Market Overview

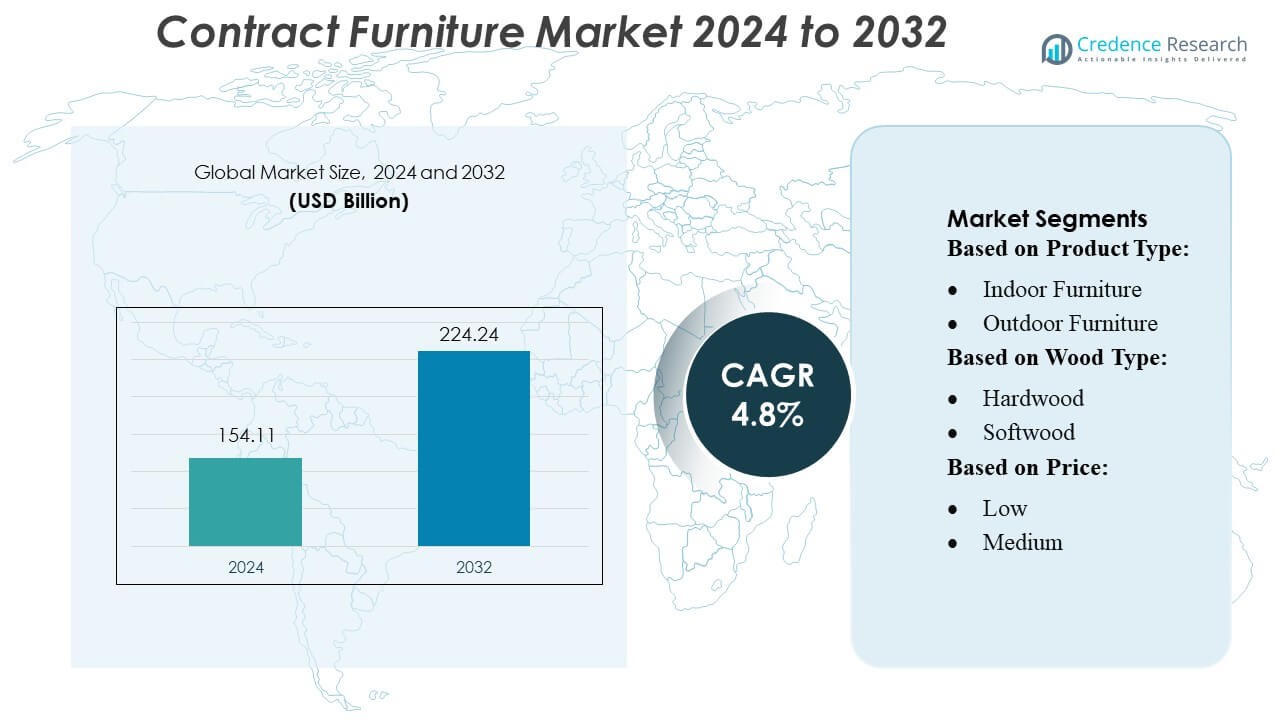

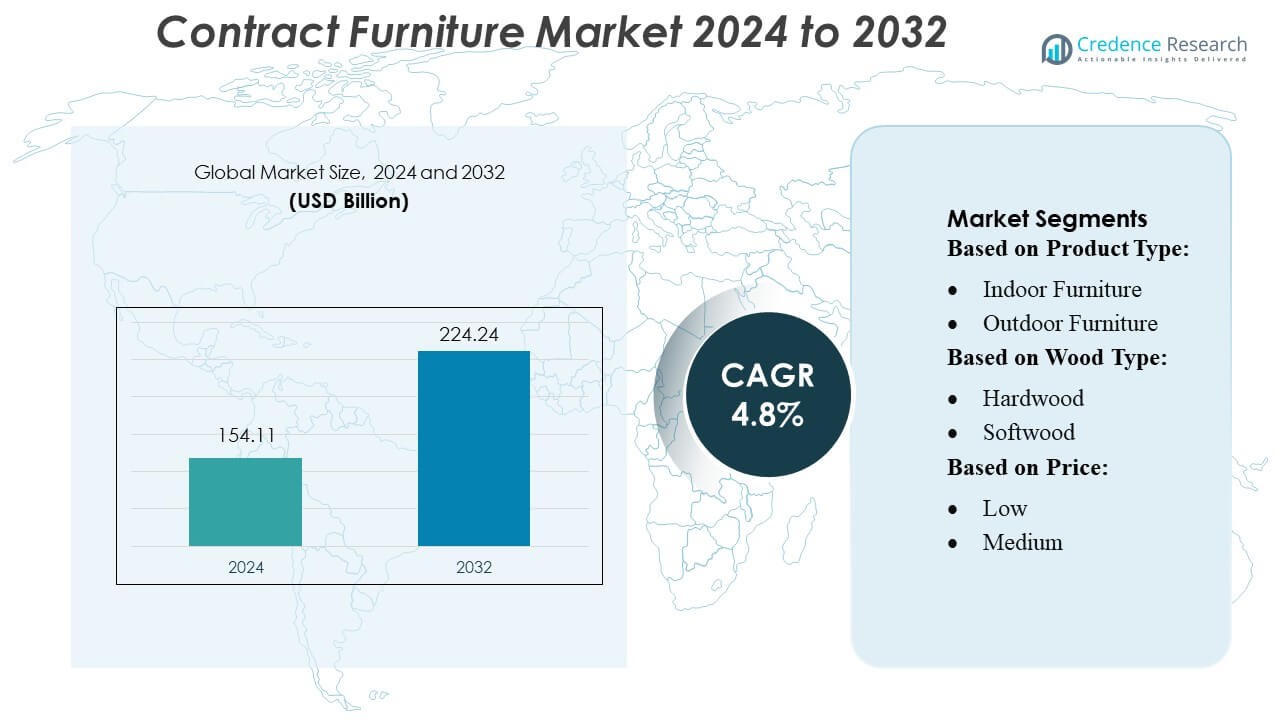

Contract Furniture Market size was valued USD 154.11 billion in 2024 and is anticipated to reach USD 224.24 billion by 2032, at a CAGR of 4.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Contract Furniture Market Size 2024 |

USD 154.11 Billion |

| Contract Furniture Market, CAGR |

4.8% |

| Contract Furniture Market Size 2032 |

USD 224.24 Billion |

The Contract Furniture Market is shaped by major global players such as Haworth Inc., Herman Miller Inc., Steelcase Inc., HNI Corporation, Knoll Inc., Teknion, Kinnarps Group, Global Furniture Group, Sedus Stoll AG, and Martela, all of which compete through innovation in ergonomic design, modular solutions, and sustainability-focused manufacturing. These companies strengthen their market positions through product diversification, digital design tools, and tailored solutions for offices, hospitality, and institutional spaces. Asia Pacific leads the global market with an exact share of 39%, driven by rapid commercial development, strong urbanization, and expanding corporate infrastructure across major economies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Contract Furniture Market was valued at USD 154.11 billion in 2024 and is projected to reach USD 224.24 billion by 2032, growing at a CAGR of 4.8%, supported by rising investments in workspace modernization and commercial infrastructure.

- Market growth is driven by increasing demand for ergonomic, modular, and flexible furniture solutions as organizations redesign offices to support hybrid work models and enhance employee well-being.

- Key trends include rapid adoption of sustainable materials, digital design tools, and customized project-based solutions, with major players innovating in circular design, smart features, and configurable layouts.

- Competitive intensity remains high as global and regional manufacturers expand portfolios, improve manufacturing efficiency, and focus on sustainability, while price pressure and raw-material volatility act as key restraints.

- Asia Pacific leads the market with a 39% share, followed by North America and Europe, while the indoor furniture segment dominates with over 57% share, supported by strong demand across corporate, hospitality, and institutional sectors.

Market Segmentation Analysis:

By Product Type

Indoor furniture is the dominant segment, capturing about 57% of the contract furniture market. Its lead comes from strong demand in offices, hotels, educational spaces, and commercial interiors that require durable and functional pieces year-round. Growth is supported by rising investments in ergonomic designs, modular layouts, and workspace modernization. Outdoor furniture is expanding steadily, but its share remains lower due to seasonal usage and limited application outside hospitality and leisure projects.

- For instance, Martela reported refurbishing over 23,140 pieces of used furniture through its Martela Outlet in 2023, integrating circular economy principles into its indoor offering.

By Wood Type

Hardwood holds the largest share at around 62%, driven by its strength, long lifespan, and premium appearance that appeal to high-traffic commercial environments. Businesses prefer hardwood for its durability and lower long-term maintenance. Softwood remains a smaller segment, chosen mainly for budget-friendly projects where ease of manufacturing and lightweight construction are priorities. However, increasing demand for sustainable and quickly renewable materials supports modest growth in softwood-based contract furniture.

- For instance, Steelcase has published 297 BIFMA LEVEL® certified products, many of which use responsibly sourced hardwood, as disclosed in its 2023 Impact Report.

By Price Range

The medium-price segment leads the market with approximately 52–53% share, as it offers a balanced mix of quality, durability, and affordability suitable for most commercial installations. Companies in corporate, hospitality, and institutional sectors prefer mid-range solutions because they provide reliable performance without the cost premium of high-end furniture. Low-price products attract cost-sensitive buyers for large-scale installations, while high-price furniture is chosen for luxury, boutique, or design-focused projects where aesthetics and customization matter most.

Key Growth Drivers

- Expansion of Commercial and Hospitality Infrastructure

Rapid development of commercial spaces—including offices, coworking hubs, hotels, and mixed-use complexes—continues to drive strong demand for contract furniture. Companies increasingly invest in modern, ergonomic, and space-efficient setups to enhance productivity and visitor experience. Hospitality chains also require durable, coordinated furniture solutions for frequent refurbishment cycles. As global urbanization accelerates and developers prioritize quality interiors, demand rises for furniture offering long service life, standardized aesthetics, and compliance with safety norms, making infrastructure expansion a core market growth driver.

- For instance, Kinnarps Group advanced its circular-economy leadership by selling more than 4 million units of its modular 6000/8000/Plus task chairs since the early 1990s, as reported in their 2023 Sustainability Report.

- Rising Demand for Customization and Ergonomic Solutions

Organizations are prioritizing customized layouts and ergonomic furniture to support employee well-being and brand-aligned interior design. The shift toward hybrid work models and flexible workspace planning increases demand for modular desks, collaborative seating, and adaptable configurations. Businesses across sectors—corporate, education, and healthcare—prefer solutions tailored to functionality, comfort, and durability. Growing awareness of ergonomics, productivity enhancement, and workplace health & safety standards further strengthens adoption. As companies redesign spaces for versatility and performance, customizable and ergonomic contract furniture experiences sustained market momentum.

- For instance, Global Furniture Group strengthens its technological edge with several verified innovations: for instance, it diverts 7.5 tons of wood and plastic waste every day using its patented wood/polymer molding process.

- Adoption of Sustainable Materials and Green Manufacturing

Sustainability has become a major purchasing criterion as organizations commit to environmental certifications and carbon-reduction goals. Contract furniture manufacturers increasingly use certified wood, recycled materials, bio-based composites, and low-VOC finishes to meet regulatory and client expectations. Green manufacturing processes—such as energy-efficient production and responsible sourcing—enhance brand value and procurement eligibility for government and corporate buyers. With global emphasis on circularity, waste reduction, and eco-friendly interiors, sustainability initiatives significantly accelerate demand for environmentally responsible contract furniture solutions.

Key Trends & Opportunities

- Growth of Modular and Flexible Workspace Furniture

As companies shift to hybrid and activity-based work models, modular furniture that allows quick reconfiguration is gaining traction. Demand grows for movable partitions, flexible seating, multi-functional desks, and furniture systems that adapt to changing team sizes and space requirements. This trend creates strong opportunities for manufacturers offering scalable, lightweight, and easy-to-assemble products. Educational and hospitality sectors also adopt flexible layouts to enhance space utility. The need for adaptable environments positions modular solutions as a key opportunity for future market expansion.

- For instance, Sedus Stoll AG has innovated with its se:matrix shelving system, which offers three standard modules that can be combined in linear or right-angled configurations, with widths from 400 mm to 2,000 mm and heights up to 2,015 mm.

- Rising Influence of Digital Procurement and Smart Furniture

Digital procurement platforms, virtual design tools, and 3D visualization software increasingly influence purchasing behavior in the contract furniture market. Businesses prefer vendors offering digital catalogs, configurators, and online customization tools for faster decision-making. Simultaneously, smart furniture—such as sensor-enabled desks, occupancy-tracking systems, and connected ergonomics solutions—is emerging as a high-value opportunity. These technologies support space optimization and employee wellness strategies. As organizations prioritize data-driven interior planning, digitalization and smart features open new growth pathways for innovative manufacturers.

- For instance, Mirra 2 Chair and Stool now have a carbon footprint reduced by up to 17% compared with earlier versions, by using 100 percent recycled material in the nylon base and spine.

- Expansion in Healthcare and Educational Infrastructure

Growing investment in healthcare and educational infrastructure presents substantial opportunities for contract furniture suppliers. Hospitals, clinics, and long-term care centers require resilient, hygienic, and compliant furniture. Meanwhile, universities and learning institutions increasingly adopt collaborative, ergonomic, and technology-integrated solutions to enhance learning environments. With global funding for these sectors rising, the demand for specialized contract furniture—such as medical seating, patient room furniture, lecture hall systems, and multipurpose classroom setups—continues to expand, supporting consistent market growth.

Key Challenges

- High Volatility in Raw Material Prices

Fluctuations in the prices of wood, metal, foam, coatings, and polymers significantly impact the cost structure of contract furniture manufacturers. Supply chain disruptions, inflation, and global logistics constraints further amplify pricing instability. This volatility challenges companies in maintaining profit margins—especially in large-scale contracts with fixed pricing. Manufacturers must navigate unpredictable input costs while ensuring product quality and delivery timelines. As a result, the industry faces increasing pressure to adopt strategic sourcing, material optimization, and cost-efficient design practices.

- Intense Competition and Pressure for Price Differentiation

The market is highly competitive, with global brands, regional manufacturers, and low-cost suppliers all vying for large enterprise and institutional contracts. Buyers often prioritize price, durability, and delivery timelines, making differentiation difficult for mid-tier manufacturers. Frequent bidding wars and procurement-driven negotiations compress margins. Additionally, the need for continuous design innovation—combined with rising expectations for sustainability and customization—adds operational complexity. This competitive landscape poses a significant challenge for companies aiming to balance affordability, innovation, and long-term profitability.

Regional Analysis

North America

North America holds about 30% of the contract furniture market, supported by strong demand from offices, hospitality, and institutional facilities. Companies continue modernizing workspaces with ergonomic, modular, and sustainable furniture, which drives steady growth. The region benefits from high commercial construction activity and early adoption of workspace trends such as hybrid offices and flexible layouts. Major manufacturers and design-focused companies are also based in the U.S., strengthening regional supply. Rising investments in corporate renovations and green-certified interiors further support North America’s leading position in the market.

Europe

Europe accounts for roughly 30% of global contract furniture sales, driven by high-quality manufacturing, strong design standards, and strict sustainability regulations. Demand is strong in offices, education, and hospitality, especially in Germany, the UK, France, and the Nordic countries. The region’s focus on eco-friendly materials and workplace well-being influences procurement decisions, supporting advanced ergonomic and modular solutions. Renovation of aging commercial infrastructure and increased investment in collaborative and flexible spaces also contribute to growth, keeping Europe a key market with consistent long-term demand.

Asia Pacific

Asia Pacific holds the largest share, around 38–40%, making it the fastest-growing region in the contract furniture market. Rapid urbanization, expanding office spaces, and rising investments in hospitality and commercial buildings drive strong demand. China, India, Japan, and Southeast Asia lead growth due to large-scale real estate development and increasing adoption of affordable modular furniture. Expanding corporate presence and rising middle-class consumption further boost the market. The region also benefits from cost-efficient manufacturing, enabling wide product availability across mid-range and budget segments.

Latin America

Latin America captures around 5–6% of the market, supported by ongoing commercial development in Brazil, Mexico, and Chile. Demand increases as multinational companies expand operations and the hospitality sector grows. Buyers prioritize cost-effective, durable furniture suited for high-use environments. However, economic fluctuations and import dependencies slow overall growth. Local manufacturers and global suppliers are responding with competitively priced modular furniture to meet rising office and institutional needs, helping the region maintain steady but moderate progress.

Middle East & Africa

The Middle East & Africa holds about 4–5% of the contract furniture market, with demand concentrated in Gulf countries such as the UAE and Saudi Arabia. Large-scale commercial, hospitality, and mixed-use developments continue to drive procurement of high-end and customized contract furniture. Government diversification programs and investment in tourism, offices, and educational facilities support market expansion. While the region remains smaller in size, strong construction activity and premium design requirements create solid opportunities for luxury, durable, and project-specific furniture solutions.

Market Segmentations:

By Product Type:

- Indoor Furniture

- Outdoor Furniture

By Wood Type:

By Price:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Contract Furniture Market features leading global players such as Martela, Steelcase Inc., Kinnarps Group, Knoll Inc., Global Furniture Group, Sedus Stoll AG, Teknion, Herman Miller Inc., HNI Corporation, and Haworth Inc. The Contract Furniture Market is characterized by strong competition among global and regional manufacturers that focus on design innovation, product durability, and large-scale project capabilities. Companies compete by expanding modular and ergonomic furniture lines that support hybrid work models, flexible layouts, and collaborative spaces. Sustainability has become a major differentiator, with manufacturers integrating certified wood, recycled materials, and low-emission finishes into their portfolios. Digital configurators, rapid customization, and project-specific furnishing solutions strengthen customer engagement and procurement efficiency. Additionally, firms continue investing in automation, global distribution networks, and strategic partnerships to capture demand from offices, hospitality, education, and healthcare sectors.

Key Player Analysis

- Martela

- Steelcase Inc.

- Kinnarps Group

- Knoll Inc.

- Global Furniture Group

- Sedus Stoll AG

- Teknion

- Herman Miller Inc.

- HNI Corporation

- Haworth Inc.

Recent Developments

- In March 2024, Teknion announced a partnership with the UK-based furniture maker Modus. Modus is the first British-based partner with Teknion, and this new venture enabled both parties to expand their global presence and localize their manufacturing capabilities.

- In January 2024, Hooker Furnishings launched two new showrooms at the Las Vegas Market for its Pulaski, Samuel Lawrence Drew & Jonathan Home, and PRI brands to broaden its customer base and support its diversification strategy. The company showcased its brands across a total of four showrooms at the market to reinforce its growth initiatives and market outreach.

- In April 2023, Godrej and Boyce launched i-Report, an app that seeks to better the safety standards in the material handling sector in India. The app provides incident reporting, auditing, training, and consultation as remote and real-time services. Therefore, it fills the gaps of the industry’s safety policies and standards and provides a 360-degree safety solution to clients and partners.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product Type, Wood Type, Price and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue expanding as companies redesign workplaces to support hybrid and flexible work models.

- Demand for ergonomic and wellness-focused furniture will rise as organizations prioritize employee comfort and productivity.

- Sustainable materials and circular design practices will become standard requirements across major procurement projects.

- Modular and reconfigurable furniture systems will gain traction due to their adaptability in dynamic commercial spaces.

- Smart furniture with sensors and occupancy-tracking features will see increased adoption in modern offices.

- Hospitality and education sectors will drive new opportunities as institutions invest in modern interior upgrades.

- Manufacturers will strengthen digital tools such as 3D configurators and virtual design platforms to improve client engagement.

- Regional production capabilities will expand as companies reduce supply-chain risks and lead times.

- Customized and project-specific furniture solutions will become more common in large commercial developments.

- Competition will intensify as global and regional players diversify portfolios to address evolving design and sustainability standards.