Market Overview

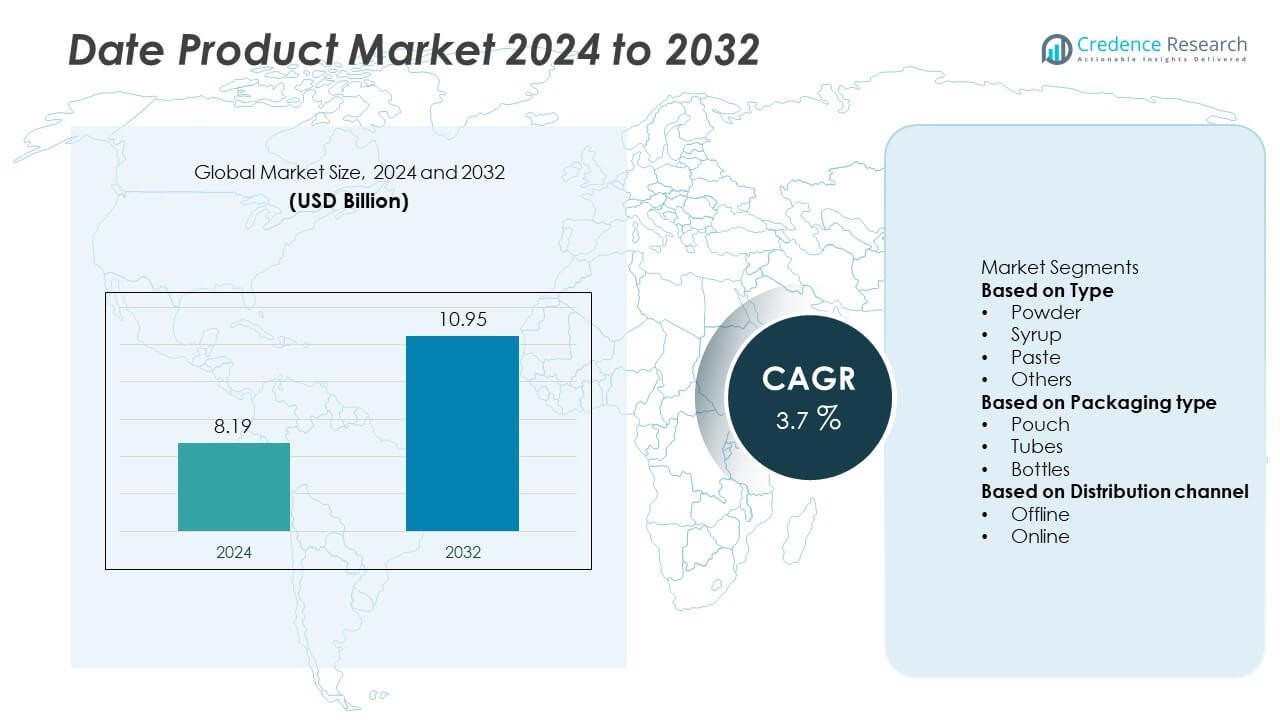

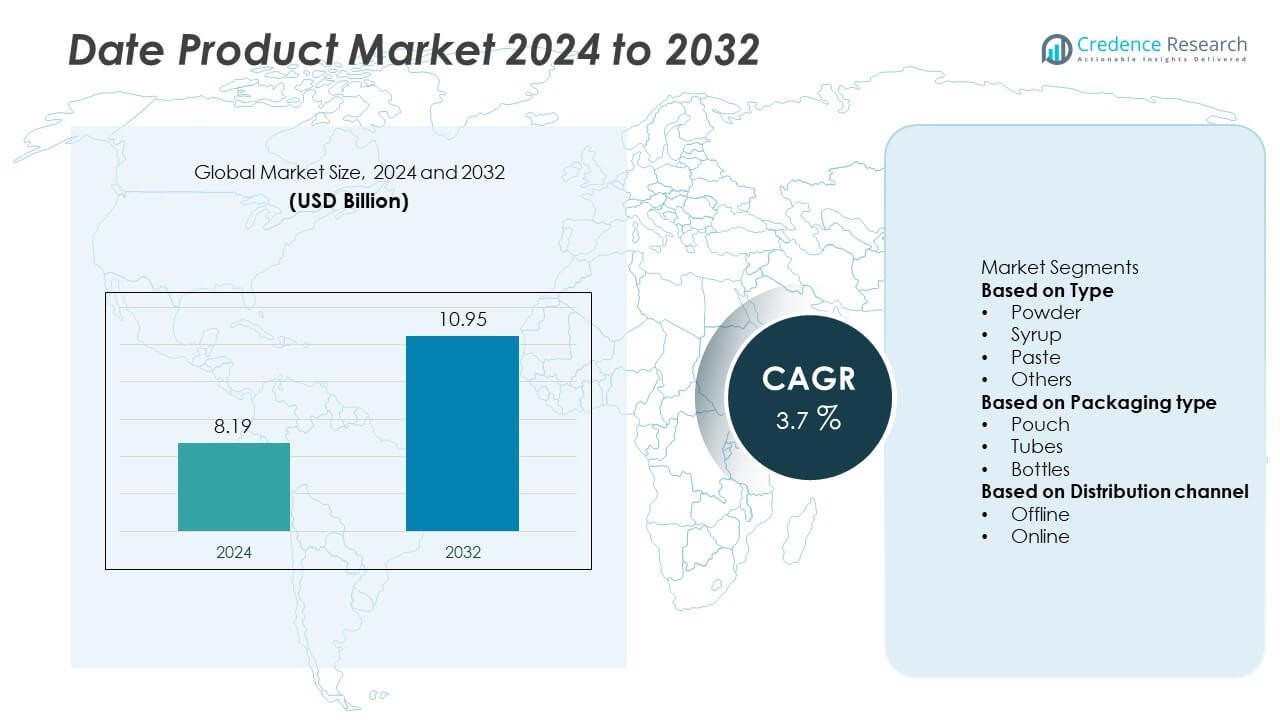

The global Date Product market was valued at USD 8.19 billion in 2024 and is projected to reach USD 10.95 billion by 2032, growing at a CAGR of 3.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Date Product Market Size 2024 |

USD 8.19 Billion |

| Date Product Market, CAGR |

3.7% |

| Date Product Market Size 2032 |

USD 10.95 Billion |

The Date Product market is led by key players such as Bateel International, Arat Company PJS, Emirates Dates, Al Foah, Bayara Saudi Arabia, Atul Rajasthan Date Palm, Barari Group, Ario, Al Barakah Dates Factory, and Arava Dates. These companies dominate through advanced processing facilities, global distribution networks, and a diverse range of date-based products including syrups, pastes, and powders. North America held the largest share of 32% in 2024, driven by growing demand for natural sweeteners and functional foods. Europe followed with 28%, supported by strong consumption of organic and vegan food products, while Asia Pacific accounted for 26%, fueled by rising health awareness and increasing use of date products in beverages and confectionery.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The global date product market was valued at USD 8.19 billion in 2024 and is projected to reach USD 10.95 billion by 2032, growing at a CAGR of 3.7% during 2025–2032.

- Increasing demand for natural sweeteners and clean-label ingredients drives market growth across food and beverage applications.

- Rising popularity of organic, vegan, and functional date-based products such as syrups, powders, and pastes highlights a key market trend.

- Leading companies such as Bateel International, Al Foah, and Al Barakah Dates Factory maintain competitiveness through innovation, global exports, and sustainable sourcing.

