Market Overview

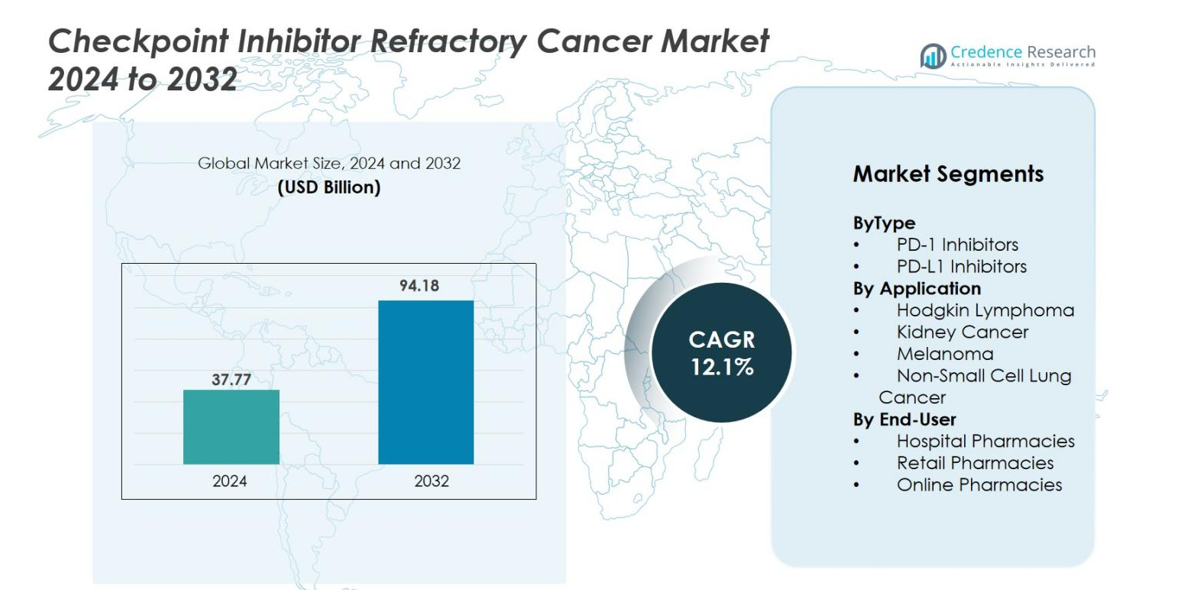

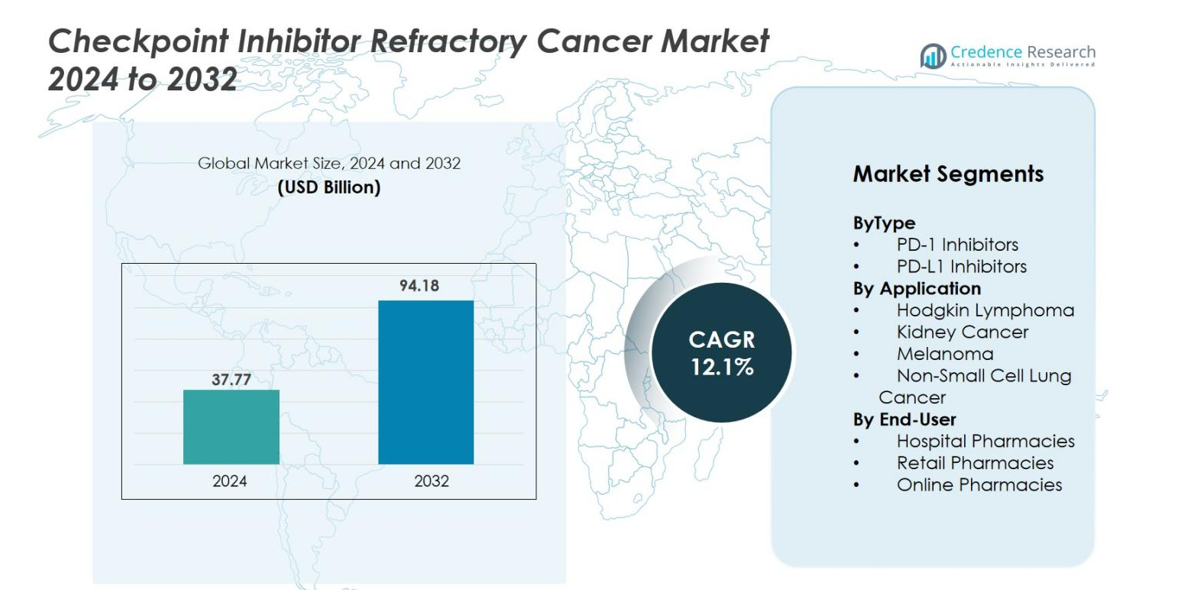

Checkpoint Inhibitor Refractory Cancer Market size was valued at USD 37.77 Billion in 2024 and is anticipated to reach USD 94.18 Billion by 2032, at a CAGR of 12.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Checkpoint Inhibitor Refractory Cancer Market Size 2024 |

USD 37.77 Billion |

| Checkpoint Inhibitor Refractory Cancer Market, CAGR |

12.1% |

| Checkpoint Inhibitor Refractory Cancer Market Size 2032 |

USD 94.18 Billion |

Checkpoint Inhibitor Refractory Cancer Market is shaped by the strong presence of leading players such as Bristol-Myers Squibb, Merck, AstraZeneca, Genentech/Roche, Regeneron Pharmaceuticals, Pfizer–Merck KGaA, Janssen, Eisai, Mirati Therapeutics, Exelixis, Ascentage Pharma, ImmunityBio, and OncoSec Medical, all of which are advancing next-generation immune-oncology therapies and combination regimens to address rising immunotherapy resistance. These companies focus on expanding pipelines targeting secondary immune checkpoints and developing personalized treatment approaches for refractory cancers. North America leads the global market with 41% share, supported by advanced clinical infrastructure and early access to innovative immunotherapies, followed by Europe with 28% share driven by strong oncology networks and consistent adoption of biomarker-guided treatment pathways.

Market Insights

- Checkpoint Inhibitor Refractory Cancer Market reached USD 37.77 billion in 2024 and is projected to hit USD 94.18 billion by 2032, expanding at a 12.1% CAGR during the forecast period.

