Market Overview

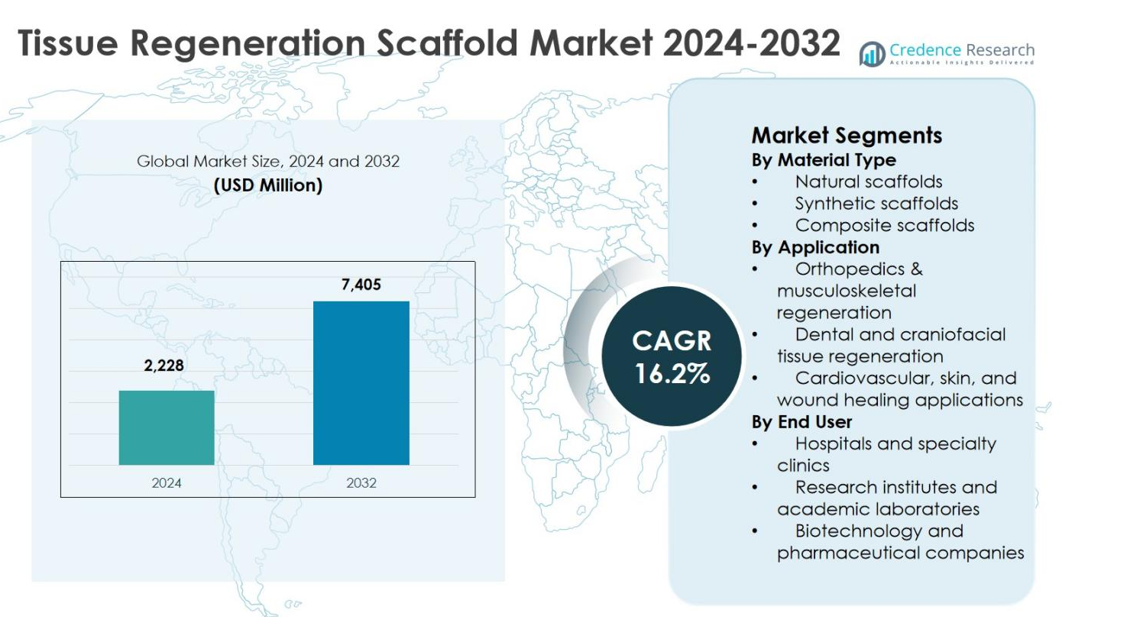

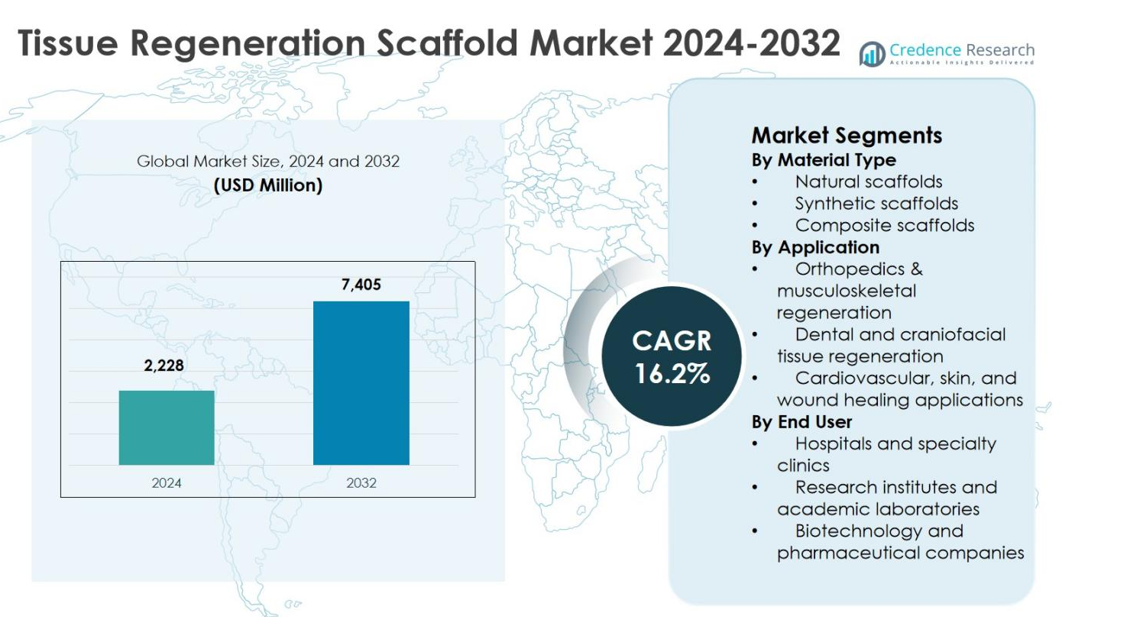

The Tissue Regeneration Scaffold Market size was valued at USD 2,228 million in 2024 and is anticipated to reach USD 7,405 million by 2032, expanding at a CAGR of 16.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Tissue Regeneration Scaffold Market Size 2024 |

USD 2,228 million |

| Tissue Regeneration Scaffold Market , CAGR |

16.2% |

| Tissue Regeneration Scaffold Market Size 2032 |

USD 7,405 million |

The Tissue Regeneration Scaffold Market is driven by the strong presence of established medical device and regenerative medicine companies focusing on innovation, portfolio expansion, and clinical adoption. Key players such as Integra LifeSciences Corporation, MiMedx Group, Organogenesis Holdings, Smith & Nephew plc, Stryker Corporation, Zimmer Biomet Holdings, Medtronic plc, Baxter International, Tissue Regenix Group, and AlloSource actively invest in advanced synthetic and composite scaffold technologies to support orthopedic, dental, and wound healing applications. Regionally, North America led the market with a 38.6% share in 2024, supported by advanced healthcare infrastructure, high procedure volumes, and strong research activity. Europe followed with steady adoption, while Asia Pacific emerged as a high-growth region due to expanding healthcare access and regenerative therapy awareness.

Market Insights

- The Tissue Regeneration Scaffold Market was valued at USD 2,228 million in 2024, is expected to reach USD 7,405 million by 2032, and is projected to grow at a CAGR of 16.2% during the forecast period.

- The market growth is driven by increasing orthopedic, dental, and wound healing procedures, rising demand for personalized regenerative therapies, and advancements in scaffold design and biomaterials.

- Key trends include the rising adoption of composite and bioactive scaffolds, integration of growth factors and stem cell technologies, and growing research collaborations that accelerate clinical applications.

