Market Overview

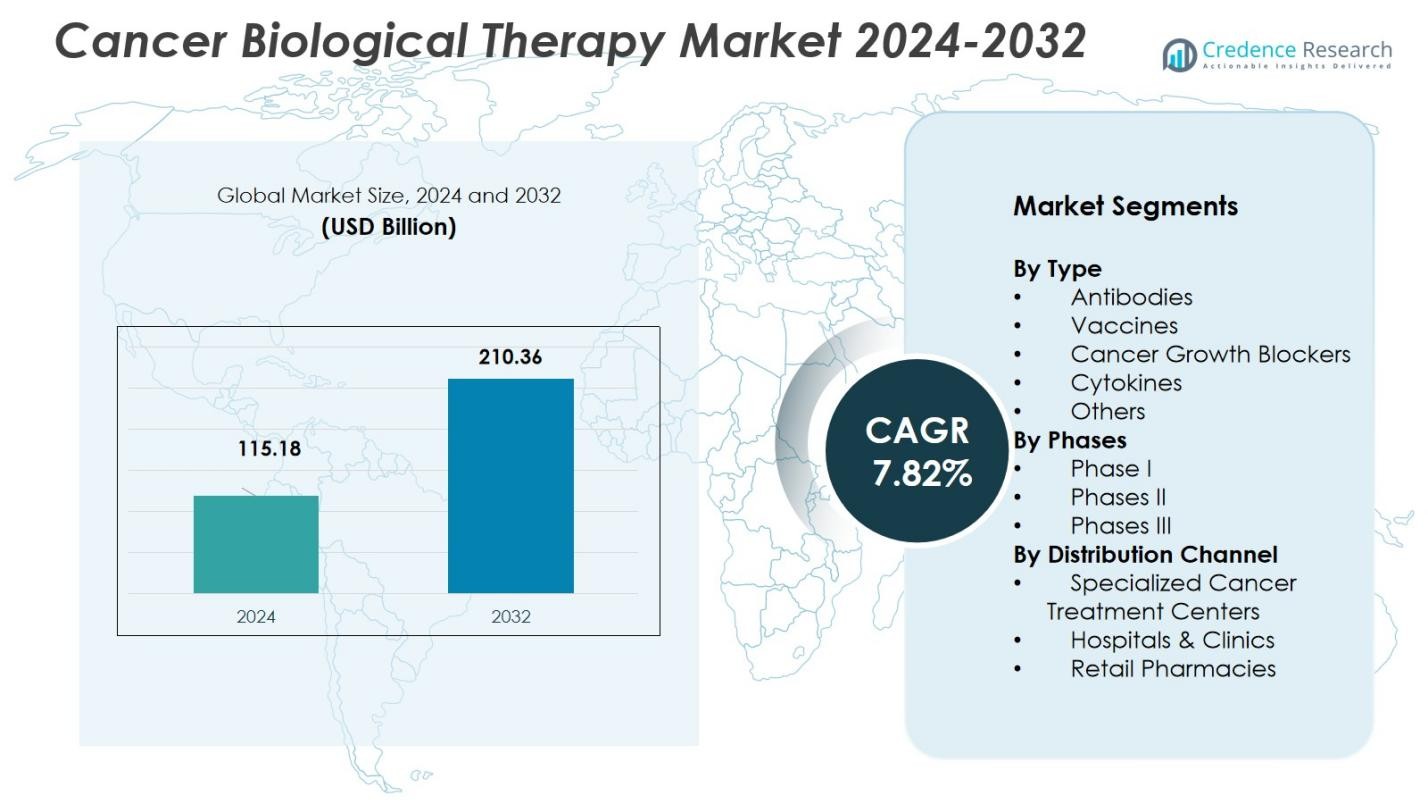

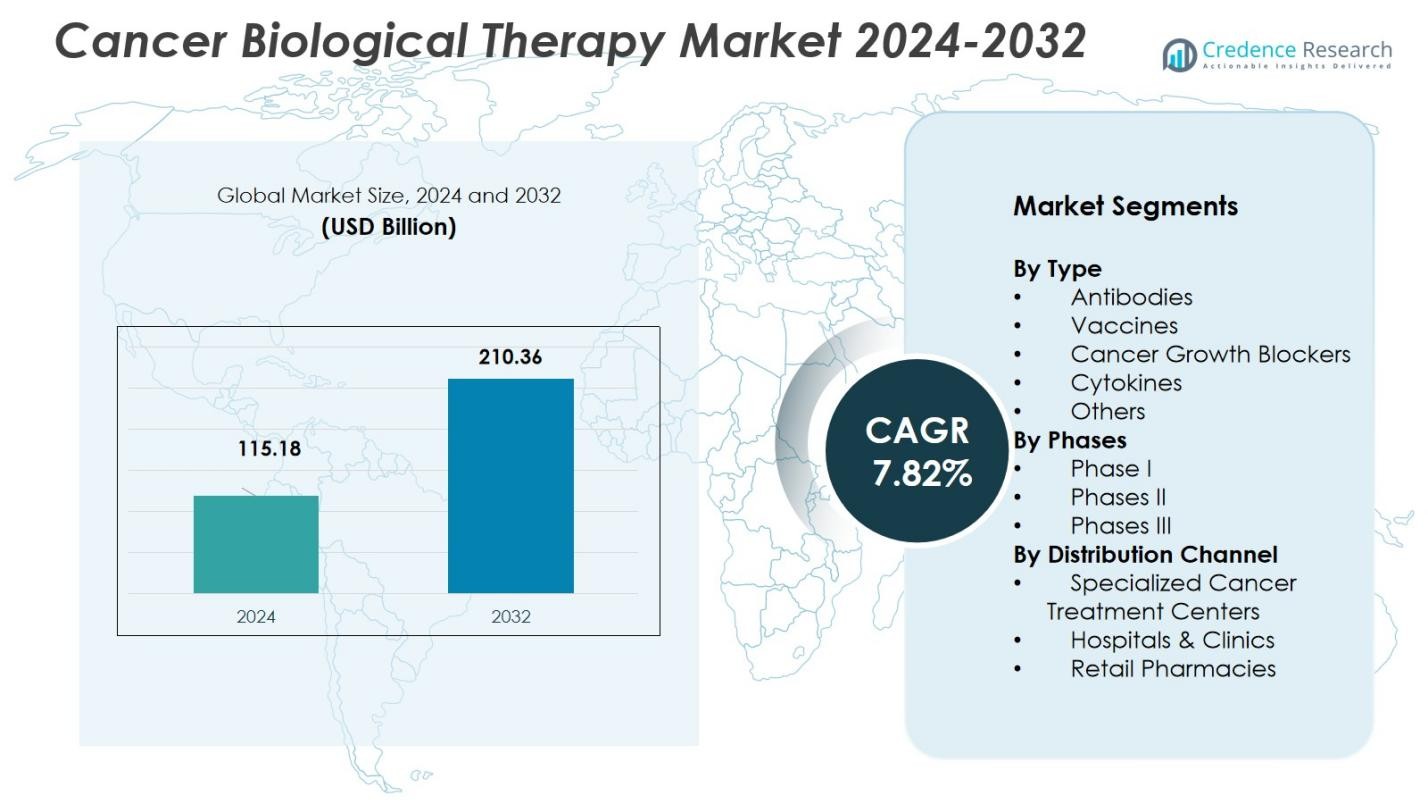

The Cancer Biological Therapy Market size was valued at USD 115.18 Billion in 2024 and is anticipated to reach USD 210.36 Billion by 2032, at a CAGR of 7.82% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cancer Biological Therapy Market Size 2024 |

USD 115.18 Billion |

| Cancer Biological Therapy Market, CAGR |

7.82% |

| Cancer Biological Therapy Market Size 2032 |

USD 210.36 Billion |

Cancer Biological Therapy Market shows strong participation from leading firms such as Roche, Merck, Novartis, Pfizer, Sanofi, Bayer, ELI Lilly, Incyte, Bristol‑Myers Squibb and Amgen operating globally with diverse biologic portfolios. The market’s largest regional contributor is North America, which held a 44.4% share in 2024, benefiting from advanced healthcare infrastructure, high cancer incidence, strong regulatory support and high adoption of biologic therapies. Europe and Asia‑Pacific follow, with Europe contributing a substantial share supported by mature oncology research and reimbursement frameworks, while Asia‑Pacific is witnessing rapid growth driven by rising cancer prevalence, expanding healthcare investment and increasing access to modern biologic treatments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Cancer Biological Therapy Market size was valued at USD 115.18 Billion in 2024 and is anticipated to reach USD 210.36 Billion by 2032, at a CAGR of 7.82% during the forecast period.

