Market Overview:

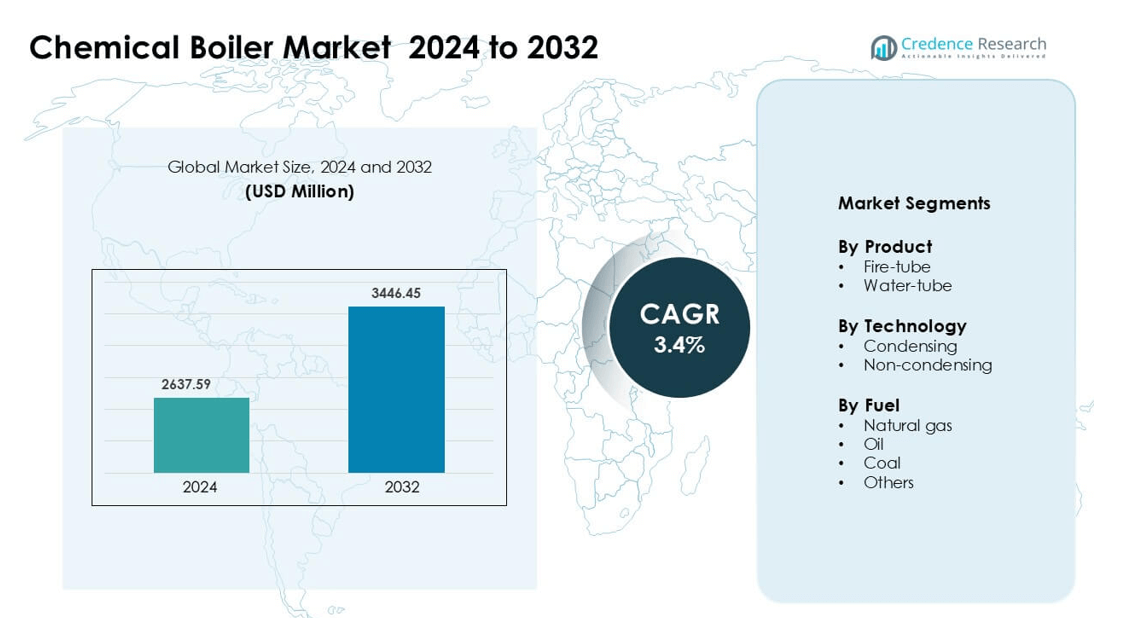

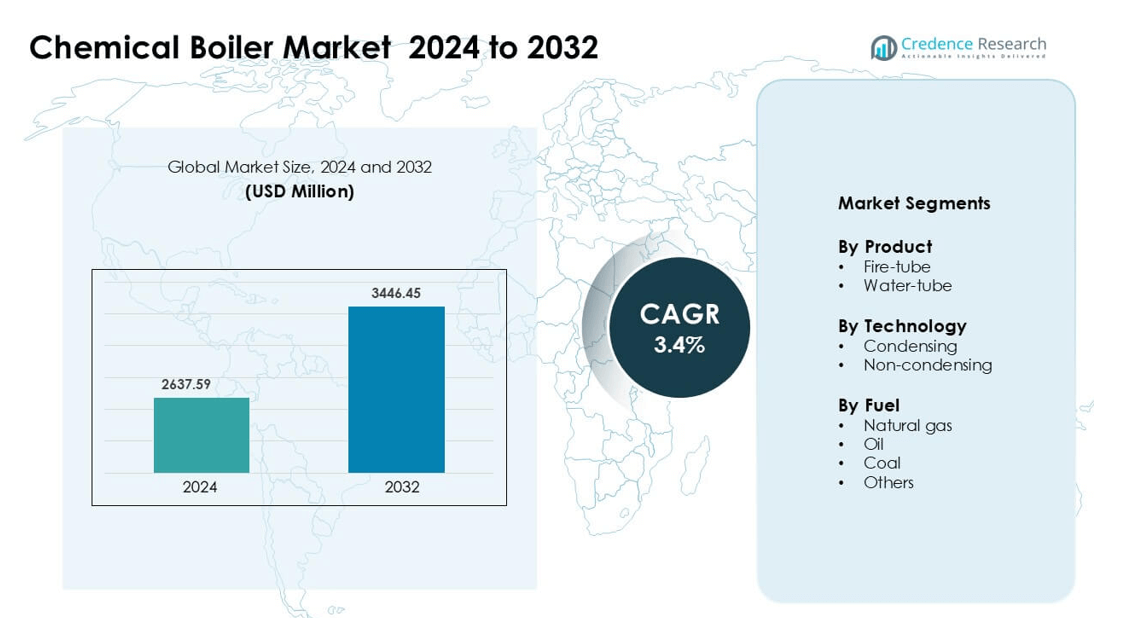

Chemical Boiler Market was valued at USD 2637.59 million in 2024 and is anticipated to reach USD 3446.45 million by 2032, growing at a CAGR of 3.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Chemical Boiler Market Size 2024 |

USD 2637.59 million |

| Chemical Boiler Market, CAGR |

3.4% |

| Chemical Boiler Market Size 2032 |

USD 3446.45 million |

The chemical boiler market features strong competition among major manufacturers such as Babcock & Wilcox Enterprises, Clayton Industries, Cleaver-Brooks, FERROLI S.p.A, Fulton, Cochran, Hurst Boiler & Welding, Forbes Marshall, Babcock Wanson, and Boilermech Holdings Berhad. These companies offer high-efficiency fire-tube and water-tube systems, advanced combustion controls, and modular packaged boilers tailored for petrochemical, fertilizer, and specialty chemical plants. Product development focuses on low-emission burners, heat recovery units, and digital monitoring platforms to improve reliability and reduce fuel costs. Asia-Pacific leads the global market with a 39% share, driven by rapid industrial expansion, new chemical production facilities, and increased adoption of high-capacity steam systems across China, India, Japan, and South Korea.

Market Insights

- The chemical boiler market is valued at USD 2637.59 in 2024 and grows at a CAGR of 3.4%, driven by rising installations in chemical processing and expansion of high-capacity steam systems.

- Strong market drivers include efficiency upgrades, replacement of aging coal units with natural gas systems, and higher adoption of condensing boilers to reduce operating cost and emissions.

- Major trends focus on modular and packaged boiler designs, heat-recovery integration, and increasing automation with IoT-based monitoring that reduces downtime and optimizes fuel use.

