Market Overview:

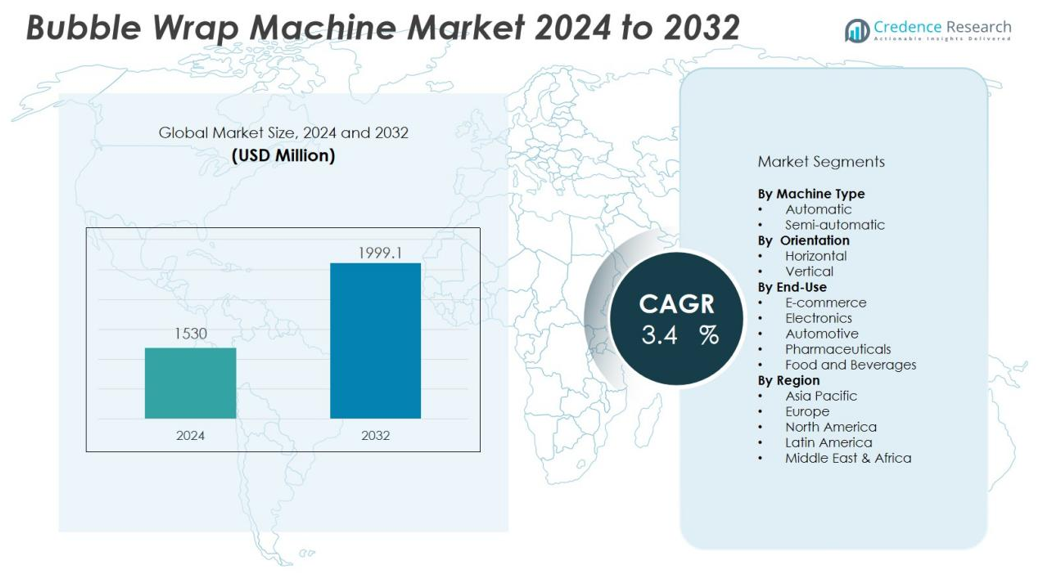

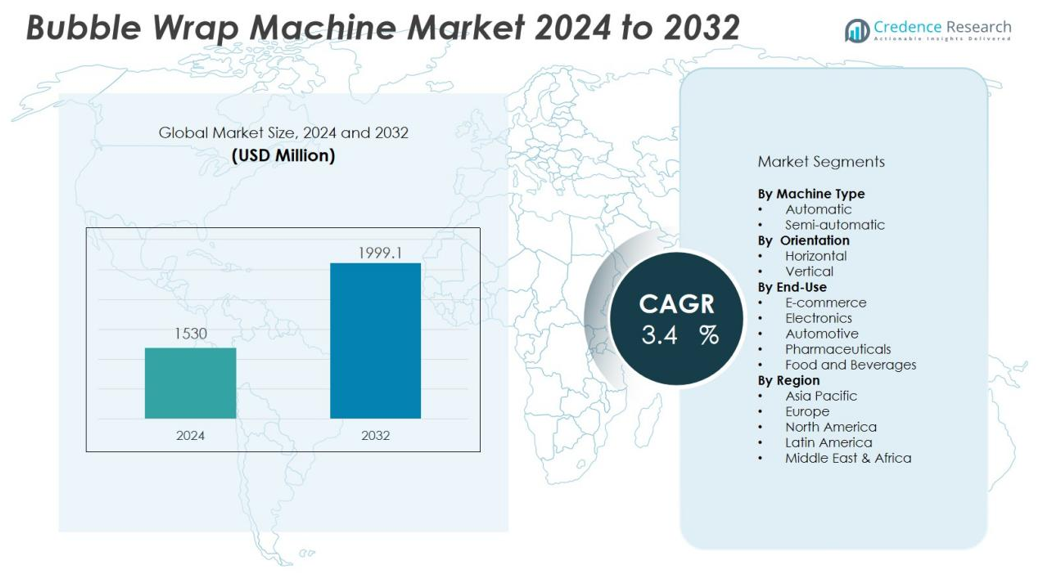

The bubble wrap machine market size was valued at USD 1530 million in 2024 and is anticipated to reach USD 1999.1 million by 2032, at a CAGR of 3.4 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Bubble Wrap Machine Market Size 2024 |

USD 1530 million |

| Bubble Wrap Machine Market, CAGR |

3.4% |

| Bubble Wrap Machine Market Size 2032 |

USD 1999.1 million |

Key market drivers include the rising adoption of online shopping, which fuels demand for protective packaging to ensure safe product delivery. Companies are investing in advanced bubble wrap machines to streamline operations, minimize labor costs, and improve packaging speed and quality. Environmental concerns and the push for sustainable packaging solutions further encourage manufacturers to develop recyclable and biodegradable bubble wrap materials, prompting machine upgrades and new installations.