- Increasing cancer prevalence and advancements in biologic research, including monoclonal antibodies and immunotherapies, are driving market growth.

- The growing trend towards personalized and combination therapies is shaping the market, as these treatments offer better efficacy and patient outcomes.

- The “Antibodies” segment holds the largest market share of 45% in 2024, with monoclonal antibodies leading the way in targeted cancer treatments.

- North America leads the market with a 44.4% share, followed by Europe at 28.7%, while Asia‑Pacific is rapidly growing with an increasing adoption of biologic therapies due to rising healthcare investments.

Market Segmentation Analysis:

By Type

In the Cancer Biological Therapy Market, the “Antibodies” segment is the dominant sub-segment, holding a significant market share of 45% in 2024. This growth is driven by the increasing adoption of monoclonal antibodies, which offer targeted treatment options with fewer side effects. The effectiveness of antibodies in treating various cancers such as breast, lung, and colorectal cancer contributes to their widespread use in both therapeutic and preventive applications. Innovations in antibody-drug conjugates and biosimilars are further enhancing market growth and broadening treatment access across patient populations.

- For instance, humanized monoclonal antibodies h1B8 and h6D4 targeting ROR1 have shown remarkable anti-tumor activity against lung, liver, and breast cancers in preclinical models, demonstrating their effectiveness in suppressing tumor growth.

By Phases

The “Phase III” sub-segment holds the largest market share of 55% in the Cancer Biological Therapy Market, reflecting its pivotal role in the final stages of clinical trials before drug approval. Phase III trials typically involve large-scale patient groups, confirming the drug’s efficacy and safety. The dominance of this phase is driven by the high demand for therapies that have successfully undergone earlier-stage trials and are ready for commercial release. With several biologic therapies nearing the end of Phase III trials, this sub-segment is poised for continued expansion in the coming years.

- For instance, Merck’s Keytruda, which underwent large-scale Phase III testing involving more than 1,000 participants to establish its effectiveness in melanoma.

By Distribution Channel

The “Specialized Cancer Treatment Centers” sub-segment dominates the Cancer Biological Therapy Market, accounting for a market share of 50% in 2024. These centers are equipped with advanced medical technologies and specialized oncology care, making them the preferred distribution channel for biological therapies. Their dominance is fueled by the increasing demand for precision medicine and personalized care for cancer patients, as well as the ability to offer cutting-edge biologic treatments in controlled, expert environments. Specialized centers also offer better patient outcomes due to their focus on cancer-specific therapeutic approaches.

Key Growth Drivers

Increasing Cancer Prevalence

The rising global prevalence of cancer is a major growth driver for the Cancer Biological Therapy Market. With the incidence of various cancer types, including breast, lung, and colorectal cancers, steadily increasing, there is a growing demand for effective biological therapies. As the population ages, the incidence of cancer is expected to continue rising, fueling the demand for targeted, innovative treatments. Advances in biologics offer hope for better survival rates and fewer side effects compared to traditional therapies, driving market growth.

- For instance, Bristol Myers Squibb has revolutionized cancer treatment with checkpoint inhibitors that activate the immune system to fight cancer, significantly improving survival rates in various cancers.

Advancements in Biologic Research

Continuous advancements in biologic research and technology are accelerating the development of novel therapies, propelling growth in the Cancer Biological Therapy Market. Research into monoclonal antibodies, gene therapies, and immunotherapies is opening up new avenues for cancer treatment, particularly in targeting specific cancer cells while minimizing harm to healthy tissue. These innovations are expected to significantly enhance the effectiveness of cancer treatments, improving patient outcomes and expanding the market for biological therapies in oncology.

- For instance, in 2025 the FDA approved Lynozyfic, a bispecific antibody that binds simultaneously to cancer cells and immune cells in relapsed or refractory multiple myeloma patients who have received at least four prior therapies. This targeted immunotherapy helps the immune system directly attack tumors.

