Market Overview

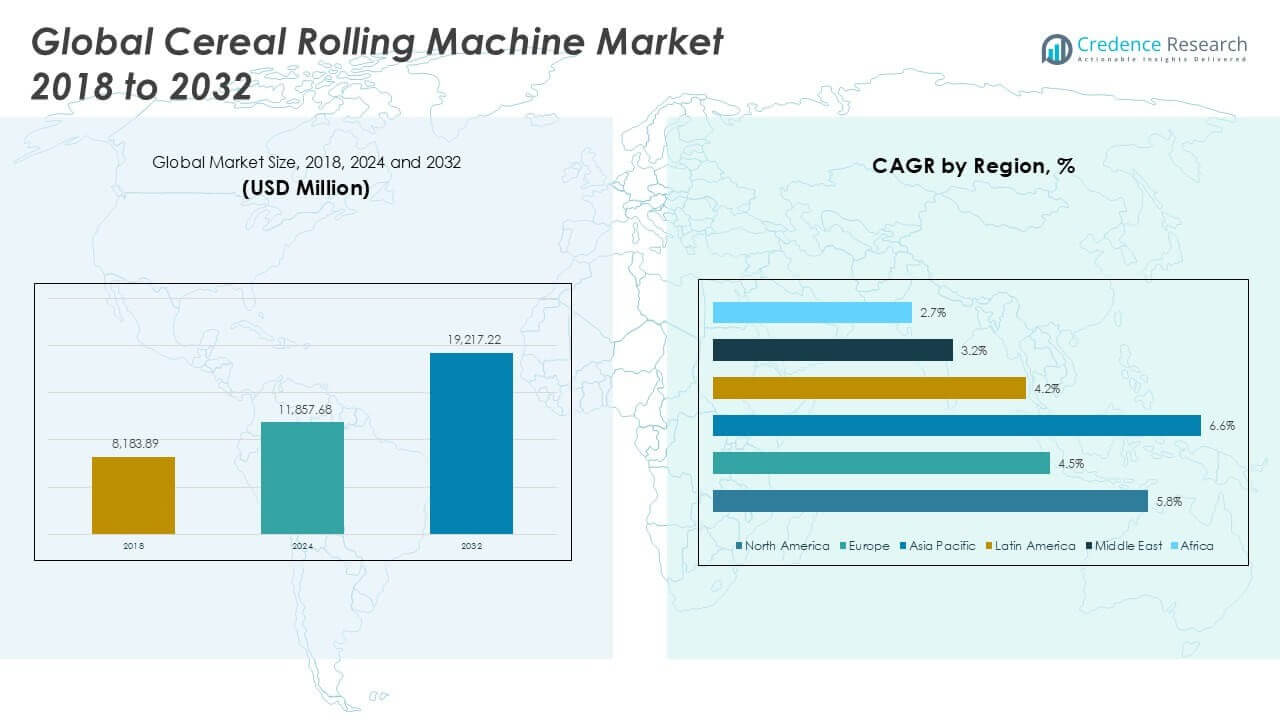

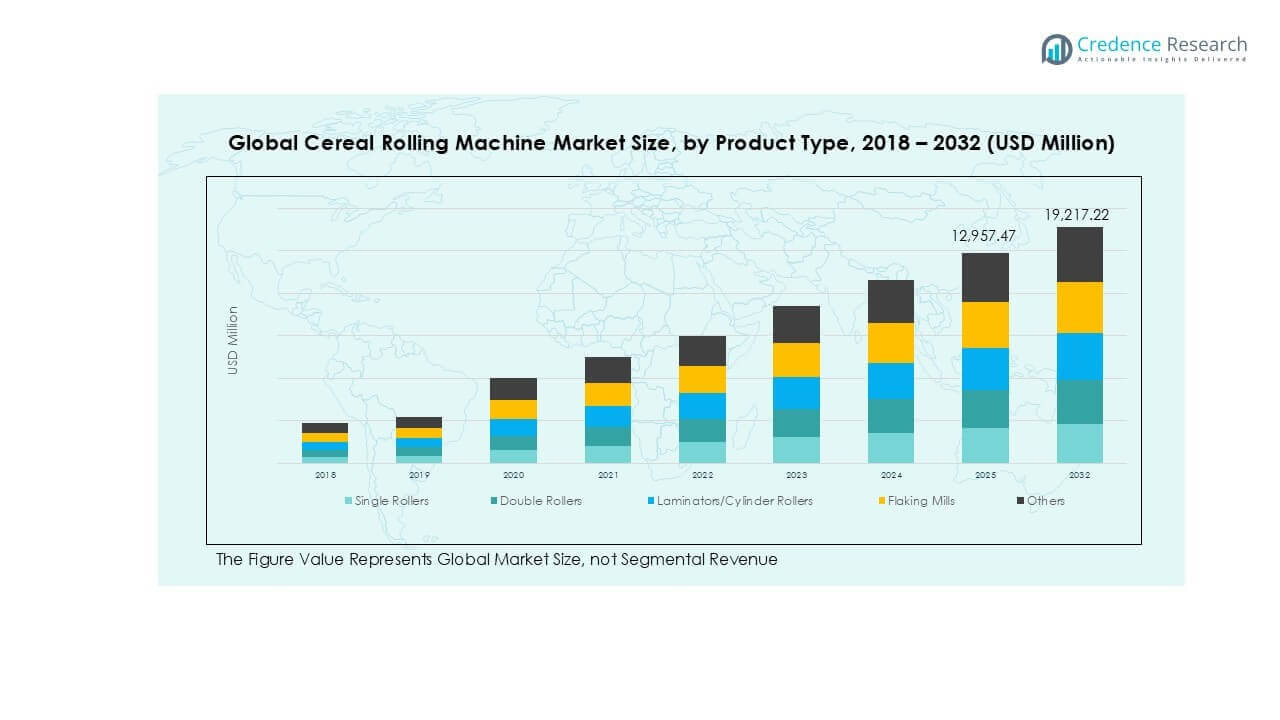

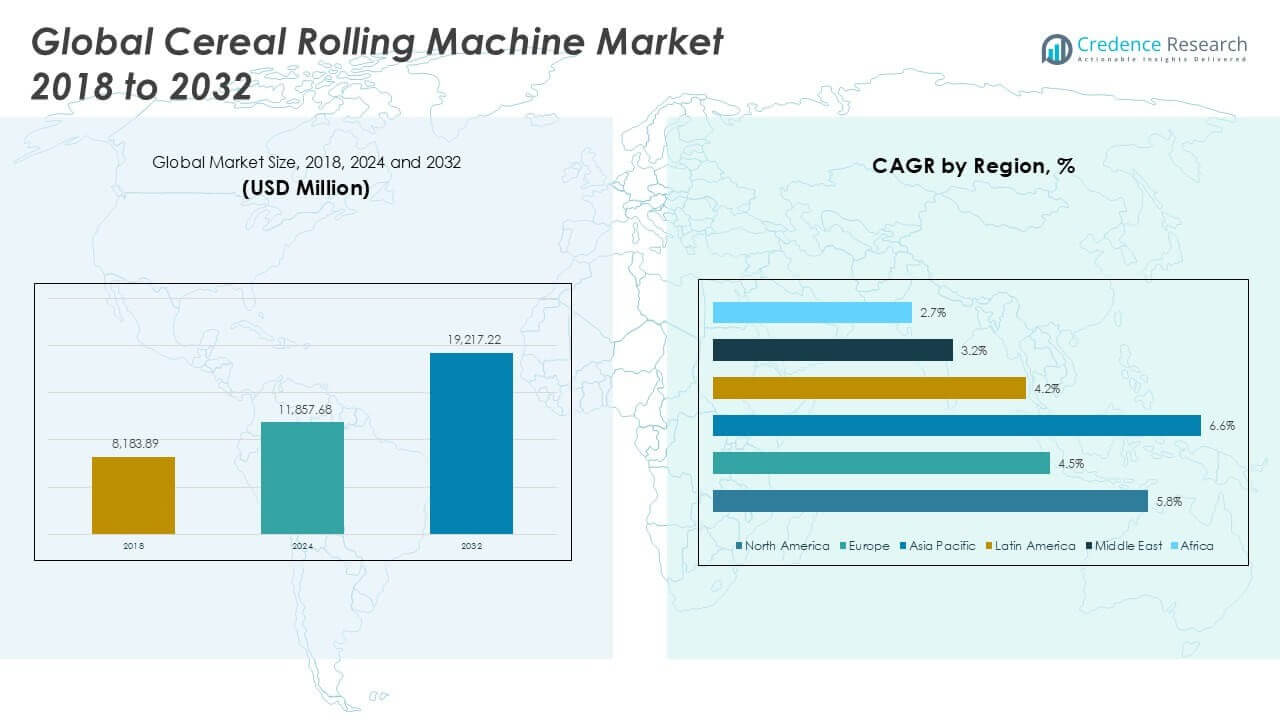

