| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| China Water Pump Market Size 2023 |

USD 6,735.39 Million |

| China Water Pump Market, CAGR |

6.12% |

| China Water Pump Market Size 2032 |

USD 11,508.85 Million |

Market Overview:

China Water Pump Market size was valued at USD 6,735.39 million in 2023 and is anticipated to reach USD 11,508.85 million by 2032, at a CAGR of 6.12% during the forecast period (2023-2032).

Several factors are propelling the growth of China’s water pump market. The nation’s rapid urbanization necessitates the expansion and modernization of municipal water supply and wastewater treatment facilities. Industrial growth, particularly in sectors like manufacturing, chemicals, and power generation, demands efficient water management systems, thereby increasing the need for advanced pumps. Additionally, the Chinese government’s emphasis on sustainable practices has led to increased investments in energy-efficient and smart pump technologies, aligning with global trends towards environmental conservation. Rising demand for renewable energy solutions and stricter environmental regulations have further pushed manufacturers to innovate and improve pump efficiency. Moreover, the increasing adoption of automation and digital monitoring in industrial processes continues to boost the demand for technologically integrated water pumps.

Within the Asia-Pacific region, China holds a significant share of the water pump market, accounting for approximately 57.5% in 2024. The country’s extensive industrial base and ongoing infrastructure projects, including water conservation and hydropower initiatives, contribute to this dominance. Furthermore, China’s focus on improving water management systems and reducing water wastage supports the demand for high-performance water pumps. The integration of advanced technologies, such as IoT-enabled pumps, enhances operational efficiency and aligns with China’s goals for sustainable development. Eastern China, being a hub for industrial and urban activity, leads in water pump deployment, while western regions are witnessing increased investment due to developmental policies. Additionally, provincial initiatives and localized government subsidies have accelerated the installation of modern water pumping systems across both urban and rural regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- China Water Pump Market size was valued at USD 6,735.39 million in 2023 and is anticipated to reach USD 11,508.85 million by 2032, at a CAGR of 6.12% during the forecast period (2023-2032).

- The global water pump market was valued at USD 55,454.00 million in 2023 and is projected to reach USD 80,304.96 million by 2032, growing at a CAGR of 4.2% during the forecast period.

- Rapid urbanization and government-backed infrastructure development, particularly under the 14th Five-Year Plan, are significantly boosting demand for water pumps.

- Industrial sectors such as chemicals, power generation, and advanced manufacturing are driving continuous adoption of high-performance and energy-efficient pumps.

- Regulatory initiatives supporting China’s “dual carbon” goals are accelerating the shift toward low-emission, smart pumping systems.

- Technological innovation, including the integration of IoT and AI for predictive maintenance, is transforming product offerings and end-user expectations.

- High upfront costs and maintenance expenses, along with technical limitations in older infrastructure, pose notable market restraints.

- Eastern China leads the market with the highest deployment, while western regions are experiencing increased investments due to targeted development policies and subsidies.

Market Drivers:

Urbanization and Infrastructure Development

Rapid urbanization remains a central driver of the China water pump market. As urban populations continue to expand, the demand for improved water supply systems and efficient wastewater management has intensified. Local governments are investing heavily in modernizing water infrastructure to support growing urban centers, which directly boosts the demand for water pumps. For instance, smart city projects and urban sewage upgrades require advanced pumping systems like centrifugal and submersible pumps. Projects related to smart cities, urban sewage upgrades, and regional water supply enhancements require a broad range of pumping systems, from centrifugal to submersible and pressure booster pumps. The Chinese government’s ongoing commitment to infrastructure development under initiatives such as the 14th Five-Year Plan further accelerates market growth. Investment in water pipelines, treatment plants, and urban drainage networks not only strengthens water resource management but also stimulates the adoption of advanced pump technologies. This trend is particularly evident in second- and third-tier cities, where infrastructure modernization is catching up with the pace of urban expansion.

