| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| China Distributed Acoustic Sensing Market Size 2024 |

USD 79.17 Million |

| China Distributed Acoustic Sensing Market, CAGR |

14.19% |

| China Distributed Acoustic Sensing Market Size 2032 |

USD 228.80 Million |

Market Overview:

The China Distributed Acoustic Sensing Market is projected to grow from USD 79.17 million in 2024 to an estimated USD 228.80 million by 2032, with a compound annual growth rate (CAGR) of 14.19% from 2024 to 2032.

Several factors are propelling the growth of China’s DAS market. The country’s extensive oil and gas pipeline networks necessitate advanced monitoring systems to detect leaks and ensure operational safety. DAS technology offers real-time data collection and analysis, enabling prompt detection of anomalies and reducing the risk of environmental hazards. Additionally, China’s focus on enhancing infrastructure security and the increasing adoption of smart city initiatives are driving the demand for DAS systems. These systems provide continuous monitoring capabilities, essential for maintaining the integrity of critical infrastructure and ensuring public safety. Furthermore, advancements in fiber optic technology have improved the sensitivity and range of DAS systems, making them more effective and reliable for various applications.

China’s vast and diverse geographical landscape presents unique challenges and opportunities for the deployment of DAS technology. In the eastern coastal regions, characterized by dense urban populations and significant industrial activities, there is a heightened need for infrastructure monitoring to prevent disruptions and ensure safety. The implementation of DAS systems in these areas aids in the early detection of structural issues in bridges, tunnels, and high-rise buildings. In contrast, the western regions, with their extensive oil and gas fields, benefit from DAS technology’s ability to monitor pipeline integrity over long distances, reducing the risk of leaks and ensuring efficient resource management. Moreover, China’s commitment to expanding its high-speed rail network and enhancing border security further underscores the importance of DAS systems in providing real-time surveillance and monitoring capabilities across vast and varied terrains.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The market is projected to grow from USD 79.17 million in 2024 to USD 228.80 million by 2032, registering a CAGR of 14.19%.

- The Global Distributed Acoustic Sensing Market is projected to grow from USD 639.45 million in 2024 to an estimated USD 1596.46 million by 2032, with a compound annual growth rate (CAGR) of 12.12% from 2024 to 2032.

- Infrastructure expansion and smart city initiatives are driving DAS adoption for real-time structural monitoring in urban environments.

- The extensive oil and gas pipeline network in western China supports strong demand for DAS in leak detection and operational safety.

- National security priorities have accelerated DAS deployment for border surveillance and perimeter protection in sensitive zones.

- Technological advancements, including machine learning integration and improved fiber optics, are enhancing accuracy and reducing operational costs.

- High initial costs and complex integration with existing infrastructure remain major barriers, especially for small and mid-sized enterprises.

- Eastern coastal regions account for 40% of the market share, driven by dense industrialization and large-scale urban infrastructure projects.

Market Drivers:

Infrastructure Expansion and Smart City Development

The rapid urbanization across China has led to significant investments in infrastructure development, including smart cities, transportation systems, and energy networks. For instance, the Guangzhou Smart City Project Phase 1 aims to enhance urban infrastructure monitoring and management through advanced digital platforms, green data centers, and smart telecom network. This expansion has created a robust demand for real-time, high-accuracy monitoring technologies that ensure operational reliability and public safety. Distributed Acoustic Sensing (DAS) systems are increasingly adopted in urban infrastructure projects due to their capability to detect vibrations, identify potential structural weaknesses, and offer early warnings of disruptions. As the Chinese government continues to implement large-scale infrastructure initiatives such as the Belt and Road Initiative (BRI) and nationwide smart city programs, the integration of DAS technology into monitoring frameworks is expected to rise steadily.

