Market Overview:

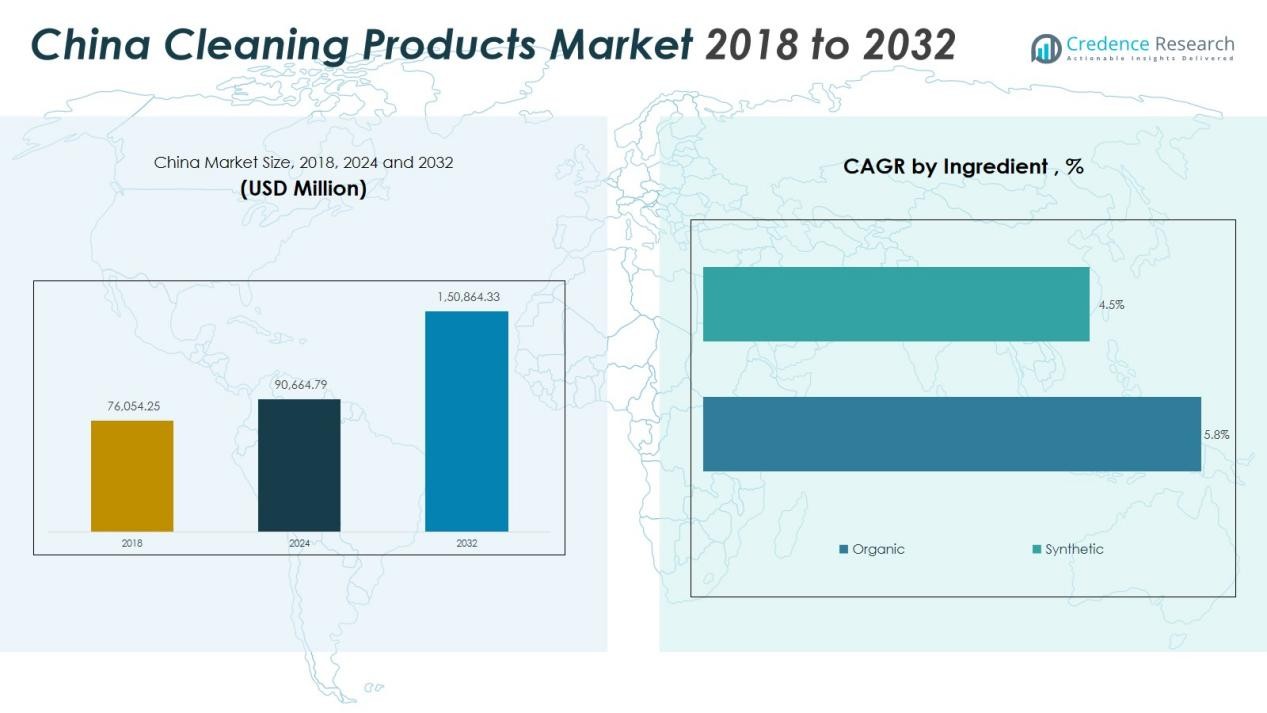

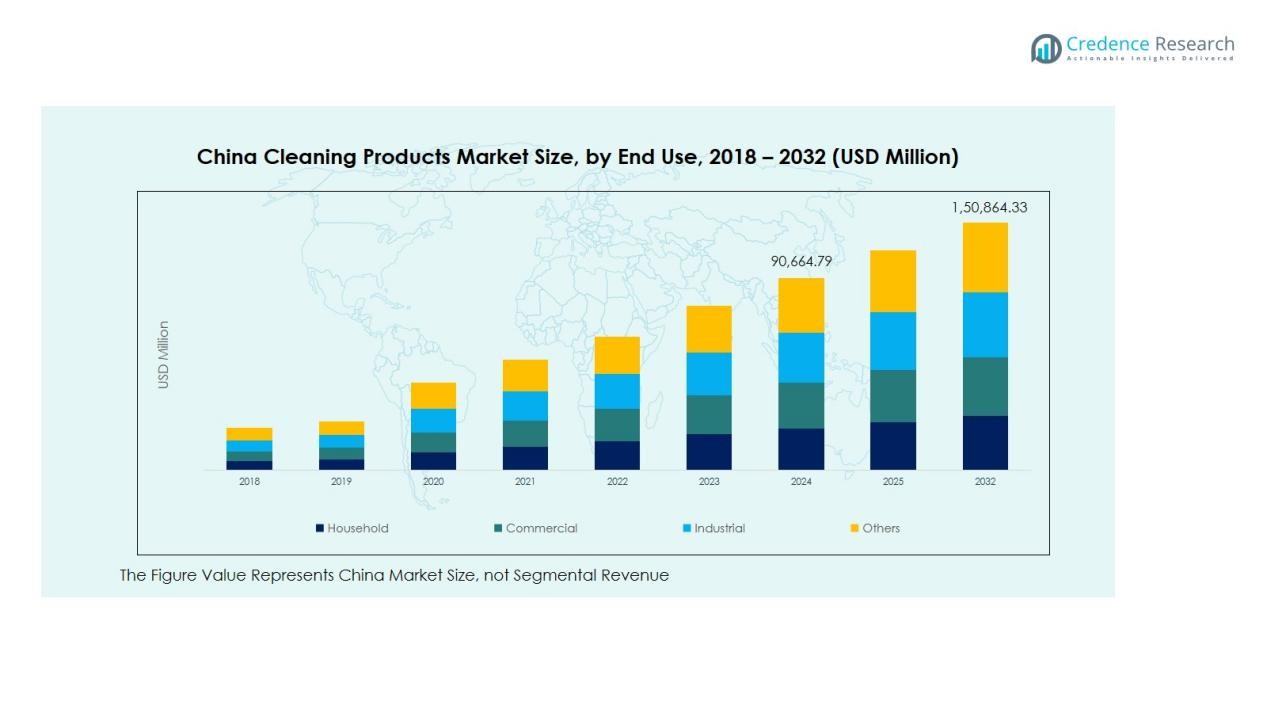

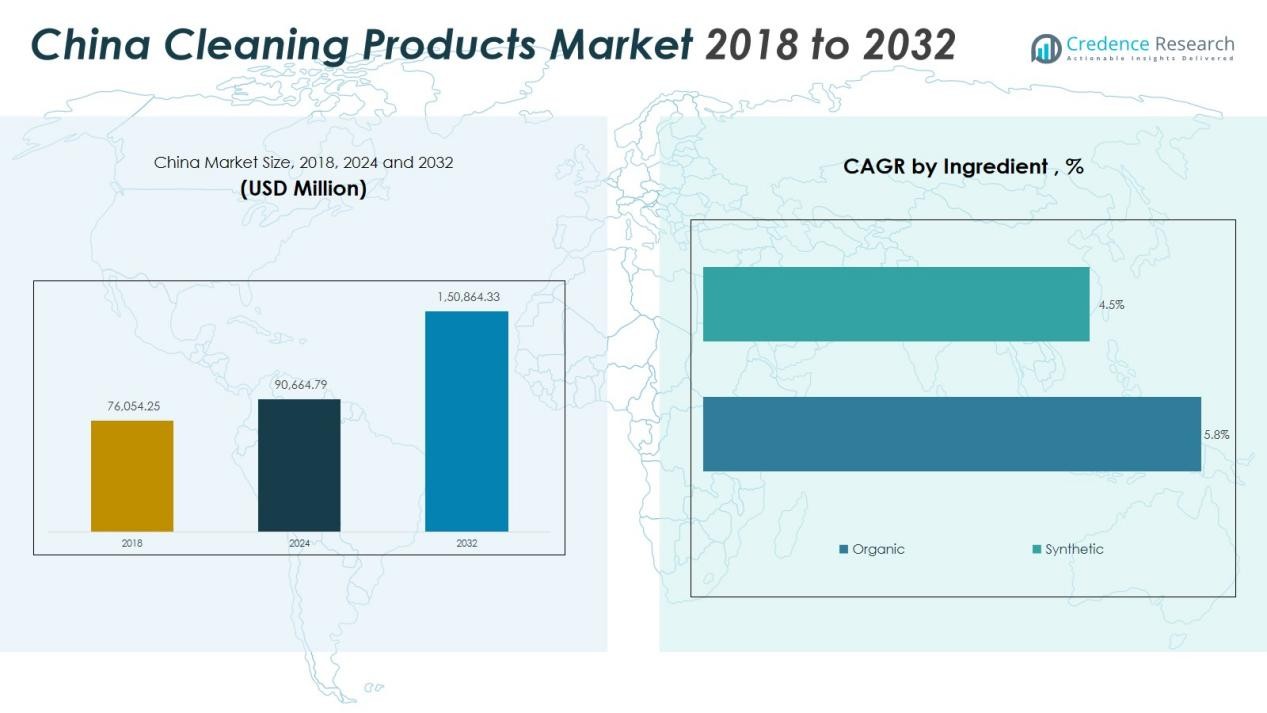

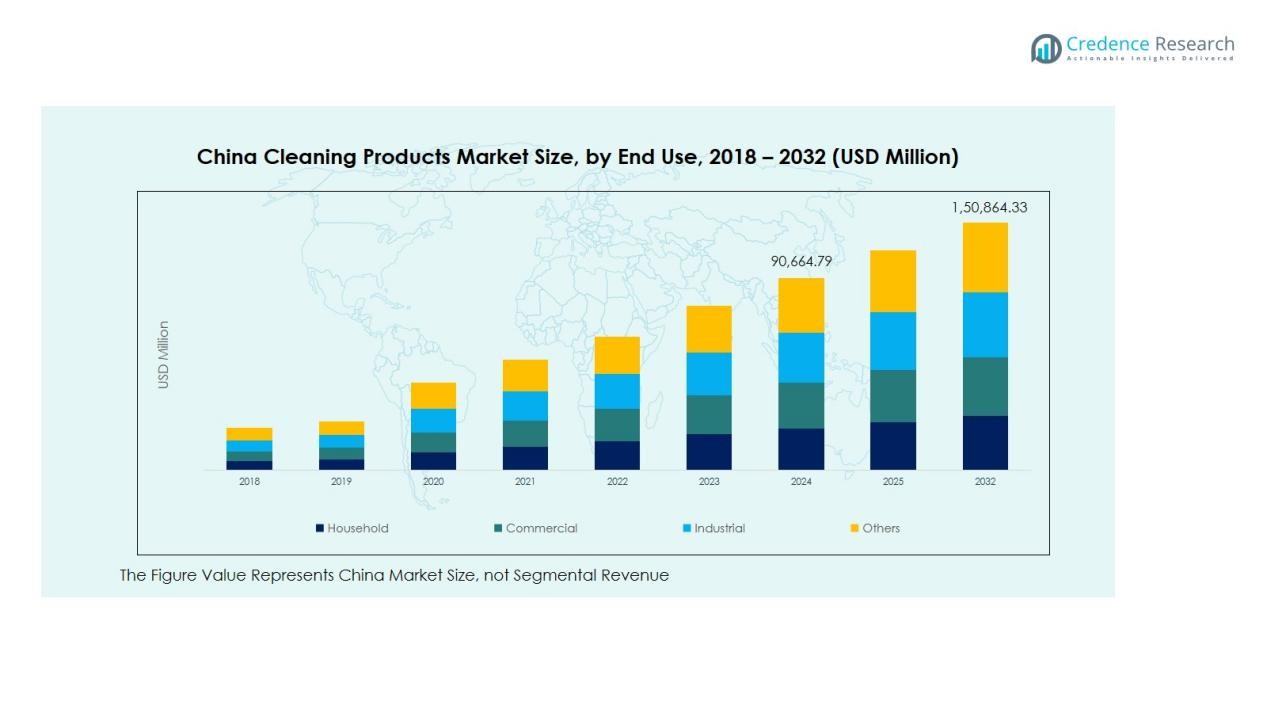

The China Cleaning Products Market size was valued at USD 76,054.25 million in 2018 to USD 90,664.79 million in 2024 and is anticipated to reach USD 1,50,864.33 million by 2032, at a CAGR of 6.57% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| China Cleaning Products Market Size 2024 |

USD 90,664.79 Billion |

| China Cleaning Products Market, CAGR |

6.57% |

| China Cleaning Products Market Size 2032 |

USD 1,50,864.33 Billion |

The primary drivers for the growth of the China cleaning products market include heightened awareness of hygiene, especially post-pandemic, which has significantly increased demand for disinfectants and multi-surface cleaners. Rising urbanization, higher disposable incomes, and busy lifestyles are pushing demand for convenient, effective cleaning solutions. Moreover, there is a strong consumer shift towards natural and eco-friendly cleaning products, which are fueling faster growth in this niche market.

China’s cleaning products market is predominantly led by first- and second-tier cities, where higher income levels and greater awareness of hygiene and sustainability drive demand for premium cleaning products. In contrast, rural areas and lower-tier cities are experiencing steady growth as organized retail and e-commerce expand. The eco-friendly segment is growing faster in China, dominating the Asia-Pacific region in both volume and growth, with natural cleaning products seeing robust double-digit growth compared to more moderate growth in traditional chemical-based products.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The China Cleaning Products Market was valued at USD 76,054.25 million in 2018, is projected to reach USD 90,664.79 million in 2024, and will grow to USD 150,864.33 million by 2032, at a CAGR of 6.57% during the forecast period.

