Market Overview

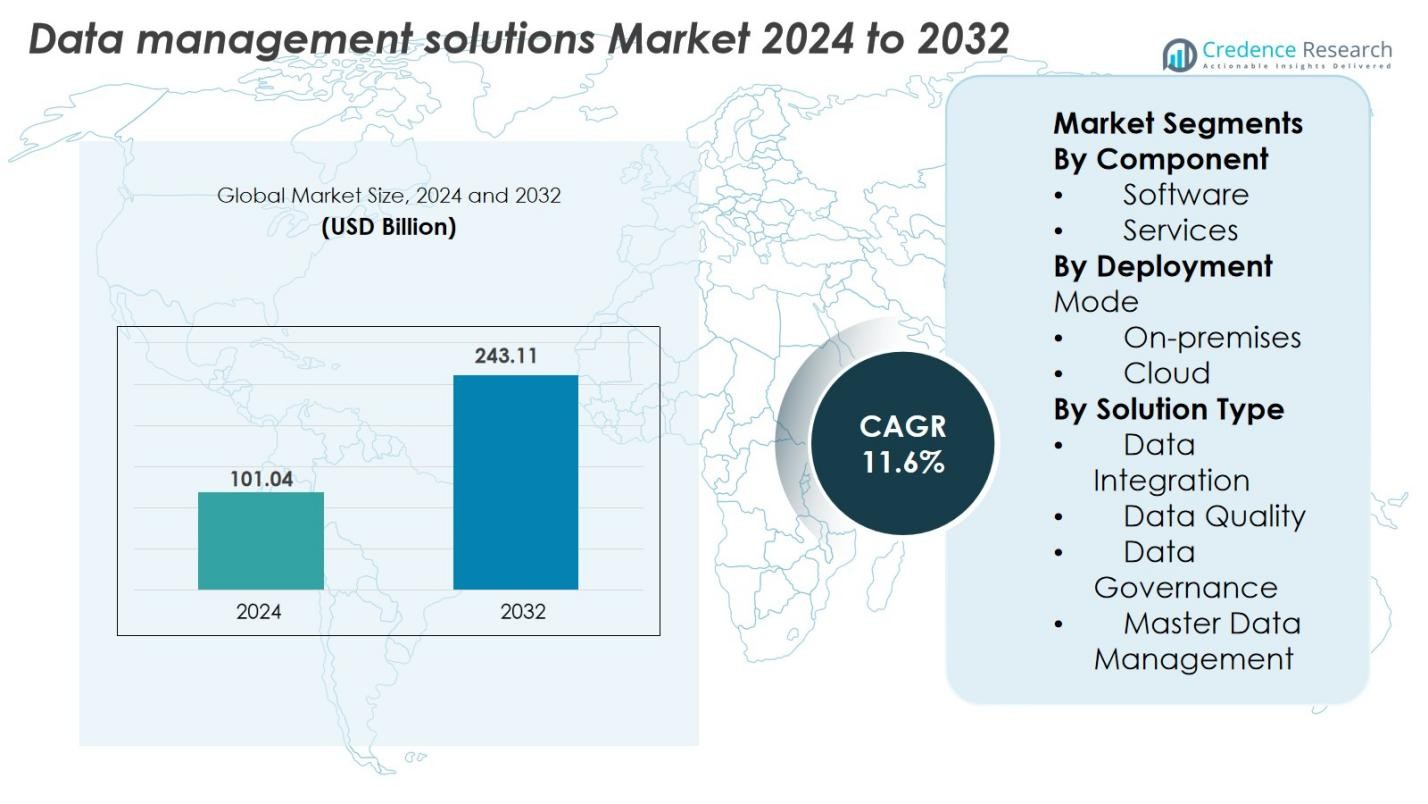

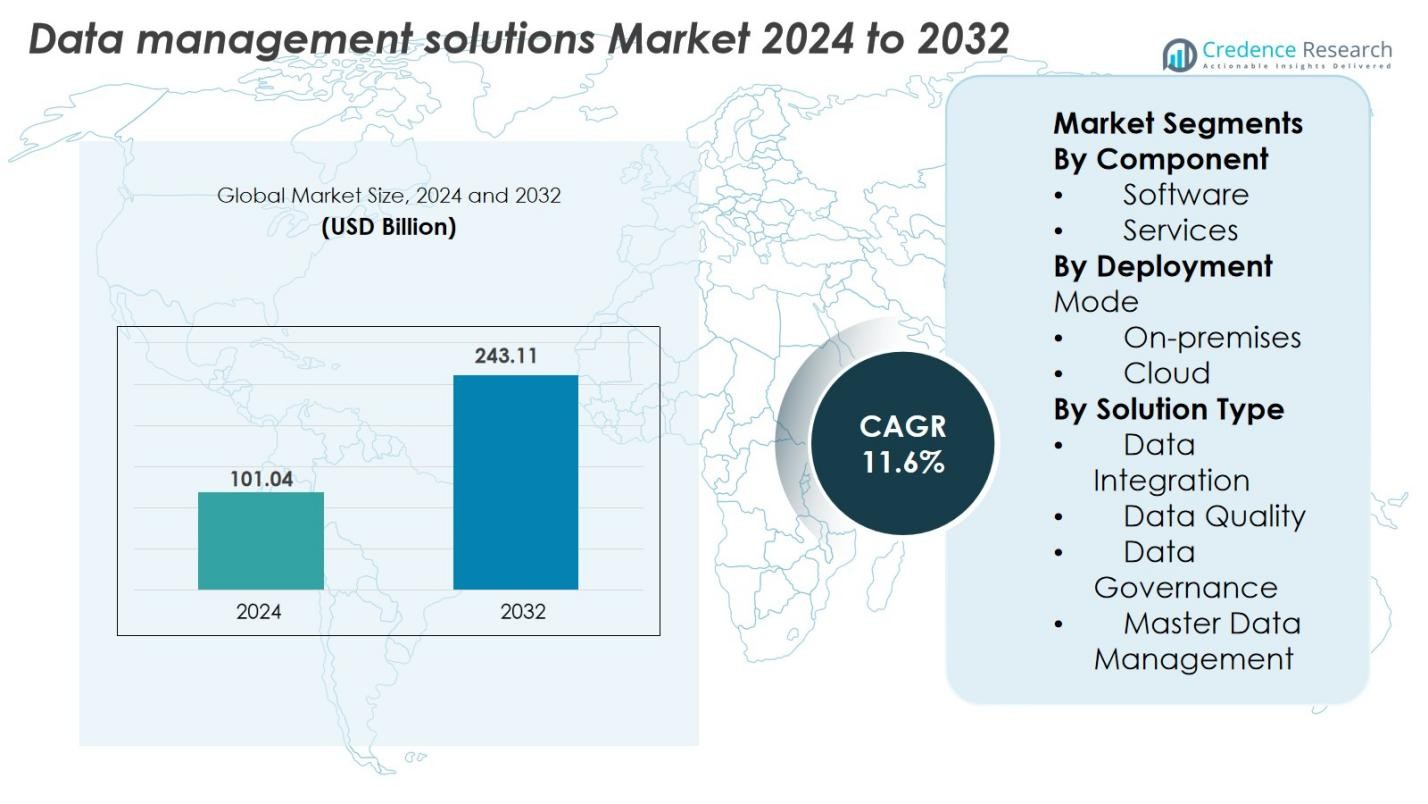

Data Management Solutions Market size was valued at USD 101.04 Billion in 2024 and is anticipated to reach USD 243.11 Billion by 2032, at a CAGR of 11.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Data Management Solutions Market Size 2024 |

USD 101.04 Billion |

| Data Management Solutions Market, CAGR |

11.6% |

| Data Management Solutions Market Size 2032 |

USD 243.11 Billion |

Data Management Solutions Market is led by major technology players including IBM Corporation, Microsoft Corporation, Oracle Corporation, SAP SE, and Amazon Web Services, who collectively shape the industry’s innovation and market direction through advanced cloud-based platforms and AI-driven data governance capabilities. These companies support enterprises in managing massive data volumes across hybrid and multi-cloud environments. North America dominates the market with approximately 35% share in 2024, driven by early technology adoption and strong regulatory frameworks. Europe follows closely with around 28% share, boosted by stringent data privacy regulations, while Asia-Pacific emerges as the fastest-growing region, supported by rapid digital transformation initiatives.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Data Management Solutions Market was valued at USD 101.04 Billion in 2024 and is projected to reach USD 243.11 Billion by 2032, growing at a CAGR of 11.6% during the forecast period.