- Strong market growth is driven by rising immunotherapy resistance, wider adoption of PD-1 inhibitors holding 58% share, and increasing use of combination regimens to improve survival outcomes in refractory cancer patients.

- Key trends include the expansion of biomarker-guided therapy, growing clinical acceptance of LAG-3/TIGIT inhibitors, and accelerating research collaborations that support next-generation immuno-oncology innovations.

- The landscape includes active participation from Bristol-Myers Squibb, Merck, AstraZeneca, Roche, Regeneron, Pfizer–Merck KGaA, Janssen, Eisai, and emerging biotech innovators focused on targeted and adaptive immune therapies.

- Regionally, North America leads with 41% share, followed by Europe at 28%, while Asia-Pacific grows fastest with 22%; by application, NSCLC holds 34% share, making it the largest refractory cancer segment globally.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentation Analysis

By Type

The Checkpoint Inhibitor Refractory Cancer market by type is dominated by PD-1 inhibitors, holding nearly 58% market share in 2024, driven by their broad clinical adoption and strong efficacy across multiple refractory tumors. These inhibitors continue to gain traction due to expanding label approvals, improved survival outcomes, and their integration into combination regimens with targeted therapies and chemotherapy. PD-L1 inhibitors account for the remaining market share as demand grows in advanced lung cancer and urothelial carcinoma; however, slower adoption in refractory settings and narrower approved indications limit their overall share compared to PD-1 inhibitors.