- East China, including cities like Shanghai and Beijing, holds the largest market share, driven by high urban populations, rising disposable income, and advanced retail networks, contributing to both traditional and eco-friendly product demand.

- Central China and Western China represent growing markets, with regions like Sichuan and Chongqing benefiting from increased urbanization and rising living standards, pushing demand for cleaning products in these areas.

- The fastest-growing region is East China, dominating the market with over 40% of the share, supported by urbanization, higher income levels, and increased hygiene awareness.

- By product type, surface cleaners hold the largest share at 32%, followed by toilet cleaners at 28%. In terms of ingredients, synthetic cleaning products dominate with 65% of the market share, while organic products are growing rapidly at a double-digit rate.

Market Drivers:

Rising Hygiene Awareness Post-Pandemic

The COVID-19 pandemic has heightened hygiene consciousness across China, significantly boosting the demand for cleaning products. Consumers are more focused on sanitation and cleanliness in both homes and public spaces. It has driven a surge in disinfectants, multi-surface cleaners, and other hygiene-related products. This shift in behavior towards maintaining cleanliness at higher standards is expected to persist, sustaining demand in the China Cleaning Products Market for the foreseeable future.

- For instance, Reckitt Benckiser experienced online sales of Dettol disinfectant rising by 643% year-on-year between February 10 and February 13, 2020 on Suning.com in China.

Urbanization and Higher Disposable Incomes

China’s rapid urbanization is a key driver of growth in the cleaning products sector. As more people move to urban areas, the demand for cleaning products increases due to smaller living spaces, higher pollution levels, and a desire for convenience. Rising disposable incomes further contribute to this trend, as consumers can afford to purchase premium cleaning products. With increased access to modern retail channels and e-commerce, urban residents have greater availability of a variety of cleaning products to suit their needs.

- For Instance, Bissell announced plans to establish a sole proprietorship in Shanghai and open 200 physical retail stores across China to expand its retail channels and meet growing urban consumer demand.

Shift Towards Eco-Friendly Products

A strong consumer preference for eco-friendly and natural cleaning products is reshaping the China Cleaning Products Market. As awareness of environmental issues grows, there is a rising demand for biodegradable and non-toxic alternatives to traditional cleaning products. Consumers are more inclined to choose eco-friendly brands that offer sustainable packaging and natural ingredients. This trend is expected to continue as environmental consciousness strengthens, particularly among urban and younger consumers.

Growth of E-Commerce Channels

The rapid growth of e-commerce in China plays a pivotal role in the expansion of the cleaning products market. Online platforms have made cleaning products more accessible to a broader range of consumers, including those in rural and tier-III cities. E-commerce enables brands to reach customers in less saturated regions, offering convenience and competitive pricing. The shift towards digital shopping continues to support the expansion of product variety and customization, further driving growth in the market.

Market Trends:

Rapid Shift to Sustainable and Smart‑Cleaning Solutions

Manufacturers in the China Cleaning Products Market are rapidly transitioning towards sustainable materials and smart functionalities. They deploy recyclable flexible packaging and eco‑friendly formulations to meet tighter environmental regulations and growing consumer demand. The market places strong emphasis on natural ingredients, biodegradable formulas and multi‑purpose cleaners that deliver convenience and performance. It also embraces smart‑home integration, where cleaning devices and solutions connect to apps or sensors and appeal to urban consumers. Brands that adopt these innovations gain competitive advantage and capture higher margin segments. The pace of change proves that the market rewards agility and innovation.

- For instance, a leading eco-friendly cleaning product company developed a biodegradable dishwashing liquid whose plant-based surfactants break down over 90% of their organic components within 28 days, a standard often used in independent laboratory tests (such as the OECD 301B test) to certify products as ‘readily biodegradable’.

Acceleration of E‑Commerce Channels and Regional Penetration

E‑commerce plays a pivotal role in the China Cleaning Products Market and offers brands national scale beyond traditional retail. Social commerce, livestreaming and mobile‑first shopping experiences drive direct‑to‑consumer growth. This shift helps brands reach lower‑tier cities and rural regions where organised retail remains under‑penetrated. Manufacturers optimise logistics, localise portfolios and tailor pricing strategies to tap volume growth outside major urban centres. They expand SKU counts, introduce micro‑brands and customise offerings for regional hygiene habits. The result proves that channel innovation and regional diversification matter as much as product innovation.

