Market Overview:

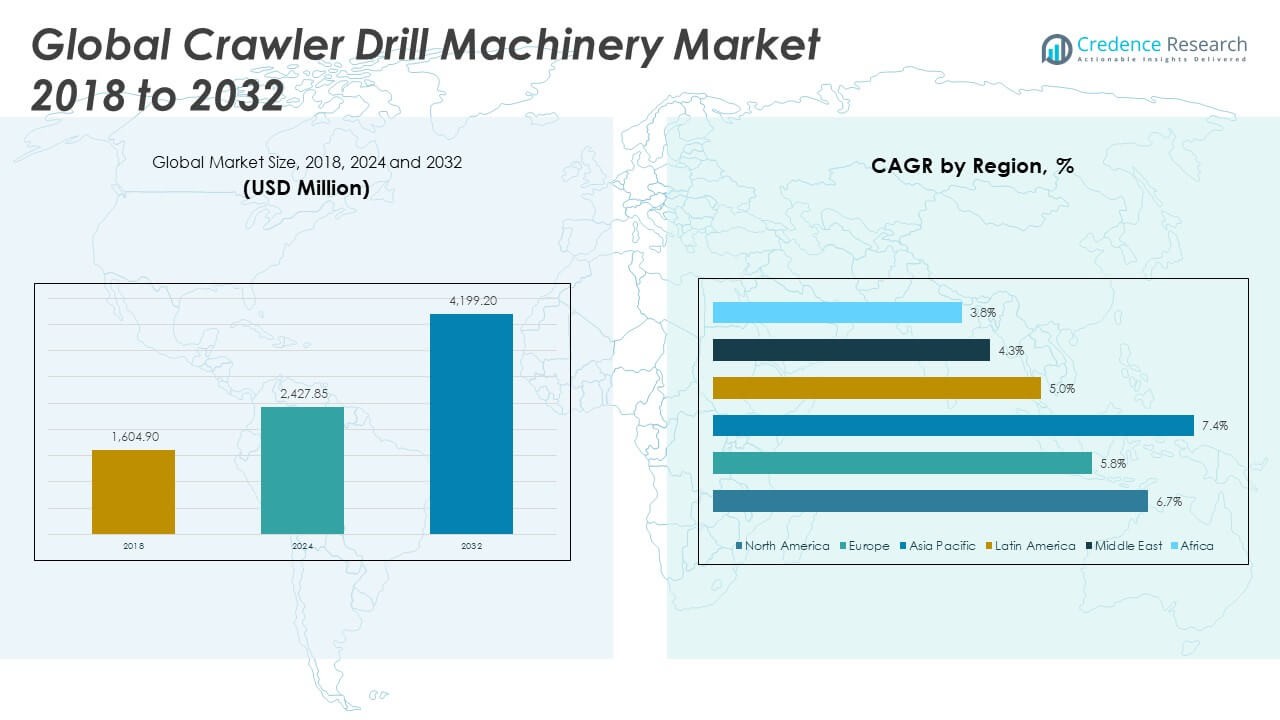

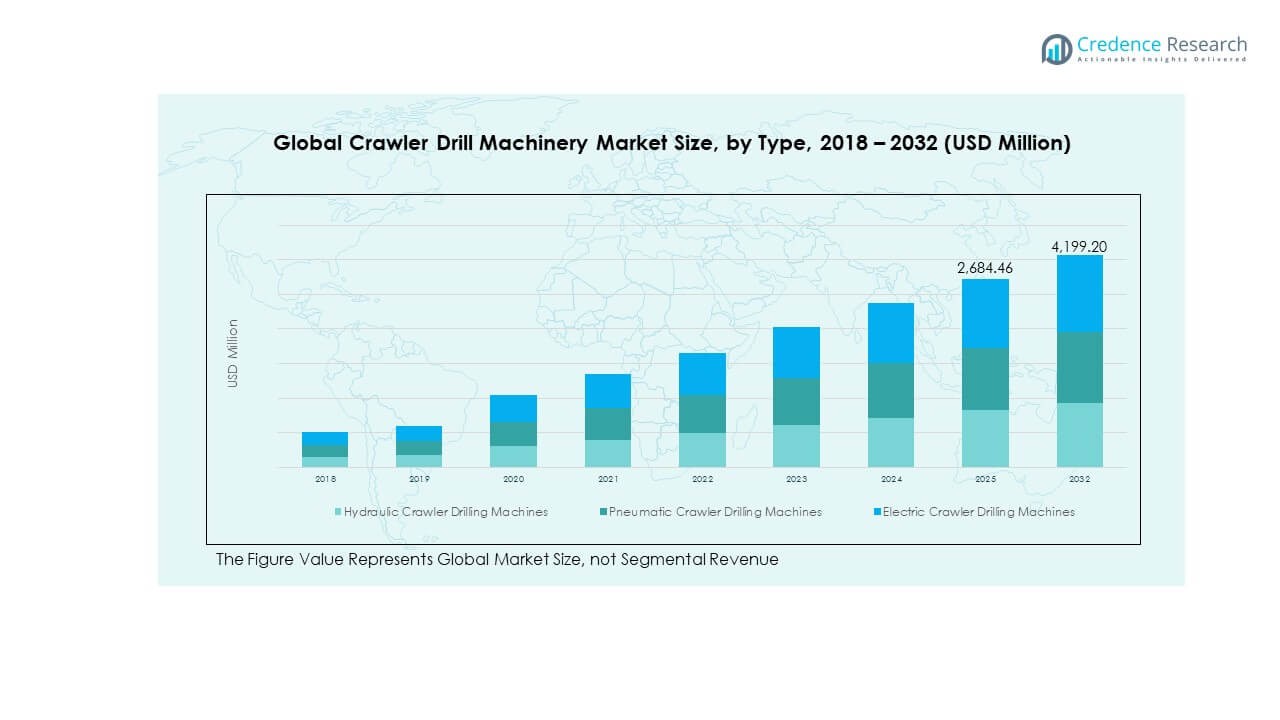

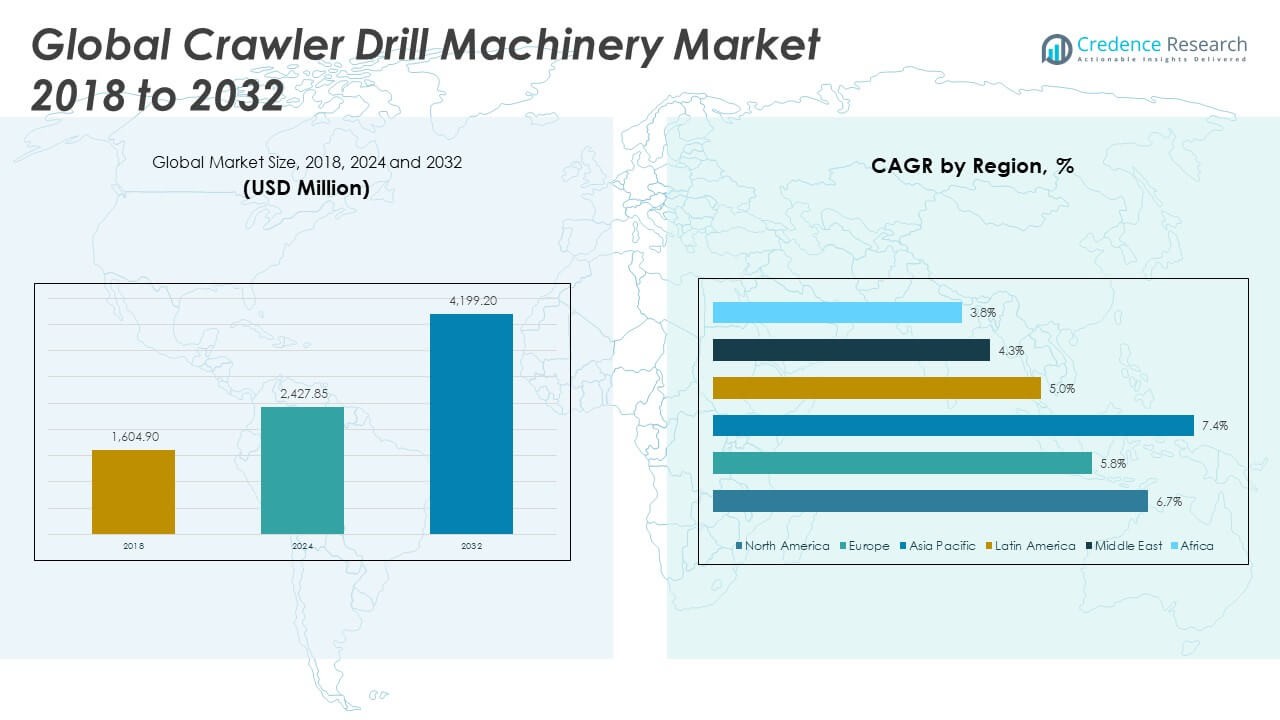

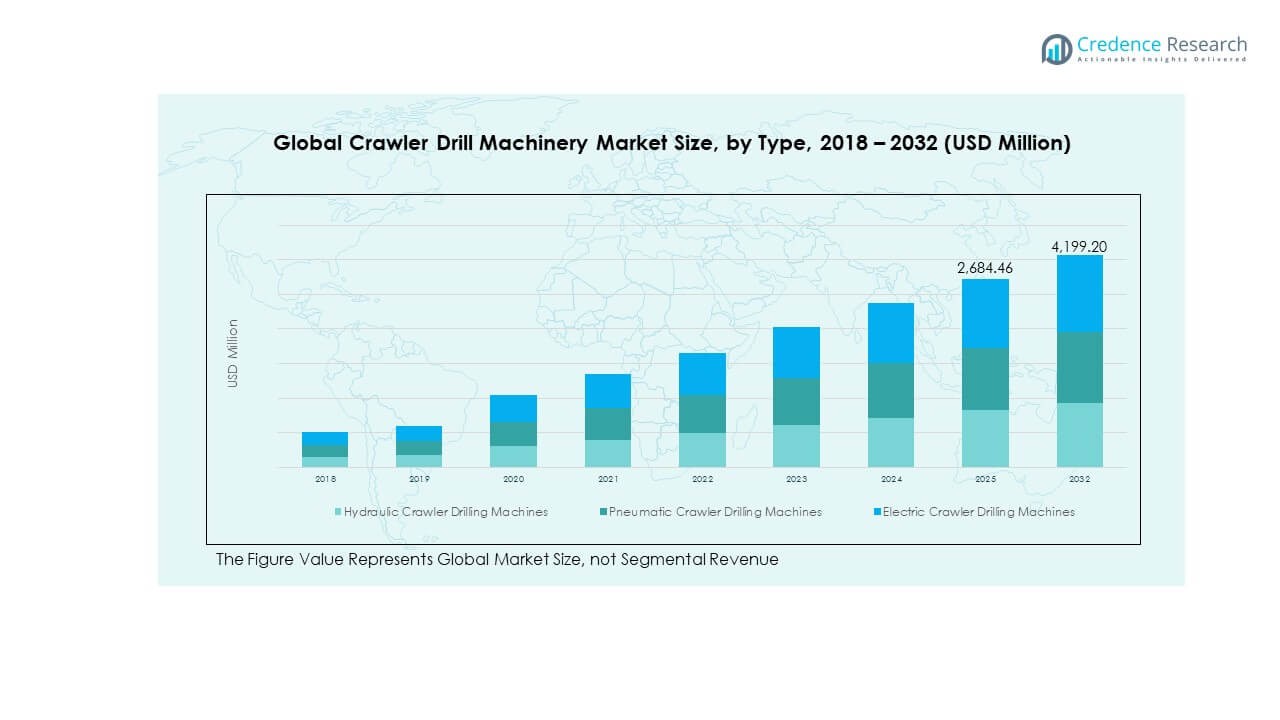

The Global Crawler Drill Machinery Market size was valued at USD 1,604.90 million in 2018 to USD 2,427.85 million in 2024 and is anticipated to reach USD 4,199.20 million by 2032, at a CAGR of 6.60% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Crawler Drill Machinery Market Size 2024 |

USD 2,427.85 Million |

| Crawler Drill Machinery Market, CAGR |

6.60% |

| Crawler Drill Machinery Market Size 2032 |

USD 4,199.20 Million |

The market growth is driven by rising demand for mechanized drilling solutions in mining, construction, and quarrying activities. Increasing focus on infrastructure development projects, coupled with advancements in automation and fuel efficiency, supports adoption across diverse industries. Manufacturers are enhancing machine capabilities with GPS, IoT-enabled monitoring, and energy-efficient systems to ensure higher productivity, lower downtime, and safer operations. The demand for crawler drill machinery is also reinforced by global emphasis on cost-effective excavation and efficient resource utilization.

