Market Overview

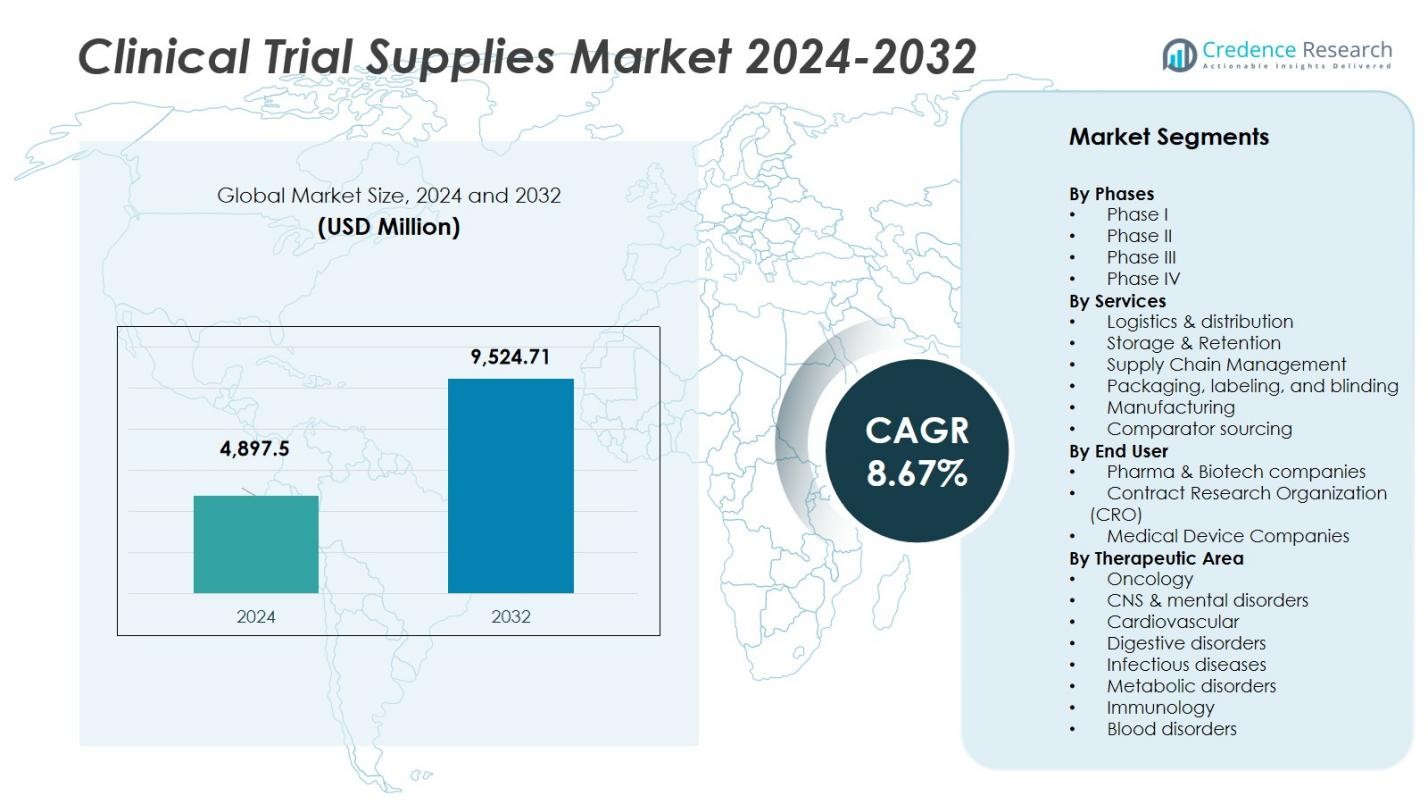

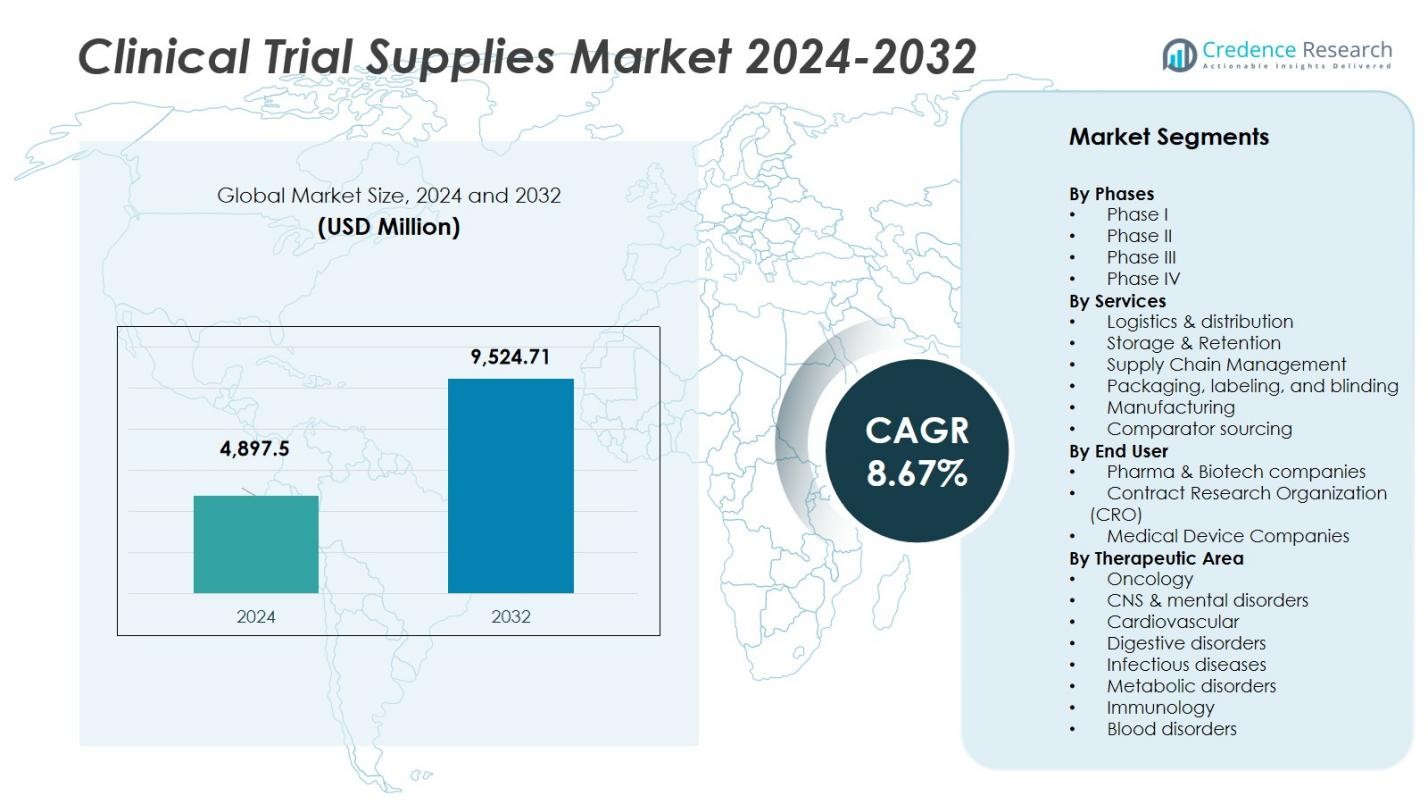

The Clinical Trial Supplies Market size was valued at USD 4,897.5 million in 2024 and is anticipated to reach USD 9,524.71 million by 2032, at a CAGR of 8.67% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Clinical Trial Supplies Market Size 2024 |

USD 4,897.5 Million |

| Clinical Trial Supplies Market, CAGR |

8.67% |

| Clinical Trial Supplies Market Size 2032 |

USD 9,524.71 Million |

The Clinical Trial Supplies Market includes key players such as Thermo Fisher Scientific, Inc., Catalent Pharma Solutions, Almac Group Ltd., PAREXEL International Corporation and Movianto GmbH, each driving service innovation and geographic expansion. The market is strong in North America, with a market share of about 55 % in 2024, reflecting the region’s advanced logistics and major trial activity. Europe holds approximately 25 % of global share, benefiting from robust pharmaceutical clusters and cross‑border trial structures. Asia‑Pacific captures around 15 % of the market, with rapid growth supported by cost‑efficient sites and expanding trial infrastructure. These regional distributions shape how the leading companies allocate resources and plan expansions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Clinical Trial Supplies Market was valued at USD 4,897.5 million in 2024 and is projected to reach USD 9,524.71 million by 2032, growing at a CAGR of 8.67 %.