- Market growth is driven by rising data volumes, increasing cloud adoption, and regulatory compliance requirements across industries like BFSI, healthcare, and telecom.

- Key trends include the adoption of AI and machine learning for automated data governance, along with the rise in edge computing for real-time data processing and analytics.

- Leading providers such as IBM, Microsoft, Oracle, and AWS dominate the landscape, offering integrated cloud-based platforms; cloud remains the dominant deployment mode with 74% share.

- North America leads with a 35% regional share, followed by Europe at 28% and Asia-Pacific at 24%, driven by digital transformation; software accounts for 68% of the component segment, making it the largest sub-segment.

Market Segmentation Analysis

By Component

The software segment dominates the Data Management Solutions Market, holding 68% market share in 2024, driven by rising demand for data analytics, compliance, and real-time data processing. Organizations are increasingly investing in advanced software tools to manage structured and unstructured datasets efficiently. In contrast, the services segment, including consulting and managed services, is growing steadily due to the shift toward digital transformation and cloud-based environments.

- For instance, Mayo Clinic’s partnership with Google Cloud Platform enables centralized management of vast healthcare datasets, leveraging AI to integrate electronic health records and accelerate clinical research.

By Deployment Mode

The cloud segment leads the deployment mode, accounting for around 74% market share in 2024, fueled by rapid adoption of SaaS-based data management platforms and cost-effective scalability. Cloud solutions are preferred for their flexibility, seamless integration, and reduced infrastructure costs, which is particularly attractive to SMEs and global enterprises undergoing digital transformation. Meanwhile, on-premises solutions retain significance in industries with stringent data security needs, such as banking and government. However, their market share is declining as organizations increasingly adopt hybrid and multi-cloud infrastructures for improved data agility and governance.

- For instance, General Electric (GE) employs a hybrid cloud approach combining on-premises data centers with AWS and Azure, enabling seamless data governance while supporting industrial IoT analytics at scale.

By Solution Type

Data Integration is the dominant solution type, capturing nearly 30% market share in 2024, driven by growing requirements to combine data from disparate sources into unified, accessible frameworks. Businesses are prioritizing integration to support analytics, AI/ML workloads, and real-time decision-making. Other key solutions include data governance and data quality, which are gaining traction due to increasing regulatory compliance needs like GDPR and CCPA. Master Data Management (MDM) is also emerging, driven by the need for accurate, consistent data records across business systems to enhance customer experience and operational efficiency.

Key Growth Drivers

Rising Data Volumes and Complexity

The exponential increase in data generated by enterprises across sectors such as finance, healthcare, e-commerce, and telecom is a major driver for the Data Management Solutions Market. As organizations face the challenge of handling vast and complex data sets from multiple sources, there is a growing need for advanced solutions that ensure efficient data integration, governance, and scalability. With the proliferation of IoT devices, social media interactions, and digital transactions, data volumes continue to surge, creating pressure on legacy systems. Modern data platforms are offering improved storage, analytics, and real-time processing capabilities.

- For instance, Microsoft’s Azure Purview employs AI-powered automated data discovery and classification, enabling organizations to maintain compliance and understand data usage across multi-cloud and on-premise environments.

Regulatory Compliance and Data Governance Requirements

Global data privacy regulations such as GDPR, CCPA, HIPAA, and PCI-DSS are pushing organizations to adopt robust data management practices to remain compliant and avoid hefty penalties. Businesses are prioritizing secure data storage, access controls, and audit trails to protect sensitive data and meet the evolving regulatory landscape. Data governance solutions help ensure data accuracy, consistency, and security throughout the data lifecycle, which has become critical in industries such as banking, healthcare, and government. This regulatory pressure is accelerating investments in advanced data governance, metadata management, and master data management systems.

- For instance, IBM Cloud offers HIPAA-ready services with comprehensive Business Associate Agreements, providing secure cloud infrastructure and data management to protect patient health information efficiently.