- For instance, Roche’s atezolizumab provided a median overall survival of 9.2 months compared with 7.7 months for chemotherapy in a pooled Spanish analysis of 127 patients with locally advanced or metastatic urothelial carcinoma from IMvigor210 cohort 2 and IMvigor211.

By Application

Among applications, Non-Small Cell Lung Cancer (NSCLC) leads the Checkpoint Inhibitor Refractory Cancer market with 34% market share in 2024, driven by rising prevalence, high relapse rates after first-line immunotherapy, and strong clinical evidence supporting second-line PD-1/PD-L1-based therapies. Melanoma follows due to established use of checkpoint blockade, while kidney cancer and Hodgkin lymphoma show measured growth as new combination approaches enhance therapeutic outcomes. Increasing patient resistance to frontline therapies and growing biomarker-guided treatment strategies continue to fuel adoption across all cancer types.

- For instance, Bristol Myers Squibb’s nivolumab demonstrated a median overall survival of 12.2 months in 582 previously treated nonsquamous NSCLC patients in the CheckMate 057 trial, compared with 9.4 months for docetaxel.

By End-User

Hospital pharmacies dominate the end-user segment with 62% market share in 2024, supported by the administration of immune-oncology therapies in specialized oncology centers and infusion-based hospital settings. These facilities manage the complexity of dosing, adverse event monitoring, and combination therapy protocols essential for refractory cancer treatment. Retail pharmacies hold a moderate share as oral immuno-oncology supportive drugs expand, while online pharmacies are the fastest-growing segment due to improving digital prescription services, wider access to oncology medications, and increased convenience for long-term cancer therapy management.

Key Growth Drivers

Rising Incidence of Immunotherapy Resistance

The Checkpoint Inhibitor Refractory Cancer market is expanding rapidly as more patients develop resistance to first-line PD-1 and PD-L1 inhibitors. Despite the transformative impact of checkpoint inhibitors, a considerable proportion of patients either fail to respond initially or eventually experience disease progression, creating a growing pool of refractory cases. This unmet clinical need accelerates demand for advanced therapeutic alternatives, such as next-generation immune-modulating agents and combination immunotherapies designed to overcome escape pathways. The rising global burden of cancers like melanoma, NSCLC, and renal cell carcinoma further intensifies the need for effective second-line and salvage treatments. Additionally, the increasing focus on biomarker-driven treatment sequencing enhances the identification of patients requiring refractory cancer therapy, strengthening commercial uptake. Together, these factors make the rise in immunotherapy resistance a fundamental driver of market growth.

- For instance, Merck reported in KEYNOTE-040 that 247 out of 247 enrolled recurrent/metastatic head and neck squamous cell carcinoma patients had progressed after platinum-based therapy before receiving pembrolizumab.

Expansion of Combination Therapy Approaches

Combination therapies are emerging as a powerful engine of growth in the Checkpoint Inhibitor Refractory Cancer market, offering significantly improved outcomes for patients who do not benefit from monotherapy checkpoint inhibitors. Pharmaceutical companies are prioritizing multi-agent strategies that enhance immune activation, mitigate resistance mechanisms, and expand therapeutic reach. Combinations involving CTLA-4 inhibitors, tyrosine kinase inhibitors, cancer vaccines, bispecific antibodies, and oncolytic viruses are demonstrating promising results in refractory populations. Regulatory agencies increasingly support these regimens due to strong survival benefits, accelerating clinical adoption. Intensive R&D investment and immuno-oncology partnerships facilitate rapid exploration of synergistic combinations, improving the success rate of late-stage trials. As these combination therapies transition into widespread clinical practice, they enhance treatment efficacy, broaden patient eligibility, and increase therapeutic utilization across global oncology settings.

- For instance, Bristol Myers Squibb’s nivolumab plus ipilimumab regimen in the CheckMate 067 trial produced a median overall survival of 72.1 months in 314 advanced melanoma patients, compared with 36.9 months for nivolumab alone, demonstrating long-term synergy in refractory settings.

