Market Overview:

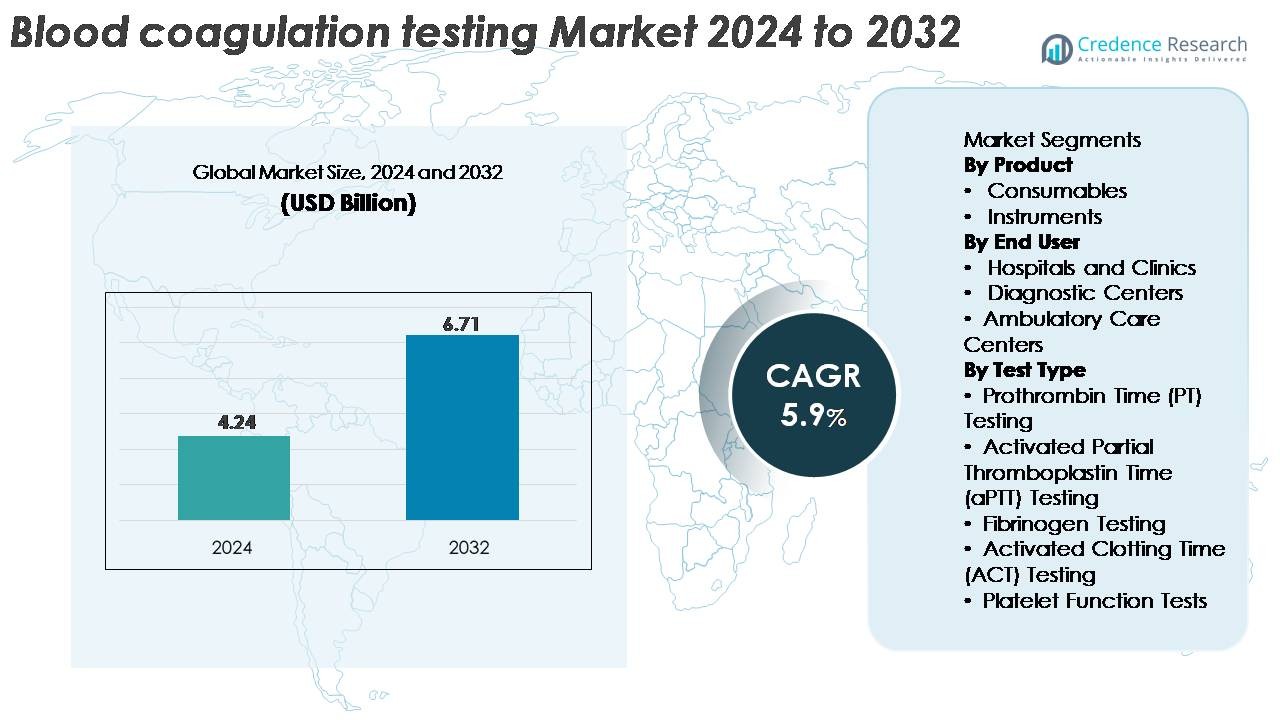

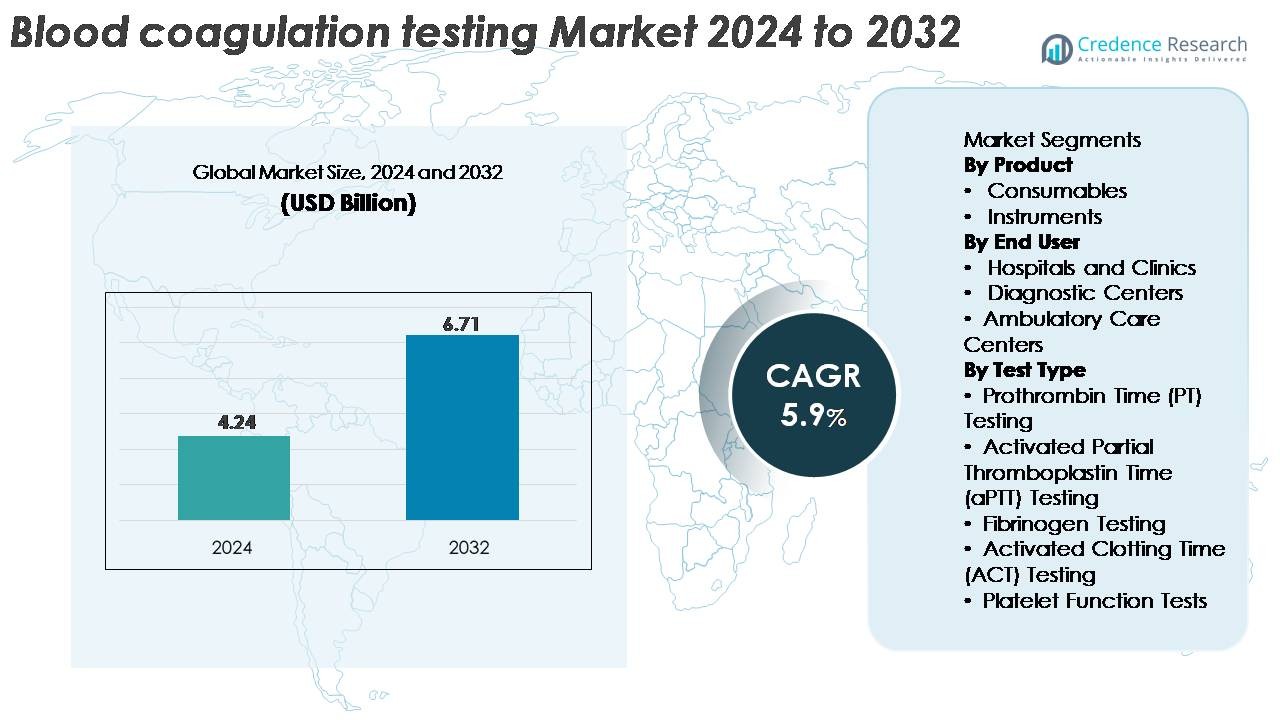

The global Blood Coagulation Testing Market was valued at USD 4.24 billion in 2024 and is projected to reach USD 6.71 billion by 2032, expanding at a CAGR of 5.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Blood Coagulation Testing Market Size 2024 |

USD 4.24 Billion |

| Blood Coagulation Testing Market, CAGR |

5.9% |

| Blood Coagulation Testing Market Size 2032 |

USD 6.71 Billion |

The blood coagulation testing market is dominated by established diagnostic manufacturers such as Bio-Rad Laboratories, Siemens Healthineers, Hemosure Inc., Danaher Corporation, Grifols S.A., Roche Diagnostics, Sysmex Corporation, Thermo Fisher Scientific, and Abbott Laboratories, all of which compete through advanced analyzers, high-precision reagents, and expanding point-of-care solutions. These companies continuously invest in automation, digital connectivity, and high-throughput platforms to strengthen their global footprint. North America leads the market with approximately 38% share, supported by strong hospital networks and rapid adoption of automated systems, followed by Europe at around 30%, driven by stringent quality standards and well-established diagnostic infrastructures.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The global Blood Coagulation Testing Market was valued at USD 4.24 billion in 2024 and is projected to reach USD 6.71 billion by 2032, expanding at a CAGR of 5.9% during the forecast period.

- Growing diagnostic demand for PT, aPTT, fibrinogen, and platelet function tests driven by rising cardiovascular diseases, surgical volumes, and anticoagulant therapy monitoring continues to accelerate market expansion across hospitals and diagnostic centers.

- Technology shifts toward automation, point-of-care INR devices, and integrated digital workflows shape current industry trends, with consumables holding the dominant product share due to recurring test requirements.

- Competitive intensity remains high as leading players such as Roche Diagnostics, Siemens Healthineers, Sysmex, and Abbott invest in high-throughput analyzers, quality-control innovations, and global distribution networks while facing constraints from high equipment costs and reimbursement variability.

