size was USD 2028 million in 2024 and will reach USD 3630.4 million by 2032 at a CAGR of 7.55%.

- Rising demand for off-road vehicles and expanding use in commercial fleets drive steady adoption.

- Strong emphasis on safety and operational efficiency pushes integration of advanced winching systems.

- Market trends highlight the use of lightweight synthetic ropes, wireless smart controls, and vehicle-specific customization.

- Competition remains intense with global and regional players focusing on innovation, OEM partnerships, and aftermarket expansion.

- High costs of advanced systems and maintenance needs act as restraints for cost-sensitive markets.

- North America leads with strong SUV and truck demand, Europe follows with strict safety standards, Asia Pacific grows fastest, while Latin America and the Middle East & Africa show steady demand from construction and utility sectors.

Market Drivers

Growing Demand for Off-Road and Recreational Vehicles

The Automotive Winches System Market benefits from the rising popularity of off-road and recreational vehicles. Enthusiasts seek reliable equipment for vehicle recovery during outdoor activities. It supports safe navigation across rugged terrains by enabling quick vehicle retrieval. Growing interest in adventure tourism and trail driving fuels demand for advanced winching solutions. Manufacturers design systems with higher pulling capacity and compact integration to suit SUVs and pickup trucks. Strong consumer interest in durable recovery tools makes winches a necessary accessory for off-road applications.

- For instance, Warn Industries’ Zeon 10-S winch offers a line pull rating of 10,000 lb with a 100 ft synthetic rope and draws 409 amps under full load when pulling that weight.

Increasing Use of Winches in Commercial and Industrial Applications

Commercial fleets and utility vehicles rely on winches for loading, towing, and recovery tasks. The Automotive Winches System Market strengthens adoption across construction, mining, and logistics operations. It ensures efficient handling of heavy loads while reducing manual effort. Growing urban infrastructure projects and rising fleet deployment drive significant use of winching systems. Integration of hydraulic and electric winches enhances operational safety and minimizes downtime. Demand for heavy-duty, reliable solutions continues to expand within industrial environments.

- For instance, David Round’s 202-Series Electric Winch, model H202SR, offers a single-line capacity of 10,000 lbs, with a drum capacity of 420 ft of ½-inch wire rope, and operates at a line speed of 14 feet per minute.

Rising Emphasis on Vehicle Safety and Operational Efficiency

Automotive winches support vehicle safety by enabling controlled load handling and recovery. The Automotive Winches System Market aligns with regulations promoting equipment that improves operator safety. It reduces accident risks during towing or recovery operations by ensuring stability. Advanced systems now include wireless controls and automatic braking features to improve usability. Fleet operators and private owners adopt winches to avoid costly delays and damage. This growing emphasis on safety and efficiency enhances market adoption across multiple vehicle categories.

Technological Advancements and Product Innovation Driving Growth

Continuous innovation in winch design boosts market growth through lightweight, high-performance models. The Automotive Winches System Market benefits from integration of smart controls and durable synthetic ropes. It allows operators to achieve precision, faster response, and longer system life. Wireless remote systems, corrosion-resistant materials, and energy-efficient motors are setting new standards. Manufacturers expand portfolios to address consumer preferences for convenience and durability. These advancements accelerate adoption across both recreational and professional vehicle markets.

Market Trends

Rising Integration of Electric and Hydraulic Winch Systems

The Automotive Winches System Market shows a clear trend toward advanced electric and hydraulic models. Electric winches dominate consumer applications due to ease of installation and control. Hydraulic winches gain popularity in heavy-duty and commercial vehicles because of higher load capacity. It supports operators with reliable performance in demanding recovery and towing tasks. Manufacturers develop hybrid systems combining electric convenience with hydraulic strength. Growing adoption of these technologies enhances flexibility across both recreational and industrial markets.

- For instance, Bosch Rexroth MOBILE GIFT-W series winch drives deliver rope pull forces ranging from 50 kN to 595 kN, making them suitable for industrial cranes, recovery trucks, and heavy construction winches where precise load handling is critical.

Increasing Focus on Lightweight and Durable Materials

Manufacturers invest in developing winches using synthetic ropes and corrosion-resistant alloys. The Automotive Winches System Market reflects a shift from traditional steel cables to lighter alternatives. It improves safety by reducing risks of recoil and operator injury. Synthetic materials also lower system weight, supporting vehicle efficiency and performance. Winches designed with composite housings and protective coatings ensure long operational life. This trend aligns with consumer demand for durable yet user-friendly equipment.