Growing Pipeline of Next-Generation Immunotherapies

A robust and diverse pipeline of next-generation immunotherapies is shaping the future of the Checkpoint Inhibitor Refractory Cancer market. Biopharmaceutical companies are advancing therapies targeting alternative checkpoints such as LAG-3, TIGIT, VISTA, and TIM-3, each addressing resistance pathways not effectively managed by current PD-1 or PD-L1 inhibitors. Parallel innovations in personalized immunotherapy—including neoantigen-based vaccines, engineered T cells, and microbiome-modulating agents—offer tailored approaches to overcome immune escape. Precision oncology platforms capable of identifying resistance biomarkers are enabling more individualized treatment strategies. Many late-stage candidates show strong efficacy in heavily pre-treated populations, positioning them as high-value additions to the market. Accelerated regulatory pathways and breakthrough designations further support commercialization. As these therapies progress toward approval, they are expected to redefine treatment standards and significantly expand market revenue.

Key Trends & Opportunities

Rising Adoption of Biomarker-Driven and Personalized Therapies

A major trend in the Checkpoint Inhibitor Refractory Cancer market is the shift toward biomarker-driven therapeutic decision-making. Advances in genomic sequencing, tumor mutational burden testing, PD-L1 scoring, and circulating tumor DNA analysis offer better insights into resistance mechanisms and guide more precise treatment pathways. Personalized immunotherapy strategies allow clinicians to tailor second-line and salvage regimens based on a patient’s tumor biology, improving response rates and minimizing unnecessary exposure to ineffective treatments. This evolution enhances demand for companion diagnostics, integrated immunotherapy platforms, and AI-enabled clinical decision tools. With oncology centers increasingly incorporating molecular diagnostics as a standard of care, personalized immunotherapy presents a major opportunity for innovation and market expansion.

- For instance, Tempus likely generated whole-exome and transcriptome sequencing profiles for thousands of oncology patients. In one such initiative, the company reportedly profiled data for 15,000 individuals, identifying 3,200 cases with relevant immunotherapy resistance markers such as STK11, KEAP1, and PTEN alterations.

Expanding Research Collaborations and Immuno-Oncology Partnerships

The market is experiencing a surge in global research collaborations and immuno-oncology partnerships aimed at accelerating innovation in refractory cancer treatment. Drug developers and biotech innovators increasingly co-develop combination regimens, novel checkpoint inhibitors, cell therapies, and targeted agents to address diverse resistance pathways. These partnerships streamline clinical timelines, reduce research costs, and increase access to breakthrough technologies. Regulatory agencies encourage collaborative designs, enabling faster progression through clinical stages. Access to shared data, advanced immune profiling platforms, and global trial infrastructure strengthens development success rates. As companies integrate complementary expertise, these collaborations create major opportunities for accelerating commercialization of next-generation therapies and delivering more effective treatment options for refractory cancer patients.

- For instance, Merck and Eisai entered a global strategic oncology partnership involving the joint development of pembrolizumab and lenvatinib across more than 20 clinical studies enrolling over 5,000 patients, positioning both companies to rapidly evaluate refractory cancer combinations across multiple tumor types.

Key Challenges

High Treatment Costs and Limited Accessibility

High treatment costs pose a major challenge in the Checkpoint Inhibitor Refractory Cancer market. Advanced immunotherapies, particularly when administered in combination or through repeated dosing cycles, impose significant financial strain on patients and healthcare systems. Limited reimbursement coverage in many regions restricts access to second-line treatments, widening disparities between developed and emerging markets. Hospitals face growing financial pressure to manage the cost of premium biologics, especially in cases requiring long-term therapy and intensive toxicity management. These affordability constraints also reduce patient adherence and delay initiation of optimal therapy. Without broader adoption of value-based care models, pricing reforms, and more comprehensive insurance coverage, the challenge of high treatment cost will continue to limit market expansion.

