Market Overview

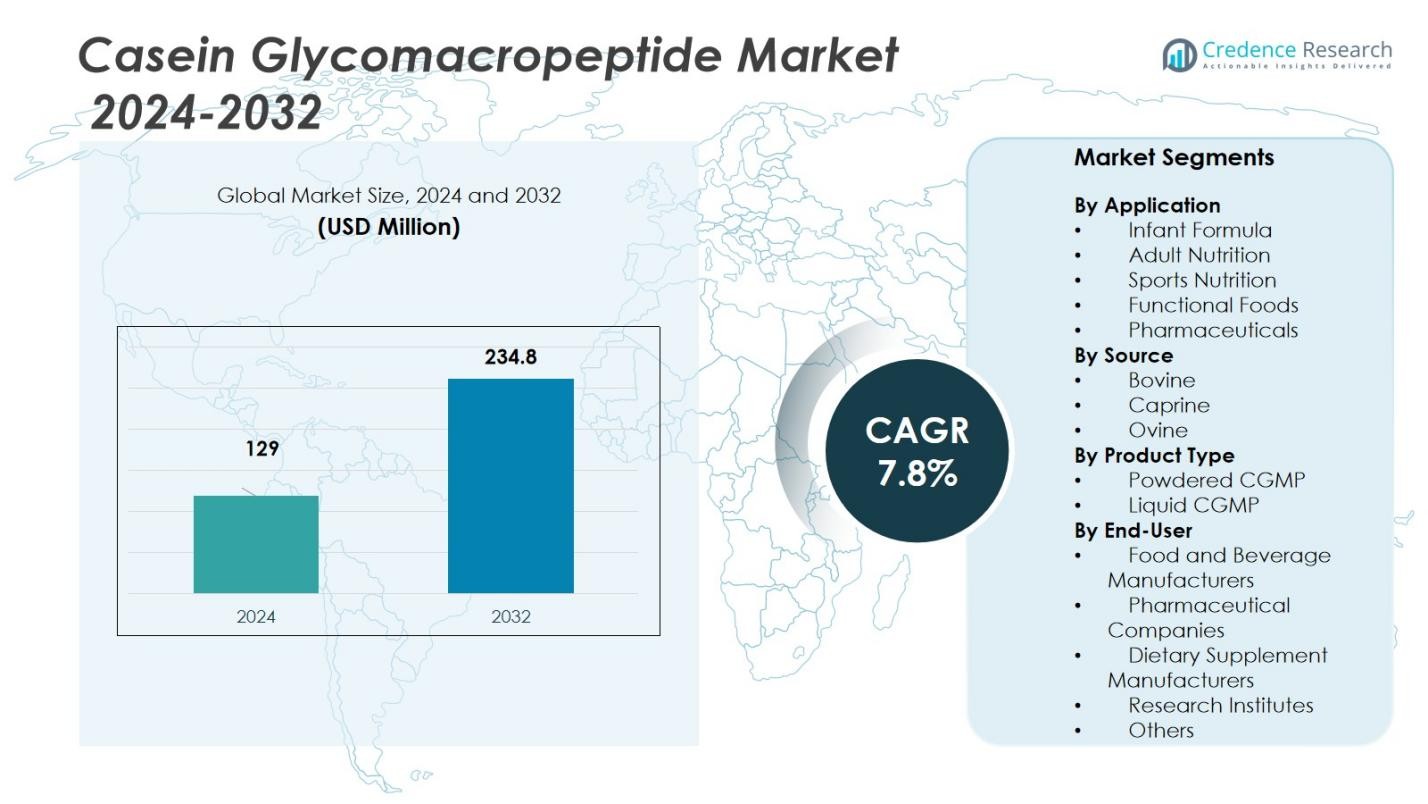

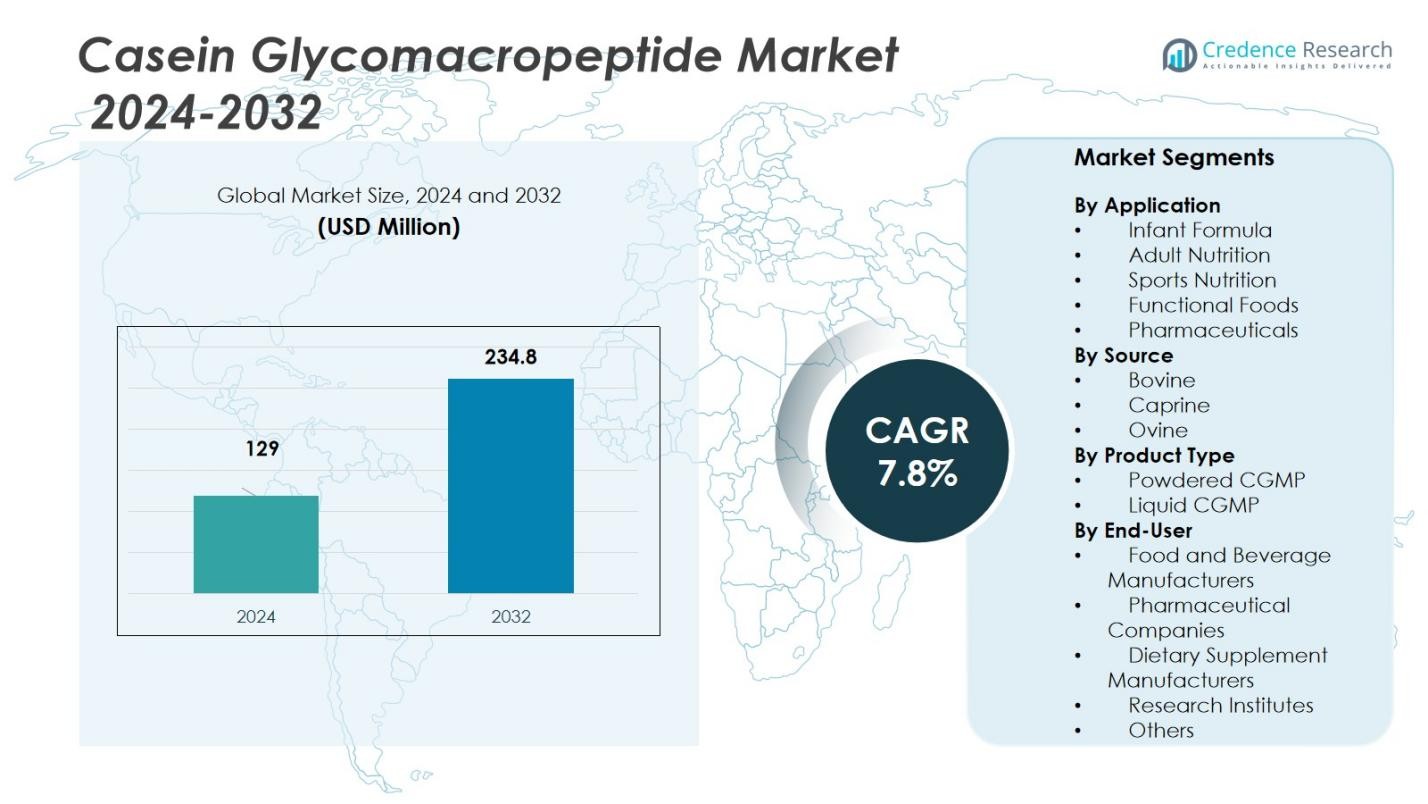

The Casein Glycomacropeptide Market size was valued at USD 129 million in 2024 and is anticipated to reach USD 234.8 million by 2032, at a CAGR of 7.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Casein Glycomacropeptide Market Size 2024 |

USD 129 Million |

| Casein Glycomacropeptide Market, CAGR |

7.8% |

| Casein Glycomacropeptide Market Size 2032 |

USD 234.8 Million |

The Casein Glycomacropeptide (CGMP) market is driven by key players such as New Zealand Milk Products, Saputo Inc., Glanbia Nutritionals, Valio Ltd., Kraft Heinz Company, FrieslandCampina, Dairy Farmers of America, Dairy Crest, and Matthews Canning Company. These companies dominate through strategic investments in R&D, product innovation, and expanding distribution networks globally. North America holds the largest market share of approximately 38%, driven by high consumer demand for protein‑rich functional foods and infant formula. Europe follows with a 30% share, bolstered by strong regulatory frameworks and growing health consciousness. The Asia Pacific region, which accounts for 22%, is rapidly expanding due to rising disposable incomes and increased demand for health supplements and infant nutrition. The market is also experiencing growth in Latin America and the Middle East & Africa, driven by increasing awareness of CGMP’s health benefits and the rise of health‑conscious consumers in these regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Casein Glycomacropeptide (CGMP) market size was valued at USD 129 million in 2024 and is expected to reach USD 234.8 million by 2032, growing at a CAGR of 7.8% during the forecast period.

