Market Overview

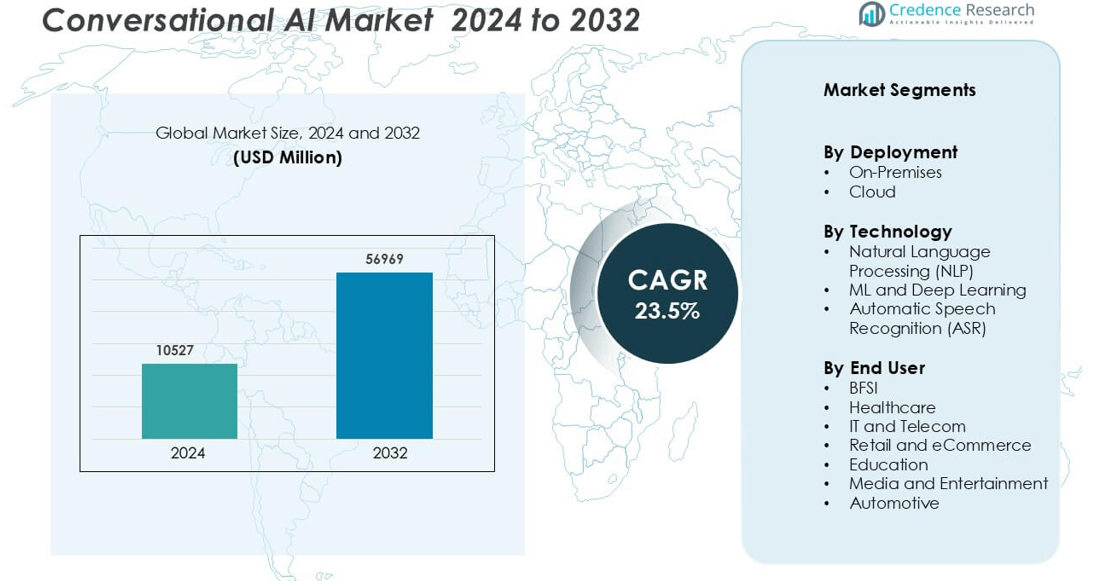

Conversational AI Market was valued at USD 10527 million in 2024 and is anticipated to reach USD 56969 million by 2032, growing at a CAGR of 23.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Conversational AI Market Size 2024 |

USD 10527 million |

| Conversational AI Market, CAGR |

23.5% |

| Conversational AI Market Size 2032 |

USD 56969 million |

The Conversational AI Market features prominent players such as Microsoft, Google, IBM, Amazon Web Services, Inc., Oracle, SAP SE, FIS, Nuance Communications, Inc., Artificial Solutions, and Kore.ai, Inc. These companies lead through advanced AI frameworks, natural language processing, and cloud-based deployment capabilities. Microsoft and Google drive innovation in enterprise automation and virtual assistant technologies, while IBM and Oracle focus on AI integration within business ecosystems. Nuance Communications excels in healthcare conversational systems, enhancing diagnostic efficiency. Regionally, North America dominates the global market with a 36% share in 2024, supported by strong technological infrastructure, rapid enterprise adoption, and consistent investment in AI-driven digital transformation initiatives.

Market Insights

- The Conversational AI Market is valued at USD 10527 million in 2024 and is projected to reach USD 56969 million by 2032, growing at a CAGR of 23.5% from 2025 to 2032.

- Increasing demand for AI-powered virtual assistants and chatbots across BFSI, healthcare, and retail sectors drives market expansion by improving customer engagement and operational efficiency.

- Advancements in natural language processing and deep learning are enhancing contextual understanding, enabling more accurate, human-like responses and fostering widespread adoption across industries.

- The market remains highly competitive, with major players such as Microsoft, IBM, Google, Oracle, and AWS focusing on innovation, partnerships, and AI integration to maintain leadership positions.

- North America leads with a 36% regional share in 2024, while the cloud deployment segment holds a 62% share, driven by scalability and cost efficiency, making these the strongest growth contributors in the global Conversational AI Market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Deployment

The cloud-based segment dominates the Conversational AI Market with a 62% market share in 2024. Cloud deployment offers faster implementation, remote accessibility, and reduced infrastructure costs, which attract enterprises seeking scalability. Businesses leverage cloud platforms to integrate conversational tools across global operations with minimal maintenance. The rise of SaaS-based AI platforms further drives this segment’s expansion. Continuous cloud innovations, including elastic computing and data integration, enhance responsiveness and user engagement across industries, making the cloud segment the preferred deployment model for modern conversational AI applications.