Energy Sector Modernization and Pipeline Surveillance

China’s growing energy consumption and the push toward securing critical energy infrastructure have amplified the need for efficient and continuous pipeline monitoring systems. The country possesses extensive oil and gas pipeline networks, especially in remote and challenging terrains where manual inspection is neither practical nor cost-effective. Distributed Acoustic Sensing technology offers a reliable solution for real-time pipeline surveillance by converting standard fiber optic cables into highly sensitive acoustic sensors. This capability allows operators to detect leaks, third-party intrusions, or any unusual activity along the pipeline route with a high degree of precision. For example, AP Sensing’s DAS systems provide continuous monitoring along pipelines, enabling early detection of threats such as unauthorized digging or landslides while ensuring regulatory compliance. As China enhances its domestic energy infrastructure and promotes the use of natural gas, the DAS market stands to benefit significantly from these modernization efforts.

Emphasis on National Security and Border Surveillance

China’s commitment to strengthening its internal security apparatus and improving border surveillance has also emerged as a major driver for the DAS market. The technology is increasingly deployed for perimeter monitoring in sensitive installations, such as military facilities, power plants, and government infrastructures. DAS systems offer a strategic advantage by detecting unauthorized access, vehicular movements, or potential sabotage attempts without the need for power-intensive sensors or constant human supervision. With geopolitical concerns and cross-border threats remaining top priorities, the government’s investments in advanced surveillance solutions are likely to increase, further promoting the adoption of DAS across security-related applications.

Technological Advancements and Cost Efficiency

Continual innovation in fiber optic sensing technology has made DAS systems more accurate, scalable, and cost-effective. Improvements in data processing algorithms, machine learning integration, and sensor calibration have significantly enhanced the ability of DAS to distinguish between different types of acoustic signals. These advancements allow for precise localization of anomalies, thereby increasing operational efficiency and reducing maintenance costs. As Chinese industries seek digital transformation and predictive maintenance solutions, the deployment of advanced DAS systems becomes a compelling choice. The declining costs of fiber optic components also contribute to the broader acceptance of DAS across both public and private sectors, reinforcing its market growth trajectory in China.

Market Trends:

Integration of Artificial Intelligence and Machine Learning

The integration of Artificial Intelligence (AI) and Machine Learning (ML) into Distributed Acoustic Sensing (DAS) systems is revolutionizing data analysis capabilities. For instance, researchers at Nanjing University have developed a Time-Wavelength Multiplexed Photonic Neural Network Accelerator (TWM-PNNA), which significantly enhances the speed and accuracy of DAS data processing for real-time applications, such as railway monitoring and earthquake detection. These technologies enhance the interpretation of complex acoustic signals, enabling more accurate detection of events such as pipeline leaks, structural anomalies, and unauthorized intrusions. In China, where vast infrastructure networks require continuous monitoring, the adoption of AI and ML in DAS systems facilitates real-time decision-making and predictive maintenance strategies. This trend aligns with the country’s broader push towards digital transformation and the development of smart infrastructure.

Expansion of Multimode Fiber Applications

While single-mode fibers have traditionally dominated the DAS market due to their long-range capabilities, there is a growing trend towards the adoption of multimode fibers in China. Advancements in multimode fiber technology have improved their performance, making them suitable for short to medium-range applications such as urban infrastructure monitoring and industrial facility surveillance. The cost-effectiveness and ease of installation associated with multimode fibers are driving their increased use in projects where extensive coverage is not required, thereby expanding the market’s reach within the country.

Diversification into New Industry Verticals

The application of DAS technology in China is expanding beyond traditional sectors like oil and gas. Industries such as transportation, power utilities, and environmental monitoring are increasingly adopting DAS for its real-time sensing capabilities. For instance, in China’s transportation sector, DAS systems are deployed for railway track monitoring and detecting structural issues in tunnels and bridges. In power utilities, it aids in the surveillance of transmission lines and substations. This diversification is driven by the need for enhanced safety measures and operational efficiency across various critical infrastructure sectors.

Government Initiatives and Regulatory Support

The Chinese government’s emphasis on infrastructure safety and technological innovation is fostering the growth of the DAS market. Policies promoting the development of smart cities and the modernization of industrial facilities are encouraging the integration of advanced monitoring systems like DAS. Additionally, regulatory frameworks mandating stringent safety standards for critical infrastructure are compelling organizations to adopt reliable sensing technologies. This supportive policy environment is instrumental in accelerating the deployment of DAS solutions across the country.

