Market Overview

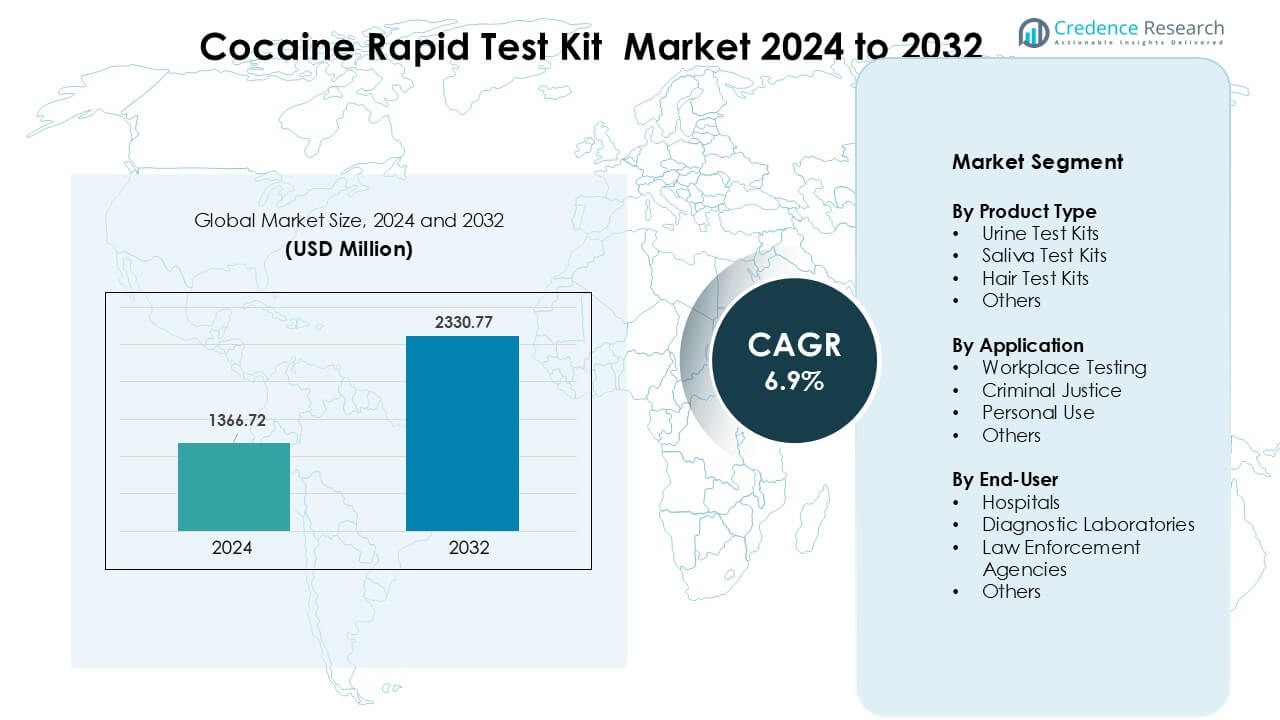

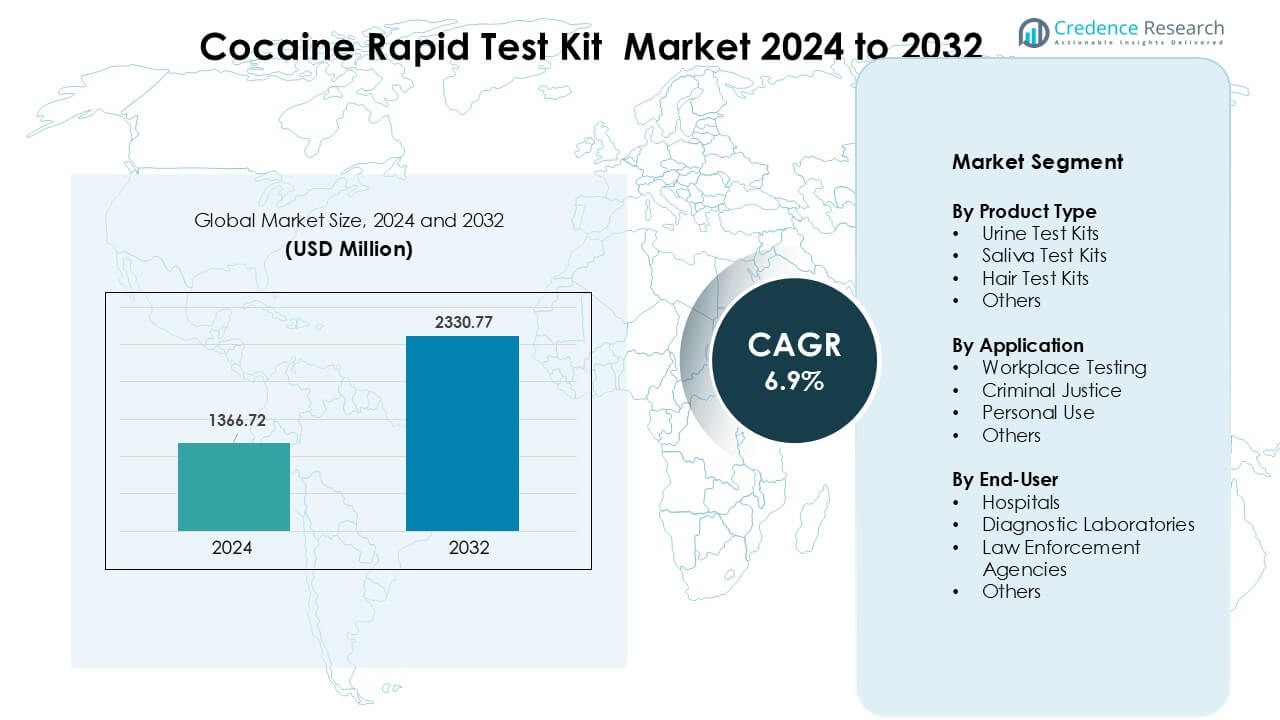

Cocaine Rapid Test Kit Market was valued at USD 1366.72 million in 2024 and is anticipated to reach USD 2330.77 million by 2032, growing at a CAGR of 6.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cocaine Rapid Test Kit Market Size 2024 |

USD 1366.72 Million |

| Cocaine Rapid Test Kit Market, CAGR |

6.9% |

| Cocaine Rapid Test Kit Market Size 2032 |

USD 2330.77 Million |

The Cocaine Rapid Test Kit Market is shaped by leading companies such as Abbott Laboratories, Thermo Fisher Scientific Inc., Siemens Healthineers AG, Roche Diagnostics, Quest Diagnostics Incorporated, Becton, Dickinson and Company, Bio-Rad Laboratories, Inc., Danaher Corporation, OraSure Technologies, Inc., and Alere Inc. These players strengthen their position through accurate immunoassay technology, multi-panel test formats, and portable devices suited for clinical, workplace, and law-enforcement settings. Innovation focuses on faster detection, improved sensitivity, and broader sample compatibility. North America remained the leading region in 2024 with about 38% market share, supported by strict workplace testing mandates, advanced healthcare systems, and strong law-enforcement adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Cocaine Rapid Test Kit Market was valued at USD 72 million in 2024 and is projected to reach USD 2330.77 million by 2032, growing at a CAGR of about 6.9%.

- Market growth is driven by strong workplace screening demand, expanding law-enforcement programs, and rising emergency toxicology testing in hospitals.

- Key trends include fast adoption of portable on-site kits, wider use of multi-panel formats, and improved sensitivity across urine, saliva, and hair test technologies; urine kits led with about 46% share in 2024.

- Leading players such as Abbott, Thermo Fisher, Siemens Healthineers, Roche Diagnostics, Quest Diagnostics, BD, Bio-Rad, Danaher, OraSure, and Alere maintain strong competition through innovation, regulatory compliance, and broad distribution networks.

