Market Overview:

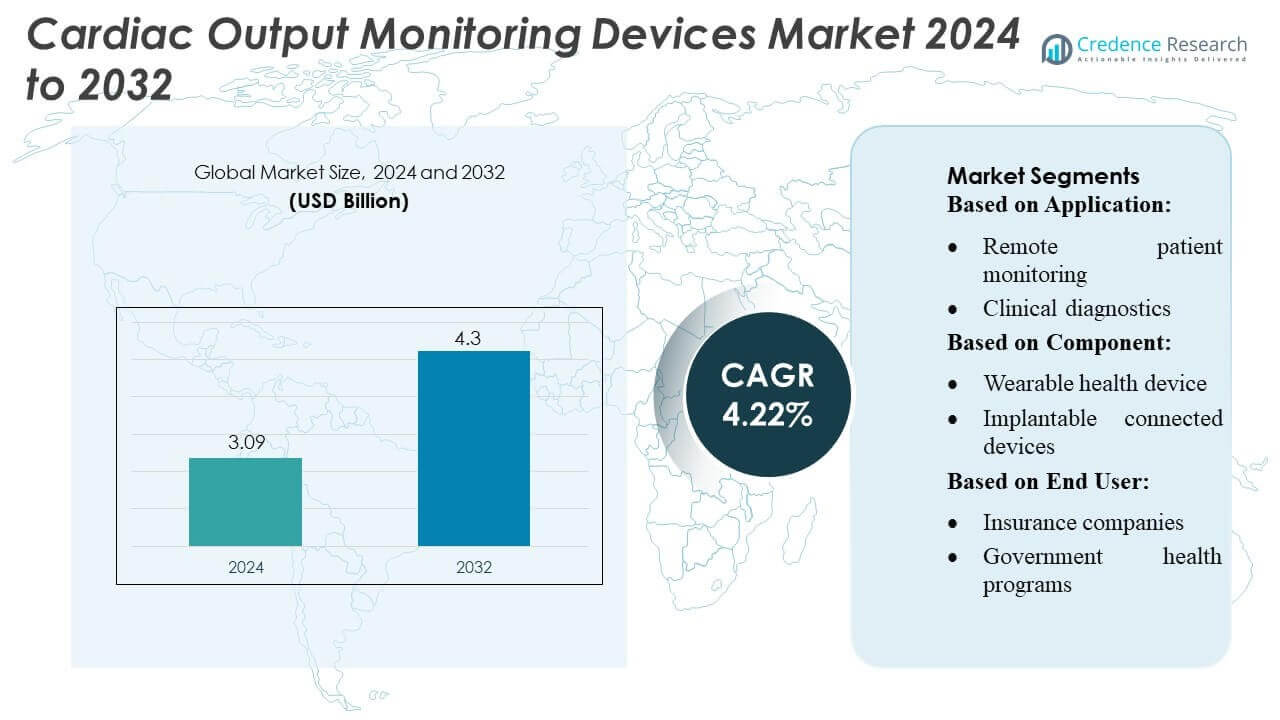

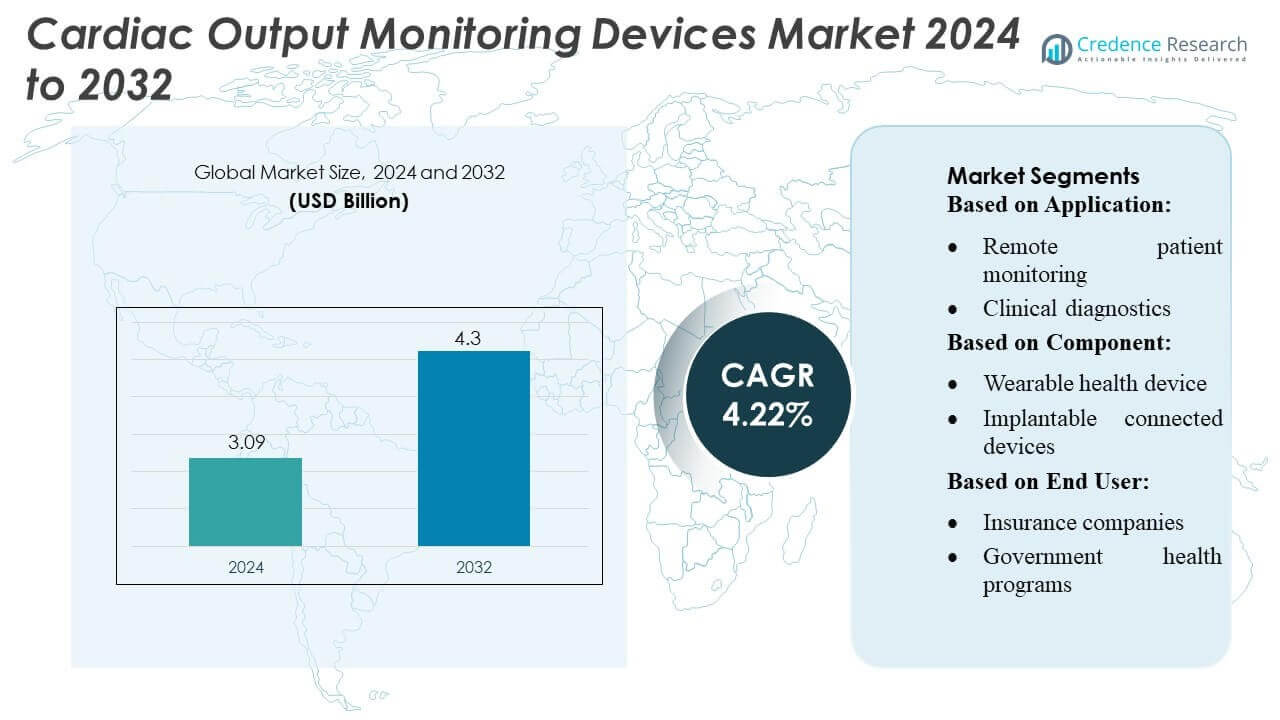

Cardiac Output Monitoring Devices Market size was valued USD 3.09 billion in 2024 and is anticipated to reach USD 4.3 billion by 2032, at a CAGR of 4.22% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cardiac Output Monitoring Devices Market Size 2024 |

USD 3.09 billion |

| Cardiac Output Monitoring Devices Market, CAGR |

4.22% |

| Cardiac Output Monitoring Devices Market Size 2032 |

USD 4.3 billion |

The cardiac output monitoring devices market is highly competitive, with top players such as Masimo Corporation, ICU Medical, Inc., GE HealthCare, OSYPKA MEDICAL, Schwarzer Cardiotek GmbH, Deltex Medical Limited, Baxter, Koninklijke Philips N.V., Getinge, and Nihon Kohden Corporation leading innovation and market expansion. These companies focus on developing non-invasive and minimally invasive monitoring systems, wearable devices, and AI-enabled platforms to enhance accuracy, patient comfort, and clinical efficiency. Strategic collaborations, mergers, and regional partnerships strengthen their global presence and distribution networks. North America remains the leading region, holding approximately 38% of the market, driven by advanced healthcare infrastructure, high adoption of remote patient monitoring technologies, and supportive reimbursement policies. Continuous R&D investment, coupled with growing awareness of cardiovascular health and telehealth integration, positions these players to sustain growth and maintain dominance in the evolving global market.

Market Insights

- The cardiac output monitoring devices market was valued at USD 3.09 billion in 2024 and is expected to reach USD 4.3 billion by 2032, growing at a CAGR of 4.22% during the forecast period.