- Leading companies such as Integra LifeSciences Corporation, MiMedx Group, Organogenesis Holdings, Smith & Nephew plc, and Stryker Corporation maintain strong positions through product innovation and strategic partnerships, while competitive dynamics focus on technology differentiation.

- Regionally, North America accounted for 6% share in 2024, followed by Europe with 29.4% and Asia Pacific with 22.8%, while high costs of development and regulatory complexities restrain broader market adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Material Type:

The Tissue Regeneration Scaffold Market, by material type, is led by synthetic scaffolds, which accounted for 44.6% market share in 2024 due to their superior mechanical strength, controlled degradation rates, and reproducibility in large-scale manufacturing. Polymers such as polylactic acid and polycaprolactone support consistent tissue growth and regulatory compliance, making them widely adopted in clinical applications. Natural scaffolds held a significant share driven by high biocompatibility, while composite scaffolds gained traction for combining bioactivity with structural integrity. Rising demand for customizable, load-bearing scaffolds continues to reinforce synthetic scaffold dominance.

- For instance, Poly-Med, Inc. provides medical-grade absorbable polylactic acid (PLA)-based scaffolds tailored for regenerative medicine, offering customizable biodegradability through hydrolysis into lactic acid for bone tissue engineering applications.

By Application:

By application, orthopedics and musculoskeletal regeneration dominated the Tissue Regeneration Scaffold Market with a 41.8% share in 2024, supported by increasing incidences of bone defects, joint disorders, and sports injuries. Scaffolds are extensively used in bone graft substitutes, cartilage repair, and spinal fusion procedures due to their ability to promote cell adhesion and osteointegration. Dental and craniofacial regeneration followed, driven by implant procedures, while cardiovascular, skin, and wound healing applications expanded steadily with advancements in bioresorbable and porous scaffold designs for soft tissue repair.