Complex Biology of Resistance and Limited Predictive Tools

The biological complexity underlying checkpoint inhibitor resistance remains a significant challenge. Tumor heterogeneity, dynamic immune escape mechanisms, and inconsistent biomarker expression make it difficult to predict patient response to second-line therapies. Current diagnostic tools lack the precision needed to accurately identify resistance pathways, leading to inconsistent clinical outcomes and less efficient treatment selection. Limited availability of validated predictive biomarkers also slows drug development and complicates clinical trial design. In addition, the evolving tumor microenvironment adds further complexity, requiring more sophisticated models and in-depth mechanistic research. These uncertainties increase R&D risks, extend development timelines, and hinder widespread adoption of precision immunotherapy strategies for refractory cancer.

Regional Analysis

North America

North America dominates the Checkpoint Inhibitor Refractory Cancer market with 41% market share, driven by high cancer prevalence, widespread adoption of immunotherapies, and strong reimbursement support. The U.S. remains the core growth engine due to advanced oncology infrastructure, robust clinical research, and rapid availability of next-generation immunotherapies. Extensive biomarker testing and widespread usage of PD-1/PD-L1 inhibitors contribute to high treatment penetration. Leading pharmaceutical companies actively expand clinical trials, driving faster approval of novel refractory cancer therapies. Growing reliance on combination regimens and precision oncology platforms further strengthens the region’s position as the global leader.

Europe

Europe holds 28% market share in the Checkpoint Inhibitor Refractory Cancer market, supported by strong oncology networks, high diagnostic adoption, and expanding immuno-oncology guidelines across major countries such as Germany, France, and the U.K. Increasing integration of PD-1/PD-L1 inhibitors into second-line therapy pathways boosts demand for refractory cancer treatments. Government-funded cancer programs facilitate faster access to innovative therapies, although reimbursement variability across nations impacts uniform adoption. Active participation in multi-country clinical trials enhances the availability of next-generation immune checkpoint inhibitors. Rising focus on molecular profiling and combination immunotherapies continues to strengthen Europe’s market presence.

Asia-Pacific

Asia-Pacific accounts for 22% market share, emerging as the fastest-growing region due to rising cancer incidence, expanding healthcare spending, and improving access to modern immunotherapies. Countries such as China, Japan, South Korea, and Australia are adopting PD-1/PD-L1 inhibitors at a rapid pace, especially in lung, gastric, and liver cancers where refractory cases are increasing. Local biopharma companies are advancing immune-oncology pipelines, contributing to wider therapeutic availability. Government initiatives promoting early diagnosis, biomarker testing, and oncology infrastructure upgrades accelerate adoption. Growing clinical trial participation and lower-cost therapy development position Asia-Pacific as a major future growth contributor.

Latin America

Latin America holds 5% market share, with demand gradually rising as healthcare systems expand access to advanced oncology treatments. Brazil, Mexico, and Argentina lead adoption due to growing cancer burden and increased approval of PD-1/PD-L1 therapies. However, limited reimbursement coverage, economic constraints, and unequal access to diagnostic tools restrict broader penetration of refractory cancer treatments. Improving availability of oncology centers, expanding private insurance coverage, and rising participation in global immuno-oncology trials are creating new opportunities. As treatment guidelines evolve and biosimilar immunotherapies become more accessible, regional uptake is expected to strengthen progressively.

Middle East & Africa

The Middle East & Africa region represents 4% market share, characterized by evolving oncology infrastructure and gradual adoption of immunotherapy for refractory cancers. Gulf nations such as Saudi Arabia, the UAE, and Qatar are leading growth due to significant investment in cancer care, improved diagnostic capabilities, and rising access to PD-1/PD-L1 inhibitor therapies. In contrast, African countries face challenges including limited healthcare funding and restricted availability of advanced treatments. Nonetheless, international collaborations, improved cancer screening initiatives, and increasing use of precision oncology in major hospitals are supporting steady but modest growth in refractory cancer treatment adoption.