- Regionally, North America leads with ~38% share, followed by Europe at ~30%, while Asia-Pacific captures ~22% as the fastest-growing region, supported by rising healthcare investments and expanding diagnostic infrastructures.

Market Segmentation Analysis:

By Product

Consumables hold the dominant share of the blood coagulation testing market, driven by their recurring use in PT, aPTT, fibrinogen, and ACT assays across both laboratory and point-of-care platforms. Their high replacement frequency, expanding test volumes, and continuous adoption of ready-to-use reagents and quality-control kits sustain strong demand. Advancements such as reagent formulations with extended stability and enhanced lot-to-lot consistency further support their leadership. Instruments contribute steady growth as automated analyzers with high throughput, integrated calibration, and real-time data connectivity gain acceptance, particularly in large laboratories and centralized diagnostic facilities.

- For instance, Roche’s CoaguChek XS PT Test Strips are manufactured with a hematocrit compensation range of 25–55% and provide reagent stability for up to 18 months at room temperature as documented in Roche’s IFU (Instructions for Use).

By End User

Hospitals and clinics represent the largest end-user segment, supported by high patient volumes, routine coagulation monitoring needs, and the widespread adoption of automated analyzers in emergency, surgical, and intensive care settings. Their dominance is reinforced by the increasing prevalence of cardiovascular diseases, anticoagulant therapy monitoring, and perioperative hemostasis assessment. Diagnostic centers continue to expand due to rising outsourcing of specialized testing and cost-efficient laboratory operations. Ambulatory care centers show growing adoption as decentralized facilities integrate point-of-care coagulation devices to support rapid clinical decision-making and reduce patient turnaround times.

- For instance, Siemens Healthineers’ Atellica COAG 360 analyzer used in high-acuity hospital labs provides a maximum throughput of approximately 350 simultaneous PT/aPTT tests per hour (or up to 210 single tests per hour) and features an automated QC scheduling system capable of running 24 QC checks in a single shift, as stated in internal product information and evaluation studies.

By Test Type

Prothrombin Time (PT) testing accounts for the largest share within test types, driven by its central role in monitoring warfarin therapy, evaluating extrinsic pathway abnormalities, and supporting pre-surgical coagulation screening. Its dominance is reinforced by growing demand for rapid, high-accuracy PT assays in both laboratory and point-of-care settings. aPTT testing also sees strong utilization for heparin therapy monitoring and intrinsic pathway evaluation. Fibrinogen, ACT, and platelet function tests address specialized diagnostic requirements in critical care, cardiovascular procedures, and bleeding disorder assessment, contributing to overall market expansion.

Key Growth Drivers:

Rising Global Burden of Cardiovascular and Hematological Disorders

The increasing incidence of cardiovascular diseases, venous thromboembolism, atrial fibrillation, and bleeding disorders significantly accelerates the demand for blood coagulation testing. Hospitals and diagnostic centers consistently perform PT, aPTT, fibrinogen, and platelet function tests to support disease diagnosis, anticoagulant therapy management, and pre-surgical risk assessment. As aging populations grow, the number of patients requiring long-term anticoagulation monitoring continues to expand, especially those on warfarin or heparin therapy. Clinical guidelines also emphasize routine coagulation profiling for high-risk groups, which strengthens overall testing frequency. Furthermore, rising surgical volumes, trauma cases, and cancer-related coagulopathies contribute to sustained diagnostic needs. Growing awareness about early detection of clotting abnormalities, combined with improved insurance coverage for laboratory procedures, amplifies utilization across primary and tertiary healthcare systems.

- For instance, Roche’s cobas t 711 analyzer used extensively in coagulation labs delivers a maximum throughput of approximately 390 tests per hour (for PT/APTT assays) and supports a high on-board sample capacity of up to 225 samples in 5-position racks, with continuous loading capabilities.

