Market Overview

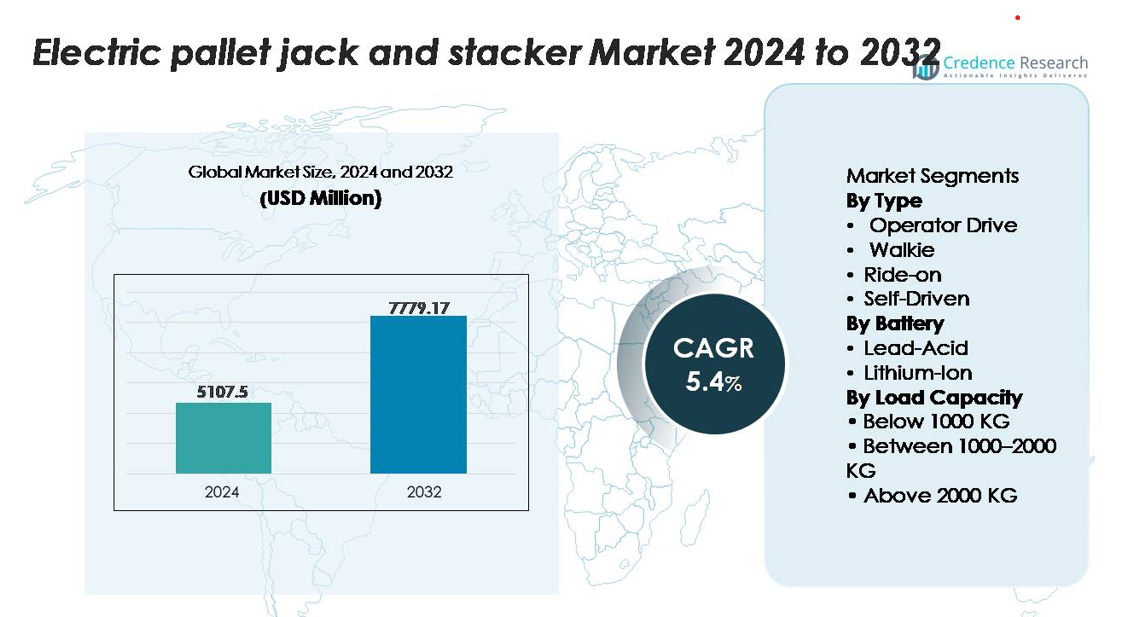

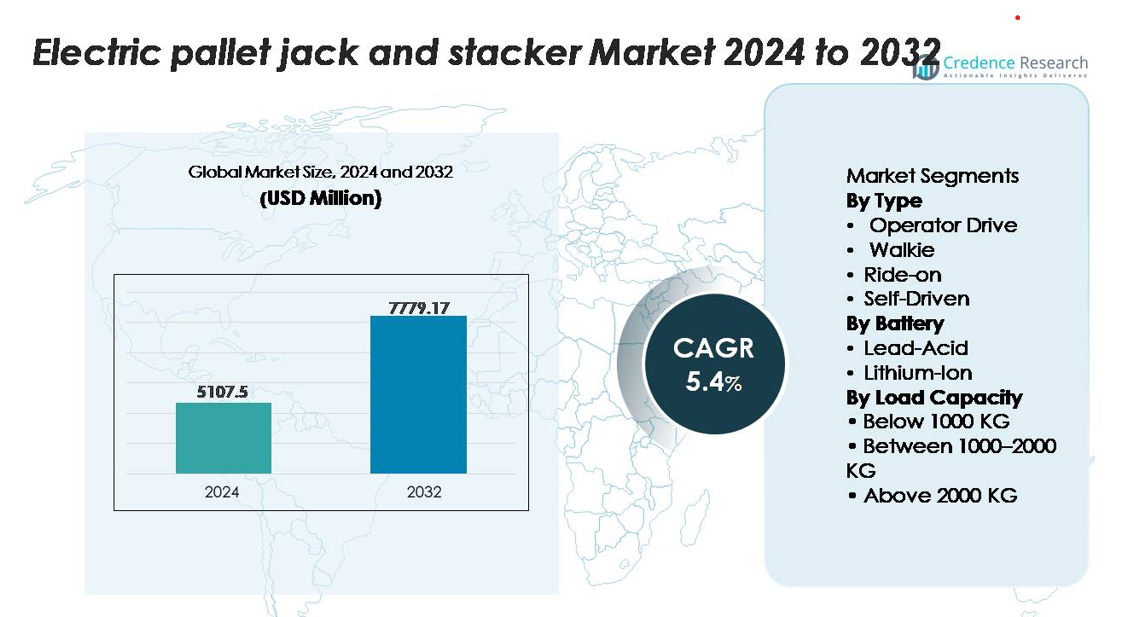

The Electric Pallet Jack and Stacker Market was valued at USD 5,107.5 million in 2024 and is projected to reach USD 7,779.17 million by 2032, expanding at a CAGR of 5.4% during the forecast period (2025–2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electric Pallet Jack and Stacker Market Size 2024 |