- Competition remains intense among players such as Babcock & Wilcox Enterprises, Clayton Industries, Cleaver-Brooks, Forbes Marshall, and FERROLI S.p.A, offering low-NOx burners, digital controls, and service contracts.

- Asia-Pacific holds 39% of global share as the dominant region, while North America and Europe account for strong replacement demand; fire-tube boilers lead the product segment with the largest share due to low maintenance and easy installation.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

Fire-tube boilers hold the dominant share in the chemical boiler market due to low operating cost, simple design, and easier maintenance. Chemical processors use these systems for batch heating, cleaning, and low-pressure steam generation, which supports wide adoption among small and mid-scale plants. Compact footprints and quick installation increase their preference in retrofit projects. Water-tube boilers grow in large processing facilities that require high-pressure steam and continuous heating for petrochemicals, polymers, and specialty chemicals. Rising plant capacity expansions and strict output needs push long-term demand for water-tube units.

- For instance, Cleaver-Brooks CBEX Elite boiler is widely advertised as having an industry-first 10:1 turndown ratio while maintaining low excess air (3% O2 across the firing range).

By Technology

Condensing boilers lead the market because they deliver higher efficiency and reduced heat losses. These systems recover latent heat from exhaust gases, helping chemical manufacturers cut fuel consumption and limit emissions. Their long service life and compatibility with natural gas pipelines increase use in modern processing plants. Non-condensing boilers remain relevant in older facilities that operate under stable load cycles and lower efficiency targets. Replacement of aging non-condensing units with energy-efficient condensing designs continues to strengthen this segment’s adoption rate.

