| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Bridal Gowns Market Size 2024 |

USD 46.45 Million |

| Bridal Gowns Market, CAGR |

6.67% |

| Bridal Gowns Market Size 2032 |

USD 80.76 Million |

Market Overview

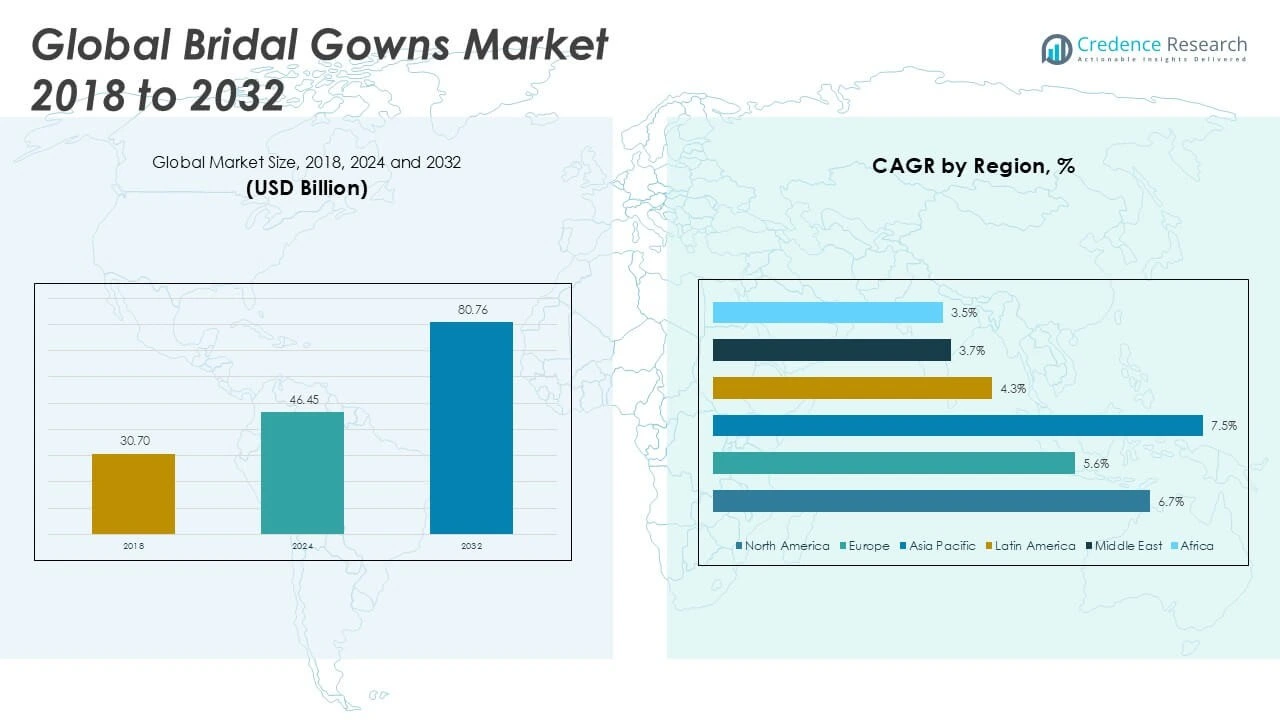

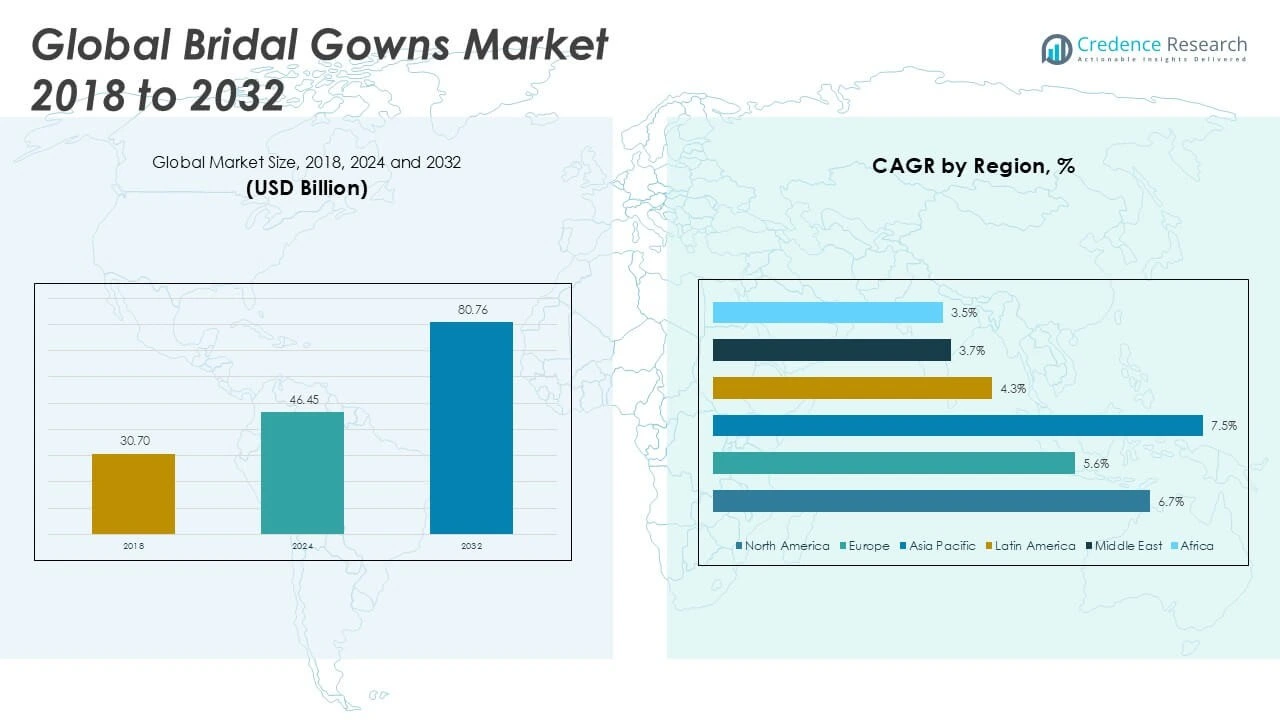

Bridal Gowns Market size was valued at USD 30.70 billion in 2018 to USD 46.45 billion in 2024 and is anticipated to reach USD 80.76 billion by 2032, at a CAGR of 6.67% during the forecast period.

The Bridal Gowns Market is experiencing steady growth driven by rising disposable incomes, increasing preference for personalized and designer wedding attire, and the expanding influence of social media and celebrity culture on bridal fashion choices. Demand remains strong as couples prioritize unique experiences and luxury aesthetics for weddings, encouraging innovation in fabric, design, and customization options. The market is further supported by the growing number of destination weddings and a shift toward sustainable, eco-friendly materials. E-commerce platforms and virtual try-on technologies have enhanced accessibility and convenience for brides, broadening the customer base and fueling global market expansion. Emerging trends include minimalist designs, cultural fusion styles, and inclusive sizing, reflecting evolving consumer expectations and diverse demographics. With a focus on individual expression and premium experiences, manufacturers and designers continue to adapt to changing tastes, ensuring the bridal gowns market remains dynamic and competitive worldwide.

The geographical analysis of the Bridal Gowns Market reveals strong growth across North America, Europe, and Asia Pacific, driven by cultural diversity, evolving fashion trends, and rising disposable incomes. North America and Europe remain significant hubs for luxury and designer bridal wear, with the United States, the United Kingdom, and France leading in demand for premium and customized gowns. Asia Pacific is witnessing rapid expansion, fueled by large populations, growing middle-class segments, and increasing influence of Western wedding traditions in countries like China, India, and Japan. This regional dynamism has encouraged both global and local brands to expand their reach and diversify offerings. Key players shaping the competitive landscape of the Bridal Gowns Market include JLM Couture Inc., Elie Saab, and Pronovias Fashion Group, all of which continue to innovate through exclusive collections, international collaborations, and enhanced digital engagement to meet the preferences of modern brides.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Bridal Gowns Market size was valued at USD 30.70 billion in 2018 to USD 46.45 billion in 2024 and is anticipated to reach USD 80.76 billion by 2032, at a CAGR of 6.67% during the forecast period.

- The market shows strong momentum due to rising disposable incomes, evolving wedding traditions, and greater demand for personalized bridal wear.