Regionally, Asia-Pacific dominates the bubble wrap machine market, driven by rapid industrialization, robust manufacturing activities, and a thriving e-commerce sector. North America and Europe also represent significant market shares due to the presence of established packaging industries and strict regulations regarding product safety during transit. Growing export-import activities and heightened focus on supply chain efficiency further accelerate market adoption across these regions.

Market Insights:

- The bubble wrap machine market reached USD 1,530 million in 2024 and will rise to USD 1,999.1 million by 2032.

- Growth is fueled by e-commerce expansion, global trade, and rising demand for secure, protective packaging.

- Companies invest in automation to improve production efficiency, reduce labor costs, and deliver custom packaging.

- Environmental regulations push manufacturers to adopt machines compatible with recyclable and biodegradable films.

- High initial investment and maintenance requirements present barriers for small and medium enterprises.

- Asia-Pacific holds the largest share at 41%, driven by rapid industrialization and thriving e-commerce sectors.

- North America and Europe maintain significant market shares, supported by advanced infrastructure and strict safety regulations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Expansion of E-Commerce and Global Trade Stimulates Market Demand:

The rise of e-commerce and the globalization of trade have transformed packaging requirements across industries. Companies rely on secure and efficient protective packaging to prevent damage during transportation, which drives the adoption of automated bubble wrap machines. The surge in direct-to-consumer shipments from online retailers intensifies the need for high-throughput and cost-effective solutions. The bubble wrap machine market benefits from these trends, with manufacturers investing in advanced equipment to support growing parcel volumes.

- For instance, Sealed Air NewAir I.B. Flex Bubble Wrap Machine produces up to 90 feet of inflatable packaging per minute, substantially increasing packing line efficiency for high-volume e-commerce operations.

Technological Advancements Enhance Efficiency and Customization:

Modern bubble wrap machines incorporate cutting-edge technologies that improve speed, reliability, and flexibility. Automation enables precise control over bubble size and film thickness, meeting diverse packaging needs. Integration with smart sensors and digital interfaces enhances productivity and reduces waste. The bubble wrap machine market responds to evolving customer expectations by offering machines that support custom packaging and rapid changeovers.

- For instance, Sealed Air’s Universal Inflation System uses smart technology to automatically detect and configure the right seal temperature, airflow, and pressure for each material type, supporting over 80 types of BUBBLE WRAP® film while switching between materials on demand.

Environmental Regulations and Sustainability Initiatives Influence Purchasing Decisions:

Global awareness of plastic pollution and tightening environmental regulations encourage companies to adopt sustainable packaging solutions. Manufacturers develop machines compatible with recyclable or biodegradable films, aligning with eco-friendly business practices. It helps businesses comply with government mandates and meet consumer demand for responsible packaging. The bubble wrap machine market reflects this shift, with sustainability shaping product development and procurement.

Growth in Manufacturing and Logistics Sectors Increases Equipment Demand:

Industrial growth and the expansion of global logistics networks boost demand for protective packaging at every stage of the supply chain. Electronics, automotive, pharmaceuticals, and food sectors require reliable cushioning solutions to safeguard products. Investment in bubble wrap machines supports uninterrupted production and efficient distribution. The bubble wrap machine market captures this momentum by delivering reliable and scalable equipment for high-volume operations.

Market Trends:

Automation, Digitalization, and Smart Technology Integration Shape Product Development:

Rapid advances in automation and digitalization set new benchmarks for operational efficiency in packaging lines. Smart bubble wrap machines now feature programmable logic controllers, touchscreen interfaces, and real-time monitoring, enabling manufacturers to reduce downtime and improve quality control. Integration with Industry 4.0 systems allows remote diagnostics and predictive maintenance, ensuring continuous and optimized machine performance. The demand for customization pushes suppliers to offer machines with adjustable bubble sizes and film thickness, supporting a wide range of packaging needs. Connectivity and data analytics capabilities enable users to analyze production trends and maximize throughput. The bubble wrap machine market evolves with these technologies, allowing businesses to increase productivity while minimizing resource consumption.

- For instance, the ZL6000 Air Pillow Bubble Roll Wrap Machine allows users to control bubble size, thickness, and roll length via adjustable digital settings, supporting a high degree of customization for specific packaging requirements.

Sustainability and Eco-Friendly Materials Gain Industry Focus:

Environmental concerns drive companies to prioritize sustainability in packaging operations. It leads to a growing preference for machines designed to process recyclable, biodegradable, or compostable films. Equipment manufacturers are innovating to ensure compatibility with these eco-friendly materials without sacrificing efficiency or product protection. Demand for on-demand bubble wrap production is rising, as companies seek to reduce storage space and cut excess material usage. Industry players also explore solutions that minimize energy consumption and waste generation throughout the packaging process. The bubble wrap machine market incorporates these trends, supporting the shift toward responsible, sustainable packaging across various sectors.