- For instance, Forbes Marshall 2000 Kg/hr B Series Industrial Boiler, which can operate at pressures like 10.55 bar g (approximately 10 bar) and can be equipped with an optional automatic boiler blowdown control system.

By Fuel

Natural gas-fired boilers dominate the fuel segment due to cleaner combustion, lower operating cost, and easy integration with condensing technology. Chemical manufacturers prefer natural gas to meet emission control rules and reduce particulate output. Oil-fired systems serve regions with limited gas pipeline networks, while coal-fired boilers witness decline because of environmental restrictions. Other fuels such as biomass and biogas gain slow traction as companies test renewable heating options. Incentives for cleaner fuel transition and carbon-reduction goals continue to support natural gas as the leading choice in chemical processing facilities.

Key Growth Drivers

Rising Demand for High-Capacity Steam Systems in Chemical Processing

The chemical sector requires continuous steam supply for distillation, reaction heating, drying, sterilization, and power generation. As production lines expand and shift toward large-scale operations, manufacturers invest in efficient boilers that support high-pressure and high-temperature applications. Water-tube and condensing boilers gain traction due to faster heat transfer, improved thermal efficiency, and compatibility with automated controls. The growth of petrochemicals, polymers, fertilizers, and specialty chemicals further increases reliance on stable steam systems. Upgrades in existing plants and construction of new facilities in Asia-Pacific and the Middle East drive long-term equipment demand. Industry emphasis on reducing downtime, optimizing energy use, and enhancing production rates continues to fuel investment in high-performance boiler systems.

- For instance, B&W is indeed a well-known supplier of water-tube boilers for industrial use, including in petrochemical and polymer plants.

Shift Toward Cleaner and Energy-Efficient Fuel Technologies

Strict emission norms push chemical facilities to replace coal and oil-fired boilers with natural gas, biomass, and hybrid fuel systems. Condensing boilers gain strong adoption due to their ability to capture latent heat and reduce fuel consumption. Energy-efficient models also help manufacturers meet sustainability targets and lower carbon footprints while keeping operating costs under control. Government incentives for gas pipeline expansion and green technology adoption further accelerate this transition. Continuous innovation in combustion controls, heat recovery units, and digital monitoring systems improves system performance. As chemical producers face rising fuel bills and pressure to comply with green regulations, demand for advanced, low-emission boiler technologies continues to grow across global facilities.

- For instance, The ClearFire-LC features an integrated premix burner with linkageless controls that provide a turndown ratio of 5:1 (up to 5 parts maximum capacity to 1 part minimum capacity).

Increasing Automation and Digital Boiler Control Systems

Modern chemical plants rely on automation to enhance safety, reduce manual intervention, and maintain continuous operation. Smart boilers equipped with real-time monitoring, predictive maintenance, and automated fuel control are gaining wide acceptance. These systems help operators prevent failures, detect leaks, and maintain optimized combustion. Digital controls also integrate with plant management platforms, supporting remote oversight and energy analytics. Growing industrial IoT adoption boosts the use of automated feedwater systems, pressure controls, and emission monitoring sensors. Reduced downtime, fewer operational hazards, and lower energy wastage make automated boilers a preferred choice in large chemical facilities. Technology upgrades in legacy plants and increasing investment in Industry 4.0 expand this driver further.

Key Trends & Opportunities

Rising Adoption of Heat Recovery and Waste Energy Utilization

Chemical plants generate large amounts of waste heat from steam exhaust, flue gases, and high-temperature reactors. Manufacturers are integrating heat recovery steam generators (HRSGs), economizers, and waste heat boilers to improve energy efficiency. This trend reduces fuel consumption and supports emission control goals, especially in large petrochemical complexes. Boiler suppliers develop compact and modular recovery systems suitable for small and mid-size chemical facilities. The ability to turn process waste into useful steam or power creates long-term cost savings. As energy prices rise and sustainability reporting becomes mandatory, heat recovery solutions offer a major opportunity for suppliers and end-users. Partnerships between boiler manufacturers and EPC companies also help in deploying turnkey systems.