- For instance, in the pivotal SUMMIT randomized trial, Vericel’s MACI showed clinically superior improvements in pain and function (via KOOS subscores) compared to microfracture at 2 and 5 years.

By End User:

Based on end user, hospitals and specialty clinics accounted for the largest share of 48.3% in 2024, driven by high procedural volumes, availability of advanced surgical infrastructure, and growing adoption of regenerative therapies in clinical settings. These facilities serve as primary centers for orthopedic, dental, and wound care procedures utilizing scaffolds. Biotechnology and pharmaceutical companies followed due to increased investment in product development, while research institutes and academic laboratories contributed through preclinical studies and translational research supporting innovation and commercialization of next-generation scaffold technologies.

Key Growth Drivers

Rising Demand for Regenerative and Personalized Therapies

The Tissue Regeneration Scaffold Market is strongly driven by the growing demand for regenerative and personalized medical treatments. Increasing prevalence of orthopedic disorders, traumatic injuries, and chronic wounds has accelerated adoption of scaffold-based solutions that support tissue repair and functional restoration. Clinicians increasingly prefer scaffolds that enable patient-specific healing outcomes through controlled cell growth and integration. Advancements in biomaterials and fabrication techniques allow customization based on defect size and tissue type, improving clinical success rates. This shift toward precision medicine continues to expand scaffold utilization across multiple therapeutic areas.

- For instance, Vericel Corporation’s MACI uses autologous cultured chondrocytes on a porcine collagen membrane scaffold to treat knee cartilage defects, with cells grown to nearly 1 million per square centimeter for precise filling and integration tailored to defect size.

Expansion of Orthopedic and Dental Procedures

The rapid growth in orthopedic and dental surgical procedures represents a major driver for the Tissue Regeneration Scaffold Market. Aging populations, rising sports injuries, and higher incidences of degenerative bone and joint conditions have increased demand for bone graft substitutes and cartilage repair solutions. In dental and craniofacial applications, scaffolds support implant stability and bone regeneration, enhancing procedural outcomes. Improved reimbursement frameworks and broader access to advanced surgical care further support adoption. Continuous innovation in load-bearing and bioactive scaffolds strengthens their role in routine orthopedic and dental practices.

- For instance, University of Queensland researchers developed patient-specific 3D-printed polycaprolactone (PCL) scaffolds for alveolar ridge augmentation. In a 46-year-old patient’s case, the scaffold enabled new bone to fully fill the defect over six months, achieving good implant stability with no complications.

Technological Advancements in Scaffold Design and Manufacturing

Ongoing advancements in scaffold design and manufacturing technologies significantly propel market growth. Innovations such as 3D printing, electrospinning, and nanofiber fabrication enable precise control over scaffold porosity, geometry, and mechanical properties. These technologies improve cell adhesion, vascularization, and tissue integration, enhancing therapeutic effectiveness. Automation and scalable manufacturing processes also support consistent quality and regulatory compliance. As technology maturity increases, manufacturers can deliver high-performance scaffolds suitable for complex clinical applications, accelerating adoption across hospitals, research institutions, and biotechnology companies.

Key Trends & Opportunities

Increasing Adoption of Composite and Bioactive Scaffolds

A key trend shaping the Tissue Regeneration Scaffold Market is the rising adoption of composite and bioactive scaffolds. These scaffolds combine the biocompatibility of natural materials with the mechanical strength of synthetic polymers, delivering improved performance across diverse applications. Incorporation of growth factors, stem cells, and bioactive molecules enhances tissue regeneration efficiency. This trend creates opportunities for manufacturers to develop multifunctional scaffolds targeting complex tissue defects, positioning composite solutions as a high-value segment with strong commercialization potential.

- For instance, Integra LifeSciences develops composite scaffolds for tissue repair in neurosurgery and regenerative applications, leveraging biomaterials that integrate with brain, spine, and peripheral nerve tissues for reconstruction.