Geographically, Asia Pacific dominates the crawler drill machinery market due to extensive mining operations in China, India, and Australia, along with large-scale infrastructure investments. North America and Europe follow, supported by advanced construction technologies and quarrying projects. Meanwhile, Latin America and Africa are emerging markets driven by growing exploration of natural resources and government initiatives for road and rail development. Middle Eastern countries are also expanding demand, owing to ongoing urbanization and construction of large-scale commercial and industrial complexes.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Global Crawler Drill Machinery Market was valued at USD 1,604.90 million in 2018, grew to USD 2,427.85 million in 2024, and is expected to reach USD 4,199.20 million by 2032 at a CAGR of 6.60%.

- Asia Pacific held 45.1% of the share in 2024, followed by Europe with 20.1% and North America with 17.3%, supported by large mining bases, infrastructure upgrades, and advanced construction practices.

- Asia Pacific is the fastest-growing region with a 45.1% share, driven by rapid urbanization, mineral exploration, and sustained investment in transport and energy projects.

- Hydraulic crawler drilling machines dominated with 62% share, followed by pneumatic models at 23%, reflecting their strong role in large-scale projects.

- By application, mining accounted for 48% share, while construction contributed 32%, reinforcing mining as the primary driver of equipment demand.

Market Drivers

Rising Infrastructure Development Projects Accelerating Demand for Advanced Drilling Equipment

The Global Crawler Drill Machinery Market benefits from a strong pipeline of infrastructure projects across transportation, energy, and urban development sectors. Governments are investing heavily in highways, rail networks, and smart cities, requiring advanced drilling equipment for foundations and tunneling. Contractors prefer crawler drill machines for their mobility on rough terrain and ability to operate in large-scale construction sites. It improves operational efficiency by reducing downtime and enabling precise drilling. Mining expansion in developing countries further pushes demand. Growing reliance on mechanized solutions supports consistent uptake. Demand is reinforced by global megaprojects requiring reliable equipment.

- For example, Epiroc highlights that its SmartROC T35 surface crawler drill delivers superior fuel efficiency compared to other rigs in its class, designed to burn less diesel while maintaining high drilling precision and reliability in challenging rock conditions.

Expanding Mining Activities Strengthening Equipment Adoption Across Regions

Mining operations drive a significant portion of crawler drill machinery demand, particularly in mineral-rich economies. The Global Crawler Drill Machinery Market gains from expansion in iron ore, coal, copper, and gold mining projects. Crawler drills offer efficient penetration in hard rock formations, making them indispensable in mining. It supports productivity by reducing manual effort and ensuring consistent drilling depth. Countries in Asia Pacific and Africa experience strong growth in mineral exploration. Rising investment in resource extraction sustains equipment deployment. Growing interest in automated drilling enhances productivity in large mines. The requirement for durable and energy-efficient machines strengthens adoption.

Rising Adoption of Automation and Digital Technologies in Construction Equipment

Automation in construction equipment continues to accelerate growth for crawler drill machinery. The Global Crawler Drill Machinery Market benefits from integration of GPS guidance, telematics, and IoT-enabled monitoring systems. These features enhance safety, reduce human error, and optimize drilling operations. It allows operators to track equipment health and prevent breakdowns, extending machine lifespan. Contractors favor automated crawler drills for their ability to complete projects faster with fewer operators. Governments encourage digital adoption in infrastructure development, further stimulating demand. Rising emphasis on cost efficiency increases preference for smart machinery. Growing availability of data-driven performance insights improves decision-making on project sites.