Expansion of Point-of-Care Testing (POCT) in Decentralized Settings

Adoption of point-of-care coagulation devices is accelerating as healthcare providers prioritize rapid decision-making and improved patient throughput. POCT systems deliver near-immediate PT/INR and aPTT results, enabling faster clinical interventions in emergency departments, operating rooms, and ambulatory care centers. These devices support remote monitoring for patients on chronic anticoagulation therapy, reducing clinic visits and enhancing treatment compliance. Technological improvements such as handheld analyzers, cartridge-based reagents, wireless connectivity, and user-friendly interfaces make POCT attractive for decentralized and resource-constrained settings. As value-based care models expand, clinicians increasingly rely on POCT to reduce turnaround time and optimize patient outcomes. Home-care monitoring also gains momentum as clinicians adopt remote patient management platforms that integrate POCT results directly into electronic medical records.

- For instance, Roche’s CoaguChek Pro II provides PT/INR results in approximately 60 seconds using a 10 µL capillary blood sample and stores up to 2,000 patient results, as documented in Roche’s IFU.

Technological Advancements in Automated and High-Throughput Analyzers

Advances in automated blood coagulation analyzers significantly boost test accuracy, laboratory efficiency, and workflow optimization. Modern analyzers incorporate high-throughput processing, multi-channel detection, automated reagent handling, and intelligent quality-control systems to reduce operator dependency and minimize analytical errors. Integration with laboratory information systems enhances data traceability and accelerates clinical reporting. Manufacturers continue to introduce systems with enhanced optical detectors, mechanical clot-detection algorithms, and built-in calibration technologies that support both routine and specialized testing. Automation is particularly valuable for large hospitals and diagnostic chains that handle high specimen volumes and require consistent, reproducible outcomes. As laboratories shift toward consolidated and centralized testing models, demand for high-performance analyzers with reduced operational costs and advanced digital interoperability continues to rise.

Key Trends & Opportunities:

Growth of Personalized Anticoagulation Management and Home-Based Monitoring

Personalized medicine is creating new opportunities in coagulation testing as clinicians increasingly tailor anticoagulant therapy based on individual risk factors, drug response, and genetic markers. Home-based PT/INR monitoring systems enable continuous assessment for patients on long-term therapy, reducing adverse events and hospitalization rates. The growing integration of mobile applications, connected sensors, and digital health platforms allows patients to transmit results remotely, enabling real-time dose adjustments. This trend also supports chronic disease management models that emphasize patient engagement and long-term adherence. As digital health ecosystems expand, manufacturers have significant opportunities to develop integrated home-care coagulation solutions with cloud-enabled analytics and automated alerts for clinicians.

- For instance, The Roche CoaguChek Vantus is a user-friendly, handheld system intended for single-patient self-testing of International Normalized Ratio (INR) values by adults (age 22 and older) who are stable on vitamin K antagonist therapy.

Rising Adoption of AI, Data Integration, and Automation in Hemostasis Laboratories

Artificial intelligence and advanced data analytics are increasingly transforming coagulation laboratories by enabling predictive quality control, automated error detection, and algorithm-driven interpretation of test patterns. AI-enabled analyzers improve workflow efficiency by forecasting reagent usage, optimizing sample prioritization, and reducing manual intervention. Integration of coagulation data with hospital information systems enhances clinical decision support, particularly for critical-care scenarios such as sepsis-induced coagulopathy or intraoperative bleeding risk. Automated platforms capable of running multiple assays simultaneously support laboratories facing staffing constraints and growing test volumes. These technologies provide strong opportunities for manufacturers to expand their portfolio into intelligent, interconnected diagnostic ecosystems that support precision hemostasis management.

- For instance,”Siemens Healthineers’ Atellica COAG 360 incorporates automated quality control (QC) scheduling and uses sophisticated algorithm-driven clot-curve integrity checksto identify aberrant results in real time.”