- Personalization and customization are reshaping product offerings, with modern brides seeking unique designs, sustainable materials, and digital shopping experiences.

- North America, Europe, and Asia Pacific represent key growth regions, with the United States, China, and India leading in both demand and innovation.

- Major players such as JLM Couture Inc., Elie Saab, and Pronovias Fashion Group drive competition through new collections, strategic collaborations, and expansion into digital channels.

- Market restraints include supply chain disruptions, fluctuating raw material costs, and challenges posed by fast-fashion competitors offering lower-priced alternatives.

- Regional analysis indicates a dynamic market environment, with established markets focusing on luxury and innovation, while emerging regions emphasize affordability, accessibility, and growing adoption of Western-style weddings.

Market Drivers

Rising Disposable Incomes and Aspirational Lifestyles Fuel Market Expansion

Growing disposable incomes worldwide enable consumers to allocate more funds toward special occasions such as weddings. The Bridal Gowns Market benefits significantly from this shift, as brides increasingly seek premium, custom-made, or designer gowns to reflect their aspirations. Affluent consumers are willing to pay for unique designs and personalized experiences, making luxury brands and couture designers more accessible and popular. Urbanization and higher living standards in developing regions further encourage spending on wedding attire. Social and cultural emphasis on weddings as milestone events has intensified, driving demand for exclusive and sophisticated bridal collections. With more resources at their disposal, couples are prioritizing style, quality, and memorable experiences when selecting bridal wear. These factors collectively sustain steady growth in the market.

For instance, according to the U.S. Census Bureau, approximately 2.02 million weddings took place in the U.S. in 2022, reflecting the ongoing prioritization of weddings in consumer spending.

Evolving Fashion Preferences and Influence of Media Shape Product Demand

The Bridal Gowns Market is undergoing transformation due to evolving fashion preferences, largely influenced by media, celebrities, and digital content. Brides are seeking inspiration from social media platforms, fashion magazines, and celebrity weddings, which elevates expectations for style, design, and innovation in bridal gowns. This trend motivates designers and brands to introduce modern silhouettes, fresh color palettes, and new materials, responding to the growing demand for unique and personalized wedding attire. Media exposure accelerates the adoption of global fashion trends, encouraging cultural fusion and experimentation with traditional designs. Consumers value individuality and are less inclined to follow conventional norms, resulting in increased diversity of bridal styles. It drives continuous product development and maintains strong consumer engagement.

For instance, Instagram and Pinterest have significantly influenced bridal fashion, with 72% of U.S. adults using social media platforms to explore wedding trends.

Technological Advancements and E-Commerce Drive Market Accessibility

Technology has played a crucial role in expanding the reach of the Bridal Gowns Market. E-commerce platforms and virtual try-on tools have improved the shopping experience for brides, making high-quality gowns more accessible across geographies. Online channels allow for easier comparison, customization, and delivery, appealing to tech-savvy and convenience-oriented consumers. Digital marketing and influencer collaborations enable brands to connect directly with potential buyers, driving awareness and boosting sales. Enhanced logistics infrastructure supports efficient fulfillment, reducing barriers for international customers. It ensures that both established and emerging brands can compete effectively on a global scale.

Sustainability and Inclusivity Gain Prominence in Consumer Choices

The Bridal Gowns Market is witnessing heightened demand for sustainable and inclusive products. Environmentally conscious consumers are prioritizing eco-friendly materials, ethical production processes, and transparent sourcing practices in their purchasing decisions. Manufacturers and designers are responding by offering gowns made from organic fabrics and implementing sustainable practices throughout the value chain. Inclusivity in sizing, style, and cultural representation is also reshaping product offerings, addressing diverse body types and preferences. Brands embracing sustainability and inclusivity are gaining market share and customer loyalty, reinforcing their competitive advantage. It reflects the industry’s shift toward socially responsible and customer-focused business models.

Market Trends

Personalization and Customization Set New Standards in Bridal Attire

Personalization is reshaping the Bridal Gowns Market, with brides seeking unique gowns that reflect individual style and preferences. Custom-designed dresses, personalized embroidery, and bespoke fittings are now standard offerings for many bridal boutiques and luxury brands. Designers are collaborating directly with clients to create exclusive pieces, elevating the perceived value of their collections. This shift encourages innovation in patterns, embellishments, and materials, enhancing the overall bridal shopping experience. The trend toward one-of-a-kind gowns strengthens brand differentiation in a competitive landscape. It fosters long-term relationships between designers and customers, making the bridal journey memorable and distinctive.

