Market Overview

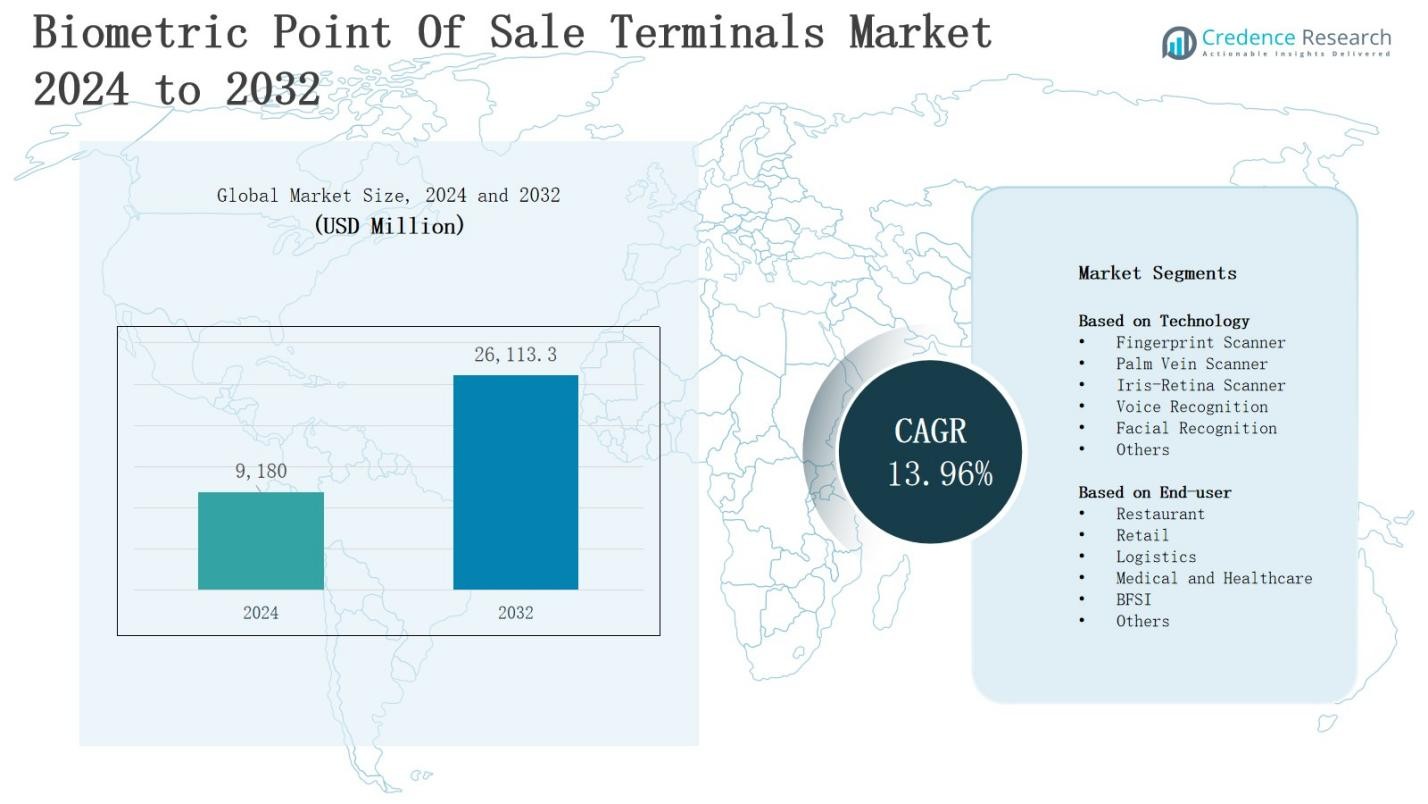

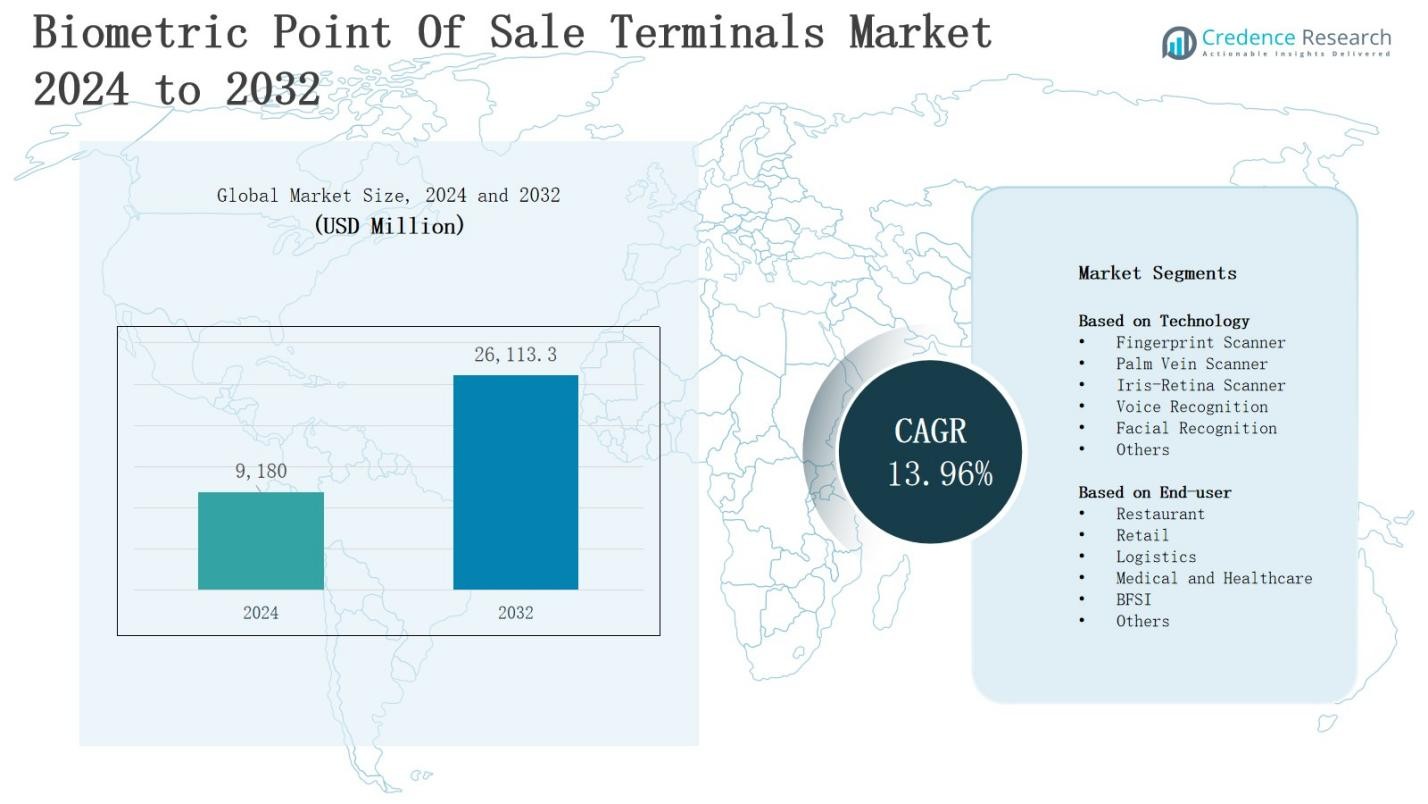

The biometric point of sale terminals market is projected to grow from USD 9,180 million in 2024 to USD 26,113.3 million by 2032, registering a CAGR of 13.96% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Biometric Point Of Sale Terminals Market Size 2024 |

USD 9,180 Million |

| Biometric Point Of Sale Terminals Market, CAGR |

13.96% |

| Biometric Point Of Sale Terminals Market Size 2032 |

USD 26,113.3 Million |

The biometric point of sale terminals market grows with rising demand for secure and seamless payment solutions, driven by increasing fraud concerns, regulatory compliance, and consumer preference for contactless authentication. Retailers and financial institutions adopt biometric-enabled POS systems to enhance transaction security, reduce identity theft, and improve customer experience. Technological advancements in fingerprint, facial, and iris recognition strengthen adoption, while integration with mobile wallets and digital banking expands application scope. Trends include growing use in emerging economies, deployment of cloud-based biometric solutions, and the shift toward multimodal authentication to ensure higher accuracy, convenience, and scalability in diverse environments.