Growing Emphasis on Energy Efficiency and Environmental Sustainability in Heavy Equipment

Sustainability drives investment in crawler drill machinery equipped with energy-efficient engines and reduced emissions technology. The Global Crawler Drill Machinery Market aligns with stricter environmental standards set by regulatory bodies worldwide. Manufacturers are introducing hybrid and electric models to reduce dependence on diesel. It improves fuel efficiency while lowering operational costs for contractors. Governments encourage green construction equipment through policy support and incentives. Growing pressure to meet carbon neutrality goals stimulates innovation in machinery. Contractors favor sustainable machines that comply with global standards. The rising focus on cleaner technologies makes energy efficiency a major driver of growth.

- For example, Sandvik confirms that the Leopard DI650i is a next-generation crawler drill rig designed for surface mining and construction. It is equipped with advanced control systems and an energy-efficient power pack, which reduces fuel consumption per drilled meter by up to 15% while maintaining productivity. The machine also aligns with stricter emission standards and supports operator cost savings through lower fuel usage and improved automation features.

Market Trends

Rising Penetration of Electric and Hybrid Crawler Drill Models in Global Markets

The Global Crawler Drill Machinery Market experiences a notable shift toward electrification in heavy equipment. Manufacturers are introducing electric and hybrid crawler drills to reduce fuel consumption and comply with emission standards. It attracts adoption among contractors focused on reducing operational costs. Battery technologies have improved, enabling longer runtimes for electric models. Hybrid drills appeal to operators seeking a balance between fuel efficiency and power. Governments encourage the transition through green equipment policies. Growing interest in renewable-powered equipment strengthens this trend. Industry players invest in R&D to bring sustainable solutions to mainstream markets.

Integration of Remote-Control and Autonomous Operation Features for Safety and Precision

The Global Crawler Drill Machinery Market embraces autonomous technologies to enhance safety and operational control. Manufacturers are equipping machines with remote-control systems that allow operators to manage drilling from a safe distance. It reduces risk in hazardous mining and tunneling environments. Autonomous drilling improves accuracy and ensures consistent penetration depth. Companies deploy AI-based systems to support predictive maintenance and reduce downtime. Enhanced connectivity through 5G supports seamless remote operation. Contractors value increased efficiency from machine learning-driven control. The industry is moving steadily toward semi-autonomous and fully autonomous crawler drill models.

- For example, Epiroc’s BenchREMOTE system allows an operator to control up to three SmartROC D65 drills simultaneously from a distance of 100 meters, reducing onsite exposure and improving precision in quarrying

Increasing Demand for Multi-Purpose and Versatile Crawler Drill Machinery in Diverse Applications

The Global Crawler Drill Machinery Market shows a trend toward versatile machines capable of serving multiple industries. Contractors seek equipment that can handle mining, quarrying, and infrastructure development simultaneously. It reduces capital expenditure by eliminating the need for multiple machines. Manufacturers are developing crawler drills with modular attachments to serve different drilling requirements. The demand for adaptability supports innovation in machine design. Growth in small and mid-sized contractors further increases preference for multi-purpose solutions. The need for flexibility drives uptake across emerging economies. Versatile equipment gains traction as companies optimize project costs.

Rising Application of Telematics and Data Analytics in Equipment Lifecycle Management

The Global Crawler Drill Machinery Market increasingly relies on telematics for real-time performance monitoring. Companies integrate analytics tools to track equipment usage and predict failures. It enhances asset management by allowing timely maintenance interventions. Data-driven insights help contractors reduce downtime and extend machine lifespan. Telematics supports rental operators in managing large fleets more efficiently. The availability of cloud-based platforms improves accessibility of performance reports. Predictive analytics becomes a crucial tool for cost optimization. Growing reliance on digital lifecycle management underscores the trend of data-driven decision-making in the industry.

- For example, Sandvik’s My Sandvik Digital Services platform supports crawler drill machinery fleets by enabling predictive maintenance and real-time performance monitoring, which enhances reliability, reduces unplanned downtime, and strengthens productivity in quarrying and mining operations.

Market Challenges Analysis

High Capital Investment and Rising Maintenance Costs Limiting Adoption Across Smaller Contractors

The Global Crawler Drill Machinery Market faces barriers due to high upfront investment required for advanced models. Smaller contractors struggle with budget limitations, often preferring rental options over purchase. It creates dependency on third-party rental providers, restricting ownership flexibility. High maintenance expenses, particularly for machines operating in harsh mining conditions, add further pressure. The cost of spare parts and skilled labor for servicing equipment also remains high. Manufacturers attempt to mitigate the challenge through leasing models, yet affordability still restricts adoption in developing regions. Economic uncertainties also delay procurement decisions.