For instance, Rosa Clará launched a collection specifically geared toward youthful brides, featuring organza and sheath-style silhouettes.

Digital Platforms and Virtual Experiences Expand Consumer Access

Digital transformation is accelerating in the Bridal Gowns Market, where e-commerce, virtual consultations, and online customization tools have become essential. Brides are exploring and purchasing gowns online, often using augmented reality or virtual fitting rooms to visualize options before making decisions. These tools eliminate geographical barriers and provide convenient, interactive shopping experiences. Social media and influencer marketing amplify brand reach, shaping purchase decisions and spotlighting emerging designers. Virtual bridal shows and online communities support information sharing and trend discovery among brides-to-be. It strengthens engagement and enables brands to adapt quickly to shifting preferences.

For instance, AI-powered virtual fitting rooms are being integrated into bridal e-commerce platforms to enhance the shopping experience.

Sustainable Fashion Choices Gain Ground Among Modern Brides

Sustainability is a growing trend in the Bridal Gowns Market, with an increasing number of brides opting for eco-friendly fabrics and ethical production. Designers are incorporating recycled materials, reducing waste, and supporting fair labor practices to meet evolving consumer values. Rental and second-hand bridal gown platforms are gaining popularity, offering affordability and sustainability without sacrificing style. Transparent supply chains and certifications are becoming key decision factors for environmentally conscious buyers. The focus on green practices influences not only fabric choices but also packaging and distribution. It signals a broader shift toward responsible consumption in the bridal industry.

Inclusive Designs Reflect Diversity and Changing Social Norms

The Bridal Gowns Market is experiencing a movement toward greater inclusivity, with designers offering expanded size ranges, adaptive features, and multicultural styles. Brands are showcasing models of all shapes, sizes, and backgrounds, reflecting the real diversity of today’s brides. Adaptive gowns for different abilities and culturally inspired collections appeal to a broader clientele, increasing market reach. The industry’s embrace of body positivity and representation drives loyalty and creates new growth opportunities. Social expectations are evolving, making inclusivity a competitive advantage for progressive brands. It ensures the market remains relevant to a wide and diverse consumer base.

Market Challenges Analysis

Rising Costs and Supply Chain Disruptions Impact Market Stability

The Bridal Gowns Market faces significant challenges due to fluctuating raw material prices, rising labor costs, and supply chain disruptions. Global events and economic uncertainty create volatility in sourcing high-quality fabrics and skilled craftsmanship, leading to higher production expenses. Small and mid-sized designers find it difficult to maintain profitability while ensuring product quality. Delays in shipping and logistics can affect timely delivery, impacting customer satisfaction and brand reputation. The industry’s reliance on specialized materials and custom fittings intensifies these risks. It compels market players to seek innovative solutions in procurement and production to remain competitive.

For instance, textile companies are collaborating with designers to stay on top of the latest trends and improve their product range to attract more customers.

Intense Competition and Shifting Consumer Behavior Create Market Pressures

The Bridal Gowns Market encounters intense competition from established brands, emerging designers, and fast-fashion retailers offering lower-cost alternatives. Evolving consumer behavior, influenced by trends toward online shopping and last-minute purchasing, disrupts traditional sales models and forecasting. Price sensitivity among certain consumer segments limits the ability of premium brands to pass on rising costs. The expectation for personalized and rapid service further complicates operations for businesses with limited resources. Navigating changing preferences and maintaining a balance between innovation and affordability present ongoing challenges. It requires continuous adaptation to market dynamics and evolving consumer demands.

Market Opportunities

Emergence of Digital Platforms and Global Market Expansion

The Bridal Gowns Market presents substantial opportunities through the integration of digital platforms and expansion into emerging economies. Online retail channels, virtual consultations, and augmented reality fitting solutions provide new ways to reach tech-savvy brides and enhance the shopping experience. Brands that invest in digital marketing and seamless e-commerce infrastructure can tap into previously underserved markets and broaden their customer base. Globalization enables designers to offer diverse styles catering to multicultural preferences, driving demand in both established and developing regions. It allows companies to strengthen brand visibility and accessibility across borders, increasing sales potential.