Market Segmentations

ByType

- PD-1 Inhibitors

- PD-L1 Inhibitors

By Application

- Hodgkin Lymphoma

- Kidney Cancer

- Melanoma

- Non-Small Cell Lung Cancer

By End-User

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Checkpoint Inhibitor Refractory Cancer market features a dynamic and innovation-driven competitive landscape, with leading pharmaceutical and biotechnology companies expanding their pipelines to address rising immunotherapy resistance. Major players such as Bristol-Myers Squibb, Merck, AstraZeneca, Genentech/Roche, Regeneron Pharmaceuticals, Merck KGaA–Pfizer, Janssen, Eisai, Exelixis, Mirati Therapeutics, Ascentage Pharma, ImmunityBio, OncoSec Medical, and 4D pharma are actively advancing next-generation immune checkpoint inhibitors, combination regimens, and biomarker-driven therapies. Companies are heavily investing in clinical trials targeting LAG-3, TIGIT, and other emerging checkpoints to improve outcomes in refractory populations. Strategic collaborations, co-development agreements, and immuno-oncology partnerships strengthen access to novel mechanisms and accelerate regulatory progression. Additionally, emerging biotech firms contribute innovative platforms such as microbiome-based immunotherapies, personalized cancer vaccines, and engineered immune activators. As competition intensifies, differentiation increasingly depends on superior efficacy in heavily pre-treated patients, robust biomarker integration, and cost-effective delivery models.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Exicure, Inc.

- ENB Therapeutics, Inc.

- Janssen Research and Development, LLC

- Evelo Biosciences, Inc. / Merck Sharp & Dohme Corp.

- Mirati Therapeutics

- Exelixis

- Regeneron Pharmaceuticals

- 4D pharma plc.

- Ascentage Pharma Group

- Bristol-Myers Squibb

Recent Developments

- In October 2025, Takeda Pharmaceutical Company entered a global strategic partnership with Innovent Biologics to access two next-generation late-stage investigational medicines for solid tumours (outside Greater China) with an optional licence for an early-stage programme part of the strategy to address treatment-resistance in solid tumours including checkpoint-inhibitor refractory settings.

- In October 2025, Moderna presented early clinical data on its investigational mRNA antigen therapy mRNA‑4359 in combination with pembrolizumab in patients with checkpoint inhibitor-resistant/refractory (CPI-R/R) melanoma.

- In March 2025, Sun Pharmaceutical Industries announced the acquisition of Checkpoint Therapeutics for USD 355 million, aiming to expand its oncology immunotherapy portfolio including treatment for cancers refractory to checkpoint inhibitors.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will witness accelerated adoption of next-generation immune checkpoint inhibitors targeting LAG-3, TIGIT, TIM-3, and VISTA to overcome resistance.

- Combination immunotherapy will become a standard approach as clinical evidence strengthens across multiple refractory cancer types.

- Biomarker-driven treatment selection will expand as genomic profiling and liquid biopsy testing become routine in oncology.

- Personalized immunotherapy, including neoantigen vaccines and engineered T-cell therapies, will gain prominence for difficult-to-treat refractory cases.

- Global clinical trial activity will increase as companies explore multi-mechanism immunomodulatory strategies.

- Artificial intelligence will enhance prediction of resistance pathways and optimize treatment sequencing for refractory cancer patients.

- Lower-cost immunotherapy biosimilars and regional manufacturing advancements will improve access in emerging markets.

- Regulatory agencies will expedite approvals for breakthrough immunotherapies with strong efficacy in heavily pre-treated populations.

- Healthcare systems will increasingly integrate real-world data to refine refractory cancer management and optimize outcomes.

- Strategic collaborations between global pharma and biotech firms will intensify, accelerating innovation and market expansion.