- For instance, Master Pull’s Classic synthetic winch line with a 3/8-inch diameter has a breaking strength of 17,600 lbs, offering much lighter handling compared to steel cables of similar strength.

Expanding Use of Smart Controls and Remote Operation Features

Technological innovation transforms the user experience with advanced control systems. The Automotive Winches System Market now includes models with wireless remotes and Bluetooth integration. It allows operators to manage recovery operations from a safe distance. Smart sensors enable load monitoring, automatic braking, and enhanced precision. Demand for connected solutions grows among off-road enthusiasts and commercial fleets. These features improve usability and strengthen safety during critical operations.

Growing Customization and Vehicle-Specific Winch Solutions

Manufacturers expand offerings to include winches designed for SUVs, trucks, and specialized vehicles. The Automotive Winches System Market embraces customization to meet diverse user requirements. It supports growth by offering tailored mounting options and modular accessories. Customized solutions ensure compatibility with different vehicle platforms and load conditions. Rising consumer preference for personalized equipment drives continuous product development. This trend reinforces the role of winches as essential recovery and utility tools.

Market Challenges Analysis

High Cost of Advanced Systems and Maintenance Concerns

The Automotive Winches System Market faces challenges from the high cost of advanced winch models. Electric and hydraulic systems with smart features require significant investment, limiting adoption among cost-sensitive users. It often raises concerns about affordability in emerging markets where vehicle accessories are price-driven. Maintenance and replacement of parts, including motors and synthetic ropes, add to long-term expenses. Frequent exposure to harsh weather and heavy loads can accelerate wear and tear. These financial and durability issues restrict broader market penetration across both consumer and commercial segments.

Safety Risks, Operational Complexity, and Regulatory Barriers

Improper use of winches presents safety risks such as load failures or operator injury. The Automotive Winches System Market encounters hurdles from the complexity of operation that demands user training. It requires strict adherence to safety guidelines to avoid accidents during towing or recovery tasks. Regulatory standards on load capacity, safety features, and installation practices add further pressure on manufacturers. Meeting these requirements increases production costs and slows market entry for smaller players. Limited awareness about correct usage and compliance continues to pose challenges for consistent market growth.

Market Opportunities

Expanding Demand from Off-Road Recreation and Adventure Tourism

The Automotive Winches System Market holds strong opportunities in the off-road and adventure tourism sector. Growing participation in outdoor activities drives demand for reliable recovery and towing equipment. It enables safe navigation across rugged terrains and enhances the utility of SUVs and pickup trucks. Rising disposable income supports consumer investment in premium accessories like high-capacity winches. Adventure tourism operators also seek durable systems to ensure customer safety and satisfaction. This expanding segment creates long-term prospects for manufacturers targeting recreational vehicle owners.

Increasing Adoption in Commercial, Industrial, and Military Applications

Commercial fleets, construction equipment, and defense vehicles create significant opportunities for winch adoption. The Automotive Winches System Market benefits from rising investments in infrastructure, mining, and logistics. It supports efficient handling of heavy loads, reducing manual effort and operational downtime. Military modernization programs further drive the need for advanced hydraulic and electric winches. Customized solutions for specialized vehicles enhance safety, reliability, and productivity. These diverse applications strengthen market opportunities by broadening adoption beyond recreational use.

Market Segmentation Analysis:

By Vehicle Type

The Automotive Winches System Market is segmented into passenger cars and commercial vehicles, each showing distinct demand patterns. Passenger cars, especially SUVs and off-road models, drive strong adoption due to recreational and utility applications. It allows consumers to handle recovery operations efficiently during outdoor activities. Commercial vehicles such as trucks and utility fleets rely on winches for towing, load handling, and operational support. Heavy-duty winches remain essential for logistics, construction, and emergency response fleets. Both categories present growth potential, with commercial vehicles emphasizing durability and passenger vehicles focusing on versatility.

- For instance, a VEVOR electric winch rated for 13,000 lb line pull uses 85 ft of synthetic rope and includes a three-stage planetary gear set to maintain stability under load.