Focus on Sustainability and Inclusive Offerings Drives Differentiation

Growing awareness of environmental and social issues creates opportunities for the Bridal Gowns Market to stand out with sustainable practices and inclusive product lines. Eco-friendly materials, transparent supply chains, and ethical production methods appeal to conscientious consumers seeking responsible options. Brands embracing inclusive sizing, adaptive designs, and cultural representation can attract a broader demographic and foster brand loyalty. Collaboration with local artisans and use of regionally inspired motifs help designers create distinctive offerings for diverse clientele. It positions the market for long-term growth by aligning with evolving consumer values and societal expectations.

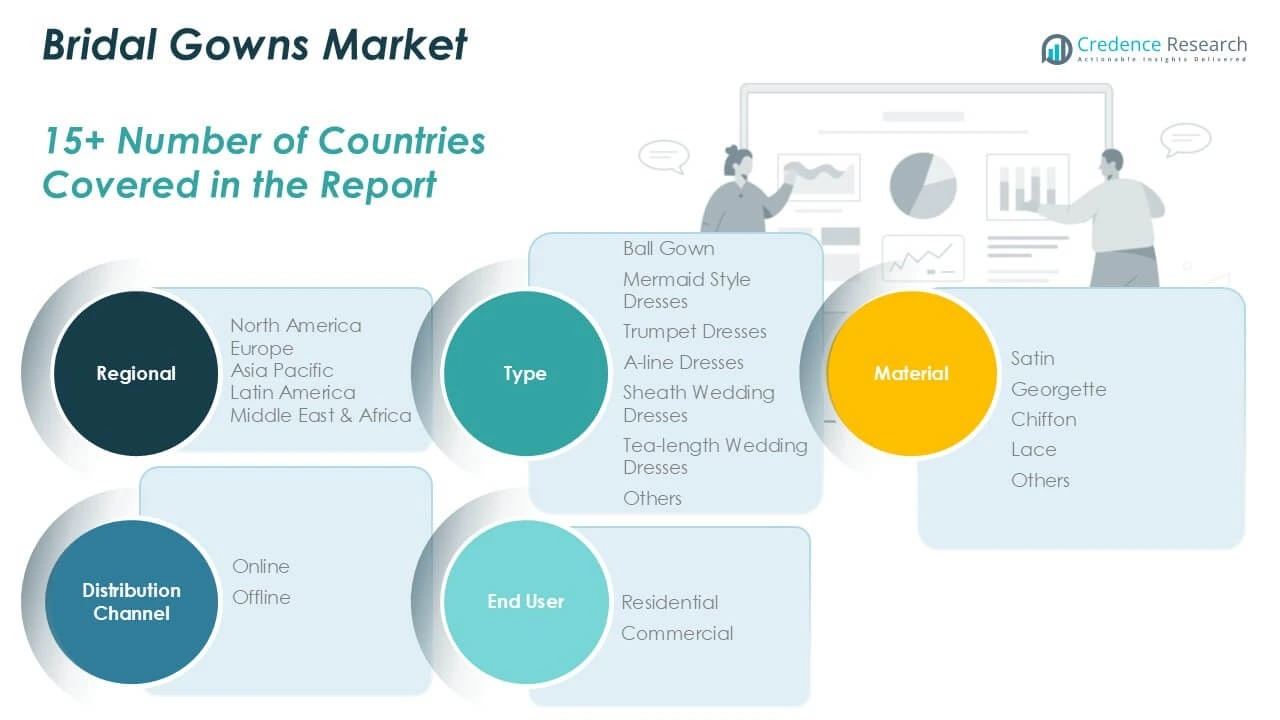

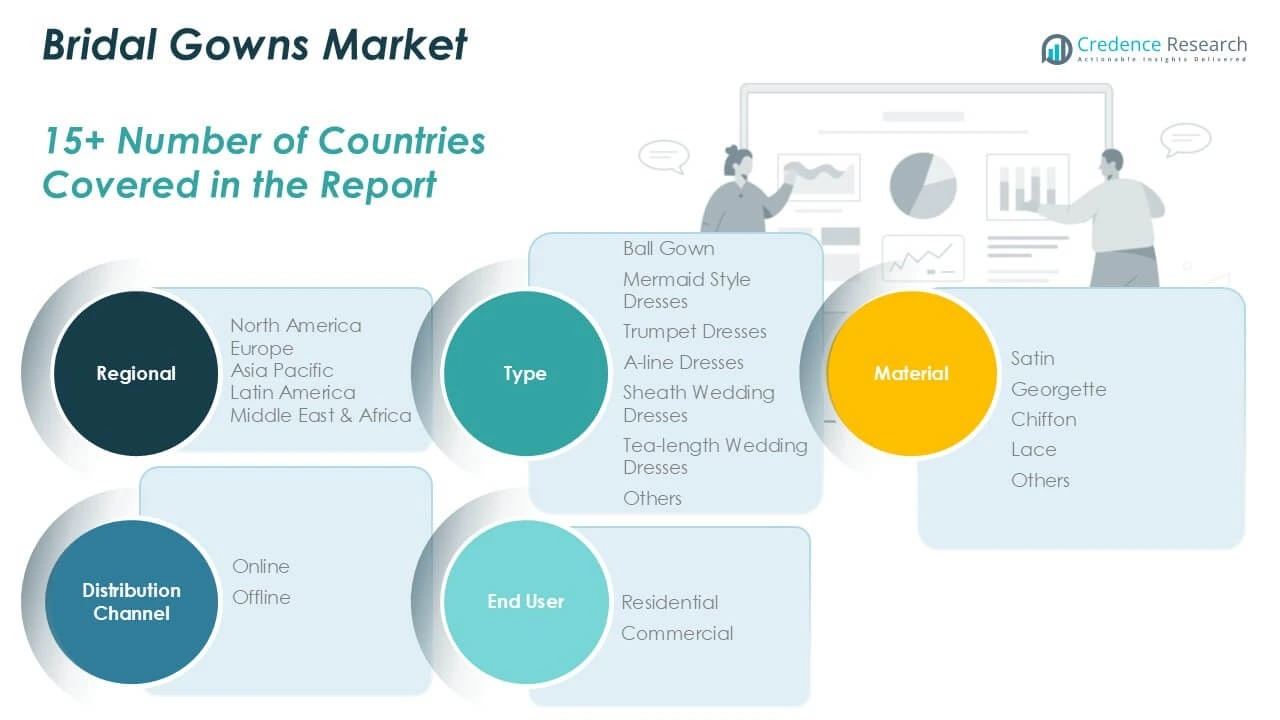

Market Segmentation Analysis:

By Type:

Ball gowns retain their popularity for traditional ceremonies, offering dramatic silhouettes and a sense of grandeur. Mermaid style dresses and trumpet dresses appeal to brides seeking a sophisticated, form-fitting look that accentuates the body’s natural curves. A-line dresses remain a versatile favorite, suitable for various wedding themes and body types. Sheath wedding dresses attract those who prefer minimalist elegance and contemporary styling, while tea-length wedding dresses offer a vintage-inspired choice favored for informal or outdoor celebrations. Other unique designs address niche demands and cater to brides looking for personalized statements, reflecting the increasing desire for individuality within the market.

By Material:

The Bridal Gowns Market features a wide range of luxurious fabrics designed to elevate the aesthetic and comfort of each gown. Satin is favored for its smooth texture and classic sheen, often chosen for formal and evening weddings. Georgette and chiffon provide lighter, flowy options that lend themselves to airy, romantic designs, popular for destination and summer weddings. Lace remains synonymous with bridal elegance, frequently used for intricate detailing and overlays, giving gowns a timeless, feminine appeal. Other materials continue to emerge as designers explore new fabric blends and sustainable alternatives, meeting the changing expectations of eco-conscious brides.

By Distribution Channel:

The Bridal Gowns Market is witnessing a clear shift toward omnichannel strategies. The online segment has grown rapidly, driven by the convenience of browsing extensive collections, virtual fittings, and home delivery options. Brides benefit from access to global brands and the ability to compare styles and prices without geographical constraints. Offline channels, including specialty bridal boutiques and high-end department stores, maintain their relevance by offering personalized fittings and expert consultations, delivering a premium, in-person shopping experience. It ensures that both digital and physical touchpoints cater to diverse consumer preferences, supporting market expansion and customer satisfaction.