- For instance, TecMaschin’s LPM16 bubble wrap machine operates at speeds up to 16m/min and allows quick adjustments for bubble size and material thickness, with user-friendly digital controls and compatibility with various films (HDPE, LDPE, polyacrylic), supporting rapid changeovers for complex packaging requirements.

Market Challenges Analysis:

High Initial Capital Investment and Maintenance Complexity Restrict Adoption:

The requirement for substantial upfront investment remains a barrier for small and medium-sized businesses. Bubble wrap machines equipped with advanced automation and digital interfaces often command high acquisition costs, which can deter companies with limited capital resources. Ongoing maintenance and the need for skilled operators further add to operational expenses. It raises the total cost of ownership, making it challenging for price-sensitive buyers to justify machine upgrades or replacements. The bubble wrap machine market must address these financial hurdles to broaden its customer base.

Environmental Regulations and Material Compatibility Concerns Limit Market Growth:

Stringent environmental regulations and evolving standards for packaging materials require manufacturers to adapt rapidly. Not all bubble wrap machines can process newer biodegradable or recyclable films, limiting flexibility for users aiming to meet sustainability goals. Equipment compatibility issues may result in production disruptions and increased costs for machine modifications. Companies face uncertainty in selecting technology that aligns with both regulatory mandates and future packaging trends. The bubble wrap machine market encounters these challenges while striving to remain innovative and compliant.

Market Opportunities:

Rising Demand for Sustainable Packaging Solutions Creates Growth Potential:

Global focus on sustainability opens new avenues for innovation in packaging technologies. Companies seek machines that efficiently produce bubble wrap from biodegradable and recyclable materials, supporting eco-friendly business models. Investments in R&D allow manufacturers to design equipment that meets both performance and environmental requirements. It enables businesses to align with regulatory mandates and appeal to environmentally conscious consumers. The bubble wrap machine market can expand its reach by offering advanced solutions tailored to green packaging initiatives.

- Commerce Expansion and Customization Needs Offer New Revenue Streams:

The surge in e-commerce creates significant opportunities for on-demand and customizable packaging solutions. Companies require machines that deliver high-speed, flexible production to meet diverse shipping requirements. Integration with automated warehouse systems supports streamlined operations and just-in-time manufacturing. Custom bubble sizes and film options enhance product protection and branding for online retailers. The bubble wrap machine market can capitalize on this trend by delivering versatile machines that adapt to evolving packaging and logistics needs.

Market Segmentation Analysis:

By Machine Type:

The bubble wrap machine market features automatic and semi-automatic machines as its primary segments. Automatic machines command significant demand due to their high-speed production capabilities and advanced automation features. These machines support large-scale operations, reduce labor costs, and offer consistent product quality. Semi-automatic machines appeal to small and medium enterprises that prioritize flexibility and lower capital investment. It enables manufacturers to cater to businesses of all sizes and adapt to varying production requirements.

- For instance, Sealed Air’s BUBBLE WRAP® Brand Flex system produces up to 90 linear feet of inflatable cushioning per minute, enabling rapid packaging for e-commerce fulfillment centers.

By Orientation:

Horizontal and vertical bubble wrap machines represent the major orientation segments. Horizontal machines dominate the market for their ability to handle wide film rolls and deliver high output, making them suitable for large packaging operations. Vertical machines occupy a niche space, serving facilities with space constraints and specialized packaging needs. The segment reflects customer preferences for layout efficiency and production flow optimization. It provides end users with options that fit diverse operational setups.

- For instance, the VELTEKO WASHDOWN vertical packaging machine achieves speeds of up to 160 bags per minute while maintaining a compact design for hygienic, high-throughput environments—making it particularly effective in settings where space and sanitation are critical.

By End-Use:

Key end-use sectors for the bubble wrap machine market include e-commerce, electronics, automotive, pharmaceuticals, and food and beverages. E-commerce and electronics industries generate substantial demand due to their reliance on protective packaging for safe product delivery. Automotive and pharmaceutical sectors also invest in advanced machines to protect sensitive components and products during transit. Food and beverage applications focus on maintaining product integrity and hygiene. It positions the bubble wrap machine market as an essential contributor across a broad range of industries.