- North America held the largest regional share of around 38% in 2024, followed by Europe at 27% and Asia Pacific at 22%, supported by strict testing policies and high adoption across workplaces, hospitals, and law-enforcement agencies.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Product Type

Urine test kits held the dominant share of about 46% in 2024. These kits lead due to simple use, fast detection, and reliable screening windows for cocaine metabolites. Employers and agencies prefer urine tests because they support bulk testing and meet established compliance norms. Wider availability, low cost, and strong integration in routine drug-screening programs also strengthen adoption. Saliva and hair kits grow at a steady pace as agencies seek longer detection windows and on-site testing options.

- For instance, standard urine testing for cocaine actually detects the metabolite Benzoylecgonine (BE), which remains detectable in urine typically for 2 to 4 days after use.

By Application

Workplace testing led the application segment in 2024 with nearly 52% share. Employers invest in routine screening to reduce safety risks, ensure compliance, and maintain productivity. Cocaine rapid test kits support quick on-site checks, which helps companies shorten investigation time and prevent delays. Rising regulations, high awareness, and an expanding corporate workforce drive usage. Criminal justice and personal use segments show stable growth as law-enforcement units and individuals seek accurate and fast screening tools.

- For instance, for investigations requiring a longer history of drug use rather than just recent use, many forensic or court-ordered programs prefer hair testing because hair analysis can reveal drug ingestion over the past ~90 days, offering a broader window than urine or saliva tests.

By End-User

Law enforcement agencies dominated the end-user category in 2024 with around 48% share. Agencies use cocaine rapid test kits for roadside checks, criminal investigations, and instant field screening. The need for fast, reliable, and portable tools drives strong adoption across police units and border control. Hospitals and diagnostic laboratories record rising demand as healthcare teams perform emergency screening and clinical assessments. Broader access to handheld kits and improved detection sensitivity further support market expansion across all end-user groups.

Key Growth Drivers

Growing Demand for Fast and Reliable Drug Screening

Demand for cocaine rapid test kits grows as workplaces, hospitals, and law-enforcement agencies need fast and dependable screening tools. Companies adopt these kits to manage safety risks, reduce accidents, and comply with strict drug-free policies. Hospitals use rapid tests to support emergency care, enabling doctors to make quick clinical decisions. Police units rely on mobile testing during roadside checks and field investigations. The shift toward quick detection methods encourages investment in portable kits. Rising substance-use cases across urban regions further expand demand, as users require accurate results without long processing times.

- For instance, point-of-care rapid drug tests, which use immunochromatographic or lateral-flow methods, can deliver a positive/negative result within minutes a major advantage over typical lab-based drug screening that can take 2–3 days to return results.

Strengthening Workplace and Regulatory Compliance Requirements

Tighter compliance rules in public and private sectors drive broad use of rapid test kits. Employers follow strict screening policies to maintain safe environments, reduce liabilities, and meet insurance requirements. Industries such as transportation, construction, and manufacturing lead adoption due to high safety sensitivity. Regulations encourage periodic workforce testing, which boosts bulk kit purchases. Law-enforcement groups also follow structured protocols that favor reliable, standardized testing tools. Consistent regulatory updates across North America and Europe further push organizations to invest in efficient cocaine detection systems. These conditions create steady and predictable market demand.

- For instance, Rapid tests are primarily screens that provide a negative or non-negative result. They are faster and cheaper, which makes them popular for initial/high-volume screening.

Advancements in Testing Accuracy and Product Innovation

Improved test sensitivity and expanded detection windows support rapid growth across the market. Modern kits use enhanced antibodies, multi-panel formats, and digital readers to deliver more accurate results. These upgrades reduce false readings and improve confidence for hospitals, workplaces, and police agencies. Manufacturers release compact, easy-to-use devices that work in remote or high-pressure settings. Innovation also focuses on faster turnaround times and broader compatibility with multiple sample types, including saliva and hair. Rising investment in R&D helps companies launch next-generation kits that support both clinical and field operations, increasing adoption across end-users.