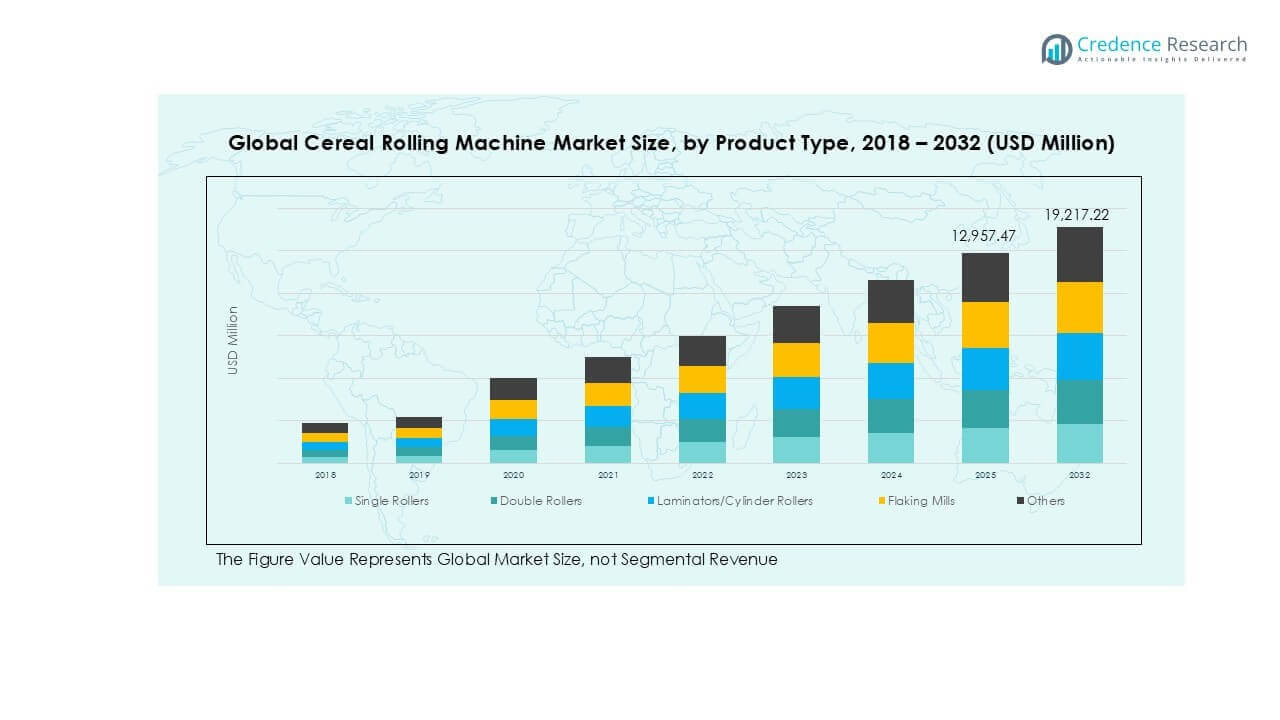

Global Cereal Rolling Machine market size was valued at USD 8,183.89 million in 2018 to USD 11,857.68 million in 2024 and is anticipated to reach USD 19,217.22 million by 2032, at a CAGR of 5.79% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cereal Rolling Machine Market Size 2024 |