Key Challenges:

High Cost of Advanced Testing Systems and Operational Complexity

Despite their clinical value, advanced coagulation analyzers and consumables involve substantial acquisition, maintenance, and operational costs. Smaller laboratories and healthcare facilities in low-resource regions face challenges in adopting fully automated platforms due to budget constraints and the need for specialized operators. Frequent reagent replenishment, calibration requirements, and stringent quality-control protocols add to operational complexity. Additionally, the high capital expenditure limits the penetration of next-generation systems in emerging markets. These cost pressures often lead facilities to rely on outdated analyzers or send samples to external laboratories, resulting in delayed turnaround times and potential diagnostic inefficiencies.

Regulatory Stringency and Variability in Reimbursement Policies

The blood coagulation testing market operates within a highly regulated framework that mandates rigorous validation, standardization, and compliance across all devices, reagents, and analytical processes. Stringent approval requirements lengthen product launch timelines and increase development costs for manufacturers. Variability in reimbursement structures across regions further complicates adoption, especially for newer testing technologies and home-based monitoring devices. Inconsistent coverage for routine PT/INR monitoring or specialized platelet function tests discourages utilization in certain markets. Regulatory disparities between countries also challenge global manufacturers, requiring extensive localization efforts and additional investment in documentation, clinical evidence, and post-market surveillance.

Regional Analysis:

North America

North America holds the largest share of the blood coagulation testing market, accounting for around 38%, supported by strong healthcare infrastructure, high diagnostic awareness, and widespread adoption of automated analyzers. The region benefits from high surgical volumes, extensive anticoagulation monitoring programs, and rapid uptake of point-of-care INR testing among outpatient populations. Favorable reimbursement frameworks encourage routine PT, aPTT, and platelet function testing across hospitals and specialized diagnostic networks. Additionally, the prevalence of cardiovascular diseases and aging demographics sustains test demand. Continuous technological upgrades and integration of digital laboratory systems further enhance the region’s leadership.

Europe

Europe represents the second-largest market with approximately 30% share, driven by robust national healthcare systems, well-established laboratory networks, and standardized coagulation testing protocols across the region. Adoption of high-throughput analyzers is strong, particularly in Germany, the U.K., France, and Italy, where centralized diagnostic laboratories manage large specimen loads. Rising cases of thrombotic disorders, expanding elderly populations, and increased anticoagulant therapy usage contribute to sustained market growth. The region’s regulatory emphasis on assay accuracy, quality control, and laboratory automation encourages continuous equipment modernization. Growing preference for point-of-care INR testing in primary care settings further supports market expansion.

Asia-Pacific

Asia-Pacific is the fastest-growing region, holding around 22% of global market share and expanding rapidly due to rising healthcare investments, increasing surgical procedures, and improved diagnostic access. China, India, Japan, and South Korea lead growth as hospitals adopt automated coagulation systems to enhance efficiency and meet rising patient loads. Growing prevalence of cardiovascular diseases and diabetes increases the need for routine coagulation monitoring. Government-backed healthcare reforms and the expansion of private diagnostic chains strengthen testing volumes. Demand for affordable reagents and mid-range analyzers also drives adoption in emerging markets, while point-of-care testing gains momentum in remote settings.

Latin America

Latin America accounts for nearly 6% of the global market, supported by expanding healthcare infrastructure, rising chronic disease burden, and increasing use of anticoagulation therapy. Brazil, Mexico, Argentina, and Colombia represent key markets where hospitals are modernizing diagnostic capabilities through semi-automated and fully automated coagulation analyzers. Limited reimbursement frameworks and budget constraints slow adoption of premium systems; however, growing private-sector diagnostic networks drive consistent testing demand. Awareness programs for stroke, thrombosis, and atrial fibrillation are improving test penetration. The region also sees rising utilization of PT/INR point-of-care devices in outpatient and emergency care settings.

Middle East & Africa

The Middle East & Africa region holds around 4% market share, characterized by growing healthcare modernization initiatives and increasing investment in clinical diagnostics. Gulf countries, particularly the UAE, Saudi Arabia, and Qatar, lead adoption with strong demand for automated analyzers in tertiary hospitals and specialty care centers. Rising cases of cardiovascular disorders and greater use of anticoagulants contribute to increased testing volumes. In Africa, market growth is slower due to limited diagnostic infrastructure, though improvements in private laboratory networks are enhancing access. Expanding medical tourism and rising surgical procedures in the Middle East support additional growth opportunities.

