Key Growth Drivers

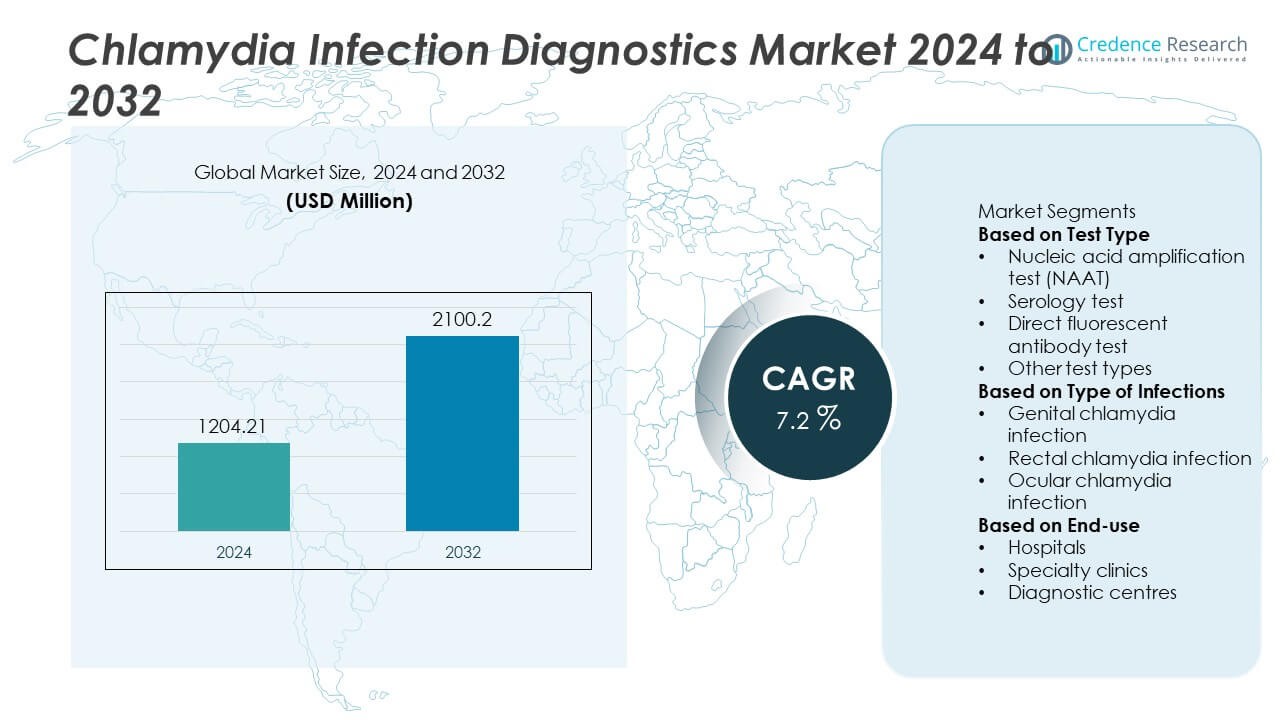

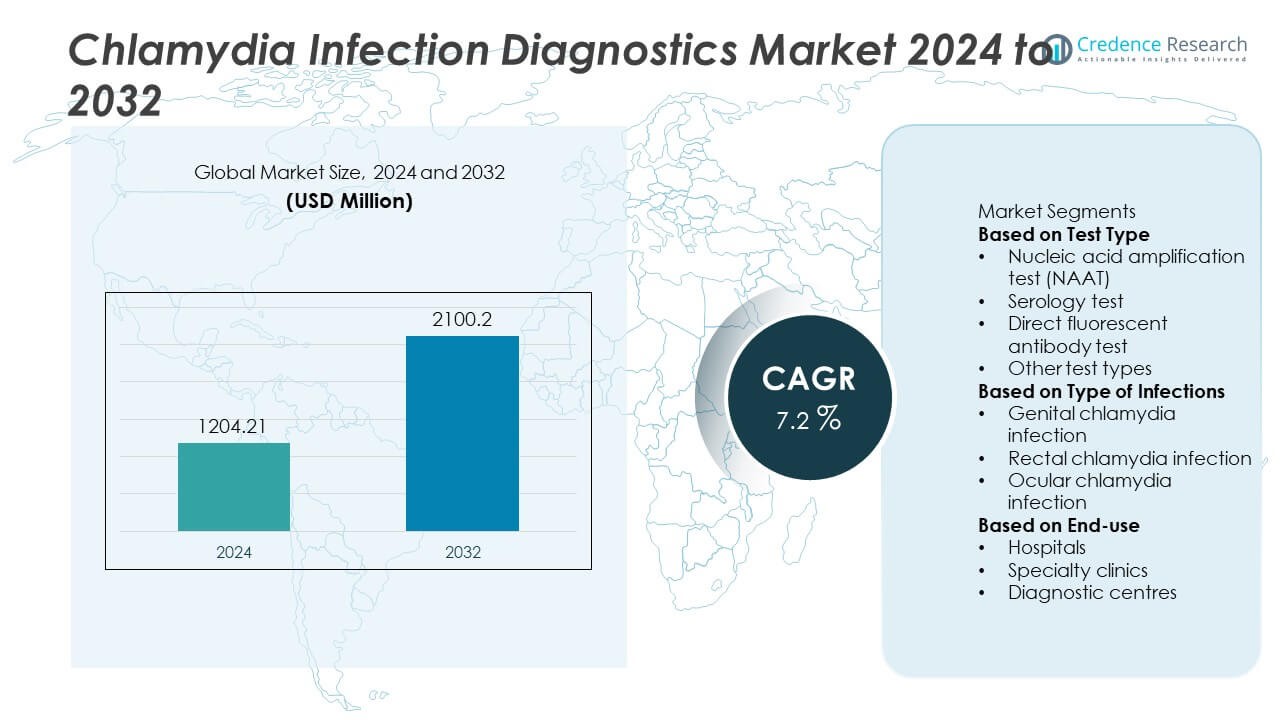

The Chlamydia Infection Diagnostics Market was valued at USD 1,204.21 million in 2024 and is projected to reach USD 2,100.2 million by 2032, growing at a CAGR of 7.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Chlamydia Infection Diagnostics Market Size 2024 |

USD 1,204.21 Million |

| Chlamydia Infection Diagnostics Market, CAGR |

7.2% |

| Chlamydia Infection Diagnostics Market Size 2032 |

USD 2,100.2 Million |

The chlamydia infection diagnostics market is driven by key players such as Hologic, Inc., Thermo Fisher Scientific Inc., BD, Trinity Biotech Plc., Abbott, Siemens Healthineers, QuidelOrtho Corporation, Bio-Rad Laboratories, Inc., DiaSorin S.p.A., and F. Hoffmann-La Roche Ltd. These companies focus on developing innovative molecular assays, rapid tests, and point-of-care diagnostic solutions to improve detection accuracy and accessibility. North America leads the global market with a 39.2% share in 2024, supported by strong healthcare infrastructure and government screening programs. Europe follows with a 28.5% share, driven by high awareness and advanced diagnostic capabilities, while Asia-Pacific, holding 23.7% share, is emerging as a key growth region due to expanding healthcare access and increasing STI prevalence.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The chlamydia infection diagnostics market was valued at USD 1,204.21 million in 2024 and is projected to reach USD 2,100.2 million by 2032, registering a CAGR of 7.2% during the forecast period.

- Rising prevalence of sexually transmitted infections and increasing government screening programs are driving market growth. The nucleic acid amplification test (NAAT) segment leads with a 62.8% share due to its high sensitivity and accuracy.

- Technological advancements such as AI integration, point-of-care testing, and multiplex diagnostic platforms are shaping market trends and improving early disease detection.

- Major players including Hologic, Inc., Thermo Fisher Scientific, Abbott, and Siemens Healthineers focus on product innovation, automation, and strategic partnerships to strengthen their global presence.

- North America dominates with a 39.2% share, followed by Europe at 28.5% and Asia-Pacific with 23.7%, driven by growing awareness, healthcare access, and adoption of advanced diagnostic technologies.