Market Challenges Analysis:

High Initial Investment and Integration Complexity

One of the primary restraints impacting the growth of the Distributed Acoustic Sensing (DAS) market in China is the high initial capital investment required for system deployment. The costs associated with advanced fiber optic cables, specialized interrogators, and signal processing infrastructure can be substantial, especially for small and medium enterprises. For instance, the integration of DAS technology in the Pinghu oilfield in the East China Sea involved significant costs due to the need for specialized vertical seismic profiling (VSP) systems and advanced imaging strategies to optimize subsurface evaluations. Moreover, integrating DAS systems with existing infrastructure poses technical challenges, often requiring retrofitting and compatibility adjustments. This complexity slows adoption among organizations that lack the technical expertise or budget to implement comprehensive sensing networks.

Limited Standardization and Technical Expertise

The absence of unified technical standards for DAS systems presents a significant barrier to market scalability in China. Variability in system performance across different manufacturers creates challenges in interoperability and long-term maintenance. Additionally, the deployment and operation of DAS technology require specialized skills in fiber optics, signal interpretation, and acoustic data analytics. The shortage of trained professionals with experience in DAS installation and diagnostics further impedes widespread adoption, particularly in regions with less industrial development.

Environmental Interference and Signal Interpretation Issues

China’s diverse geography, ranging from densely populated urban zones to remote mountainous areas, introduces environmental variables that can interfere with DAS signal accuracy. External noise, temperature fluctuations, and ground vibrations not related to the monitored infrastructure may lead to false positives or missed detections. This challenge necessitates the development of advanced filtering and calibration mechanisms, adding to the complexity and cost of deployment. The reliability of signal interpretation remains a concern, especially in applications that demand high precision, such as pipeline surveillance or seismic monitoring.

Data Privacy and Regulatory Concerns

As DAS systems collect and process vast amounts of real-time acoustic data, concerns around data privacy and regulatory compliance have emerged. In sensitive sectors such as defense, public utilities, and transportation, strict data governance policies limit how data can be collected, stored, and analyzed. Navigating these regulatory frameworks without compromising system functionality remains a persistent challenge for market participants.

Market Opportunities:

The China Distributed Acoustic Sensing (DAS) market presents considerable growth opportunities driven by the country’s strategic push toward industrial automation, smart infrastructure, and digital transformation. As China continues to modernize its transportation systems, energy networks, and urban environments, there is a growing demand for advanced monitoring solutions that provide real-time, continuous data without requiring extensive manual intervention. DAS technology, with its capability to convert existing fiber optic networks into intelligent sensing platforms, is well-positioned to capitalize on this demand. The government’s initiatives to promote smart city development and critical infrastructure resilience offer a strong foundation for increased DAS adoption across sectors such as railway monitoring, traffic management, structural health surveillance, and tunnel safety.

Moreover, the expansion of renewable energy projects and the deployment of subsea and land-based energy transmission lines further widen the scope for DAS applications. The ability of DAS systems to perform under challenging environmental conditions makes them a suitable choice for monitoring wind farms, offshore platforms, and long-distance power grids. Additionally, the proliferation of 5G infrastructure and the integration of edge computing and AI-driven analytics into sensing systems enhance the operational value of DAS solutions. As industries in China increasingly prioritize predictive maintenance and operational efficiency, the DAS market stands to benefit from both public and private sector investments in next-generation sensing technologies. The convergence of innovation, policy support, and infrastructural need positions the China DAS market for robust and sustained growth in the years ahead.

Market Segmentation Analysis:

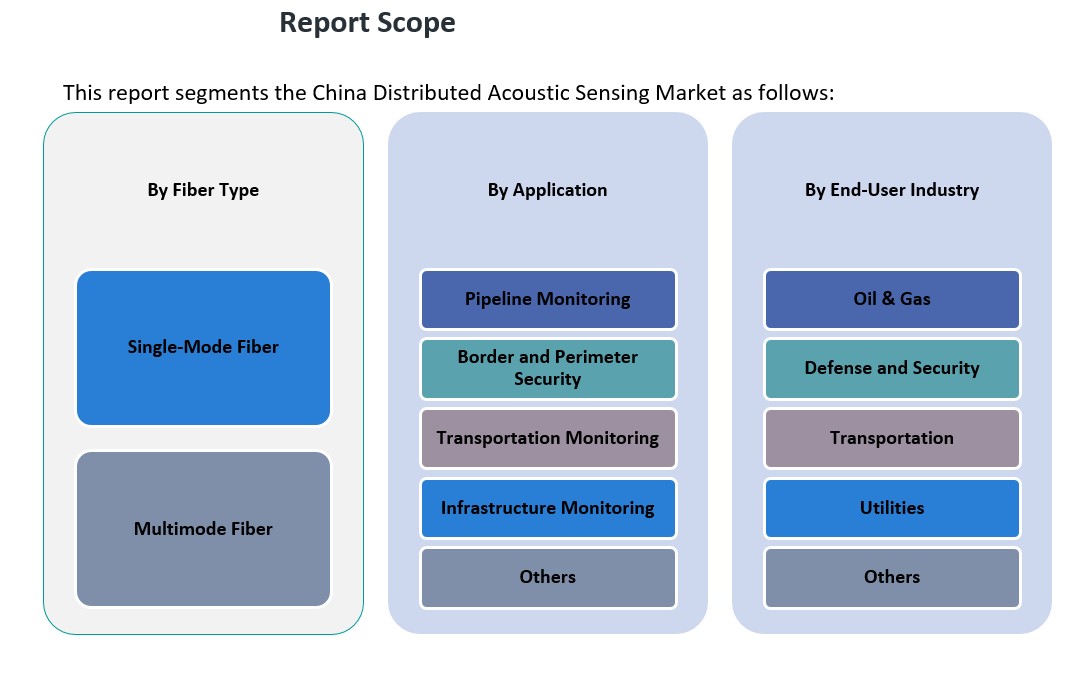

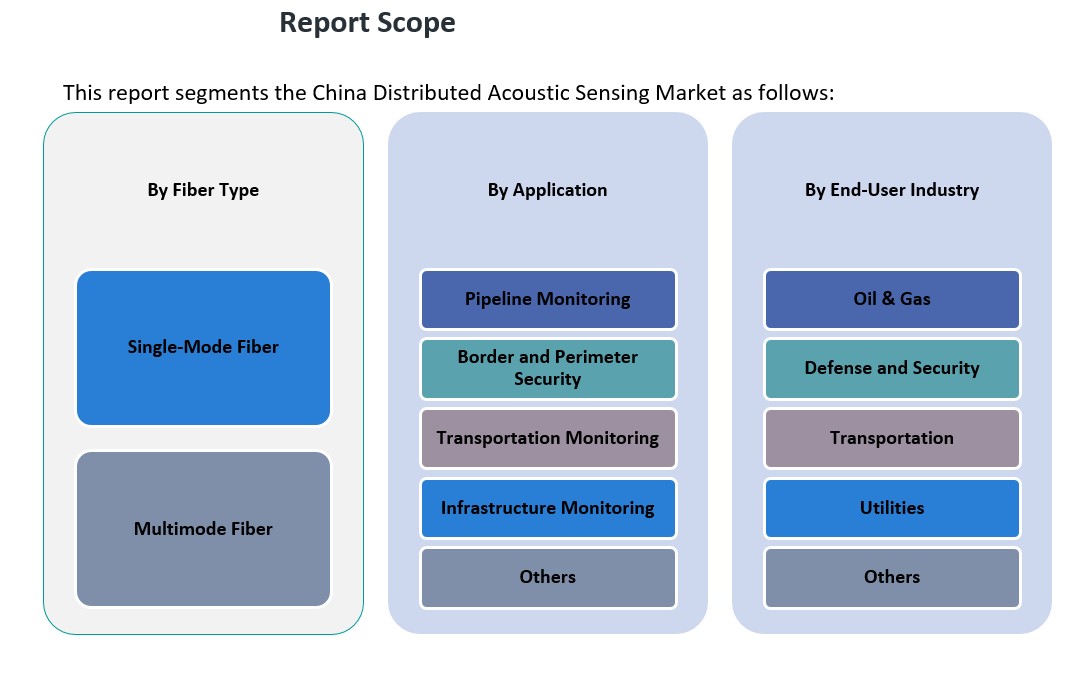

The China Distributed Acoustic Sensing (DAS) market is segmented by fiber type, application, and end-user industry, each offering distinct growth trajectories.