Supportive Regulatory Environment

The supportive regulatory environment for biologic drugs plays a crucial role in driving the Cancer Biological Therapy Market forward. Regulatory agencies such as the FDA and EMA have streamlined approval processes for biologic therapies, accelerating the introduction of new treatments. Additionally, initiatives such as fast-tracking promising cancer therapies and providing incentives for the development of orphan drugs are helping to bring new biologics to market faster. This supportive framework encourages investment in cancer research and development, further fueling market expansion.

Key Trends & Opportunities

Personalized Cancer Therapy

Personalized or precision medicine is a growing trend in the Cancer Biological Therapy Market. By tailoring treatments to an individual’s genetic makeup, doctors can offer more targeted and effective therapies, improving outcomes while reducing side effects. This shift towards personalized cancer treatment is unlocking significant opportunities for biologic therapies, especially in fields like immunotherapy and gene therapy. As more biomarkers are discovered, the market for personalized biologic treatments is poised to expand, creating new avenues for both existing and emerging companies.

- For instance, Medanta uses AI-driven algorithms combined with immunotherapy techniques to customize cancer treatment, enhancing efficacy and safety for each patient.

Combination Therapies

Combination therapies are becoming increasingly popular in the Cancer Biological Therapy Market. By combining biological therapies with other treatments such as chemotherapy, radiation, or targeted therapies, these treatments offer enhanced efficacy and the potential for better patient outcomes. Combination therapies are particularly beneficial for cancers that are difficult to treat with single-drug therapies. As the scientific understanding of cancer biology advances, the opportunities for developing effective combination therapies are expanding, presenting a significant market opportunity for drug developers.

- For instance, GSK submitted a Biologics License Application for Blenrep combined with bortezomib plus dexamethasone or pomalidomide plus dexamethasone to treat multiple myeloma patients who had prior therapy lines.

Key Challenges

High Treatment Costs

One of the major challenges facing the Cancer Biological Therapy Market is the high cost of treatments. Biological therapies, particularly monoclonal antibodies and gene therapies, can be prohibitively expensive, limiting access to patients who may benefit from these treatments. The high costs not only pose challenges for healthcare systems but also create barriers to access for patients in low- and middle-income countries. Reducing the cost of production, improving affordability, and increasing insurance coverage for biologic therapies are essential to addressing this challenge.

Regulatory and Market Access Barriers

Despite supportive regulatory environments, navigating the regulatory landscape for cancer biological therapies can be complex and time-consuming. Different regions have varying approval requirements, which can delay the introduction of new treatments to the market. Additionally, market access barriers such as reimbursement issues and pricing negotiations can hinder the widespread adoption of biologic therapies. Streamlining regulatory pathways and improving global market access will be critical to ensuring that cancer patients worldwide benefit from the latest biologic treatments.

Regional Analysis

North America

North America leads the Cancer Biological Therapy Market with a market share of 43.9% in 2024. The region’s dominance is underpinned by advanced healthcare infrastructure, high per‑capita healthcare expenditure, and widespread adoption of biologic therapies. Strong R&D investment, presence of leading pharmaceutical companies, and efficient regulatory pathways enable rapid commercialization of innovative biologics. High cancer incidence combined with rising demand for targeted, immunotherapy, and personalized treatment options sustains robust growth. The established clinical and reimbursement ecosystem further ensures patients’ access to cutting‑edge cancer biologics, consolidating North America’s leading position.

Europe

Europe secures a significant share of the Cancer Biological Therapy Market, accounting for 28.7% of the global market in 2024. The region benefits from mature healthcare systems, strong oncology research bases, and growing uptake of biologic therapies. Countries such as Germany, France, and the UK show strong demand owing to aging populations, rising cancer burden, and supportive reimbursement frameworks. Regulatory harmonization and cross‑country clinical trial networks accelerate the launch of biologic therapies. The robust presence of domestic and multinational pharmaceutical players further drives adoption of advanced therapies such as monoclonal antibodies and immunotherapies.

Asia‑Pacific

The Asia‑Pacific region emerges as a high‑growth contributor to the Cancer Biological Therapy Market, holding a market share of 15.8% in 2024. Increasing cancer incidence, rising healthcare investment, and expanding access to advanced treatments are driving demand for biologic therapies. Growing demand for precision medicine, rising awareness, and expanding oncology infrastructure in major countries fuel uptake. While the current share is smaller relative to developed regions, accelerating growth trajectories and rising government support for cancer treatment suggest the Asia‑Pacific market is poised for rapid expansion. The region represents a key future growth engine for biologic cancer therapies.