Market Segmentation Analysis:

By Test Type

The nucleic acid amplification test (NAAT) segment dominates the chlamydia infection diagnostics market, accounting for 62.8% share in 2024. Its leadership is attributed to its superior sensitivity, specificity, and rapid detection capabilities compared to traditional testing methods. NAAT is widely adopted for detecting Chlamydia trachomatis DNA in urine and swab samples, improving diagnostic accuracy in both symptomatic and asymptomatic cases. Continuous technological advancements, automation, and integration with multiplex testing platforms further enhance its clinical efficiency. Serology and direct fluorescent antibody tests maintain niche applications but are gradually being replaced by NAAT due to better reliability and reduced turnaround time.

- For instance, Hologic, Inc.’s Aptima Chlamydia trachomatis Assay demonstrated a sensitivity of 96.7% (87/90) and specificity of 99.2% (1,545/1,557) in clinical studies of clinician-collected endocervical plus urine specimens.

By Type of Infections

The genital chlamydia infection segment leads the market with 69.4% share in 2024, driven by its high global prevalence among sexually active individuals. Increasing awareness of reproductive health and the expansion of routine STI screening programs have strengthened testing rates. The rising number of reported cases in women, particularly due to untreated infections leading to pelvic inflammatory disease, drives continuous demand for early detection. Rectal and ocular infections are less common but are gaining diagnostic importance due to higher recognition of extra-genital chlamydia transmission, especially among high-risk populations.

- For instance, the BD MAX™ CT/GC/TV assay has demonstrated high clinical sensitivity and specificity (typically exceeding 90% for sensitivity and 98% for specificity depending on the specimen type) in detecting Chlamydia trachomatis across multiple infection sites including female urine and vaginal swabs, supporting high-sensitivity screening.

By End-use

Hospitals dominate the chlamydia infection diagnostics market with a 46.1% share in 2024, owing to advanced laboratory infrastructure and the availability of comprehensive diagnostic services. Hospitals are preferred for accurate confirmatory testing and management of complex cases. Diagnostic centres follow closely, supported by their growing presence in urban areas and focus on affordable, rapid testing solutions. Specialty clinics are expanding adoption through targeted sexual health screening and preventive care programs. The increasing integration of digital health tools and electronic reporting systems across healthcare facilities further enhances diagnostic efficiency and patient management.

Market Overview

Rising Prevalence of Sexually Transmitted Infections (STIs)

The increasing global prevalence of sexually transmitted infections, particularly Chlamydia trachomatis, is a major driver for the chlamydia infection diagnostics market. Growing awareness of reproductive health and government-led screening initiatives have increased the demand for early detection. According to WHO, chlamydia remains one of the most frequently reported bacterial STIs worldwide. Expanding testing coverage and the inclusion of chlamydia screening in national public health programs continue to strengthen market growth, particularly across high-risk and young adult populations.

- For instance, BD’s women’s health initiative supported over 10 million chlamydia and gonorrhea screening tests in collaboration with U.S. CDC programs, leveraging BD MAX™ molecular systems deployed in more than 3,500 laboratories to improve national STI surveillance accuracy.

Advancements in Diagnostic Technologies

Technological innovations such as nucleic acid amplification tests (NAATs), point-of-care (POC) devices, and automated molecular platforms are transforming chlamydia diagnosis. These advancements have improved sensitivity, reduced turnaround time, and enhanced detection accuracy, even in asymptomatic patients. The increasing use of multiplex testing systems that detect multiple STIs simultaneously is also boosting adoption rates. Continuous investment in diagnostic R&D and the expansion of laboratory automation are further driving market penetration globally.

- For instance, Abbott’s Alinity m STI assay can process up to 324 samples in under eight hours, detecting Chlamydia trachomatis, Neisseria gonorrhoeae, Trichomonas vaginalis, and Mycoplasma genitalium in a single run with a limit of detection as low as 0.6 IFU/mL, significantly improving clinical lab throughput and diagnostic reliability.

Growing Awareness and Screening Programs

Rising public health campaigns and awareness programs promoting STI testing have significantly accelerated chlamydia diagnosis. Governments and NGOs are conducting regular screening drives and offering subsidized testing in both developed and developing regions. Educational initiatives targeting sexual health and preventive care are improving patient compliance. The inclusion of chlamydia screening in prenatal and reproductive health checkups further supports early diagnosis and reduces the risk of complications, fueling market growth.