USD 5,107.5 million |

| Electric Pallet Jack and Stacker Market, CAGR |

5.4% |

| Electric Pallet Jack and Stacker Market Size 2032 |

USD 7,779.17 million |

The Electric Pallet Jack and Stacker market is shaped by leading material-handling manufacturers such as Toyota Material Handling, Crown Equipment Corporation, Jungheinrich AG, Hyster-Yale Materials Handling, Mitsubishi Logisnext, Linde Material Handling (KION Group), Hangcha Group, and Noblelift. These companies compete through advanced lithium-ion platforms, ergonomic walkie and ride-on models, and expanding semi-autonomous capabilities tailored for high-velocity logistics operations. North America dominates the global market with an exact 38% share, driven by large-scale warehouse automation, mature 3PL networks, and rapid modernization of retail and cold-chain distribution. Europe and Asia-Pacific follow as major manufacturing and logistics hubs, supported by strong electrification and industrial expansion trends.

Market Insights

- The Electric Pallet Jack and Stacker market was valued at USD 5,107.5 million in 2024 and is projected to reach USD 7,779.17 million by 2032, registering a 4% CAGR during the forecast period.

- Market growth is driven by warehouse automation, e-commerce expansion, and the shift from manual to powered handling, with the 1000–2000 KG load-capacity segment holding the largest share due to its suitability for most distribution and manufacturing operations.

- Key trends include rapid adoption of lithium-ion battery systems, growing demand for compact narrow-aisle equipment, and rising integration of semi-autonomous navigation technologies in high-throughput facilities.

- The landscape is competitive, led by Toyota Material Handling, Crown, Jungheinrich, Linde, and Hyster-Yale, each expanding intelligent fleet-management features, while cost-sensitive regions face restraints from high initial investment and charging-infrastructure limitations.

- Regionally, North America leads with 38%, followed by Europe at 29% and Asia-Pacific at 24%, reflecting strong industrial bases and accelerated warehouse modernization.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type:

Operator-driven models dominate the electric pallet jack and stacker market, accounting for the largest share due to their widespread use in warehouses, retail backrooms, and manufacturing floors. Within this category, walkie pallet jacks lead adoption as they offer maneuverability in tight aisles, simplified controls, and lower acquisition costs. Ride-on units follow, driven by higher throughput needs and ergonomic advantages for long-distance material movement. Self-driven systems are expanding gradually as automation gains traction, supported by navigation sensors and fleet-management software that reduce labor dependency and enhance operational continuity.

- For instance, Crown Equipment’s PE Series rider pallet truck integrates a 24-volt AC drive motor delivering up to 6.5 mph travel speed under load and is equipped with an onboard InfoLink telematics module capable of capturing more than 40 real-time operating parameters per vehicle, improving fleet optimization in high-volume distribution centers.

By Battery:

Lithium-ion models represent the dominant sub-segment, capturing the highest market share owing to rapid charging capability, maintenance-free operation, and significantly longer cycle life compared with lead-acid units. Their consistent voltage output enables stronger lifting performance during extended shifts, making them preferred in fast-paced logistics and e-commerce operations. Lead-acid batteries maintain relevance in cost-sensitive environments, but declining due to bulkier form factors, higher upkeep requirements, and longer charging times. Growing warehouse electrification and sustainability initiatives continue to accelerate the shift toward lithium-ion–powered pallet jacks and stackers.

- For instance, Jungheinrich’s lithium-ion system for its EJE Series electric pallet trucks uses a 24-volt, 260 Ah battery capable of achieving a full recharge in approximately 80 minutes and delivering up to 3,000 charge cycles, enabling continuous multi-shift operation without the need for battery swapping or maintenance.