Digital Transformation and Cloud Adoption

The ongoing wave of digital transformation across industries is a significant driver of demand for data management solutions. Enterprises are migrating legacy systems to modern platforms and adopting cloud-based architectures, creating opportunities for integrated, scalable data management tools. Cloud data management offers real-time access, lower infrastructure costs, and improved collaboration, which aligns with organizational goals of agility and innovation. Hybrid and multi-cloud environments are becoming the norm, prompting the need for unified data governance and security across distributed systems. Businesses are also adopting automation, AI, and analytics-driven approaches to streamline data flows and improve insights.

Key Trends & Opportunities

Integration of AI and Machine Learning in Data Management

Artificial intelligence and machine learning are transforming the Data Management Solutions Market by enabling automated data discovery, quality enhancement, and metadata tagging. AI-driven platforms can detect anomalies, remove redundancies, and ensure clean, reliable datasets, drastically reducing manual intervention. The integration of advanced analytics and natural language processing (NLP) enables users to derive meaningful insights from unstructured data such as emails, logs, and social media content. AI also empowers predictive data governance, making it easier to anticipate data compliance risks and ensure policy adherence.

- For instance, IBM’s watsonx.data platform unifies multiple data systems into a single integrated platform, automating indexing and classification to ensure clean, reliable datasets with minimal manual oversight.

Growing Demand for Real-Time Data Processing and Edge Analytics

The increasing need for real-time data insights, especially in sectors like manufacturing, logistics, and finance, is creating new opportunities in the market. Organizations are exploring edge computing to process data closer to the source, reducing latency and improving decision-making. This trend is further propelled by IoT adoption, where connected devices generate continuous streams of data that need to be managed efficiently and securely. Real-time data plays a crucial role in use cases such as predictive maintenance, fraud detection, and automated response systems.

- For instance, GE Digital uses its Predix platform to integrate IIoT sensor data from manufacturing equipment in real-time, enabling immediate anomaly detection and predictive maintenance that minimizes downtime.

Key Challenges

Data Security and Privacy Concerns

Despite advancements in data management technologies, security continues to be a critical challenge, especially with increasing cyber threats and data breaches. Rapid data growth and multi-cloud integration expand the attack surface, making sensitive information vulnerable to unauthorized access and leakage. Compliance frameworks require strict control, encryption, and monitoring of data, which often strain organizational resources. Implementing end-to-end encryption, identity management, and zero-trust security models have become high priorities, but this can increase complexity and cost. Hybrid cloud and distributed systems also make it harder to maintain consistent security protocols.

Integration with Legacy Systems and Data Silos

A major challenge in the Data Management Solutions Market is integrating modern data platforms with legacy systems that are still widely used by large enterprises. Many organizations struggle with fragmented data silos that prevent unified analytics and hinder innovation. Legacy systems often lack compatibility with cloud-based platforms, increasing the time and cost required for integration. This issue is further compounded by non-standardized data formats and inconsistent data quality. Businesses must invest in robust data integration tools and strategies to break down silos and enable seamless data flow across multiple platforms. Moreover, resistance to change and limited IT expertise can impede modernization efforts.

Regional Analysis

North America

North America leads the global Data Management Solutions Market with a 35% market share in 2024, driven by early adoption of cloud technologies, strong regulatory frameworks, and rapid digital transformation across industries such as BFSI, healthcare, and retail. The U.S. is the largest contributor due to high investment in AI-driven data governance, cybersecurity, and analytics platforms. Leading enterprises and tech giants like Microsoft, IBM, and Google foster innovation and integration of advanced data management tools. Strong demand for data compliance and the proliferation of IoT devices further strengthen market growth across the region.

Europe

Europe accounts for 28% of the global market in 2024, supported by stringent regulatory mandates like GDPR that drive demand for data governance and privacy-compliant solutions. Countries such as Germany, the U.K., and France are at the forefront of enterprise data strategy modernization, particularly within the manufacturing, telecom, and financial sectors. The growing shift toward cloud-based architectures and digital transformation initiatives in mid-sized enterprises is accelerating market expansion. Additionally, collaborations between technology providers and regulatory bodies are encouraging innovation in secure data platforms, creating a favorable ecosystem for Data Management Solutions adoption.