- North America leads the market with approximately 38% share, driven by advanced healthcare infrastructure, widespread adoption of remote monitoring, and supportive reimbursement policies, while Europe and Asia-Pacific are emerging regions with growing demand.

- Clinical diagnostics dominates the application segment, accounting for the largest share due to rising cardiovascular disease prevalence and increasing ICU and perioperative monitoring. Non-invasive and minimally invasive devices are gaining traction in hospitals, clinics, and home care settings.

- Market growth is fueled by innovations in wearable devices, AI-enabled monitoring platforms, and integration with telehealth services, while strategic collaborations and mergers enhance global presence.

- Challenges include high device costs, limited reimbursement in some regions, and regulatory compliance requirements, which may slow adoption in emerging markets despite rising patient awareness and demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Application

The cardiac output monitoring devices market by application is led by clinical diagnostics, capturing approximately 38% of the segment share due to rising demand for accurate hemodynamic assessments in critical care and perioperative settings. Clinical diagnostics devices provide real-time insights into cardiac function, improving patient outcomes and reducing hospital stays. Remote patient monitoring is gaining traction, fueled by telehealth adoption and the growing prevalence of cardiovascular diseases. Therapeutics applications are expanding as integration with drug delivery systems enhances treatment personalization. Overall, advancements in minimally invasive techniques and data analytics drive growth across applications.