USD 11,857.68 Million |

| Cereal Rolling Machine Market, CAGR |

5.79% |

| Cereal Rolling Machine Market Size 2032 |

USD 19,217.22 Million |

The Global Cereal Rolling Machine market features strong competition among key players including Idugel Group, Krüger & Salecker, Grace Food Processing, Best Engineering Technologies, Jay Industries, Guru Nanak Engineering Works, Sanskriti Food Equipments Exim Pvt Ltd, and Wuxi Kingunion S & T Co., Ltd. These companies focus on automation, efficiency, and product customization to serve diverse applications such as cereal flaking and snack manufacturing. Asia Pacific leads the market with a 45% share in 2024, driven by rising demand for ready-to-eat foods and large-scale food processing investments. North America follows with 28%, supported by advanced manufacturing infrastructure and high cereal consumption, while Europe holds 18% backed by strong demand for breakfast cereals and strict quality standards. Together, these regions dominate global revenues, shaping technology adoption and competitive dynamics in the industry.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Global Cereal Rolling Machine market was valued at USD 11,857.68 million in 2024 and is projected to reach USD 19,217.22 million by 2032, growing at a CAGR of 5.79%.

- Rising demand for ready-to-eat cereals and snack bars drives machine adoption, with flaking mills holding the largest product segment share due to their wide application in cereal flaking and breakfast food processing.

- Automation and energy-efficient technologies are key trends, as automatic machines dominate the operation type segment, ensuring efficiency, lower labor costs, and precision across large-scale processing facilities.

- The market remains competitive with players such as Idugel Group, Krüger & Salecker, Grace Food Processing, and Wuxi Kingunion S & T Co., Ltd, focusing on innovation, cost efficiency, and expanding presence in emerging markets.

- Asia Pacific leads with 45% regional share in 2024, followed by North America at 28% and Europe at 18%, reflecting strong demand across developed and developing food industries.

Market Segmentation Analysis:

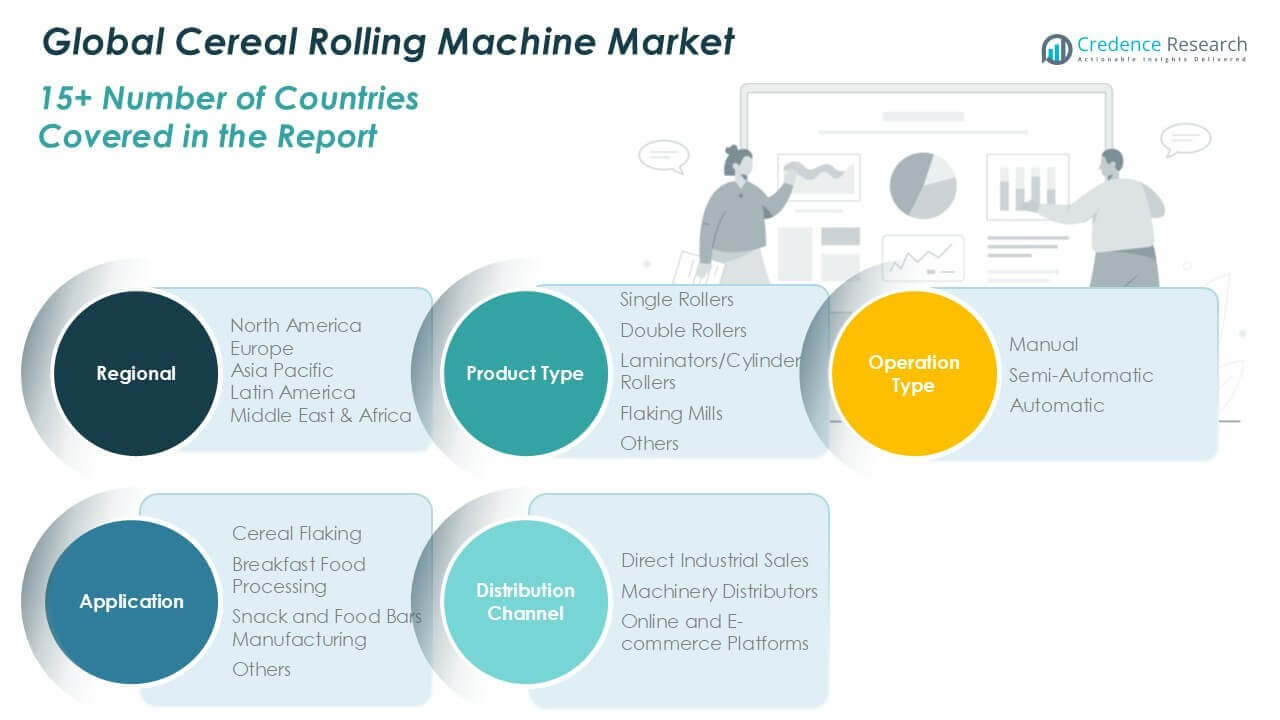

By Product Type

The product type segment is led by flaking mills, holding the largest share in 2024. Flaking mills dominate due to their extensive use in processing grains for breakfast cereals and industrial food applications. Their ability to deliver uniform flake thickness and high-capacity output makes them preferred among manufacturers. Double rollers also show steady growth, supported by demand in mid-scale processing. Laminators and single rollers find niche adoption, while the “others” category covers customized machines for specialty cereal processing. Performance efficiency and consistency are key drivers across this segment.

- For instance, Bühler is a significant provider of equipment for breakfast cereal production, with some of its flaking mills having a throughput of over 20 tons per hour.

By Operation Type

Automatic machines dominate the operation type segment, capturing the largest market share in 2024. Their demand is driven by large-scale manufacturers seeking efficiency, reduced labor costs, and precise control in cereal processing. Semi-automatic machines hold a moderate share, preferred by mid-sized players balancing automation with cost efficiency. Manual machines remain limited to small-scale or traditional processing setups. The shift toward Industry 4.0 technologies and smart automation accelerates adoption of fully automated cereal rolling machines, further strengthening their market leadership across global production facilities.

- For instance, GEA provides fully automated, PLC-controlled, and IoT-connected machinery for the food and beverage industry, enabling continuous, highly efficient production in large-scale operations.

By Application

Cereal flaking is the dominant application, holding the maximum share in 2024. Its leadership stems from rising consumption of flaked cereals in breakfast foods and snacks. Breakfast food processing follows closely, supported by demand for ready-to-eat and convenience foods across urban markets. Snack and food bar manufacturing grows steadily as consumers shift to health-oriented snack options. The “others” segment includes niche applications in specialty food production. Strong consumer demand for convenience-driven and nutritious products continues to fuel the growth of cereal flaking applications, sustaining its leading position.

Key Growth Drivers

Rising Demand for Processed Breakfast Foods

The growing global preference for ready-to-eat cereals significantly drives demand for cereal rolling machines. Flaking mills and rollers enable large-scale production of uniform, high-quality cereal products. Manufacturers focus on automation to meet volume requirements and ensure product consistency. The rising urban population, busy lifestyles, and health-conscious choices continue to strengthen this demand. As breakfast cereals remain a staple in developed economies and expand in emerging markets, equipment manufacturers benefit from sustained and diversified customer needs, securing growth across food processing sectors.

- For instance, Bühler produces various flaking mills, such as the PolyFlake and the MDFA, that are used to process grains including corn, wheat, oats, and multigrain for cereals.

Technological Advancements in Machinery

Automation and precision technologies drive innovation in cereal rolling machines, increasing efficiency and reducing operational costs. Modern systems incorporate smart sensors, digital monitoring, and automated control for consistency in output. This enhances productivity while lowering human error and labor dependence. Energy-efficient designs also support sustainability goals in the food industry. Integration with Industry 4.0 platforms strengthens machine adoption among global players. These technological advances allow producers to achieve higher throughput, better quality control, and greater flexibility, positioning advanced rolling machines as a critical asset for cereal manufacturers.

- For instance, GEA’s fully automated roller mills integrate IoT-based predictive maintenance, a technology designed to reduce downtime across large-scale cereal plants.

