Market Overview

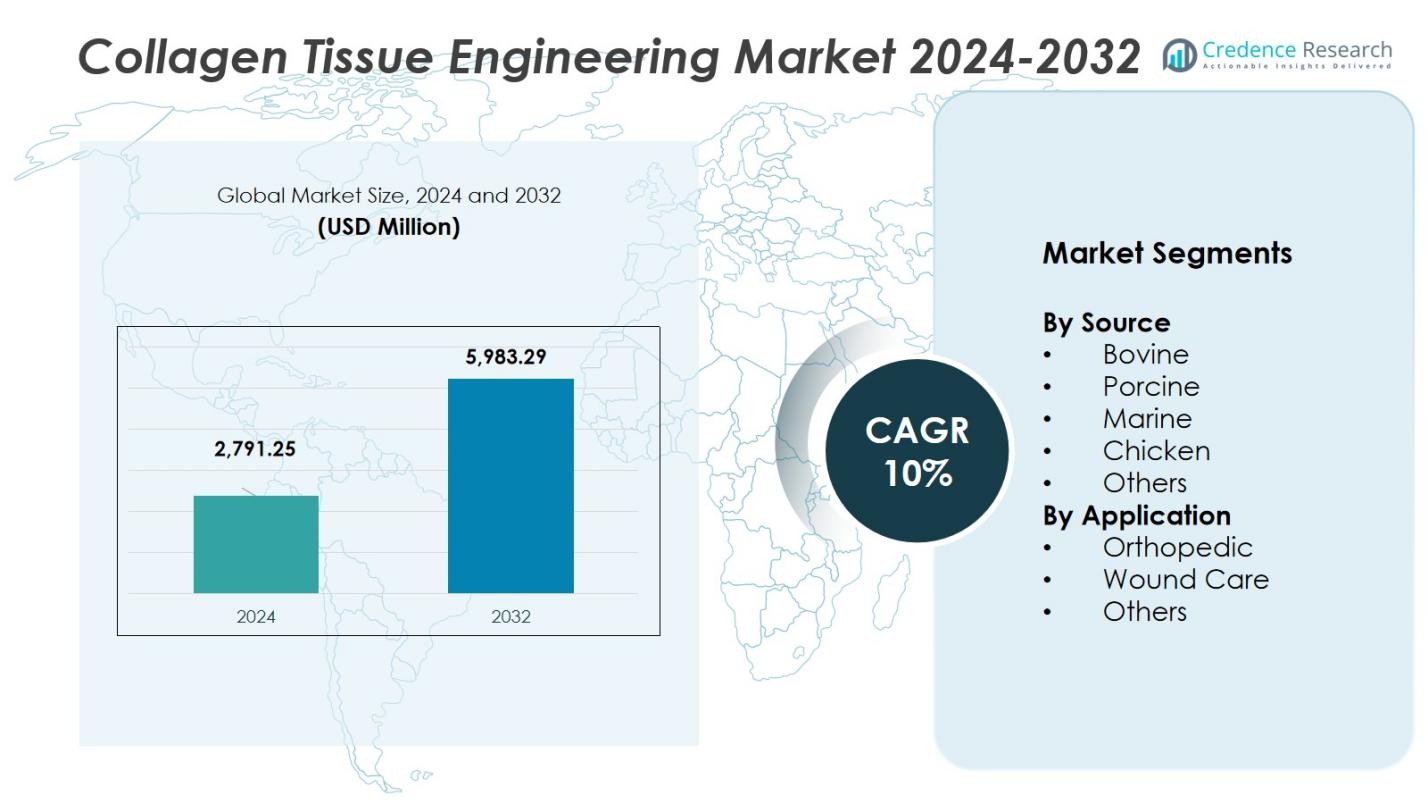

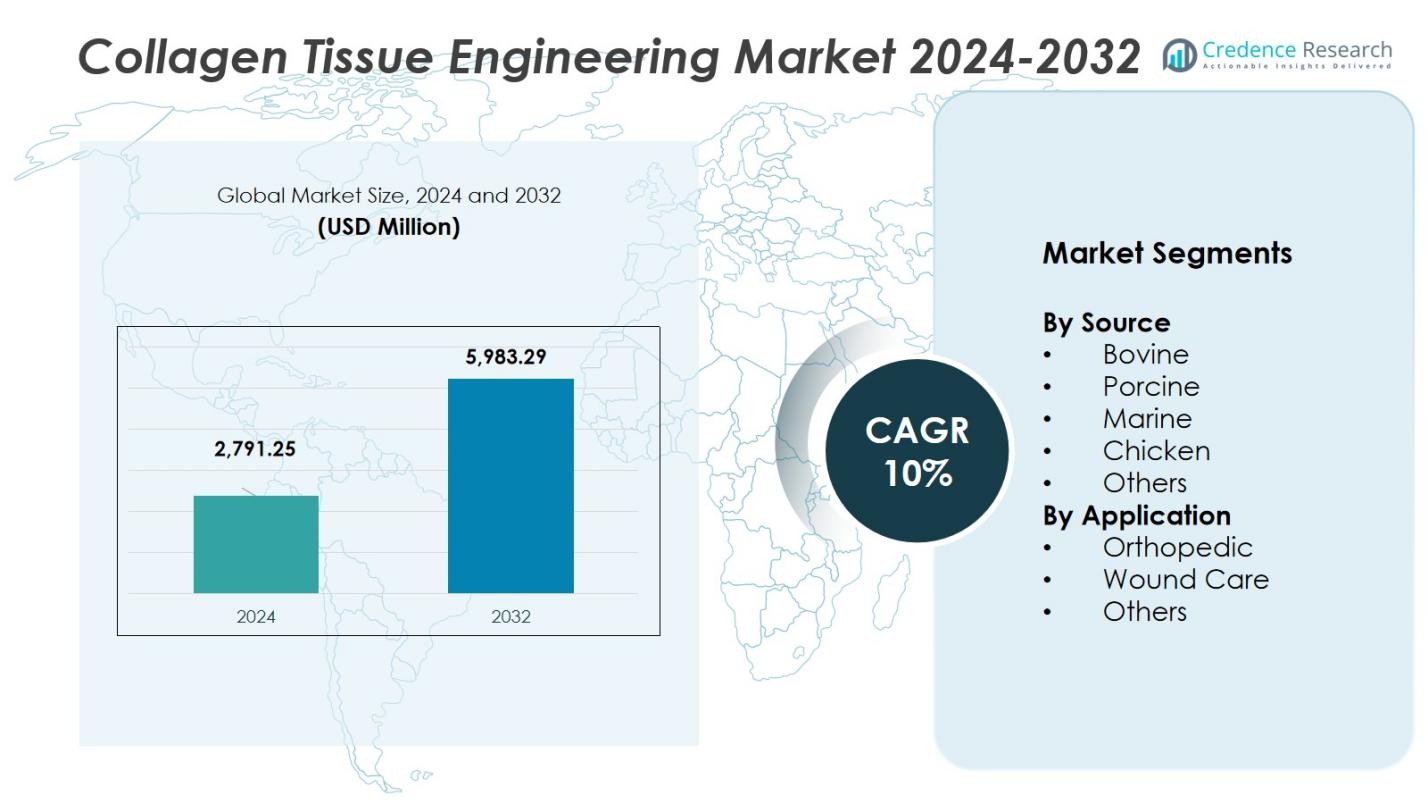

The Collagen Tissue Engineering Market size was valued at USD 2,791.25 million in 2024 and is anticipated to reach USD 5,983.29 million by 2032, at a CAGR of 10% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Collagen Tissue Engineering Market Size 2024 |

USD 2,791.25 Million |

| Collagen Tissue Engineering Market, CAGR |

10% |

| Collagen Tissue Engineering Market Size 2032 |

USD 5,983.29 Million |

The Collagen Tissue Engineering Market features key players such as Collagen Matrix Inc., Medtronic Plc, Advanced BioMatrix Inc., Collagen Solutions Plc, and CollPlant Ltd., who steer innovation and global outreach within the sector. These companies deploy strategies including advanced biomaterial R&D, strategic partnerships, and production scale‑up to solidify their positions. Geographically, North America serves as the leading region with a market share of 37%, supported by strong healthcare infrastructure and early adoption of collagen‑based therapies. Europe follows with 29%, benefiting from robust research ecosystems and regulatory support, while the Asia‑Pacific region holds 24%, driven by rising healthcare investment and expanding access to regenerative treatments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Collagen Tissue Engineering Market size was valued at USD 2,791.25 million in 2024 and is projected to reach USD 5,983.29 million by 2032, growing at a CAGR of 10% during the forecast period.