By fiber type, single-mode fiber dominates the market due to its capability to transmit data over long distances with minimal signal loss, making it ideal for pipeline and perimeter monitoring. However, multimode fiber is gradually gaining traction in urban and industrial settings, where its cost-effectiveness and suitability for short-range applications make it a preferred choice for facility and infrastructure monitoring.

By application, pipeline monitoring holds a substantial share, driven by China’s extensive oil and gas network and the critical need for real-time leak detection and security. Transportation monitoring is also a fast-growing segment, with DAS systems increasingly deployed to ensure the safety and integrity of railway lines, bridges, and tunnels. Border and perimeter security applications are expanding due to heightened government focus on surveillance and national security. Infrastructure monitoring, including buildings, dams, and tunnels, is witnessing steady adoption, while other niche applications in mining and environmental monitoring contribute to market diversification.

By end-user industry, the oil and gas sector remains the leading adopter of DAS solutions, given the need for continuous pipeline surveillance and operational efficiency. The defense and security sector is also a key contributor, integrating DAS for strategic monitoring of sensitive facilities. Transportation and utilities sectors are rapidly embracing DAS for infrastructure resilience and system reliability. Other industries, including manufacturing and smart cities, represent emerging areas of application, enhancing the market’s long-term potential.

Segmentation:

By Fiber Type:

- Single-Mode Fiber

- Multimode Fiber

By Application:

- Pipeline Monitoring

- Transportation Monitoring

- Border and Perimeter Security

- Infrastructure Monitoring

- Others

By End-User Industry:

- Oil & Gas

- Defense and Security

- Transportation

- Utilities

- Others

Regional Analysis:

China’s Distributed Acoustic Sensing (DAS) market exhibits strong regional variation, with adoption levels closely aligned with each region’s industrial focus, infrastructure development, and security priorities. The eastern coastal provinces, including Jiangsu, Zhejiang, and Guangdong, represent the most advanced and industrialized areas of the country. These regions collectively account for 40% of the national DAS market share. Their dominance stems from extensive applications in urban infrastructure monitoring, smart transportation systems, and large-scale smart city initiatives. The integration of DAS into fiber optic networks supports real-time structural health monitoring and enhances public safety in densely populated areas.

The central and western provinces, such as Sichuan, Xinjiang, and Inner Mongolia, contribute 35% to the national DAS market. These regions are home to significant oil and gas reserves and energy infrastructure, where DAS systems are extensively used for pipeline surveillance, leak detection, and perimeter monitoring. Given the remote and challenging environments in these areas, DAS offers a cost-effective and reliable solution for continuous monitoring of long-distance transmission assets.

Northern China, including Beijing, Tianjin, and surrounding areas, holds 15% of the market share. These locations have a strong focus on national defense and critical infrastructure protection. The deployment of DAS systems in this region is primarily driven by applications in border security, governmental facility surveillance, and protection of transport corridors. The rising emphasis on advanced security technologies supports the gradual increase in adoption in this part of the country.

Southern provinces such as Yunnan and Guangxi account for the remaining 10% of the DAS market. Although currently smaller in scale, these regions show strong potential due to ongoing investments in infrastructure development and environmental monitoring. DAS is being implemented for applications such as early detection of geohazards, landslides, and structural stress in bridges and tunnels. With the continued rollout of regional development projects and ecological conservation programs, DAS deployment in southern China is expected to expand steadily.

Key Player Analysis:

- AP Sensing GmbH

- Bandweaver Technologies

- Silixa Ltd.

- Omnisens SA

- Fotech Solutions Ltd.

- OptaSense (QinetiQ Group)

- Schlumberger Limited

- Baker Hughes Company

- OFS Fitel LLC

- Hifi Engineering Inc.