- The primary driver of market growth is the increasing demand for protein‑enriched infant formula, with a growing preference for specialized nutrition products.

- Key trends include a rising focus on functional foods and adult nutrition, with CGMP gaining popularity for its digestive health benefits and immune‑boosting properties

- The market is highly competitive, with major players like New Zealand Milk Products, Saputo, Glanbia Nutritionals, and FrieslandCampina vying for market share through innovation and strategic partnerships.

- North America leads the market with a share of 38%, followed by Europe at 30% and Asia Pacific at 22%, driven by consumer demand for health supplements and infant nutrition across these regions.

Market Segmentation Analysis:

By Application

\The Casein Glycomacropeptide (CGMP) market is primarily segmented by application into infant formula, adult nutrition, sports nutrition, functional foods, and pharmaceuticals. Among these, infant formula dominates the market with the largest share, driven by the increasing demand for specialized nutrition products for infants, particularly in developing regions. The growth of the infant formula segment is further supported by rising awareness of health benefits and a growing preference for protein-enriched baby food products. Infant formula holds a market share of approximately 40%, followed by adult nutrition and sports nutrition.

- For instance, in adult nutrition, Arla Foods Ingredients offers Lacprodan® CGMP-20, a low-phenylalanine CGMP product used to support patients with phenylketonuria, demonstrating CGMP’s specialized dietary role.

By Source

The CGMP market is segmented by source into bovine, caprine, and ovine. Bovine CGMP holds the largest market share, accounting for nearly 60%, driven by the widespread availability of bovine milk and the established dairy industry infrastructure. The use of bovine-derived CGMP in a wide range of applications, including infant formulas and nutritional supplements, propels its dominance. While caprine and ovine CGMP segments hold smaller shares, they are witnessing growth due to rising demand for alternative dairy sources among specific consumer groups with sensitivities to bovine milk proteins.

- For instance, Thermo Fisher Scientific supplies GMP-grade fetal bovine serum (FBS) used extensively in biopharmaceutical cell culture, highlighting the importance of bovine-derived CGMP in pharmaceutical applications.

By Product Type

The product type segment in the Casein Glycomacropeptide market includes powdered CGMP and liquid CGMP. Powdered CGMP is the dominant product type, accounting for approximately 70% of the market share. This segment benefits from its versatility in various applications, particularly in functional foods and nutritional supplements, due to its stability and ease of use. The growing demand for powdered nutritional products, especially in the pharmaceutical and sports nutrition sectors, continues to support the dominance of powdered CGMP. Liquid CGMP, while smaller, is gaining traction in pharmaceutical applications where liquid formulations are preferred for ease of absorption.

Key Growth Drivers

Increasing Demand for Infant Nutrition

The growing global demand for infant formula is a key growth driver for the Casein Glycomacropeptide (CGMP) market. With rising birth rates in emerging economies and an increased focus on infant health and nutrition, CGMP’s presence in infant formula products is expanding. Its beneficial properties, including support for gut health and immunity, make it a preferred choice for formulating infant foods. As parents increasingly seek high-quality, protein-rich formulas, CGMP’s use in infant nutrition continues to see significant growth, propelling the market forward.

- For instance, Mead Johnson Nutrition (a Reckitt company) has incorporated Milk Fat Globule Membrane (MFGM) components similar to those in human milk into their Enfamil infant formulas since 2018, enhancing cognitive development and immune support.

Rising Health Consciousness Among Adults

Adults are becoming more health-conscious, leading to higher demand for nutritional supplements and functional foods that enhance well-being. This has been a significant growth driver for CGMP, particularly in adult nutrition and sports nutrition. CGMP is recognized for its ability to support digestion and immune health, driving its incorporation into functional foods and nutritional supplements. The increasing trend of self-care and the growing popularity of personalized nutrition among adults are fueling the demand for CGMP-based products, contributing to market expansion.

- For instance, SteelFit, a company producing CGMP-containing sports nutrition supplements in an NSF-cGMP certified facility, ensuring product quality and efficacy for fitness enthusiasts.