Industrial Expansion and Water-Intensive Processes

China’s strong industrial base continues to be a major contributor to water pump demand, particularly across sectors such as chemicals, power generation, metallurgy, and manufacturing. These industries rely on water-intensive processes that necessitate continuous and efficient water circulation, cooling, and waste discharge. As industrial output grows, companies increasingly require durable and energy efficient pumping solutions that can support high-capacity operations. For example, the mining sector requires robust dewatering pumps to handle groundwater challenges in coal mines. Furthermore, China’s strategic focus on transitioning to advanced manufacturing and clean energy production creates fresh demand for precision-engineered pumping systems. In sectors such as solar PV, wind, and hydropower, water pumps are critical components for cooling systems, slurry handling, and process optimization. Industrial compliance with environmental standards also encourages the use of upgraded pump systems that offer reduced energy consumption and operational flexibility.

Government Regulations and Sustainability Goals

The push toward environmental sustainability has significantly influenced the water pump market in China. Regulatory bodies have implemented stricter guidelines on water conservation, emissions control, and industrial discharge. In response, industries and municipalities are upgrading to energy-efficient pumps that comply with national environmental standards and international efficiency ratings. These shifts have encouraged widespread adoption of variable speed drive pumps and smart water systems that offer real-time monitoring and control. In line with China’s “dual carbon” goals to peak carbon emissions by 2030 and achieve carbon neutrality by 2060 energy efficient water management solutions have become a national priority. As part of this initiative, subsidies and tax incentives are provided to promote the adoption of green technologies, including low-emission and low-noise pumps. The integration of digital tools such as AI and IoT into pumping systems further supports energy optimization and sustainability compliance.

Technological Advancements and Digital Integration

Technological innovation plays a crucial role in transforming the China water pump market. Manufacturers are increasingly incorporating smart features, including sensors, remote monitoring capabilities, and automation technologies, into pump systems. These advancements enable predictive maintenance, minimize downtime, and extend equipment life, delivering cost and efficiency benefits to end-users. The rise of Industry 4.0 across China’s manufacturing sector has driven greater integration of digital technologies with industrial equipment, including water pumps. Smart factories and connected infrastructure projects demand intelligent pump systems that can communicate seamlessly with centralized control units. As a result, demand is shifting toward digitally integrated solutions that offer not only mechanical reliability but also analytical insights and operational transparency.

Market Trends:

Rising Demand for Smart Water Management Solutions

A prominent trend in the China water pump market is the rising adoption of smart water management systems. With increasing stress on water resources, both public and private sectors are shifting towards integrated systems that optimize water usage and reduce wastage. Smart water pumps, equipped with digital monitoring tools and real-time data analytics, are gaining momentum across municipal and industrial applications. These systems enable users to track performance metrics, automate operations, and detect anomalies early, enhancing system reliability and efficiency. The push for smart infrastructure aligns with China’s broader digital transformation goals and is becoming a standard feature in new water management projects.

Growth in Agricultural Irrigation Applications

Agricultural development continues to be a key focus in China, especially in the context of national food security goals. The government has been actively promoting modern irrigation techniques to increase farming efficiency and yield. As a result, there is a growing trend toward the use of energy-efficient and solar-powered water pumps in rural areas. For instance, the Shule River irrigation area in Gansu province uses digital twin technology combined with drip irrigation and precision fertilization to optimize water use and labor efficiency. This approach has made the region a leading example of water-saving agriculture. These pumps support sustainable irrigation practices by reducing dependence on grid electricity and minimizing operational costs for farmers. According to industry estimates, the adoption of solar water pumps in Chinese agriculture is growing significantly reflecting a long-term commitment to rural modernization and renewable energy utilization.

Shift Toward Customization and Application-Specific Pumps

Manufacturers in the Chinese water pump market are increasingly offering customized and application-specific solutions to cater to diverse industry needs. The demand for specialized pumps such as those designed for corrosive fluids, high-pressure operations, or compact installations has grown significantly. For example, sectors like pharmaceuticals and food processing demand pumps with precise material specifications and operating parameters. This shift reflects the maturation of the market, where end-users seek not only performance and durability but also operational compatibility and lifecycle efficiency. Local manufacturers are also investing in R&D to create differentiated products that meet the evolving technical demands of niche applications.