The biometric point of sale terminals market shows diverse geographical presence, with North America holding 32% share driven by advanced payment infrastructure, and Europe capturing 27% share supported by strict data protection regulations. Asia Pacific leads with 30% share due to rapid digital transformation and financial inclusion initiatives. Latin America accounts for 6% share, while the Middle East & Africa hold 5% supported by smart city and fintech growth. Key players include FUJITSU, Ingenico, DERMALOG Identification Systems GmbH, M2SYS Technology, Mantra Softech, Aratek BIYO LLC, Chongqing Huifan Technology, and Feigete Intelligent Technology.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The biometric point of sale terminals market is projected to grow from USD 9,180 million in 2024 to USD 26,113.3 million by 2032, registering a CAGR of 13.96%.

- Rising concerns over payment fraud, identity theft, and compliance requirements drive adoption of biometric POS systems across retail, BFSI, and healthcare.

- Technological advancements in fingerprint, facial, and iris recognition, supported by AI and cloud integration, enhance accuracy, speed, and scalability.

- North America holds 32% share, Europe 27%, Asia Pacific 30%, Latin America 6%, and the Middle East & Africa 5%.

- High implementation costs, infrastructure gaps, and strict regulatory requirements challenge small businesses and slow adoption in price-sensitive markets.

- Opportunities emerge in emerging economies where governments and financial institutions promote biometric authentication to expand financial inclusion.

- Key players include FUJITSU, Ingenico, DERMALOG Identification Systems GmbH, M2SYS Technology, Mantra Softech, Aratek BIYO LLC, Chongqing Huifan Technology, and Feigete Intelligent Technology.

Market Drivers

Rising Need for Secure Payment Authentication

The biometric point of sale terminals market expands with growing concerns over payment fraud, identity theft, and data breaches. Businesses prioritize security solutions that reduce risks while improving trust in digital transactions. Biometric verification through fingerprints, facial recognition, or iris scans ensures higher accuracy compared to traditional PINs or passwords. It builds consumer confidence by delivering secure and frictionless payments. Regulatory compliance across banking and retail further strengthens adoption, making biometrics central to payment innovation.

- For instance, JPMorgan Chase has introduced biometric Paypad devices integrating facial and palm vein recognition to enhance secure, touchless payments in the U.S. financial sector.

Growing Adoption in Retail and Financial Services

The biometric point of sale terminals market gains traction from retailers, banks, and financial service providers seeking efficient, fraud-resistant systems. Retailers use biometric POS to accelerate checkout and personalize shopping experiences, while banks integrate biometrics to secure customer transactions. It enhances operational efficiency by reducing reliance on physical cards. Integration with digital wallets and mobile banking expands functionality, making biometric POS a preferred tool in omnichannel payment ecosystems worldwide.

- For instance, Thales’ EMV biometric payment card achieves a success rate exceeding 95% in fingerprint authentication and enables transactions up to 120% faster than traditional PIN or signature-based methods, improving checkout speed significantly.

Technological Advancements Driving Accuracy and Usability

The biometric point of sale terminals market benefits from rapid innovation in recognition technologies. Fingerprint sensors now deliver faster response times, while facial and iris recognition systems improve accuracy across diverse environments. It supports large-scale adoption by enabling quick authentication with minimal errors. Cloud integration enhances flexibility, and AI-powered algorithms increase precision. These improvements encourage enterprises to implement biometric solutions for consistent, user-friendly, and secure payment experiences across multiple industries.

Expanding Deployment Across Emerging Economies

The biometric point of sale terminals market experiences strong demand in emerging economies driven by rapid digitalization and growing financial inclusion. Governments and institutions promote biometric payments to expand secure banking access. It enables businesses in Asia-Pacific, Latin America, and Africa to serve unbanked populations effectively. Rising smartphone penetration supports biometric adoption, while lower hardware costs make solutions more affordable. Expanding retail networks and e-commerce growth further accelerate global deployment of biometric-enabled POS systems.