- Key drivers of market growth include the increasing ageing population, rising chronic disease burden, and advancements in regenerative medicine, which are driving demand for collagen scaffolds in orthopaedics, wound care, and other applications.

- Trends indicate a shift towards personalized medicine, with custom-engineered collagen scaffolds becoming more prevalent, alongside a rise in non-mammalian and recombinant collagen sourcing.

- Competitive dynamics are shaped by major players such as Collagen Matrix Inc., Medtronic Plc, and Collagen Solutions Plc, with a focus on innovation, partnerships, and geographic expansion to capture market share.

- Regional analysis shows North America holds the largest market share at 37%, followed by Europe at 29%, and Asia Pacific at 24%, with emerging markets in Asia presenting strong growth potential.

Market Segmentation Analysis:

By Source

The collagen tissue engineering market is significantly driven by bovine‑derived collagen, which holds 46% of the market share. This dominance is attributed to its abundant availability, cost‑effectiveness, and well‑established supply chains. Bovine collagen is widely used in orthopedic applications, particularly in bone and cartilage regeneration. Other notable sources include porcine collagen, which represents 20-25% of the market, driven by its structural similarity to human collagen, and marine collagen, which accounts for 15% and appeals to consumers seeking non‑mammalian alternatives due to ethical concerns.

- For instance, porcine collagen, favored for its structural similarity to human collagen, is commonly employed in wound healing and dental procedures where tissue scaffolding is critical, owing to its strong, oriented collagen fibril structure.

By Application

Orthopedic applications dominate the collagen tissue engineering market, accounting for 55% of the market share. This is due to the increasing demand for collagen‑based solutions in bone grafting, spinal fusion, and cartilage repair, driven by a growing aging population and rising incidence of musculoskeletal conditions. Wound care applications follow closely, holding 30% of the market, driven by the rising prevalence of chronic wounds and burns. Additionally, the “Others” category, including dental, cardiovascular, and aesthetic uses, captures 15% of the market, reflecting the expanding versatility of collagen in regenerative medicine.

- For instance, Products such as Collagen Solutions’ dental membranes and DSM-Firmenich’s medical-grade collagen in cosmetic and cardiovascular therapies illustrate this expanding versatility of collagen in regenerative medicine.

Key Growth Drivers

Growing ageing population and chronic disease burden

The growing global ageing population is increasing the demand for tissue‑repair solutions, driving the collagen tissue engineering market. The rise in osteoarthritis, fractures, and chronic wounds amplifies the need for collagen-based scaffolds in orthopedic and wound-care applications. Additionally, the increasing prevalence of diabetes and cardiovascular diseases, which often result in tissue damage, further supports the demand for collagen biomaterials. As these health conditions rise, collagen’s regenerative properties make it an essential solution for effective treatments.

- For instance, life expectancy has increased globally to 73.3 years as of 2024, contributing to longer durations of chronic disease management where collagen-based scaffolds play a critical role in improving patient outcomes in musculoskeletal, wound healing, and cardiovascular therapies.

Advancements in regenerative medicine and biomaterials technology

Technological advancements in tissue engineering, such as improved scaffold design, bioprinting, and recombinant collagen production, are accelerating the growth of the collagen tissue engineering market. Collagen’s compatibility with the human extracellular matrix makes it a key material in regenerative treatments. Innovations in these technologies are leading to more effective and personalized collagen-based products for diverse medical applications. This evolution in biomaterials has made collagen an increasingly viable option for tissue repair and regeneration, driving the market forward.

- For instance, innovations in collagen scaffold design include the development of photo-cross-linked hydrogels like collagen methacrylate (COLMA), which promote cell proliferation and chondrogenic differentiation, enhancing cartilage formation and bone repair outcomes.