Operational Challenges in Harsh Terrains and Limited Skilled Workforce Affecting Efficiency

The Global Crawler Drill Machinery Market also encounters challenges related to terrain adaptability and workforce availability. Harsh environments such as quarries and deep mines create operational strain on crawler drills, impacting machine lifespan. It requires advanced engineering to withstand extreme conditions, increasing manufacturing complexity. Limited availability of skilled operators restricts optimal use of technologically advanced drills. Companies struggle to train workers on IoT-enabled and semi-autonomous equipment. Harsh weather conditions in remote mining areas further delay operations. Dependence on continuous training programs burdens contractors. Operational challenges slow down the pace of technology adoption in the sector.

Market Opportunities

Rising Investments in Resource Exploration and Infrastructure Modernization Stimulating Long-Term Growth

The Global Crawler Drill Machinery Market presents strong opportunities from increasing investments in mining exploration and infrastructure development. Governments allocate budgets toward expanding mineral extraction and building energy-efficient urban projects. It creates a steady pipeline of contracts for machinery suppliers. Emerging economies continue to adopt crawler drills to accelerate development programs. Growing exploration in oil, gas, and minerals supports consistent procurement. Rapid urbanization enhances equipment demand in tunneling and foundation drilling. Public-private partnerships further stimulate investments.

Advancements in Digitalization and Product Innovation Enhancing Market Prospects Globally

The Global Crawler Drill Machinery Market also gains opportunities from digital transformation and product innovation. It benefits from rising adoption of IoT-based monitoring and autonomous technologies. Manufacturers are focusing on developing electric and hybrid models to comply with sustainability standards. Rental operators expand fleets with digitalized equipment to improve customer access. Product differentiation through smart features enhances competitiveness. Contractors seek machinery that aligns with both productivity and environmental objectives. Innovation and digital integration strengthen market potential in both developed and emerging regions.

Market Segmentation Analysis:

The Global Crawler Drill Machinery Market is segmented

By type

Into hydraulic, pneumatic, and electric crawler drilling machines. Hydraulic crawler drilling machines hold a significant share due to their high power output, adaptability to tough terrains, and efficiency in large-scale projects. Pneumatic crawler drilling machines are favored in operations requiring cost-effective and reliable performance, particularly in small to medium construction and quarrying projects. Electric crawler drilling machines are gaining traction as industries shift toward energy efficiency and sustainability, with manufacturers focusing on reduced emissions and low operating costs to align with global green initiatives.

- For example, Furukawa Rock Drill’s hydraulic crawler drills use hydraulic drifters capable of 80–200 revolutions and 2,000–5,000 blows per minute, enabling powerful penetration in hard rock. Components are precision-machined to an accuracy of 1/1,000 mm, providing efficient, high-performance output for large infrastructure and mining projects.

By application

The Global Crawler Drill Machinery Market spans mining, construction, water well drilling, geothermal, and environmental applications. Mining remains the largest application segment, driven by global demand for minerals and natural resources, where crawler drills deliver precise penetration in hard rock formations. Construction contributes significantly with the rise in infrastructure development projects requiring foundation and tunneling operations. Water well drilling creates opportunities in regions facing groundwater scarcity, while geothermal applications gain momentum with investments in renewable energy exploration. Environmental applications, including soil testing and remediation, are expanding steadily as governments emphasize sustainability and land rehabilitation. Each segment reinforces the market’s diverse scope and growth potential.

- For example, the BDM-270-pro crawler-type water well drilling rig offers a drilling depth of up to 270 meters and supports hole diameters ranging from 105 to 325 mm, operating with pneumatic systems suited for efficient water well projects.