- Phase III holds the largest segment share at around 45 %, reflecting high demand for large‑scale efficacy trials.

- The logistics & distribution service segment leads with roughly 35 % share, driven by the complexity of global drug shipments and temperature‑sensitive therapies.

- North America dominates regional share at about 55 %, followed by Europe at ~25 % and Asia‑Pacific at ~15 %, with emerging regions making up the remainder.

- The market faces restraints from stringent regulatory requirements across multiple countries and supply chain disruptions that delay trial material delivery and increase costs.

Market Segmentation Analysis:

By Phases:

In the Clinical Trial Supplies Market, Phase III holds the largest market share, accounting for approximately 45% of the total market. This phase involves large-scale clinical trials aimed at assessing the efficacy and safety of new treatments. The dominance of Phase III is driven by the growing demand for advanced therapeutics and the need for extensive data before regulatory approval. Additionally, increasing investments in research and development by pharmaceutical companies contribute significantly to the growth of this segment, driving market expansion during this critical stage of clinical trials.

- For instance, Pfizer’s Phase III CREST trial demonstrated that their investigational drug sasanlimab combined with BCG significantly improved event-free survival in patients with high-risk non-muscle invasive bladder cancer, highlighting the impact of extensive data generation in this phase.

By Services:

The logistics & distribution segment leads the Clinical Trial Supplies Market, capturing around 35% of the total market share. This service is crucial for ensuring the timely and efficient delivery of clinical trial supplies to global sites. The growing trend of multi-site international clinical trials and the increasing complexity of trial logistics, including temperature-sensitive drugs, are key drivers for this segment’s growth. Logistics companies are increasingly leveraging technology and supply chain management platforms to optimize operations, further contributing to the expansion of the logistics & distribution segment.

- For instance, Parexel expanded its clinical trial supplies and logistics depot in Suzhou, China, to enhance local distribution capabilities for complex global trials.

By End User:

Pharma & Biotech companies dominate the Clinical Trial Supplies Market, with a market share of approximately 60%. This segment is primarily driven by the rising number of drug development pipelines and the ongoing research into biologics and novel therapeutics. Pharmaceutical and biotech firms are increasing their focus on expanding their portfolios through clinical trials, which fuels the demand for clinical trial supplies. As a result, this end-user segment is expected to continue driving the market’s growth, with significant investments in R&D and clinical trials in both developed and emerging markets.

Key Growth Drivers

Increasing Demand for Biologics

The growing demand for biologics is a significant driver for the Clinical Trial Supplies Market. As the biopharmaceutical sector expands, especially with the rise of monoclonal antibodies and gene therapies, there is an increasing need for clinical trial supplies tailored to biologic drugs. These treatments often require specialized packaging, storage, and distribution services due to their temperature sensitivity and complex manufacturing processes. The surge in biologic drug development is expected to continue fueling market growth as more companies invest in the development of innovative therapies.

- For instance, Thermo Fisher Scientific has developed advanced packaging solutions tailored for biologic drugs that maintain required storage conditions and ensure compliance with regulatory standards.

Rising Number of Clinical Trials Globally

The number of clinical trials conducted worldwide has been rising steadily, which is directly boosting the demand for clinical trial supplies. As more new drug candidates enter the clinical development pipeline, pharmaceutical companies, CROs, and research institutions are conducting a higher volume of trials across various phases. With a growing focus on personalized medicine and the expansion of trials into emerging markets, the demand for reliable, efficient clinical trial supply chain solutions is poised for continued growth, thereby driving the overall market expansion.

- For instance, ClinicalTrials.gov reports over 556,000 registered studies worldwide as of October 2025, with more than 313,000 conducted outside the U.S., highlighting the global expansion of trials.

Advancements in Supply Chain Technology

Advancements in supply chain management and logistics technologies are enhancing the efficiency and reliability of clinical trial supplies. Innovations such as temperature-controlled shipping, real-time tracking systems, and automated inventory management are improving the delivery of clinical trial materials. These technological advancements help reduce delays and enhance the accuracy of supply chains, ensuring that materials are delivered on time and under optimal conditions. As the industry becomes more globalized and trials become more complex, these technological improvements are key to supporting the market’s expansion.