Growing Popularity of Plant-Based Alternatives

The rise in plant-based diets and alternative dairy products is propelling the CGMP market, especially in regions where lactose intolerance is prevalent. As consumers seek alternatives to traditional dairy products, CGMP derived from sources such as caprine and ovine is gaining traction. These alternatives cater to individuals with dietary restrictions and sensitivities, further expanding the consumer base for CGMP. The shift towards plant-based and dairy-free options, coupled with an increase in consumer awareness about health benefits, is a critical driver for CGMP market growth.

Key Trends & Opportunities

Expanding Application in Pharmaceuticals

One of the notable trends in the CGMP market is its growing application in the pharmaceutical industry. CGMP is increasingly used in the development of therapeutic products due to its potential health benefits, such as its immune-boosting properties and digestive health support. With advancements in pharmaceutical formulations, CGMP is finding applications in managing chronic conditions like irritable bowel syndrome and enhancing drug delivery systems. This trend presents opportunities for CGMP to become a key ingredient in pharmaceutical innovations, expanding its market footprint.

- For instance, the FDA-approved drug linaclotide targets the cyclic guanosine monophosphate (cGMP) pathway to treat adult patients with irritable bowel syndrome with constipation (IBS-C), demonstrating therapeutic applications of CGMP in managing chronic digestive conditions.

Technological Advancements in Production

Technological advancements in dairy processing are creating significant opportunities for the CGMP market. Innovations in extraction methods, such as membrane filtration and enzyme-based processing, are improving the efficiency and cost-effectiveness of CGMP production. These advancements are making CGMP more accessible for use in a wide range of applications, from nutritional supplements to functional foods. As technology continues to evolve, it is expected to drive down production costs and increase the scalability of CGMP, offering new growth prospects for the market.

- For instance, Quintus, a high-pressure processing (HPP) technology manufacturer, introduced the QIF 600L system that increases processing capacity to 4,150 kg per hour, improving efficiency and reducing energy costs while maintaining product quality.

Key Challenges

Price Volatility of Raw Materials

One of the key challenges facing the CGMP market is the volatility in the prices of raw materials, particularly dairy-based sources like bovine and caprine milk. The fluctuating costs of milk, driven by factors such as climate change, feed prices, and supply chain disruptions, pose a significant challenge to CGMP producers. This volatility can impact the overall cost structure and profitability of CGMP-based products, limiting their affordability and accessibility to a broader consumer base. Addressing raw material price fluctuations will be critical to the market’s long-term stability.

Regulatory Hurdles

The CGMP market faces regulatory challenges, especially in regions with stringent food safety and health regulations. As CGMP is primarily used in food and pharmaceutical products, it must comply with various regulatory standards set by health authorities, such as the FDA and EFSA. Any changes in these regulations or delays in approval processes for new applications can impede market growth. Navigating complex and evolving regulatory landscapes is crucial for manufacturers to ensure product safety, quality, and market access.

Regional Analysis

North America

The Casein Glycomacropeptide (CGMP) market in North America holds approximately 38% of the global market share. A strong consumer demand for protein‑rich and specialty nutrition formats drives this region’s dominance. Advanced dairy processing infrastructure and proactive regulatory frameworks further support CGMP adoption. The region also benefits from high awareness of CGMP’s therapeutic potential in conditions like phenylketonuria (PKU). Growth is also fuelled by sports‑nutrition and adult‑wellness trends, which increasingly incorporate CGMP‑based ingredients.

Europe

Europe accounts for around 30% of the CGMP market globally. The region’s share reflects solid demand for functional foods, nutritional supplements, and infant formulas using CGMP. Well‑structured food‑safety regulation and growing health consciousness among consumers further bolster this market. European manufacturers actively innovate CGMP applications, particularly for gut health and immunity. While growth is somewhat tempered by mature markets and regulatory complexity, strong incumbent dairy industries and established ingredient supply chains maintain Europe’s substantial share.

Asia Pacific

In Asia Pacific, the CGMP market holds about 22% of global revenue and is marked by rapid growth. Rising disposable incomes, urbanisation and shifting dietary preferences toward high‑protein and functional foods are key drivers. Markets in China, India and Southeast Asia are expanding their use of CGMP in infant and adult nutrition. Retail modernisation and increasing acceptance of speciality ingredients among Asian consumers further enhance growth. While infrastructure and regulatory systems are evolving, the region presents the most dynamic expansion opportunity for CGMP adoption.