Competitive Analysis:

The China Distributed Acoustic Sensing (DAS) market is moderately competitive, with both international and domestic players actively expanding their presence. Key global companies such as Halliburton, Schlumberger, and Baker Hughes leverage their established technologies and global expertise to support large-scale energy and infrastructure projects across China. Domestic firms, including Wuhan Geolen and OptaSense China, focus on localized solutions and partnerships to address specific regulatory and technical requirements. Competition centers around technological innovation, sensor sensitivity, data analytics capabilities, and deployment scalability. Players increasingly invest in integrating artificial intelligence and machine learning to enhance DAS performance and differentiation. Additionally, strategic collaborations with government bodies and energy companies strengthen market positioning. As demand for real-time monitoring solutions rises across sectors such as oil and gas, transportation, and utilities, competitive dynamics are expected to intensify, driving further innovation, cost optimization, and service customization in the Chinese DAS landscape.

Recent Developments:

- In July 2024, VIAVI Solutions Inc.introduced the NITRO® Fiber Sensing solution, a cutting-edge real-time asset monitoring and analytics system designed for critical infrastructure. This innovative solution integrates Distributed Acoustic Sensing (DAS), Distributed Temperature Sensing (DTS), and Simultaneous Temperature and Strain Sensing (DTSS) technologies. It enables operators to monitor fiber optic cables for temperature, strain, and acoustic vibrations, providing precise alerts to detect and prevent external threats such as human interference or environmental hazards.

- In September 2023, researchers from the University of New Mexicoand Sandia National Laboratories developed a novel method to monitor local sea ice in Alaska using Distributed Acoustic Sensing (DAS) technology. By leveraging a telecommunications fiber optic cable combined with machine learning algorithms, the team analyzed ground vibrations caused by ocean waves to detect sea ice coverage and strength.

- In December 2023, Luna Innovations Inc. acquired Silixa Ltd., a UK-based leader in distributed fiber optic sensing solutions. This strategic acquisition enhanced Luna’s capabilities in distributed acoustic sensing (DAS), distributed temperature sensing (DTS), and distributed strain sensing (DSS), enabling improved performance for applications in energy, natural environments, mining, and defense.

Market Concentration & Characteristics:

The China Distributed Acoustic Sensing (DAS) market exhibits a moderately concentrated structure, characterized by the presence of both global industry leaders and specialized domestic firms. International companies such as Schlumberger, Halliburton, and Baker Hughes have established a significant footprint, particularly in large-scale energy and infrastructure projects. Concurrently, domestic enterprises like Wuhan Geolen and OptaSense China are gaining prominence by offering localized solutions tailored to the specific regulatory and operational requirements of the Chinese market. The market is defined by its emphasis on technological innovation, with a focus on enhancing sensor sensitivity, expanding detection ranges, and integrating advanced data analytics. The adoption of artificial intelligence and machine learning is becoming increasingly prevalent, enabling more accurate interpretation of acoustic data and facilitating predictive maintenance strategies. Furthermore, strategic collaborations between technology providers and end-user industries are fostering the development of customized DAS applications, particularly in sectors such as oil and gas, transportation, and utilities. The market’s evolution is also influenced by China’s commitment to infrastructure modernization and smart city initiatives, which are driving the demand for real-time monitoring solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Fiber Type, Application and End-User Industry. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Increasing infrastructure investments will drive wider adoption of DAS across transportation and construction sectors.

- Expansion of oil and gas exploration activities in remote regions will boost demand for long-range fiber optic monitoring.

- Advancements in AI and machine learning will enhance signal interpretation and system responsiveness.

- Government initiatives supporting smart city development will create new opportunities for real-time infrastructure monitoring.

- Rising focus on national security will encourage the deployment of DAS for perimeter and border surveillance.

- Integration with 5G and edge computing will improve data transmission efficiency and processing speeds.

- Growing awareness of predictive maintenance benefits will accelerate DAS implementation in utilities and industrial assets.

- Technological collaborations between domestic and global firms will stimulate product innovation and market competitiveness.

- Standardization efforts and regulatory clarity will promote uniform deployment practices across industries.

- Expanding environmental monitoring applications will open new market segments in disaster-prone and ecologically sensitive areas.