Expansion of Export-Oriented Production

China has emerged as a key exporter of water pumps, particularly to markets in Southeast Asia, Africa, and Latin America. Competitive pricing, improved product quality, and expanding manufacturing capabilities have strengthened China’s position in the global supply chain. In recent years, Chinese firms have increased their focus on complying with international quality certifications such as ISO and CE, enhancing their global competitiveness. Moreover, the easing of cross-border trade restrictions and the growth of e-commerce platforms have further facilitated the export of Chinese pump technologies. This trend has also encouraged domestic manufacturers to standardize production processes and innovate more aggressively to maintain their global presence.

Market Challenges Analysis:

High Initial Investment and Maintenance Costs

One of the primary restraints in the China water pump market is the high initial investment required for advanced and energy-efficient pump systems. Although modern pumps offer long-term operational benefits, the upfront costs of acquisition, installation, and system integration can deter small-scale users and budget-constrained municipalities. Moreover, the cost of maintenance, particularly for high-capacity or technologically integrated pumps, adds to the financial burden. This concern is more pronounced in rural areas, where access to technical support and replacement parts remains limited.

Technical Limitations and Compatibility Issues

As the market shifts toward smart and digitally integrated water pumps, compatibility with existing legacy systems poses a significant challenge. Many older infrastructure setups are not designed to support IoT-enabled or sensor-based pump technologies, requiring substantial modifications or complete system overhauls. This limits the scalability of modern pump adoption in certain regions and industries. Additionally, a shortage of skilled labor familiar with advanced pump technologies hinders the effective deployment and operation of these systems, especially in remote and underdeveloped areas.

Fluctuations in Raw Material Prices

Volatility in the prices of raw materials, such as stainless steel, cast iron, and aluminum, used in pump manufacturing significantly affects production costs and profit margins. Chinese manufacturers are especially vulnerable to global commodity price shifts, trade tensions, and supply chain disruptions. For example, disruptions in global steel supply chains due to geopolitical events have led to price spikes, forcing manufacturers to either absorb losses or increase pump prices. These fluctuations not only impact pricing strategies but also pose challenges in inventory planning and long-term contract management.

Environmental and Regulatory Compliance Pressure

While environmental regulations promote sustainable growth, they also introduce compliance challenges for manufacturers. Meeting increasingly stringent energy efficiency and emission standards requires continuous investment in R&D and process upgrades. Smaller manufacturers may struggle to keep pace with regulatory changes, leading to reduced market competitiveness and potential operational disruptions.

Market Opportunities:

The China water pump market presents substantial growth opportunities, primarily driven by the country’s ongoing urban and rural development initiatives. As China continues to modernize its water infrastructure, the demand for efficient and technologically advanced pumping systems is expected to rise. Government-backed projects focusing on urban water supply expansion, rural water access, and smart city developments create a favorable environment for pump manufacturers to introduce innovative solutions. Additionally, the rising emphasis on environmental protection and the need for wastewater treatment in both urban and industrial settings offer significant opportunities for the deployment of high-efficiency and low-emission pump technologies. These trends align with China’s long-term sustainability goals and open avenues for local and international players to tap into public infrastructure contracts and long-term supply agreements.

Moreover, the rapid digitalization of the industrial sector and the increasing penetration of Industry 4.0 in China present a strong opportunity for smart pump solutions. The integration of automation, real-time data monitoring, and IoT capabilities into pump systems is gaining traction, particularly in manufacturing, power generation, and chemical processing industries. This creates room for growth in the high-value segment of intelligent and predictive maintenance-enabled pumps. Additionally, the surge in agricultural modernization supported by government incentives is fostering demand for solar-powered and energy-efficient pumps in rural areas. These evolving dynamics underscore a market ripe for innovation, customization, and export potential, allowing manufacturers to differentiate themselves through performance, adaptability, and sustainability.