- For instance, Amazon Lex offers a free tier for the first year, which includes processing up to 10,000 text requests and 5,000 speech requests per month.

By Technology

Natural Language Processing (NLP) leads the Conversational AI Market with a 47% share in 2024. NLP enables chatbots and virtual assistants to interpret and respond to human language more accurately. The advancement of contextual understanding and sentiment analysis has significantly improved interaction quality. Integration of NLP with deep learning models enhances intent recognition, enabling better personalization. Industries adopt NLP-driven AI for customer support and intelligent automation, improving satisfaction levels. The ongoing development of multilingual and domain-specific NLP tools strengthens this segment’s dominance and widens its application scope across global markets.

- For instance, as of January 2022, Dialogflow supported 55 language variations for text chats, and the official documentation lists an extensive range of root languages and locale-specific versions for various features (Text, Speech-to-Text, Text-to-Speech, etc.

By End User

The BFSI segment holds the largest share of 29% in 2024, leading the Conversational AI Market. Financial institutions use AI-powered chatbots for round-the-clock customer assistance, fraud detection, and transaction support. Conversational AI helps banks streamline service delivery while cutting operational costs. The adoption of secure, compliant conversational systems enhances trust and efficiency in customer interactions. Growing demand for personalized financial recommendations and AI-driven virtual banking further fuels this segment’s growth. The BFSI industry’s continuous push toward automation and digital engagement ensures its sustained leadership in conversational AI adoption.

Key Growth Drivers

Rising Adoption of AI-Powered Customer Engagement Solutions

The growing demand for automated and personalized customer interactions is a major driver for the Conversational AI Market. Businesses across BFSI, retail, and telecom are deploying AI-driven chatbots and virtual assistants to handle high customer volumes efficiently. These systems enhance engagement through real-time communication and contextual understanding. Companies benefit from reduced response times and improved customer satisfaction rates. AI integration into omnichannel platforms also supports seamless service delivery across websites, mobile apps, and voice interfaces. As organizations focus on 24/7 service availability, conversational AI becomes central to digital customer experience strategies.

- For instance, Bank of America’s Erica virtual assistant has surpassed 3 billion client interactions since its launch in 2018, nearly double the figure cited in the original claim. The current average is more than 58 million interactions per month.

Advancements in Natural Language Processing and Deep Learning

Significant progress in NLP and deep learning models enhances the accuracy and intelligence of conversational AI systems. Modern AI solutions can interpret complex language patterns, emotions, and user intents, enabling more human-like communication. Continuous algorithmic improvements and training on diverse datasets make virtual assistant context-aware and adaptive. The combination of machine learning and NLP allows for dynamic conversation flows and predictive insights. These advancements reduce errors in speech recognition and response generation, improving usability in sectors like healthcare, education, and finance. The sophistication of AI models continues to drive higher adoption across industries seeking smarter automation.

Expanding Integration Across Enterprise Ecosystems

Organizations are increasingly integrating conversational AI into CRM, ERP, and HRM systems to streamline operations. Such integration helps automate repetitive tasks like data entry, ticket resolution, and employee support. It enables enterprises to gather actionable insights from user interactions and optimize decision-making. Businesses also leverage these systems to support multilingual communication and enhance inclusivity. The rise of API-driven architectures facilitates smooth AI adoption within existing infrastructure. As enterprises embrace digital transformation strategies, the role of conversational AI expands beyond customer service to internal process optimization and workforce productivity enhancement.

Key Trend & Opportunity

Emergence of Voice-Enabled AI Assistants

Voice technology is becoming a transformative trend in the Conversational AI Market. The growing use of smart speakers, automotive voice systems, and virtual assistants accelerates voice AI adoption. Businesses integrate speech recognition with AI to enable hands-free, faster communication for consumers and employees. Industries such as automotive, healthcare, and retail use voice-enabled systems for accessibility and convenience. This trend also opens opportunities for brands to build unique voice identities and enhance customer loyalty. Continuous improvements in Automatic Speech Recognition (ASR) and multi-accent training strengthen voice interaction reliability, positioning it as a key growth avenue.