Key Trends & Opportunities

Rising Adoption of Portable and On-Site Testing Solutions

Portable cocaine rapid test kits create major opportunities as agencies and employers shift to on-site detection. Handheld devices remove the need for laboratory processing, reducing downtime and enabling instant decisions. Field teams benefit from lightweight tools designed for roadside checks, event security, and emergency environments. The market sees strong interest in self-use kits for personal monitoring and home testing. Growth in mobile health technologies also supports expansion, as users prefer simple devices that deliver fast results. This shift strengthens demand for compact, digitally supported products.

- For instance, some modern at-home or point-of-care drug tests use lateral-flow immunoassay strips (urine or saliva) that return results in about five minutes a critical advantage over lab-based tests that can take days.

Expansion of Multi-Panel Drug Screening Technologies

Multi-panel kits offer key opportunities by enabling detection of cocaine along with several other substances. Workplaces favor these tools to improve efficiency and reduce costs linked with repeated tests. Laboratories adopt multi-panel formats to support wider toxicology assessments. New designs use advanced immunoassay materials that allow higher accuracy and longer detection windows. As drug-use patterns diversify across regions, multi-panel technology becomes more valuable. Manufacturers focus on developing flexible, customizable panels that appeal to employers, hospitals, and law-enforcement groups.

- For instance, some multi-drug test panels on the market can screen for up to 16 substances (or their metabolites) in a single urine sample, covering cocaine, amphetamines, opioids, cannabinoids, benzodiazepines, barbiturates, and more reducing the need for multiple separate assays.

Key Challenges

Risk of False Positives and False Negatives

False results create a major challenge for the market, especially during high-stakes screening in workplaces and criminal investigations. Inaccurate detection can lead to wrongful disciplinary actions, legal disputes, and reduced trust in test outcomes. Interference from medications, improper sampling, and poor storage conditions increase this risk. End-users need continued training and standardized procedures to maintain accuracy. Manufacturers aim to reduce variability, but complete elimination remains difficult. These issues create hesitation among some organizations and raise demand for confirmatory lab testing.

Limited Detection Window Across Certain Test Types

Some rapid test formats, especially saliva and urine kits, provide short detection windows, limiting their use in post-incident or delayed screening scenarios. This limitation affects reliability for law-enforcement agencies investigating time-gapped incidents. Workplaces also face challenges when screenings occur long after substance use. Hair tests address this issue but are slower, more costly, and less suitable for on-site checks. End-users must balance speed, sensitivity, and time range when choosing kits. This challenge shapes procurement decisions and affects adoption patterns across regions.

Regional Analysis

North America

North America held the largest share of about 38% in 2024. Strong workplace testing policies, advanced law-enforcement programs, and high substance-use monitoring needs support broad adoption. The U.S. leads due to strict DOT guidelines, active criminal justice screening, and rapid integration of portable kits in police departments. Hospitals use these tests for emergency toxicology, raising steady demand. Canada follows with growing investment in workplace safety and expanded public-health screening. High awareness, strong compliance frameworks, and wide product availability reinforce North America’s continued lead in the Cocaine Rapid Test Kit Market.

Europe

Europe captured nearly 27% share in 2024, driven by strong regulatory oversight and structured drug-monitoring programs across workplaces and public institutions. The U.K., Germany, and France lead adoption due to strict compliance rules and increased workplace testing. Law-enforcement units use rapid kits for field investigations and scheduled screening operations, supporting consistent demand. Hospitals and laboratories also integrate these tools for urgent toxicology assessments. Broader awareness campaigns and rising substance-use cases among younger populations encourage continued market growth. The region benefits from strong supply chains and robust healthcare infrastructure.

Asia Pacific

Asia Pacific accounted for about 22% share in 2024 and remains the fastest-growing region. Expanding urban populations, rising substance-use concerns, and tightening workplace policies enhance adoption of cocaine rapid test kits. China, India, and Australia lead due to increasing law-enforcement screening and broader use in private workplaces. Growing investment in healthcare modernization supports higher testing in hospitals and diagnostic labs. Affordable rapid kits and mobile technologies further strengthen adoption. Wider government campaigns targeting drug control continue to raise screening demand across public and private sectors.