Segments:

Based on Type:

- Ball Gown

- Mermaid Style Dresses

- Trumpet Dresses

- A-line Dresses

- Sheath Wedding Dresses

- Tea-length Wedding Dresses

- Others

Based on Material:

- Satin

- Georgette

- Chiffon

- Lace

- Others

Based on Distribution Channel:

Based on End User:

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America Bridal Gowns Market

North America Bridal Gowns Market grew from USD 9.96 billion in 2018 to USD 14.86 billion in 2024 and is projected to reach USD 25.94 billion by 2032, reflecting a compound annual growth rate (CAGR) of 6.7%. North America is holding a 32% market share. The United States leads regional demand, supported by a strong culture of destination and luxury weddings and significant influence from Hollywood bridal fashion trends. Canada contributes to growth with a rising focus on designer and sustainable gowns. The region benefits from advanced retail infrastructure and a high propensity for spending on premium wedding attire. Major brands and designers have established a robust presence, driving continuous product innovation. It remains a global trendsetter in bridal fashion.

Europe Bridal Gowns Market

Europe Bridal Gowns Market grew from USD 6.48 billion in 2018 to USD 9.34 billion in 2024 and is projected to reach USD 14.94 billion by 2032, at a CAGR of 5.6%. Europe is holding a 19% market share. Key countries including the United Kingdom, France, Italy, and Germany contribute to market expansion with their long-standing traditions in luxury fashion and craftsmanship. Demand for bespoke and couture gowns is strong, with Paris and Milan recognized as global bridal fashion hubs. The region emphasizes elegance and innovation in design, attracting brides from around the world. Changing consumer preferences for sustainable and minimalist options support ongoing growth. It sustains a leading reputation for high-quality bridal wear.

Asia Pacific Bridal Gowns Market

Asia Pacific Bridal Gowns Market grew from USD 12.08 billion in 2018 to USD 19.03 billion in 2024 and is expected to reach USD 35.32 billion by 2032, posting a CAGR of 7.5%. Asia Pacific is holding a 44% market share, led by China, India, and Japan. Rising disposable incomes, increasing wedding spending, and growing popularity of Western-style ceremonies drive significant demand. China’s vibrant manufacturing sector and India’s elaborate wedding culture contribute to a diverse market landscape. Local and international brands compete, offering a wide range of price points and styles. It benefits from a youthful population and digital adoption, accelerating market penetration.

Latin America Bridal Gowns Market

Latin America Bridal Gowns Market grew from USD 1.03 billion in 2018 to USD 1.530 billion in 2024 and is projected to reach USD 2.22 billion by 2032, with a CAGR of 4.3%. Latin America is holding a 3% market share, with Brazil and Mexico leading demand. The region’s wedding culture is influenced by vibrant traditions, family gatherings, and a preference for colorful, unique bridal attire. Growth is driven by expanding middle-class populations and increasing access to international brands. The adoption of e-commerce platforms supports accessibility to global trends and premium products. It faces challenges from economic fluctuations but remains an emerging opportunity for market players.

Middle East Bridal Gowns Market

Middle East Bridal Gowns Market grew from USD 0.68 billion in 2018 to USD 0.92 billion in 2024 and is forecast to reach USD 1.28 billion by 2032, with a CAGR of 3.7%. The Middle East holds a 2% market share, with the United Arab Emirates and Saudi Arabia as key countries. High-value weddings, luxury preferences, and a growing market for modest yet glamorous bridal gowns define the regional landscape. Bridal boutiques and international designers cater to diverse cultural and religious requirements, blending tradition with modern fashion. The influx of expatriates adds to the market’s variety and demand. It continues to develop as a niche for premium and customized bridal wear.

Africa Bridal Gowns Market

Africa Bridal Gowns Market grew from USD 0.46 billion in 2018 to USD 0.77 billion in 2024 and is projected to reach USD 1.06 billion by 2032, at a CAGR of 3.5%. Africa is holding a 1% market share, with South Africa, Nigeria, and Egypt as prominent countries. The market is characterized by a rich mix of cultural traditions and a rising interest in Western bridal styles. Increasing urbanization and a young, aspirational population drive growth in urban centers. Local designers are gaining recognition, offering affordable and innovative options to a diverse clientele. It faces challenges from limited distribution networks but shows potential for future expansion through digital channels and international collaborations.