Increased investment and regulatory support in tissue engineering

Investment in research and development, along with regulatory support for regenerative medicine, is boosting the collagen tissue engineering market. Governments and institutions are recognising the potential of engineered collagen biomaterials in therapeutic applications, encouraging innovation through grants and favorable policies. These initiatives help accelerate the development and approval of new collagen-based products, increasing their market accessibility. This support is vital in enabling collagen tissue engineering products to enter the market more swiftly, increasing the scope for wider adoption.

Key Trends & Opportunities

Rise of personalized medicine and custom‑engineered collagen scaffolds

A growing trend in the collagen tissue engineering market is the rise of personalized medicine, where custom-engineered collagen scaffolds are designed to meet individual patient needs. Advances in imaging and 3D bioprinting technologies allow for the creation of patient-specific biomaterials tailored to unique anatomical and pathological profiles. This trend offers significant growth opportunities by improving clinical outcomes, particularly in niche applications such as complex bone defects and soft tissue repairs, creating new avenues for collagen tissue engineering.

- For instance, researchers have developed macroporous alginate scaffolds functionalized with collagen peptides that support immune cell function to fight tumors, exemplifying precision biomaterials for personalized therapies.

Expansion into emerging application areas and markets

The collagen tissue engineering market is expanding into new application areas such as cardiovascular, dental, and soft tissue repair, providing additional growth opportunities. Emerging markets in regions like Asia-Pacific present untapped potential due to improvements in healthcare infrastructure and growing medical expenditure. As more applications for collagen biomaterials are discovered, and healthcare access improves in developing regions, manufacturers have the chance to introduce their products into diverse markets, further broadening the global reach and expanding the overall market share.

- For instance, 3D-printed collagen–nanocellulose hybrid bioscaffolds have been developed for bone and skin tissue engineering, showing enhanced mechanical strength and suitability for neovascularization and long-term cell growth.

Key Challenges

High production costs and scalability constraints

The collagen tissue engineering market faces challenges related to high production costs and scalability. The advanced manufacturing processes required to produce high-quality, tailored collagen scaffolds are expensive and difficult to scale efficiently. These cost barriers can limit the widespread adoption of collagen-based products, especially in price-sensitive markets. As a result, companies may struggle to maintain profitability while ensuring product affordability for healthcare systems, hindering broader market penetration and slowing overall growth.

Regulatory complexity and biomaterial sourcing concerns

Collagen-based tissue engineering products often encounter regulatory hurdles due to their complex classification as either biologics, devices, or combination products. These regulatory challenges can lead to lengthy approval processes and increased compliance costs. Additionally, ethical and safety concerns related to the sourcing of animal-derived collagen, such as potential immunogenicity and disease transmission, complicate market acceptance. These factors present obstacles in gaining widespread adoption and sourcing raw materials, affecting both the supply chain and the final product’s marketability.

Regional Analysis

North America

North America leads the collagen tissue engineering market with a market share of 37%, driven by robust healthcare infrastructure, extensive regenerative medicine research, and high adoption of collagen‑based therapies. The region benefits from strong reimbursement frameworks and substantial investment in advanced biomaterials, enabling companies to commercialise innovative collagen scaffolds more rapidly. Increasing prevalence of musculoskeletal disorders and chronic wounds among ageing populations further fuels demand. As a result, North America continues to establish itself as the benchmark region for tissue engineering applications that leverage collagen materials.

Europe

Europe commands a market share of 29% in the collagen tissue engineering market, underpinned by a strong research ecosystem and collaborations between academic institutions and industry. The region’s emphasis on regenerative medicine and its regulatory support for advanced biomaterials contribute to steady expansion. Growth is further supported by increasing healthcare spending and the rising burden of chronic wounds and orthopaedic conditions. European manufacturers are also benefiting from cross‑border integration within the European Union, enabling efficient distribution of collagen‑based therapies across multiple countries.

Asia Pacific

The Asia Pacific region holds around 24% share of the collagen tissue engineering market and is distinguished by the fastest growth trajectory among global regions. Expansion is driven by rising healthcare expenditure, improving medical infrastructure, and a growing ageing population in countries such as China, India, and Japan. Regulatory reforms and increased local manufacturing of biomaterials accelerate market access. The region presents significant opportunity for collagen scaffold providers to meet unmet needs in orthopaedics and wound care in emerging markets.