Market Trends

Integration of Multimodal Biometric Authentication

The biometric point of sale terminals market advances with a clear shift toward multimodal authentication combining fingerprints, facial recognition, and iris scans. Businesses adopt these solutions to enhance accuracy, reduce false rejections, and improve convenience in diverse operating environments. It ensures stronger fraud prevention by layering multiple verification methods. Retailers and banks see greater reliability when handling high transaction volumes. Multimodal systems also support faster approvals, encouraging widespread adoption across both developed and emerging markets.

Expansion of Cloud-Based and AI-Powered Solutions

The biometric point of sale terminals market embraces cloud-enabled platforms and AI-driven algorithms to improve performance and scalability. Cloud integration allows centralized data management, reducing hardware dependency and improving cost efficiency for enterprises. It enhances transaction speed, ensuring seamless operations for retailers and financial institutions. AI-driven systems adapt to environmental changes and user behaviors, refining recognition accuracy. Vendors continue investing in machine learning models that increase predictive capability, securing long-term adoption across global markets.

- For instance, HID Global’s DigitalPersona® 4500 Fingerprint Reader has been deployed across more than 1,100 outlets by BMA International, significantly reducing employee theft and boosting authentication accuracy by requiring biometric proof of presence.

Increasing Role in Digital Wallet and Mobile Payment Ecosystems

The biometric point of sale terminals market aligns closely with the rise of digital wallets and mobile-first banking ecosystems. Consumers prefer contactless payments, and biometric integration ensures both speed and security. It bridges the gap between smartphones, wearable devices, and POS infrastructure, creating a unified payment experience. Partnerships between fintech firms and POS providers accelerate innovation. The convergence of mobile payments with biometrics fosters consumer loyalty, while offering merchants enhanced efficiency and reduced fraud exposure.

- For instance, Verifone partnered with PopID to embed biometric sensors in their payment terminals, enabling face and palm authentication for faster, more secure transactions and loyalty integration.

Adoption Driven by Emerging Economies and Financial Inclusion

The biometric point of sale terminals market gains momentum in emerging economies where financial inclusion remains a priority. Governments and institutions promote biometric authentication to expand access to secure banking services. It enables merchants in developing regions to reduce cash dependency and support unbanked populations. Growing smartphone penetration and cost-effective biometric hardware accelerate deployment. Expanding retail networks, combined with regulatory initiatives, ensure widespread adoption, positioning biometric POS as a transformative solution in global payment ecosystems.

Market Challenges Analysis

High Implementation Costs and Infrastructure Limitations

The biometric point of sale terminals market faces challenges from high installation costs and the need for supporting infrastructure. Many small and medium-sized businesses hesitate to invest in advanced biometric systems due to expensive hardware, software integration, and maintenance. It limits adoption in price-sensitive markets where traditional POS systems remain dominant. Limited connectivity in rural and underdeveloped regions further restricts deployment. Vendors must address affordability and infrastructure readiness to accelerate widespread adoption and bridge the accessibility gap.

Privacy Concerns and Regulatory Hurdles

The biometric point of sale terminals market encounters resistance due to concerns about data privacy, storage security, and regulatory compliance. Consumers often hesitate to share biometric data due to fears of misuse or breaches. It creates adoption barriers in regions with strict data protection laws, where regulatory approvals delay implementations. The complexity of cross-border compliance challenges multinational retailers. Vendors must demonstrate strong encryption and transparent practices to build trust, ensure compliance, and encourage broader market acceptance.

Market Opportunities

Rising Demand for Contactless and Cashless Transactions

The biometric point of sale terminals market holds strong opportunities driven by the global shift toward contactless and cashless transactions. Consumers increasingly prefer biometric-enabled payments for speed, security, and convenience. It empowers retailers and financial institutions to meet changing consumer expectations while reducing risks tied to card fraud or PIN theft. Expanding e-commerce, mobile banking, and smart retail ecosystems further support growth. The pandemic accelerated adoption of touch-free authentication, reinforcing long-term demand for biometric POS solutions.