Segmentation:

By Type

- Hydraulic Crawler Drilling Machines

- Pneumatic Crawler Drilling Machines

- Electric Crawler Drilling Machines

By Application

- Mining

- Construction

- Water Well Drilling

- Geothermal

- Environmental Applications

By Region

- North America: U.S., Canada, Mexico

- Europe: UK, France, Germany, Italy, Spain, Russia, Rest of Europe

- Asia Pacific: China, Japan, South Korea, India, Australia, Southeast Asia, Rest of Asia Pacific

- Latin America: Brazil, Argentina, Rest of Latin America

- Middle East: GCC Countries, Israel, Turkey, Rest of Middle East

- Africa: South Africa, Egypt, Rest of Africa

Regional Analysis:

North America

The North America Global Crawler Drill Machinery Market size was valued at USD 284.62 million in 2018 to USD 419.56 million in 2024 and is anticipated to reach USD 730.70 million by 2032, at a CAGR of 6.7% during the forecast period. North America accounts for 17.3% of the global market share. The region benefits from advanced construction practices and the presence of established mining operations in the U.S. and Canada. Strong investments in shale gas exploration and infrastructure upgrades drive consistent equipment demand. It gains momentum from technology adoption, including automated drilling systems and IoT-enabled monitoring. Contractors prefer machines with enhanced safety features and higher penetration capacity. Mexico contributes growth through mining expansion, particularly in precious metals. Government support for energy projects sustains crawler drill usage. The region remains a strong adopter of innovation and premium equipment.

Europe

The Europe Global Crawler Drill Machinery Market size was valued at USD 472.04 million in 2018 to USD 689.26 million in 2024 and is anticipated to reach USD 1,124.95 million by 2032, at a CAGR of 5.8% during the forecast period. Europe holds 20.1% of the global market share. Demand is driven by extensive infrastructure modernization and quarrying projects across Germany, France, and Italy. The market benefits from strict regulations encouraging energy-efficient equipment. It shows strong adoption of electric and hybrid crawler drills, reflecting regional emphasis on sustainability. Mining operations in Russia and Eastern Europe further reinforce demand. Contractors in the region prioritize cost efficiency and environmental compliance. Manufacturers gain growth opportunities by offering versatile and eco-friendly solutions. The region positions itself as a hub for innovative crawler drill deployment.

Asia Pacific

The Asia Pacific Global Crawler Drill Machinery Market size was valued at USD 698.51 million in 2018 to USD 1,095.86 million in 2024 and is anticipated to reach USD 2,011.46 million by 2032, at a CAGR of 7.4% during the forecast period. Asia Pacific dominates with 45.1% of the global market share. Growth is fueled by massive mining projects in China, Australia, and India. Large-scale infrastructure initiatives such as high-speed rail, metro systems, and smart cities reinforce demand. It benefits from availability of affordable equipment from regional manufacturers. Strong industrialization and urbanization accelerate crawler drill adoption. Japan and South Korea lead in advanced technology integration. Emerging economies invest heavily in mineral exploration and energy projects. The region remains the largest contributor to both demand and innovation in the industry.

Latin America

The Latin America Global Crawler Drill Machinery Market size was valued at USD 78.84 million in 2018 to USD 117.84 million in 2024 and is anticipated to reach USD 181.31 million by 2032, at a CAGR of 5.0% during the forecast period. Latin America represents 4.1% of the global market share. Mining-rich countries such as Brazil and Chile drive steady demand for crawler drill equipment. The region witness’s growth from expansion in copper, gold, and lithium mining projects. It gains further momentum from construction of highways and urban infrastructure. Contractors face budget limitations, which increases reliance on rental equipment. Argentina shows potential in geothermal and renewable energy projects. Governments emphasize mining exports, stimulating equipment requirements. Market penetration grows gradually as modernization efforts progress.

Middle East

The Middle East Global Crawler Drill Machinery Market size was valued at USD 43.71 million in 2018 to USD 60.28 million in 2024 and is anticipated to reach USD 87.46 million by 2032, at a CAGR of 4.3% during the forecast period. The Middle East accounts for 2.0% of the global market share. Large-scale infrastructure developments in GCC countries create consistent demand. It benefits from ongoing construction of industrial zones, commercial hubs, and transport infrastructure. Mining projects in Turkey and Saudi Arabia further strengthen equipment adoption. Contractors prefer crawler drills with enhanced durability for desert terrains. The market reflects gradual adoption of advanced technology, with growing interest in fuel-efficient models. Israel contributes to niche growth in tunneling and environmental projects. The region shows potential with expanding government-led construction projects.