- For nstance, Amazon announced in May 2023 that customers had purchased over 500 million Alexa-enabled devices globally.

Growing Demand for Multilingual and Emotionally Intelligent Systems

The global expansion of businesses increases demand for conversational AI capable of understanding multiple languages and emotional tones. Multilingual bots enable companies to engage with diverse customer bases without language barriers. Emotion recognition through sentiment analysis allows AI to adapt responses empathetically, improving the quality of interactions. These features are particularly valuable in healthcare and education, where understanding context and emotion enhances user trust. Companies investing in such emotionally intelligent systems gain a competitive edge by delivering personalized experiences. The advancement of localized AI models presents a strong opportunity for future market expansion.

- For instance, Google Assistant supports over 30 languages and functions in 90 countries, adapting to local accents and dialects.

Key Challenge

Data Privacy and Security Concerns

Rising data privacy risks remain a major challenge for conversational AI adoption. These systems process sensitive user data, including financial and personal information, creating potential vulnerabilities. Compliance with regulations such as GDPR and CCPA requires strict data handling and transparency measures. Unauthorized data access or breaches can lead to loss of consumer trust and legal penalties. Companies must ensure end-to-end encryption and secure cloud infrastructure to mitigate risks. Balancing data utility with privacy protection remains a complex issue, particularly in industries like banking and healthcare where security standards are stringent.

Complexity in Language Understanding and Context Retention

Despite technological progress, achieving accurate contextual understanding remains difficult for conversational AI. Variations in dialects, slang, and phrasing often lead to misinterpretation or irrelevant responses. Maintaining conversation continuity over multiple exchanges requires advanced memory and reasoning capabilities, which many systems still lack. These limitations can result in inconsistent user experiences and reduce adoption rates. Developing AI that can adapt to real-time learning and evolving linguistic patterns is a key challenge. Companies need continuous training, diverse datasets, and human-in-the-loop systems to enhance contextual accuracy and ensure meaningful interactions.

Regional Analysis

North America

North America dominates the Conversational AI Market with a 36% market share in 2024. The region’s leadership stems from the rapid adoption of AI technologies by enterprises across BFSI, healthcare, and retail sectors. Strong presence of key players like IBM, Google, and Microsoft supports technological innovation and widespread integration of virtual assistants. High consumer awareness and robust cloud infrastructure further enhance adoption rates. Additionally, the U.S. government’s supportive AI policies and investments in data analytics contribute to expanding deployment, making North America the global hub for conversational AI development and implementation.

Europe

Europe holds a 27% share of the Conversational AI Market in 2024, driven by growing digital transformation initiatives across industries. The region emphasizes ethical AI deployment and compliance with GDPR regulations, promoting secure conversational systems. Countries such as the U.K., Germany, and France are investing in AI-powered customer experience platforms for banking, automotive, and telecom sectors. Businesses in Europe are focusing on multilingual capabilities and privacy-focused AI applications. Continuous innovation in natural language processing and speech analytics ensures steady market growth while aligning with regional data protection frameworks.

Asia-Pacific

Asia-Pacific accounts for a 25% market share in 2024 and represents the fastest-growing regional market for conversational AI. Rapid digitalization, smartphone penetration, and expanding eCommerce platforms drive adoption. Countries like China, India, Japan, and South Korea invest heavily in AI-driven automation and customer engagement technologies. Local enterprises increasingly integrate chatbots for multilingual and voice-based interactions. Government initiatives supporting AI research and the growth of regional startups further accelerate market expansion. The region’s focus on cost-effective, scalable cloud infrastructure continues to strengthen its position as a key growth engine.

Latin America

Latin America captures a 7% share of the Conversational AI Market in 2024, supported by growing investments in digital customer engagement. Brazil and Mexico lead regional adoption, particularly in banking, telecom, and retail sectors. Businesses seek to improve service accessibility through AI-powered chatbots and voice assistants, especially in customer-centric industries. The region’s improving internet connectivity and mobile adoption further aid growth. While infrastructure limitations remain, the increasing number of regional AI solution providers and localized language models are enhancing deployment and user engagement across emerging economies.