Expansion of Snack and Functional Food Markets

The rapid growth of snack bars, granola, and functional foods fuels demand for specialized cereal processing equipment. Cereal rolling machines, particularly flaking mills and laminators, play a vital role in shaping products with the desired texture and nutritional profile. Consumers increasingly choose healthier, protein-rich, and fortified options, pushing manufacturers to expand output. This trend directly supports machine demand, as producers scale to deliver diverse, value-added snacks. The versatility of modern cereal rolling machines positions them as essential tools for meeting evolving consumer preferences in global snack categories.

Key Trends & Opportunities

Adoption of Energy-Efficient and Eco-Friendly Equipment

Sustainability in manufacturing is a growing trend, with food producers investing in energy-efficient machines. Cereal rolling machines with reduced power consumption and improved material efficiency align with global carbon reduction targets. Companies seek equipment that lowers operational costs while meeting environmental regulations. This creates strong opportunities for manufacturers that focus on eco-friendly designs. As governments encourage green technology adoption, suppliers introducing sustainable rolling machines gain a competitive edge, enhancing their presence in international markets where environmental compliance is a key purchasing factor.

- For instance, Bühler has a history of introducing energy-efficient innovations across its product lines, including milling technology. The OLFB flaking mill, which was promoted as early as 2016, features a single overhead drive and an optimized system that reduces power consumption by up to 15%.

Growth of E-Commerce Distribution Channels

The expansion of online and e-commerce platforms presents a strong opportunity for cereal rolling machine suppliers. Smaller and mid-sized food producers increasingly source equipment through digital marketplaces. Online distribution enhances accessibility, offering broader reach across geographies. It reduces dependency on traditional distributors while opening direct sales opportunities. The growth of e-commerce enables machine suppliers to showcase products, provide technical support, and expand customer networks more efficiently. As digital adoption accelerates globally, online sales channels will continue to reshape distribution strategies in the cereal machinery market.

- For instance, Alibaba’s B2B platform lists tens of thousands of cereal processing machine products, connecting equipment manufacturers and suppliers with millions of buyers across more than 200 countries and regions.

Key Challenges

High Initial Investment Costs

The significant capital required for purchasing and installing advanced cereal rolling machines poses a barrier for many manufacturers. Small and mid-sized enterprises struggle with upfront expenses despite the long-term efficiency benefits. Advanced machines with automation and digital integration add to overall costs. Financing limitations and uncertain returns delay adoption in price-sensitive markets. As competition grows, cost-effective solutions and flexible financing options become critical to widen accessibility. Addressing these high investment hurdles remains a key challenge for equipment suppliers targeting diverse customer segments.

Maintenance and Operational Complexity

Cereal rolling machines require regular maintenance to ensure smooth operation and consistent product output. Complex machinery with advanced automation features demands skilled technicians, which increases training and service costs. Frequent breakdowns or inefficient handling can lead to production downtime, impacting profitability. Manufacturers in emerging regions often face shortages of skilled operators, limiting adoption of advanced machines. Developing user-friendly designs with reduced maintenance needs is essential to overcome this challenge. Simplifying operations while ensuring reliability will be critical to drive greater adoption across global markets.

Regional Analysis

North America

North America held a strong share of the cereal rolling machine market, reaching USD 3,316.53 million in 2024, up from USD 2,326.11 million in 2018. The region is projected to attain USD 5,398.02 million by 2032, advancing at a CAGR of 5.8%. North America accounted for nearly 28% of the global market in 2024, supported by high cereal consumption and the presence of leading food processing companies. Technological innovation and automation adoption further strengthen regional growth, with the U.S. leading in large-scale cereal production.

Europe

Europe recorded USD 2,088.29 million in 2024, rising from USD 1,524.99 million in 2018, and is expected to reach USD 3,076.92 million by 2032. The market grows at a CAGR of 4.5%, representing about 18% of global share in 2024. Strong consumer demand for breakfast cereals and snack bars drives machine adoption across the region. EU sustainability regulations also encourage investment in energy-efficient processing equipment. Countries such as Germany, France, and the UK lead adoption due to robust food processing industries and steady technological upgrades.