Market Segmentation Analysis:

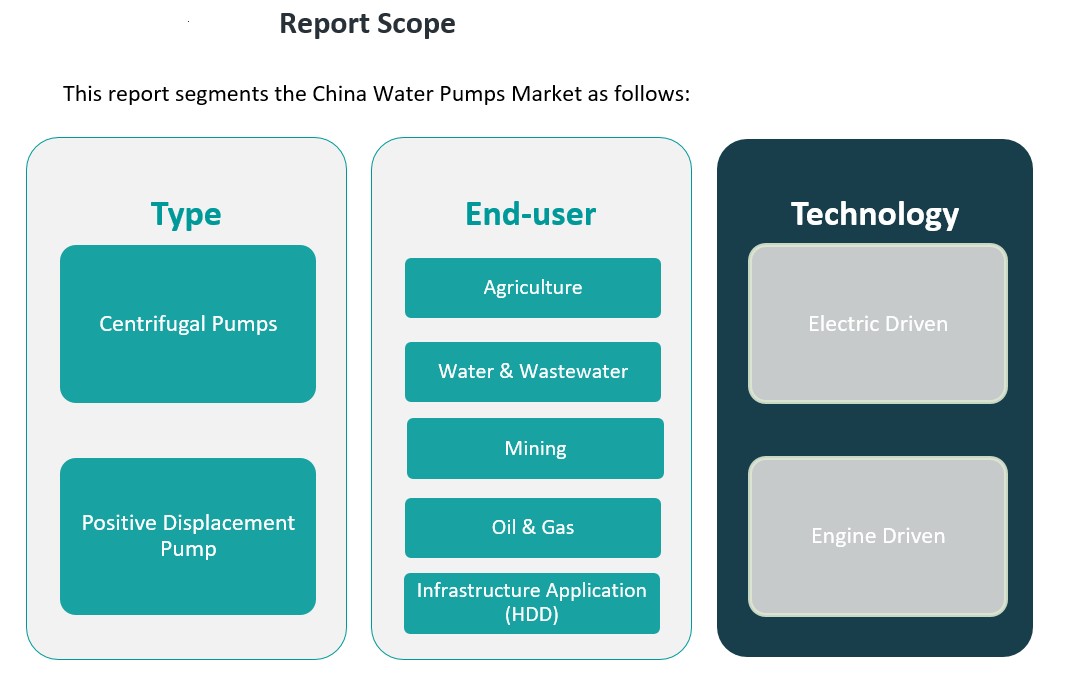

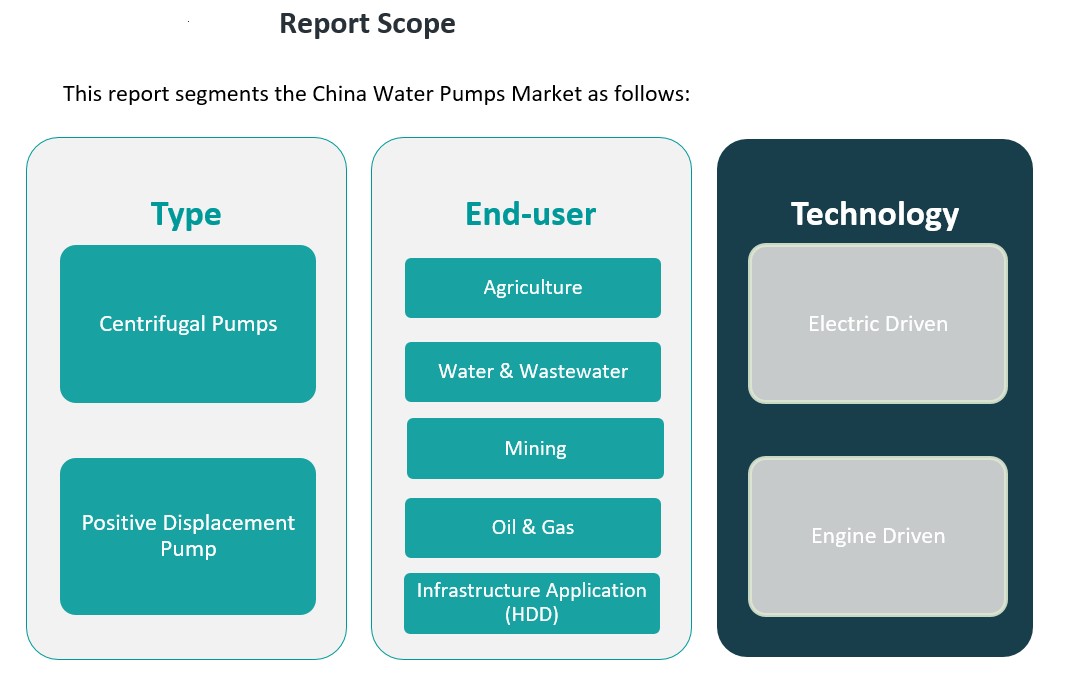

The China water pump market is segmented by type, end-user, and technology, each reflecting distinct demand patterns driven by specific industrial and infrastructural needs.

By type, centrifugal pumps dominate the market due to their broad application across water supply, industrial processes, and municipal wastewater treatment. Their relatively low cost, ease of maintenance, and suitability for continuous operations make them the preferred choice in both urban and rural settings. Positive displacement pumps, while accounting for a smaller share, are gaining traction in applications requiring precise flow control, especially in the chemical, oil & gas, and food processing industries.

In terms of end-user segments, the water and wastewater sector holds a significant share, supported by China’s ongoing efforts to upgrade its water infrastructure and expand access to safe water. The agriculture segment follows closely, with the adoption of modern irrigation techniques and solar-powered pumps in rural regions. The oil & gas and mining sectors also contribute steadily, driven by the need for rugged, high-capacity pump systems. Infrastructure applications, particularly horizontal directional drilling (HDD), are witnessing rising adoption of specialized pumping solutions as urban construction activities expand.

By technology, electric-driven pumps lead the market, favored for their energy efficiency, compatibility with automation, and suitability in urban settings. Engine-driven pumps serve as an important alternative in off-grid and emergency applications, especially in agriculture and mining. The increasing integration of smart controls and IoT capabilities within electric pump systems is further reinforcing their dominance in modern industrial and municipal environments.

Segmentation:

By Type Segment:

- Centrifugal Pumps

- Positive Displacement Pumps

