Market Overview

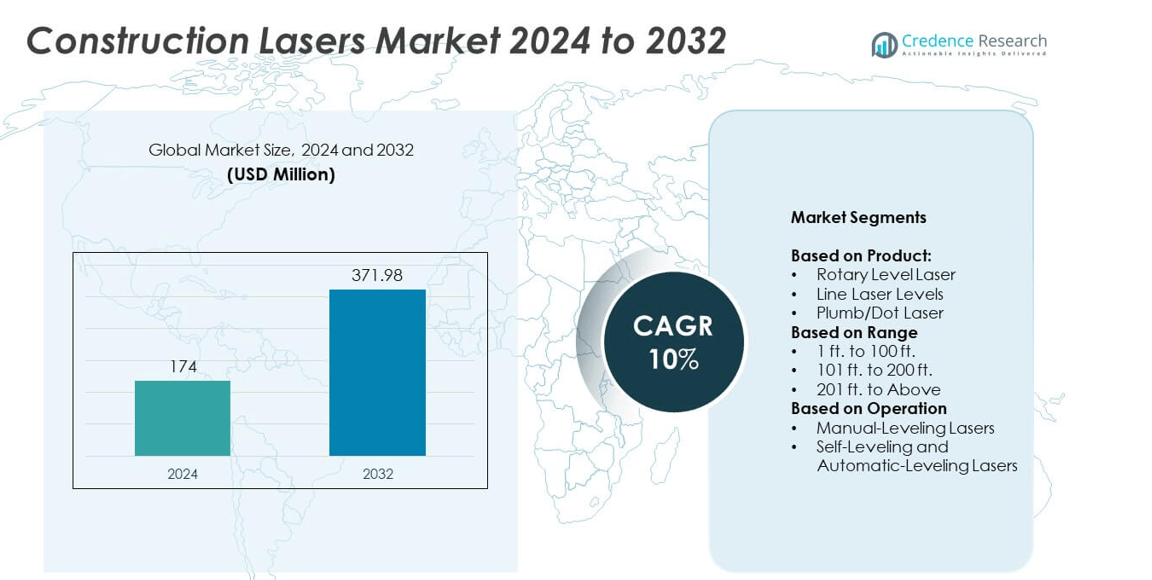

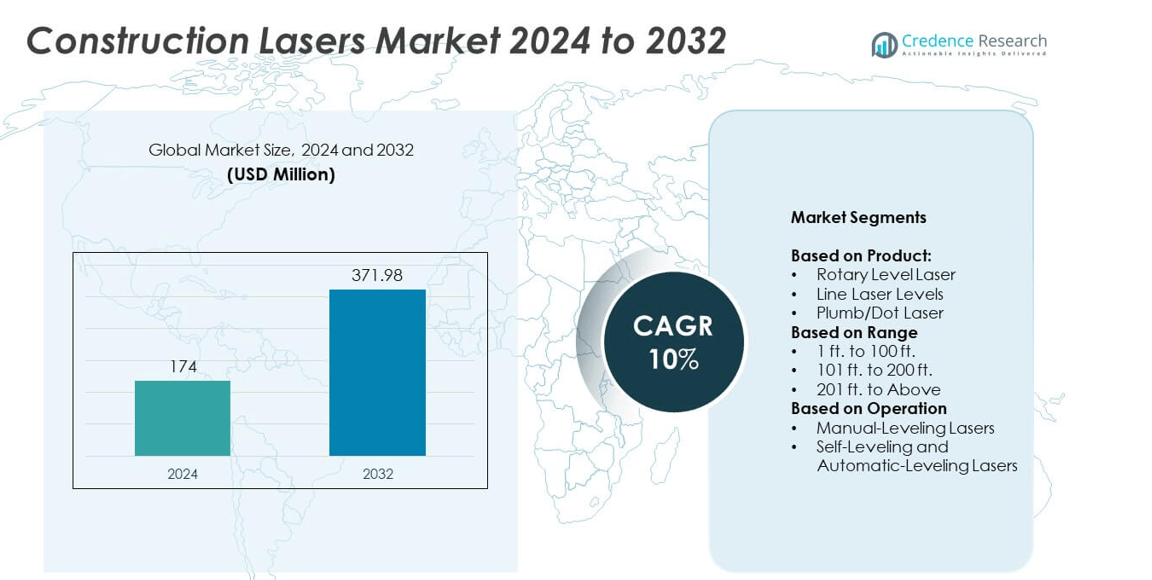

Construction Lasers market size was valued USD 174 Million in 2024 and is anticipated to reach USD 371.98 Million by 2032, at a CAGR of 10% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Construction Lasers Market Size 2024 |

USD 174 Million |

| Construction Lasers Market, CAGR |

10% |

| Construction Lasers Market Size 2032 |

USD 371.98 Million |

The construction lasers market is led by key players such as Laser Tools Co. Inc, Spectra Precision, Fluor, STABILA, Trimble, Hilti, Topcon, Qualcomm, Stanley Black & Decker, Inc., ADA Instruments, Pacific Laser Systems, SOLA, Makita, Leica Geosystems AG, AdirPro, DotProduct, and Kapro Industries Ltd. These companies focus on developing advanced rotary and self-leveling lasers with improved accuracy, durability, and digital integration to meet growing construction demands. North America emerged as the leading region, holding 38% of the market share in 2024, driven by significant infrastructure investments, technological adoption, and the presence of established construction equipment manufacturers.

Market Insights

- The construction lasers market was valued at USD 174 million in 2024 and is expected to reach USD 371.98 million by 2032, growing at a CAGR of 10%.

- Rising infrastructure development, urbanization, and demand for accurate leveling tools are driving market growth across residential, commercial, and industrial construction projects.

- Key trends include the adoption of smart, connected laser systems, integration with BIM platforms, and rising popularity of compact, multi-functional devices for small and mid-sized contractors.

- The market is moderately competitive, with companies focusing on innovation, product durability, wireless connectivity, and expanding distribution networks to maintain an edge.

- North America led the market with 38% share in 2024, followed by Europe at 27% and Asia Pacific at 25%, while rotary level lasers accounted for the largest product share, driven by their wide application in grading, alignment, and large-scale infrastructure projects.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

Rotary level lasers dominated the construction lasers market with over 45% share in 2024. Their ability to project 360-degree horizontal and vertical reference lines makes them ideal for large construction sites. These lasers are preferred for grading, foundation work, and alignment applications that demand high accuracy. Line laser levels followed closely, finding use in interior construction, tiling, and framing due to their ease of setup. Demand is driven by growing infrastructure projects and contractors’ focus on reducing human error. Advanced models with digital displays and Bluetooth connectivity further boost adoption across residential and commercial projects.

- For instance, Spectra Precision sells the LL500 self-leveling rotary laser with a working diameter of 1,600 ft and accuracy of ±1/16-inch at 100 ft.

By Range

Construction lasers in the 101 ft. to 200 ft. range accounted for around 50% of market share in 2024. This range supports most mid-size construction tasks, including site leveling, ceiling alignment, and wall positioning, making it the preferred choice among contractors. Models in this range balance cost and coverage, offering high precision without excessive investment. The segment benefits from growing mid-scale infrastructure projects, especially in developing regions. Increasing demand for portable and battery-efficient devices with extended operating ranges is encouraging manufacturers to introduce improved models with enhanced beam visibility and rugged design.

- For instance, the Topcon RL-H5A rotary laser has a working span of 800 meters (≈ 2,600 ft) diameter.

By Operation

Self-leveling and automatic-leveling lasers led the market with approximately 60% share in 2024. These lasers automatically adjust to maintain accuracy, saving time and reducing manual calibration efforts. Their adoption is rising in commercial and civil construction projects where efficiency and precision are critical. Manual-leveling lasers remain in use for smaller projects and budget-conscious buyers but are gradually being replaced. Growth is driven by the demand for user-friendly tools that minimize errors and support faster project execution. Integration of smart sensors and wireless controls is further improving productivity on construction sites.

Market Overview

Rising Infrastructure Development

Rising infrastructure spending is the primary growth driver for the construction lasers market. Large-scale projects such as highways, airports, and urban redevelopment demand precise leveling and alignment tools. Rotary and line lasers ensure accuracy in grading, excavation, and layout tasks, reducing project delays. Emerging economies are investing heavily in public infrastructure, boosting demand for advanced surveying tools. Government initiatives to upgrade aging infrastructure in developed regions further strengthen the market. This driver remains the most critical as it directly fuels product adoption across residential, commercial, and industrial construction sectors.

- For instance, the LRE203-G rotary laser from UniqueNav features an automatic leveling horizontal accuracy of $\pm$15″ (arc seconds). When used with a receiver, the instrument has a working range of up to 1,000 meters diameter. This makes it suitable for large-scale construction and surveying projects

Adoption of Digital Construction Tools

The integration of digital construction tools drives market growth by enabling precision and automation. Self-leveling lasers, often paired with digital measuring devices, enhance efficiency and reduce human errors. Contractors increasingly favor connected devices that integrate with Building Information Modeling (BIM) systems. This digital shift supports faster project completion and reduces rework. Manufacturers are launching smart lasers with Bluetooth and wireless connectivity to cater to this demand. The adoption of automated solutions is expected to expand with Industry 4.0 practices, fueling further penetration of technologically advanced construction lasers globally.

- For instance, the DeWalt DCLE34033D1 High Precision 3 x 360° Green Laser features three full-coverage green laser lines. It has an accuracy of $\pm\(1/8-inchat50ft(\)\pm$3.1mm at 15m). The visible working range is up to 230 ft (70 m). When used with an optional DW0892G detector in pulse mode, the working range extends to 330 ft (100 m). The laser is compatible with either a 12V MAX or 20V MAX battery.

Growing Focus on Worker Productivity

Increasing demand for improved worker productivity significantly supports market expansion. Construction lasers reduce manual effort in leveling, alignment, and layout tasks, enabling faster project execution. Companies seek to minimize labor costs and improve output, making precision tools essential. The need for accurate measurements in large construction projects enhances reliance on automated systems. Portable and battery-efficient models allow teams to work continuously without downtime. This focus on efficiency is pushing contractors to replace traditional tools with advanced laser equipment, driving overall market growth across all construction project sizes.

Key Trends & Opportunities

Integration of Smart Technologies

Smart construction lasers equipped with wireless connectivity and sensor-based automation are gaining popularity. These devices allow remote operation and instant data transfer, streamlining construction workflows. Integration with cloud platforms enables real-time monitoring and error detection, improving decision-making. Manufacturers are leveraging IoT and AI to enhance beam accuracy and adapt to site conditions. This trend opens opportunities for suppliers to target high-tech infrastructure projects and smart city developments. The push toward connected job sites ensures that smart-enabled laser tools will see strong adoption over the forecast period.

- For instance, PLS (a Fluke company)’s HV2R Manual-Slope Rotary Laser Kit features accuracy of ≤ 2.2 mm at 30 m (≈ 3/32-inch at 100 ft), working range of ≤ 30 m without detector and ≤ 300 m with its XLD detector.

Rise of Compact and Multi-Function Devices

There is a growing opportunity in compact, multi-functional laser devices that offer portability and flexibility. Contractors increasingly demand tools that can handle multiple tasks, such as grading, alignment, and squaring, with a single setup. Compact models save space and are ideal for interior and residential applications where mobility is key. Manufacturers are focusing on lightweight yet rugged designs that deliver professional accuracy. This trend aligns with the increasing demand for cost-effective solutions for small and medium contractors, creating new revenue streams for market players globally.

- For instance, Spectra Precision’s LL300N rotary laser has ±3/32 inch accuracy at 100 ft, a working diameter range of 1,650 ft (500 m), and battery life of about 90 hours on alkaline batteries.

Key Challenges

High Initial Investment Costs

The high upfront cost of advanced construction lasers remains a major challenge for market penetration. Small contractors and individual users often hesitate to invest in rotary or self-leveling models due to budget constraints. Although these tools improve accuracy and save time, the initial expense can be prohibitive, especially in price-sensitive markets. Rental services and used equipment markets are growing as a result, impacting direct sales. Manufacturers must focus on offering affordable models or financing options to expand adoption among small and mid-scale construction businesses.

Lack of Skilled Operators

The shortage of trained personnel to operate advanced construction lasers poses another challenge. Accurate use of self-leveling and rotary lasers requires some level of technical expertise. Inexperienced operators can misinterpret readings, leading to costly construction errors and rework. Training programs and easy-to-use interfaces are critical to overcome this barrier. Manufacturers are working on developing user-friendly devices with intuitive controls and auto-calibration features. However, widespread adoption may still be limited until workforce training improves, particularly in developing markets where skill gaps are more prominent.

Regional Analysis

North America

North America held the largest share of the construction lasers market with 38% in 2024. The region benefits from robust investments in commercial buildings, infrastructure upgrades, and smart city projects. The U.S. dominates due to rapid adoption of self-leveling and rotary lasers in road construction and residential developments. Contractors focus on precision tools to reduce project delays, driving strong demand. Canada’s construction sector also contributes through public infrastructure spending and housing projects. Growing use of digital construction technologies, coupled with government funding for transportation and energy infrastructure, supports continued growth of construction lasers across the region.

Europe

Europe accounted for 27% of the construction lasers market in 2024, driven by renovation projects and energy-efficient building initiatives. Countries like Germany, the U.K., and France lead adoption due to stringent building standards and growing demand for precise leveling tools. Urban redevelopment projects and government focus on sustainable infrastructure contribute to market expansion. Integration of lasers with digital measuring systems is gaining traction, improving efficiency. The shift toward prefabrication and modular construction supports demand for accurate tools. Eastern Europe is experiencing gradual growth, supported by rising construction investments in Poland, Hungary, and other emerging economies.

Asia Pacific

Asia Pacific captured 25% market share in 2024, supported by rapid urbanization and infrastructure expansion in China, India, and Southeast Asia. Mega projects such as metro rail networks, smart cities, and industrial zones drive demand for rotary and line lasers. Affordable labor and government funding encourage the use of modern tools to speed up timelines. Manufacturers are increasingly targeting this region with cost-effective and portable solutions. Japan and South Korea contribute through technological innovation and advanced construction practices. The growing real estate sector and large-scale public infrastructure projects are expected to sustain strong market growth.

Latin America

Latin America represented 6% of the construction lasers market in 2024. Brazil, Mexico, and Chile are leading contributors, supported by increasing investment in residential and commercial construction. Infrastructure modernization programs, particularly in transportation and energy, drive adoption of precise leveling and alignment tools. Demand is rising for cost-effective and durable equipment suited to varied site conditions. Economic fluctuations and budget limitations remain challenges but are being offset by public-private partnerships. Adoption of portable laser devices is increasing among small contractors, helping improve productivity and accuracy in construction projects across the region’s emerging economies.

Middle East & Africa

Middle East & Africa held a 4% share of the construction lasers market in 2024. Rapid urbanization and ambitious infrastructure projects, including smart cities and mega real estate developments, fuel market demand. The Gulf countries dominate due to large-scale investments in commercial buildings, airports, and transport networks. Africa is witnessing steady growth through housing projects and government-backed infrastructure initiatives. The region is gradually adopting self-leveling lasers to meet project quality standards. Although economic volatility and limited skilled workforce pose challenges, increasing foreign investment and construction activity continue to support the market’s expansion across key countries.

Market Segmentations:

By Product:

- Rotary Level Laser

- Line Laser Levels

- Plumb/Dot Laser

By Range

- 1 ft. to 100 ft.

- 101 ft. to 200 ft.

- 201 ft. to Above

By Operation

- Manual-Leveling Lasers

- Self-Leveling and Automatic-Leveling Lasers

By Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The construction lasers market is characterized by the presence of key players such as Laser Tools Co. Inc, Spectra Precision, Fluor, STABILA, Trimble, Hilti, Topcon, Qualcomm, Stanley Black & Decker, Inc., ADA Instruments, Pacific Laser Systems, SOLA, Makita, Leica Geosystems AG, AdirPro, DotProduct, and Kapro Industries Ltd. Competition is driven by continuous innovation, with companies focusing on developing advanced self-leveling and rotary lasers with enhanced accuracy and durability. Many players are integrating wireless connectivity and digital interfaces to meet the demand for smart construction tools. Partnerships with distributors and contractors expand market presence and improve after-sales service networks. Manufacturers are also investing in compact, battery-efficient models to cater to small and medium contractors. The competitive landscape is further shaped by price differentiation, product reliability, and regional expansion strategies, ensuring that companies remain competitive in a growing market focused on precision and efficiency.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Laser Tools Co. Inc

- Spectra Precision

- Fluor

- STABILA

- Trimble

- Hilti

- Topcon

- Qualcomm

- Stanley Black & Decker, Inc.

- ADA Instruments

- Pacific Laser Systems

- SOLA

- Makita

- Leica Geosystems AG

- AdirPro

- DotProduct

- Kapro Industries Ltd.

Recent Developments

- In 2025, STABILA launched the LAX 500 G cross line plus plumb point laser. This model features highly visible green laser lines that allow users to work directly at distances up to 40 meters, enhancing usability for interior construction tasks.

- In 2023, Topcon positioning systems launched the LN-50 3D laser. This new layout navigator offers streamline precision measurement. The range for this new laser is 50-meters, which is user friendly, self-leveling and cost effective.

- In 2022, Precisional LLC acquired four industrial technology businesses from Trimble, including Spectra Precision Tools.

Report Coverage

The research report offers an in-depth analysis based on Product, Range, Operation and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady growth driven by infrastructure development projects worldwide.

- Demand for self-leveling and automatic lasers will increase due to rising need for accuracy.

- Adoption of smart and connected laser devices will expand with digital construction trends.

- Compact and multi-functional lasers will gain popularity among small and mid-scale contractors.

- Asia Pacific will emerge as a major growth hub supported by urbanization and mega projects.

- Manufacturers will focus on rugged, battery-efficient models for outdoor construction applications.

- Integration with BIM systems will enhance efficiency and project planning in construction sites.

- Rental services for construction lasers will expand, catering to cost-sensitive contractors.

- Product innovation will focus on improving visibility and range for large-scale projects.

- Training programs will grow to address skill gaps and ensure proper equipment handling.