Market Segmentations:

By Product

By End User

- Hospitals and Clinics

- Diagnostic Centers

- Ambulatory Care Centers

By Test Type

- Prothrombin Time (PT) Testing

- Activated Partial Thromboplastin Time (aPTT) Testing

- Fibrinogen Testing

- Activated Clotting Time (ACT) Testing

- Platelet Function Tests

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape:

The competitive landscape of the blood coagulation testing market is characterized by a mix of global diagnostic leaders and specialized hemostasis solution providers focused on automation, accuracy, and workflow optimization. Major players consistently invest in R&D to enhance analyzer throughput, reagent stability, and digital integration capabilities. Companies strengthen portfolios through modular analyzers, cartridge-based POCT systems, and advanced optical or mechanical clot detection technologies. Strategic initiatives including partnerships with hospitals, expansion into emerging markets, and updates to quality-control systems help maintain competitive positioning. Vendors increasingly emphasize integrated data management, connectivity with LIS platforms, and compliance with regulatory standards. Additionally, growing demand for point-of-care PT/INR devices fuels competition among manufacturers developing portable, user-friendly systems for decentralized and home-based monitoring. As diagnostic networks consolidate, competition intensifies around service reliability, reagent availability, and long-term maintenance contracts. This dynamic ecosystem encourages continuous innovation and differentiated product offerings across both centralized and decentralized testing environments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Bio-Rad Laboratories (US)

- Siemens Healthineers (DE)

- Hemosure Inc. (US)

- Danaher Corporation (US)

- Grifols S.A. (ES)

- Roche Diagnostics (CH)

- Sysmex Corporation (JP)

- Thermo Fisher Scientific (US)

- Abbott Laboratories (US)

Recent Developments:

- In October 2025, the Blood Coagulation Testing Market is witnessing trends such as increased digitalization, sustainability initiatives, and the integration of artificial intelligence in testing processes. Strategic alliances are becoming increasingly important, as companies collaborate to enhance their technological capabilities and market reach. Looking ahead, competitive differentiation is likely to evolve, shifting from traditional price-based competition to a focus on innovation, advanced technology, and reliable supply chains. This transition may ultimately redefine how companies position themselves in the market, emphasizing the importance of adaptability and forward-thinking strategies.

- In August 2025, Roche Diagnostics (Switzerland) announced the launch of a new point-of-care testing device designed to provide rapid results for coagulation assessments. This strategic move is likely to enhance patient care by enabling timely clinical decisions, thereby reinforcing Roche’s commitment to innovation in diagnostic solutions. The introduction of this device may also position Roche favorably against competitors by addressing the growing demand for efficient testing solutions in various healthcare settings.

Report Coverage:

The research report offers an in-depth analysis based on Product, End-User, Test type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for automated coagulation analyzers will rise as hospitals and diagnostic networks accelerate workflow digitalization and centralized testing models.

- Point-of-care INR and coagulation devices will gain broader adoption in ambulatory and home-care settings to support faster clinical decisions.

- Integration of AI-driven analytics will improve test accuracy, instrument calibration, and predictive quality control across hemostasis laboratories.

- Manufacturers will expand cartridge-based and low-volume reagent systems to enhance ease of use and reduce operational complexity.

- Personalized anticoagulation management will grow as clinicians adopt remote monitoring tools for long-term therapy oversight.

- Development of compact, connected analyzers will strengthen diagnostic capacity in emerging and resource-limited regions.

- Interoperability with LIS and hospital information systems will become a core differentiator among leading vendors.

- R&D investments will focus on improving sensitivity and specificity of specialty tests such as platelet function and fibrinogen assays.

- Regulatory emphasis on assay standardization will drive demand for high-quality, compliant reagents and instruments.

- Strategic collaborations between diagnostic companies and healthcare providers will expand global access to advanced coagulation testing solutions.