Key Trends & Opportunities

Key Trends & Opportunities

Shift Toward Point-of-Care and At-Home Testing

The growing preference for point-of-care and home-based chlamydia testing is creating new opportunities for manufacturers. These solutions offer convenience, privacy, and faster results, encouraging more individuals to undergo screening. Companies are developing portable and user-friendly diagnostic kits that utilize molecular and lateral flow technologies. This trend aligns with the rise of telemedicine and digital health, enabling remote consultation and result sharing. The increasing availability of FDA-approved and CE-marked at-home kits further enhances market accessibility.

- For instance, QuidelOrtho Corporation’s Sofia 2 Fluorescent Immunoassay Analyzer is used in many point-of-care locations worldwide and delivers Influenza A+B, RSV, Strep A, or COVID-19 results in as few as 3-15 minutes using fluorescent lateral flow technology, supporting rapid point-of-care diagnostic workflows.

Integration of Artificial Intelligence in Diagnostics

Artificial intelligence and machine learning are being increasingly integrated into STI diagnostic workflows to improve accuracy and efficiency. AI-driven image analysis and data interpretation tools are enhancing test result precision and enabling faster clinical decisions. Digital platforms also assist in tracking infection patterns, predicting outbreaks, and optimizing laboratory resource management. This technological evolution supports data-driven public health strategies and offers diagnostic companies opportunities to develop smart, connected testing systems.

- For instance, F. Hoffmann-La Roche Ltd has incorporated advanced automation and software-controlled systems in its cobas® 5800, 6800, and 8800 molecular systems to ensure high quality and reduce manual errors.

Key Challenges

Limited Awareness in Developing Regions

Despite growing diagnostic advancements, limited awareness and stigma surrounding STIs hinder market expansion in low-income regions. Many individuals avoid testing due to social barriers or lack of education about sexual health. Inadequate screening infrastructure and limited access to modern laboratories further restrict diagnostic reach. Expanding awareness campaigns and improving accessibility to affordable testing services are essential to address this challenge and ensure early detection in underserved populations.

High Cost of Advanced Diagnostic Tests

The high cost of molecular diagnostic tests, such as NAATs, remains a significant barrier, particularly in resource-constrained settings. Many healthcare facilities in developing regions rely on outdated or low-sensitivity methods due to budget limitations. Limited reimbursement policies for STI diagnostics also affect adoption. Manufacturers face the challenge of balancing technological innovation with cost-effectiveness to promote wider accessibility. Efforts to develop low-cost, high-performance POC tests are critical to overcoming this restraint and ensuring equitable diagnostic availability.

Regional Analysis

North America

North America dominates the chlamydia infection diagnostics market with a 39.2% share in 2024, driven by high awareness of sexually transmitted infections and strong healthcare infrastructure. The United States leads the region, supported by government-funded screening programs and advanced diagnostic technologies such as NAAT and POC testing. The Centers for Disease Control and Prevention (CDC) actively promotes early detection among high-risk groups, boosting testing volumes. Increasing adoption of at-home test kits and digital health services enhances accessibility, while Canada contributes steadily through improved laboratory networks and public health initiatives focusing on preventive sexual healthcare.

Europe

Europe holds a 28.5% share in 2024, supported by widespread implementation of national screening programs and increasing awareness of reproductive health. The United Kingdom, Germany, and France are key contributors due to strong diagnostic infrastructure and high testing rates. Public health agencies in the region emphasize early detection through routine STI screening among adolescents and women. Expanding access to molecular testing technologies and government-backed educational initiatives drive consistent market growth. Furthermore, growing collaborations between diagnostic companies and healthcare organizations enhance innovation and the availability of cost-effective chlamydia testing solutions.

Asia-Pacific

Asia-Pacific accounts for a 23.7% share in 2024, fueled by rising STI incidence, urbanization, and expanding healthcare access. Countries such as China, Japan, India, and South Korea are investing in improving diagnostic capabilities and public awareness programs. Increasing government attention toward reproductive health and the adoption of advanced diagnostic technologies are strengthening regional growth. The presence of cost-effective manufacturers and growing availability of POC tests further support demand. Expanding sexual health education and rising female healthcare participation continue to improve early diagnosis rates, positioning Asia-Pacific as a rapidly growing regional market.