By End-User Segment:

- Agriculture

- Water & Wastewater

- Mining

- Oil & Gas

- Infrastructure Application (HDD)

By Technology Segment:

- Electric Driven

- Engine Driven

Regional Analysis:

The China water pump market exhibits significant regional variations, influenced by factors such as industrialization levels, urbanization rates, and infrastructure development. Eastern China, encompassing provinces like Jiangsu, Zhejiang, and Shandong, leads the market with approximately 40% share. This dominance is attributed to the region’s dense industrial base, advanced manufacturing sectors, and extensive urban infrastructure projects. The concentration of chemical, petrochemical, and power generation industries in these provinces drives the demand for high-capacity and specialized water pumps.

Central China, including provinces such as Henan, Hubei, and Hunan, accounts for around 25% of the market share. The region’s growing urban centers and expanding agricultural activities necessitate efficient water management systems, thereby increasing the demand for water pumps. Government initiatives aimed at improving rural water supply and irrigation infrastructure further bolster market growth in this area.

Western China, comprising provinces like Sichuan, Yunnan, and Shaanxi, holds approximately 20% of the market. Despite being less industrialized, the region is witnessing increased investment in infrastructure and water conservation projects. The development of hydropower stations and efforts to enhance water accessibility in remote areas contribute to the rising demand for water pumps.

Northeastern China, including Liaoning, Jilin, and Heilongjiang provinces, represents about 10% of the market share. The region’s focus on revitalizing its industrial base and upgrading municipal water systems drives the need for modern pumping solutions. Additionally, the cold climate necessitates specialized pumps capable of operating efficiently in low-temperature conditions.