Key Trends & Opportunities

Growth of Personalized Medicine

Personalized medicine is emerging as a key trend in the Clinical Trial Supplies Market, offering significant opportunities for growth. As treatments become more individualized, clinical trials are increasingly focusing on targeted therapies based on genetic, molecular, and environmental factors. This trend is creating demand for highly specialized trial supplies, including those for precision drugs and diagnostics. Personalized medicine’s expansion is expected to open new avenues for market players to provide tailored solutions, ranging from advanced packaging to temperature-sensitive logistics and tracking, aligning with the trend toward more patient-specific treatments.

- For instance, Illumina Inc., a key player in genomic sequencing technologies, has been instrumental in advancing personalized medicine by enabling more cost-efficient genetic profiling critical for targeted therapy trials.

Expansion in Emerging Markets

Emerging markets are presenting a growing opportunity for the Clinical Trial Supplies Market. As pharmaceutical and biotech companies increasingly expand their clinical trials into regions like Asia-Pacific, Latin America, and the Middle East, there is a rising need for supply chain solutions that cater to diverse regulatory requirements and logistical challenges. The ongoing shift toward global trials in these regions, coupled with economic growth and improvements in healthcare infrastructure, is driving demand for clinical trial supplies. Companies focusing on these regions can tap into an expanding market as clinical research becomes more geographically diverse.

- For instance, PAREXEL International expanded its depot in Santiago, Chile, to enhance supply chain management for trials in Latin America, exemplifying focused investments to support emerging markets.

Key Challenges

Regulatory Complexity

One of the key challenges facing the Clinical Trial Supplies Market is navigating the complex and varied regulatory environments across different countries. Different regions have specific regulations regarding the storage, transportation, and handling of clinical trial materials. Compliance with these regulations can be costly and time-consuming for companies operating globally. The need to adhere to strict regulatory standards while conducting international trials complicates supply chain management, requiring market players to invest in expertise and infrastructure to ensure compliance across different jurisdictions.

Supply Chain Disruptions

Supply chain disruptions continue to be a major challenge for the Clinical Trial Supplies Market. Factors such as natural disasters, geopolitical instability, and the COVID-19 pandemic have highlighted the vulnerability of global supply chains. These disruptions can lead to delays in the delivery of critical clinical trial materials, affecting trial timelines and patient safety. The increased complexity of clinical trials, with multi-site and international operations, further exacerbates these challenges. Companies must develop more resilient supply chain strategies to mitigate the impact of unforeseen disruptions and ensure continuity in clinical trials.

Regional Analysis

North America

The North America region held a market share of around 55% in 2024 for the clinical trial supplies industry. The dominance reflects a high concentration of clinical trial activity, advanced logistics infrastructure, and strong regulatory frameworks in countries like the US and Canada. Sponsors increasingly run decentralized and globalised studies from this region, driving demand for specialised packaging, temperature‑controlled storage and rapid distribution. Further investment in cold‑chain logistics and digital supply‑chain tracking systems supports this lead, while the large number of contract research organisations (CROs) in the region strengthens the supply service network.

Europe

Europe accounted for approximately 25% of the global clinical trial supplies market in 2024. Robust biotech and pharmaceutical ecosystems in the UK, Germany and France drive this share, supported by favourable regulatory policies and cross‑border clinical trial initiatives. European stakeholders increasingly adopt integrated supply‑chain models and advanced packaging technologies to support specialised biologics trials. Growing partnerships between CROs and local logistics providers enhance readiness across multiple trial phases. However, competition from Asia‑Pacific for cost‑efficient trials and emerging regulatory demands keep European players focused on value‑added services rather than volume alone.

Asia‑Pacific

The Asia‑Pacific region captured roughly 15% of the clinical trial supplies market in 2024, and is forecasted to grow faster than other regions. Major growth drivers include lower per‑patient trial costs, large treatment‑naïve populations, and improving regulatory regimes in countries such as India and China. In addition, global sponsors increasingly establish regional supply hubs and direct‑to‑patient models in Asia‑Pacific to optimise timelines and costs. Investment in cold‑chain infrastructure and digitised trial logistics is gaining momentum. As multinational trials expand in this region, the share of clinical trial supplies procured, packaged and shipped locally is expected to rise significantly.