- For instance, ICU Medical’s CardioFlo™ Hemodynamic Monitoring Sensor, when used with its Cogent™ 2‑in‑1 Hemodynamic Monitoring System, delivers continuous cardiac output (CO), stroke volume (SV), stroke volume variation (SVV), and pulse pressure variation (PPV) by analyzing arterial waveform data using the proprietary PulseCo™ algorithm.

By Component

Within the component segment, hardware, particularly wearable health devices, dominates with nearly 45% market share, reflecting the increasing consumer demand for continuous and non-invasive cardiac monitoring. Implantable connected devices and remote patient monitoring hardware are growing rapidly due to technological innovation in sensors, wireless connectivity, and AI-based predictive analytics. Software and services segments are also expanding as platforms for real-time monitoring, analytics, and cloud integration enhance efficiency and patient engagement. The growth is driven by rising adoption of smart healthcare solutions and emphasis on remote cardiovascular care.

- For instance, GE’s interoperable platform integrates advanced software algorithms — such as EK‑Pro arrhythmia detection and Marquette 12SL for diagnostic‑quality ECG — enabling seamless capture of multi‑parameter data (ECG, SpO₂, NIBP.

By End User

Among end users, hospitals hold the largest share at around 40%, driven by extensive deployment of cardiac output monitoring in ICUs, operating rooms, and cardiac care units. Clinics and telehealth platforms are rapidly increasing adoption, supported by the growing prevalence of outpatient care and home monitoring programs. Payers and government health programs are encouraging the use of advanced monitoring devices through reimbursement incentives. Patient-centric demand, fueled by awareness and digital health adoption, further supports market expansion, emphasizing early detection and continuous management of cardiovascular conditions.

Key Growth Drivers

Rising Prevalence of Cardiovascular Diseases

The increasing global burden of cardiovascular diseases, including heart failure, arrhythmias, and ischemic conditions, is a primary driver for cardiac output monitoring devices. Hospitals and clinics are prioritizing continuous hemodynamic monitoring to reduce morbidity and improve patient outcomes. Early detection and real-time management of cardiac events have become critical, driving demand for both invasive and non-invasive monitoring solutions. Additionally, aging populations in developed and emerging economies further support sustained market growth, emphasizing the need for efficient, accurate cardiac output assessment tools.

- For instance, Deltex Medical delivers advanced haemodynamic monitoring solutions via its core system CardioQ‑ODM (and updated variants), which employ 4 MHz continuous‑wave oesophageal Doppler ultrasound to directly measure descending aortic blood flow.

Advancements in Remote Patient Monitoring Technologies

Technological innovations in remote monitoring, including wearable sensors, wireless connectivity, and AI-powered analytics, are accelerating market adoption. These devices enable continuous cardiac output tracking outside clinical settings, improving patient compliance and reducing hospital readmissions. Integration with telehealth platforms allows physicians to monitor high-risk patients in real time, enhancing preventive care. The growing focus on home-based healthcare and personalized medicine reinforces the importance of remote cardiac monitoring, making this a key driver for adoption across healthcare providers and patient segments globally.

- For instance, Baxter did launch the Welch Allyn Connex 360 Vital Signs Monitor, which features all the vital sign measurements listed (blood pressure, temperature, pulse rate, respiration rate, and SpO₂) for adult, pediatric, and neonatal patients.

Increasing Adoption of Minimally Invasive and Non-Invasive Devices

Minimally invasive and non-invasive cardiac output monitoring devices are gaining preference due to reduced patient risk, faster recovery, and ease of use. Hospitals and outpatient centers increasingly favor these devices to minimize procedural complications and shorten ICU stays. Continuous technological improvements, such as advanced sensors and portable monitoring systems, enhance accuracy and usability. This trend is further reinforced by clinician preference for less intrusive diagnostic tools, coupled with rising awareness of patient comfort and safety, driving higher adoption rates across clinical and remote monitoring applications.

Key Trends & Opportunities

Integration with AI and Predictive Analytics

The integration of artificial intelligence and predictive analytics into cardiac output monitoring platforms is transforming patient care. AI-enabled algorithms provide early warnings of cardiac dysfunction, optimize treatment plans, and enhance decision-making for clinicians. Predictive analytics also help identify at-risk populations, supporting preventive interventions and reducing hospitalizations. As healthcare systems increasingly embrace digital transformation, these innovations present opportunities for device manufacturers to offer value-added services and expand market reach through smarter, data-driven cardiac monitoring solutions.

- For instance, Philips’ Cardiologs AI analytics platform — used alongside the company’s wearable ePatch ambulatory monitor — delivers up to 14‑day continuous ECG data analysis and has been deployed across 14 hospitals in Spain to detect arrhythmias that conventional Holter monitors missed.