Lastly, the remaining 5% of the market is distributed among other regions, including autonomous areas and municipalities. These areas, though smaller in market size, present niche opportunities for water pump manufacturers, particularly in addressing unique geographical and climatic challenges. Overall, the diverse regional demands within China offer a broad spectrum of opportunities for tailored water pump solutions.

Key Player Analysis:

- SLB

- Ingersoll Rand

- The Weir Group PLC

- Vaughan Company

- KSB SE & Co. KGaA

- Pentair

- Grundfos Holding A/S

- Xylem

- Flowserve Corporation

- ITT Inc.

- Ebara Corporation

- Kaiquan

- Modo

Competitive Analysis:

The China water pump market features a competitive landscape marked by the presence of both domestic manufacturers and international players. Leading Chinese companies such as Grundfos China, Wilo China, Ebara Great Pumps, and Shanghai Kaiquan dominate through extensive product portfolios and strong distribution networks. These firms leverage local manufacturing capabilities and technical expertise to offer cost-effective and application-specific solutions. International brands like Xylem Inc., Sulzer Ltd., and KSB SE maintain a competitive edge by introducing advanced technologies, particularly in energy-efficient and smart pumping systems. Competition is further intensified by increasing investment in R&D, product innovation, and aftermarket services. Strategic collaborations with government and industrial clients enhance brand positioning and long-term contract acquisition. The market also witnesses the emergence of niche players focusing on specialized segments such as solar-powered and IoT-enabled pumps. Overall, sustained innovation and service differentiation remain key factors driving competitiveness in this evolving market.

Recent Developments:

- Servotech Power Systems Ltd.launched solar pump controllers on October 28, 2024, designed for 2HP to 10HP water pumps. This aligns with initiatives like PM-KUSUM to promote sustainable farming practices through water-efficient solutions.

- Roto Pumps Ltd.announced the launch of its subsidiary, Roto Energy Systems Ltd., in Feb 2024. This new division focuses on solar-powered water pumping solutions, including submersible and surface pumps, catering to eco-friendly water management needs.

- Grundfos’ commitment to the Water Resilience Coalition in March 2025 aligns with the water pump market’s focus on sustainability and efficient water management. The coalition’s goals include measurable improvements in global water sustainability by 2030.

- On February 28, 2025, KSB launched the MultiTec Plus pump series, specifically optimized for drinking water transport. This product integrates energy-saving technologies and real-time monitoring capabilities, emphasizing advancements in smart and sustainable water pumping solutions.

Market Concentration & Characteristics:

The China water pump market is moderately fragmented, characterized by a blend of domestic manufacturers and international players. Leading companies such as Grundfos, Wilo, Ebara, and Shanghai Kaiquan dominate through extensive product portfolios and strong distribution networks. These firms leverage local manufacturing capabilities and technical expertise to offer cost-effective and application-specific solutions. International brands like Xylem Inc., Sulzer Ltd., and KSB SE maintain a competitive edge by introducing advanced technologies, particularly in energy-efficient and smart pumping systems. Competition is further intensified by increasing investment in R&D, product innovation, and aftermarket services. Strategic collaborations with government and industrial clients enhance brand positioning and long-term contract acquisition. The market also witnesses the emergence of niche players focusing on specialized segments such as solar-powered and IoT-enabled pumps. Overall, sustained innovation and service differentiation remain key factors driving competitiveness in this evolving market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Type Segment, End-User Segment and Technology Segment. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Continued urbanization will drive demand for advanced municipal water and wastewater pump systems.

- Expansion of industrial zones will increase the need for high-capacity and energy-efficient pumps.

- Integration of IoT and smart control features will shape product development and adoption.

- Rising investments in renewable energy projects will boost demand for solar-powered water pumps.

- Agricultural modernization will support growth in rural irrigation pump installations.

- Government regulations on energy efficiency will accelerate the shift to low-emission pump technologies.

- Growth in export opportunities will position China as a global manufacturing hub for water pumps.

- Adoption of predictive maintenance tools will enhance operational efficiency and lifecycle management.

- Demand for customized and application-specific pumps will increase across specialized industries.

- Strategic partnerships between local and international players will strengthen technological innovation and market reach.