Latin America, Middle East & Africa (MEA)

The combined Latin America and MEA region represented the remaining 5% of the global clinical trial supplies market in 2024. Growth in these regions is driven by emerging trial sites, regulatory reforms and expanding health‑care infrastructure in countries such as Brazil, Mexico, South Africa and the UAE. Sponsors are tapping into these markets for patient‑diverse and cost‑efficient trial populations. Logistics firms are setting up regional depots and tailored supply services. Despite current small share, the region presents strong future opportunity as infrastructure improves and global trials increasingly target non‑traditional geographies.

Market Segmentations:

By Phases

- Phase I

- Phase II

- Phase III

- Phase IV

By Services

- Logistics & distribution

- Storage & Retention

- Supply Chain Management

- Packaging, labeling, and blinding

- Manufacturing

- Comparator sourcing

By End User

- Pharma & Biotech companies

- Contract Research Organization (CRO)

- Medical Device Companies

By Therapeutic Area

- Oncology

- CNS & mental disorders

- Cardiovascular

- Digestive disorders

- Infectious diseases

- Metabolic disorders

- Immunology

- Blood disorders

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the clinical trial supplies market includes major players such as Thermo Fisher Scientific Inc., Catalent Inc., Almac Group Ltd., PAREXEL International Corporation, and Movianto GmbH. These firms compete primarily through global infrastructure investment, service portfolio expansion, and strategic acquisitions. They aggressively build temperature‑controlled distribution networks, integrated packaging and labeling services, and end‑to‑end supply chain management solutions. The market features moderate concentration: the top five players collectively capture an estimated 40‑50% of industry share. Competitive intensity remains high, driven by expanding biologics trials and global site proliferation, which compel firms to differentiate via specialized services and geographic coverage. Continuous innovation in logistics, tracking technology, and client partnerships remains central to maintaining market leadership.

Key Player Analysis

- Parexel International Corporation

- Thermo Fisher Scientific, Inc.

- Almac Group Ltd.

- UDG Healthcare

- Movianto GmbH

- Patheon, Inc.

- Piramal Pharma Solutions

- Sharp Packaging Services

- Biocair International Ltd.

- Catalent Pharma Solutions

Recent Developments

- In March 2025, DHL Group completed its acquisition of CRYOPDP (Cryoport), a specialist in clinical trial logistics for biopharma and cell & gene therapies. The move strengthens DHL’s presence in temperature‑controlled and specialised courier services for trial materials.

- In September 2025, Catalent, Inc. and Science 37 announced a partnership to enhance the investigational medicinal product (IMP) supply chain and enable at-home trial participation.

- In March 2025, DHL Group acquired CRYOPDP (a subsidiary of Cryoport Inc.), strengthening its specialty logistics services for biologics and clinical trial materials.

- In July 2025, Aptar Pharma acquired the clinical-trial materials manufacturing capabilities of Mod3 Pharma (formerly Enteris Biopharma).

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Phase, Services, Therapeutic Area, End User and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand as the number of global clinical trials increases, including trials in Asia‑Pacific and emerging regions.

- Demand will grow for specialized supplies supporting biologics, gene therapies, and cell‑based treatments, driving complexity in packaging and logistics.

- Direct‑to‑patient (DTP) and decentralized trial models will become more common, boosting demand for flexible supply chain solutions.

- Real‑time tracking, blockchain, and digital monitoring technologies will be further adopted to enhance supply chain visibility and control.

- Cold‑chain and temperature‑controlled logistics capacity will need expansion due to biologics and complex therapies requiring tight thermal management.

- Emerging markets will gain a larger share as clinical research shifts to cost‑efficient geographies with growing healthcare infrastructure.

- Strategic alliances and mergers among supply‑chain service providers, CROs, and pharma firms will increase to build end‑to‑end capabilities.

- Regulatory harmonisation and streamlined approval pathways will support faster trial set‑up and supply deployment.

- Environmental and sustainability pressures will lead firms to adopt greener logistics, packaging materials, and supply‑chain models.

- Resilience planning will become critical as supply chains face disruptions from pandemics, geopolitics, and global logistics constraints.