Growing Research Collaborations and Translational Studies

Expanding collaboration between research institutes, academic laboratories, and biotechnology companies presents a significant opportunity in the Tissue Regeneration Scaffold Market. Increased funding for translational research accelerates the movement of scaffold technologies from laboratory settings to clinical applications. Partnerships enable faster validation, clinical trials, and regulatory approvals while reducing development risks. These collaborations also support innovation in next-generation scaffolds designed for specific tissues, opening new revenue streams and strengthening long-term market expansion across both developed and emerging healthcare systems.

- For instance, RCSI’s TERG collaborates with the RCSI School of Pharmacy and Biomolecular Sciences and the National University of Ireland Maynooth’s Department of Biology to create growth factor-enhanced collagen-glycosaminoglycan scaffolds for airway regeneration and respiratory drug delivery.

Key Challenges

High Development and Manufacturing Costs

High development and manufacturing costs remain a critical challenge for the Tissue Regeneration Scaffold Market. Advanced biomaterials, complex fabrication techniques, and stringent quality control requirements significantly increase production expenses. Customization and incorporation of bioactive components further elevate costs, impacting pricing and affordability. Smaller manufacturers and research-driven startups face barriers to scaling operations, while healthcare providers in cost-sensitive regions may limit adoption. Addressing cost efficiency without compromising performance remains essential for broader market penetration.

Regulatory Complexity and Clinical Validation Requirements

Regulatory complexity and extensive clinical validation requirements pose another major challenge for the Tissue Regeneration Scaffold Market. Scaffold products must meet strict safety, biocompatibility, and efficacy standards before commercialization. Lengthy approval timelines and high clinical trial costs delay market entry and increase financial risk for developers. Variations in regulatory frameworks across regions further complicate global expansion strategies. Navigating these regulatory hurdles requires significant expertise and investment, potentially slowing innovation and limiting the pace of new product launches.

Regional Analysis

North America

North America dominated the Tissue Regeneration Scaffold Market with a 38.6% market share in 2024, supported by advanced healthcare infrastructure, high adoption of regenerative therapies, and strong presence of leading biotechnology and medical device companies. The region benefits from significant investments in tissue engineering research, favorable reimbursement policies, and early adoption of innovative scaffold technologies. High prevalence of orthopedic disorders, sports injuries, and chronic wounds continues to drive procedural volumes. Additionally, robust clinical trial activity and regulatory clarity accelerate commercialization, reinforcing North America’s leadership position in scaffold-based tissue regeneration solutions.

Europe

Europe accounted for a 29.4% share of the Tissue Regeneration Scaffold Market in 2024, driven by rising demand for advanced orthopedic and dental regeneration procedures. Strong government support for regenerative medicine research, particularly in Germany, the United Kingdom, and France, supports market growth. Increasing aging population and higher incidence of musculoskeletal disorders contribute to sustained demand. European manufacturers emphasize biocompatible and bioresorbable scaffolds aligned with stringent regulatory standards. Collaborative research initiatives between academic institutions and industry players further strengthen innovation and adoption across both clinical and research applications.

Asia Pacific

Asia Pacific held a 22.8% market share in 2024 and represents the fastest-growing region in the Tissue Regeneration Scaffold Market. Rapid expansion of healthcare infrastructure, increasing medical tourism, and growing awareness of regenerative treatments are key growth drivers. Countries such as China, Japan, South Korea, and India are witnessing rising orthopedic surgeries and dental implant procedures. Government investments in biotechnology research and expanding manufacturing capabilities enhance regional competitiveness. Cost-effective production and a large patient pool create strong opportunities for both global and domestic players to expand their market presence.

Latin America

Latin America captured a 5.6% share of the Tissue Regeneration Scaffold Market in 2024, supported by gradual improvements in healthcare access and growing adoption of advanced surgical procedures. Brazil and Mexico lead regional demand due to expanding private healthcare sectors and increasing orthopedic and trauma cases. Rising awareness of regenerative medicine and improving clinical expertise support scaffold adoption. However, limited reimbursement coverage and budget constraints restrict faster penetration. Strategic partnerships with global manufacturers and investments in specialty clinics are expected to support steady market development across the region.