Key Player Analysis

- JLM Couture Inc.

- Elie Saab

- Justin Alexander Inc.

- E.W. Ltd.

- Louis Vuitton

- Kleinfeld Bridal Corp.

- Harrods Limited

- Moonlight Bridal Design Inc.

- Maggie Sottero Designs L.L.C.

- Pronovias Fashion Group

Competitive Analysis

The competitive landscape of the Bridal Gowns Market is shaped by a blend of established luxury houses and specialized bridal designers that set global trends and standards. Leading players such as JLM Couture Inc., Elie Saab, Justin Alexander Inc., V.E.W. Ltd., Louis Vuitton, Kleinfeld Bridal Corp., Harrods Limited, Moonlight Bridal Design Inc., Maggie Sottero Designs L.L.C., and Pronovias Fashion Group command strong brand recognition and customer loyalty. These companies leverage their extensive design portfolios, exclusive collaborations, and international distribution networks to maintain a competitive edge. Their strategies focus on frequent launches of new collections, customization options, and incorporating sustainable materials to align with shifting consumer preferences. Digital engagement, including virtual consultations and interactive online platforms, allows these brands to reach a wider, tech-savvy customer base. Leading players invest in strategic partnerships and flagship store expansions, strengthening their global presence. Intense competition drives continuous innovation in fabrics, silhouettes, and customer experience. With rising consumer expectations for personalized and premium offerings, these companies maintain market leadership by adapting swiftly to fashion trends and leveraging both digital and offline retail channels.

Recent Developments

- In November 2024, Renowned designer Ravi Bajaj unveiled his new wedding wear label, Aurum, through a lavish fashion show at DLF Emporio, New Delhi, in collaboration with T&T Motors.

- In October 2024, Tasva, the designer Indian clothing brand co-owned by Aditya Birla Fashion Retail Ltd. and Tarun Tahiliani, showcased its autumn/winter 2024 wedding collection, “Baaraat,” at the Travancore Palace in New Delhi. Bollywood actor Ranbir Kapoor was the show-stopper, while digital influencers and celebrities also participated.

- In June 2024, Kleinfeld Bridal, renowned for its role in ‘Say Yes to the Dress,’ unveiled KleinfeldAgain.com, an online marketplace for buying and selling pre-owned wedding dresses. This initiative reflects the increasing consumer shift towards circular fashion, catering to brides seeking alternatives to traditional salon experiences.

Market Concentration & Characteristics

The Bridal Gowns Market exhibits a moderate to high level of market concentration, with a select group of established brands and designers holding significant influence over global trends and consumer preferences. It features a blend of luxury fashion houses, specialized bridal boutiques, and emerging designers, creating a dynamic and competitive environment. Key characteristics include a strong emphasis on product customization, high quality craftsmanship, and frequent introduction of new collections to capture evolving tastes. The market benefits from robust demand for personalized and premium bridal wear, driven by cultural traditions and aspirational lifestyles. Digital transformation has accelerated market access and customer engagement, with online platforms playing an increasingly important role. It remains sensitive to fashion trends, seasonality, and consumer expectations for exclusivity, ensuring continuous innovation and differentiation among leading players.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Material, Distribution Channel, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is projected to experience steady growth, driven by increasing demand for personalized and luxury bridal wear.

- Sustainable and eco-friendly bridal gowns are gaining popularity, reflecting a shift towards environmentally conscious consumer preferences.

- The rise of virtual fittings and online consultations is transforming the bridal shopping experience, enhancing accessibility and convenience.

- Emerging designers are entering the market, offering unique and customizable designs that cater to diverse tastes and preferences.

- Non-traditional wedding dresses, including colorful and gender-neutral options, are becoming more mainstream, reflecting evolving societal norms.

- The trend of multiple wedding outfits for various ceremonies and events is increasing, boosting overall demand for bridal attire.

- Destination weddings are influencing the demand for lightweight and versatile bridal gowns suitable for various climates and settings.

- The integration of technology, such as AI and 3D printing, is enabling innovative designs and personalized bridal wear solutions.

- The second-hand and rental bridal gown market is expanding, offering cost-effective and sustainable options for brides.

- Social media platforms continue to play a significant role in shaping bridal fashion trends and influencing consumer purchasing decisions.