- North America held 32%, followed by Europe at 28% and Asia Pacific at 26%, while the syrup segment accounted for 42% of the market in 2024, supported by growing use in bakery, confectionery, and beverage formulations.

Market Segmentation Analysis:

By Type

The syrup segment held a 42% share in 2024, emerging as the leading type in the date product market. Its dominance is driven by growing use in bakery, confectionery, and beverage applications as a natural sweetener alternative to refined sugar. Date syrup offers high nutritional value, rich flavor, and easy solubility, making it popular in both household and commercial food production. Rising demand for clean-label, plant-based ingredients has further strengthened the position of date syrup in global health-conscious consumer markets.

- For instance, Al Barakah Dates Factory operates the world’s largest private date-processing facility in Dubai, handling over 100,000 tons of dates annually to produce syrup, paste, and powders for export to more than 90 countries.

By Packaging Type

The pouch segment accounted for a 46% share in 2024, dominating the market due to its lightweight, cost-effective, and eco-friendly packaging benefits. Pouches extend shelf life and ensure convenient storage and transportation, making them preferred by manufacturers and retailers alike. Increasing demand for flexible packaging formats among consumers seeking portability and reduced material waste supports market expansion. Tubes and bottles also show growth potential, particularly in premium and export-oriented product categories requiring aesthetic appeal and product protection.

- For instance, Bayara uses the latest technologies to process a variety of products, including dates, in its facilities in Saudi Arabia and the United Arab Emirates, for distribution across the GCC markets.