Asia-Pacific

Asia-Pacific holds a 24% share in 2024, emerging as the fastest-growing region due to increasing digitization, cloud adoption, and data-driven initiatives across China, Japan, India, and Southeast Asia. Rapid growth in e-commerce, fintech, and smart manufacturing industries significantly boosts data generation, necessitating robust management frameworks. Government-backed digital transformation programs and regulatory reforms are also encouraging enterprises to adopt modern data platforms. The availability of cost-efficient cloud services and rise of local data center infrastructure are further catalyzing adoption. SMEs and start-ups in the region drive demand for scalable, AI-enabled data tools to enhance customer engagement and operational efficiency.

Latin America

Latin America represents 8% of the global Data Management Solutions Market in 2024, driven by the growing need to modernize IT infrastructure across banking, telecom, and retail sectors. Brazil and Mexico lead regional adoption due to increasing regulatory compliance requirements and the rise in cloud-based enterprise applications. Despite economic challenges, demand for digital transformation and analytics tools remains strong among mid-sized enterprises. Partnerships with global tech firms and local service providers are helping improve access to data management technologies. However, data security concerns and limited cloud readiness pose constraints on faster adoption across certain markets.

Middle East & Africa

The Middle East & Africa region accounts for around 5% of the market in 2024, with growth supported by digital government initiatives, increased cloud adoption, and investments in smart city projects. The UAE, Saudi Arabia, and South Africa are leading adopters, particularly in banking, energy, and public sectors. Enterprises are focusing on data compliance, cybersecurity, and integrating AI-based analytics to improve service efficiency. Yet, market growth is constrained by lower digital maturity levels and limited local data infrastructure in several countries. Despite these challenges, heightened focus on digital transformation offers significant future growth potential in this region.

Market Segmentations

By Component

By Deployment Mode

By Solution Type

- Data Integration

- Data Quality

- Data Governance

- Master Data Management

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Data Management Solutions Market is characterized by a mix of established technology giants and specialized data management providers that offer comprehensive platforms and domain-focused solutions. Leading players such as IBM Corporation, Oracle Corporation, Microsoft Corporation, SAP SE, and Amazon Web Services dominate the market through extensive product portfolios, cloud-based data management platforms, and strategic partnerships. Companies like Informatica, Teradata, Cloudera, Snowflake, and SAS Institute strengthen their presence through AI-enabled data integration, governance, and analytics solutions. These key players focus on enhancing data security, scalability, and real-time processing capabilities to support evolving enterprise needs. Market competition intensifies with the rise of emerging vendors offering cloud-native and industry-specific tools. Key strategies include product innovation, acquisitions, and expansion of service offerings to meet the growing demand for automated, integrated data environments. The shift toward hybrid and multi-cloud architectures has further fueled investment in next-generation data management platforms.

Key Player Analysis

- IBM Corporation

- Oracle Corporation

- Microsoft Corporation

- SAP SE

- Amazon Web Services (AWS)

- SAS Institute Inc.

- Teradata Corporation

- Informatica LLC

- Cloudera, Inc.

- Google LLC

Recent Developments

- In October 2025 CertifyOS launched its new “Provider Hub” AI-powered provider-data-management platform, aiming to unify, cleanse and validate provider data for health plans and digital-health companies.

- In May 2025 Databricks agreed to acquire startup Neon for about US$ 1 billion, to enhance its AI-driven data-management and cloud-database capabilities.

- In May 2025, Hitachi Vantara launched its new software solution Virtual Storage Platform 360, a data-management offering designed to deliver a simplified, streamlined experience for managing large-scale enterprise data.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Component, Deployment Mode, Solution Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to expand rapidly as enterprises prioritize data-driven decision-making.

- AI and machine learning will play a pivotal role in automating data quality, integration, and governance.

- Cloud-native platforms will dominate, with hybrid and multi-cloud strategies becoming standard practice.

- Increased demand for real-time analytics will drive adoption of edge-based data management solutions.

- Regulatory compliance and data privacy requirements will push companies to invest in secure data governance.

- Growth in IoT and connected devices will generate more unstructured data, fueling market innovation.

- Self-service data platforms will empower non-technical users and enhance organizational agility.

- Emerging markets in Asia-Pacific and Latin America will become key drivers of future demand.

- The rise of data fabric architectures will improve data unification and accessibility across platforms.

- Partnerships between tech providers and industry-specific vendors will lead to tailored solutions for verticals like healthcare and finance.