By Application

Applications span wiper blades, pumps, nozzles, hoses and connectors, and reservoirs, reflecting broader integration within vehicle systems. Winches in pump-driven mechanisms and connected hose assemblies improve performance in industrial-grade and heavy-duty operations. It supports vehicle maintenance and efficient fluid management in demanding environments. Nozzles and reservoirs also play a role in ensuring consistent functionality for auxiliary systems linked to winching tasks. Advanced integration strengthens reliability and widens the scope of adoption across vehicle types. Each application area demonstrates how winches interact with broader automotive components to support safe and efficient vehicle operations.

- For instance, A Linde Hydraulics “HPV-02” axial piston pump can be used in winch drive systems and can be equipped with an integrated gear pump. Standard integrated gear pump sizes include 16 cm³/rev, 22.5 cm³/rev, and 38 cm³/rev. Actual pump dimensions vary by model and configuration.

By Sales Channel

Sales channels divide between OEM and aftermarket, with both offering growth opportunities. OEM channels dominate initial adoption due to integration at the production stage, ensuring system compatibility and high performance. It provides manufacturers with opportunities to strengthen customer trust through factory-installed solutions. Aftermarket channels serve a critical role in customization and replacement demand. Consumers and fleet operators turn to aftermarket suppliers for tailored systems, upgrades, and cost-effective options. Growth in e-commerce platforms and specialty dealers enhances the reach of aftermarket distribution. Together, OEM and aftermarket segments create a balanced market landscape, supporting widespread access to winching solutions.

Segments:

Based on Vehicle Type:

- Passenger Cars

- Commercial Vehicles

Based on Application:

Based on Sales Channel:

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America holds the largest share of 35% in the Automotive Winches System Market. The United States dominates demand, supported by its strong base of pickup trucks, SUVs, and recreational vehicles that frequently use winching systems. Consumers in this region show a higher preference for advanced products with wireless controls, synthetic ropes, and corrosion-resistant designs. It benefits from higher disposable income levels, which allow customers to invest in premium recovery equipment. OEM integration of winch systems in vehicles such as off-road trucks strengthens demand at the production stage, while aftermarket sales remain significant among outdoor enthusiasts. Commercial and utility fleets also contribute strongly, as winches are critical for load handling and recovery in industries like construction, mining, and logistics. Regulatory standards focused on safety and operational efficiency push manufacturers to deliver compliant, high-quality systems, further driving the region’s leadership in the global market.

Europe

Europe accounts for 22% of the global market share and stands as a strong contributor driven by its advanced automotive industry. Germany, France, and the United Kingdom represent key hubs for vehicle manufacturing and aftermarket equipment sales. Luxury and performance vehicle manufacturers often integrate winch systems as part of specialized designs that emphasize safety and reliability. It aligns with Europe’s strict regulations, where product safety and emission standards guide both OEMs and aftermarket players. Off-road and adventure tourism, particularly in Nordic countries and Eastern Europe, creates further demand for winches designed for recreational use. Consumers in this region place high value on durable and efficient solutions, which strengthens demand for hydraulic and advanced electric winches. Strong distribution networks, together with Europe’s focus on sustainable and long-lasting materials, create consistent opportunities for manufacturers offering high-quality products.

Asia Pacific

Asia Pacific holds 28% share, making it the fastest-growing region in the Automotive Winches System Market. China leads with its vast automotive production capacity, while India and Japan contribute through rising demand for SUVs, commercial fleets, and off-road vehicles. It benefits from rapid urbanization, which increases the need for towing and recovery services in densely populated areas. Adventure tourism is growing in countries such as Australia, India, and Southeast Asian markets, creating demand for lightweight, cost-efficient winch systems. Regional manufacturers focus on affordable models to cater to price-sensitive consumers while also innovating with synthetic ropes and modular designs. Expanding infrastructure projects and fleet modernization efforts in construction and mining sectors also drive adoption of heavy-duty winches. Asia Pacific’s role as both a high-demand and high-production hub ensures that the region will remain a central focus for manufacturers in the coming years.