Latin America

Latin America holds a 5.4% share in 2024, with Brazil and Mexico leading due to growing healthcare investments and expanding laboratory infrastructure. Rising awareness of sexually transmitted infections and the availability of affordable diagnostic kits are improving early detection. Government-supported sexual health campaigns and the inclusion of chlamydia screening in public health programs drive adoption. Despite progress, limited access in rural areas and social stigma around STI testing remain challenges. However, ongoing partnerships with global diagnostic firms are expected to improve affordability and accessibility, supporting steady market growth across the region.

Middle East & Africa

The Middle East & Africa region represents a 3.2% share in 2024, driven by increasing healthcare modernization and gradual improvement in diagnostic capabilities. Countries such as Saudi Arabia, South Africa, and the United Arab Emirates are witnessing higher investment in STI awareness and laboratory infrastructure. However, cultural taboos and limited screening facilities continue to restrict widespread testing. International health organizations and NGOs are working to expand education and access to affordable diagnostic technologies. Growing collaborations with global healthcare providers are expected to enhance regional market presence and strengthen early chlamydia detection efforts.

Market Segmentations:

By Test Type

- Nucleic acid amplification test (NAAT)

- Serology test

- Direct fluorescent antibody test

- Other test types

By Type of Infections

- Genital chlamydia infection

- Rectal chlamydia infection

- Ocular chlamydia infection

By End-use

- Hospitals

- Specialty clinics

- Diagnostic centres

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape analysis of the chlamydia infection diagnostics market highlights the presence of major players such as Hologic, Inc., Thermo Fisher Scientific Inc., BD, Trinity Biotech Plc., Abbott, Siemens Healthineers, QuidelOrtho Corporation, Bio-Rad Laboratories, Inc., DiaSorin S.p.A., and F. Hoffmann-La Roche Ltd. These companies are focusing on developing advanced molecular and point-of-care diagnostic platforms to enhance accuracy and speed in chlamydia detection. The market is moderately consolidated, with global players investing in automation, multiplex testing, and AI-based data analysis. Strategic collaborations, regulatory approvals, and expansion into emerging markets remain key competitive strategies. Continuous innovations in nucleic acid amplification tests (NAATs) and home-based diagnostic kits are driving product diversification. Companies are also emphasizing affordability and accessibility, particularly in low-resource settings, to capture wider market share and support global chlamydia screening initiatives.

Key Player Analysis

- Hologic, Inc.

- Thermo Fisher Scientific Inc.

- BD

- Trinity Biotech Plc.

- Abbott

- Siemens Healthineers

- QuidelOrtho Corporation

- Bio-Rad Laboratories, Inc.

- DiaSorin S.p.A.

- Hoffmann-La Roche Ltd

Recent Developments

- In 2025, Abbott received clearance for its simpli-COLLECT STI Test, enabling at-home urine and swab sample collection for the Alinity m system; the directly integrated Alinity m STI Assay provides multiplexed, qualitative detection and differentiation of Chlamydia trachomatis, Neisseria gonorrhoeae, Trichomonas vaginalis, and Mycoplasma genitalium, streamlining lab processing for home-based and decentralized STI diagnostics.

- In 2023, Thermo Fisher Scientific launched its TrueMark STI Select Panel, a research-use-only (RUO) test designed to simultaneously detect Chlamydia trachomatis and three other STI pathogens using a real-time PCR workflow.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Test Type, Type of Infections, End-use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for accurate and rapid chlamydia testing will continue to rise with growing STI awareness.

- Point-of-care and at-home diagnostic kits will gain strong adoption for convenience and privacy.

- Molecular diagnostic advancements will enhance detection speed and reliability in clinical settings.

- Integration of AI and digital health tools will improve test interpretation and patient data management.

- Expansion of national screening programs will strengthen preventive healthcare strategies.

- Emerging economies will invest more in diagnostic infrastructure to support early STI detection.

- Partnerships between diagnostic companies and public health agencies will boost testing accessibility.

- Multiplex assays capable of detecting multiple STIs will become increasingly common.

- Regulatory support for innovative and cost-effective diagnostic solutions will drive market expansion.

- Rising telehealth adoption will facilitate remote testing, result reporting, and patient counseling services.

Key Trends & Opportunities

Key Trends & Opportunities