Latin America

Latin America represents approximately 6% of the global CGMP market. The region’s share is supported by emerging interest in dairy‑based supplements and functional foods, particularly in Brazil and Mexico. However, growth is constrained by limited consumer awareness, economic volatility and less developed specialty ingredient supply chains. Opportunities exist as players introduce CGMP‑fortified products aimed at health‑conscious middle‑class consumers. Strategic expansion and local education on CGMP benefits are vital for increasing market penetration in Latin America.

Middle East & Africa

The Middle East & Africa region holds around 4% of the CGMP market share globally. Its smaller share reflects early‑stage development of functional‑nutrition markets and infrastructure constraints. Nonetheless, growing awareness of health and sports nutrition, especially in Gulf countries and South Africa, is creating new demand paths for CGMP‑infused products. Key challenges include regulatory variability and pricing sensitivity, but rising urbanisation and evolving food‑industry standards offer long‑term opportunities for CGMP market growth in the region.

Market Segmentations:

By Application

- Infant Formula

- Adult Nutrition

- Sports Nutrition

- Functional Foods

- Pharmaceuticals

By Source

By Product Type

- Powdered CGMP

- Liquid CGMP

By End-User

- Food and Beverage Manufacturers

- Pharmaceutical Companies

- Dietary Supplement Manufacturers

- Research Institutes

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

Competitive Landscape

The global Casein Glycomacropeptide (CGMP) market features major players such as New Zealand Milk Products, Saputo Inc., Glanbia Nutritionals, Valio Ltd., Kraft Heinz Company, FrieslandCampina, Dairy Farmers of America, Dairy Crest, Matthews Canning Company and Synlogic, Inc.. These companies compete intensely through strategic initiatives like R&D investment, quality certifications, and global distribution network expansion. Many firms prioritise formulation innovation to enhance CGMP’s effectiveness in infant formula, sports nutrition and functional food sectors. Firms also focus on acquiring smaller niche players to strengthen their ingredient portfolios and geographic footprints. Increased consumer demand for protein‑rich and functional foods pushes companies to optimise extraction technologies and lower production cost to improve margins. As competition tightens, differentiation through branded ingredients and strong partnerships with food and pharmaceutical manufacturers is increasingly vital.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Matthews Canning

- Saputo

- Glanbia Nutritionals

- FrieslandCampina

- Synlogic

- Dairy Farmers of America

- Kraft Heinz

- Dairy Crest

- Valio

- New Zealand Milk Products

Recent Developments

- In October 2025, Arla Foods Ingredients launched a new concept (Easy Bite) for high‑protein snacks, which signals innovation in the CGMP/dairy‑derived protein ingredient space.

- In April 2025, Food Standards Australia New Zealand (FSANZ) granted approval for the use of MFGM as a nutritional ingredient in baby formula. The approval will take effect once it is formally accepted by the Food Ministers Meeting of Australia and New Zealand.

- In August 2023, Arla Foods Ingredients and Novozymes announced a partnership to develop advanced protein ingredients (via precision fermentation), including for disease‑specific medical nutrition.

Report Coverage

The research report offers an in-depth analysis based on Application, Source, Product Type, End User and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for CGMP in functional foods will accelerate as consumers seek ingredients supporting gut health and immunity.

- Growth in the sports nutrition segment will boost CGMP use, driven by its slow‑digesting amino acid profile and muscle recovery benefits.

- The infant nutrition sector will remain a strong growth vector for CGMP, as demand rises for specialized proteins in baby formulas.

- Expansion in pharmaceutical and medical nutrition applications will push CGMP adoption, especially for metabolic disorders like phenylketonuria.

- Emerging‑market growth (Asia‑Pacific, Latin America) will open new CGMP opportunities, thanks to rising income levels and shifting diets.

- Technological advancements in extraction and purification will reduce CGMP production costs and improve ingredient accessibility.

- Manufacturers will increasingly form strategic partnerships and alliances to bring CGMP‑containing products to market faster.

- Clean‑label and dairy‑derived protein trends will favour CGMP as a premium ingredient in the clean‑label movement.

- Producing CGMP from alternative sources (caprine, ovine) will gain traction to cater to niche dairy‑sensitive or specialty groups.

- Cost pressures and regulatory complexity will remain headwinds, but improved manufacturing scale and regulatory clarity will enhance market resilience.