Middle East & Africa

The Middle East & Africa region holds a 5% share of the Conversational AI Market in 2024. Growth is fueled by rising adoption of digital transformation strategies and government-backed AI initiatives, particularly in the UAE, Saudi Arabia, and South Africa. Enterprises in banking, healthcare, and telecom sectors are integrating conversational AI to enhance service efficiency. Investments in smart city projects and Arabic-language AI development further boost regional adoption. Although limited technological infrastructure challenges growth, the increasing focus on automation and AI innovation ensures steady market advancement across key countries.

Market Segmentations:

By Deployment

By Technology

- Natural Language Processing (NLP)

- ML and Deep Learning

- Automatic Speech Recognition (ASR)

By End User

- BFSI

- Healthcare

- IT and Telecom

- Retail and eCommerce

- Education

- Media and Entertainment

- Automotive

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Conversational AI Market is highly competitive, with leading companies focusing on innovation, scalability, and domain-specific customization. Major players such as Microsoft, IBM, Oracle, and Amazon Web Services, Inc. are strengthening their portfolios through AI platform enhancements and cloud-based conversational services. Google continues to expand its Dialogflow and Gemini-powered solutions for enterprise-grade applications. SAP SE and FIS integrate AI into business process automation and financial service platforms. Meanwhile, Kore.ai, Inc. and Artificial Solutions specialize in enterprise-grade virtual assistant frameworks, offering multilingual and omnichannel capabilities. Nuance Communications, Inc., now part of Microsoft, dominates healthcare conversational AI through clinical documentation tools. Strategic partnerships, acquisitions, and integration of advanced NLP, ASR, and machine learning technologies define the competitive environment. Continuous investment in AI ethics, compliance, and contextual understanding further distinguishes market leaders, driving innovation and strengthening their foothold across key industries such as BFSI, healthcare, retail, and telecommunications.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- ai, Inc.

- Oracle

- Microsoft

- Artificial Solutions

- SAP SE

- FIS

- IBM

- Amazon Web Services, Inc.

- Nuance Communications, Inc.

- Google

Recent Developments

- In May 2025, Kore.ai and Microsoft announced a strategic partnership to accelerate enterprise AI transformation. This integrates Kore.ai’s conversational and generative AI capabilities with Microsoft’s cloud and AI services, enabling enterprises to deploy AI-powered solutions at scale. The partnership focuses on enhancing employee and customer experiences through intelligent automation and seamless integration within existing Microsoft environments.

- In April 2025, Microsoft Copilot Studio introduced a limited research preview of the “computer use” feature, enabling AI agents to interact directly with websites and desktop applications—navigating menus, clicking buttons, and entering data—effectively automating tasks even in systems lacking APIs. Additionally, new Microsoft Graph connectors for Guru and GitLab enhance integration capabilities, and support for customer-managed keys has been added to bolster data security. Other enhancements include advanced approvals in agent workflows, ROI analysis via Viva Insights, and improved analytics for autonomous agents.

- In March 2023, Nuance Communications launched Dragon Ambient eXperience (DAX) Express, a new AI-powered clinical documentation solution. Built upon the successful DAX platform and leveraging OpenAI’s GPT-4, DAX Express automates the creation of clinical notes by combining conversational and ambient AI. This solution aims to reduce administrative burdens for clinicians, allowing them to focus on patient care. DAX Express integrates seamlessly with existing Dragon Medical solutions and the electronic medical record, enhancing efficiency and improving the overall healthcare experience.

Report Coverage

The research report offers an in-depth analysis based on Deployment, Technology, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Conversational AI will evolve toward more human-like dialogue through emotion recognition and contextual learning.

- Voice-enabled AI systems will gain traction across automotive, healthcare, and smart home applications.

- Integration with generative AI models will enhance personalization and intent prediction accuracy.

- Enterprises will adopt AI-driven chatbots for end-to-end customer journey management and analytics.

- Multilingual and regional language support will expand accessibility in emerging economies.

- Cloud-based conversational platforms will remain the preferred choice for scalability and flexibility.

- AI ethics, transparency, and data governance will become key factors influencing adoption.

- The education and BFSI sectors will increasingly deploy conversational AI for training and customer interaction.

- Partnerships between AI developers and enterprise software providers will accelerate product innovation.

- Asia-Pacific will emerge as the fastest-growing region, driven by rapid digitalization and expanding AI investments.