Expansion of Telehealth and Remote Care Services

Telehealth adoption is driving new opportunities for cardiac output monitoring devices, particularly in remote patient management and chronic disease care. Patients with cardiovascular conditions can now receive continuous monitoring at home, reducing the need for frequent hospital visits. Collaboration with telehealth platforms enables real-time data transmission and clinician oversight, enhancing care efficiency. This trend opens avenues for wearable and implantable device manufacturers to develop connected solutions that cater to remote diagnostics and therapeutic interventions, broadening the market potential across developed and emerging regions.

- For instance, Nihon Kohden’s hemodynamic module (AP-170P Hemodynamic Unit) supports advanced methods like transpulmonary thermodilution (PiCCO) and arterial pulse contour analysis (ProAQT), enabling comprehensive volumetric and circulatory parameter measurement for critically ill patients.

Rising Patient Awareness and Self-Monitoring Initiatives

Growing awareness of cardiovascular health and proactive patient engagement is increasing demand for home-use cardiac monitoring solutions. Patients are adopting wearable and connected devices to track their cardiac output, manage chronic conditions, and prevent complications. Educational campaigns and digital health initiatives promote self-monitoring, enhancing compliance and early detection of anomalies. This trend creates opportunities for companies to introduce user-friendly, patient-centric devices and integrated digital platforms, expanding market penetration while supporting preventive healthcare models and personalized cardiac management strategies.

Key Challenges

High Device Costs and Reimbursement Limitations

The high cost of advanced cardiac output monitoring devices remains a significant market challenge, particularly for small clinics and emerging markets. Limited reimbursement policies in certain regions further constrain adoption, as hospitals and patients may struggle with out-of-pocket expenses. Additionally, the cost of integrating monitoring systems with telehealth platforms or hospital information systems adds financial barriers. Addressing affordability and reimbursement coverage is critical for broader market penetration, especially for non-invasive and wearable devices aimed at remote monitoring and outpatient care.

Data Privacy and Regulatory Compliance Issues

With the increasing use of connected monitoring devices and telehealth platforms, data privacy and regulatory compliance have emerged as major challenges. Healthcare providers and manufacturers must adhere to stringent regulations such as HIPAA and GDPR to protect patient information. Cybersecurity risks and potential breaches of sensitive cardiac data can undermine patient trust and slow adoption. Ensuring robust data encryption, secure transmission, and regulatory alignment is essential for market growth, particularly as wearable and remote monitoring devices expand in both developed and emerging healthcare markets.

Regional Analysis

North America

North America dominates the cardiac output monitoring devices market, holding approximately 38% share, driven by high healthcare expenditure, advanced infrastructure, and rapid adoption of remote patient monitoring technologies. The United States leads the region with extensive hospital networks, ICUs, and cardiac care units investing in both invasive and non-invasive devices. Rising prevalence of cardiovascular diseases and supportive reimbursement policies further fuel demand. Technological advancements, including wearable and AI-integrated devices, enhance patient management and clinician efficiency. Canada and Mexico are gradually increasing adoption, supported by government health programs and expanding telehealth initiatives, strengthening regional market growth.

Europe

Europe accounts for around 28% of the global cardiac output monitoring devices market, with Germany, France, and the UK leading adoption. Growth is driven by increasing cardiovascular disease prevalence, aging populations, and advanced healthcare systems emphasizing critical care and diagnostics. Government support, favorable reimbursement policies, and initiatives promoting digital health and telemedicine accelerate market penetration. Non-invasive and wearable devices are gaining popularity due to patient safety and comfort considerations. The region also benefits from high R&D investments, collaboration between hospitals and medical device companies, and robust regulatory frameworks, ensuring sustained market expansion.

Asia-Pacific

Asia-Pacific holds roughly 22% market share and is emerging as the fastest-growing region for cardiac output monitoring devices. Rising incidence of cardiovascular diseases, expanding healthcare infrastructure, and increasing awareness about cardiac health drive adoption in China, India, Japan, and Australia. Telehealth platforms and remote patient monitoring solutions are increasingly integrated to manage growing patient populations. Government initiatives promoting digital healthcare and chronic disease management further support growth. Technological innovations, including cost-effective and portable monitoring devices, cater to emerging markets, creating opportunities for both domestic and global players to expand presence in this high-potential region.

Latin America

Latin America represents about 6% of the global market, with Brazil and Mexico as key contributors. Market growth is fueled by increasing cardiovascular disease burden, urbanization, and improvements in healthcare infrastructure. Hospitals and clinics are adopting non-invasive and minimally invasive monitoring devices to enhance patient care and reduce complications. Telehealth adoption is gradually increasing, supporting remote monitoring initiatives in rural areas. Challenges such as limited reimbursement policies and high device costs slightly hinder market expansion. However, rising awareness of cardiovascular health and government investments in digital health and chronic disease management are expected to create moderate growth opportunities.