Latin America

Latin America registers a market share of 5% in the collagen tissue engineering sector, reflecting burgeoning interest but limited penetration compared to developed regions. Growth is predominantly supported by expanding hospital infrastructure, rising incidence of trauma and chronic wounds, and increased awareness of regenerative therapies. Challenges such as reimbursement constraints and supply‑chain limitations moderate growth, yet regional players and global suppliers are increasingly targeting Latin America as a strategic growth region.

Middle East & Africa

The Middle East & Africa region accounts for approximately 4% of the collagen tissue engineering market, with growth anchored in government‑led healthcare initiatives and rising incidence of chronic diseases. Adoption is driven by investments in advanced healthcare facilities and interest in regenerative solutions. However, market expansion is tempered by fragmented regulatory environments and limited local manufacturing, prompting reliance on imports. The region shows promising potential for collagen‑based therapies as infrastructure and funding mature.

Market Segmentations:

By Source

- Bovine

- Porcine

- Marine

- Chicken

- Others

By Application

- Orthopedic

- Wound Care

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape in the collagen tissue engineering market is characterized by major players such as Collagen Matrix Inc., Medtronic Plc, Advanced BioMatrix Inc., Collagen Solutions Plc, and CollPlant Ltd. These companies lead the market with their extensive product offerings and advanced research capabilities. They focus on developing collagen scaffolds for a range of applications, including orthopaedics, wound care, and soft tissue repair. Key strategies in this competitive space include product innovation, strategic collaborations, and expanding global distribution networks. Additionally, newer entrants are exploring recombinant and marine-derived collagen to address rising consumer demand for sustainable and ethical alternatives. Competitive pressures drive continuous improvements in cost efficiency, manufacturing scalability, and regulatory compliance. Companies are also investing in enhancing their intellectual property portfolios to maintain a competitive edge, further intensifying competition in this rapidly growing market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In June 2025, CollPlant Ltd. expanded its collaboration with STEMCELL Technologies to extend use of its plant‑derived recombinant human collagen (rhCollagen) into clinical development and commercial‑scale manufacturing

- In March 2023, Collagen Matrix Inc. rebranded as Regenity Biosciences and unveiled new material platforms to accelerate innovation in its collagen‑based regenerative devices.

- In June 2023, RegenLab USA LLC signed a collaborative agreement with Long Island University Brooklyn NYS, home to the “Dassault Systemes Center of Excellence,” to support research in regenerative medicine.

- In January 2023, Essent Biologics, a prominent producer of human-derived cell and scaffold materials, announced the launch of Human Native Tissue-Derived Type I Atelocollagen for the cell and tissue engineering industry.

Report Coverage

The research report offers an in-depth analysis based on Source, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The collagen tissue engineering market will benefit from escalating demand for musculoskeletal repair, driven by the increasing prevalence of bone and cartilage disorders in aging populations.

- Advances in scaffold fabrication including 3D bioprinting and electrospinning will unlock more complex, patient‑specific collagen constructs and expand clinical adoption.

- Rising regulatory support for regenerative therapies will lower market entry barriers, stimulating faster commercialisation of collagen‑based biomaterials.

- Development of non‑mammalian and recombinant collagen sources will address ethical, religious and zoonotic concerns, opening broader global acceptance.

- Emerging applications in dental, cardiovascular and soft‑tissue repair will diversify use‑cases and increase collagen scaffold uptake beyond orthopaedics and wound care.

- Growth in emerging markets—especially Asia‑Pacific—with improving healthcare infrastructure and medical spending will provide significant upside for collagen tissue‑engineering products.

- Partnerships between biomaterial manufacturers, research institutions and clinical centres will accelerate product innovation and enhance market presence.

- Cost‑effective manufacturing methods and scale‑up of production will improve affordability and adoption in cost‑sensitive markets.

- Tailored therapies and custom‑engineered collagen scaffolds will support personalised medicine strategies and drive premium product segments.

- Continued focus on enhancing mechanical strength, bioactivity and long‑term performance of collagen scaffolds will improve clinical outcomes and further legitimise their use in load‑bearing applications.