Growing Penetration in Emerging Markets and New Applications

The biometric point of sale terminals market benefits from expanding deployment across emerging economies and new industry applications. Rising financial inclusion initiatives create a strong push for secure biometric authentication in developing regions. It offers significant potential in healthcare, transportation, and government services where secure identity verification is essential. Affordable biometric hardware and cloud-enabled systems increase accessibility for small businesses. Strategic partnerships with fintech firms and retailers further enhance scalability, opening lucrative opportunities for global expansion.

Market Segmentation Analysis:

By Technology

The biometric point of sale terminals market demonstrates strong adoption across multiple biometric technologies. Fingerprint scanners lead adoption due to their cost-effectiveness, speed, and accuracy in high-volume retail and banking transactions. Facial recognition is expanding quickly, supported by demand for contactless solutions in post-pandemic environments. Iris-retina and palm vein scanners offer advanced security, appealing to sectors requiring higher accuracy such as healthcare and BFSI. Voice recognition and other emerging modalities strengthen user convenience, creating opportunities for diverse, multimodal authentication systems.

- For instance, FingoPay partnered with imageHOLDERS to integrate Sthaler finger vein readers within tablet enclosures for secure contactless payments in retail locations like Costcutter at Brunel University.

By End-user

The biometric point of sale terminals market finds significant demand across varied end-user industries. Retail dominates adoption, leveraging biometrics for faster checkouts and fraud prevention. Restaurants use these systems to streamline payments and improve customer experience. BFSI institutions employ biometric POS to secure transactions and protect sensitive data. Medical and healthcare facilities utilize them for accurate patient identification and billing. Logistics firms adopt biometric verification to ensure secure deliveries. Other sectors expand applications, driving widespread market growth.

- For instance, Supremax and NEC Corporation have developed fingerprint and facial recognition-based POS terminals to enhance payment security in retail stores.

Segments:

Based on Technology

- Fingerprint Scanner

- Palm Vein Scanner

- Iris-Retina Scanner

- Voice Recognition

- Facial Recognition

- Others

Based on End-user

- Restaurant

- Retail

- Logistics

- Medical and Healthcare

- BFSI

- Others

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America holds 32% share of the biometric point of sale terminals market, driven by advanced payment infrastructure, strong regulatory frameworks, and high consumer adoption of secure transaction methods. Retailers and banks lead deployment, supported by investments in biometric authentication to combat fraud. It benefits from the widespread use of mobile banking and digital wallets. The United States dominates adoption due to robust financial systems and high awareness. Canada contributes steadily with strong retail and healthcare integration.

Europe

Europe accounts for 27% share of the biometric point of sale terminals market, supported by strict data protection regulations and high emphasis on payment security. Banks and financial institutions adopt biometric-enabled POS systems to comply with evolving security mandates. It gains traction in retail and restaurant sectors where digital payment ecosystems are mature. Germany, the United Kingdom, and France lead adoption due to strong infrastructure. Growth is reinforced by consumer preference for contactless authentication and cross-border payment solutions.

Asia Pacific

Asia Pacific leads with 30% share of the biometric point of sale terminals market, supported by rapid digital transformation, government financial inclusion programs, and rising smartphone penetration. China, India, and Japan drive large-scale deployments in retail, BFSI, and healthcare. It grows rapidly due to rising demand for secure, cashless transactions across urban and semi-urban areas. Lower hardware costs and supportive government initiatives accelerate expansion. The region presents strong opportunities due to its expanding consumer base and e-commerce adoption.

Latin America

Latin America represents 6% share of the biometric point of sale terminals market, supported by growing demand for secure payment solutions in retail and BFSI. Brazil and Mexico lead adoption due to rising digital banking penetration. It benefits from government-backed financial inclusion programs that encourage biometric integration. Rising e-commerce adoption strengthens growth potential. However, high costs and infrastructure gaps challenge rapid scaling. Expansion continues as local vendors and fintech firms drive innovation and partnerships.

Middle East & Africa

The Middle East & Africa holds 5% share of the biometric point of sale terminals market, supported by emerging investments in digital payment systems. Gulf countries lead adoption due to strong banking ecosystems and government-backed smart city initiatives. It sees rising demand in retail, BFSI, and healthcare sectors. Africa presents growth opportunities through financial inclusion programs targeting unbanked populations. Infrastructure gaps remain a challenge, but rising smartphone use and partnerships with fintech firms support gradual market expansion.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- FUJITSU

- Mantra Softech (India) Pvt. Ltd.