- For instance, brands commonly leverage social commerce and livestreaming during the Tmall Double 11 shopping festival to significantly increase market penetration in lower-tier cities.

Market Challenges Analysis:

Escalating Input Costs and Regulatory Compliance Challenges

The China Cleaning Products Market faces intense pressure from fluctuating raw‑material prices, particularly for surfactants and solvents. Supply‑chain disruptions and rising energy expenses squeeze margins and force manufacturers to revise pricing. It must also meet stricter environmental regulations that govern chemical usage, plastic waste and biodegradability, which drive higher research and reformulation costs. Meeting these new standards reduces agility and raises overhead, especially for smaller players. The industry’s complexity increases when regional regulatory frameworks differ across provinces. Firms that cannot absorb these costs risk losing competitiveness or exiting certain segments.

Intense Price Sensitivity and Fragmented Market Structure

The China Cleaning Products Market operates in a heavily fragmented environment with many local and regional competitors, which drives aggressive pricing and erodes profitability. It proves difficult to differentiate purely on price when low‑cost substitutes mirror established brands. Penetrating rural and lower‑tier city markets remains challenging due to lower consumer awareness of branded cleaning solutions and sensitivity to cost. The presence of counterfeit or low‑quality products further undermines consumer trust and complicates brand building. Entrants and incumbents alike struggle to maintain product integrity and margin in such a price‑driven environment. Key players often must focus on value‑added features or premiumisation to escape the trap of competing on cost alone.

Market Opportunities:

Emerging Premium‑and‑Health‑Centric Product Segments

The China Cleaning Products Market shows strong opportunity in premium, health‑focused cleaning solutions. Consumers increasingly favour plant‑based formulas, mild fragrances and gentle finishes that link to wellness and safety. Manufacturers who align with this demand can launch premium tiers and command higher margins. It also makes sense to offer cleaning kits or value‑bundles that meet seasonal rituals and organised living trends. Brands can expand clean designs, reusable packaging and smaller pack sizes to appeal to younger, eco‑aware households. Targeted messaging around safety, hygiene and wellbeing will resonate with urban users and affluent buyers.

Expansion into Less‑Saturated Geographies and Omni‑Channel Platforms

There is significant room for growth in lower‑tier cities and rural regions where branded cleaning products still reach limited penetration. The China Cleaning Products Market can deepen reach by leveraging mobile‑first commerce, livestreaming and localised distribution networks. It makes strategic sense to build micro‑brands or regional variants that suit local needs and price sensitivities. Companies that optimise supply‑chain logistics and tailor SKUs for local preferences will capture volume growth. Collaborations with digital platforms and community‑based retail raise brand access and awareness. This dual focus on channel innovation and geographic expansion supports sustained market capture.

Market Segmentation Analysis:

By Product Type

The China Cleaning Products Market is divided into several product types, with surface cleaners, toilet cleaners, and dishwashing products leading in terms of revenue. Surface cleaners, driven by increasing hygiene awareness, dominate due to their widespread use in households and commercial spaces. Toilet and floor cleaners follow closely behind, benefiting from growing demand for sanitation and cleanliness. Fabric cleaners are also growing steadily as consumers seek specialized products for laundry care. Other product categories, such as glass and metal cleaners, see consistent demand in both residential and commercial sectors, while niche segments like personal care cleaners and building cleaners remain focused on specific applications.

- For instance, Blue Moon Group Holdings reported a revenue of HK$8.56 billion for the fiscal year ended December 31, 2024, which was an increase from the previous year. However, the company also reported a net loss of approximately HK$749.31 million for that same year.

By Ingredient

The China Cleaning Products Market is further segmented by ingredient into organic and synthetic products. Organic cleaning products, which cater to the rising demand for eco-friendly and sustainable solutions, have gained substantial traction. Consumers are increasingly opting for non-toxic, biodegradable ingredients. Synthetic products, however, continue to dominate the market due to their established effectiveness and lower cost. The growth of organic cleaners is expected to continue as awareness about environmental impact rises, but synthetic products will still hold a significant market share for their superior cleaning power and affordability.

- For instance, Evonik successfully launched REWOFERM® RL 100, the world’s first commercially available rhamnolipid biosurfactant produced at industrial scale at its Slovakia facility, which began production ahead of schedule in 2023.

By End-Use

The market is segmented by end-use into household, commercial, and industrial categories. Household cleaning products lead the market, driven by urbanization, higher disposable incomes, and the increasing focus on hygiene. The commercial segment follows closely, particularly in hospitality, healthcare, and offices, where cleanliness standards are stringent. The industrial sector sees steady demand, particularly for heavy-duty cleaning solutions in manufacturing and warehousing.