Middle East & Africa

The Middle East & Africa region accounted for a 3.6% market share in 2024, reflecting early-stage adoption of tissue regeneration scaffold technologies. Growth is driven by increasing investments in healthcare infrastructure, particularly in the Gulf Cooperation Council countries, and rising demand for advanced wound care and orthopedic treatments. Expanding medical tourism and government initiatives to modernize healthcare systems support market entry. However, limited local manufacturing capabilities and uneven access to advanced therapies constrain growth. Ongoing infrastructure development and training initiatives are expected to gradually improve regional adoption rates.

Market Segmentations:

By Material Type

- Natural scaffolds

- Synthetic scaffolds

- Composite scaffolds

By Application

- Orthopedics & musculoskeletal regeneration

- Dental and craniofacial tissue regeneration

- Cardiovascular, skin, and wound healing applications

By End User

- Hospitals and specialty clinics

- Research institutes and academic laboratories

- Biotechnology and pharmaceutical companies

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Integra LifeSciences Corporation, MiMedx Group, Inc., Organogenesis Holdings Inc., Smith & Nephew plc, Tissue Regenix Group plc, Stryker Corporation, Zimmer Biomet Holdings, Inc., Medtronic plc, Baxter International Inc., and AlloSource. The Tissue Regeneration Scaffold Market is characterized by moderate consolidation, with leading players focusing on product innovation, portfolio expansion, and strategic collaborations to strengthen market presence. Companies prioritize development of advanced synthetic and composite scaffolds that offer improved mechanical strength, biocompatibility, and controlled degradation. Strategic partnerships with research institutes and hospitals support clinical validation and accelerate commercialization. Market participants also invest in acquisitions to enhance technological capabilities and expand geographic reach. Emphasis on regulatory compliance, scalable manufacturing, and customization capabilities remains critical to maintaining competitiveness. Continuous investment in research and development enables differentiation, while expanding clinical applications in orthopedics, dental, and wound care sustains long-term competitive positioning.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Integra LifeSciences Corporation

- AlloSource

- MiMedx Group, Inc.

- Organogenesis Holdings Inc.

- Smith & Nephew plc

- Tissue Regenix Group plc

- Stryker Corporation

- Zimmer Biomet Holdings, Inc.

- Medtronic plcBaxter International Inc.

- Baxter International Inc.

Recent Developments

- In December 2025, the FDA approved the Acellular Nerve Allograft peripheral nerve scaffold for treatment of sensory and motor nerve discontinuity, marking a regulatory milestone in scaffold-based nerve regeneration.

- In December 2025, Tiger Aesthetics Medical announced a strategic investment in GenesisTissue Inc to advance personalized 3D bioprinting technologies for breast reconstruction and cosmetic applications.

- In June 2025, CollPlant Biotechnologies secured a European patent allowance for its collagen-based formulations usable as soft tissue fillers and implants, enhancing its tissue repair portfolio

Report Coverage

The research report offers an in-depth analysis based on Material Type, Application, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Tissue Regeneration Scaffold Market is expected to witness sustained growth driven by expanding applications in orthopedics, dental, and wound healing therapies.

- Advancements in biomaterials will improve scaffold biocompatibility, mechanical strength, and controlled biodegradation.

- Increased adoption of 3D printing technologies will enable patient-specific and anatomically precise scaffold designs.

- Composite scaffolds combining natural and synthetic materials will gain wider acceptance for complex tissue regeneration.

- Integration of growth factors and stem cell technologies will enhance regenerative outcomes and clinical success rates.

- Expanding clinical validation and real-world evidence will support broader physician adoption across healthcare settings.

- Strategic collaborations between biotechnology companies and research institutes will accelerate innovation and commercialization.

- Regulatory frameworks will continue to evolve, improving clarity for product approvals and market entry.

- Growth in emerging economies will be supported by improving healthcare infrastructure and rising surgical volumes.

- Continuous investment in research and manufacturing scalability will strengthen long-term market sustainability.