By Load Capacity:

The 1000–2000 KG category holds the dominant market share as it fits the primary load profile of distribution centers, FMCG warehouses, and manufacturing plants that frequently handle medium-weight pallets. This capacity range delivers optimal balance between power, stability, and versatility, enabling efficient operation across inbound, outbound, and in-plant logistics. Below-1000 KG units serve retail and small facility applications, whereas above-2000 KG models cater to heavy industrial and metalworking environments. Rising SKU variety and multi-pallet handling needs further strengthen demand for the 1000–2000 KG segment across global operations.

Key Growth Drivers

Rising Warehouse Automation and High-Velocity Fulfillment Requirements

The shift toward automated and high-speed material-handling workflows is a primary driver of electric pallet jack and stacker adoption. E-commerce, quick-commerce, and omnichannel retail models demand rapid pallet movement, frequent restocking, and precise order consolidation, pushing facilities to replace manual equipment with powered alternatives. Electric pallet jacks significantly reduce operator fatigue, improve picking efficiency, and maintain consistent throughput during peak demand cycles. Distribution centers increasingly integrate digital telematics, operator-assist technologies, and programmable performance modes to enhance safety and productivity. As warehouses scale to manage higher SKU densities, shorter lead times, and 24/7 operations, electric pallet jacks and stackers provide an essential bridge between manual lifting equipment and fully autonomous systems, accelerating operational modernization across industries.

- For instance, the Toyota Material Handling Tora-Max walkie pallet jack (model 2TWB40) integrates a 24-volt AC drive motor capable of delivering travel speeds up to 3.1 mph under a full load (4,000 lbs). The equipment typically uses a sealed, maintenance-free 24-volt lead-acid battery with a capacity around 160 Ah.

Expansion of Manufacturing, FMCG, and Cold-Chain Infrastructure

Rapid growth in manufacturing, food processing, pharmaceuticals, and temperature-controlled logistics is fueling sustained demand for reliable electric material-handling equipment. Electric pallet jacks and stackers offer smooth handling, precise lift control, and reduced noise levels, which are essential in hygiene-sensitive and controlled environments. Facilities operating multi-shift workflows increasingly prioritize equipment with long duty cycles, minimal downtime, and low operational emissions. Electric models support these needs while complying with evolving regulatory mandates aimed at reducing diesel and LPG dependence inside warehouses. Additionally, investments in regional production hubs, automated packaging lines, and frozen-goods distribution centers require maneuverable equipment that can function efficiently in narrow aisles and low-temperature zones, further strengthening market growth.

- For instance, Hyster offers specialized electric pallet trucks with optional freezer or subZERO packages, which can be rated for operation down to –40°C. The company also provides a range of lithium-ion battery options across its electric fleet, with some configurations offering up to 6 kWh of usable energy or more via onboard chargers, ensuring reliable performance in frozen-storage and pharmaceutical cold-chain facilities.

Increasing Transition from Manual to Powered Handling for Safety Compliance

Growing emphasis on workforce safety, ergonomic improvements, and lifting-injury reduction is driving companies to replace manual pallet trucks with powered electric alternatives. Electric pallet jacks and stackers reduce strain-related injuries by handling heavier loads with minimal operator effort and improved stability. Regulatory bodies and labor agencies increasingly mandate safe-lifting standards and encourage adoption of powered equipment, especially in high-frequency material movement environments. Electric units with enhanced braking systems, stability sensors, and speed-limiting controls support compliance while minimizing accident rates. As enterprises prioritize employee well-being, reduce insurance claims, and address labor shortages through improved mechanization, the adoption of electric pallet jacks and stackers continues to accelerate across logistics, retail, and industrial sectors.

Key Trends & Opportunities

Growing Adoption of Lithium-Ion Technology and Intelligent Power Management

A major trend influencing the market is the widespread shift from traditional lead-acid systems toward advanced lithium-ion powerpacks. Li-ion batteries offer rapid charging, partial-charge tolerance, and extended life cycles, allowing operations to eliminate battery rooms and reduce downtime between shifts. Smart battery-management systems with real-time diagnostics, thermal stability monitoring, and predictive maintenance capabilities create strong operational advantages. As facilities move to continuous and multi-shift operations, opportunities emerge for manufacturers offering integrated li-ion solutions, modular battery swaps, and telematics-enabled performance tracking. Sustainability goals further amplify this transition as lithium-ion significantly reduces energy waste and lifetime operating costs.

- For instance, Jungheinrich’s 48-volt lithium-ion module for its ETV reach trucks delivers 360 Ah capacity, supports more than 4,000 charge cycles, and reaches 80% charge in approximately 30 minutes using its proprietary high-frequency charger.