Latin America

Latin America contributes 9% of the market share, with Brazil and Mexico serving as primary growth centers. Expanding construction, utility, and transportation industries create steady demand for winches in commercial vehicles and heavy equipment. It remains a developing market, where affordability plays a critical role in adoption. The aftermarket sector dominates due to the preference for lower-cost solutions and replacement parts. Off-road sports, particularly in Brazil and Chile, generate consumer demand for recovery equipment designed for personal vehicles and SUVs. While penetration of advanced hydraulic and electric winches is lower compared to developed regions, the steady rise in industrial projects opens opportunities for suppliers to introduce durable, mid-range products. Growth in e-commerce channels also increases consumer access to international brands, strengthening aftermarket development across the region.

Middle East & Africa

The Middle East & Africa represent 6% share of the Automotive Winches System Market. Countries such as Saudi Arabia, the UAE, and South Africa account for most of the demand due to their active mining, oil & gas, and construction sectors. It shows reliance on heavy-duty winches for fleet operations, equipment handling, and emergency recovery. Off-road adventure tourism, particularly desert expeditions in the Gulf countries, supports consumer adoption of winches for SUVs and all-terrain vehicles. Economic diversity creates challenges, as premium systems remain concentrated in high-income Gulf states while African nations often demand more cost-effective models. Manufacturers catering to this region focus on rugged designs, corrosion-resistant materials, and simpler product configurations to withstand extreme environmental conditions. Growing infrastructure investment across Africa provides further opportunities for suppliers of utility-focused winches.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- TRICO Products Corporation

- DOGA Group

- Robert Bosch GmbH

- Mitsuba Corporation

- Valeo SA

- Tenneco Inc.

- DENSO Corporation

- Magneti Marelli S.p.A.

- PEWAG Schneeketten GmbH

- HELLA GmbH & Co. KGaA

Competitive Analysis

The competitive landscape of the Automotive Winches System Market companies include DENSO Corporation, DOGA Group, HELLA GmbH & Co. KGaA, Magneti Marelli S.p.A., Mitsuba Corporation, PEWAG Schneeketten GmbH, Robert Bosch GmbH, Tenneco Inc., TRICO Products Corporation, and Valeo SA. The Automotive Winches System Market is shaped by innovation, regional expansion, and strong OEM partnerships. Companies focus on developing advanced electric and hydraulic systems with higher load capacity, smart controls, and lightweight materials to meet evolving customer needs. It drives competition as manufacturers aim to balance affordability with premium performance across both OEM and aftermarket channels. Strategic collaborations and acquisitions support entry into new markets, while research and development investments ensure compliance with safety regulations and sustainability standards. Growing demand from off-road vehicles, commercial fleets, and industrial applications pushes suppliers to enhance product reliability and durability. The market remains highly dynamic, with continuous innovation and service expansion defining success.Top of FormBottom of Form

Recent Developments

- In February 2025, the MAMA Foundation introduced its first helicopter with winch capabilities. The BK117 B-2 model will support search and rescue operations in challenging terrains and maritime environments.

- In November 2024, The Black Phoenix Group LLC finalized the acquisition of PACCAR Winch from PACCAR Inc. PACCAR Winch, known for its industrial winches, hoists, and drive systems under brands like BRADEN, CARCO, and Gearmatic, will continue operations under its existing management team.

- In June 2024, Tesla is preparing to roll out a significant update to its auto wiper system as part of the 2024.14 Software Update, aimed at addressing longstanding complaints about its performance. This update comes in response to persistent feedback from owners who have reported issues with the wipers being overly sensitive or insufficiently response during varying weather conditions.

- In January 2024, ZKW Group introduced a headlamp washer system integrated with ultrasonic cleaning technology. Unlike traditional washer jets, this system utilizes high-frequency ultrasonic waves to break down dirt and grime without excessive fluid use.

Report Coverage

The research report offers an in-depth analysis based on Vehicle Type, Application, Sales Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for advanced electric winches will expand across passenger and commercial vehicles.

- Hydraulic winches will maintain strong adoption in heavy-duty and industrial applications.

- Smart winches with wireless controls and sensors will gain wider market acceptance.

- Lightweight materials such as synthetic ropes will replace traditional steel cables.

- OEM integration will increase as manufacturers add factory-installed winching systems.

- Aftermarket channels will grow with customization and replacement demand.

- Off-road tourism and adventure sports will boost consumer-focused winch sales.

- Industrial sectors like mining and construction will strengthen adoption of durable systems.

- Safety regulations will drive innovation in automatic braking and load monitoring features.

- Emerging markets will create opportunities for affordable, rugged, and efficient winch solutions.