Africa

The Africa Global Crawler Drill Machinery Market size was valued at USD 27.19 million in 2018 to USD 45.06 million in 2024 and is anticipated to reach USD 63.33 million by 2032, at a CAGR of 3.8% during the forecast period. Africa holds 1.4% of the global market share. The region experiences steady growth through mineral-rich countries like South Africa and Egypt. It benefits from expanding mining of diamonds, platinum, and rare earth minerals. Infrastructure development projects in emerging economies further support demand. It faces challenges of limited capital investment and high reliance on imported machinery. Governments encourage resource exploration, creating long-term opportunities. Contractors prioritize machines offering durability and cost efficiency. The market shows gradual progress with growing foreign direct investments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Casagrande SpA

- Sumitomo

- Jupiter Rockdrills

- Kawasaki

- Altius Equipment

- Hitachi

- Tadano

- Sennebogen

- Enteco

- Furukawa

Competitive Analysis:

The Global Crawler Drill Machinery Market features a competitive landscape led by established companies such as Casagrande SpA, Sumitomo, Hitachi, Furukawa, and Tadano. These players emphasize product innovation, technological integration, and regional expansion to strengthen their positions. It is marked by frequent mergers, acquisitions, and collaborations aimed at enhancing product portfolios and expanding geographic reach. Companies are investing in hybrid and electric crawler drills to align with sustainability goals and regulatory standards. The market also witnesses rising competition from regional manufacturers offering cost-effective equipment. Differentiation through durability, automation, and after-sales service support remains a key growth strategy. Competitive intensity continues to increase as global and regional firms target emerging economies with tailored solutions.

Recent Developments:

- In April 2025, Sumitomo announced a strategic partnership with ABB aimed at decarbonizing mining fleets, focusing on developing electrified crawler drill machinery for sustainable mining operations. This initiative was formalized at bauma 2025 to accelerate energy delivery infrastructure for electric drills and other heavy equipment.

- In April 2025, Kawasaki established a new sales company in Indonesia to address rising demand for hydraulic equipment and crawler drill components, strengthening its Southeast Asian distribution and inventory functions.

- In June 2025, Tadano finalized the acquisition of IHI Transport Machinery’s transportation system business, establishing IUK Crane Ltd. (soon to be Tadano Infrastructure Solutions Ltd.), and extended its crawler crane portfolio, enhancing global customer value with a broader range that now includes advanced lattice boom crawler cranes.

- In March 2025, Sennebogen launched the new 6203 E telescopic crawler crane, featuring a maximum load capacity of 200 metric tons and a jib length of up to 78 meters, addressing demand for heavy-duty crawler solutions in infrastructure and wind energy segments.

Market Concentration & Characteristics:

The Global Crawler Drill Machinery Market shows moderate concentration with a mix of global leaders and regional players. It is defined by continuous innovation, strong focus on automation, and emphasis on sustainability. Market characteristics include high capital intensity, reliance on advanced engineering, and growing demand for versatile equipment. It demonstrates a balance between premium technology-driven products in developed regions and cost-effective solutions in emerging markets. Rental services also play a key role in expanding access to advanced machinery across diverse industries. It continues to evolve with rising adoption of digital platforms for equipment lifecycle management. Competitive dynamics remain influenced by technological differentiation and long-term service support.

Report Coverage:

The research report offers an in-depth analysis based on Type and Application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Global Crawler Drill Machinery Market will advance with growing adoption of automation and digital control systems in construction and mining.

- Demand for electric and hybrid crawler drills will expand, driven by environmental regulations and sustainability initiatives.

- Emerging economies will remain critical growth hubs due to infrastructure expansion and resource exploration projects.

- Rental and leasing models will gain traction, enabling small and mid-sized contractors to access advanced machinery.

- Remote monitoring and predictive maintenance technologies will become standard features across equipment portfolios.

- Market competition will intensify as regional manufacturers introduce cost-effective alternatives alongside global leaders.

- Advanced safety features will shape product innovation to address rising regulatory standards and workforce protection.

- Integration of versatile attachments will enhance machine utility, supporting adoption in diverse industries.

- Strategic collaborations and acquisitions will strengthen supply chains and accelerate global market penetration.

- Investments in R&D will focus on durability, fuel efficiency, and smart connectivity to sustain long-term growth.