Expansion of Semi-Autonomous and Self-Driven Material Handling Platforms

The integration of navigation sensors, obstacle-detection systems, and fleet-management software is enabling the rise of self-driven pallet movement in large and high-throughput facilities. These platforms help minimize labor dependency, support repetitive transport tasks, and maintain consistent workflow with reduced human intervention. Growth of autonomous mobile robots (AMRs) and digital warehouse ecosystems creates opportunities for electric pallet jack and stacker manufacturers to incorporate autonomous guidance modules or develop hybrid human-assist technologies. As companies digitize their intralogistics, demand for interoperable, safety-certified, and automation-ready equipment continues to grow, positioning self-driven pallet equipment as a key future opportunity segment.

- For instance, Crown Equipment’s DualMode T automated pallet truck uses a LiDAR-based navigation system capable of recognizing obstacles within a 360-degree field and transitioning between manual and automated modes while maintaining travel speeds up to 3.7 mph in automated operation.

Increasing Demand for Compact and Narrow-Aisle Equipment in Urban Warehousing

Urban fulfillment centers, micro-distribution hubs, and last-mile logistics facilities require compact and highly maneuverable equipment capable of operating efficiently in constrained spaces. Electric pallet jacks and stackers designed for narrow aisles, mezzanines, and high-density racking environments are gaining strong traction. This trend presents opportunities for manufacturers offering shorter wheelbases, enhanced steering agility, and optimized lift heights. Rapid urbanization and rising same-day delivery expectations further accelerate investment in compact equipment that enhances storage density and shortens picking routes within smaller operational footprints.

Key Challenges

High Initial Investment and Maintenance Cost Constraints for Small Operators

Despite long-term operational savings, the upfront cost of electric pallet jacks and stackers remains a major barrier for small warehouses, retail outlets, and SMEs still reliant on manual pallet trucks. Lithium-ion models, although more efficient, require significantly higher purchase expenditures, which can delay adoption in cost-sensitive environments. Additionally, specialized components, onboard electronics, and diagnostic systems increase maintenance complexity, necessitating trained technicians and structured service contracts. These factors make total cost of ownership a critical challenge for smaller enterprises and hinder widespread fleet modernization, particularly in developing markets with limited capital budgets.

Limited Charging Infrastructure, Downtime Concerns, and Battery Performance Variability

Insufficient charging stations, constrained electrical capacity, and lack of standardized charging protocols pose operational challenges, especially in facilities transitioning from manual to fully electric fleets. Lead-acid units require long charging windows and cooling periods, while lithium-ion systems depend on reliable high-output power sources. Downtime due to battery depletion or inadequate charging management can disrupt material movement cycles. Additionally, extreme temperature environments—such as cold-chain facilities—can reduce battery efficiency and accelerate degradation if equipment is not designed with appropriate thermal controls. These charging and performance constraints remain key inhibitors to seamless large-scale adoption.

Regional Analysis

North America

North America holds the largest share at 38%, driven by extensive warehouse automation, strong e-commerce penetration, and widespread adoption of lithium-ion–powered equipment. The U.S. leads the region with accelerated investment in high-throughput distribution centers, cold-chain expansion, and safety-compliance modernization. Material-handling OEMs benefit from strong demand for operator-driven walkie and ride-on pallet jacks that support multi-shift workflows. Growth is further supported by labor-shortage pressures that encourage wider use of electric and semi-automated pallet-moving equipment across 3PLs, food distribution hubs, and large retailers upgrading aging manual fleets.

Europe

Europe accounts for 29% of the market, supported by stringent workplace safety regulations, early electrification adoption, and strong intralogistics optimization across manufacturing and automotive industries. Germany, France, Italy, and the Nordics lead in implementing advanced lifting technologies, including automation-ready pallet jacks designed for narrow-aisle operations. Investments in regional food processing and pharmaceutical logistics further strengthen equipment demand. Sustainability mandates and energy-efficiency goals accelerate the shift toward lithium-ion models, while ongoing warehouse modernization in Central and Eastern Europe expands the addressable market for medium-capacity electric pallet jacks and stackers.

Asia-Pacific

Asia-Pacific captures 24% of the market, driven by rapid expansion of e-commerce fulfillment centers, manufacturing hubs, and retail distribution networks. China and India anchor demand with large-scale facility construction and accelerated movement toward electric and semi-automated handling equipment. The region’s strong push for higher productivity, rising labor costs, and dense warehouse layouts increases adoption of walkie pallet jacks and compact stackers. Growing investments in electronics, FMCG, and automotive production amplify equipment needs, while government-led industrial automation incentives further support the transition from manual pallet trucks to battery-powered material-handling solutions.