- Ingenico

- Chongqing Huifan Technology Co., Ltd.

- Feigete Intelligent Technology Co., Limited

- Aratek BIYO LLC

- DERMALOG Identification Systems GmbH

- M2SYS Technology

Competitive Analysis

The biometric point of sale terminals market reflects intense competition shaped by global technology providers, payment solution companies, and regional specialists focusing on secure authentication. It is characterized by continuous innovation, strategic collaborations, and expanding product portfolios to address growing demand across retail, BFSI, healthcare, and logistics. Leading players such as FUJITSU, Ingenico, DERMALOG Identification Systems GmbH, M2SYS Technology, and Mantra Softech (India) Pvt. Ltd. invest heavily in advanced fingerprint, facial, and iris recognition solutions that enhance transaction accuracy and customer experience. Aratek BIYO LLC, Chongqing Huifan Technology Co., Ltd., and Feigete Intelligent Technology Co., Limited strengthen competitiveness through affordability and regional market presence, serving small and medium businesses in emerging economies. Companies emphasize AI-driven recognition, cloud integration, and multimodal authentication to differentiate offerings and capture new revenue streams. Strategic moves include partnerships with fintech firms, retail chains, and financial institutions to widen adoption and accelerate scalability. Strong brand reputation, regulatory compliance, and ability to deliver cost-effective yet secure solutions remain defining factors shaping leadership and market positioning.

Recent Developments

- In January 2025, Verifone introduced its new Victa line of POS devices at the National Retail Federation convention, integrating advanced biometric features including fingerprint readers.

- In June 2025, NEXT Biometrics received a NOK 6.3 million purchase order for its newly launched FAP 20 Basalt L1 Slim fingerprint sensor, to be deployed in POS devices for India’s Aadhaar program with shipments beginning in Q3 2025.

- In February 2025, NCR Voyix announced a strategic partnership with UK payment technology provider Worldpay to deliver a unified cloud-based software and payment solution tailored for retailers and restaurants.

- In August 2025, Fingerprint Cards secured a licensing agreement with Egis Technology covering PC-related biometric assets, marking a strategic move to monetize existing intellectual property

Market Concentration & Characteristics

The biometric point of sale terminals market shows moderate to high concentration, shaped by the presence of global technology leaders, regional vendors, and specialized solution providers competing on innovation, pricing, and scalability. It is characterized by rapid technological evolution, with companies advancing fingerprint, facial, iris, and palm vein recognition systems to enhance speed and accuracy in transactions. Large players such as FUJITSU, Ingenico, and DERMALOG Identification Systems GmbH dominate with extensive portfolios and strong global reach, while regional firms like Mantra Softech, Aratek BIYO LLC, and Chongqing Huifan Technology strengthen competition in emerging markets through affordability and localized solutions. Market characteristics include strong integration with mobile wallets, cloud platforms, and AI-driven authentication, combined with rising adoption in retail, BFSI, and healthcare. Vendors focus on balancing cost-effectiveness with compliance, reliability, and user convenience, positioning biometric POS as a mainstream payment technology with growing presence across both developed and developing economies.

Report Coverage

The research report offers an in-depth analysis based on Technology, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of multimodal biometric authentication will expand to improve accuracy and user convenience.

- Retail and BFSI sectors will remain leading adopters due to demand for secure and seamless payment systems.

- Cloud-based biometric POS platforms will gain traction for scalability and cost efficiency.

- AI-powered recognition will enhance speed, precision, and adaptability in diverse environments.

- Emerging economies will drive strong growth through financial inclusion initiatives and digital transformation.

- Healthcare and logistics will increasingly deploy biometric POS for secure identification and payments.

- Partnerships between fintech firms and biometric solution providers will accelerate market penetration.

- Consumer trust in biometric payments will strengthen with advanced data encryption and privacy safeguards.

- Declining hardware costs will improve affordability for small and medium-sized enterprises.

- Regulatory support for secure payment authentication will create favorable conditions for long-term adoption.