Middle East & Africa

The Middle East & Africa holds approximately 6% market share, with the UAE, Saudi Arabia, and South Africa driving demand. Rising prevalence of cardiovascular diseases, growing healthcare investments, and expansion of advanced hospital infrastructure support adoption of cardiac output monitoring devices. Telemedicine and remote monitoring solutions are gaining traction to address limited access in rural areas. Government initiatives promoting digital healthcare and chronic disease management encourage market growth. However, high device costs, low awareness in some regions, and regulatory challenges remain constraints. Strategic collaborations and partnerships with global medical device manufacturers are expected to strengthen regional market presence.

Market Segmentations:

By Application:

- Remote patient monitoring

- Clinical diagnostics

By Component:

- Wearable health device

- Implantable connected devices

By End User:

- Insurance companies

- Government health programs

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The cardiac output monitoring devices market players such as Masimo Corporation, ICU Medical, Inc., GE HealthCare, OSYPKA MEDICAL, Schwarzer Cardiotek GmbH, Deltex Medical Limited, Baxter, Koninklijke Philips N.V., Getinge, and Nihon Kohden Corporation. The cardiac output monitoring devices market is highly competitive, driven by continuous technological innovation and increasing demand for accurate, real-time patient monitoring. Companies focus on developing non-invasive and minimally invasive devices, wearable solutions, and AI-integrated platforms to enhance clinical outcomes and patient comfort. Strategic initiatives such as partnerships, collaborations, and mergers help expand regional reach and strengthen distribution networks. Investment in R&D enables differentiation through improved device accuracy, portability, and seamless integration with telehealth systems. Regulatory compliance, reimbursement support, and cost-effectiveness are critical factors influencing market positioning, while emphasis on patient-centric and remote monitoring solutions continues to drive growth across global healthcare settings.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Masimo Corporation

- ICU Medical, Inc.

- GE HealthCare

- OSYPKA MEDICAL

- Schwarzer Cardiotek GmbH

- Deltex Medical Limited

- Baxter

- Koninklijke Philips N.V.

- Getinge

- Nihon Kohden Corporation

Recent Developments

- In July 2025, Terumo Health Outcomes (THO) and Caretaker Medical partnered to distribute the VitalStream wearable hemodynamic monitoring platform in the U.S.. The VitalStream system provides continuous, non-invasive, beat-by-beat cardiovascular data, such as blood pressure, to help clinicians in high-acuity settings detect changes earlier and make more timely treatment decisions.

- In July 2025, OMRON Healthcare has expanded its collaboration with Tricog Health, an AI-driven cardiac care company, to launch KeeboHealth- an advanced connected health platform designed to transform remote cardiac care and accelerate progress toward OMRON’s ‘Going for Zero’ vision, a world with zero cardiovascular events.

- In April 2025, Medtronic expanded its Acute Care & Monitoring portfolio by entering a U.S. distribution agreement with Retia Medical for the Argos cardiac output monitor, which uses an advanced Multi-Beat Analysis algorithm to provide accurate, real-time hemodynamic data for high-risk surgical and critically ill patients.

- In April 2025, BD launched the HemoSphere Alta, an advanced hemodynamic monitoring platform featuring AI-driven predictive algorithms like the Cerebral Autoregulation Index (CAI) and Hypotension Prediction Index (HPI) along with a 15″ touchscreen and hands-free voice/gesture controls to help clinicians proactively manage blood pressure and blood flow in critical care settings

Report Coverage

The research report offers an in-depth analysis based on Application, Component, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of non-invasive and minimally invasive monitoring devices is expected to increase across hospitals and home care settings.

- Integration of AI and predictive analytics will enhance early detection and personalized cardiac care.

- Wearable and connected devices will drive growth in remote patient monitoring applications.

- Telehealth and home-based monitoring programs will expand, supporting chronic disease management.

- Rising prevalence of cardiovascular diseases and aging populations will sustain long-term demand.

- Advances in sensor technology will improve device accuracy, reliability, and ease of use.

- Expansion in emerging markets will create new growth opportunities for manufacturers.

- Collaborations between healthcare providers and technology developers will accelerate innovation.

- Regulatory support and reimbursement initiatives will encourage wider adoption of monitoring solutions.

- Patient awareness and proactive self-monitoring will increasingly influence market growth.