By Distribution Channel

The offline distribution channel held a 63% share in 2024, supported by strong sales through supermarkets, hypermarkets, and specialty stores. Consumers prefer offline retail for product assurance, quality inspection, and brand familiarity, particularly in regions with traditional food markets. However, the online channel is growing rapidly as e-commerce platforms offer wider product access, discounts, and doorstep delivery. Increasing digitalization, improved logistics, and online grocery adoption are driving steady growth in the online retail segment for date-based products globally.

Key Growth Drivers

Rising Demand for Natural and Healthy Sweeteners

The growing preference for natural sugar alternatives is driving demand for date-based products. Dates are rich in fiber, antioxidants, and essential minerals, making them a healthier substitute for refined sugar. Manufacturers increasingly use date syrup and powder in bakery, confectionery, and beverage products to meet clean-label and plant-based consumer trends. The shift toward natural sweeteners for diabetic-friendly and functional foods continues to propel the date product market globally.

- For instance, Bateel International produces gourmet date-based products through its vertically integrated farms in Al Ghat, Saudi Arabia, which cultivate over 100,000 organic date palms managed under precision irrigation systems to ensure sustainable yields.

Expansion of Functional and Nutritional Food Applications

Date products are witnessing rising use in protein bars, smoothies, and ready-to-eat snacks due to their high energy value and natural sweetness. The clean-label movement and consumer focus on wholesome ingredients have boosted their adoption in sports nutrition and vegan formulations. Food processors prefer date paste and syrup for flavor enhancement and sugar reduction. Growing demand for nutrient-dense, minimally processed ingredients continues to strengthen market expansion in the functional food sector.

- For instance, Al Foah Company operates one of the largest integrated date-processing networks in the Middle East and has a total annual processing capacity of over 113,000 metric tons. It has advanced dehydration and grinding systems designed to create fine date powders for nutritional and energy food manufacturing, among other date products.

Growing Popularity of Organic and Clean-Label Products

The surge in organic food consumption has directly increased the demand for organic date products. Consumers are increasingly aware of the health and environmental benefits of chemical-free ingredients. Producers are responding with certified organic date syrup, paste, and powder to cater to this segment. Retailers and brands emphasizing sustainable sourcing and transparent labeling are enhancing consumer trust, driving higher market penetration of organic date-based products across developed and emerging economies.

Key Trends & Opportunities

Rising Adoption in Plant-Based and Vegan Products

The growth of the vegan and plant-based food movement is creating strong opportunities for date-based products. Dates provide natural sweetness and texture, making them ideal for dairy-free desserts, energy bars, and plant-based beverages. Companies are incorporating date syrup and paste as natural binders and sweeteners in vegan product lines. This trend is expected to strengthen as consumers seek alternatives that align with sustainable and cruelty-free dietary preferences.

- For instance, California-based Joolies introduced an organic medjool date syrup line, and the company also produces Jooliettes, which are dark chocolate-covered date nibbles that won an Expo East award for Best New Sweet Snack

Product Innovation and Value-Added Offerings

Manufacturers are developing innovative date-based formulations such as flavored syrups, organic powders, and blended sweeteners to capture niche markets. The integration of dates into functional foods and ready-to-eat formats offers significant potential for differentiation. Expanding product portfolios with premium, fortified, or infused date variants is helping brands attract health-conscious and premium buyers. Continuous R&D investments in improving texture, flavor, and shelf stability create new growth avenues in the global market.

- For instance, a date syrup with a lower glycemic index and no added sugar has been developed as a natural sweetener, offering a potential alternative for diabetic-friendly applications.

Key Challenges

Price Volatility and Supply Chain Dependence

The date product market faces challenges due to fluctuating raw material prices and regional production dependency. Climate variability and limited cultivation zones in the Middle East and North Africa can disrupt supply consistency. Rising logistics costs and quality variations affect pricing stability for manufacturers. To mitigate these issues, companies are diversifying sourcing regions and investing in local processing facilities to ensure steady supply and product quality.

Limited Awareness in Emerging Markets

Despite growing global demand, consumer awareness of date-based products remains limited in some developing economies. Many consumers still associate dates with traditional snacks rather than modern food ingredients. Lack of marketing, premium pricing, and limited availability in mass retail channels hinder widespread adoption. Strengthening brand education, promotional campaigns, and affordable product offerings are essential to increase market penetration in these emerging regions.

Regional Analysis

North America

North America held a 32% market share in 2024, driven by increasing consumer preference for natural sweeteners and functional foods. The U.S. leads regional demand, supported by the growing popularity of plant-based snacks, organic food products, and clean-label formulations. Date syrup and powder are gaining traction as healthier alternatives to refined sugar in bakery and beverage applications. Expanding distribution through supermarkets and online platforms, along with rising awareness of Middle Eastern superfoods, continues to strengthen market growth across the region.