Latin America

Latin America accounts for 7.2% of the Cancer Biological Therapy Market in 2024. Increasing cancer prevalence, improving healthcare infrastructure, and rising access to oncology treatments are driving uptake of biologic therapies. However, market growth is moderated by limited access in rural areas, variable reimbursement policies, and affordability challenges. As awareness improves and public and private investment in healthcare expands, Latin America is gradually evolving into a noteworthy regional market for cancer biologics, though its share remains lower compared to North America, Europe, and Asia‑Pacific.

Middle East & Africa

The Middle East & Africa region represents a smaller but gradually emerging market for cancer biologic therapies, with a market share of 4.4% in 2024. Uptake is driven by increasing cancer burden, improvements in healthcare infrastructure in urban centers, and growing demand for modern oncology treatments. Key challenges—such as fragmented healthcare systems, limited reimbursement coverage, and affordability constraints—slow adoption. However, as regional governments and private stakeholders invest in oncology care capacity and as access to biologic therapies improves, the region is expected to see incremental growth and slowly increase its contribution to the global cancer biologics market.

Market Segmentations:

By Type

- Antibodies

- Vaccines

- Cancer Growth Blockers

- Cytokines

- Others

By Phases

- Phase I

- Phases II

- Phases III

By Distribution Channel

- Specialized Cancer Treatment Centers

- Hospitals & Clinics

- Retail Pharmacies

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Cancer Biological Therapy Market is highly competitive, with key players such as Roche, Merck, Bristol-Myers Squibb, Amgen, and Pfizer leading the market in terms of product offerings and market share. These companies dominate the market through a combination of robust product pipelines, strategic partnerships, and acquisitions. Roche and Bristol-Myers Squibb, for instance, are pioneers in immunotherapy treatments, particularly in monoclonal antibodies, which continue to capture significant market shares. Merck’s Keytruda has been one of the leading immunotherapy drugs, propelling the company’s strong market presence. Additionally, Amgen’s advancements in biologics for cancer treatment and Pfizer’s ongoing efforts in the development of targeted therapies further bolster their competitive positions. The market is also witnessing increasing collaboration between biopharmaceutical companies and research institutions, accelerating the development of novel therapies. As the demand for personalized and targeted cancer treatments rises, competition is intensifying, with these key players focusing on innovation and expanding their product portfolios.

Key Player Analysis

- Bristol-Myers Squibb

- Merck

- Roche

- Pfizer

- Amgen

- Sanofi

- Bayer

- Incyte

- Novartis International

- ELI Lilly

Recent Developments

- In June 2025, Bristol‑Myers Squibb partnered with BioNTech to co‑develop and co‑commercialize a next‑generation bispecific antibody candidate (BNT327) for solid tumors, marking a landmark immunotherapy collaboration.

- In February 2025, AbbVie signed a collaboration and option-to-license agreement with Xilio Therapeutics to jointly develop novel tumor‑activated immunotherapies, including masked T‑cell engagers, advancing next‑gen cancer biologic therapy.

- In March 2025, Bristol‑Myers Squibb agreed to acquire 2seventy bio a cell therapy firm for approximately US$ 286 million, gaining full control over its CAR‑T cell therapy portfolio to streamline future profits.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Phases, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Cancer Biological Therapy Market is expected to witness significant growth as the demand for targeted and personalized treatments increases.

- Advances in immunotherapy, including CAR-T cell therapies and immune checkpoint inhibitors, will continue to drive market expansion.

- The rise in cancer prevalence, particularly in aging populations, will further fuel the demand for biological treatments.

- Collaboration between pharmaceutical companies and biotechnology firms will accelerate the development of innovative therapies.

- The market will see a growing trend toward combination therapies, improving the efficacy of biological treatments.

- Regulatory support and faster approval pathways will enhance market access for novel biologic therapies.

- Increased investments in research and development will lead to the introduction of new biologic treatments, expanding therapeutic options.

- Greater awareness of biologic therapies among healthcare professionals and patients will boost market adoption.

- The growing emphasis on precision medicine and biomarkers will shape the future of cancer biological therapies.

- Emerging markets in Asia-Pacific and Latin America will present new growth opportunities as access to cancer treatments improves.