Latin America

Latin America holds a 6% market share, shaped by gradual modernization of logistics infrastructure and rising investment in industrial automation across Brazil, Mexico, and Chile. Adoption is strongest in FMCG, food processing, and consumer-goods warehouses requiring improved handling efficiency. Economic constraints encourage preference for operator-driven models with lower acquisition costs, while gradual uptake of lithium-ion systems emerges in multinational 3PL and retail facilities. Growth of regional manufacturing clusters and expansion of cold-chain capabilities contribute to increasing demand for electric pallet jacks and stackers, despite cost sensitivity and uneven infrastructure development across markets.

Middle East & Africa

The Middle East & Africa region represents 3% of the market, growing steadily as logistics hubs in the UAE, Saudi Arabia, and South Africa expand warehouse capacity and diversify industrial operations. Large-scale retail and food distribution networks drive adoption of electric pallet jacks for indoor handling and hygiene-sensitive environments. Government investment in free-trade zones and industrial parks boosts demand for medium-capacity stackers. However, penetration remains limited by high initial investment requirements and inconsistent electrification infrastructure, making operator-driven units the primary choice. Gradual modernization and increased interest from global logistics players support long-term growth prospects.

Market Segmentations:

By Type

- Operator Drive

- Walkie

- Ride-on

- Self-Drive

By Battery

By Load Capacity

- Below 1000 KG

- Between 1000–2000 KG

- Above 2000 KG

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Electric Pallet Jack and Stacker market is defined by a mix of global material-handling leaders and rapidly advancing regional manufacturers focused on expanding electrified intralogistics portfolios. Companies such as Toyota Material Handling, Crown Equipment, Jungheinrich AG, Hyster-Yale, Linde Material Handling (KION Group), Mitsubishi Logisnext, Hangcha Group, and Noblelift dominate through strong product breadth, advanced ergonomics, and continuous investment in lithium-ion technology. These players emphasize high-efficiency walkie and ride-on models, improved operator safety systems, and fleet-management telematics tailored for multi-shift warehouse operations. Strategic initiatives include localized manufacturing, expanded dealer networks, and integration of semi-autonomous guidance modules to enhance productivity in high-velocity logistics operations. Competition intensifies as manufacturers target e-commerce fulfillment centers and 3PL hubs with compact, narrow-aisle solutions and fast-charging power systems. Emerging Asian players increasingly challenge established brands by offering cost-effective, automation-ready models. Overall, innovation, energy efficiency, and after-sales support remain core differentiators across global markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- KION Group

- Hyundai Construction Equipment

- EP Equipment

- Hyster-Yale Materials Handling

- Toyota Material Handling Group

- Doosan Corporation

- Mitsubishi Logisnex

- Hangcha Forklift

- Crown Equipment Corporation

Recent Developments

- In May 2025, the group announced the completion of a 73,500 square-foot electrification fabrication facility at its Houston campus dedicated to electric Class I and Class II material-handling products

- In April 2025, the company introduced a “Green” product range focused on lithium-ion driven electric pallet trucks and stackers with fast-charging and modular battery systems.

- In March 2025, Hyster announced an expanded J230-400XD series of high-capacity electric forklifts (23,000–40,000 lb class) with integrated lithium-ion drive architecture aimed at heavy-duty applications

Report Coverage

The research report offers an in-depth analysis based on Type, Battery, Load capacity and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for electric pallet jacks and stackers will rise as warehouses accelerate automation and shift toward fully electrified handling fleets.

- Lithium-ion adoption will grow rapidly, supported by fast charging, longer service life, and reduced maintenance requirements.

- Semi-autonomous and sensor-assisted navigation features will increasingly integrate into mid-range equipment for repetitive transport tasks.

- Compact and narrow-aisle models will gain prominence as urban fulfillment centers expand in high-density locations.

- Manufacturers will prioritize ergonomic designs and safety-enhancing technologies to reduce operator fatigue and incident rates.

- Fleet telematics and real-time equipment monitoring will become standard across large distribution networks.

- Cold-chain and food-processing facilities will drive demand for specialized low-temperature electric equipment.

- Regional production and localized assembly will expand to improve cost efficiency and lead times.

- Competition will intensify as Asian manufacturers gain global visibility with cost-effective, automation-ready models.

- Sustainability commitments will accelerate the phaseout of internal combustion and manual pallet-handling equipment.