- For instance, Clayton Industries offers the Clayton Waste Heat Boiler, capable of producing 4,535 kilograms of steam per hour from exhaust gas streams at temperatures above 482°C, allowing chemical plants to reclaim thermal energy that would otherwise be released into the atmosphere.

Growth of Modular and Packaged Boiler Systems

Packaged boilers offer quick installation, reduced civil work, and lower maintenance complexity. Chemical companies prefer modular units for expansion projects, temporary capacity boosts, and remote plant locations. These boilers are factory-assembled, tested before delivery, and have shorter commissioning times compared to traditional unit-built boilers. Compact designs support smaller footprints, making them suitable for brownfield facilities. Rising demand for standardized, plug-and-play boiler solutions strengthens this trend. As chemical production becomes more flexible, modular systems enable rapid scaling and cost optimization. Manufacturers also add automation and remote monitoring features into packaged units to attract modern processing plants.

- For instance, Fulton supplies its VSRT-250 packaged steam boiler has a pressure rating of 10.34 bar, delivered as a single skid-mounted unit requiring no field assembly, which reduces onsite installation time for chemical facilities.

Key Challenges

High Initial Costs and Expensive Technology Upgrades

Advanced boiler systems with condensing technology, automation, and heat recovery features require significant upfront investment. Small and mid-size chemical companies face budget constraints when replacing traditional coal or oil-fired units. Additional costs include pipeline expansion, control system integration, and compliance documentation. Although advanced boilers reduce long-term fuel and maintenance expenses, the short-term financial impact limits adoption speed. Financing hurdles are stronger in developing markets where plant operators rely on low-cost combustion systems. This challenge slows modernization and forces many facilities to continue operating older, less efficient equipment.

Environmental Compliance and Complex Regulatory Processes

Chemical producers must adhere to strict air emission standards covering NOx, SOx, and particulate matter. Meeting regulations often requires costly retrofits, filtration systems, and fuel switching. Compliance documentation, safety audits, and frequent inspection cycles increase operational workload for plant management. In some regions, environmental permits delay new boiler installations, affecting project timelines. As nations tighten climate rules and carbon reporting standards, chemical facilities face pressure to adopt green technologies. These requirements raise the overall ownership cost of boiler systems and push manufacturers to constantly redesign and upgrade their product lines.

Regional Analysis

North America

North America commands 26% of the chemical boiler market due to strong chemical production capacity, advanced refineries, and high adoption of natural gas-fired and condensing systems. The United States drives most demand as manufacturers replace aging coal units to comply with EPA emission rules and reduce operating costs. Shale gas availability strengthens the shift toward cleaner combustion. Canada follows with modernization across fertilizer and specialty chemical plants. Strong safety mandates, digital monitoring technologies, and the presence of leading boiler suppliers help North America maintain steady growth and recurring replacement demand.

Europe

Europe holds 22% of the global share, supported by strict environmental regulations and long-term decarbonization goals. EU directives push chemical producers toward high-efficiency boilers, heat recovery units, and low-NOx combustion systems. Germany, France, Italy, and the Netherlands lead modernization efforts across polymer and refinery facilities. Carbon taxation policies encourage the replacement of older oil and coal-fired units. Demand is stronger for natural gas and biomass-based systems, while digital controls and automation gain traction. Continued investment in energy-efficient upgrades helps Europe remain a key region despite slower plant expansion rates.

Asia-Pacific

Asia-Pacific leads the chemical boiler market with 39% share, driven by rapid expansion of petrochemical, fertilizer, and specialty chemical production. China, India, Japan, and South Korea invest in large manufacturing complexes requiring high-pressure steam systems. Industrial growth, government incentives for chemical exports, and strong FDI inflows support widespread capacity additions. Coal and natural gas remain major fuels, though environmental standards push adoption of cleaner combustion and condensing units. Rising installation of modular and packaged boilers in Southeast Asia adds to regional momentum. Local manufacturers and lower production costs further strengthen dominance.