Latin America

Latin America held around 8% share in 2024, supported by rising drug-control initiatives across Brazil, Mexico, and Colombia. Law-enforcement agencies use rapid kits for roadside checks, border security, and criminal investigations. Workplace testing expands as companies strengthen safety standards in transportation, mining, and manufacturing. Hospitals rely on rapid kits for emergency screening, increasing market penetration. Despite economic variability, public-health investments and drug-monitoring programs continue to grow. Partnerships between local distributors and global manufacturers help improve access to reliable and affordable test kits.

Middle East & Africa

The Middle East & Africa region captured nearly 5% share in 2024, with demand driven by stricter enforcement regulations and expanding healthcare infrastructure. The UAE and Saudi Arabia lead adoption due to strong workplace testing rules and growing law-enforcement use. Hospitals incorporate rapid kits to support emergency toxicology decisions, while public-health agencies use them for targeted screening campaigns. Africa shows gradual growth as awareness rises and access to medical supplies improves. International suppliers collaborate with regional distributors to expand availability and training.

Market Segmentations:

By Product Type

- Urine Test Kits

- Saliva Test Kits

- Hair Test Kits

- Others

By Application

- Workplace Testing

- Criminal Justice

- Personal Use

- Others

By End-User

- Hospitals

- Diagnostic Laboratories

- Law Enforcement Agencies

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Cocaine Rapid Test Kit Market features strong competition led by Abbott Laboratories, Thermo Fisher Scientific Inc., Siemens Healthineers AG, Roche Diagnostics, Quest Diagnostics Incorporated, Becton, Dickinson and Company, Bio-Rad Laboratories, Inc., Danaher Corporation, OraSure Technologies, Inc., and Alere Inc. These companies compete through advanced immunoassay technology, improved sensitivity, and wider multi-panel screening formats. Leaders focus on portable, easy-to-use kits designed for workplaces, hospitals, and law-enforcement agencies. Investments in digital readers, faster detection chemistry, and broader sample compatibility help strengthen their positions. Global players also expand distribution networks and strategic partnerships to reach emerging markets. Compliance with regulatory standards and strong clinical validation further supports competitive advantage.

Key Player Analysis

- Abbott Laboratories

- Thermo Fisher Scientific Inc.

- Siemens Healthineers AG

- Roche Diagnostics

- Quest Diagnostics Incorporated

- Becton, Dickinson and Company

- Bio-Rad Laboratories, Inc.

- Danaher Corporation

- OraSure Technologies, Inc.

- Alere Inc.

Recent Developments

- In September 2025, Siemens Healthineers announced a new benchtop drug‑testing analyzer: Atellica DT 250 Analyzer. This device supports comprehensive drug‑testing (urine, serum, plasma), with automated validity checks (adulteration, dilution) and fast turnaround (first results in as soon as 8 minutes).

- In April 2024, the FDA cleared a whole blood rapid test to help with the assessment of concussion at the patient’s bedside, run on Abbott’s portable i-STAT Alinity instrument.

- In February 2024, A major market research report covering drug abuse testing (including providers such as Danaher Corporation and Bio-Rad Laboratories, Inc.) was released, projecting growth from US$ 6.18 billion in 2023 to US$ 10.28 billion by 2030.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for rapid screening will rise as workplaces strengthen drug-testing rules.

- Law-enforcement agencies will expand field use of portable and high-accuracy kits.

- Hospitals will adopt advanced devices to support faster emergency toxicology decisions.

- Multi-panel drug tests will gain wider use due to broader substance detection needs.

- Digital readers and connected testing tools will see strong integration in routine screening.

- Manufacturers will focus on improving sensitivity and reducing false-result risks.

- Adoption will grow in emerging markets as awareness and healthcare access increase.

- Online distribution will expand as buyers seek convenient and fast procurement options.

- Regulatory updates will continue to shape product design and validation standards.

- Partnerships between global suppliers and regional distributors will improve market reach.

Market Segmentation Analysis:

Market Segmentation Analysis: