Market Overview

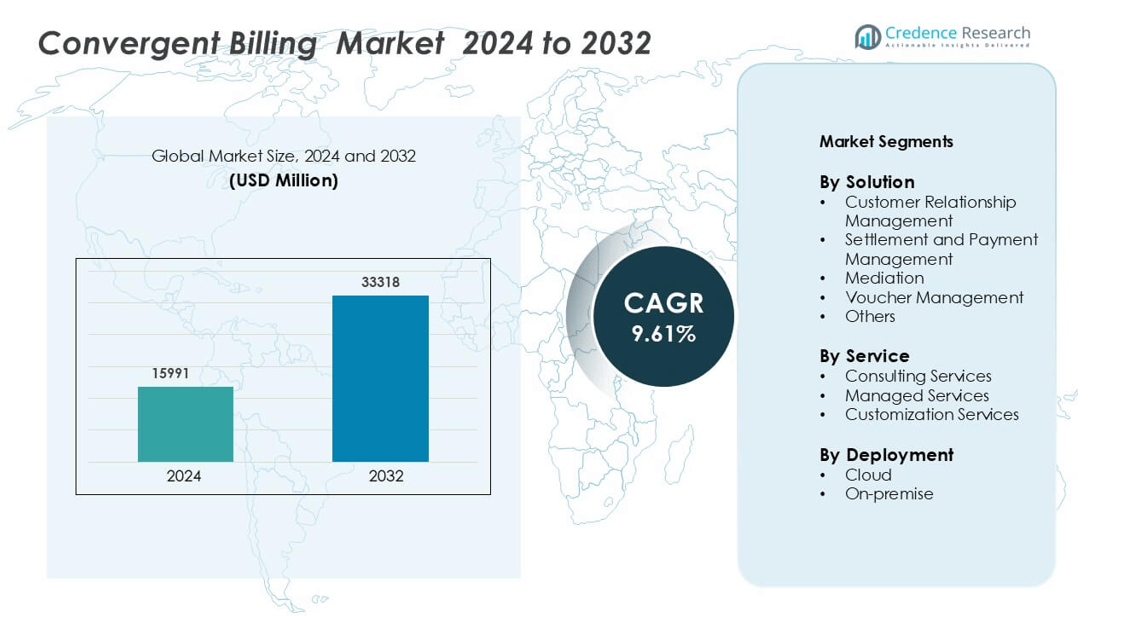

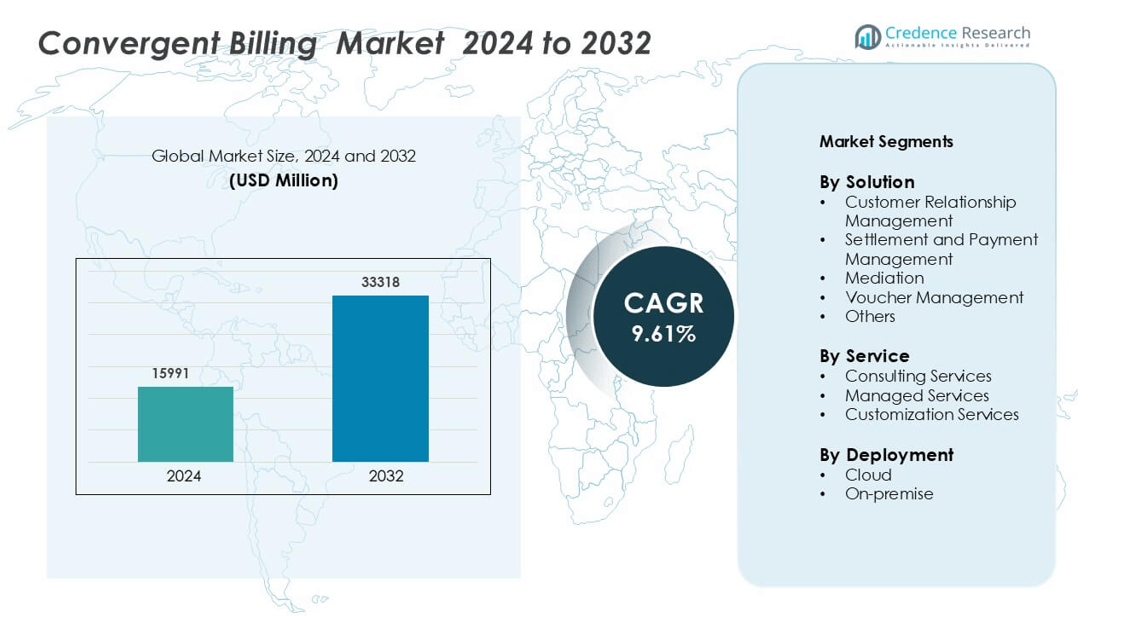

Convergent Billing Market was valued at USD 15991 million in 2024 and is anticipated to reach USD 33318 million by 2032, growing at a CAGR of 9.61% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Convergent Billing Market Size 2024 |

USD 15991 million |

| Convergent Billing Market, CAGR |

9.61% |

| Convergent Billing Market Size 2032 |

USD 33318 million |

The convergent billing market features strong competition among major players such as SAP SE, Huawei Technologies Co., Ltd., Comarch SA, CSG International, Optiva Inc., Amdocs, Mind CTI, IDI Billing, Sterlite Technologies Limited, and Nokia Corporation. These companies lead the industry through advanced cloud-based platforms, AI-driven billing automation, and customer-focused digital transformation strategies. They emphasize scalability, real-time analytics, and integration capabilities to support telecom and digital service providers. Regionally, North America leads the convergent billing market with a 36% market share, driven by rapid 5G deployment, widespread cloud adoption, and the presence of major technology vendors offering end-to-end billing and revenue management solutions

Market Insights

- The Convergent Billing Market is projected to grow from USD 15991 million in 2024 to USD 33318 million by 2032, registering a CAGR of 9.61%.

- Rising demand for real-time charging, cloud-based billing systems, and integrated customer management drives market expansion across telecom and digital service sectors.

- Increasing adoption of AI-driven analytics, subscription-based models, and multi-service billing platforms defines key trends supporting revenue diversification.

- Leading players such as SAP SE, Huawei Technologies, and Amdocs focus on automation, partnerships, and scalable cloud infrastructure amid high implementation costs and data security concerns.

- North America leads with a 36% share, followed by Europe at 27%, while Asia-Pacific shows the fastest growth. By solution, the settlement and payment management segment dominates with a 34% share, supported by high adoption in telecom billing operations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Solution

The settlement and payment management segment dominates the convergent billing market with a market share of 34%. This dominance stems from the growing need for real-time revenue recognition and automated payment reconciliation in telecom and digital service sectors. Businesses are adopting these solutions to improve billing accuracy, reduce operational errors, and enhance customer experience through unified transaction management. Rising digital transformation and the integration of advanced analytics further strengthen the demand for this segment, enabling faster dispute resolution and transparent financial operations across diverse service platforms.

- For instance, CSG Forte payments platform processes 215 million transactions annually, totaling over $164 billion in payments, for more than 130,000 businesses across various industries, a different metric from the daily billing events mentioned in the original claim.

By Service

The managed services segment leads the market, holding a 41% share in 2024. Companies prefer managed services due to their ability to reduce infrastructure costs and ensure continuous system optimization. These services enable telecom operators and enterprises to focus on core business operations while outsourcing complex billing functions. The rising trend toward subscription-based models and recurring revenue streams also fuels demand for managed services, providing scalability and operational flexibility. Increasing reliance on third-party expertise supports efficient maintenance and integration of multi-tenant billing environments.

- For instance, Amdocs’ managed services offering supports over 200 million subscribers globally and processes over 250 million digital commerce transactions each month.

By Deployment

The cloud deployment segment dominates the convergent billing market with a 57% market share. Its growth is driven by increasing adoption of cloud-native platforms for scalable and cost-efficient operations. Cloud-based billing solutions enable rapid implementation, seamless upgrades, and enhanced accessibility across geographically distributed networks. Organizations prefer these systems for their flexibility in handling dynamic pricing models and their ability to support digital service providers in real time. The segment’s expansion is further supported by advancements in cybersecurity and regulatory compliance features integrated into cloud infrastructure.

Key Growth Drivers

Rising Adoption of Digital Transformation Across Telecom and IT Sectors

The ongoing digital transformation in telecom and IT industries drives strong demand for convergent billing solutions. As operators expand into digital services such as IoT, OTT, and cloud platforms, the need for unified billing systems has grown. Convergent billing enables a single view of customer transactions, streamlining revenue management across multiple services. It reduces billing errors and accelerates time-to-market for new offerings. Moreover, as businesses transition from legacy systems to agile billing architectures, they increasingly adopt cloud-native and AI-driven billing systems to support dynamic pricing and personalized services. This transformation is reshaping operational efficiency and customer retention strategies across global markets.

- For instance, Comarch actively promotes its BSS/OSS solutions as being 5G-ready, capable of supporting network slicing, multi-party arrangements, and new business models for 5G monetization.

Growing Demand for Real-Time Charging and Customer-Centric Billing

The shift toward customer-centric billing models has significantly boosted the adoption of convergent billing platforms. Real-time charging systems allow telecom operators to monitor data, voice, and content usage instantly, ensuring accurate and transparent billing. Customers benefit from flexible pricing options, loyalty rewards, and bundled plans customized to individual usage patterns. This enhances user satisfaction while reducing churn rates. Furthermore, telecom providers leverage these systems to deploy cross-service promotions and converged offers. The increasing penetration of 5G networks, digital wallets, and subscription services further accelerates this trend, as enterprises seek platforms capable of managing high transaction volumes with minimal latency.

- For instance, Ericsson reported more than 2.3 billion end-users managed via its convergent charging platform, providing real-time rating and charging across services.

Expansion of Cloud-Based Billing Infrastructure

Cloud deployment continues to be a key driver for the convergent billing market. Organizations are shifting from on-premise systems to scalable cloud-based architectures for improved agility, cost reduction, and remote accessibility. Cloud solutions facilitate seamless integration with CRM, ERP, and payment gateways, enabling real-time synchronization and analytics. This shift also supports faster updates, automated maintenance, and enhanced compliance with data protection standards. As telecom operators expand services globally, cloud platforms enable centralized management of complex billing operations across regions. Vendors are also offering hybrid and SaaS models to address diverse enterprise needs, reinforcing the segment’s long-term growth trajectory.

Key Trends & Opportunities

Integration of Artificial Intelligence and Analytics in Billing Systems

AI and advanced analytics are transforming convergent billing by enabling predictive insights and automation. Machine learning algorithms analyze user behavior, helping operators develop personalized pricing and targeted offers. Predictive analytics improves demand forecasting and fraud detection, optimizing revenue assurance. Moreover, AI-powered chatbots and virtual assistants enhance customer support by resolving billing queries in real time. This integration also streamlines operational workflows by automating dispute management and anomaly detection. As telecom and digital service providers aim for hyper-personalization, AI-driven billing intelligence presents vast opportunities for revenue optimization and improved customer experience.

- For instance, Ericsson’s Data & AI platform processed over 40 billion call detail records (CDRs) for a leading US service provider, reducing order-failure rates to less than 5%.

Growing Opportunities in Multi-Play and Subscription-Based Services

The rise of multi-play and subscription-based services has opened new opportunities for convergent billing providers. Consumers now expect seamless management of bundled services like broadband, streaming, and mobile connectivity under one bill. Convergent billing supports flexible monetization models, including pay-as-you-go, prepaid, and recurring plans. This trend is particularly strong in regions where digital entertainment and e-commerce platforms are growing rapidly. Telecom operators and OTT service providers use these systems to introduce converged offerings with unified payment options and promotional flexibility. As the global subscription economy expands, convergent billing platforms will play a vital role in supporting diversified business models.

- For instance, 6D Technologies’ Canvas platform achieved invoice processing speed improvements of around 45% and error reductions near 60% in major telecom deployments.

Key Challenges

High Implementation Costs and Legacy System Integration

Despite its advantages, the high cost of implementing convergent billing systems remains a major challenge. Integrating modern platforms with existing legacy systems requires significant time, technical expertise, and investment. Many telecom operators operate across outdated infrastructure, complicating the transition process. Migration risks, such as data loss and system downtime, further hinder adoption. Additionally, customization to meet regional regulatory standards adds to the expense. Small and mid-sized operators often find it difficult to justify the financial outlay, delaying modernization initiatives. Addressing interoperability and ensuring seamless system integration are crucial to overcoming these barriers.

Data Security and Compliance Concerns in Cloud Environments

As more operators adopt cloud-based billing solutions, concerns over data privacy and security have intensified. Convergent billing systems handle sensitive financial and customer information, making them prime targets for cyberattacks. Regulatory compliance with frameworks like GDPR, PCI DSS, and regional telecom laws adds further complexity. Unauthorized access or data breaches can lead to reputational damage and financial losses. Vendors are investing in advanced encryption, multi-factor authentication, and zero-trust architectures to enhance security resilience. However, maintaining consistent compliance across multiple jurisdictions remains a persistent challenge, requiring continuous updates and monitoring.

Regional Analysis

North America

North America dominates the convergent billing market with a 36% market share. The region’s leadership stems from early adoption of digital transformation across telecom, IT, and media industries. Major telecom operators in the U.S. and Canada invest heavily in cloud-native billing systems to improve transparency and customer engagement. The presence of leading vendors offering AI-driven billing and analytics solutions further enhances regional growth. The expanding subscription-based economy and increasing 5G deployment accelerate market expansion, as enterprises seek integrated platforms for managing multi-service offerings and ensuring seamless customer experiences.

Europe

Europe accounts for a 27% share of the global convergent billing market, driven by strong regulatory frameworks and growing digital ecosystem investments. Telecom providers across the U.K., Germany, and France are adopting converged billing to comply with data protection standards and optimize revenue assurance. The push for next-generation connectivity, including fiber and 5G, has encouraged operators to modernize legacy billing infrastructure. Additionally, increased adoption of managed and consulting services supports transformation initiatives across enterprises. European firms’ focus on operational efficiency and customer data transparency sustains steady growth in this market segment.

Asia-Pacific

Asia-Pacific holds a 25% market share and represents the fastest-growing region in the convergent billing landscape. Expanding telecom networks in China, India, and Japan, coupled with growing smartphone penetration, boost adoption. The region’s digital economy is thriving due to rising OTT subscriptions, mobile payments, and IoT-based services. Local telecom operators are rapidly deploying converged billing solutions to manage high transaction volumes and improve service monetization. Government-backed digitalization programs, combined with large-scale 5G rollouts, further strengthen market prospects. The region’s cost-effective cloud infrastructure enhances scalability for enterprises adopting hybrid billing models.

Latin America

Latin America captures 7% of the convergent billing market, driven by telecom modernization and growing demand for real-time charging solutions. Countries such as Brazil, Mexico, and Chile are witnessing increased investments in digital infrastructure and cloud-based billing systems. Operators are focusing on customer retention through personalized service bundles and unified payment platforms. The rise of fintech and digital content services creates a favorable environment for converged billing adoption. However, limited technical expertise and regulatory disparities across nations may restrain faster deployment, though regional collaborations are helping improve standardization and service quality.

Middle East & Africa

The Middle East and Africa region accounts for a 5% market share, supported by expanding telecom networks and smart city projects. Gulf nations, including the UAE and Saudi Arabia, are leading in deploying 5G-enabled billing systems to support integrated data and voice services. African telecom operators are embracing cloud-based billing to enhance efficiency and reduce operational costs. The rising penetration of mobile wallets and digital services further drives adoption. Despite challenges related to infrastructure gaps and affordability, growing public-private partnerships and technology investments indicate promising long-term potential for market development.

Market Segmentations:

By Solution

- Customer Relationship Management

- Settlement and Payment Management

- Mediation

- Voucher Management

- Others

By Service

- Consulting Services

- Managed Services

- Customization Services

By Deployment

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the convergent billing market is highly dynamic, with global and regional players focusing on innovation, scalability, and customer-centric solutions. Key companies such as SAP SE, Huawei Technologies Co., Ltd., Comarch SA, CSG International, Optiva Inc., and Amdocs dominate through advanced cloud-based and AI-integrated billing platforms. These firms emphasize product diversification, strategic partnerships, and acquisitions to strengthen market presence and address evolving telecom and digital service demands. Vendors are prioritizing automation, real-time analytics, and multi-service integration to enhance operational efficiency and customer experience. Emerging players like Mind CTI, IDI Billing, and Sterlite Technologies Limited are expanding their portfolios through modular billing architectures tailored for SMEs and regional operators. The market’s competition remains intense, driven by continuous technological upgrades, compliance requirements, and the shift toward subscription and digital service monetization models across global telecom networks.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In September 2023, Amdocs has announced the business momentum of its 5G Charging efforts, enabling telecom service operators to capitalize on new monetization prospects in the 5G era. This aims to unlock limitless monetization scenarios for advanced 5G and others.

- In September 2022, Optiva Inc. unveiled their first 5G telecom charging solution for purchase through Google Cloud Marketplace. This engine is pre-integrated with Google Cloud, allowing communication service providers (CSPs) to quickly obtain the software and seamlessly connect it to other areas of its architecture in 90 days.

Report Coverage

The research report offers an in-depth analysis based on Solution, Service, Deployment and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The convergent billing market will witness steady growth driven by rising digital transformation across telecom sectors.

- Cloud-based deployment will continue to dominate as enterprises seek scalable and cost-efficient billing solutions.

- Integration of AI and machine learning will enhance automation, predictive analytics, and real-time decision-making.

- 5G expansion will create new opportunities for flexible and high-volume billing systems.

- Subscription and usage-based business models will increase demand for converged revenue management platforms.

- Data security and compliance solutions will gain importance with growing adoption of cloud billing.

- Strategic partnerships between telecom operators and billing vendors will accelerate market penetration.

- Vendors will focus on modular, API-based architectures to improve system interoperability.

- Asia-Pacific will emerge as the fastest-growing regional market due to rapid digitalization.

- Continuous innovation in billing automation will drive customer satisfaction and operational efficiency.