Europe

Europe accounted for a 28% share of the global date product market in 2024, supported by strong demand for organic and vegan food ingredients. Countries such as Germany, France, and the U.K. lead consumption due to growing adoption of natural sweeteners in processed foods. The presence of health-conscious consumers and established retail networks supports market expansion. Imports from Middle Eastern and North African countries continue to meet regional demand, while the increasing use of date syrup in confectionery and bakery industries sustains growth.

Asia Pacific

Asia Pacific captured a 26% market share in 2024, emerging as one of the fastest-growing regions. Rapid urbanization, expanding middle-class income, and rising health awareness are driving the use of date-based products in food and beverage applications. India, China, and Japan are key contributors due to growing demand for natural sweeteners and energy-rich snacks. Local production and import partnerships from Gulf countries are strengthening supply chains. Increasing preference for organic and minimally processed foods further supports long-term growth in the region.

Middle East & Africa

The Middle East & Africa accounted for a 10% share in 2024, supported by the region’s strong production base and cultural consumption of dates. Countries such as Saudi Arabia, the UAE, and Egypt are major producers and exporters of date products globally. The market benefits from advanced processing facilities and growing diversification into syrups, pastes, and powders. Government support for agribusiness expansion and export promotion is strengthening regional competitiveness. Increasing packaged date product exports to Europe and Asia further drive steady growth.

Latin America

Latin America represented a 4% share of the market in 2024, with rising awareness of healthy snacking and natural sweeteners. Brazil and Mexico lead regional demand due to growing consumer inclination toward organic and functional food ingredients. Import growth from Middle Eastern suppliers and local innovations in date-based beverages and spreads are contributing to expansion. Retail penetration through supermarkets and online platforms supports wider accessibility. Continued promotion of plant-based and sustainable ingredients is expected to accelerate market development across the region.

Market Segmentations:

By Type

- Powder

- Syrup

- Paste

- Others

By Packaging type

By Distribution channel

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Date Product market is shaped by leading players such as Bateel International, Arat Company PJS, Emirates Dates, Al Foah, Bayara Saudi Arabia, Atul Rajasthan Date Palm, Barari Group, Ario, Al Barakah Dates Factory, and Arava Dates. These companies dominate through extensive product portfolios, strong sourcing networks, and global export capabilities. Al Foah and Bateel International lead in premium and processed date categories, while Al Barakah Dates Factory and Barari Group focus on large-scale production and distribution. Regional players like Bayara Saudi Arabia and Atul Rajasthan Date Palm emphasize local cultivation and sustainable farming practices. Companies are investing in advanced processing technologies, organic certification, and innovative packaging to enhance product quality and global appeal. Strategic collaborations, product diversification into syrups and pastes, and expanding online presence continue to strengthen their competitiveness in both traditional and modern retail channels.

Key Player Analysis

- Bateel International

- Arat Company PJS

- Emirates Dates

- Al Foah

- Bayara Saudi Arabia

- Atul Rajasthan Date Palm

- Barari Group

- Ario

- Al Barakah Dates Factory

- Arava Dates

Recent Developments

- In September 2025, Al Barakah Dates Factory strengthened its global export reach via its Dubai Industrial City facility located near Jebel Ali Port and Al Maktoum Airport.

- In August 2025, Atul Rajasthan Date Palm (joint venture) had farm development work underway on a 40-hectare site in Rajasthan, India.

- In 2025, Bateel International announced a global expansion plan, targeting three continents initially and five by 2029.

- In 2024, Bateel International revealed new product and packaging innovations aimed at the travel-retail segment.

Report Coverage

The research report offers an in-depth analysis based on Type, Packaging type, Distribution channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Global demand for date-based sweeteners will continue to rise due to health-conscious consumption.

- Organic and clean-label date products will gain stronger traction in premium food categories.

- Manufacturers will focus on developing innovative products such as flavored syrups and powdered blends.

- Integration of dates in functional and protein-rich snacks will expand product applications.

- E-commerce growth will enhance accessibility and international trade for processed date products.

- Sustainable farming and fair-trade sourcing will become key priorities for leading producers.

- Asia Pacific and Europe will witness rapid growth driven by rising plant-based food adoption.

- Technological advancements in processing will improve product quality and shelf life.

- Strategic collaborations between local growers and global brands will boost supply chain stability.

- Growing use of date syrup and paste in bakery, confectionery, and beverages will sustain market expansion.