Segmentations:

By Product Type:

- Surface cleaners

- Toilet cleaners

- Glass & metal cleaners

- Floor cleaners

- Fabric cleaners

- Dishwashing products

- Others (personal care cleaners, building cleaner, etc.)

By Ingredient:

By End-Use:

- Household

- Commercial

- Industrial

- Others

By Price Range:

Regional Analysis:

East China: The Leading Hub

East China, including major cities like Shanghai, Beijing, and Hangzhou, remains the primary region driving the China Cleaning Products Market. This area has the highest concentration of urban populations, with a growing middle class that demands higher standards of hygiene and premium cleaning solutions. The rise in disposable income, paired with the rapid expansion of retail and e-commerce channels, fuels increased demand for both traditional and eco-friendly cleaning products. It benefits from advanced infrastructure and modern retail networks, making it a key area for both domestic and international brands.

Central and Western China: Growing Markets

Central and Western China represent expanding markets for cleaning products as urbanization accelerates. Regions such as Sichuan, Chongqing, and Hunan are experiencing a steady increase in household cleaning product demand. While these areas traditionally lagged behind in product penetration, growing awareness of hygiene standards, coupled with rising living standards, is leading to a stronger market presence. Retailers and brands are beginning to target these regions more aggressively, adapting their marketing strategies and product offerings to cater to local preferences and price sensitivities.

Rural and Tier-III/IV Cities: Emerging Opportunities

In rural areas and tier-III/IV cities, the China Cleaning Products Market is poised for growth. Although these regions historically saw limited adoption of branded cleaning products, e-commerce platforms have revolutionized access to these goods. With a shift toward modern living and higher consumer spending power, demand for cleaning products is expected to grow steadily. Brands looking to penetrate these areas must focus on cost-effective solutions while emphasizing product education and convenience, aligning with the local consumer’s evolving needs.

Key Player Analysis:

- Procter & Gamble (P&G)

- The Clorox Company

- Reckitt

- C. Johnson & Son

- Unilever

- Henkel AG & Co. KGaA

- Guangzhou Liby Enterprise Group (Domestic)

- Nice Group Co., Ltd. (Domestic)

- WhiteCat Household Products Co., Ltd.

Competitive Analysis:

The China Cleaning Products Market is highly competitive, with global and domestic players vying for market share. Key players such as Procter & Gamble (P&G), The Clorox Company, Reckitt, and S.C. Johnson & Son dominate the market with well-established brands and wide product portfolios. These companies benefit from strong brand recognition and extensive distribution networks across the country. Domestic brands like Guangzhou Liby Enterprise Group and Nice Group Co., Ltd. also pose strong competition by offering products tailored to local preferences at more affordable price points.

The market is seeing increasing pressure from new entrants offering eco-friendly and innovative products. Companies that invest in sustainability and adapt to changing consumer preferences for organic and green cleaning solutions gain a competitive edge. Regional players are also intensifying competition by focusing on niche segments and direct-to-consumer sales channels, leveraging e-commerce to increase accessibility in tier-III and rural markets.

Recent Developments:

- In March 2025, Procter & Gamble launched the Always Pocket Flexfoam and became the first-ever period care partner at Coachella.

- In November 2024, The Clorox Company announced a strategic partnership with Manufacture 2030 (M2030) to advance decarbonization and help suppliers meet carbon reduction targets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Product Type, Ingredient, End-Use and Price Range. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The China Cleaning Products Market is expected to continue its robust growth as consumer demand for hygiene and cleanliness rises.

- Urbanization will drive increased adoption of cleaning products in both urban and suburban regions.

- The shift toward eco-friendly and organic cleaning solutions will intensify, with consumers demanding more sustainable options.

- Premium and health-conscious cleaning products will capture a larger share of the market as consumers prioritize well-being and safety.

- E-commerce platforms will play a pivotal role in expanding market reach, particularly in tier-III and rural regions.

- Local and regional brands will focus on developing products tailored to regional preferences, increasing product customization.

- Technological innovations in cleaning products, such as smart cleaning devices and multifunctional formulations, will gain traction.

- Government regulations around product safety, packaging waste, and sustainability will shape the development of new products.

- The competition will increase as both global and local brands expand their presence in the market, leading to more aggressive pricing and marketing strategies.

- Consumer education on the benefits of cleaning products will grow, expanding the overall market as awareness increases.