Asia Pacific

Asia Pacific is the largest and fastest-growing market, valued at USD 5,423.29 million in 2024, up from USD 3,610.98 million in 2018. By 2032, it is expected to reach USD 9,320.45 million, expanding at a CAGR of 6.6%. The region held nearly 45% of the global share in 2024. Rising demand for convenience foods in China, India, and Southeast Asia drives machine sales. Increasing investments in food manufacturing, coupled with urban population growth, fuel expansion. Asia Pacific benefits from strong domestic production and government support for modernized processing industries.

Latin America

Latin America recorded USD 563.66 million in 2024, compared to USD 393.83 million in 2018, and is projected to hit USD 810.50 million by 2032. The region grows at a CAGR of 4.2% and represented about 5% of the global share in 2024. Brazil and Mexico dominate due to expanding food and beverage industries, especially in cereals and snack bars. Growing consumer interest in ready-to-eat products supports machine demand. However, economic fluctuations and infrastructure gaps remain barriers. Increasing adoption of semi-automatic machines offers mid-sized manufacturers cost-efficient opportunities.

Middle East

The Middle East market grew from USD 205.60 million in 2018 to USD 269.36 million in 2024 and is projected to reach USD 359.68 million by 2032. Growing at a CAGR of 3.2%, the region accounted for nearly 2% of global share in 2024. Rising demand for packaged and convenience foods in Gulf Cooperation Council (GCC) countries drives adoption of cereal rolling machines. However, limited large-scale food processing infrastructure slows growth. Investments in food security and diversification of economies away from oil create opportunities for machine suppliers in the region.

Africa

Africa reached USD 196.54 million in 2024, up from USD 122.38 million in 2018, and is expected to grow to USD 251.65 million by 2032. The market expands at the slowest CAGR of 2.7% and represents about 1.6% of global share in 2024. Growth is supported by gradual modernization of food industries in South Africa, Nigeria, and Kenya. However, limited industrial infrastructure and reliance on imported machinery constrain adoption. Rising urbanization and demand for packaged breakfast cereals may stimulate future opportunities, though adoption will remain slower compared to developed regions.