Middle East & Africa

The Middle East & Africa accounts for 7% share, supported by refinery expansions, large petrochemical clusters, and national industrial diversification programs. Saudi Arabia, UAE, and Qatar install high-pressure water-tube boilers in steam-intensive chemical plants and integrated polymer complexes. Abundant natural gas supply favors cleaner fuel use, while heat recovery systems gain traction to improve energy efficiency. Growth in Africa is moderate, led by South Africa’s fertilizer and polymer sectors. Free trade zones and new industrial parks attract international boiler suppliers, improving access to advanced systems and turnkey projects.

Latin America

Latin America holds 6% of the market, driven by chemical and fertilizer production across Brazil, Argentina, and Mexico. Modernization in refineries and polymer plants increases adoption of condensing boilers and automated controls. Natural gas-fired systems replace oil units as pipeline networks expand and emission compliance tightens. Market growth faces temporary delays due to regulatory processes and financing challenges, yet exports of plastics, resins, and agricultural chemicals sustain boiler demand. Partnerships between global manufacturers and local engineering firms broaden supply availability and support long-term efficiency upgrades

Market Segmentations

By Product

By Technology

- Condensing

- Non-condensing

By Fuel

- Natural gas

- Oil

- Coal

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the chemical boiler market features global and regional manufacturers offering advanced steam systems, fuel-efficient combustion technologies, and fully automated control solutions for chemical processing plants. Leading companies such as Babcock & Wilcox Enterprises, Clayton Industries, FERROLI S.p.A, and Cleaver-Brooks focus on high-pressure water-tube boilers, heat recovery solutions, and condensing models designed to reduce fuel consumption and emissions. Mid-scale suppliers, including Forbes Marshall, Cochran, and Hurst Boiler & Welding, strengthen their presence with modular packaged boilers, turnkey installation services, and maintenance contracts. Product differentiation centers on energy efficiency, safety certifications, emission control, and digital monitoring platforms that support predictive maintenance. Strategic partnerships with EPC contractors, chemical producers, and component suppliers help expand distribution networks. Many players invest in R&D to develop low-NOx burners, integrated heat recovery units, and IoT-enabled control systems. Growing demand for cleaner fuel systems, capacity expansion projects, and replacement of aging boilers continue to intensify competition across key regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Clayton Industries

- Babcock Wanson

- Fulton

- FERROLI S.p.A

- Cleaver-Brooks

- Babcock & Wilcox Enterprises

- Cochran

- Hurst Boiler & Welding

- Forbes Marshalls

- Boilermech Holdings Berhad

Recent Developments

- In October 2025, Clayton Industries published a case study with Darn Tough Vermont. Two 50 BHP generators replaced larger fire-tube units to right-size steam.

- In August 2025, Babcock Wanson launched PowerPack, a containerised plug-and-play steam plant. It’s aimed at rapid deployment and rental needs.

Report Coverage

The research report offers an in-depth analysis based on Product, Technology, Fuel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise for high-capacity water-tube boilers as chemical plants expand production lines.

- Natural gas and biomass systems will replace coal units due to emission restrictions.

- Condensing technology will gain wider adoption as manufacturers target higher efficiency and lower fuel use.

- Digital monitoring, predictive maintenance, and remote control systems will become standard features.

- Modular and packaged boilers will see higher demand for quick installation and low downtime.

- Heat-recovery units will grow as plants aim to reuse waste energy and reduce operating costs.

- Manufacturers will focus on low-NOx burners and advanced filtration to meet stricter environmental rules.

- Investments will increase in Asian countries building new petrochemical and specialty chemical facilities.

- Service-based revenue models, including maintenance and performance monitoring, will expand.

- Partnerships between boiler makers, EPC firms, and automation companies will support turnkey project delivery