Segmentations:

By Machine Type:

By Orientation:

By End-Use:

- E-commerce

- Electronics

- Automotive

- Pharmaceuticals

- Food and Beverages

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Asia-Pacific :

Asia-Pacific commands 41% share of the global bubble wrap machine market, driven by rapid industrialization and robust growth in manufacturing and logistics. China, India, and Southeast Asian countries serve as manufacturing hubs for electronics, automotive, and consumer goods. E-commerce penetration accelerates demand for protective packaging, fueling investments in modern machinery. Regional governments support infrastructure development and smart factory initiatives, further enhancing market growth. The availability of skilled labor and cost-effective production capabilities attracts global manufacturers to set up facilities in this region. It positions Asia-Pacific as the primary growth engine for the bubble wrap machine industry.

North America :

North America holds 27% share of the bubble wrap machine market, led by the United States and Canada. The region benefits from advanced manufacturing infrastructure and early adoption of automation and digital technologies. Strict product safety regulations and high e-commerce activity drive continuous investment in efficient packaging equipment. Major players introduce machines with improved customization and eco-friendly features, responding to changing industry standards. The logistics and retail sectors, including leading online marketplaces, rely on automated packaging lines to optimize operations. It sustains steady market demand and supports technological leadership in North America.

Europe :

Europe captures 21% share of the bubble wrap machine market, shaped by strict environmental regulations and a strong focus on sustainable practices. Germany, France, and the United Kingdom lead adoption of recyclable and biodegradable packaging materials. The market responds to EU directives promoting waste reduction and eco-design, driving machine upgrades and new installations. Investments in green technologies and automation support the region’s competitive edge in high-value packaging solutions. It encourages collaboration among manufacturers, suppliers, and end users to meet evolving compliance requirements and sustainability targets. Europe remains a dynamic market for innovative and responsible bubble wrap machinery.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Sealed Air Corporation

- IVEX Protective Packaging Inc.

- Automated Packaging System

- Jiffy Packaging Co.

- Veritiv Corporation

- Pregis Corporation

- Flexi-Hex

- Atlantic Packaging Products Ltd.

- Barton Jones Packaging Ltd.

- Storopack Hans Reichenecker GmbH

Competitive Analysis:

The bubble wrap machine market features strong competition among leading global and regional manufacturers. Major companies such as Sealed Air Corporation, IVEX Protective Packaging Inc., Automated Packaging System, Jiffy Packaging Co., Veritiv Corporation, Pregis Corporation, and Flexi-Hex focus on innovation, product reliability, and after-sales service to maintain market presence. It drives differentiation through advanced automation, compatibility with sustainable films, and scalable machine models for diverse applications. Companies invest in research and development to launch high-efficiency machines and secure regulatory compliance. Strategic partnerships, distribution networks, and responsive technical support enhance competitiveness across key regions. The market rewards firms that deliver tailored solutions and respond quickly to shifting customer demands in e-commerce, electronics, and logistics sectors.

Recent Developments:

- In May 2024, Specialized Packaging Group, the parent company of IVEX Protective Packaging Inc., announced the acquisition of Clark Foam to expand production capabilities within North America.

- In April 2023, Sealed Air Corporation entered a strategic partnership with Koenig & Bauer AG to advance digital printing technology for packaging.

- In January 2025, Veritiv finalized the sale of its rigid containers business (All American Containers) to TricorBraun.

Market Concentration & Characteristics:

The bubble wrap machine market exhibits moderate concentration, with a mix of established global players and regional manufacturers competing on technology, price, and service. Leading companies differentiate through advanced automation, energy efficiency, and compatibility with sustainable materials. It features high entry barriers due to significant capital requirements and technical expertise needed for product development. Strategic collaborations, continuous R&D, and a focus on after-sales support define the competitive landscape. The market prioritizes innovation in machine design, integration with smart factory systems, and tailored solutions to meet diverse packaging needs across industries.

Report Coverage:

The research report offers an in-depth analysis based on Machine Type, Orientation, End-Use and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- Increased demand for sustainable packaging solutions will drive adoption of machines capable of handling biodegradable or recyclable films in the bubble wrap machine market.

- Manufacturers will introduce modular systems that support flexible production for diverse package formats and volumes.

- Integration of predictive maintenance technologies will enhance machine uptime and reduce unplanned disruptions.

- Data analytics tools will enable real‑time quality monitoring and operational optimization across packaging lines.

- Expansion of e‑commerce and omni-channel logistics will stimulate demand for high‑speed, on‑demand bubble wrap production.

- Equipment vendors will offer scalable models that accommodate small businesses and enterprise operations alike.

- Partnerships between machine suppliers and packaging film producers will foster coordinated innovation in material and machine compatibility.

- Emerging markets in Latin America and the Middle East will present new growth opportunities through infrastructure development and industrial expansion.

- Energy‑efficient machine designs and low‑waste production methods will become standard features in new offerings.

- Collaboration between packaging equipment manufacturers and supply chain integrators will drive end‑to‑end automation and improved throughput.