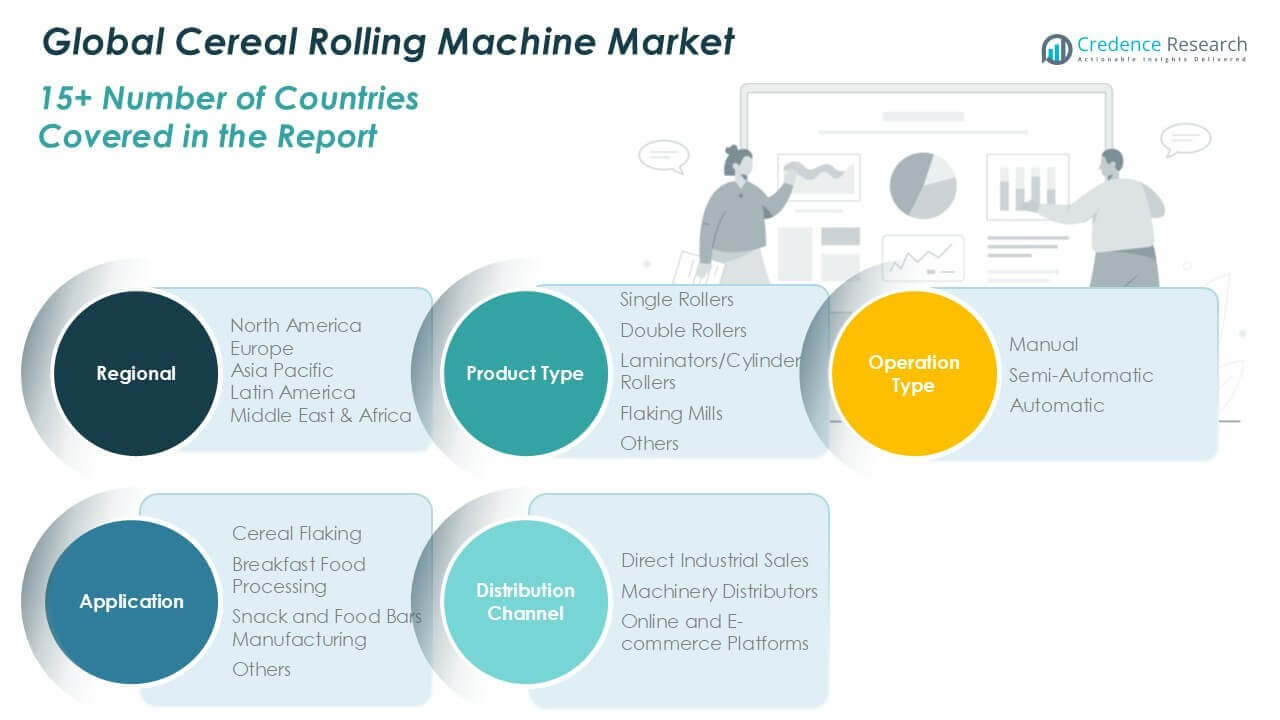

Market Segmentations:

By Product Type

- Single Rollers

- Double Rollers

- Laminators/Cylinder Rollers

- Flaking Mills

- Others

By Operation Type

- Manual

- Semi-Automatic

- Automatic

By Application

- Cereal Flaking

- Breakfast Food Processing

- Snack and Food Bars Manufacturing

- Others

By Distribution Channel

- Direct Industrial Sales

- Machinery Distributors

- Online and E-commerce Platforms

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

Competitive Landscape

The competitive landscape of the Global Cereal Rolling Machine market is characterized by a mix of established international manufacturers and emerging regional players. Companies such as Idugel Group, Krüger & Salecker, Grace Food Processing, Best Engineering Technologies, Jay Industries, Guru Nanak Engineering Works, Sanskriti Food Equipments Exim Pvt Ltd, and Wuxi Kingunion S & T Co., Ltd play a crucial role in shaping market dynamics. Leading players focus on product innovation, automation integration, and capacity expansion to meet the rising demand for cereal flaking and breakfast food processing. Regional manufacturers emphasize cost-effective solutions tailored for small and mid-sized enterprises, while global firms invest in advanced technologies to ensure efficiency, precision, and compliance with sustainability standards. Strategic partnerships, mergers, and expansion into emerging markets strengthen their competitive edge. Growing demand for energy-efficient, high-capacity machines is pushing companies to enhance R&D efforts, ensuring long-term positioning in this evolving industry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Idugel Group

- Grace Food Processing

- Best Engineering Technologies

- Jay Industries

- Krüger & Salecker

- Guru Nanak Engineering Works

- Sanskriti Food Equipments Exim Pvt Ltd

- Wuxi Kingunion S & T Co., Ltd

Recent Developments

- In October 2023, Kellogg completed the spin-off of its North American cereal business, creating two standalone companies: Kellanova and WK Kellogg Co.

- In September 2023, Nestlé acquired a majority stake in this Brazilian premium chocolate company, enhancing its confectionery portfolio in Latin America.

- In 2023, Kellogg Company reorganized and spun off its North American cereal business into a new company known as WK Kellogg Co. This restructuring had WK Kellogg Co. being in charge of brands such as Froot Loops in US, Canadian, and Caribbean countries, while Kellanova deals with these brands globally.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Operation Type, Application, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with growing demand for breakfast cereals and snack bars.

- Automation adoption will increase as manufacturers seek efficiency and consistent product quality.

- Energy-efficient and eco-friendly machines will gain preference due to sustainability goals.

- Asia Pacific will continue leading growth supported by urbanization and rising food processing investments.

- North America and Europe will maintain strong positions driven by established cereal consumption.

- Online and e-commerce distribution will open new sales opportunities for equipment suppliers.

- Flaking mills will retain dominance as the most widely used product type.

- Automatic machines will strengthen their share as food industries modernize production.

- Innovation in digital monitoring and smart controls will shape future machine design.

- Competition will intensify with global players focusing on R&D and regional expansion.